4 December 2019 Morning Session Analysis

Greenback remains hammered amid trade delay hint.

Dollar index have fall against a basket of six major currency pairs at early Asian session following a potential hint from U.S President Donald Trump on trade delay. According to the latest development, U.S President Donald Trump have stated to the reporters that a trade deal may need to wait until after the 2020 election, which is a contradicting to reports over the last two weeks. At the same time, he also mention at a press conference with Canadian Prime Minister Justin Trudeau that Beijing wants to make a deal. With the latest tariff is going to kick in near Dec 15 and no signs of positive progress in trade talk, the news splitting the confidence of investors, thus causing another major sell-off. Dollar index have slip 0.13% to 97.62 as of writing.

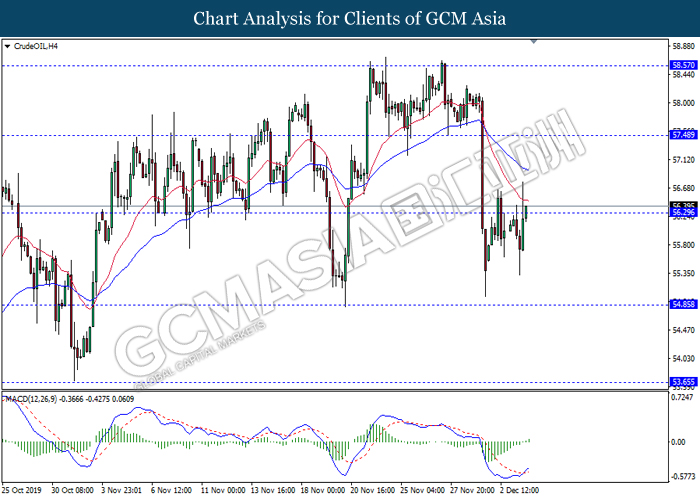

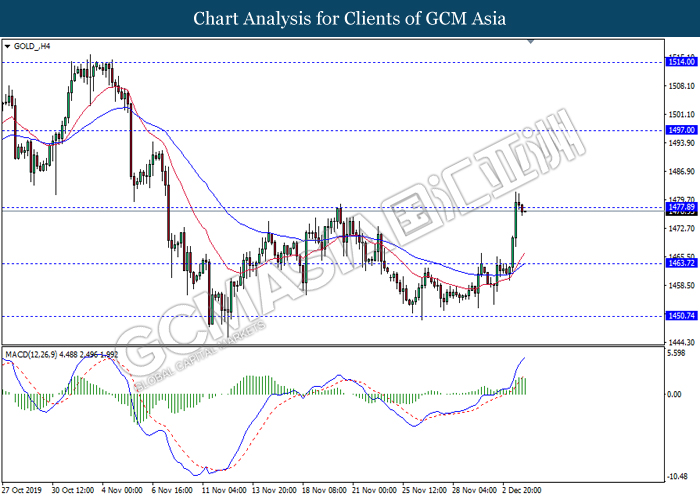

In the commodities market, crude oil price recovers and gains 0.21% to $56.36 per barrel as of writing following a decline in crude inventories. According to the reports from API, U.S crude stockpiles have dropped by 3.72M for the week ended at Nov 29. Besides that, recent sources revealed that the OPEC planned to replace its 1.2 million bpd cut plan to 1.6 million bpd cut for next year which help support the recovery for the commodity. On the other hand, gold price soars 0.16% to $1476.86 a troy ounce at the time of writing amid U.S President Donald Trump turn tables on China caused market to further sway away from riskier market and into safe-haven assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17.30 | GBP – Composite PMI (Nov) | 48.5 | 50.0 | – |

| 17.30 | GBP – Service PMI (Nov) | 48.6 | 50.0 | – |

| 21.15 | USD – ADP Nonfarm Employment Change (Nov) | 125K | 140K | – |

| 23.00 | USD – ISM Non-Manufacturing PMI | 54.7 | 54.5 | – |

| 23.30 | CrudeOIL – Crude Oil Inventories | 1.572M | -1.734M | – |

Technical Analysis

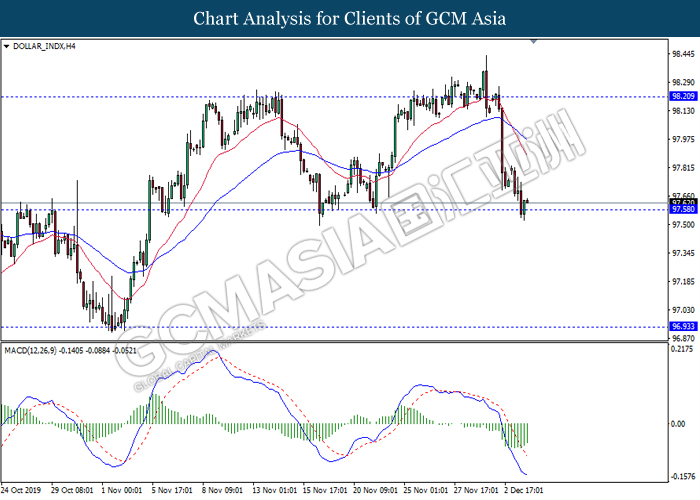

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 97.60. However, MACD which illustrate diminishing bearish momentum suggest the dollar to experience a technical correction towards the resistance level 98.20.

