8 November 2019 Morning Session Analysis

Dollar inches up on trade deal progress.

U.S dollar which traded against a basket of six major currency rivals have edge higher on early Asian session as market continue to cheer on progress of trade talk. According to the latest report, Chinese Commerce Minister Gao Feng stated that Beijing and Washington have agreed to phase out tariffs imposed during their 16-month-long trade war. Canceling tariffs is vital to the phase one trade agreement, which both sides have agreed to do as negotiation progress is made, he added. He also stated that the trade war started with tariffs and should end with the cancellation of tariffs. The ongoing positive progress of trade talk between both countries have increase hope that the two sides may sign a trade deal in the coming months, thus continue to help fuel to demand for the greenback. On the other hand, the pound sterling have suffered a huge sell-off after BoE interest rate decision. The Bank of England left its key rate unchanged at 0.75% on Thursday, but cut its growth forecasts which expecting the U.K. to grow at half of the rate of 2018 due to slowing growth across the globe and the prolonged uncertainty over Brexit. The bank also hinted that it may cut interest rates soon if that uncertainty continues to depress output. At the time of writing, dollar index soars 0.18% to 97.91 while GBP/USD fell 0.04% to 1.2815.

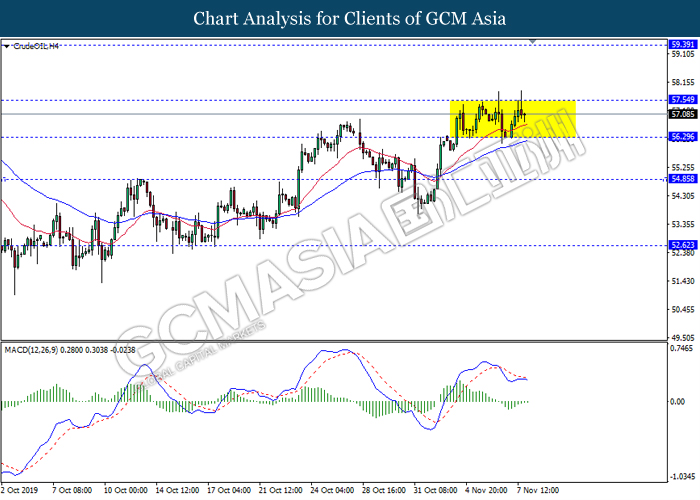

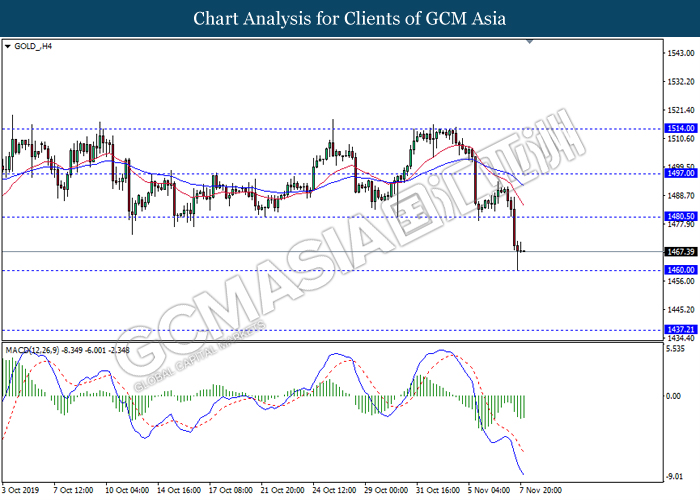

In the commodities market, crude oil price rose 0.09% to $57.05 per barrel at the time of writing following positive progress between U.S and China. As Chinese Commerce Minister Gao Feng said earlier on Thursday that Beijing and Washington have agreed to phase out their more than a yearlong of tariffs, the better headline have created an underlying support for the commodity. On the other hand, gold price plummeted 0.15% to $1467.53 a troy ounce as of writing amid increasing risk-appetite in the market due to Chinese Commerce Minister Gao Feng’s remarks.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21.30 | CAD – Employment Change | 53.7K | 15.9K | – |

