14 February 2020 Morning Session Analysis

Dollar firms higher on positive U.S inflation data.

The dollar index which traded against a basket of six major currency pairs continue to edge higher during early Asian trading session following the release of U.S inflation data. According to the Labor Department, core consumer price index in the U.S have rose to 0.2%, in line with market expectation last month. At the same time, initial jobless claims data also provide a better-than-expected results with the reading of 205K against market expectation of 210K. The positive data have showed that the economy remains in a steady pace, thus providing further boost for the greenback. Besides that, Federal Reserve member John Williams also stated that the current economy is still remain in a “very good place”. As of writing, dollar index rose 0.06% to 1.3043.

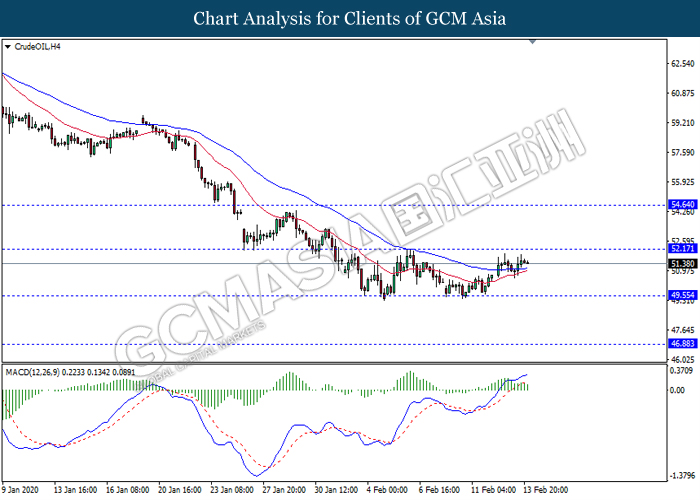

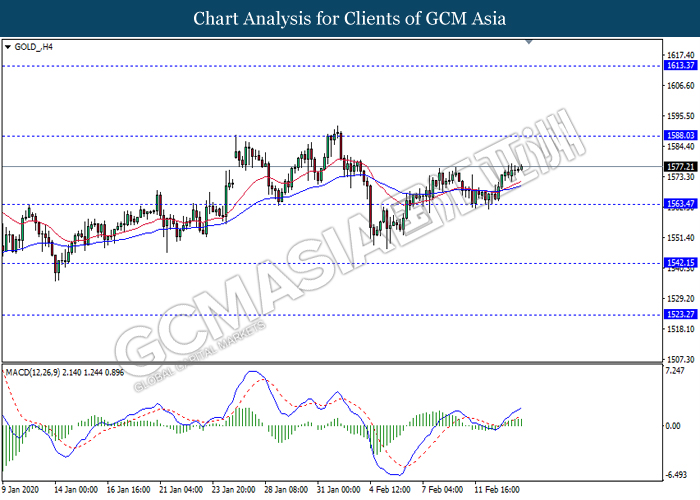

In the commodities, crude oil price climbs 0.09% to $51.47 per barrel as of writing as investors believe that Russia and OPEC will deepen its production cuts to balance worsening demand for crude from a new spike in deaths and infections related to China’s Covid-19 epidemic. Next, gold price rose 0.08% to $1576.81 a troy ounce at the time of writing amid receding risk appetite after a new spike in deaths and infections reported by China from its Covid-19 epidemic.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15.00 | EUR – German GDP (QoQ) (Q4) | -0.3% | – | – |

| 21.30 | USD – Core Retail Sales (MoM) (Jan) | 0.7% | 0.3% | – |

| 21.30 | USD – Retail Sales (MoM) (Jan) | 0.3% | 0.3% | – |

Technical Analysis

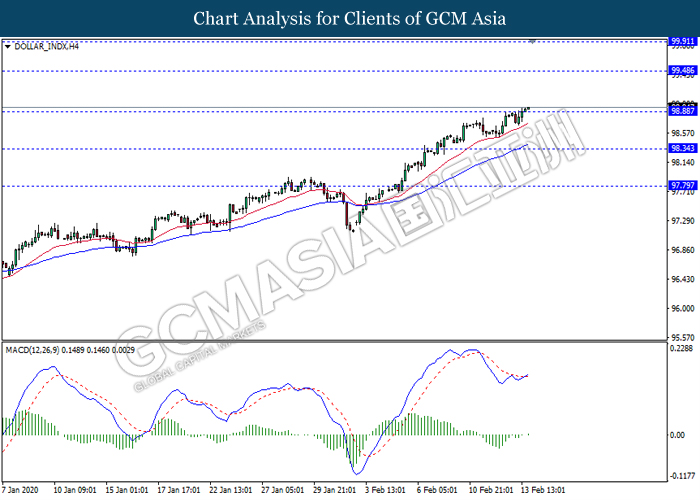

DOLLAR_INDX, H4:Dollar index was traded higher following prior breakout above the resistance level 98.90. MACD which illustrate bullish bias signal with the formation of golden cross suggest the dollar to extend its gains towards the resistance level 99.50.

