5 December 2019 Morning Session Analysis

Dollar remains low amid weak data, pound soars.

The dollar index which measured against a basket of six major currency pairs have dipped slightly during early Asian session on Thursday following disappointing figure from private payrolls and ongoing trade developments. According to Automatic Data Processing (ADP), private payrolls in the U.S have fell to a six month low in November with the reading of only 67K, missing economist forecast of 140K. Besides that, ISM Non-Manufacturing PMI also shown a weaker than expected reading of 53.9 against market forecast of 54.5. Therefore, market continue losing confidence towards the economic outlook in the U.S, causing the greenback to remain pressured. Moreover, ongoing development in trade war also caused deterioration in investor’s confidence as Wilbur Ross recent stated that if there is no deal or substantial progress in talks before Dec. 15, tariffs on remaining Chinese imports, including cell phones, laptop computers and toys, will take effect. Dollar index fell 0.14% to 97.52 as of writing. On the other hand, GBP/USD rose 0.09% to 1.3108 at the time of writing following the increasing expectation of election victory. According to various opinion polls, the results have consistently put Boris Johnson’s Tories ahead of the left-wing Labour Party by a margin of between 9 and 12 points which increased the expectation that the general election on Dec. 12th will return the Conservative Party to power with a healthy majority. Thus, the news triggered a huge demand for pound sterling.

In the commodities market, crude oil price settled up 0.17% to $58.42 per barrel as of writing amid a decline in oil stockpiles. According to the latest data by EIA, U.S. crude inventories fell by 4.86 million barrels for the week ended Nov. 29, compared with expectations for a drop of 1.73 million barrels. The data since have provided further confirmation on supply drop after recent release from API, thus, boosting further the demand for the black commodity. Next, gold price fell 0.05% to $1475.43 a troy ounce at the time of writing amid returned risk-on sentiment after U.S tout China to talk again despite President Donald Trump said a trade deal was unlikely until after 2020 a day earlier.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23.00 | CAD – Ivey PMI (Nov) | 48.2 | 53.8 | – |

Technical Analysis

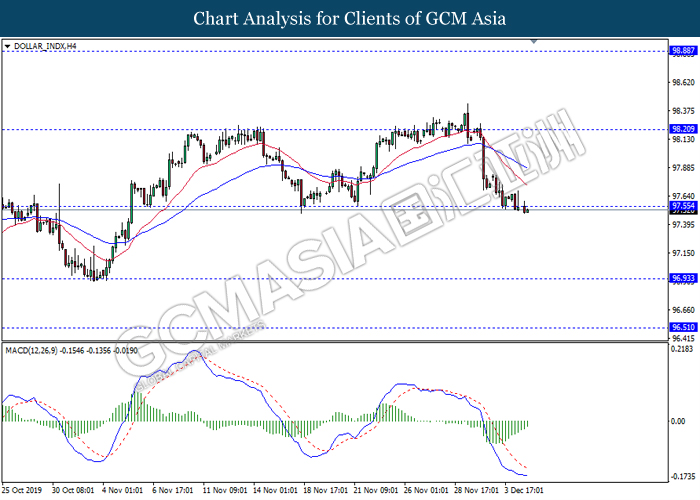

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 97.55. However, MACD which illustrate diminishing bearish momentum suggest the dollar to experience a technical correction towards the resistance level 98.20.

Resistance level: 98.20, 98.90

Support level: 97.55, 96.95

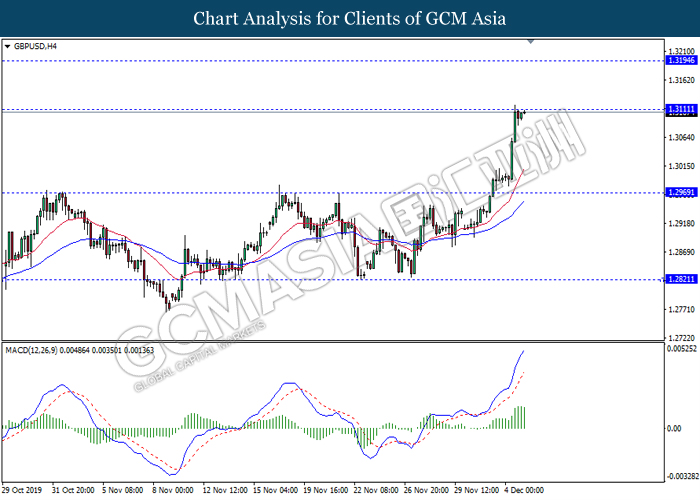

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level 1.3110. However, MACD which display diminishing bullish momentum suggest the pair to experience a technical correction towards the support level 1.2970.

