11 November 2019 Afternoon Session Analysis

Dollar held gains as market await more clarity.

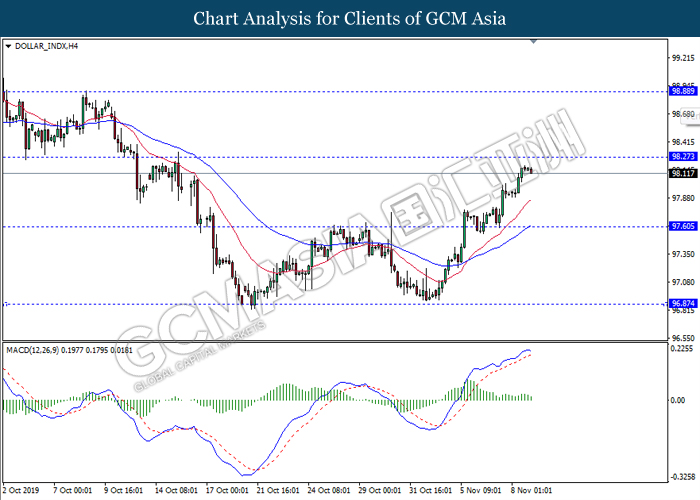

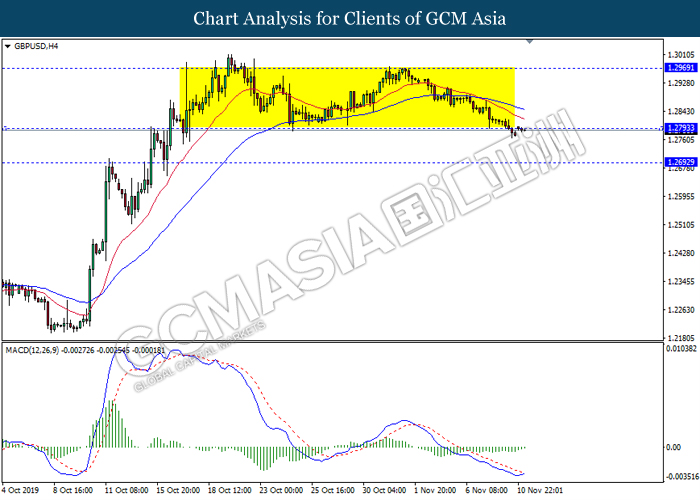

The dollar index which measured against a basket of six major currency pairs continue to hold its ground during late Asian session while investors are awaiting for further confirmation from U.S President Donald Trump and Fed Chairman Jerome Powell. Following recent fresh doubt from U.S over the progress of trade talk between U.S and China, investors are now awaiting for more clarification from Trump regarding the trade deal as U.S President Donald Trump is planned to give a speech at the Economic Club of New York on Tuesday. At the same time, investors will also be focusing on Powell speech later this week for further confirmation of its monetary plans. At the time of writing, dollar index rose 0.03% to 98.15. On the other hand, GBP/USD slips 0.05% to 1.2788 as of writing amid Brexit and uncertainty. Economy in U.K has lost its momentum this year and hurt by a global downturn due to the U.S.-China trade war as well as increased uncertainty over its exit from the European Union. Market will now awaiting for GDP data that is due to be release on Monday for further direction.

