11 September 2019 Afternoon Session Analysis

USDCAD threads lower over positive Canadian data.

USDCAD thread lower over the backdrop of positive result for the Canada Housing data which have shown on Tuesday. According to Canada Mortgage and Housing Corporation, seasonally adjusted annualized rate of housing starts increased 1.9% from a month earlier to 226,639 units in August 2019, beating market expectations of 215,000. Moreover, the value of building permits in Canada rose 3% from a year earlier to CAD 9.3 billion in July, rebounding from a downwardly revised 3.1% fall in the previous month, beating market expectations of a 2.9 percent gain. In fact, these indicators in housing sector are very crucial to determine the economy conditions for the country, as they are closely related with consumer spending, labor, profits and overhead, which might additionally enhance the economy output. Therefore, higher reading than expectation give a positive expectation to the economic condition for the country, which further taken as bullish for CAD. On the other hand, AUD/USD tumble after the Australia Westpac Consumer Sentiment data released. According to Westpac Banking Corporation, the Westpac Consumer Sentiment Index have decreased -1.7% from the previous data of 3.6%. Since this data measures the change in the level of consumer confidence in economic activity, a poor result might indicate a poor prospect for economic condition in the Australia, which might further trigger AUD/USD to depreciate more. As of writing, USD/CAD tumbled 0.03% to 1.3143 while AUD/USD depreciates by 0.06% to 0.6854.

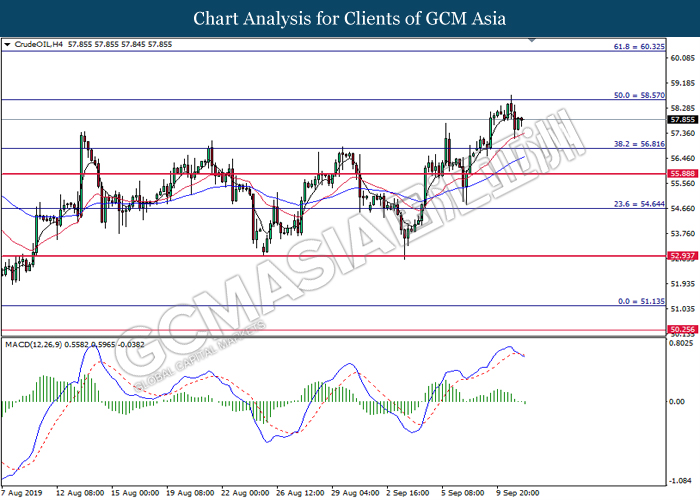

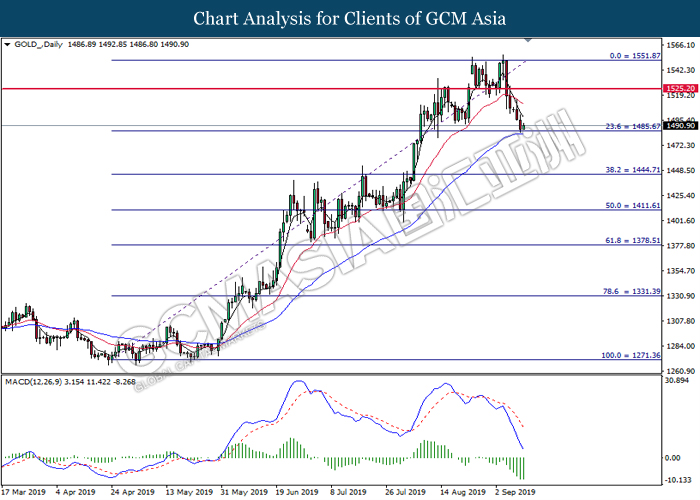

In the commodities market, crude oil slide 0.17% to 57.76 per barrel despite economic data showed a big drop in U.S oil inventories. On the other hand, gold price rose 0.39% to $1490.96 a troy ounce due to weaker US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19.00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20.30 | USD – PPI (MoM) (Aug) | 0.2% | 0.1% | – |

