13 September 2019 Morning Session Analysis

Greenback retreats amid trade truce report confusion.

Dollar index have retreat from highs on after a report on trade truce between the U.S and China denied by the White House. According to recent development, dollar was initially soared by reports from Bloomberg cited that the White House was preparing to make a limited trade agreement with China that would delay and even unwind some U.S. tariffs in exchange for Chinese promises to respect intellectual property rights and start buying U.S. agricultural goods again. However, the greenback was swiftly pared its gain after another source by CNBC stated that an unnamed senior White House official denying the story. Market remain concerned and cautious as uncertainty in trade tension continue to haunt the market. Dollar index fell 0.29% to 98.30 as of writing. Meanwhile, EUR/USD retrace 0.02% to 1.1058 at the time of writing after a sharp reversal supported by Draghi’s speech and trade developments. ECB have cut rates for the first time since 2016 as expected and also launch a new round of bond buying which it initially dragged euro down to the bottom. However, President of ECB Mario Draghi have delivered a less dovish message than the initial announcement implied, thus causing the Euro to rebound across the board.

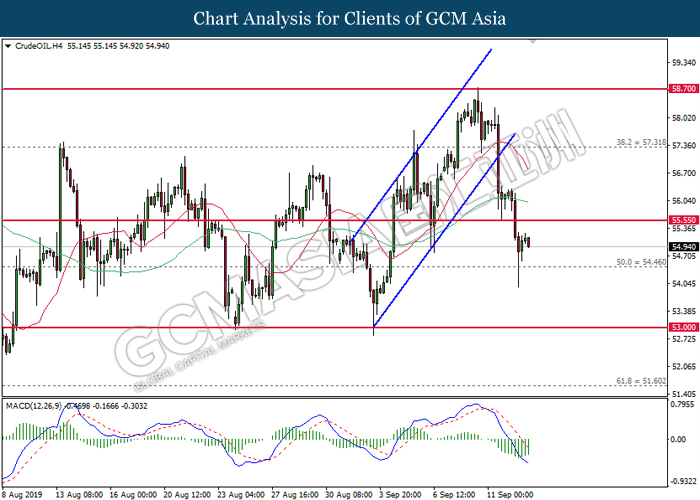

In the commodities market, crude oil price fell 0.08% to $55.05 per barrel at the time of writing amid as market fears Iran supplies might come back to play. According to recent reports, U.S. National Security Advisor John Bolton, a long-time hawk on Iran, had left the Trump administration after President Donald Trump wanted to ease sanctions on Iran in order to work out a new nuclear deal that would allow Iran to export its oil again in return for not developing atomic weapons. Next, gold price slips 0.06% to $1498.13 a troy ounce as of writing following market paring its gains on profit taking after a rally boosted ECB rate cut and dovish note from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20.30 | USD – Core Retail Sales (MoM) (Aug) | 1.0% | 0.1% | – |

| 20.30 | USD –Retail Sales (MoM) (Aug) | 0.7% | 0.2% | – |

Technical Analysis

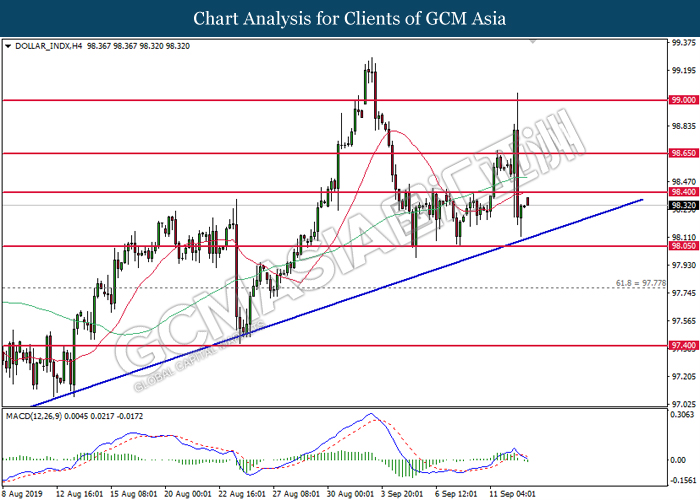

DOLLAR_INDX, H4: Dollar index was traded lower following prior retrace from the top level. MACD which begins to form a bearish signal suggests the index to be traded lower in short-term as technical correction.

