15 November 2019 Afternoon Session Analysis

Safe-haven Yen fell on market risk recovery.

The Japanese Yen which traded against the greenback have fell during late Asian session on Friday as the risk-recovery on renewed optimism surrounding the US-China trade deal. According to the latest development, White House Economic Adviser Larry Kudlow have stated that the U.S are “getting close” to trade deal with China. The remarks have since act as the main catalyst which help propelled the risk sentiment in the market. Recently, China have display a goodwill gestures which it have announced lifting the restrictions on the US poultry imports, improving the optimism of trade deal. Furthermore, despite recent skepticism from Financial Times report, the news of the restart of the US-China trade talks later on Friday also improve risk appetite. Thus, the positive news also diminished the appeal of safe-haven asset such as Yen. The focus will likely remain on the primary level phone call between the US and Chinese trade teams for fresh cues on the risk trends that will eventually impact anti-risk Yen in the day ahead. At the time of writing, USD/JPY gains 0.16% to 108.56 while dollar index have edge lower 0.03% to 98.14.

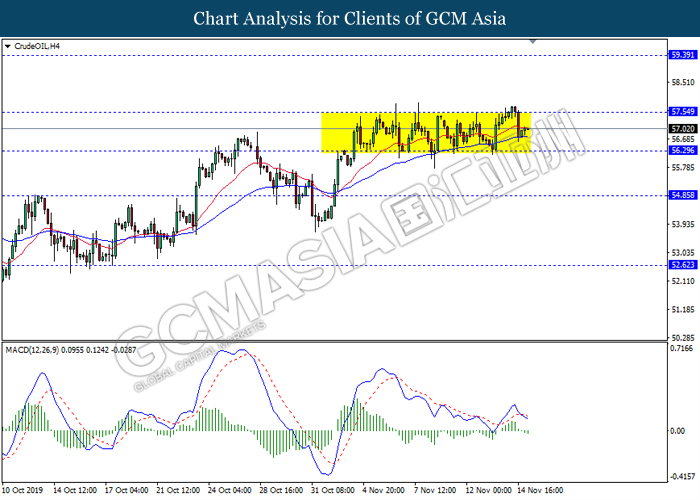

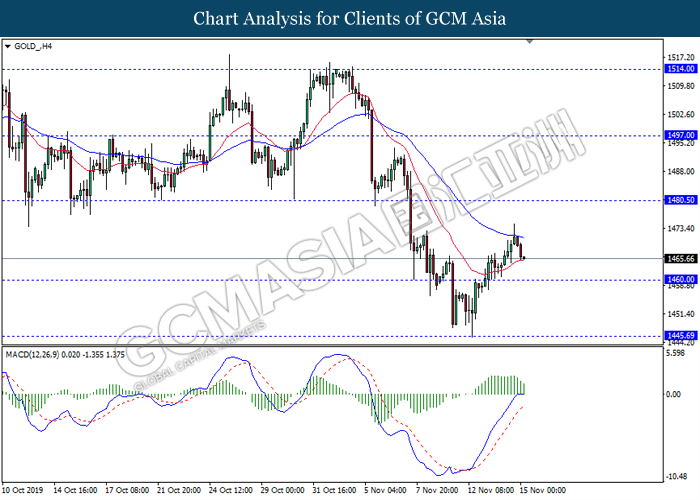

In the commodities market, crude oil price rose 0.30% to $57.03 per barrel at the time of writing as hopes of supply curb and new optimism on U.S.-China trade deal have helped bolstered the market confidence towards the commodity. On Thursday, OPEC have stated that it expected demand for its oil to fall in 2020 and expect to maintain limits on production that were introduced to cope with a supply glut. On the other hand, gold price fell 0.21% to $1468.06 as of writing amid increasing risk sentiment which have caused investors to shift their portfolio from safe-have market into more risky assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