| 22.30 | CrudeOIL – Crude Oil Inventories | -4.771M | -2.600M | – |

Technical Analysis

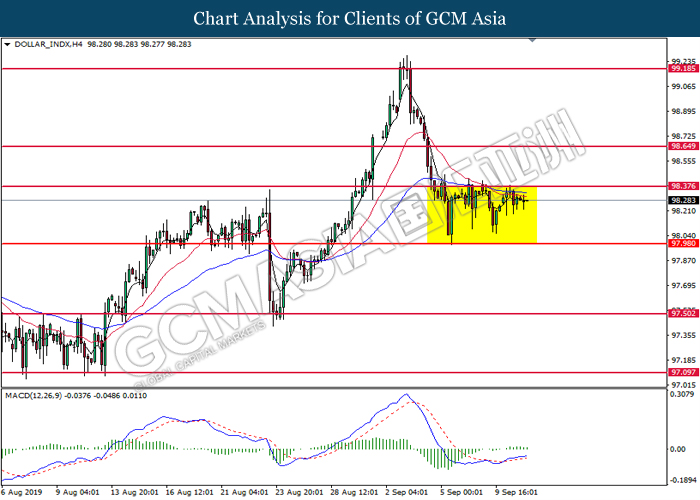

DOLLAR_INDX, H4: Dollar index remains traded within a sideways channel formation. MACD which illustrate diminished upward momentum suggests the index to be traded lower in short-term as technical correction.

Resistance level: 98.40, 98.65

Support level: 98.00, 97.50

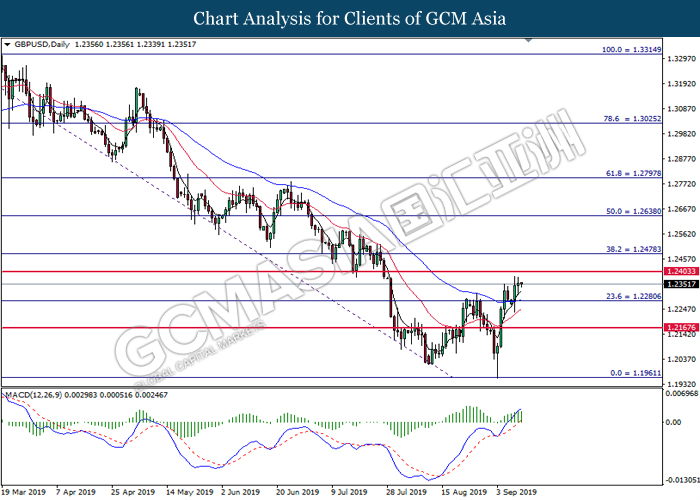

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2280. MACD which illustrate bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2405.

Resistance level: 1.2405, 1.2480

Support level: 1.2280, 1.2165

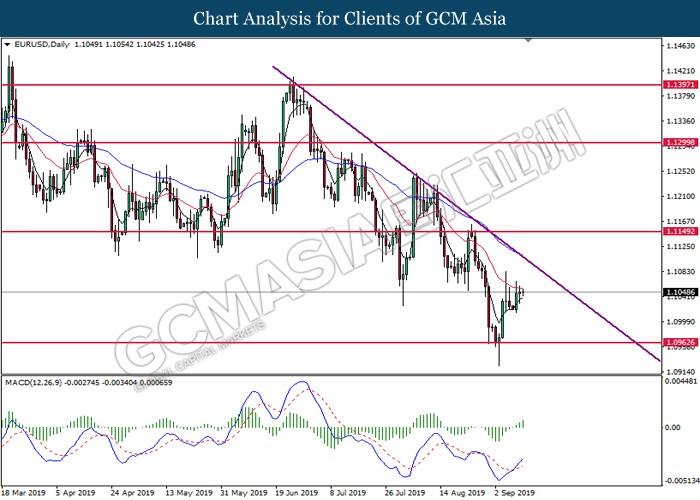

EURUSD, Daily: EURUSD was traded higher while currently testing the 20 moving average line (Red). MACD which illustrate bullish momentum suggest the pair to extend its gains after successfully breakout above the 20 moving average line (Red).

