14 November 2019 Afternoon Session Analysis

Yen surged as trade tension escalated.

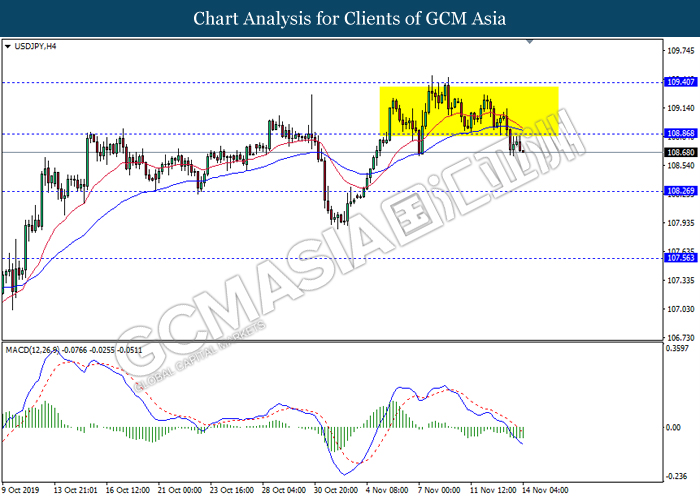

Japanese Yen surged as ongoing uncertainty which surround the current trade negotiation have sparkled the demand for the safe-haven asset such as Japanese Yen. According to Reuters, US-China trade negotiations have “hit a snag” over farm purchases, with Beijing not wanting a deal that looks one-sided in favour of the United States. In fact, such negative sentiment came after U.S President Donald Trump warned that he would raise tariffs “substantially” on Chinese goods if there was no deal, spurring a further uncertainty upon the trade talk and insinuating the demand on the Japanese Yen. However, the gains experienced by Japanese Yen was limited following the release of bleak data of Gross Domestic Product (GDP) from the region. According to the Cabinet Office, Japan Gross Domestic Product (GDP) for last quarter notched down to 0.1%, weaker than the market expectation of 0.2%. On the other hand, Australian dollar received huge sell-off pressure in the early morning following the bleak data from the Australia region was released. According to Australian Bureau of Statistic, Australian Employment change came in at -19.0k, worse than the economist forecast of 15.0k, spurring sell-off upon the Australian dollar. As of writing, USD/JPY depreciated by 0.02% to 108.80 while AUD/USD plunged 0.50% to 0.6800.