Resistance level: 99.50, 99.90

Support level: 98.90, 98.35

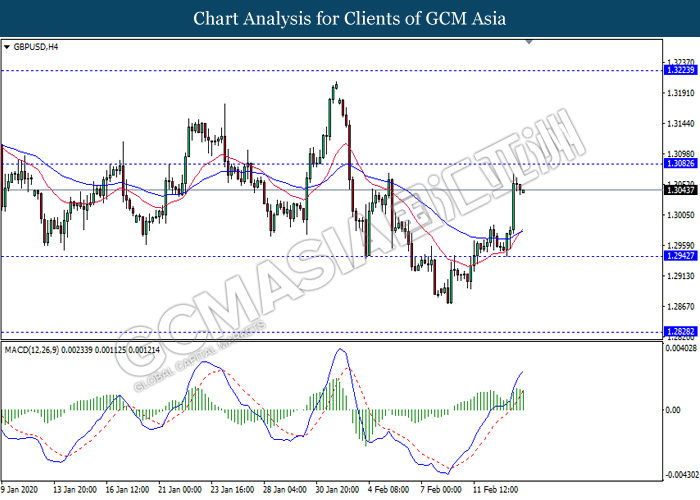

GBPUSD, H4: GBPUSD was traded higher while currently testing near the resistance level 1.3080. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction in short term towards the support level 1.2940.

Resistance level: 1.3080, 1.3225

Support level: 1.2940, 1.2830

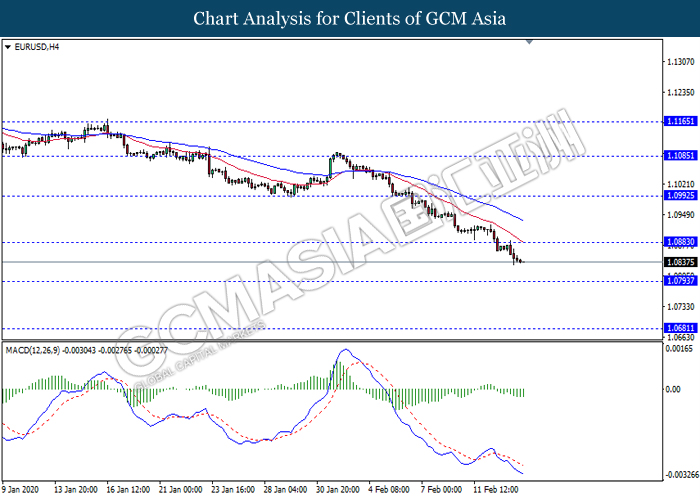

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level 1.0885. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses towards the support level 1.0795.

Resistance level: 1.0885, 1.0990

Support level: 1.0795, 1.0680

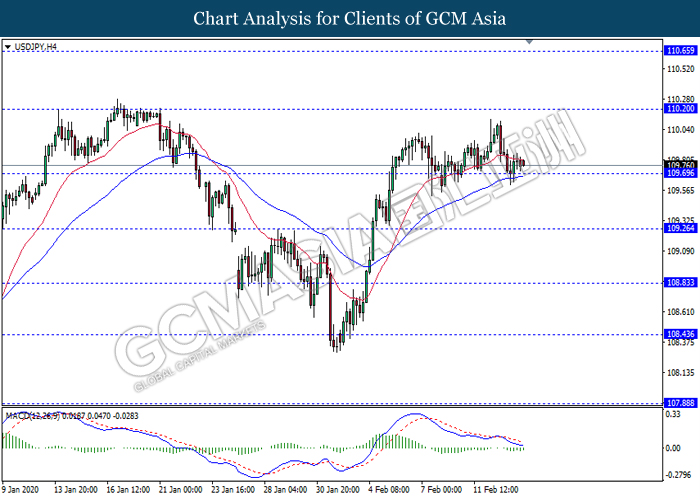

USDJPY, H4: USDJPY was traded lower while currently testing the support level 109.70. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 110.20, 110.65

Support level: 109.70, 109.25

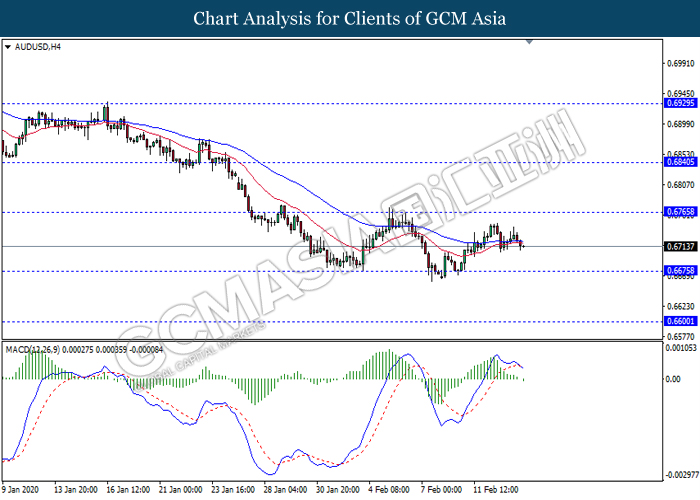

AUDUSD, H4: AUDUSD was traded lower following prior retracement from its high level. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its retracement towards the support level 0.6675.