| 23.00 | USD – Michigan Consumer Sentiment (Nov) | 95.5 | 95.9 | – |

| 02.00 (9th) | CrudeOIL – U.S. Baker Hughes Oil Rig Count | 691 | – | – |

Technical Analysis

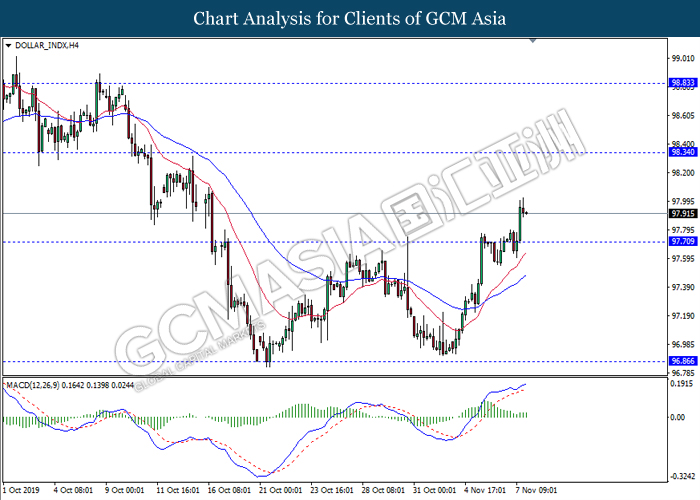

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level 97.70. However, MACD which illustrate diminishing bullish momentum suggest the dollar to experience a technical correction in short term towards the support level 97.70.

Resistance level: 98.35, 98.85

Support level: 97.70, 96.85

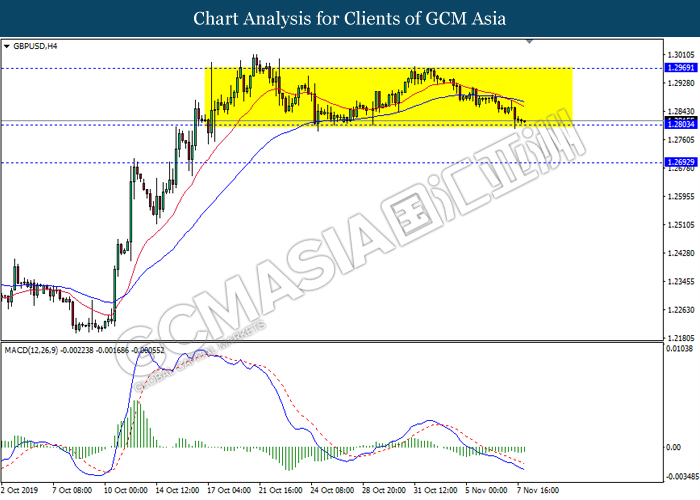

GBPUSD, H4: GBPUSD remain traded in a sideway channel while currently testing near the support level 1.2805. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher in short term as a technical correction towards the resistance level 1.2970.

Resistance level: 1.2970, 1.3095

Support level: 1.2805, 1.2690

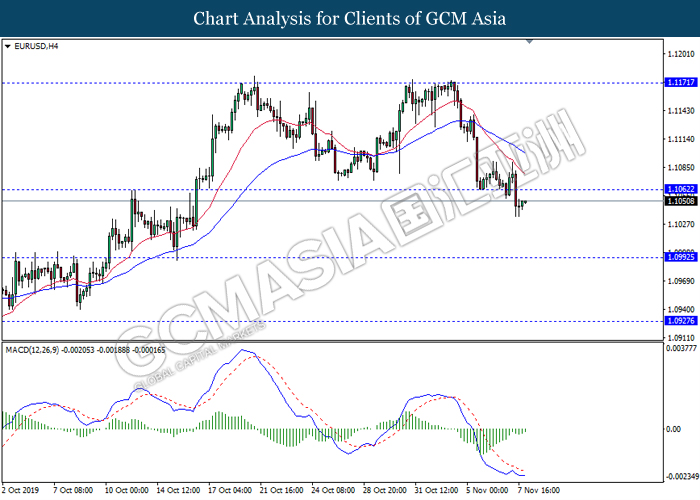

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level 1.1060. However, MACD which illustrate diminishing bearish bias signal suggest the pair to undergo a technical correction in short term towards the current resistance level 1.1060.

