08 November 2019 Afternoon Session Analysis

Probability of further rate cut declined.

Dollar index which gauge its value against a basket of six major currencies eked out its previous losses, rose back to three weeks high level. Recent good news showed that US and China are closer to the truce of trade agreement, lifted up the possibility of achieving phase 1 trade deal within a short period. In consequence, easing of trade war has further assure that Federal Reserve (Fed) will cease their rate cut plan while remain its interest rate at 1.75%. According to the Fed Rate Monitor Tool, it shows that the probability of further rate cut has further dropped to 5.9% from previous 8.9% following the optimism news of trade deal from China and US. Moreover, market worries over the risk of slowing down in global growth has reduced as if trade deal can be resolved, performance of both global top economy bodies will turn resilient, and eventually driving the other countries economy upward. As of now, greenback rose 0.01% to 97.95. On the other side, the pair of AUD/USD plunged 0.27% to 0.6875 during Asian trading session amid Reserve Bank of Australia (RBA) withhold dovish tone toward the future growth prospect of Australia. Based on the RBA Monetary Policy Statement, RBA has slashed their GDP forecast from 2.75% to 2.5% for the year through June 2020 despite there is sign showing that Australian economy is gradually exiting out from economic downturn.

In the commodities market, crude oil price fall 0.33% to $56.80 per barrel despite recent news showed that China and US may reaching a deal soon. Crude oil market is still remain gloomy as rising of stockpile in US crude oil inventories continue to weigh on this black commodity. Besides, gold inched up 0.06% to $1468.70 a troy ounce after traders chose to take profit at the psychological price level near $1460.00.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21.30 | CAD – Employment Change | 53.7K | 15.9K | – |

| 23.00 | USD – Michigan Consumer Sentiment (Nov) | 95.5 | 95.9 | – |

| 02.00 (9th) | CrudeOIL – U.S. Baker Hughes Oil Rig Count | 691 | – | – |

Technical Analysis

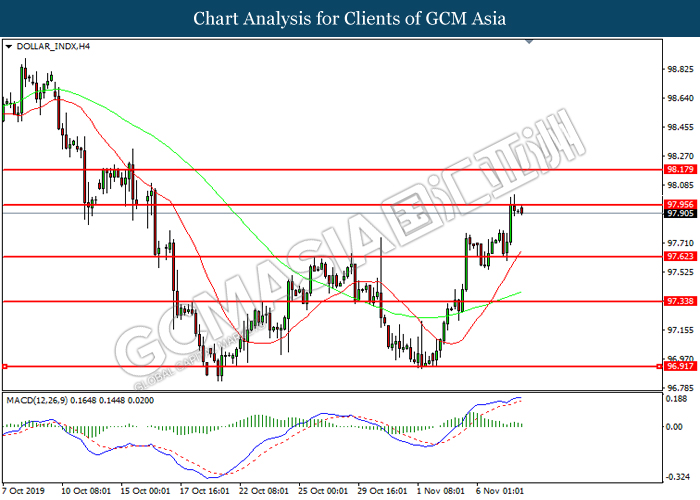

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 97.95. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 97.95, 98.20

Support level: 97.60, 97.35

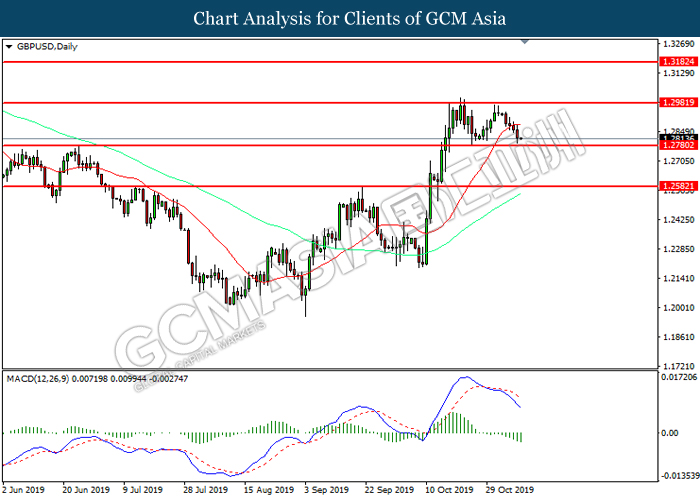

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.2980. MACD which illustrated increasing bearish momentum suggest the pair to be traded lower toward the support level at 1.2780.

