11 September 2019 Morning Session Analysis

Dollar slips following declining job openings.

Dollar index have fell against its basket of six major currency rivals as job openings in the U.S have fell for the second-straight month. According to the Labor Department, job openings have slipped by 31.000 to 7.2 million in July, which is also lesser than market expectation of 7.311M. As jobs data have showed to be weak with addition of last week of Non-Farm Payroll, market are now highly expecting the FED to cut interest rate by a quarter point this month as expectation have priced in at 92%, according to the Fed Rate Monitor Tool. The greenback fell 0.02% to 98.28 as of writing. On the other hand, GBP/USD gains further by 0.09% to 1.2355 at the time of writing following upbeat jobs data in U.K. According to National Statistics, UK’s average weekly earnings, including bonuses arrived at 4.0%, beating market expectation of 3.7%. At the same time, unemployment rate also ticked lower to 3.8% from 3.9%. The upbeat data recovered further the confidence of investors towards U.K economy and boosted the demand for the pound sterling. Despite that, market remains cautious and awaits for further catalyst as Brexit development continue to weigh in the market.

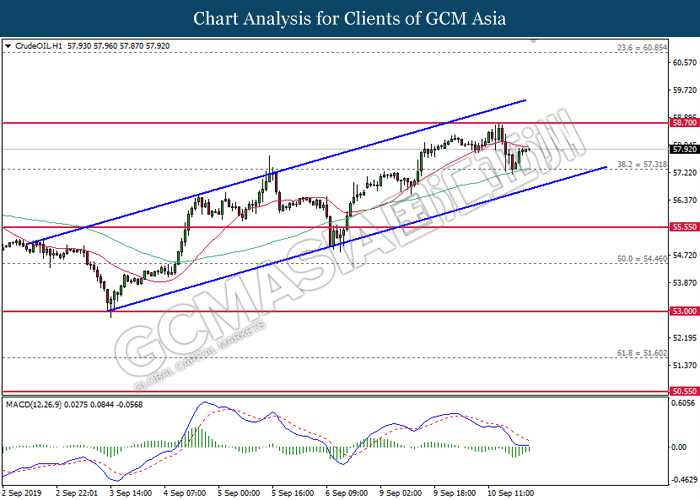

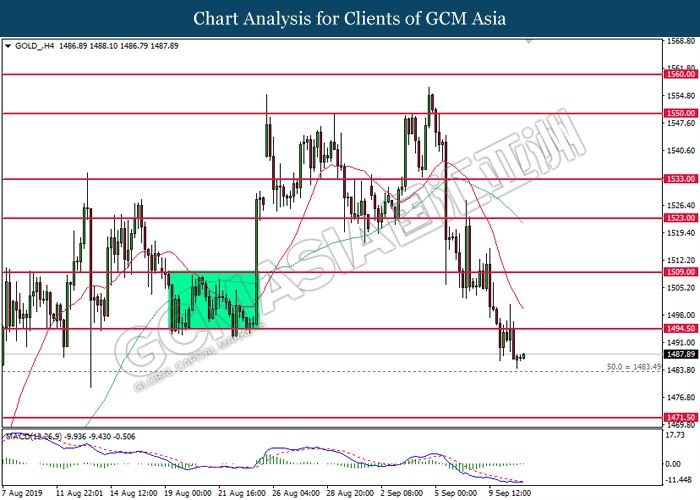

In the commodities market, crude oil price extend its climb by 0.09% to $57.94 per barrel at the time of writing, marking a fifth straight day of gains as market confidence continue to grow towards OPEC. According to recent reports, Saudi Arabia’s ne energy minister Prince Abdulaziz have reiterated a commitment to production cuts by OPEC and stated that the kingdom’s policy would not change and a global deal to cut oil production by 1.2 million barrels per day would be maintained. The statement have provide further bullish sentiment for the commodity, therefore pushing the price higher. Next, gold price recovers 0.16% to $1487.71 as of writing following a combination of weak data and unsettling words from China capped appetite for risk assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19.00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20.30 | USD – PPI (MoM) (Aug) | 0.2% | 0.1% | – |

