13 November 2019 Afternoon Session Analysis

Kiwi surged amid interest rate decision

The New Zealand dollar skyrocketed 1% on early Wednesday following the Reserve Bank of New Zealand bank maintained its Official Cash Rate (OCR) at 1.0%. Almost all analysts had forecasted a rate cut in the 1% benchmark rate to a record-low 0.75%, amid the poor global economic development. However, New Zealand Monetary Committee claimed that the employment rate in New Zealand was remained around its maximum sustainable level, while the inflation rate was still within their target range. In fact, they reiterate that New Zealand’s export commodity prices have been robust, underpinning a positive term of trade. Such monetary decision had beat the market expectation, sparkled the huge demand for the New Zealand Dollar. However, the committee claimed that they would continue to scrutinize the future economic data to gauge the likelihood of future monetary politics. On the other hand, dollar index slumped yesterday following U.S President Donald Trump in speech on Tuesday did not offer any new details on the state of the administration’s trade war with China, disappointing the investors. Meanwhile, investors remained cautious as they are still waiting for the future updates with regards to US-China trade talk to retain further trading signal. As of writing, NZD/USD surged 1.12% to 0.6395 while the dollar index appreciated by 0.02% to 98.13.

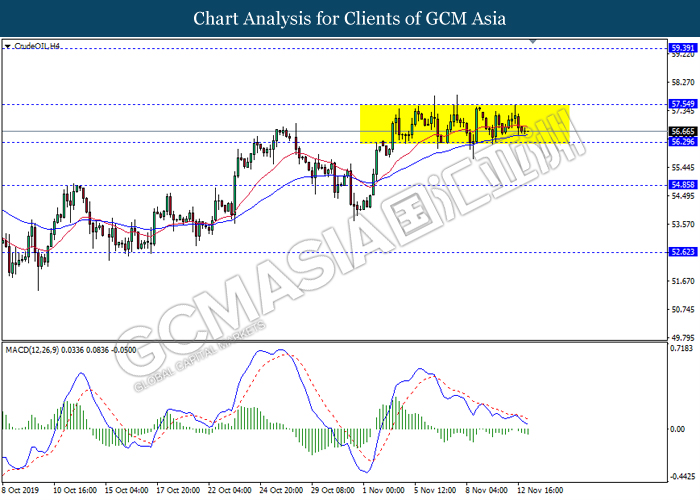

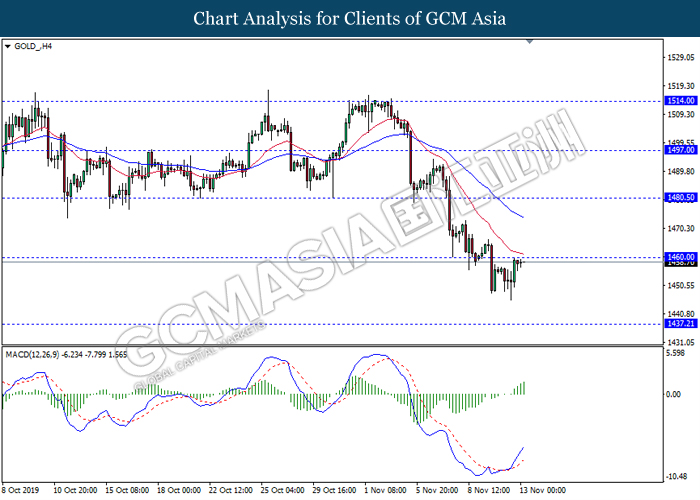

In the commodities market, crude oil price slumped 0.11% to $56.70 per barrels as the prospects for the trade deal between the United States and China dimmed, weighing on the outlook for the global economy. On the other hand, gold price surged 0.06% to $1457.11 per troy ounces as ongoing uncertainty which surrounds the current trade negations has spurred higher demand for the safe-haven.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

