13 November 2019 Morning Session Analysis

Sterling slumped after job’s data disappoints.

Pound sterling extended its losses on yesterday over the backdrop of bleak economic data from the United Kingdom. According to Office for National Statistics, UK’s Average Earnings Index +Bonus came in at 3.6% for the month of September, missing economists’ forecast of 3.8%. Similarly, Claimant Count Change for the month of October increases to 33,000 individuals, significantly higher as compared to forecast of 24,200 individuals. Both data has dialed down some positive sentiment upon the sterling which initiated a brief selloff. However, losses on the sterling remains limited after Brexit Party head Nigel Farage declared that his party will not contest for any seats currently held by the Conservative Party during UK’s general election on 12th December. The refusal to do so has increased the chances of UK Prime Minister Boris Johnson to secure and execute Brexit withdrawal agreement if Conservative Party wins the upcoming election. On the other hand, US dollar was traded higher on yesterday following a slump in other major currencies. However, traders remained cautious as they await further updates with regards to US-China trade negotiation. As of writing, the dollar index was up 0.15% to 98.15 while pair of GBP/USD ticked up 0.01% to 1.2850.

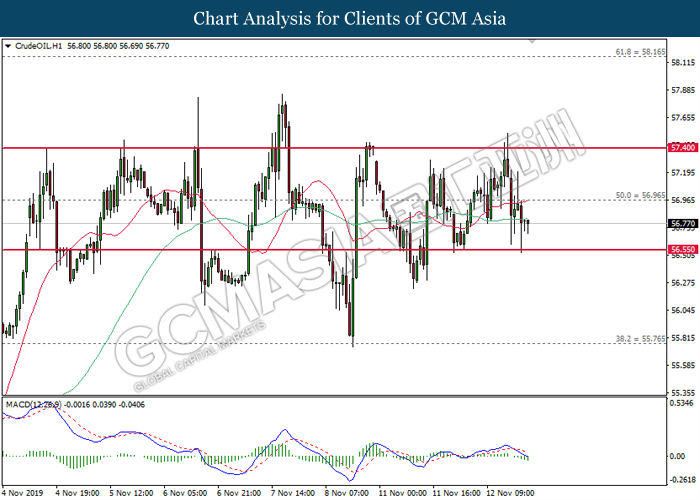

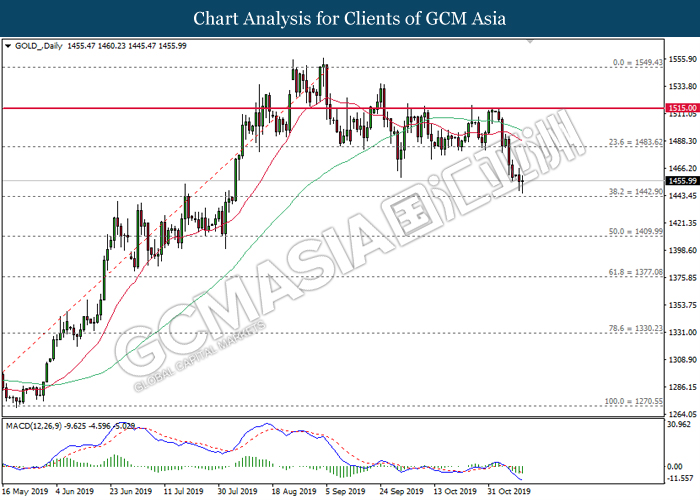

As for commodities market, crude oil price was traded flat near $56.75 per barrel. Oil prices continues to trade within a tight range as investors wait for further signals in the market with regards to US-China trade negotiation as well as weekly crude inventory reports from the US Energy Information Administration. Otherwise, gold price ticked down 0.03% to $1,456.56 a troy ounce due to stronger greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

00:00 (14th) USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – CPI (YoY) (Oct) | 1.7% | 1.6% | – |

| 21:30 | USD – Core CPI (MoM) (Oct) | 0.1% | 0.2% | – |

Technical Analysis

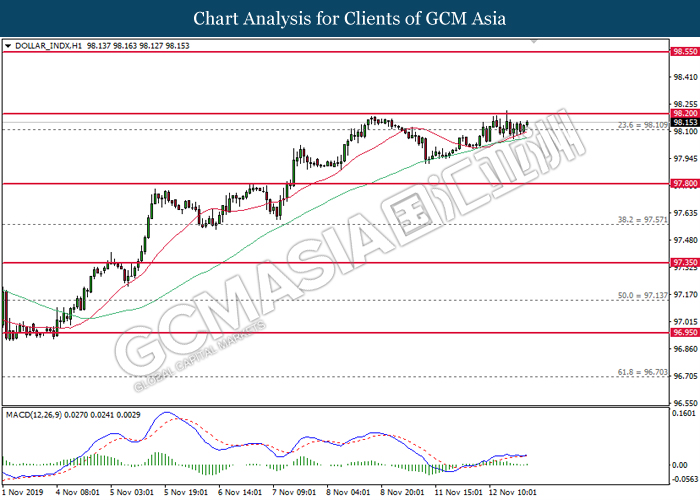

DOLLAR_INDX, H1: Dollar index was traded higher following prior rebound from the lower level. However, MACD which illustrate diminished upward momentum suggests the index to experience technical correction for short-term.