Resistance level: 98.40, 98.65

Support level: 98.05, 97.80

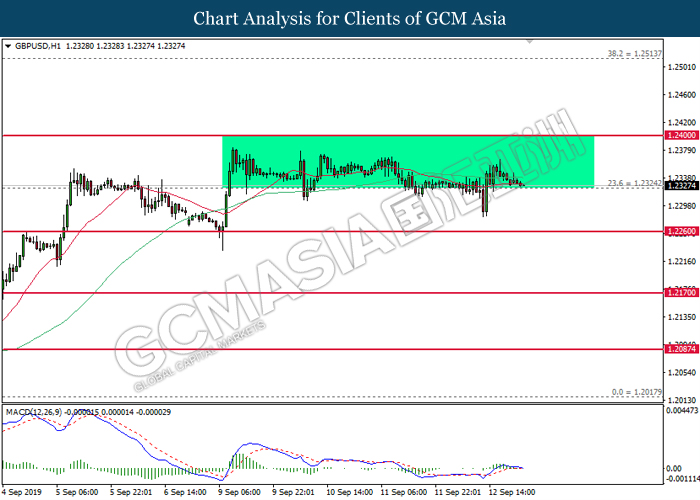

GBPUSD, H1: GBPUSD remains traded within a sideways channel formation. Due to the lack of signal from MACD and price action, it is suggested to wait for a breakout before entering the market.

Resistance level: 1.2400, 1.2515

Support level: 1.2325, 1.2260

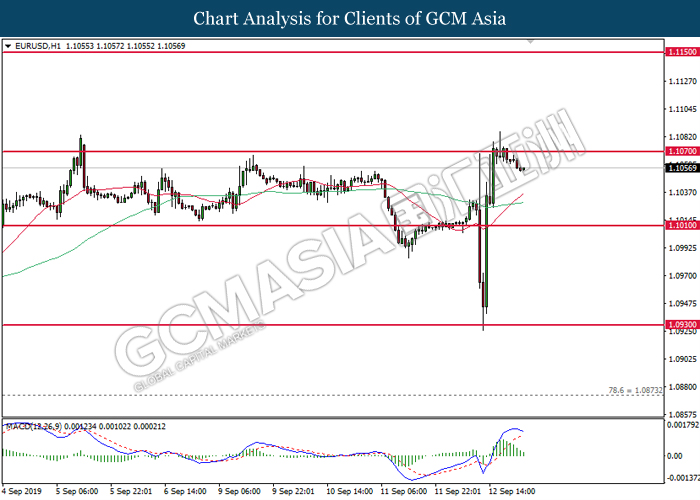

EURUSD, H1: EURUSD was traded lower following prior retrace from the resistance near 1.1070. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1070, 1.1150

Support level: 1.1010, 1.0930

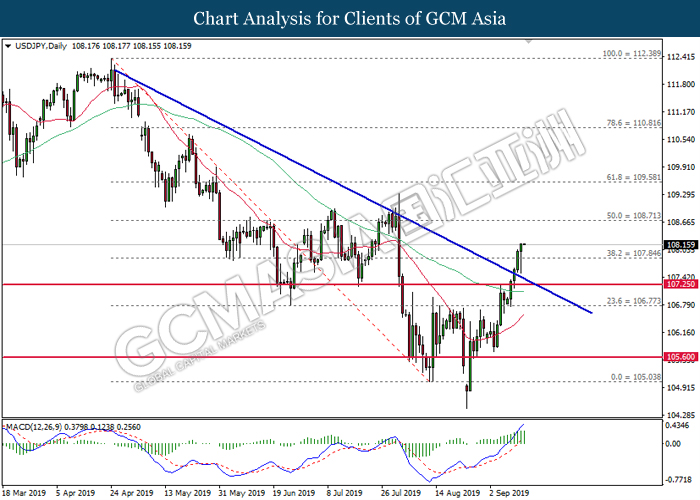

USDJPY, Daily: USDJPY extended gains following prior close above 107.85. MACD which illustrate bullish signal suggests the pair to advance further up, towards the direction of 108.70.

Resistance level: 108.70, 109.60

Support level: 107.85, 107.25

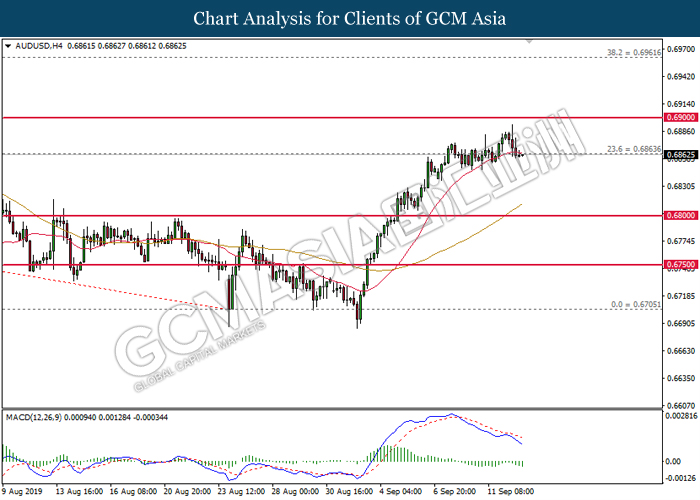

AUDUSD, H4: AUDUSD was traded lower following prior retrace from its higher levels. MACD which illustrate negative divergence signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6865, 0.6900