10.45 CAD BoC Goz Poloz Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 0.7% | 0.7% | – |

| 21:30 | US – Core Retail Sales (MoM) (Oct) | -0.1% | 0.4% | – |

| 21:30 | US – Retail Sales (MoM) (Oct) | -0.3% | 0.2% | – |

| 02:00 (16th) | CrudeOIL – U.S. Baker Hughes Oil Rig Count | 684 | – |

Technical Analysis

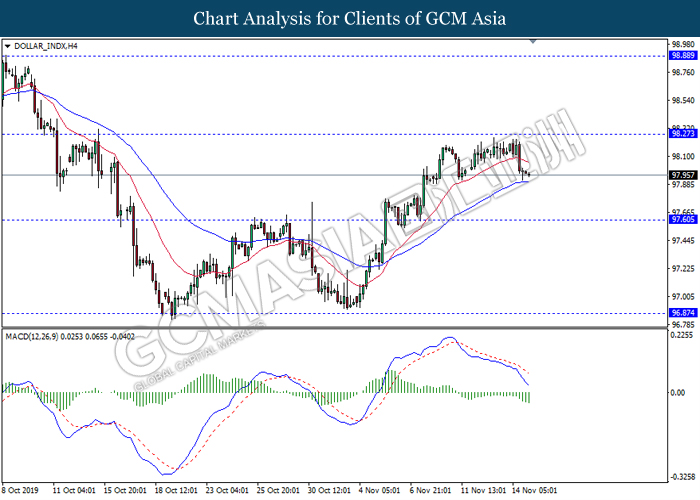

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level 98.25. MACD which illustrate ongoing bearish momentum signal suggest the dollar to extend its losses towards the support level 97.60.

Resistance level: 98.25, 98.90

Support level: 97.60, 96.85

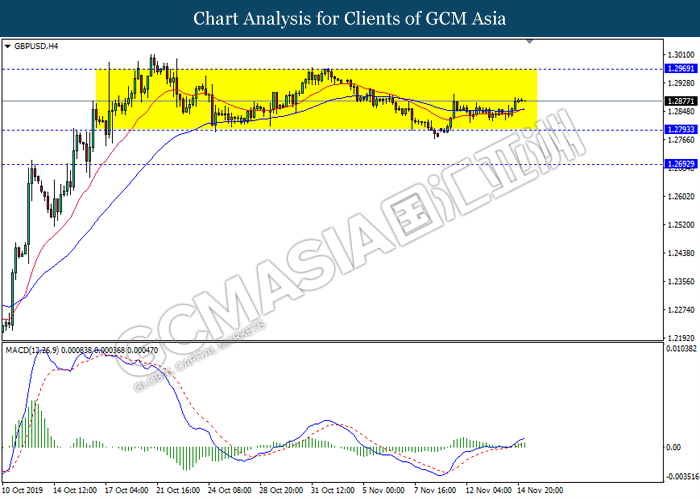

GBPUSD, H4: GBPUSD remain traded in a sideway channel. However, MACD which illustrate bullish momentum signal suggest the pair to be traded higher in short term towards the resistance level 1.2970.