00:00 (14th) USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – CPI (YoY) (Oct) | 1.7% | 1.6% | – |

| 21:30 | USD – Core CPI (MoM) (Oct) | 0.1% | 0.2% | – |

Technical Analysis

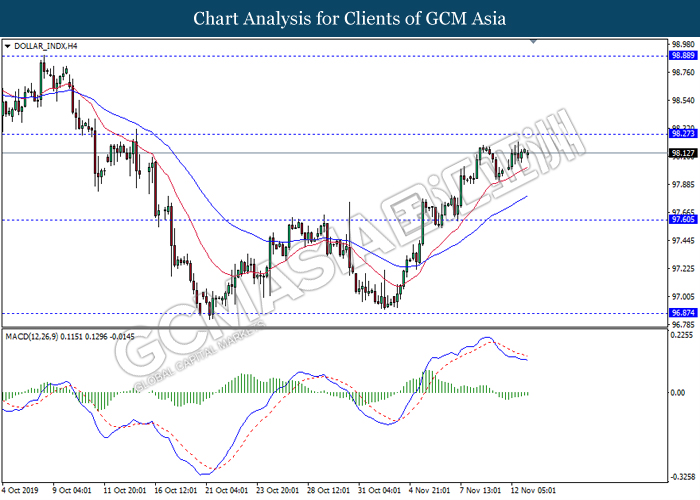

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing near the resistance level 98.25. MACD which illustrate diminishing bearish momentum suggest the dollar to extend its gains after it breaks above the resistance level.

Resistance level: 98.25, 98.90

Support level: 97.60, 96.85

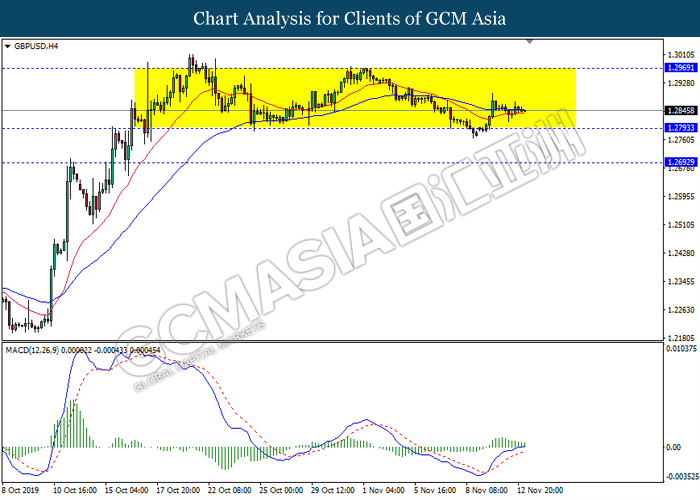

GBPUSD, H4: GBPUSD remain traded in a sideway channel while traded flat near the support level 1.2795. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower in short term towards the support level 1.2795.

Resistance level: 1.2970, 1.3095

Support level: 1.2795, 1.2690

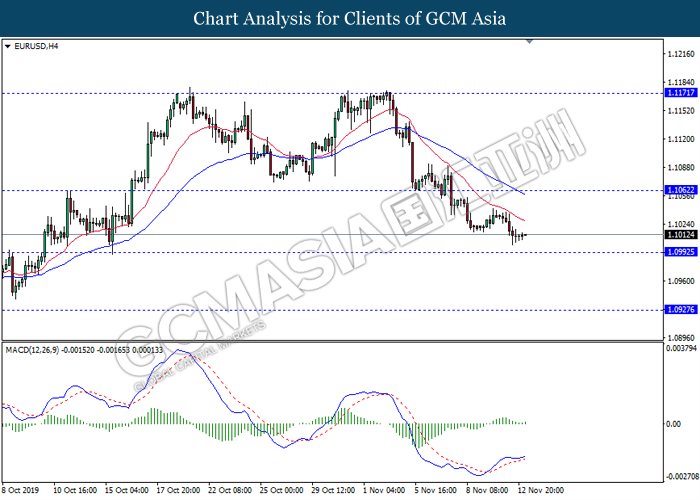

EURUSD, H4: EURUSD was traded lower while currently testing near the support level 1.0990. However, MACD which illustrate bullish bias signal suggest the pair to experience a technical correction towards the resistance level 1.1060.

