14 February 2020 Afternoon Session Analysis

Japanese yen in bid as coronavirus spreads.

Japanese yen held onto its gains during Asian trading session on Friday following renewed worries with regards to coronavirus outbreak. On yesterday, officials in Hubei stunned financial market after reporting a sharp increase in new infections and deaths from the coronavirus following the adoption of new method to diagnose the illness. High uncertainty with regards to the scale of the epidemic has discouraged investors from taking excessive risk in the FX market and thus led to higher demand for safe-haven assets such as Japanese yen. According to a poll in Reuters, economists speculate that China’s economy will grow at its slowest pace since the last financial crisis due to shutdown in numerous major cities. However, economists added that the impact may be short-lived if the epidemic is successfully contained. On the other hand, euro extended its losses following the release of bearish data from the region. For the month of January, Germany’s CPI came in at -0.6%, signifying the ineffectiveness of loose monetary policy from European Central Bank. As of writing, pair of USD/JPY was traded flat at 109.81 while EUR/USD slumped 0.05% to 1.0836.

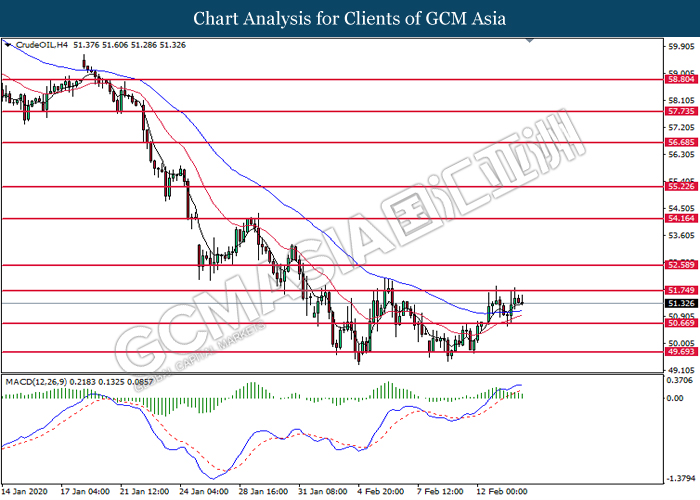

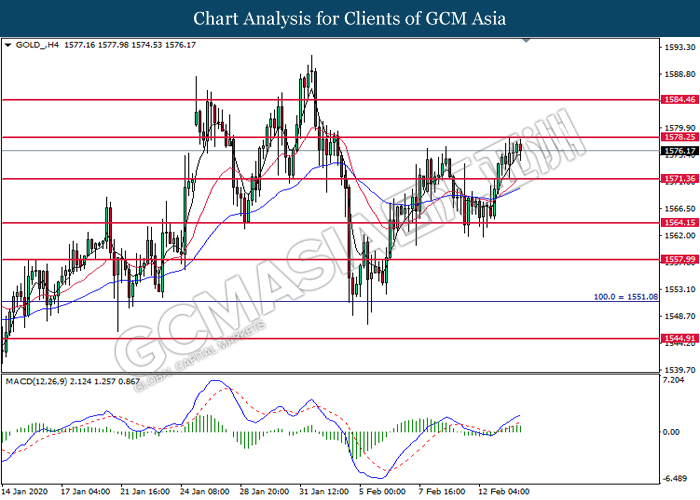

In the commodities market, crude oil price depreciates by 0.21% to $51.41 per barrel. Oil futures remains under pressure as coronavirus epidemic may significantly reduce global demand towards the commodity. On the other hand, gold price rose 0.03% to $1,576.49 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15.00 | EUR – German GDP (QoQ) (Q4) | -0.3% | – | – |

| 21.30 | USD – Core Retail Sales (MoM) (Jan) | 0.7% | 0.3% | – |

| 21.30 | USD – Retail Sales (MoM) (Jan) | 0.3% | 0.3% | – |

| 02:00

(15th) |

CrudeOIL – US Baker Hughes Oil Rig Count | 676 | – | – |

Technical Analysis

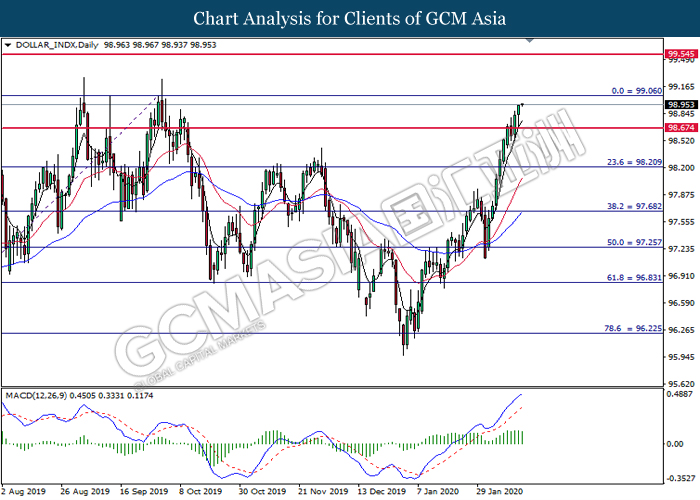

DOLLAR_INDX, Daily:Dollar index was traded higher following prior breakout above the previous resistance level at 98.65. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 99.05.

