12 November 2019 Afternoon Session Analysis

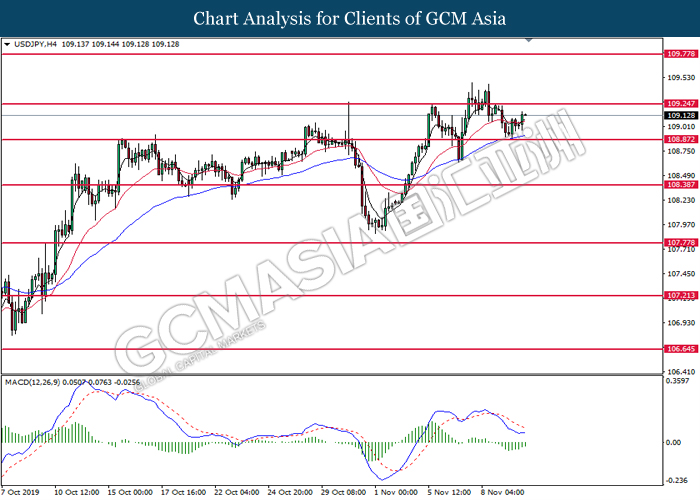

USD/JPY remains in bid despite trade concern.

The Japanese Yen which traded against the dollar have fell during late Asian session as trade progress between U.S and China and political unrest in Hong Kong continue to challenge the risk tone for traders in the market. Currently, markets continue to favor the greenback although U.S President Donald Trump have recently denied that he agreed to remove tariff on Chinese goods as part of a deal. Besides that, remarks from Japanese Prime Minster Shinzo Abe also further increase the weakness upon Japanese Yen as his comments support the need for a budget to assist economic recovery, which have decreased the appeal of Japanese Yen against the dollar as safe-haven status. On top of that, the risk safety appeal of the greenback was also boosted by a surge of unrest in Hong Kong following its police used live ammunition on protesters who had tried to block roads and delay trains during the morning commute. At the time of writing, USD/JPY rose 0.08% to 109.11 while dollar index also climbs 0.03% to 98.02.

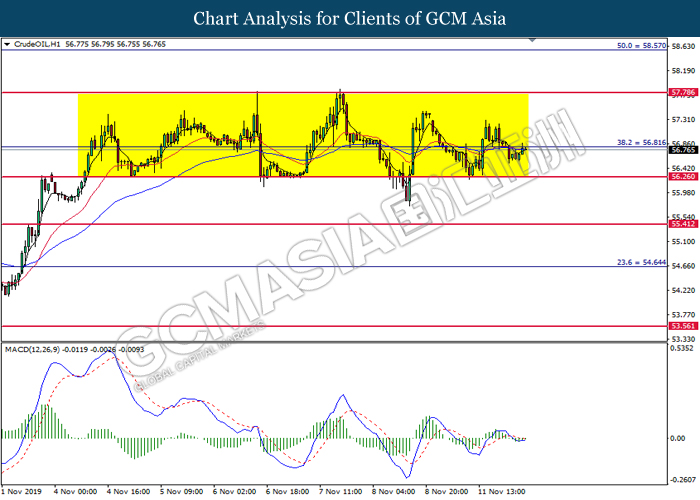

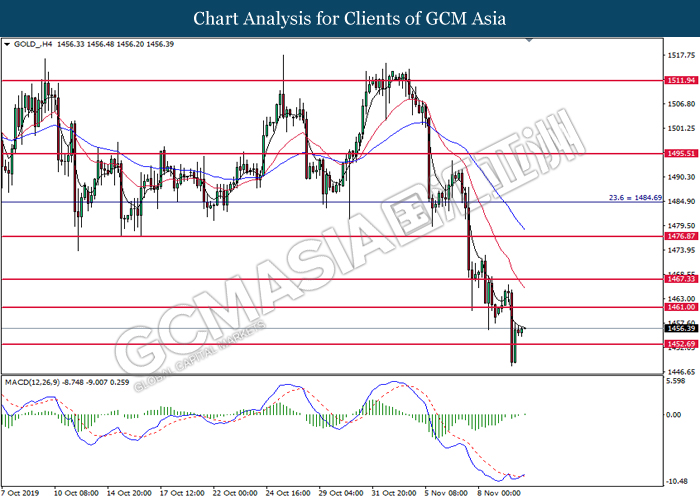

In the commodities market, crude oil price fell 0.14% to $56.78 per barrel at the time of writing as the ongoing uncertainty over U.S.-China trade talks continue to weigh down the market. Besides that, Saudi Arabia have also reinforced concerns about oversupply, diminishing further appeal for the commodity. Next, gold price slips 0.05% to $1456.43 a troy ounce as of writing following dollar strength backed by geopolitical uncertainty.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Average Earnings Index +Bonus (Sep) | 3.8% | 3.8% | – |

| 17:30 | GBP – Claimant Count Change (Oct) | 21.1K | 24.2K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Nov) | -22.8 | -13.2 | – |

