14 November 2019 Morning Session Analysis

Monetary policy unchanged while eyeing on more data.

Dollar index which gauge its value against a basket of six major currencies depreciate slightly amid Jerome Powell downbeat comment regarding the US economy outlook. In the early morning testifies, Federal Reserve (Fed) Chairman Jerome Powell stuck to his view that interest rate should be keep at current rate for the time being while signaling that further cut is still possible if US economy growth outlook remain faded. Moreover, Powell also revealed that the previous rate cut on cash rate was due to the occurring of extremely low inflation pressure in US economy, risk of global growth slowing down and tension of trade war outweigh the possibility of economy overheating. However, Core CPI data which was announced on yesterday has limit the losses of greenback. According to US Bureau of Labor Statistics, US Core CPI data came in at 0.2%, hitting the economist expectation while hinting the sign that underlying inflation start picking up. During Asian trading session, dollar index drop 0.02% to 98.00. On the other hand, the pair of USD/JPY inched up 0.01% to 108.80 following Japan GDP data showed a growth of 0.1% compared to economist forecast of 0.2%, seemingly global uncertainty risk tampered the pace the inflation growth in Japan.

In the commodities market, crude oil price inched down 0.09% to $57.30 per barrel after hitting skyrocketed for more than 2% yesterday amid surprise drop in US crude oil inventories level lit up the crude oil market sentiment. According to the API inventory data, crude oil inventory level has declined 0.5 million barrel while comparing to economist forecast of 1.649 million barrel build. Next, gold price rose 0.09% to $1464.10 a troy ounce as of writing amid uncertainty over Brexit issue and trade war dragged down the market risk appetite.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ)(Q3) | -0.1% | -0.1% | – |

| 17:30 | GBP – Retail Sales (MoM(Oct) | – | 0.2% | – |

| 21:30 | USD – PPI (MoM)(Oct) | -0.3% | 0.3% | – |

| 00:00

(15th) |

CrudeOIL – EIA Crude Oil Inventories | 7.929M | 1.649M | – |

Technical Analysis

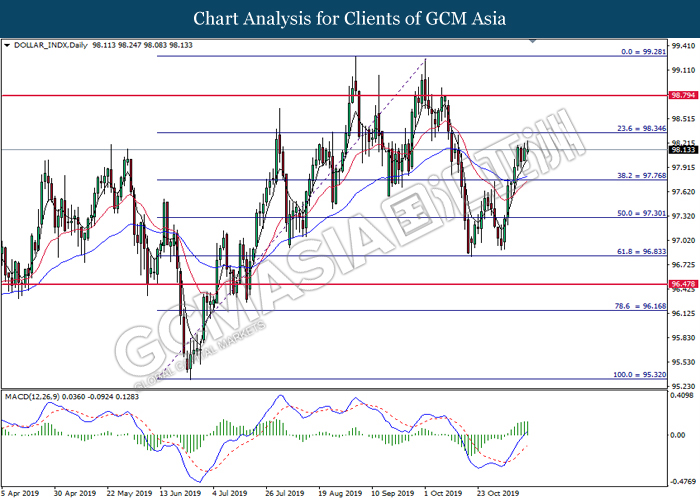

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 97.75. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 98.35.

Resistance level: 98.35, 98.80

Support level: 97.75, 97.30

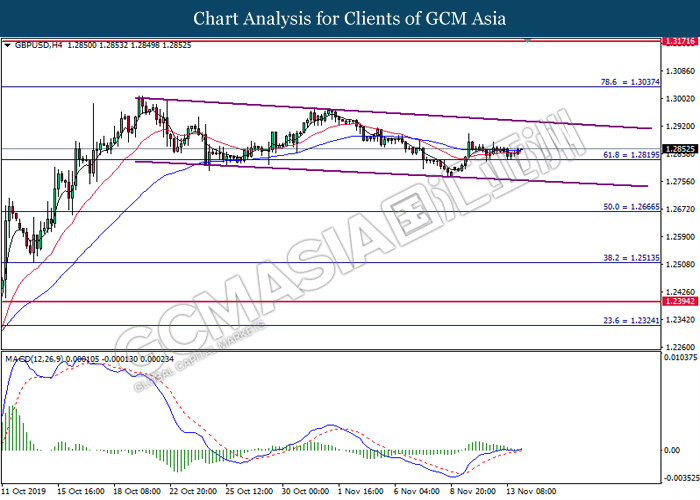

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2820. MACD which illustrated bullish signal suggest the pair to extend its gains toward the top level of downward channel.