Resistance level: 98.20, 98.55

Support level: 98.10, 97.80

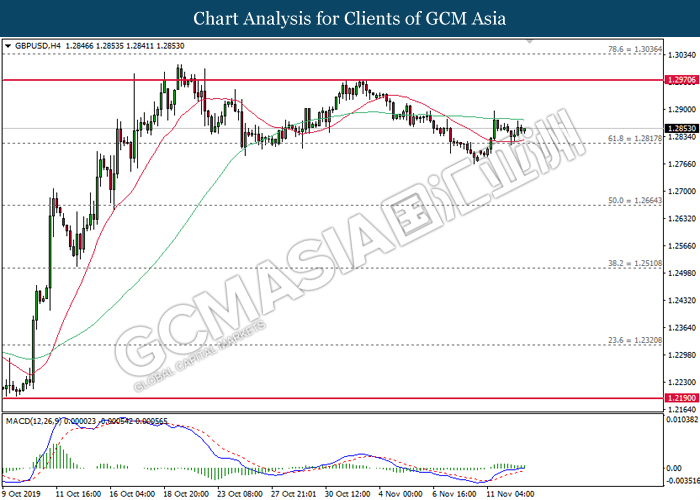

GBPUSD, H4: GBPUSD was traded flat near the support level of 1.2820. However, MACD which illustrate bullish signal suggests the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2970, 1.3035

Support level: 1.2820, 1.2665

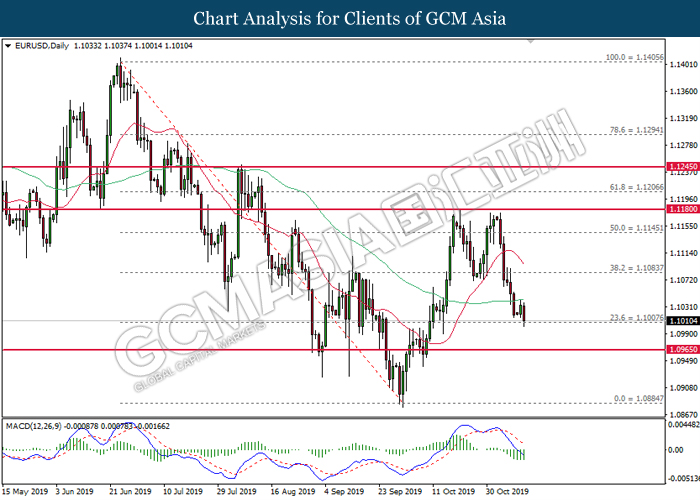

EURUSD, Daily: EURUSD was traded lower while currently testing near the support of 1.1010. MACD which illustrate diminished bearish momentum suggests the pair to experience technical correction in short-term.

Resistance level: 1.1085, 1.1145

Support level: 1.1010, 1.0965

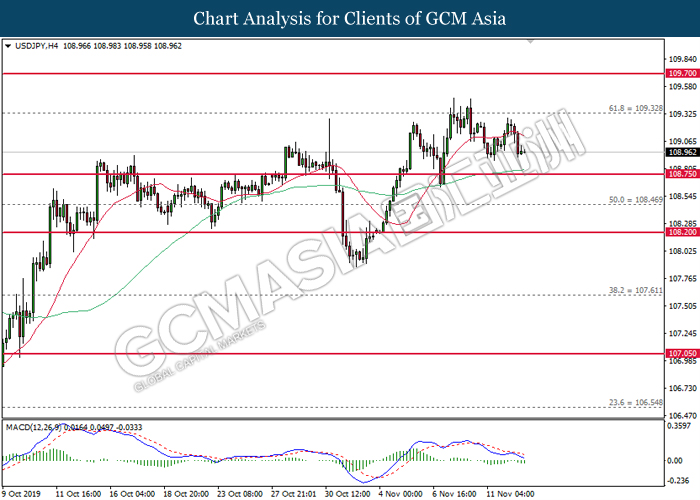

USDJPY, H4: USDJPY was traded lower following prior retrace from 109.30. MACD which illustrate bearish signal suggests the pair to extend its losses, towards the direction of 108.75.

Resistance level: 109.30, 109.70

Support level: 108.75, 108.45

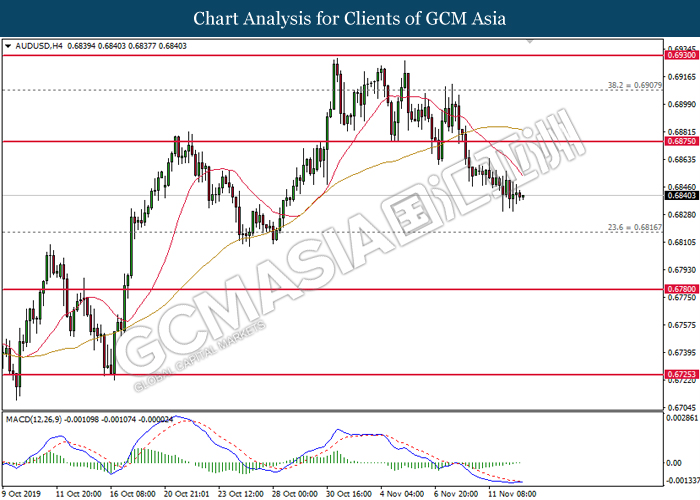

AUDUSD, H4: AUDUSD was traded lower following prior retrace from the higher levels. However, MACD which illustrate diminished downward momentum suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6875, 0.6910