Resistance level: 1.3110, 1.3195

Support level: 1.2970, 1.2820

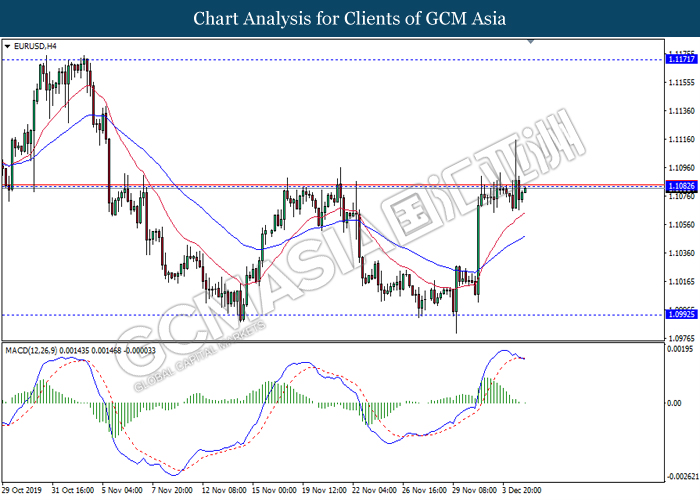

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level 1.1080. However, MACD which illustrate diminishing bullish momentum signal with the starting formation of death cross suggest the pair to be traded lower as a technical correction towards the support level 1.0990.

Resistance level: 1.1080, 1.1170

Support level: 1.0990, 1.0925

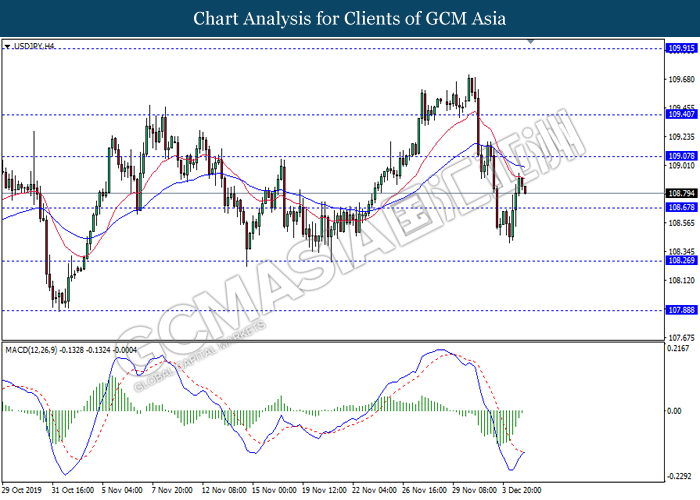

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level 108.65. MACD which illustrate bullish bias signal with the starting formation of golden cross suggest the pair to extend its gains towards the resistance level 109.05

Resistance level: 109.05, 109.40

Support level: 108.65, 108.25

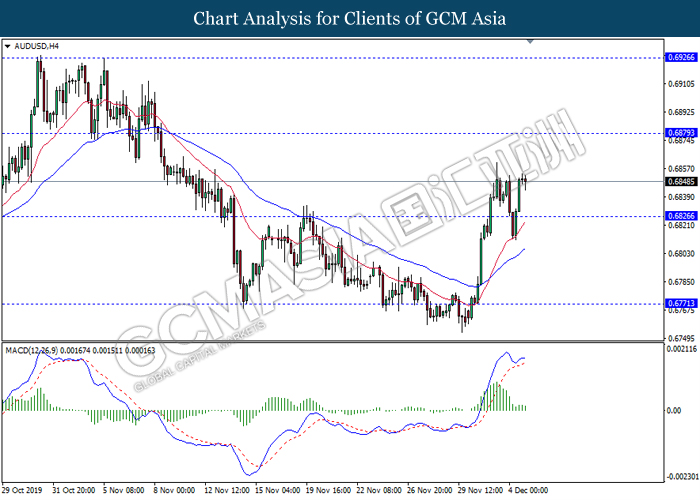

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.6825. However, MACD which display diminishing bullish momentum signal suggest the pair to be traded lower in short term towards back the support level 0.6825.

Resistance level: 0.6880, 0.6925

Support level: 0.6825, 0.6770

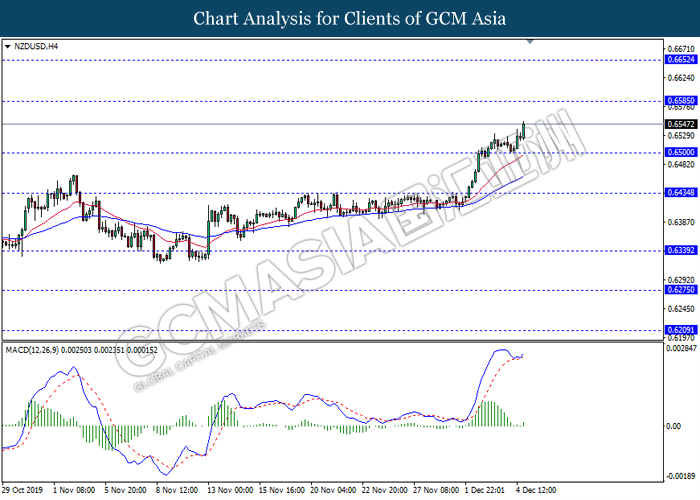

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6500. MACD which illustrate ongoing bullish momentum signal suggest the pair to extend its gains towards the resistance level 0.6585.