Technical Analysis

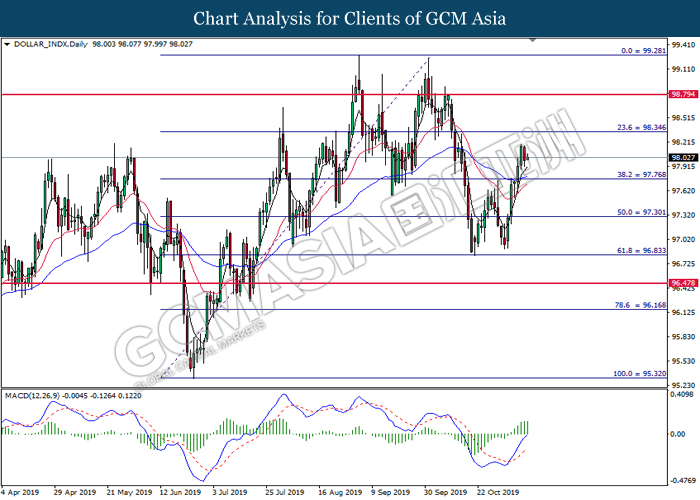

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 97.75. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 98.35.

Resistance level: 98.35, 98.80

Support level: 97.75, 97.30

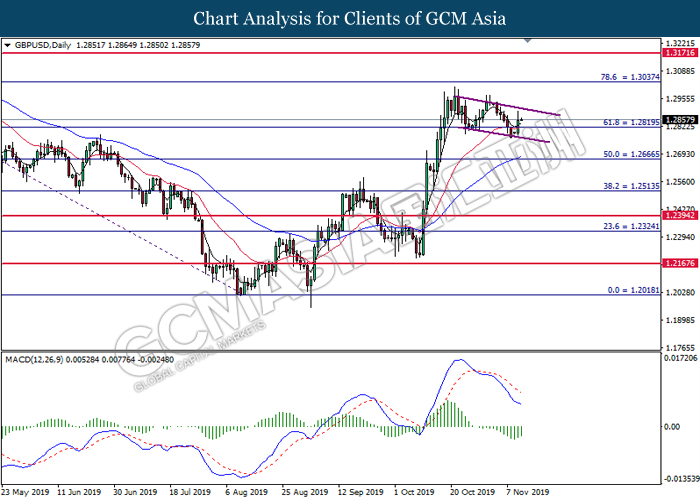

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the bottom level of downward channel. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the top level of downward channel.

Resistance level: 1.3035, 1.3170

Support level: 1.2820, 1.2665

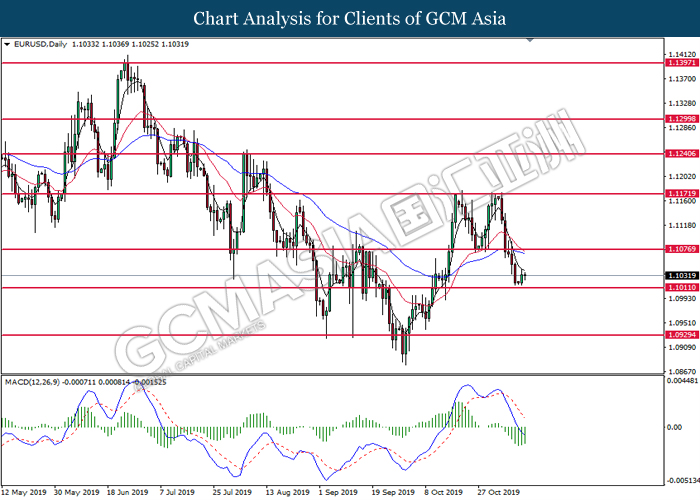

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.1010. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.1075.

Resistance level: 1.1075, 1.1170

Support level: 1.1010, 1.0930

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 108.85. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 109.25.

Resistance level: 109.25, 109.80

Support level: 108.85, 108.40

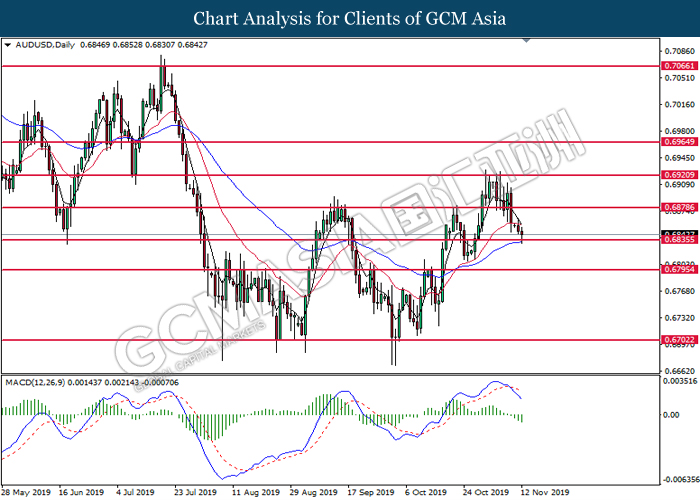

AUDUSD, Daily: AUDUSD was traded lower while currently near the support level at 0.6835. MACD which illustrated bearish momentum suggest the pair to extend its losses after successfully breakout below the support level at 0.6835.