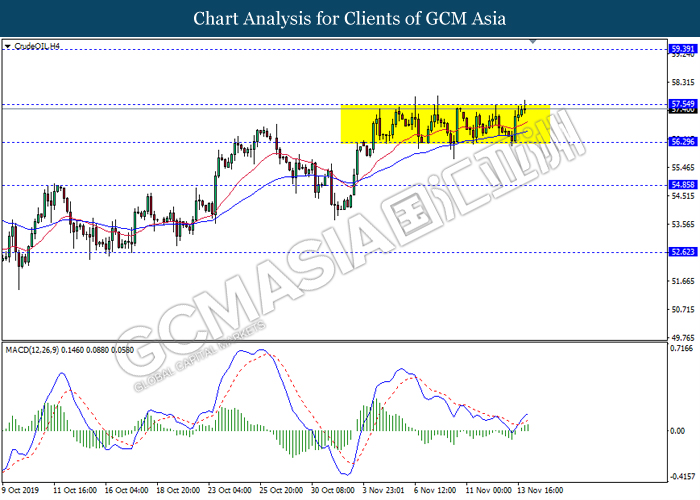

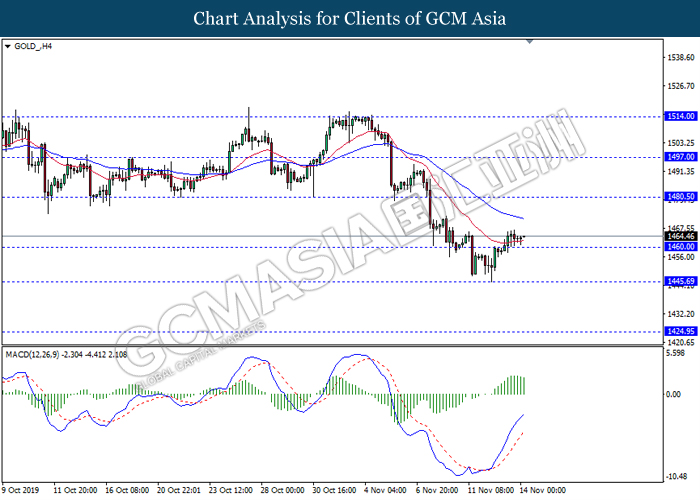

In the commodities market, crude oil price surged after U.S API Weekly Crude Oil Stock was released. According to American Petroleum Institute, U.S. API Weekly Crude Oil Stock notched down to -0.500M from the reading of 4.260M. On the other hand, gold price rose yesterday amid negative prospect for the trade deal. As of writing, crude oil price rose 0.02 % to $57.36 per barrel and gold price appreciated by 0.01% to $1462.85 per troy ounces.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ)(Q3) | -0.1% | -0.1% | – |

| 17:30 | GBP – Retail Sales (MoM(Oct) | – | 0.2% | – |

| 21:30 | USD – PPI (MoM)(Oct) | -0.3% | 0.3% | – |

| 00:00

(15th) |

CrudeOIL – EIA Crude Oil Inventories | 7.929M | 1.649M | – |

Technical Analysis

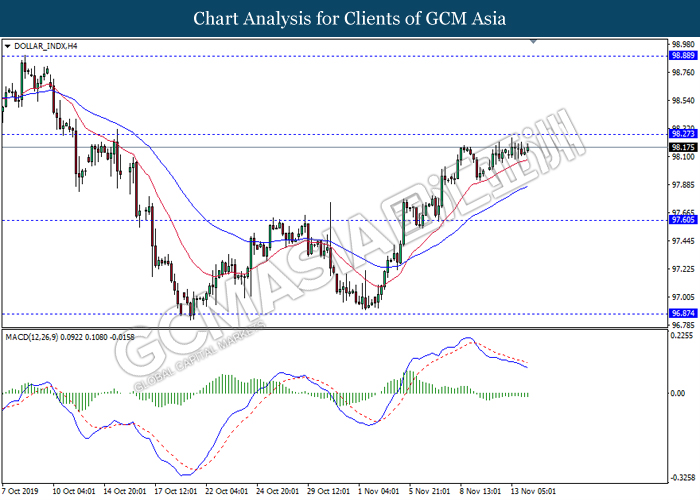

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing near the resistance level 98.25. However, MACD which illustrate bearish momentum signal suggest the dollar to experience a technical correction in short term towards the support level 97.60.

Resistance level: 98.25, 98.90

Support level: 97.60, 96.85

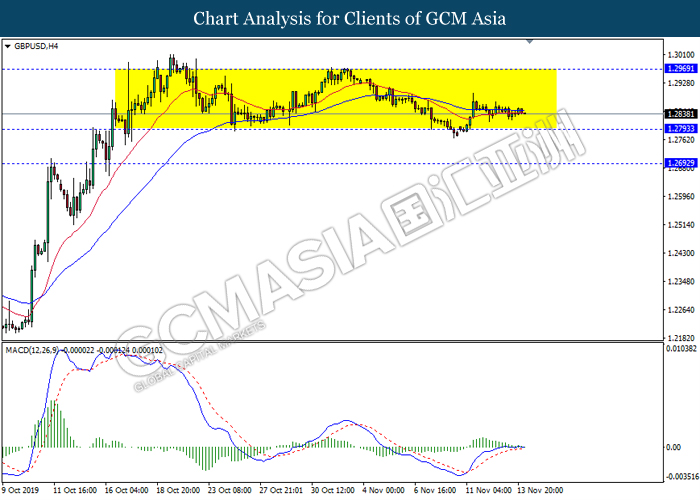

GBPUSD, H4: GBPUSD remain traded flat in a sideway channel. Due to lack of clear signal and direction from MACD, it is suggested to wait until further signal appear before entering the market.