Resistance level: 1.3035, 1.3170

Support level: 1.2820, 1.2665

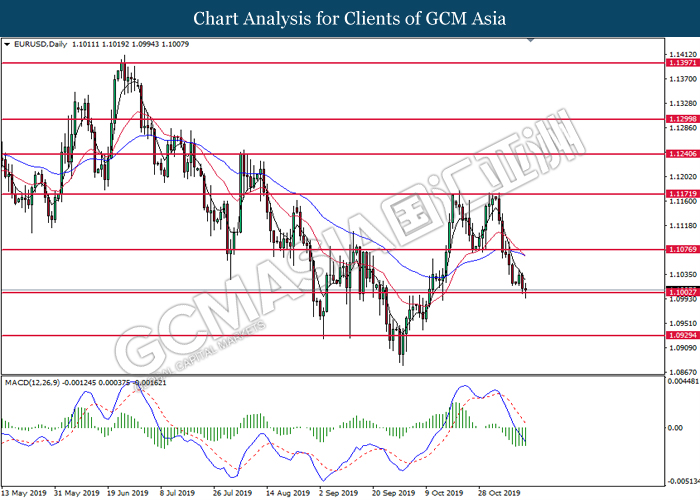

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1005. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.1005.

Resistance level: 1.1075, 1.1170

Support level: 1.1005, 1.0930

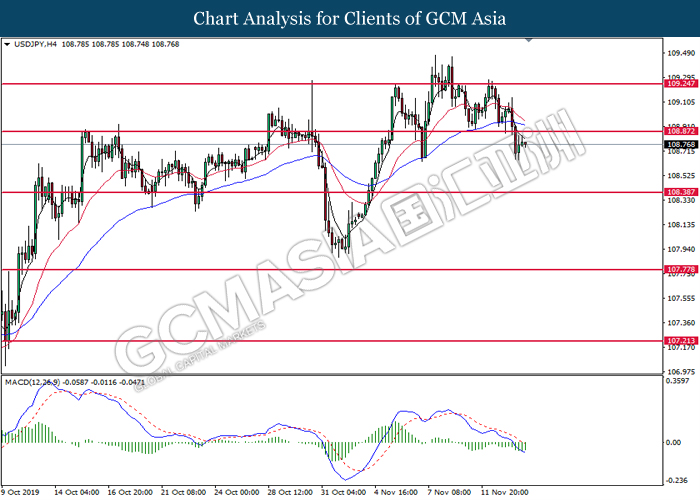

USDJPY, H4: USDJPY was traded higher following prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggest the pair to be traded lower in short term toward the support level at 108.40.

Resistance level: 108.85, 109.25

Support level: 108.40, 107.80

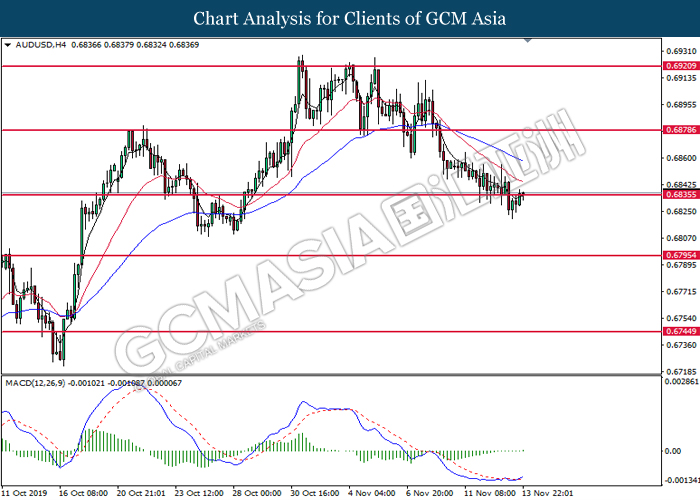

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.6835. MACD which illustrated bullish momentum and the formation of golden cross suggest the pair to extend its gains after successfully breakout above the resistance level at 0.6835.

Resistance level: 0.6835, 0.6880

Support level: 0.6795, 0.6745

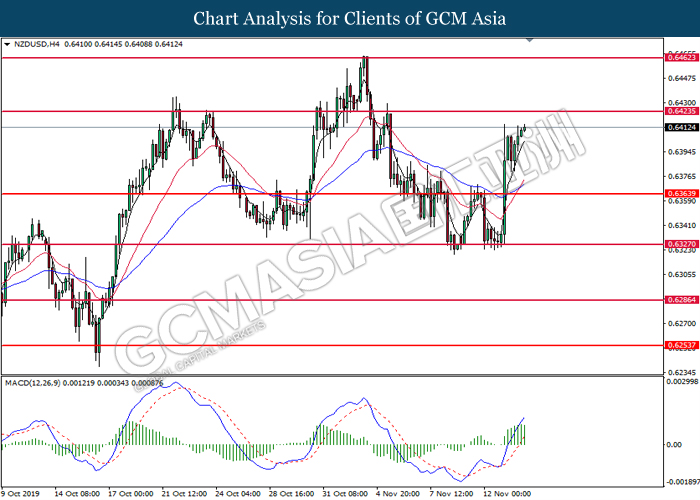

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6425.