| 22.30 | CrudeOIL – Crude Oil Inventories | -4.771M | -2.600M | – |

Technical Analysis

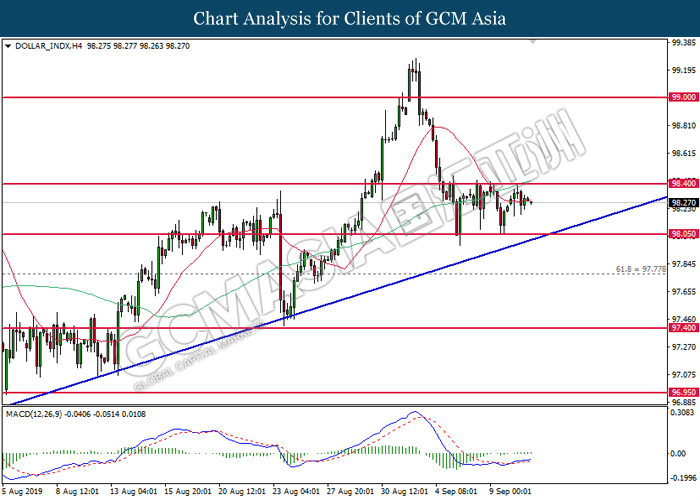

DOLLAR_INDX, H4: Dollar index remains traded within a sideways channel formation. MACD which illustrate diminished upward momentum suggests the index to be traded lower in short-term as technical correction.

Resistance level: 98.40, 99.00

Support level: 98.05, 97.80

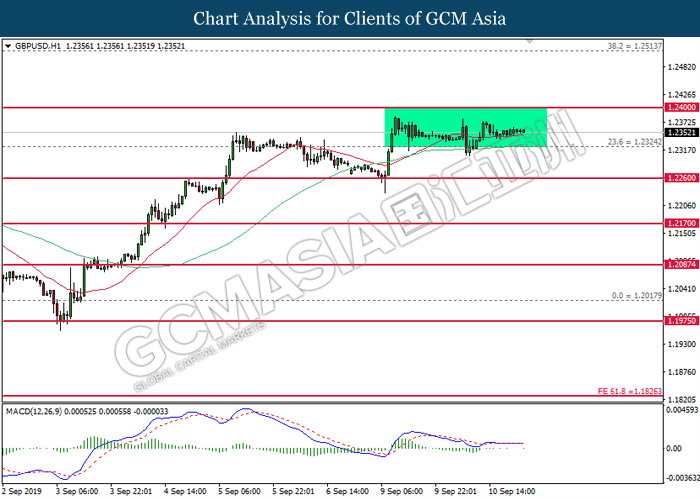

GBPUSD, H1: GBPUSD remains traded within a sideways channel formation. Due to the lack of signal from MACD and price action, it is suggested to wait for further signal before entering the market.

Resistance level: 1.2400, 1.2515

Support level: 1.2325, 1.2260

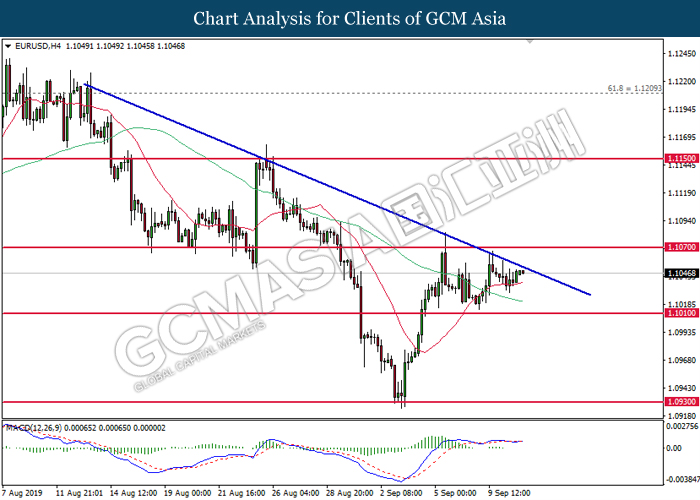

EURUSD, H4: EURUSD was traded higher while currently testing at the downward trendline. MACD which begins to form a bullish signal suggests the pair to extend its gains after breaking the trendline.