Support level: 0.6815, 0.6780

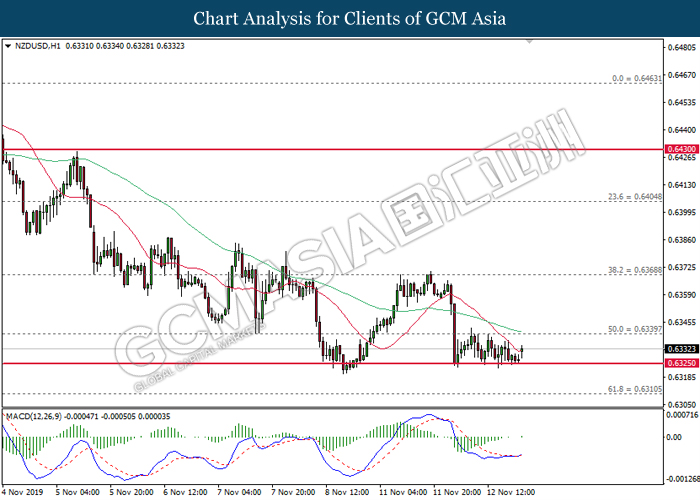

NZDUSD, H1: NZDUSD was traded higher following prior rebound from the support of 0.6325. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6340, 0.6370

Support level: 0.6325, 0.6310

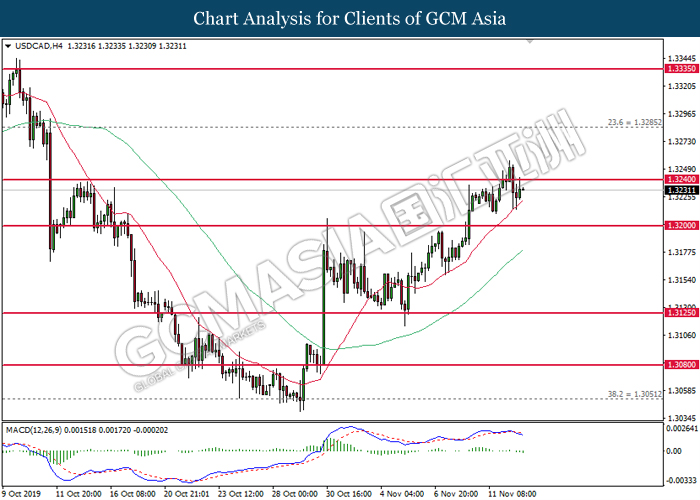

USDCAD, H4: USDCAD was traded lower following prior retrace from the higher levels. MACD which illustrate bearish signal suggests the pair to undergo technical correction in short-term.

Resistance level: 1.3240, 1.3285

Support level: 1.3200, 1.3125

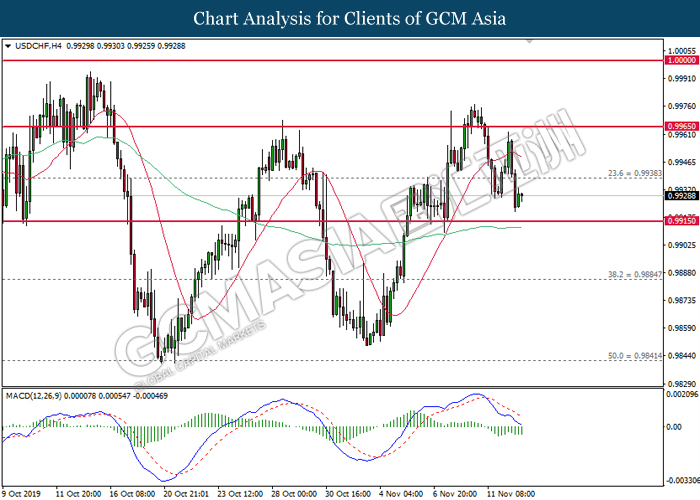

USDCHF, H4: USDCHF was traded lower following prior retrace from the higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term, towards the direction of 0.9915.

Resistance level: 0.9940, 0.9965

Support level: 0.9915, 0.9885

CrudeOIL, H1: Crude oil price was traded lower following prior retrace from the resistance near 57.40. MACD which illustrate bearish signal suggests its price to extend losses in short-term, towards the direction of 56.55.

Resistance level: 56.95, 57.40

Support level: 56.55, 55.75

GOLD_, Daily: Gold price was traded lower following prior close below 1483.60. However, MACD which illustrate diminished downward momentum suggests its price to experience technical correction for short-term.

Resistance level: 1483.60, 1515.00

Support level: 1442.90, 1410.00