Resistance level: 0.6585, 0.6650

Support level: 0.6500, 0.6435

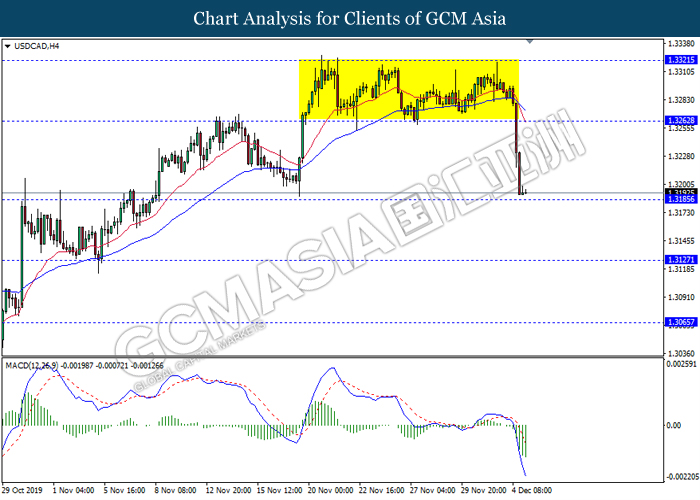

USDCAD, H4: USDCAD was traded lower while currently testing near the support level 1.3185. MACD which illustrate ongoing bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.3260, 1.3320

Support level: 1.3185, 1.3125

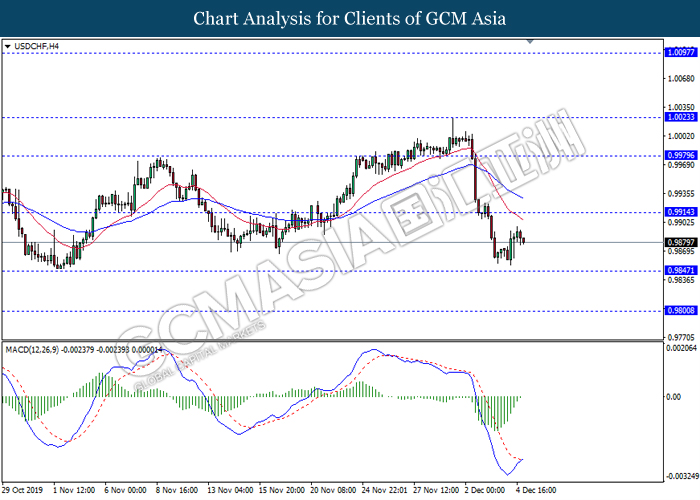

USDCHF, H4: USDCHF was traded higher following recent rebound from the support level 0.9845. MACD which illustrate diminishing bearish momentum with the starting formation of golden cross suggest the pair to extend its rebound towards the resistance level 0.9915.

Resistance level: 0.9915, 0.9980

Support level: 0.9845, 0.9800

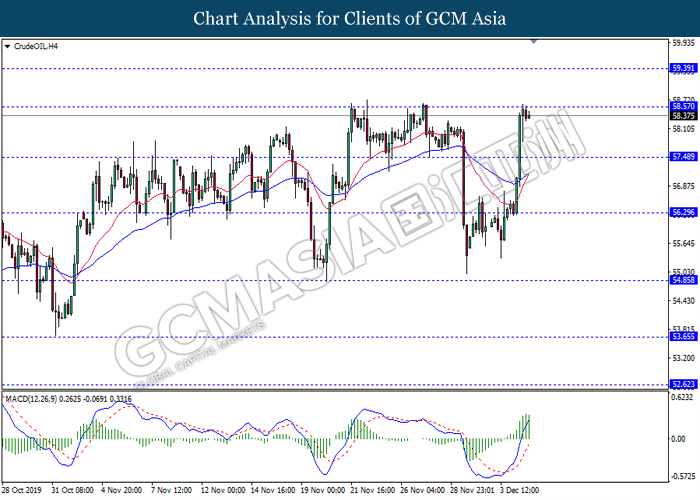

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the resistance level 58.55. However, MACD which illustrate diminishing bullish momentum suggest the commodity to experience a short term technical correction towards the support level 57.50

Resistance level: 58.55, 59.40

Support level: 57.50, 56.30

GOLD_, H4: Gold price was traded lower following prior retracement back below the resistance level 1477.90. MACD which illustrate bearish bias signal with the starting formation of death cross suggest the commodity to extend its retracement towards the support level 1463.70

Resistance level: 1477.90, 1497.00

Support level: 1463.70, 1450.75