Resistance level: 1.2980, 1.3180

Support level: 1.2780, 1.2580

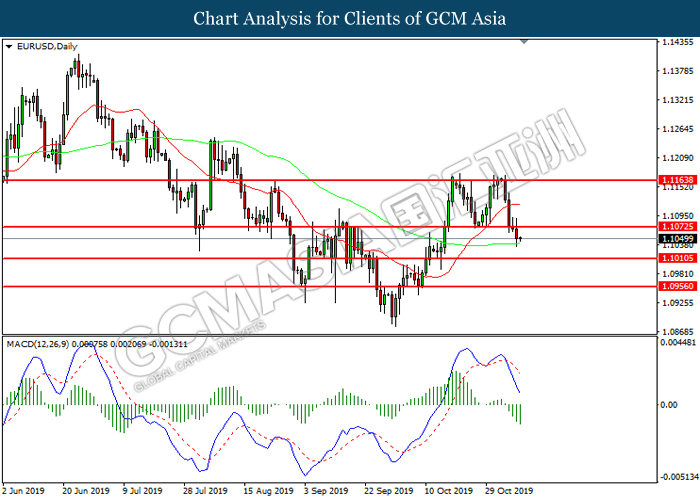

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support at 1.1075. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1010.

Resistance level: 1.1075, 1.1165

Support level: 1.1010, 1.0955

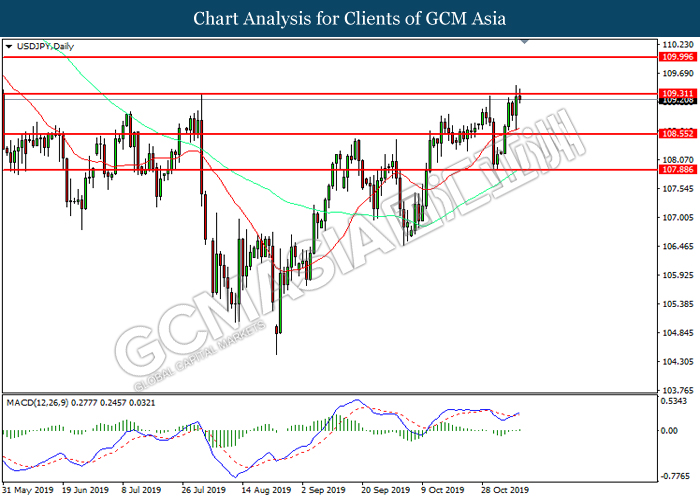

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 109.30. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.30, 110.00

Support level: 108.55, 107.90

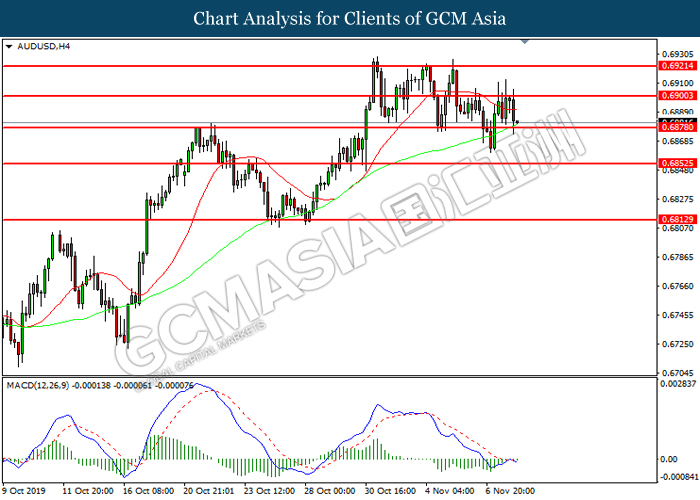

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6880. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6900, 0.6920

Support level: 0.6880, 0.6855

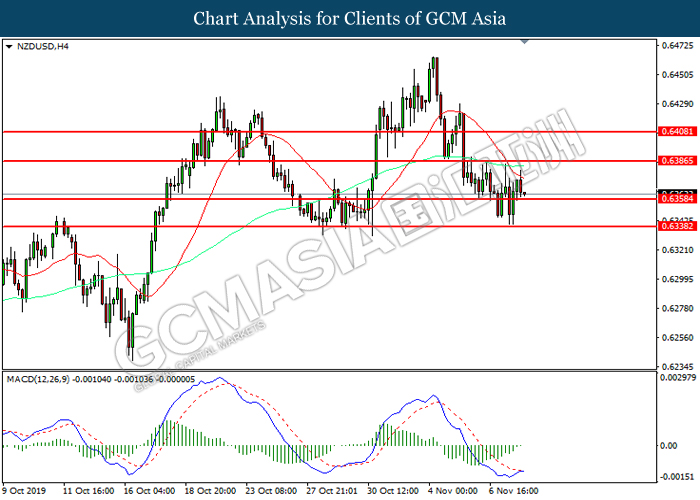

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6360. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6385, 0.6410