Resistance level: 98.20, 98.90

Support level: 97.60, 96.95

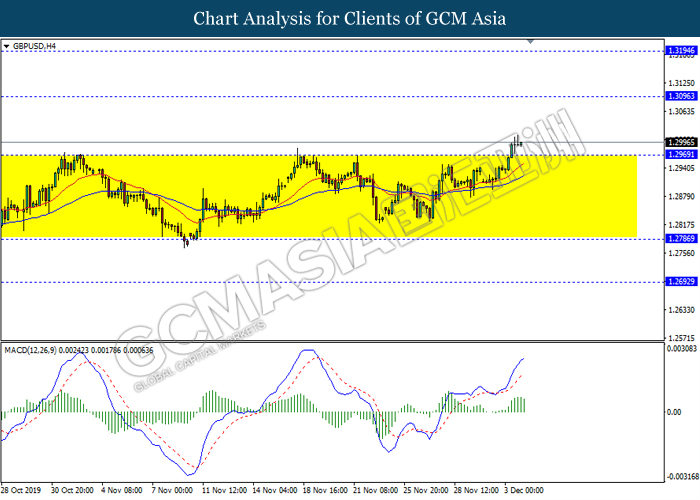

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level 1.2970. However, MACD which illustrate diminishing bullish momentum signal suggest the pair may experience a short term technical correction towards the current support level 1.2970.

Resistance level: 1.3095, 1.3195

Support level: 1.2970, 1.2785

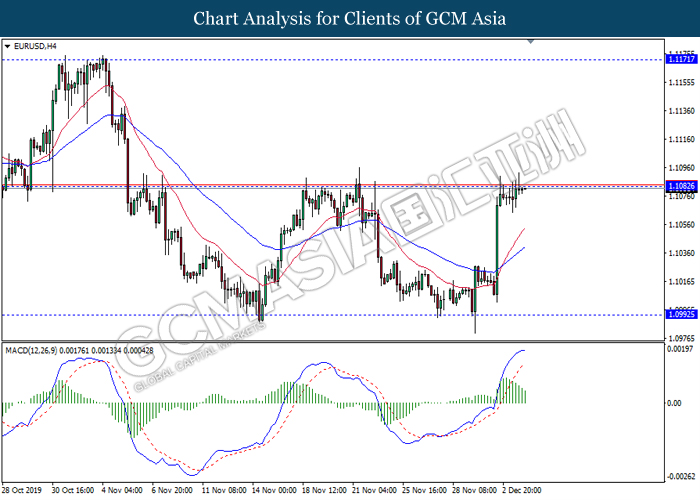

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level 1.1080. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower as a technical correction towards the support level 1.0990.

Resistance level: 1.1080, 1.1170

Support level: 1.0990, 1.0925

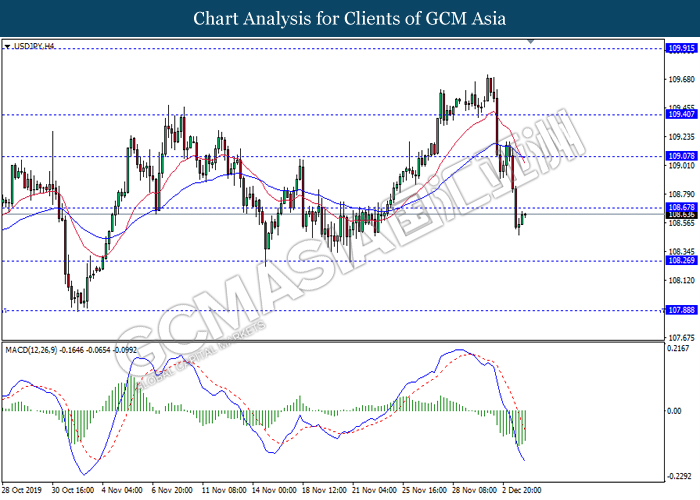

USDJPY, H4: USDJPY was traded higher while currently testing near the resistance level 108.65. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound after it breaks above the resistance level.

Resistance level: 108.65, 109.05

Support level: 108.25, 107.90

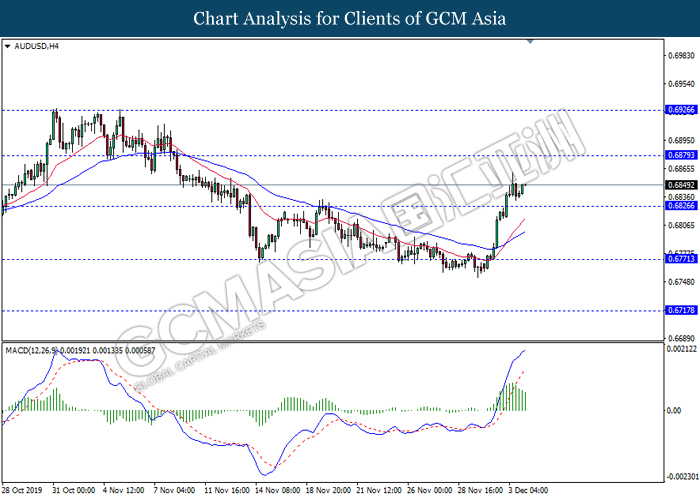

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level 0.6825. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to undergo a technical correction in short term towards the current support level 0.6825.