Resistance level: 1.1060, 1.1170

Support level: 1.0990, 1.0925

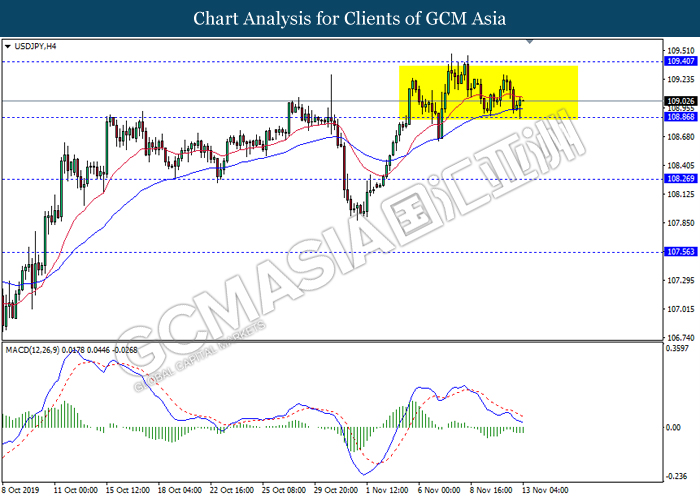

USDJPY, H4: USDJPY remain traded in a sideway channel following recent rebound from the support level 108.85. However, MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound in short term towards the resistance level 109.40.

Resistance level: 109.40, 109.90

Support level: 108.85, 108.25

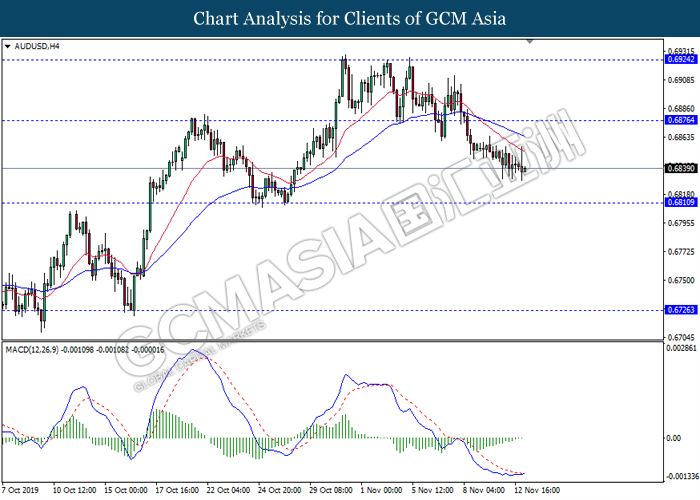

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level 0.6875. However, MACD which illustrate diminishing bearish bias signal with the starting formation of golden cross suggest the pair to experience a technical correction in short term towards the resistance level 0.6875.

