2 December 2019 Afternoon Session Analysis

Other major currency markets popped up.

Dollar index which measured its value against the other major currencies fall amid strengthening of other country’s single currency. Last Friday, German Unemployment Change data came in at -16k while comparing to market forecast of 5k, hinting EU labor market still remain stable and seemingly their economy is in the pace of returning to expansionary stage soon. This upbeat data shows that ongoing loosen monetary policy which offering more stimulus has been take into effect on EU economy while board of ECB reiterated they will continue to eye on more economic data at the meantime. As of writing, the pair of EUR/USD rose 0.04% to 1.1020. On the other hand, Caixin Manufacturing PMI data from China was also came in at an optimistic reading 51.8, unexpectedly stronger than economist forecast at 51.4 while showing sign of expansion in China economy for the first time since April. Good news from China’s economy eventually dragged up the market demand toward its major trading partner currencies, Aussie dollar and Kiwi. As of writing, the pair of AUD/USD quoted up 0.16% to 0.6775 and NZD/USD inched up 0.41% to 0.6445 respectively.

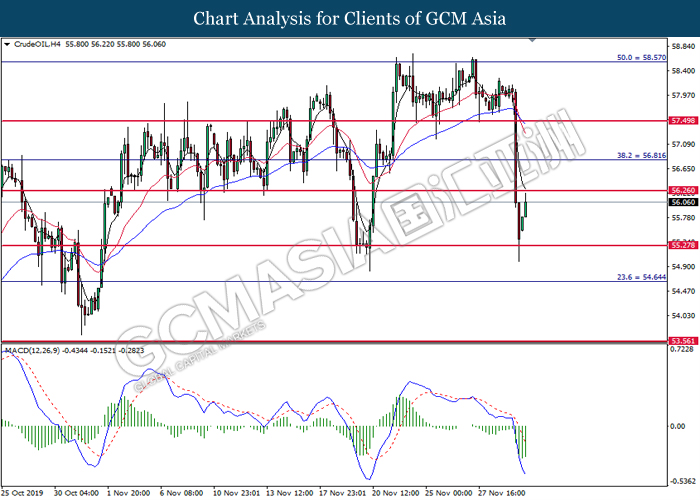

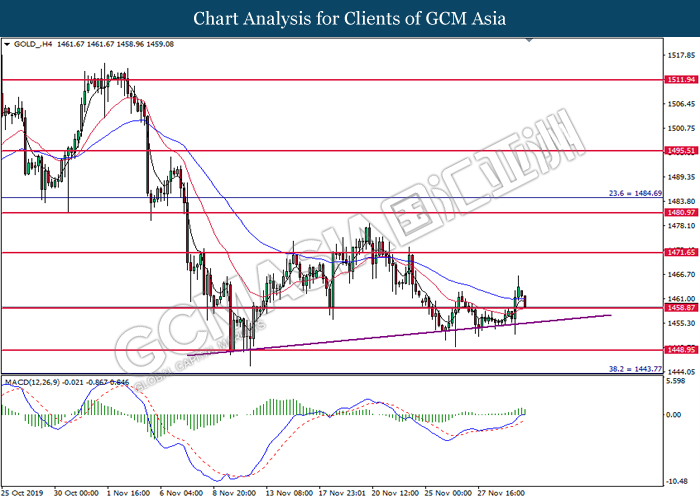

In the commodities market, crude oil price rose 1.19% to $56.00 per barrel due to bearish market profit taking after falling to 10 days low level. Previously, there was news showed that OPEC and its allies are averse to deepening their oil cut production in the coming week meeting. Besides, gold price surged 0.28% to $1459.65 a troy ounce amid heightening of investor’s risk appetite.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22.00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16.55 | EUR – German Manufacturing PMI (Nov) | 43.8 | 43.8 | – |

| 17.30 | GBP – Manufacturing PMI (Nov) | 48.3 | 48.3 | – |

| 23.00 | USD – ISM Manufacturing PMI (Nov) | 48.3 | 49.2 | – |

Technical Analysis

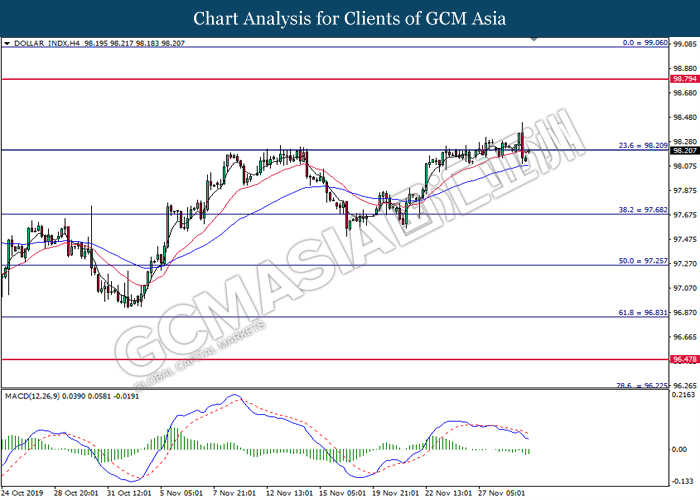

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level 98.20. MACD which illustrate diminishing bearish momentum suggest the dollar to extend its gains after successfully breakout above the resistance level at 98.20.