Resistance level: 1.1060, 1.1170

Support level: 1.0990, 1.0925

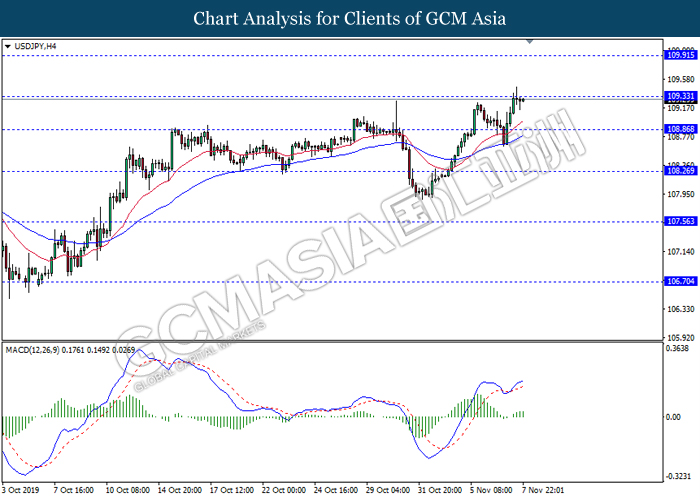

USDJPY, H4: USDJPY was traded higher while currently testing near the resistance level 109.35. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower in short term as a technical correction towards the support level 108.85.

Resistance level: 109.35, 109.90

Support level: 108.85, 108.25

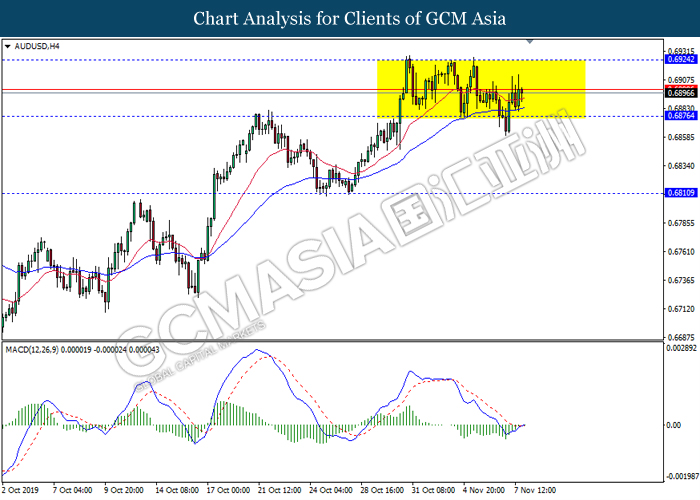

AUDUSD, H4: AUDUSD remain traded a sideway channel following recent rebound from the support level 0.6875. However, MACD which illustrate bullish bias signal with the starting formation of golden cross suggest the pair to extend its rebound in short term towards the resistance level 0.6925.

Resistance level: 0.6925, 0.6995

Support level: 0.6875, 0.6810

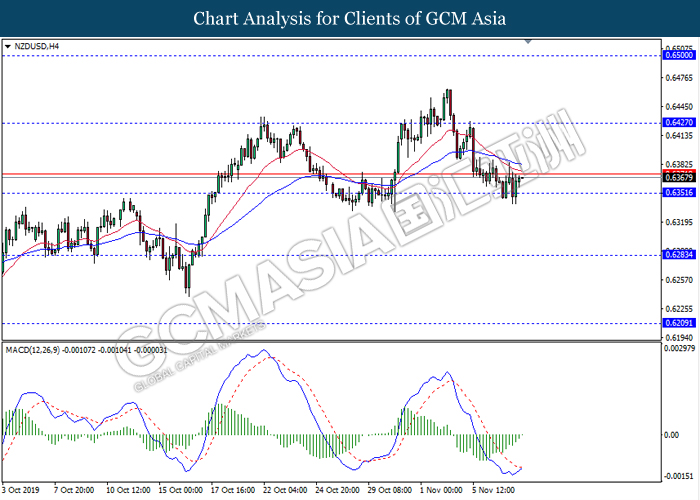

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6350. MACD which illustrate diminishing bearish momentum signal with the starting formation of golden cross suggest the pair to extend its rebound towards the resistance level 0.6425.