Resistance level: 99.05, 99.55

Support level: 98.65, 98.20

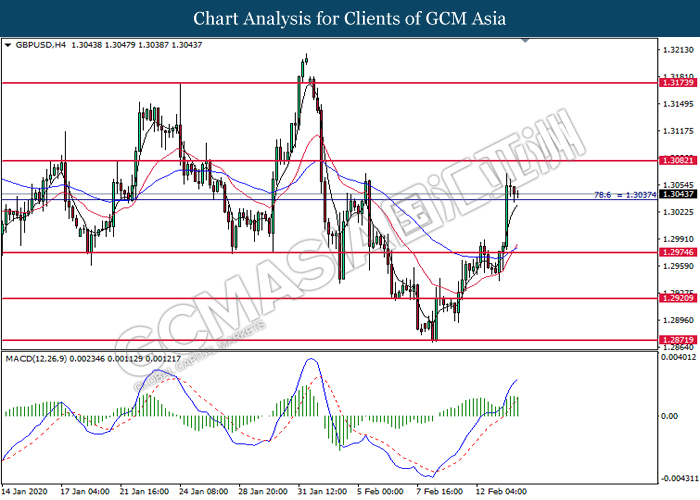

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.3035.

Resistance level: 1.3080, 1.3175

Support level: 1.3035, 1.2975

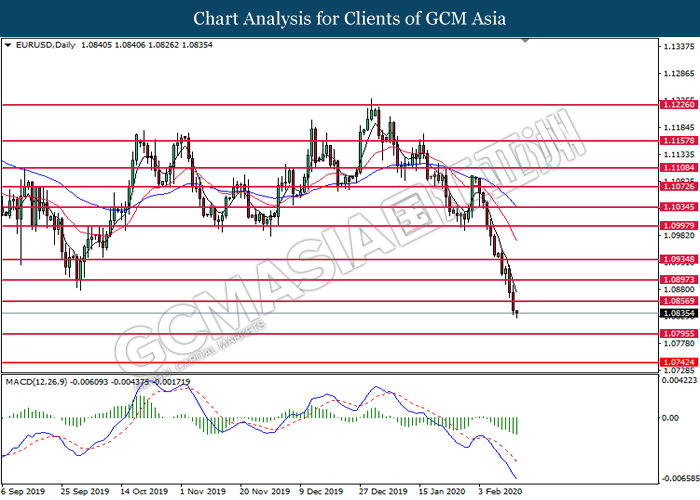

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0855. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0795.

Resistance level: 1.0855, 1.0895

Support level: 1.0795, 1.0740

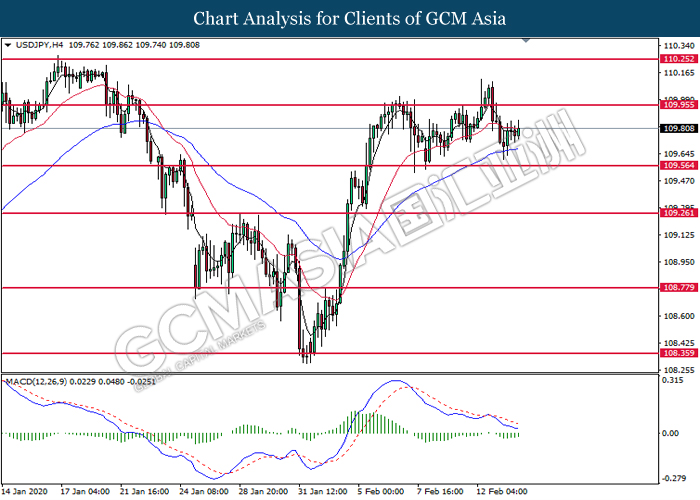

USDJPY, H4: USDJPY was traded higher following prior rebound from the 50 moving average line (Blue). MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 109.95.

Resistance level: 109.95, 110.25

Support level: 109.55, 109.25

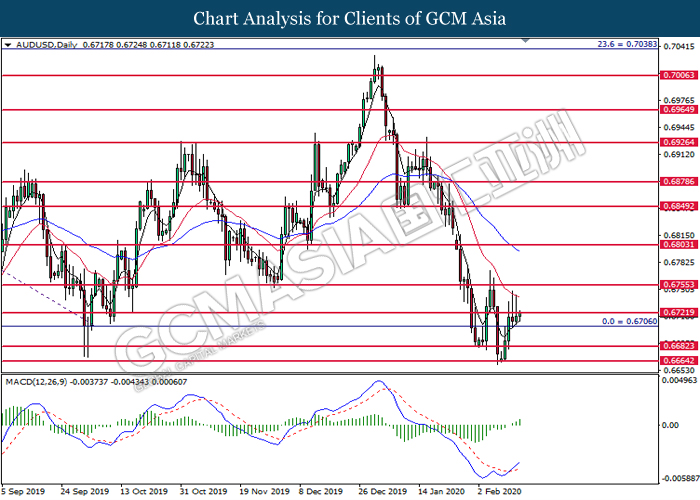

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6720. MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6720.