Resistance level: 98.20, 98.80

Support level: 97.70, 97.25

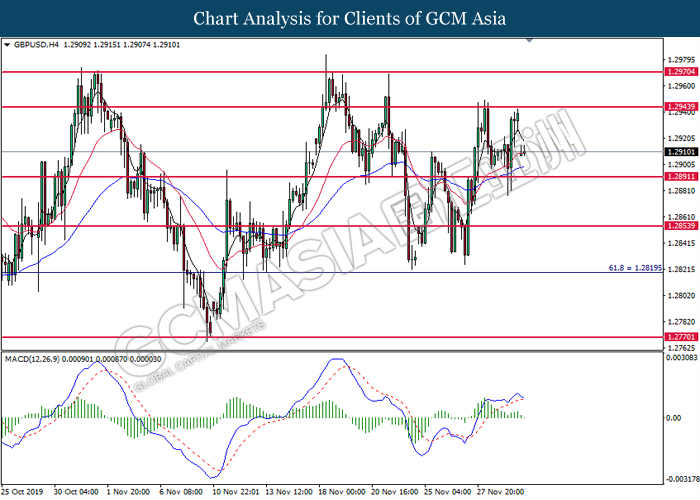

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2945. However, MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2890.

Resistance level: 1.2945, 1.2970

Support level: 1.2890, 1.2855

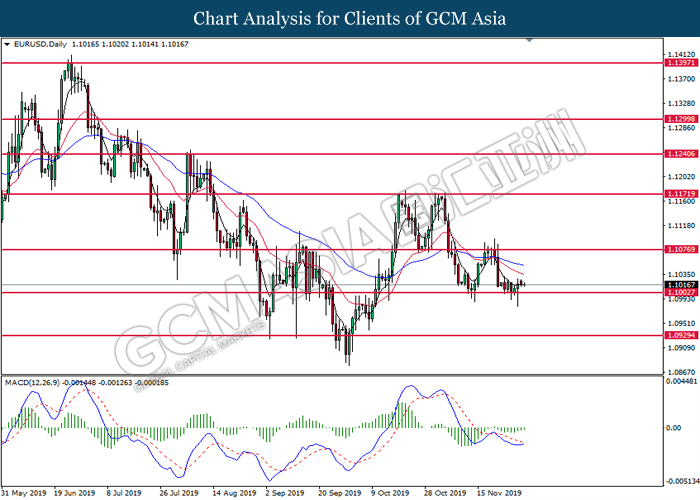

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level 1.1005. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.1075.

Resistance level: 1.1075, 1.1170

Support level: 1.1005, 1.0930

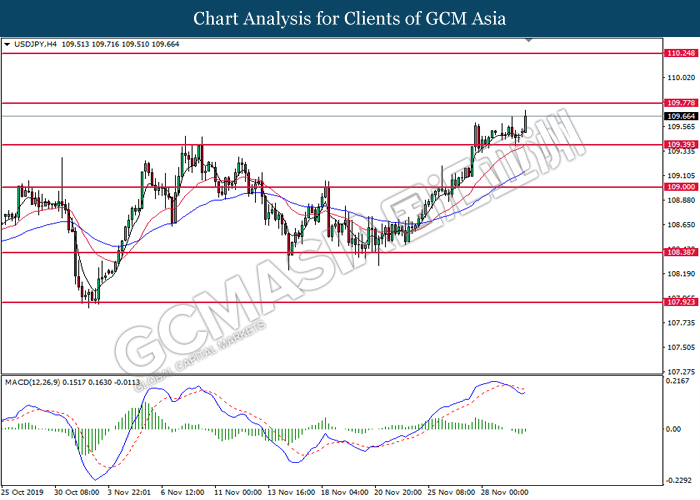

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 109.40. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 109.80.

Resistance level: 109.80, 110.25

Support level: 109.40, 109.00

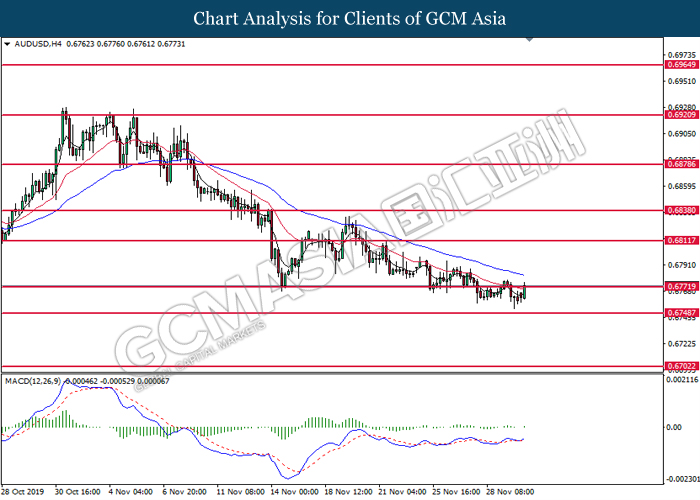

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.6770. Due to lack of signal from MACD, it is suggested to wait for further confirmation such as breakout above or retracement before entering the market.