Resistance level: 1.1150, 1.1300

Support level: 1.0965, 1.0855

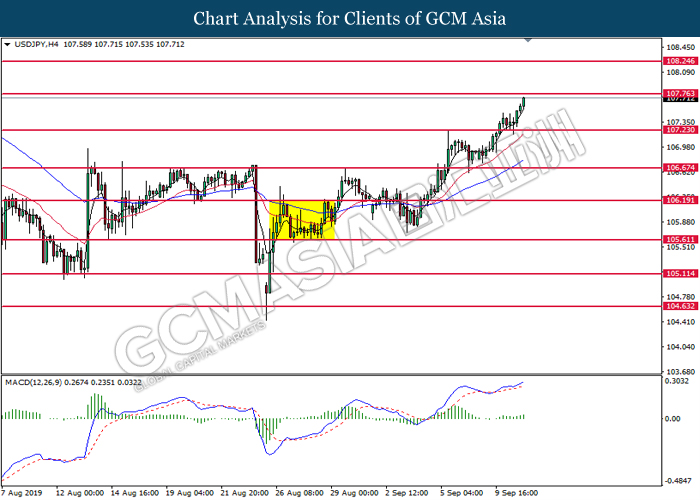

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 107.75. MACD which illustrate bullish momentum suggest the pair to extend its gains after successfully breakout above the resistance level at 107.75.

Resistance level: 107.75, 108.25

Support level: 107.25, 106.65

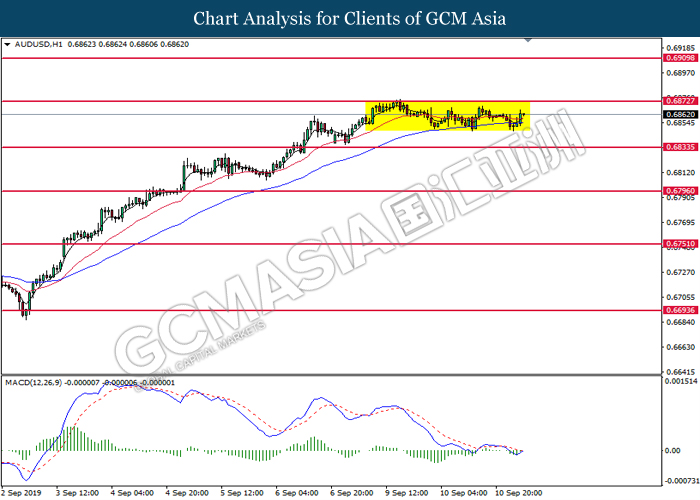

AUDUSD, H1: AUDUSD was traded higher following prior rebound from the 50 moving average line (Blue). MACD which illustrate bullish momentum and the formation of golden cross suggest the pair to extend its gains toward the resistance level at 0.6875.

