2 December 2019 Morning Session Analysis

Dollar fell amid receding trade optimism.

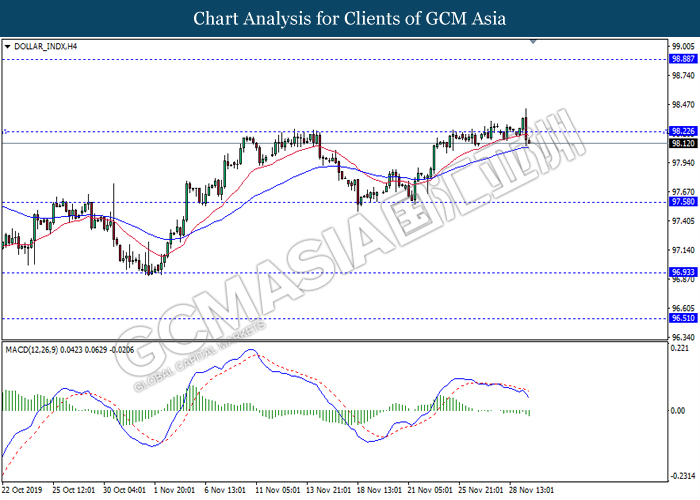

Dollar index which measured against a basket of six major rival pairs have slipped after reports of stalling progress in trade development. According to China Times, China is now insists that the the tariffs must be rolled back as part of the first-phase trade deal. President Trump’s negotiating team have stated that the China deal have been “stalled because of Hong Kong legislation”. The news have since worsen the sentiment and may derail any progress on further trade talk while the next batch of U.S tariff on Chinese goods will be kick off on Dec 15. As market are slowly back from last week’s Thanksgiving holiday, investors will continue to remain focus for further catalyst to gauge market sentiment. At the time of writing, dollar index fell 0.05% to 98.12 as of writing.

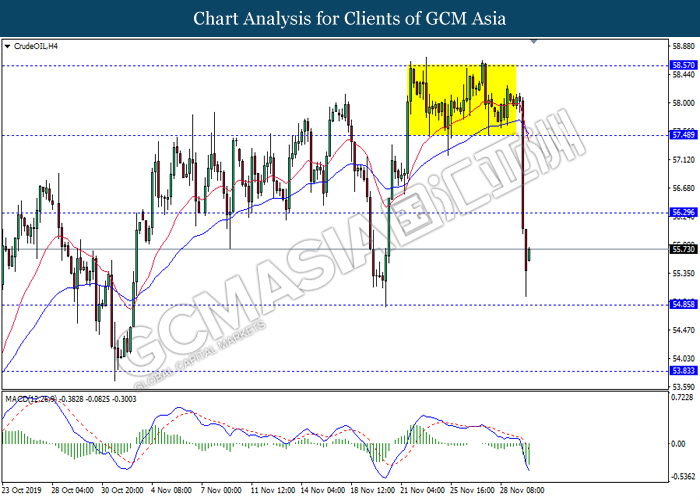

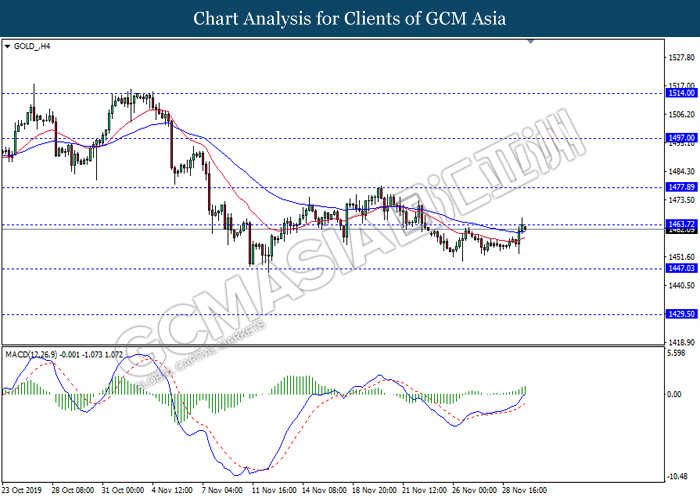

In the commodities market, crude oil recovers 0.56% to $55.70 at the time of writing after a huge sell-off by the market concerns of OPEC supply cut deal. Prince Abdulaziz bin Salman who recently took over from Khalid Al-Falih have voiced his concerns over OPEC deal, stated that Saudi Arabia will no longer compensate for other members non-compliance. The news have since causing a selling frenzy in the market. On the other hand, gold price soars 0.20% to $1462.25 a troy ounce at the time of writing following ongoing trade concerns towards U.S and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22.00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16.55 | EUR – German Manufacturing PMI (Nov) | 43.8 | 43.8 | – |

| 17.30 | GBP – Manufacturing PMI (Nov) | 48.3 | 48.3 | – |

| 23.00 | USD – ISM Manufacturing PMI (Nov) | 48.3 | 49.2 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level 98.20. MACD which illustrate bearish momentum signal suggest the dollar to extend its losses towards the support level 97.60