Resistance level: 0.6875, 0.6925

Support level: 0.6810, 0.6725

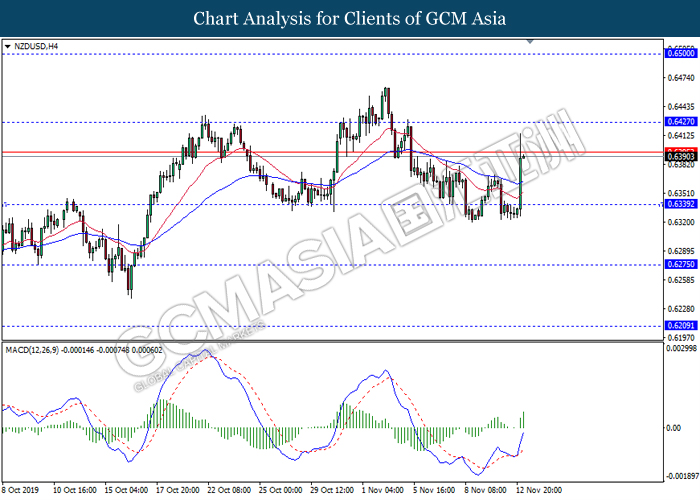

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6340. MACD which illustrate bullish bias signal suggest the pair to extend its gains towards the resistance level 0.6425.

Resistance level: 0.6425, 0.6500

Support level: 0.6340, 0.6275

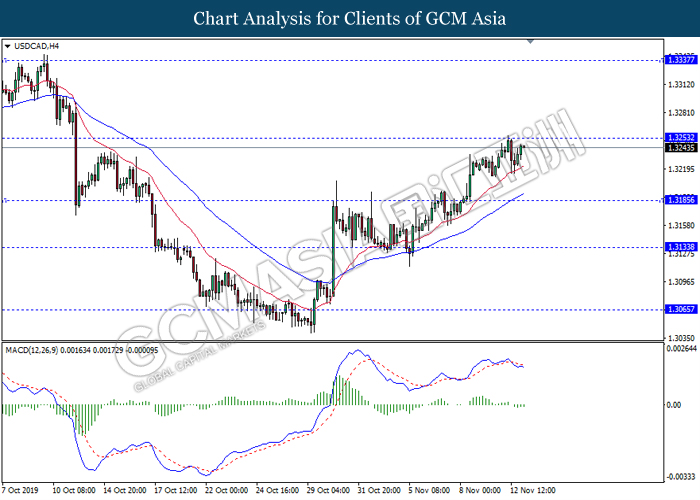

USDCAD, H4: USDCAD was traded higher while currently testing near the resistance level 1.3255. However, MACD which illustrate bearish momentum signal suggest the pair to be traded lower in short term as a technical correction towards the support level 1.3185.

Resistance level: 1.3255, 1.3335

Support level: 1.3185, 1.3135

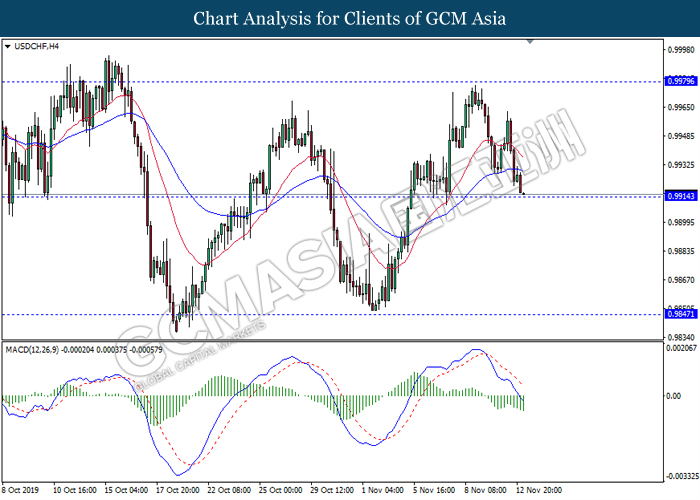

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.9915. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.9980, 1.0025

Support level: 0.9915, 0.9845

CrudeOIL, H4: Crude oil price remain traded in a sideway channel while currently testing near the support level 56.30. However, MACD which illustrate ongoing bearish bias signal suggest the commodity to be traded lower after it breaks below the support level.

Resistance level: 57.55, 59.40

Support level: 56.30, 54.85

GOLD_ H4: Gold price was traded higher while currently testing the resistance level 1460.00. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the commodity to extend its gains after it breaks above the resistance level.

Resistance level: 1460.00, 1480.50

Support level: 1437.20, 1403.50