Resistance level: 0.6875, 0.6910

Support level: 0.6835, 0.6795

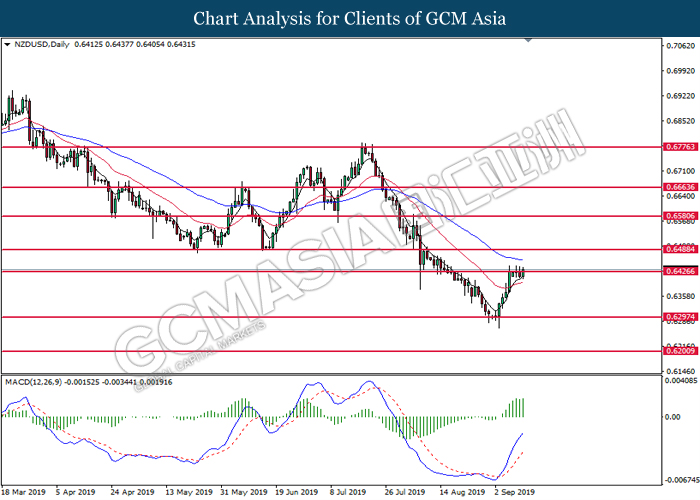

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6425. MACD which illustrate bullish bias momentum suggest the pair to extend its gains after successfully breakout above the resistance level at 0.6425.

Resistance level: 0.6425, 0.6490

Support level: 0.6295, 0.6200

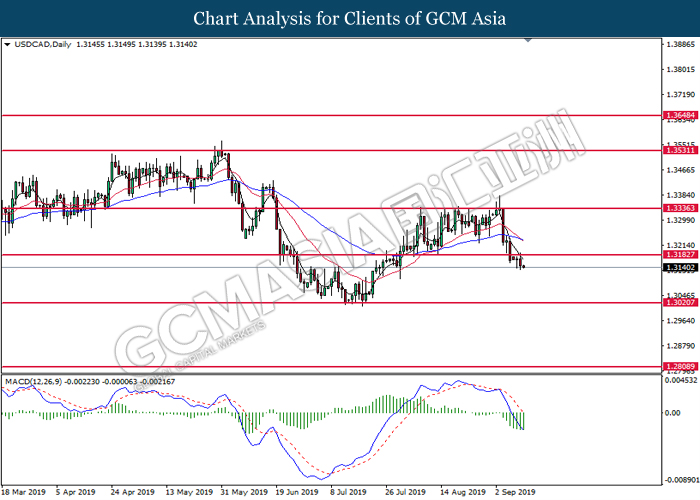

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3185. MACD which illustrate bearish momentum suggests the pair to extend its losses toward the support level at 1.3020.

Resistance level: 1.3185, 1.3335

Support level: 1.3020, 1.2810

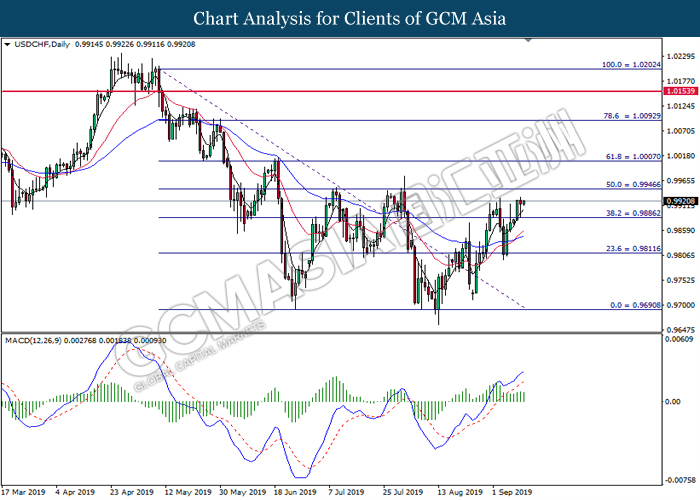

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9885. MACD which illustrate bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9945.

Resistance level: 0.9945, 1.0005

Support level: 0.9885, 0.9810

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 58.55. MACD which illustrate bearish momentum and the formation of death cross suggest its price to extend its losses toward the support level at 56.80.

Resistance level: 58.55, 60.35

Support level: 56.80, 55.90

GOLD_, Daily: Gold price was traded lower following while currently testing the support level at 1485.65. MACD which illustrate bearish bias momentum suggest its price to extend losses after it successfully breakout below the support level at 1485.65.

Resistance level: 1525.20, 1551.85

Support level: 1485.65, 1444.70