Resistance level: 98.20, 98.90

Support level: 97.60, 96.95

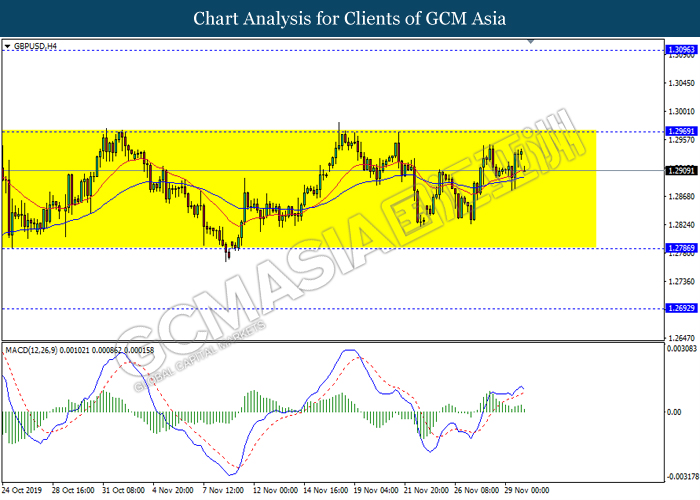

GBPUSD, H4: GBPUSD remain traded in a sideway channel following recent retracement from its high level. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower in short term towards the support level 1.2785.

Resistance level: 1.2970, 1.3095

Support level: 1.2785, 1.2690

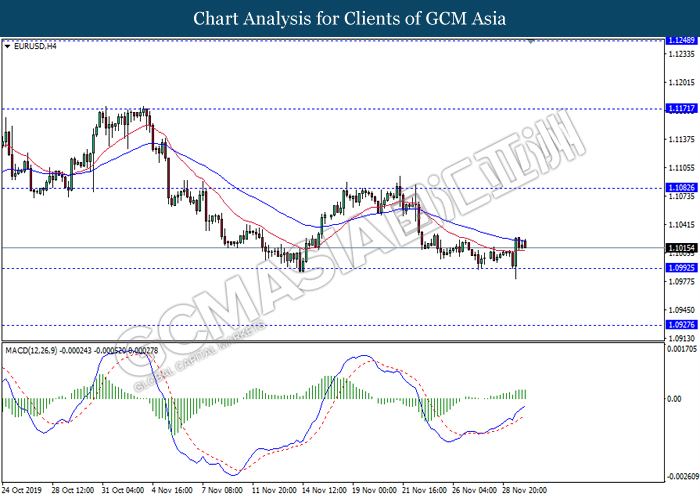

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.0990. MACD which illustrate bullish momentum suggest the pair to extend its rebound towards the resistance level 1.1080.

Resistance level: 1.1080, 1.1170

Support level: 1.0990, 1.0925

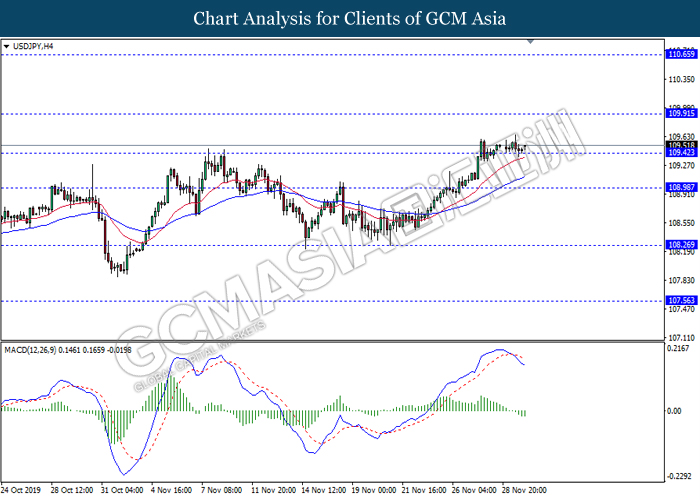

USDJPY, H4: USDJPY was traded flat near the support level 109.40. However, MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to be traded lower after it breaks below the support level.

Resistance level: 109.90, 110.65

Support level: 109.40, 109.00

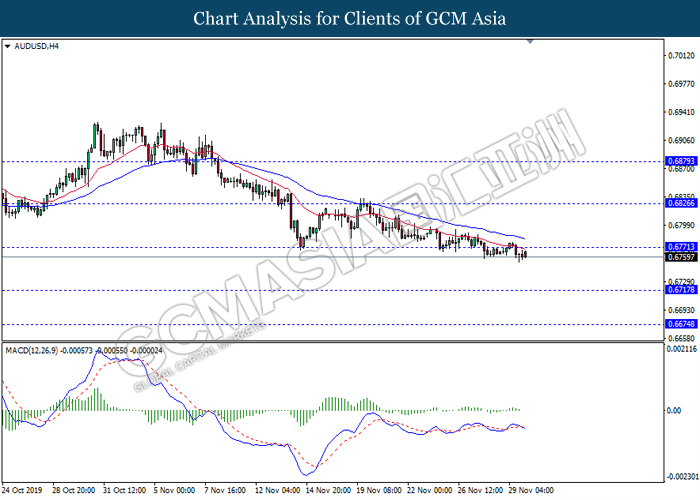

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the support level 0.6770. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6770, 0.6825