Resistance level: 0.6425, 0.6460

Support level: 0.6365, 0.6325

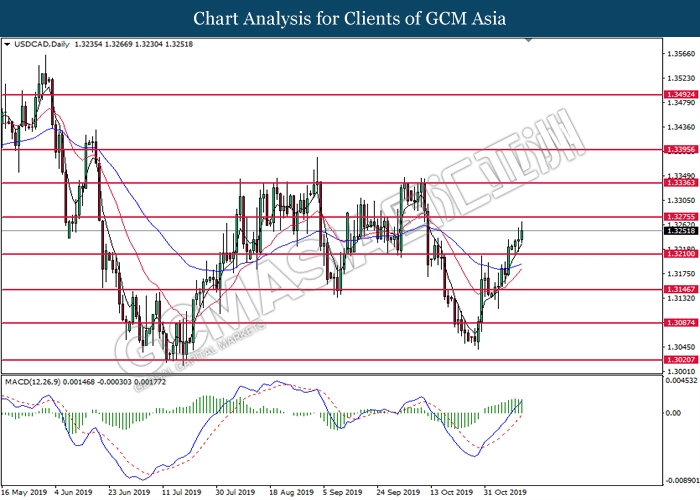

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3210. MACD which illustrated bullish momentum suggest the pair to extend its gains toward resistance level at 1.3275.

Resistance level: 1.3275, 1.3335

Support level: 1.3210, 1.3145

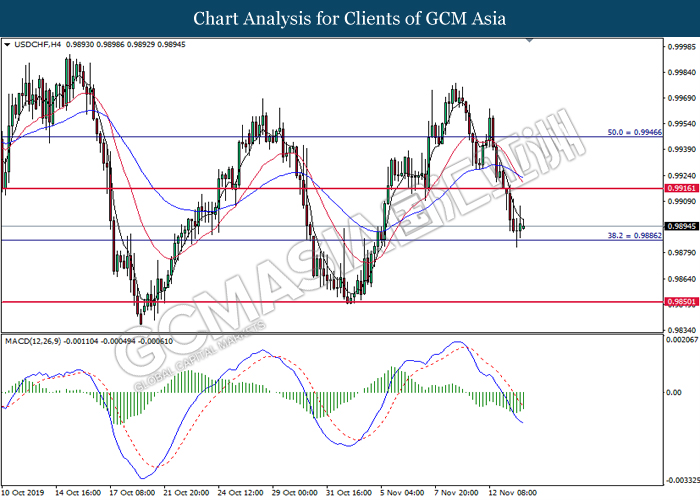

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9885. MACD which illustrated diminishing bearish momentum suggest the pair to extend its rebound toward the resistance level at 0.9915.

Resistance level: 0.9915, 0.9945

Support level: 0.9885, 0.9850

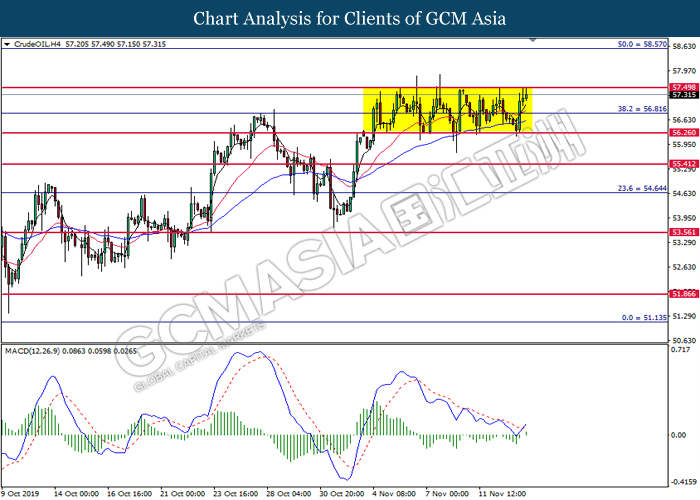

CrudeOIL, H4: Crude oil price was traded higher while currently testing the sideway channel top level at 57.50. MACD which illustrated bullish momentum and the formation of golden cross suggest the commodity to extend its gains after it successfully breakout above the resistance level at 57.50.

Resistance level: 57.50, 58.55

Support level: 56.80, 56.25

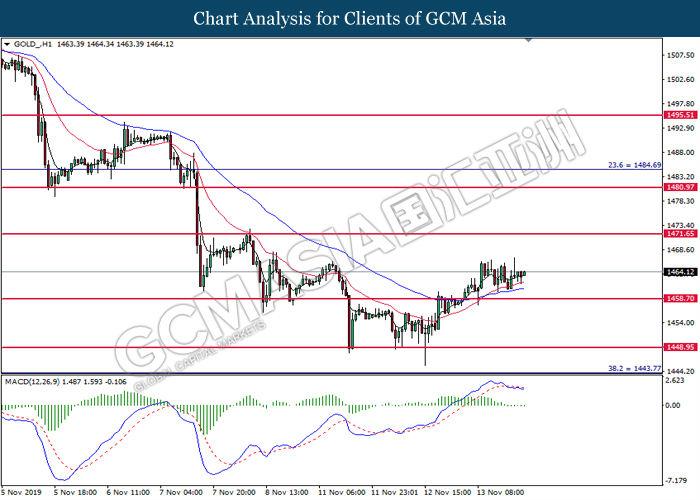

GOLD_ H1: Gold price was traded higher following prior rebound from the 20 moving average line (Red). Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering the gold market.

Resistance level: 1471.65, 1480.95

Support level: 1458.70, 1448.95