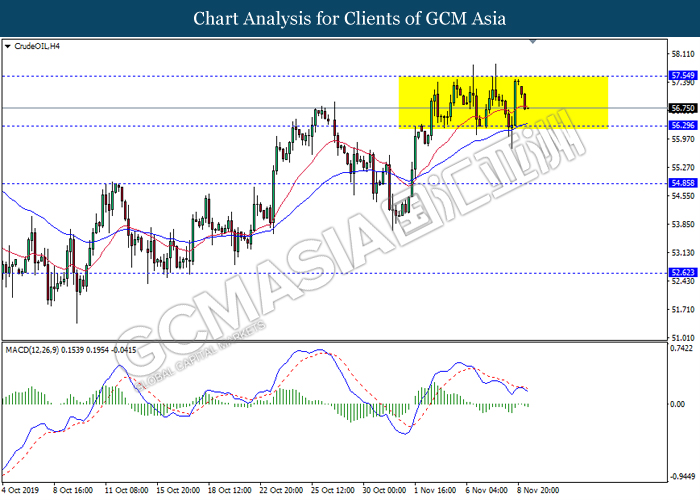

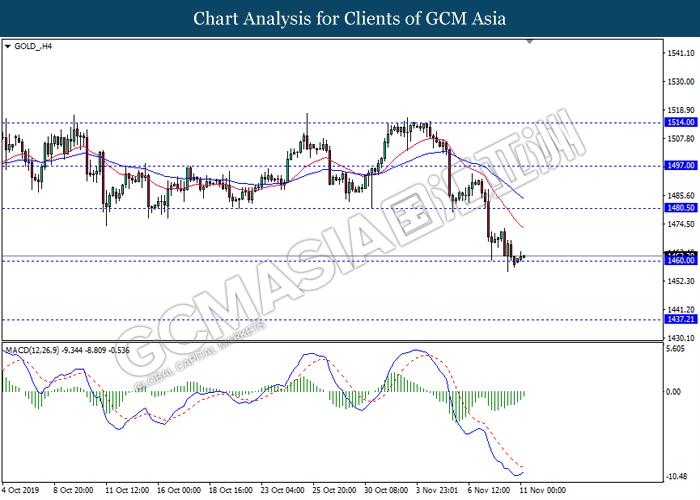

In the commodities market, crude oil price have fell 1.03% to $56.77 at the time of writing as uncertainty in trade deal have renewed investor’s caution in the market. Following the two biggest crude oil consumer as well as the biggest economies in the world, the ongoing trade war prompted analysts to lower forecasts for oil demand, raising concerns that a supply glut could develop in 2020. On the other hand, gold price recovers 0.34% to $1463.36 a troy ounce at the time of writing amid uncertainty in trade progress between U.S and China are currently fueling the demand for the safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – GDP (QoQ) (Q3) | -0.2% | 0.4% | – |

| 17:30 | GBP – Manufacturing Production (MoM) (Sep) | -0.7% | -0.3% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing near the resistance level 98.25. However, MACD which display diminishing bullish momentum signal suggest the dollar to experience a short term technical correction towards the support level 97.60.

Resistance level: 98.25, 98.90

Support level: 97.60, 96.85

GBPUSD, H4: GBPUSD remain traded in a sideway channel while currently testing the support level 1.2795. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher in short term as a technical correction towards the resistance level 1.2970.

Resistance level: 1.2970, 1.3095

Support level: 1.2795, 1.2690

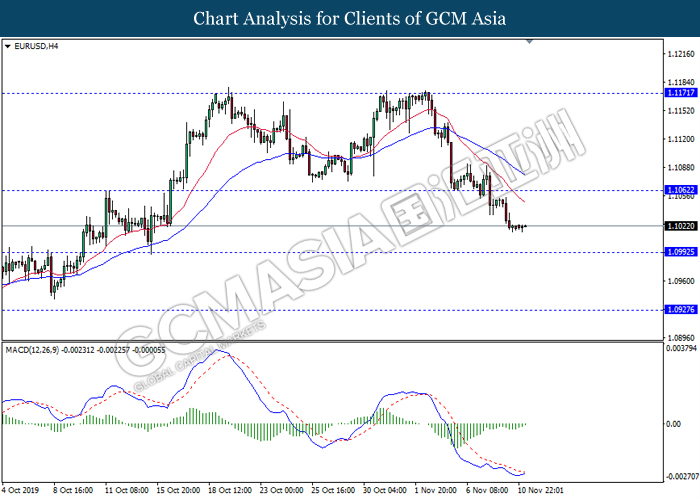

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level 1.1060. However, MACD which illustrate diminishing bearish bias signal suggest the pair to undergo a technical correction in short term towards the current resistance level 1.1060.

Resistance level: 1.1060, 1.1170

Support level: 1.0990, 1.0925

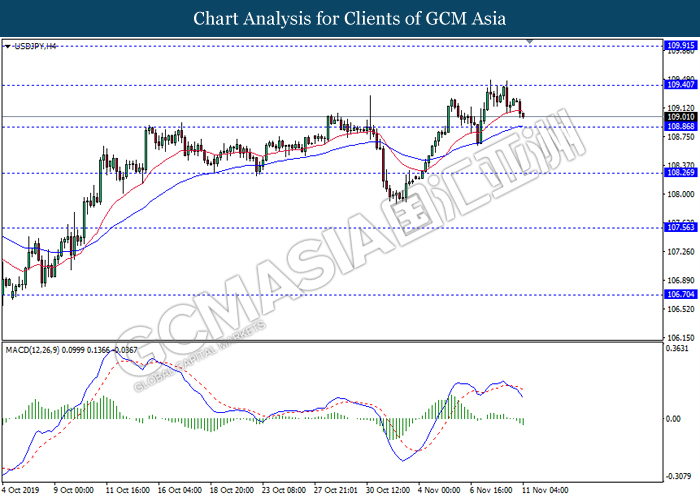

USDJPY, H4: USDJPY was traded lower while currently testing near the support level 108.85. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 109.40, 109.90

Support level: 108.85, 108.25

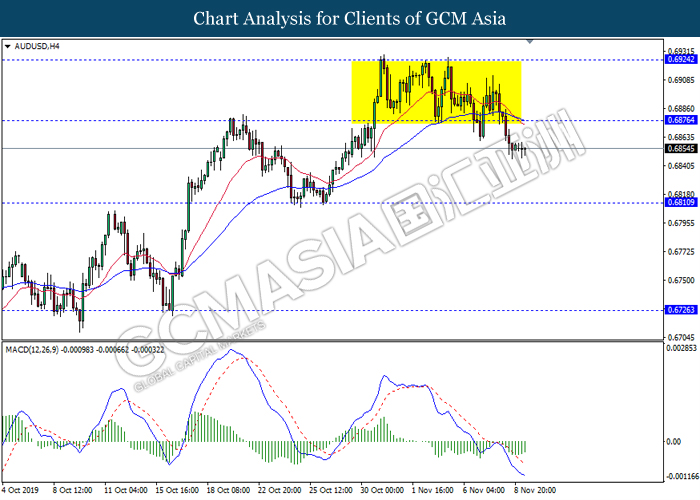

AUDUSD, H4: AUDUSD was traded flat after breakout below the previous support level 0.6875. However, MACD which illustrate diminishing bearish momentum suggest the pair may experience a technical correction in short term towards the current resistance level 0.6875.