Resistance level: 0.6770, 0.6810

Support level: 0.6750, 0.6700

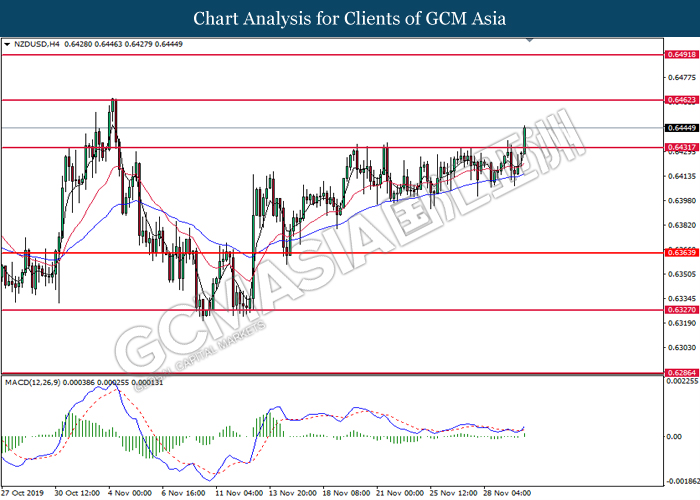

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6430. MACD which illustrate bullish momentum suggest the pair to extend its gains after its candle successfully close above the resistance level at 0.6430.

Resistance level: 0.6430, 0.6465

Support level: 0.6365, 0.6325

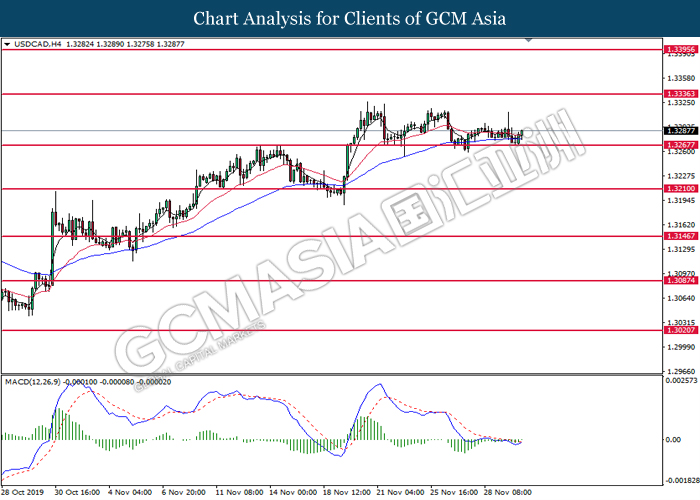

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3265. MACD which illustrate diminishing bearish momentum and the formation of golden cross suggest the pair to extend its gains toward the resistance level at 1.3335.

Resistance level: 1.3335, 1.3395

Support level: 1.3265, 1.3210

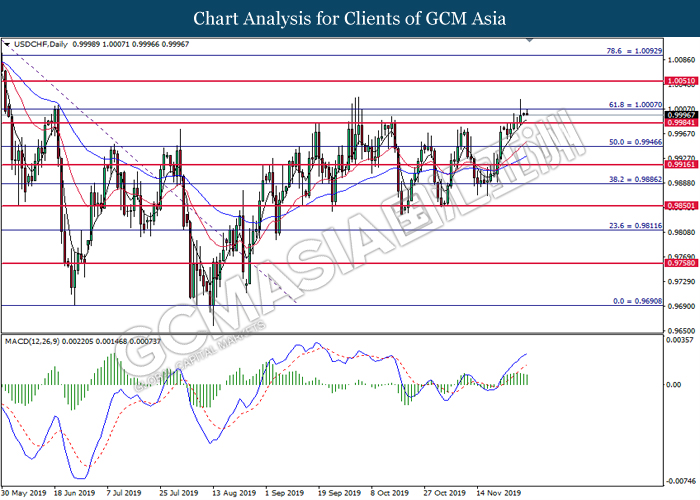

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 1.0005. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower in short term toward the support level at 0.9985.

Resistance level: 1.0005, 1.0050

Support level: 0.9985, 0.9945

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 55.30. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains toward the resistance level at 56.25.

Resistance level: 56.25, 56.80

Support level: 55.30, 54.65

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1458.85. MACD which illustrate diminishing bullish momentum signal suggest the commodity to extend its losses after it successfully breakout below the support level at 1458.85.

Resistance level: 1471.65, 1480.95

Support level: 1458.85, 1448.95