Resistance level: 1.2970, 1.3095

Support level: 1.2795, 1.2690

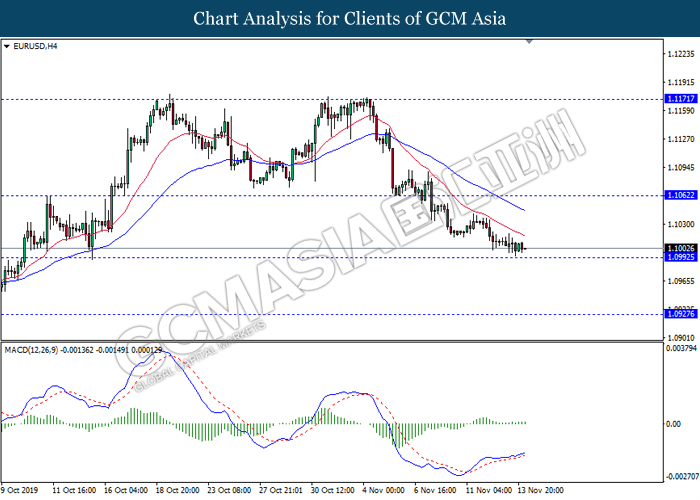

EURUSD, H4: EURUSD was traded lower while currently testing near the support level 1.0990. However, MACD which illustrate bullish bias signal suggest the pair to experience a technical correction towards the resistance level 1.1060.

Resistance level: 1.1060, 1.1170

Support level: 1.0990, 1.0925

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level 108.85. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses towards the support level 108.25.

Resistance level: 108.85, 109.40

Support level: 108.25, 107.55

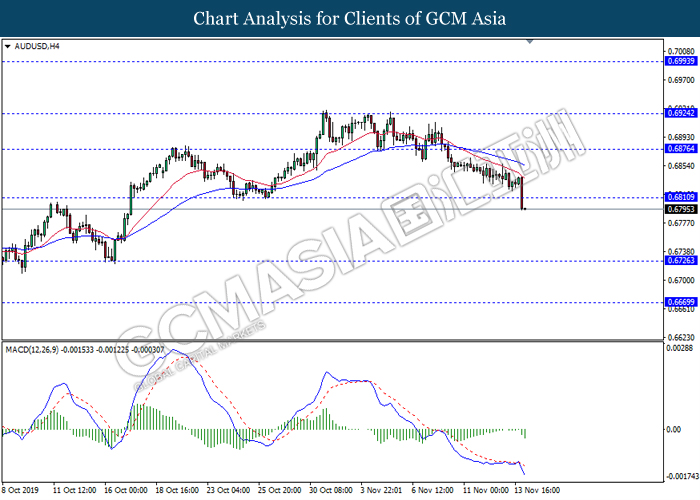

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level 0.6810. MACD which illustrate ongoing bearish bias signal suggest the pair to extend its losses towards the support level 0.6725.

Resistance level: 0.6810, 0.6875

Support level: 0.6725, 0.6670

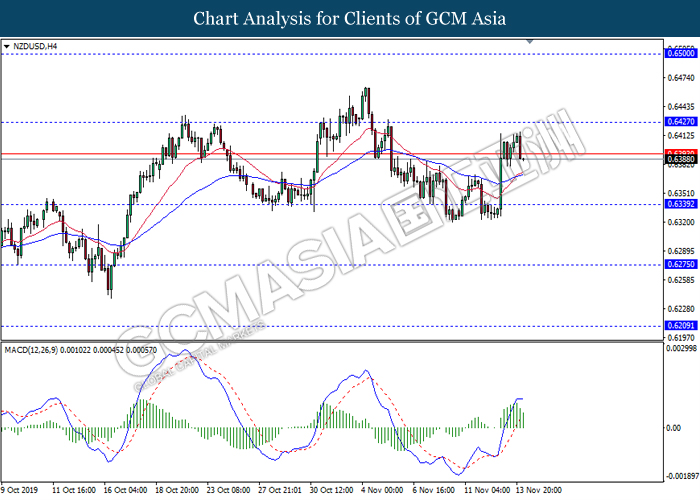

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level 0.6425. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 0.6340.