Resistance level: 0.6425, 0.6500

Support level: 0.6350, 0.6285

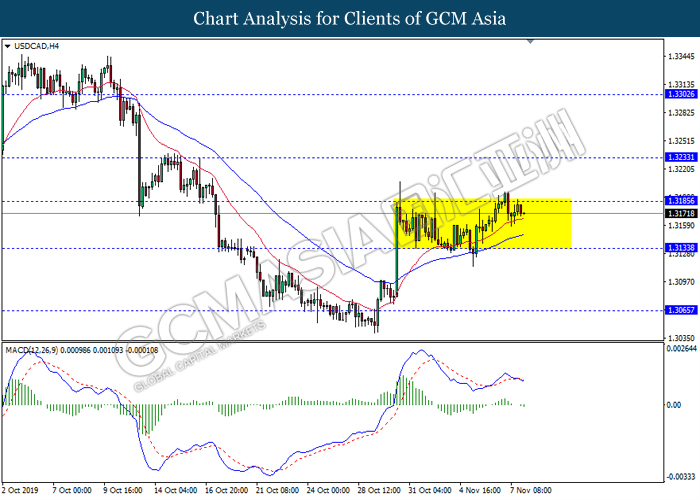

USDCAD, H4: USDCAD remain traded in a sideway channel following recent retracement from the resistance level 1.3185. However, MACD which display bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 1.3135.

Resistance level: 1.3185, 1.3235

Support level: 1.3135, 1.3065

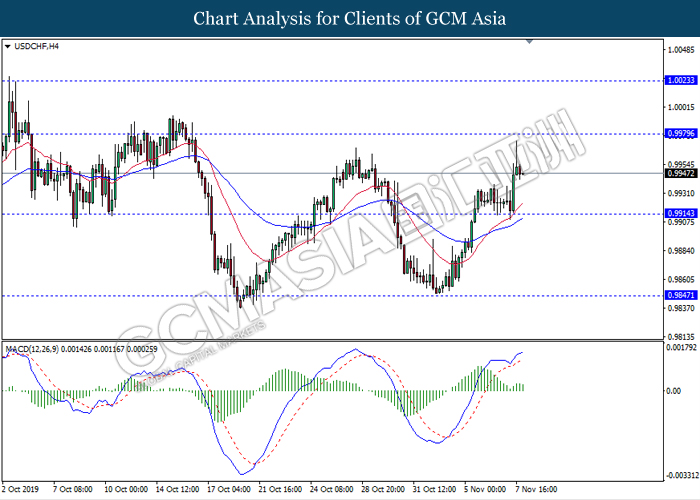

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level 0.9915. However, MACD which display diminishing bullish momentum signal suggest the pair to experience a short term technical correction towards the support level 0.9915.

Resistance level: 0.9980, 1.0025

Support level: 0.9915, 0.9845

CrudeOIL, H4: Crude oil price remain traded in a sideway channel following recent retracement from the resistance level 57.55. However, MACD which illustrate bearish bias signal suggest the commodity to extend its retracement in short term towards the support level 56.30.

Resistance level: 57.55, 59.40

Support level: 56.30, 54.85

GOLD_, H4: Gold price have traded lower following prior breakout below the previous support level 1480.50. MACD which illustrate ongoing bearish momentum suggest the commodity to extend its losses towards the support level 1460.00.

Resistance level: 1480.50, 1497.00

Support level: 1460.00, 1437.20