Support level: 0.6360, 0.6340

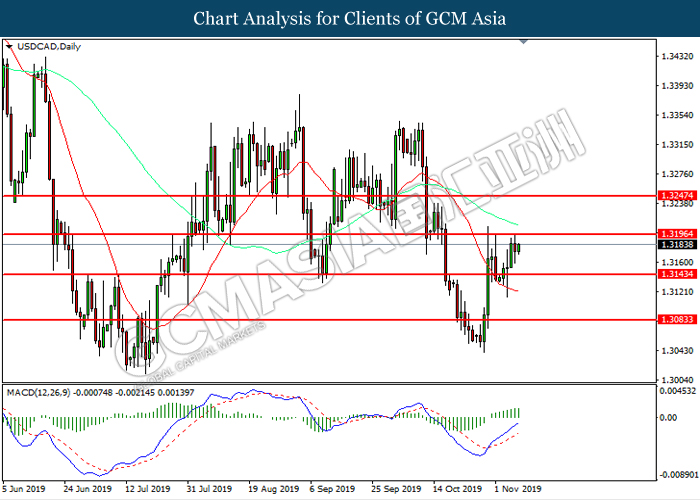

USDCAD, Daily: USDCAD was traded higher following prior rebound from the previous support level at 1.3145. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3195.

Resistance level: 1.3195, 1.3245

Support level: 1.3145, 1.3085

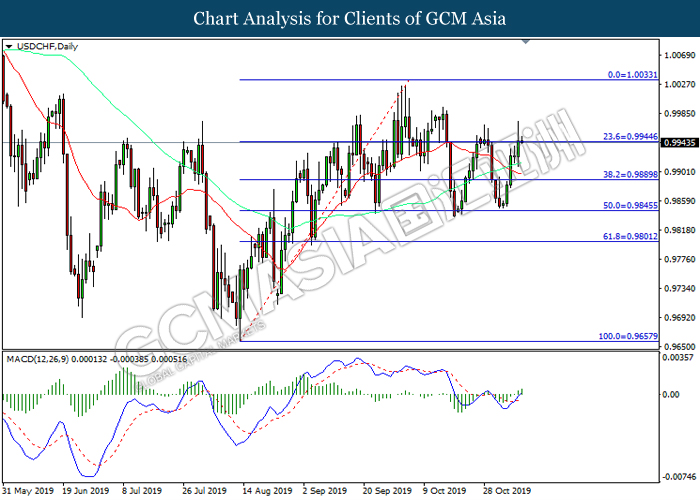

USDCHF, Daily: USDCHF was higher while currently testing the resistance level at 0.9945. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9945, 1.0035

Support level: 0.9890, 0.9845

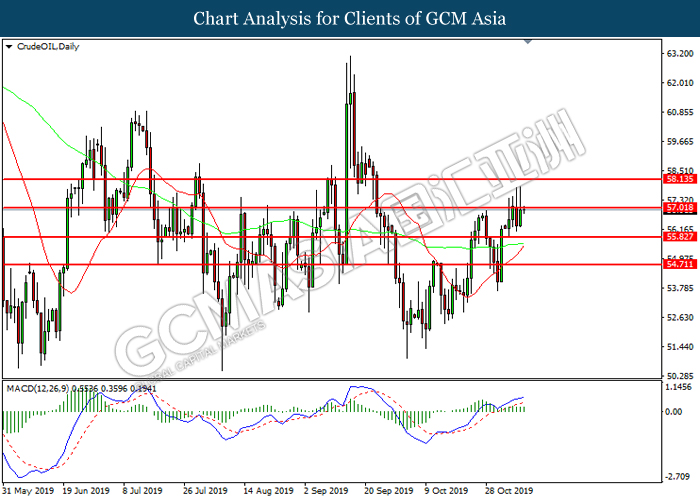

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 57.00. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 57.00, 58.15

Support level: 55.85, 54.70

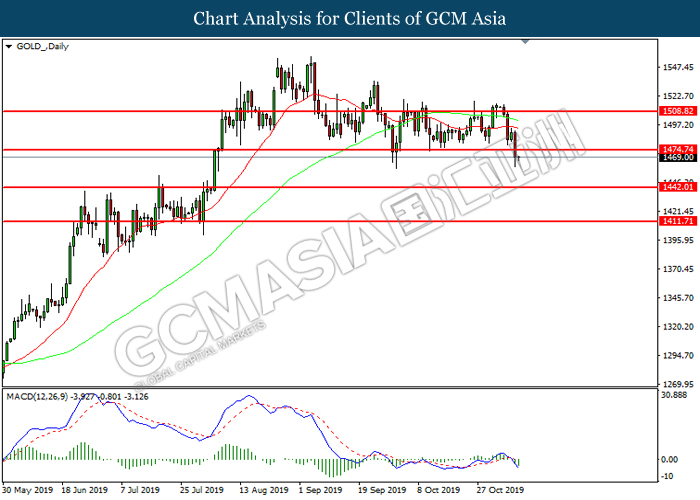

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1474.75. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward the support level at 1442.00.

Resistance level: 1474.75, 1508.80

Support level: 1442.00, 1411.70