Resistance level: 1.1070, 1.1150

Support level: 1.1010, 1.0930

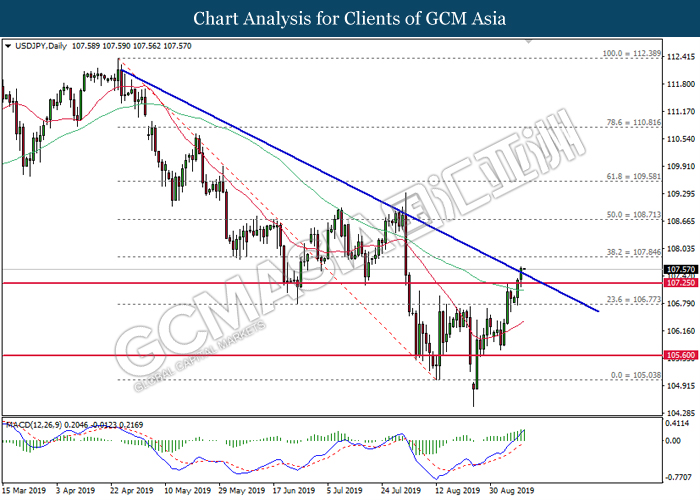

USDJPY, Daily: USDJPY was traded higher following prior breakout from the trendline. MACD which illustrate bullish signal suggest the pair to advance further up, towards the direction of 107.85.

Resistance level: 107.85, 108.70

Support level: 107.25, 106.80

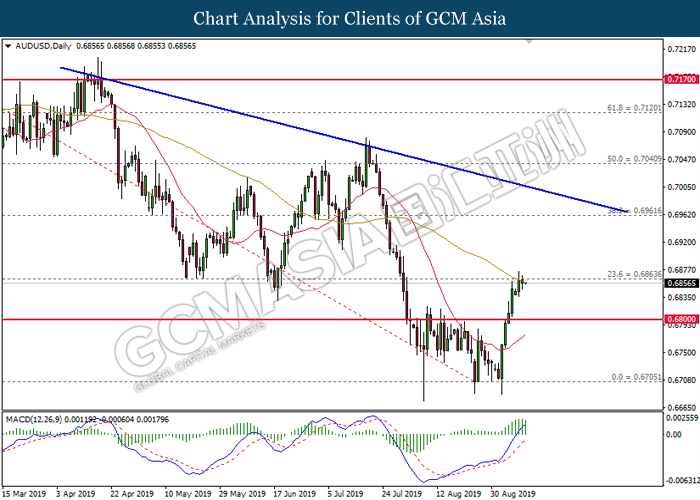

AUDUSD, Daily: AUDUSD was traded lower following prior retrace from 0.6865. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term.