Support level: 0.6800, 0.6750

NZDUSD, H1: NZDUSD was traded higher following prior rebound from the support of 0.6395. MACD which illustrate diminished downward momentum suggests the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6410, 0.6440

Support level: 0.6395, 0.6360

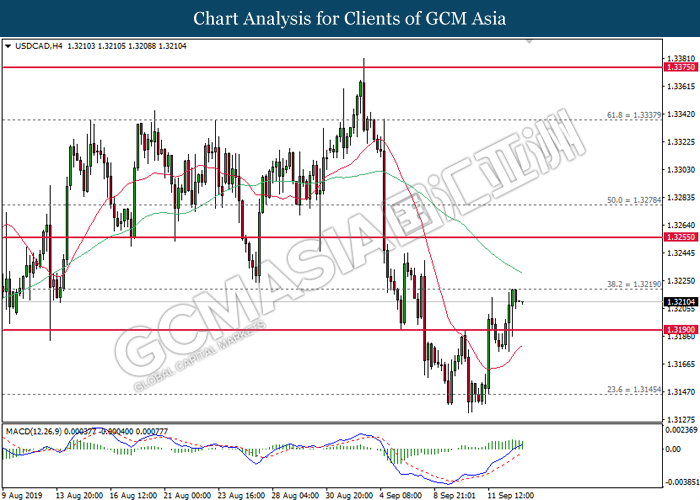

USDCAD, H4: USDCAD was traded lower following prior retrace from the resistance of 1.3220. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3220, 1.3255

Support level: 1.3190, 1.3145

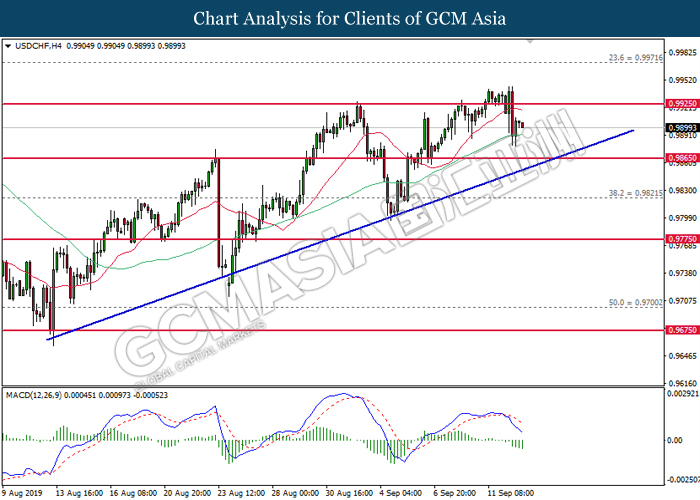

USDCHF, H4: USDCHF was traded lower following prior retrace from its higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9925, 0.9970

Support level: 0.9865, 0.9820

CrudeOIL, H4: Crude oil price was traded lower following prior breakout from the support of 55.55. MACD which illustrate persistent bearish signal suggests its price to be traded lower, towards the direction of 54.45.

Resistance level: 55.55, 57.30

Support level: 54.45, 53.00

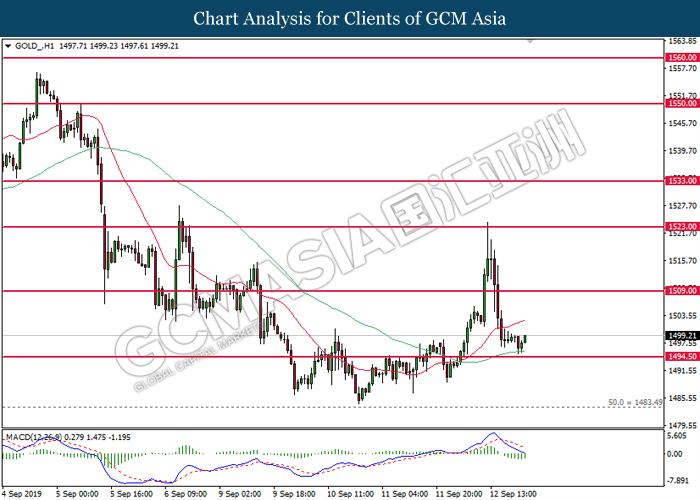

GOLD_, H1: Gold price was traded higher following prior rebound from the support level of 1494.50. MACD which illustrate diminishing downward momentum suggests its price to be traded higher in short-term.

Resistance level: 1509.00, 1523.00

Support level: 1494.50, 1483.50