Resistance level: 1.2970, 1.3095

Support level: 1.2795, 1.2690

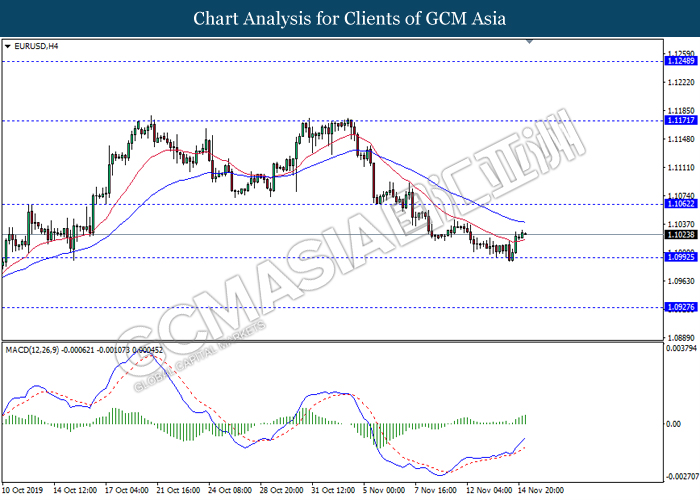

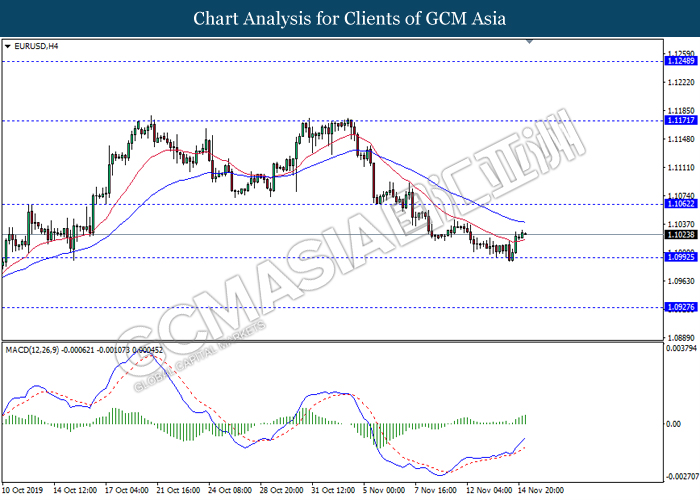

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.0990. MACD which illustrate bullish bias signal suggest the pair to extend its rebound towards the resistance level 1.1060.

Resistance level: 1.1060, 1.1170

Support level: 1.0990, 1.0925

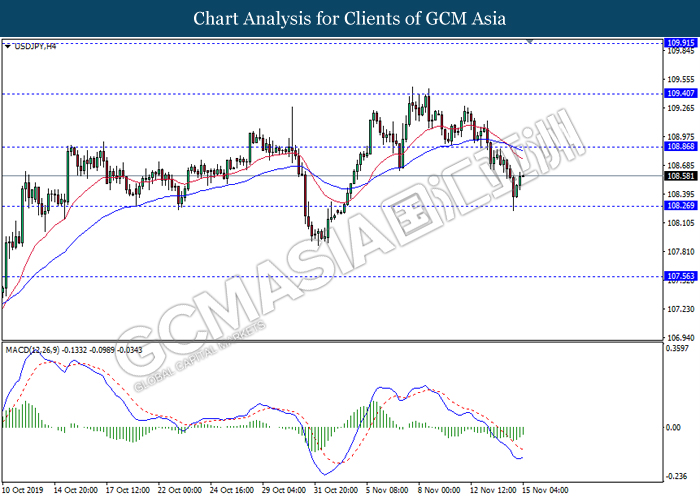

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 108.25. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 108.85.

Resistance level: 108.85, 109.40

Support level: 108.25, 107.55

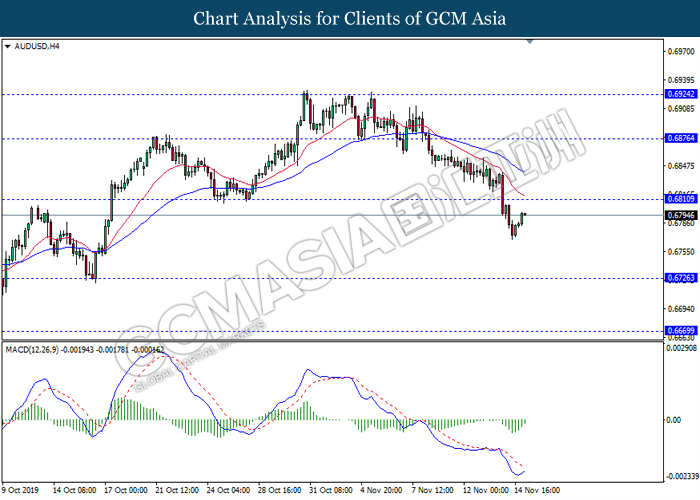

AUDUSD, H4: AUDUSD was traded higher following prior rebound from its low levels. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 0.6810.