Support level: 0.6720, 0.6675

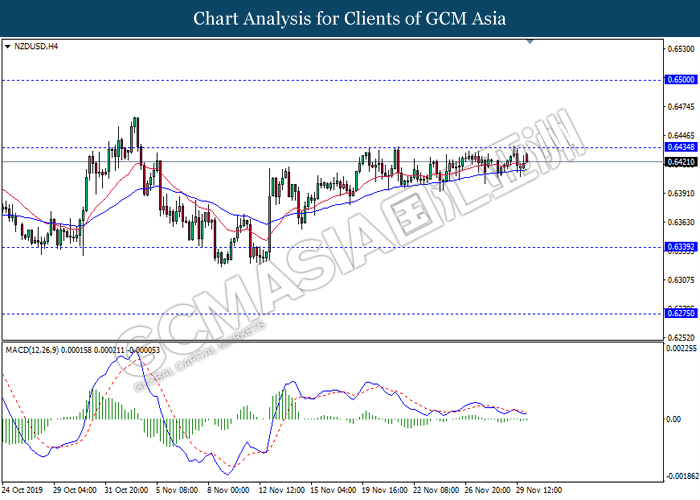

NZDUSD, H4: NZDUSD was traded flat near the resistance level 0.6435. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded higher after it breaks above the resistance level.

Resistance level: 0.6435, 0.6500

Support level: 0.6340, 0.6275

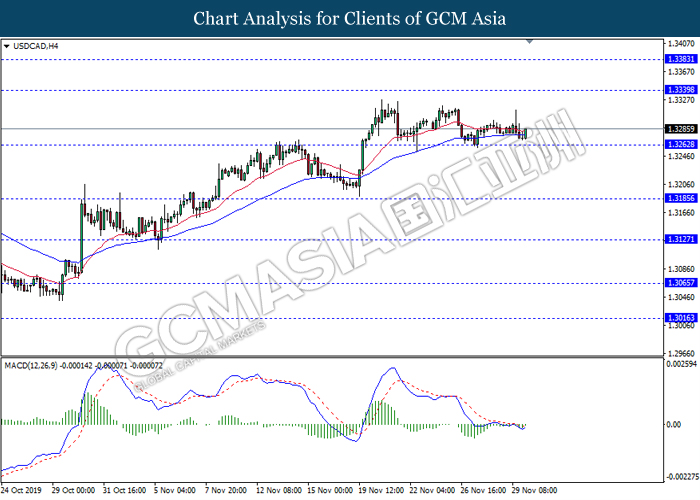

USDCAD, H4: USDCAD was traded flat near the support level 1.3260. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher towards the resistance level 1.3340.

Resistance level: 1.3340, 1.3385

Support level: 1.3260, 1.3185

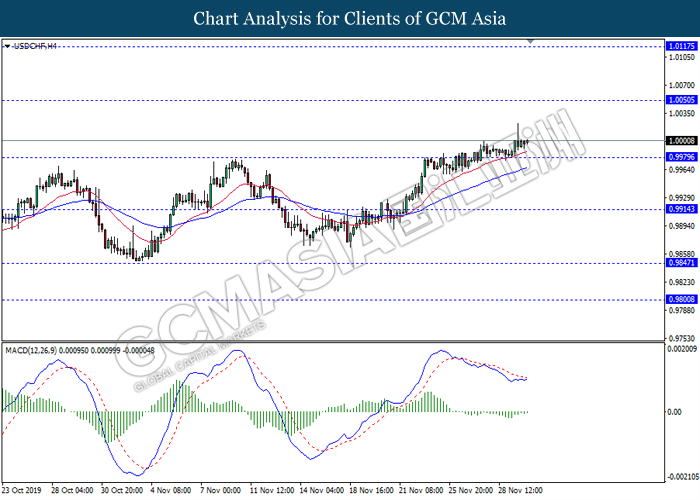

USDCHF, H4: USDCHF was traded higher following recent rebound from the support level 0.9980. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.0050.

Resistance level: 1.0050, 1.0115

Support level: 0.9980, 0.9915

CrudeOIL, H4: Crude oil price was lower following prior breakout below the support level 56.30. MACD which illustrate bearish momentum signal suggest the commodity to extend its losses towards the support level 54.85.

Resistance level: 56.30, 57.50

Support level: 54.85, 53.85

GOLD_, H4: Gold price was traded higher while currently testing near the resistance level 1463.70. However, MACD which illustrate bullish momentum signal suggest the commodity to experience a technical correction towards the support level 1447.05.

Resistance level: 1463.70, 1477.90

Support level: 1447.05, 1429.50