Resistance level: 0.6720, 0.6755

Support level: 0.6705, 0.6680

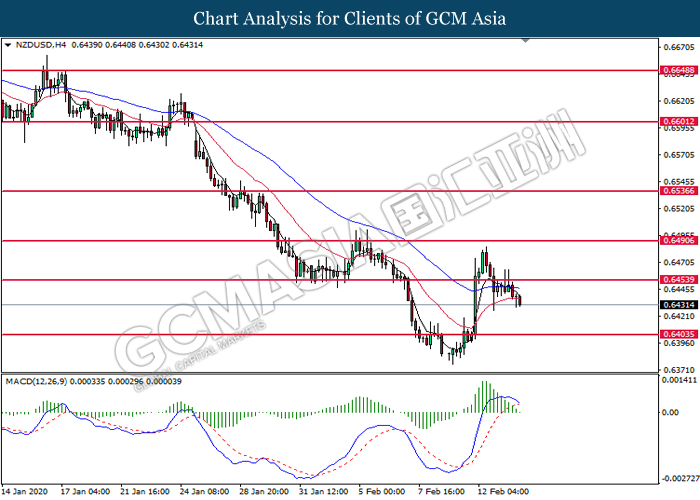

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level at 0.6455. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6405.

Resistance level: 0.6455, 0.6490

Support level: 0.6405, 0.6365

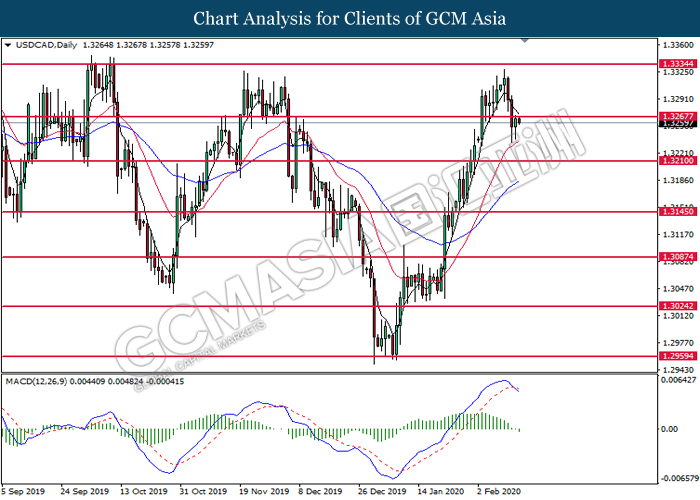

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3265. MACD which illustrated diminishing bearish momentum suggest the pair to extend its losses toward support level at 1.3210.

Resistance level: 1.3265, 1.3335

Support level: 1.3210, 1.3145

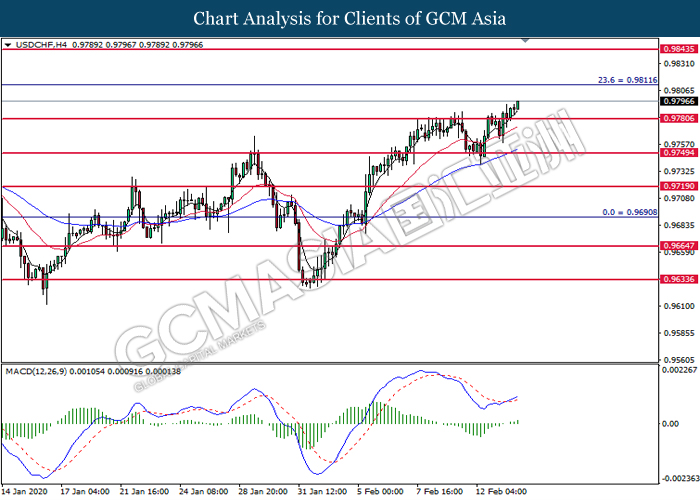

USDCHF, H4: USDCHF was traded higher following prior breakout above the resistance level at 0.9780. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9810.

Resistance level: 0.9810, 0.9845

Support level: 0.9780, 0.9750

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 51.65. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 50.65.

Resistance level: 51.65, 52.65

Support level: 50.65, 49.70

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level at 1578.25. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1571.35.

Resistance level: 1578.25, 1584.45

Support level: 1571.35, 1564.15