Resistance level: 0.6810, 0.6875

Support level: 0.6725, 0.6670

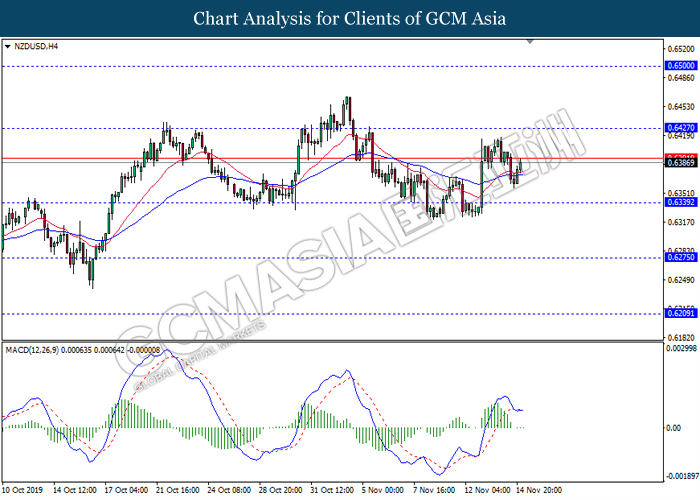

NZDUSD, H4: NZDUSD was traded higher following recent rebound from MA line. However, due to lack of momentum and clear direction from MACD, it is suggested to wait until further signal appear before entering the market.

Resistance level: 0.6425, 0.6500

Support level: 0.6340, 0.6275

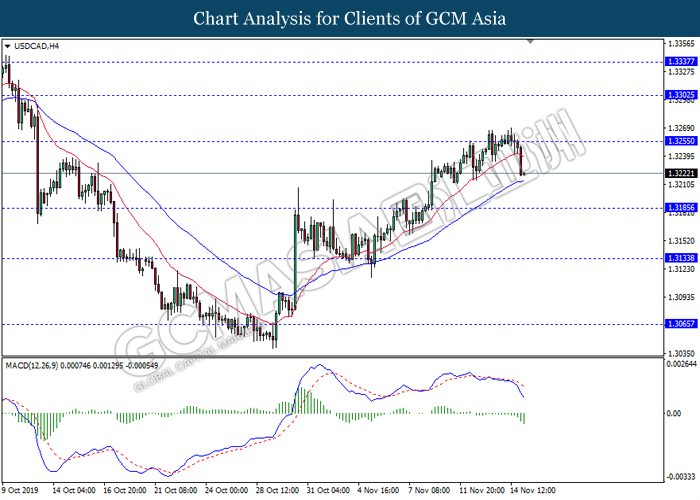

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.3255. MACD which illustrate bearish momentum signal suggest the pair to extend its retracement towards the support level 1.3185.

Resistance level: 1.3255, 1.3335

Support level: 1.3185, 1.3135

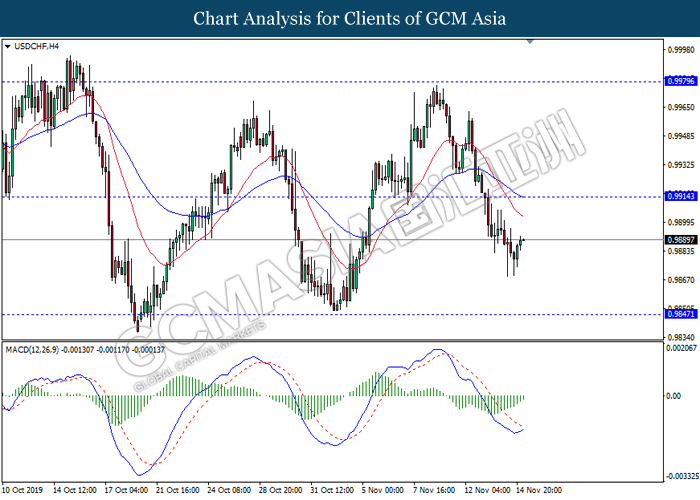

USDCHF, H4: USDCHF was traded higher following recent rebound from its low levels. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 0.9915.

Resistance level: 0.9915, 0.9980

Support level: 0.9845, 0.9800

CrudeOIL, H4: Crude oil price remain traded in a sideway channel following recent retracement from the resistance level 57.55. However, MACD which illustrate bearish momentum signal suggest the commodity to extend its retracement in short term towards the support level 56.30.

Resistance level: 57.55, 59.40

Support level: 56.30, 54.85

GOLD_ H4: Gold price was traded lower following prior retracement from the MA line 50 (blue). MACD which display diminishing bullish momentum signal suggest the commodity to extend its retracement towards the support level 1460.00.

Resistance level: 1480.50, 1497.00

Support level: 1460.00, 1445.70.