Resistance level: 0.6425, 0.6500

Support level: 0.6340, 0.6275

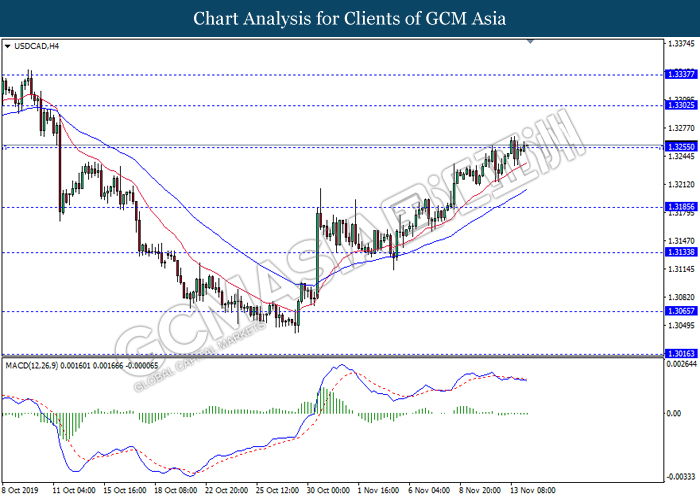

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level 1.3255. However, MACD which illustrate bearish momentum signal suggest the pair to be traded lower in short term as a technical correction towards the support level 1.3185.

Resistance level: 1.3255, 1.3300

Support level: 1.3185, 1.3135

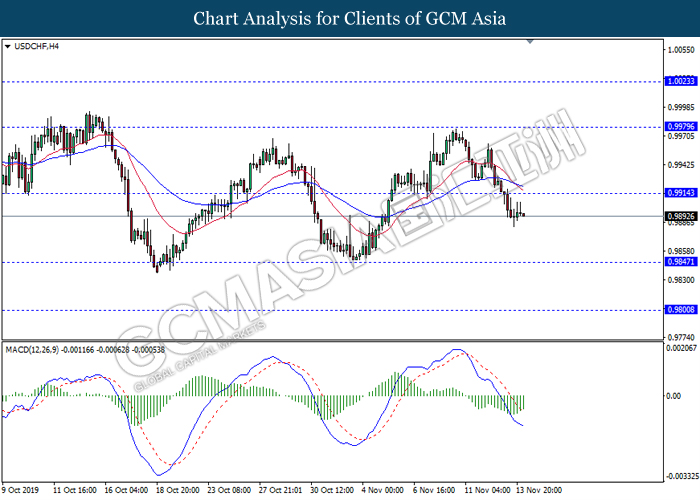

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level 0.9915. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to undergo a technical correction in short term towards the current support level 0.9915.

Resistance level: 0.9915, 0.9980

Support level: 0.9845, 0.9800

CrudeOIL, H4: Crude oil price remain traded in a sideway channel while currently testing near the resistance level 57.55. However, MACD which illustrate bullish bias signal with the formation of golden cross suggest the commodity to be traded higher after it breaks above the resistance level.

Resistance level: 57.55, 59.40

Support level: 56.30, 54.85

GOLD_ H4: Gold price was traded higher following prior breakout above the previous resistance level 1460.00. However, MACD which illustrate diminishing bullish momentum suggest the commodity to experience a short term technical correction towards back the support level 1460.00.

Resistance level: 1480.50, 1497.00

Support level: 1460.00, 1445.70