Resistance level: 0.6865, 0.6960

Support level: 0.6800, 0.6705

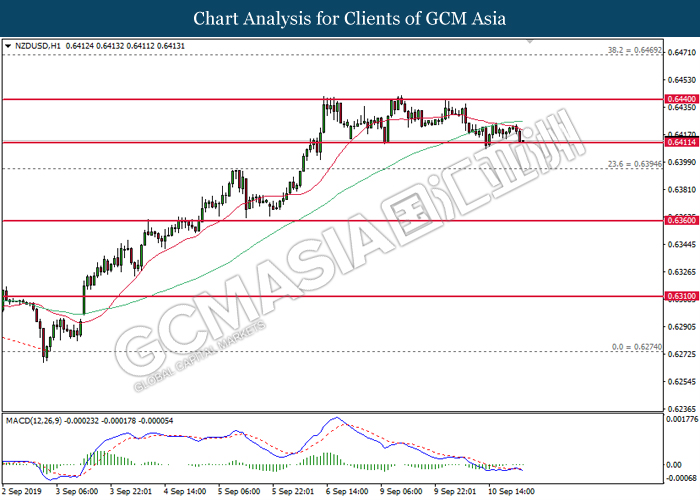

NZDUSD, H1: NZDUSD remains traded within a sideways channel while currently testing at the bottom level. Although MACD illustrate bearish signal, a break below is required to attain further confirmation.

Resistance level: 0.6440, 0.6470

Support level: 0.6410, 0.6395

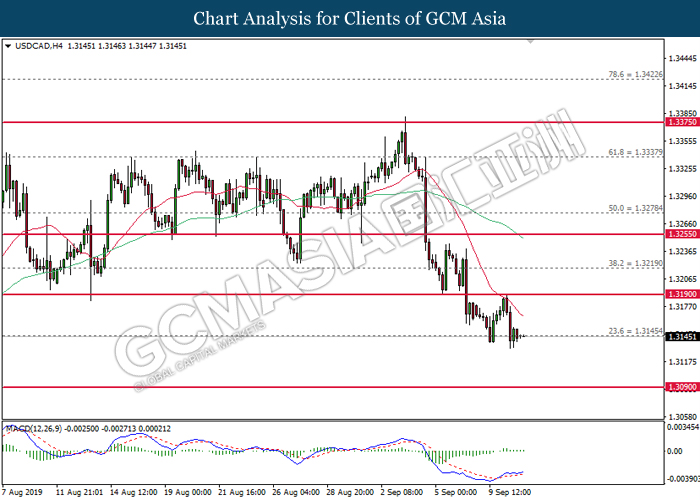

USDCAD, H4: USDCAD was traded lower while currently testing at the support of 1.3145. MACD which illustrate diminished upward momentum suggests the pair to extend its losses after breaking the support near 1.3145.

Resistance level: 1.3190, 1.3220

Support level: 1.3145, 1.3090

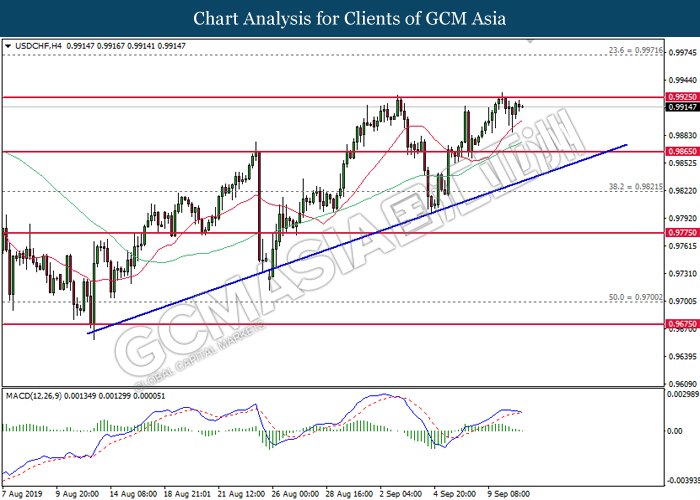

USDCHF, H4: USDCHF was traded lower following prior retrace from the resistance near 0.9925. MACD which begins to form a bearish signal suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9925, 0.9970

Support level: 0.9865, 0.9820

CrudeOIL, H1: Crude oil price remains traded within an ascending channel following prior rebound from the lower level. MACD which illustrate diminishing downward momentum suggests its price to be traded higher in short-term.

Resistance level: 58.70, 60.85

Support level: 57.30, 55.55

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1483.50. MACD which begins to form a bullish signal suggests its price to be traded higher in short-term as technical correction.

Resistance level: 1494.50, 1509.00

Support level: 1483.50, 1471.50