Resistance level: 0.6765, 0.6840

Support level: 0.6675, 0.6600

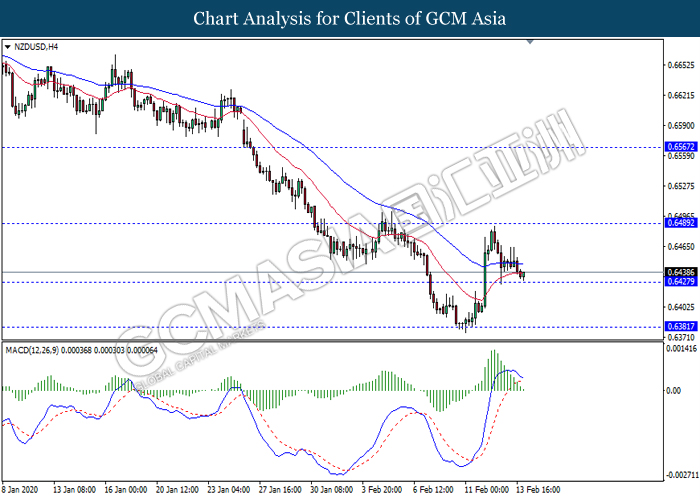

NZDUSD, H4: NZDUSD was traded lower while currently testing near the support level 0.6425. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6490, 0.6565

Support level: 0.6425, 0.6380

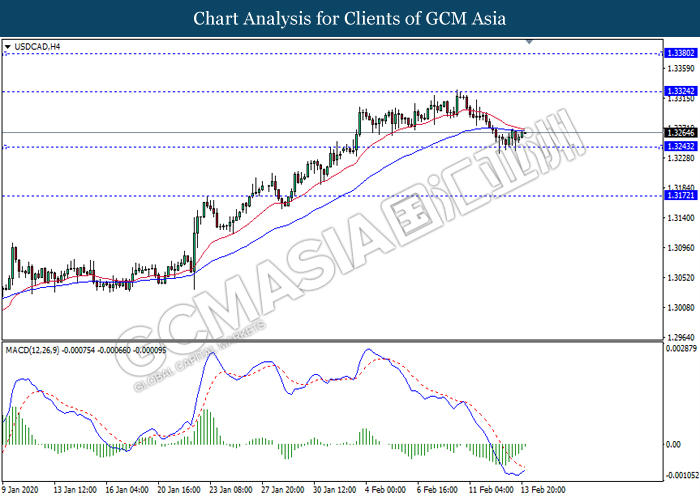

USDCAD, H4: USDCAD was traded flat near the support level 1.3245. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher towards the resistance level 1.3325.

Resistance level: 1.3325, 1.3380

Support level: 1.3245, 1.3170

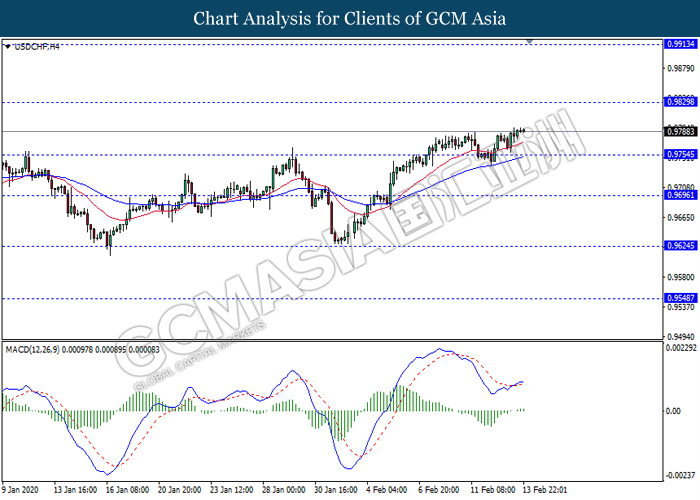

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level 0.9755. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.9830.

Resistance level: 0.9830, 0.9915

Support level: 0.9755, 0.9695

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the resistance level 52.15. However, MACD which illustrate diminishing bullish momentum suggest the commodity to experience a technical correction towards the support level 49.55.

Resistance level: 52.15, 54.65

Support level: 49.55, 46.90

GOLD_, H4: Gold price was traded higher following prior rebound from the support level 1563.45. MACD which illustrate ongoing bullish momentum suggest the commodity to extend its gains towards the resistance level 1588.00.

Resistance level: 1588.00, 1613.35

Support level: 1563.45, 1542.15