Resistance level: 0.6880, 0.6920

Support level: 0.6835, 0.6795

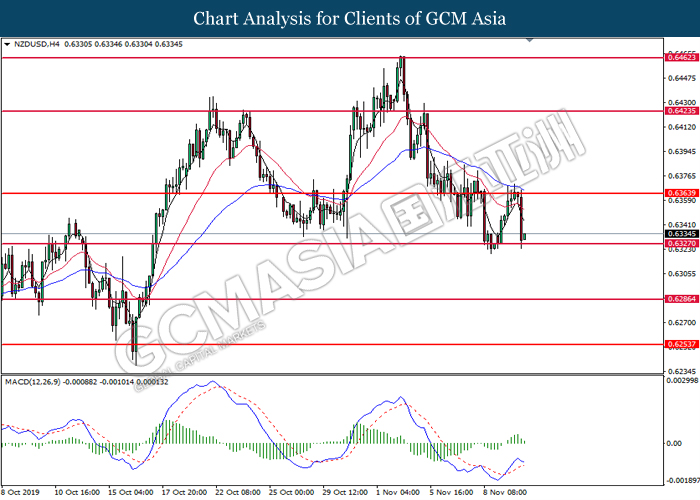

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6325. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6365, 0.6425

Support level: 0.6325, 0.6285

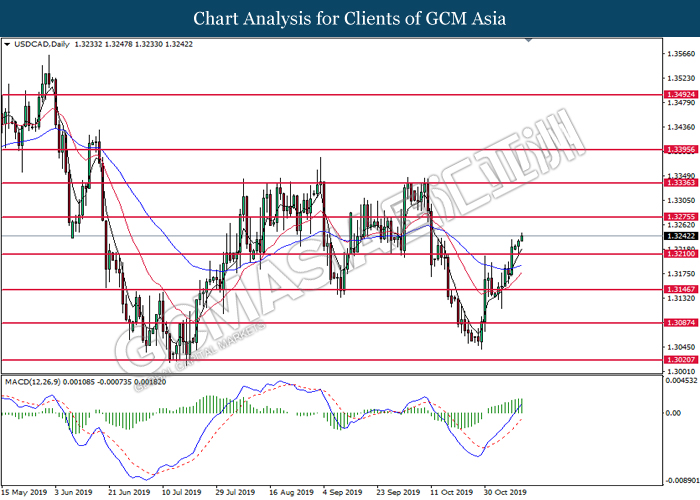

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3210. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3275.

Resistance level: 1.3275, 1.3335

Support level: 1.3210, 1.3145

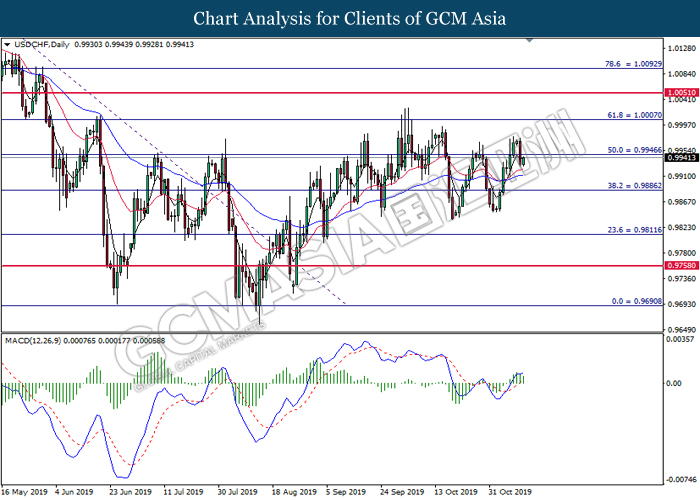

USDCHF, Daily: USDCHF was traded higher following prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction toward the lower level.

Resistance level: 0.9945, 1.0005

Support level: 0.9885, 0.9810

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level at 56.80. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 56.80.

Resistance level: 56.80, 57.80

Support level: 56.25, 55.40

GOLD_ H4: Gold price was traded higher following prior breakout above the previous resistance level at 1452.70. MACD which illustrate bullish momentum and the formation of golden cross suggest the commodity to extend its gains toward the resistance level at 1461.00.

Resistance level: 1461.00, 1467.35

Support level: 1452.70, 1443.75