Resistance level: 0.6875, 0.6925

Support level: 0.6810, 0.6725

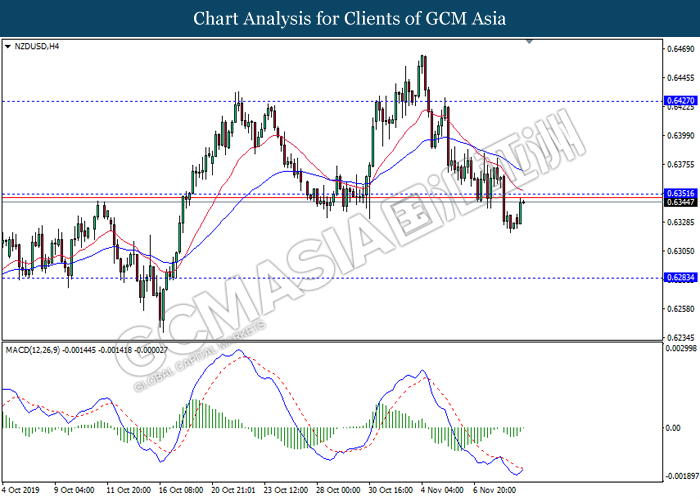

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6350. MACD which illustrate bullish bias signal with the starting formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.6350, 0.6425

Support level: 0.6285, 0.6210

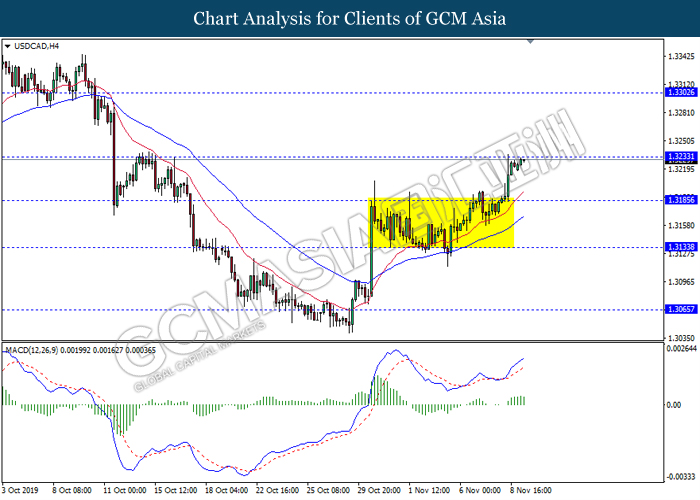

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level 1.3235. MACD which illustrate ongoing bullish bias signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 1.3235, 1.3300

Support level: 1.3185, 1.3135

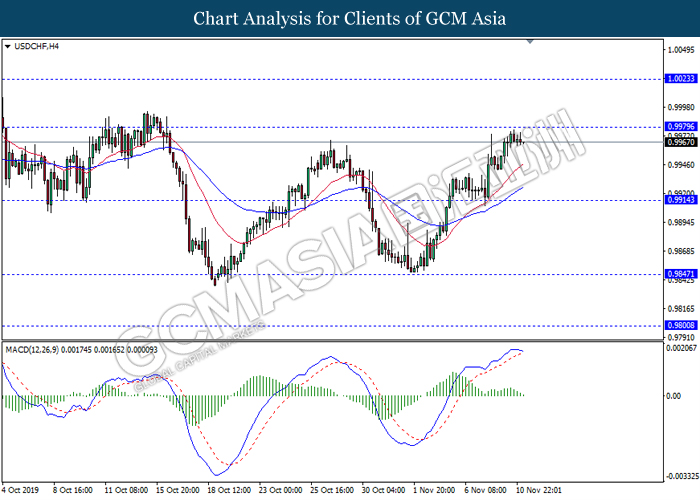

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 0.9980. MACD which illustrate diminishing bullish momentum signal with the starting formation of death cross suggest the pair to extend its retracement towards the support level 0.9915.

Resistance level: 0.9980, 1.0025

Support level: 0.9915, 0.9845

CrudeOIL, H4: Crude oil price remain traded in a sideway channel following recent retracement from the resistance level 57.55. However, MACD which illustrate bearish bias signal suggest the commodity to extend its retracement in short term towards the support level 56.30.

Resistance level: 57.55, 59.40

Support level: 56.30, 54.85

GOLD_, H4: Gold price have traded lower while currently testing the support level 1460.00. However, MACD which display diminishing bearish momentum signal suggest the commodity to be traded higher as a technical correction towards the resistance level 1480.50

Resistance level: 1480.50, 1497.00

Support level: 1460.00, 1437.20