Resistance level: 0.6880, 0.6925

Support level: 0.6825, 0.6770

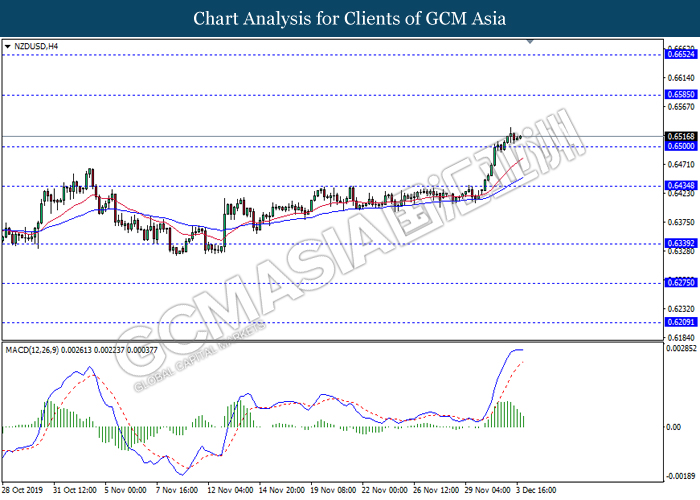

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level 0.6500. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a short term technical correction towards the current support level 0.6500.

Resistance level: 0.6585, 0.6650

Support level: 0.6500, 0.6435

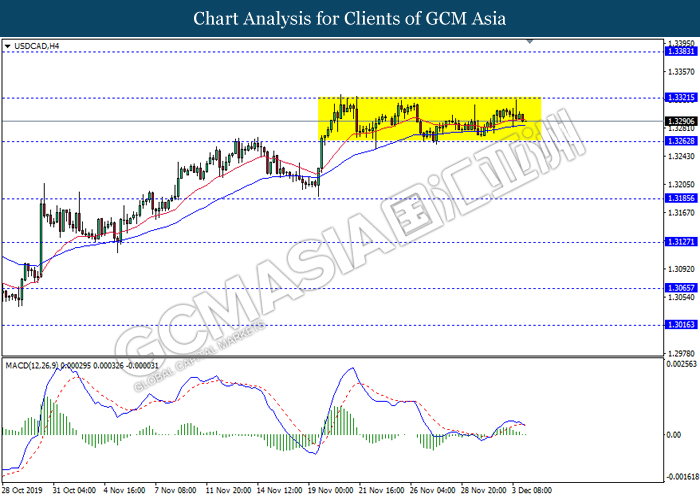

USDCAD, H4: USDCAD remain traded in a sideway channel. However, MACD which illustrate diminishing bullish momentum signal with the starting formation of death cross suggest the pair to be traded lower in short term towards the support level 1.3260.

Resistance level: 1.3320, 1.3385

Support level: 1.3260, 1.3185

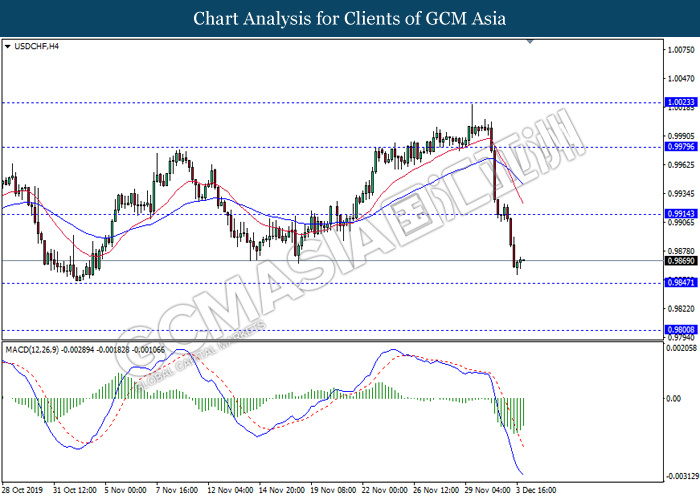

USDCHF, H4: USDCHF was traded lower while currently testing near the support level 0.9845. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to experience a technical correction towards the resistance level 0.9915.

Resistance level: 0.9915, 0.9980

Support level: 0.9845, 0.9800

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 56.30. MACD which illustrate bullish bias signal with the formation of golden cross suggest the commodity to be traded higher after it breaks above the resistance level.

Resistance level: 56.30, 57.50

Support level: 54.85, 53.85

GOLD_, H4: Gold price was traded higher while currently testing the resistance level 1477.90. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to experience a technical correction towards the support level 1463.70.

Resistance level: 1477.90, 1497.00

Support level: 1463.70, 1450.75