15 November 2019 Morning Session Analysis

Greenback slumped, eyed on trade war.

The dollar index which gauge its value against a basket of six major currencies plunged amid hope upon the resolution of trade war faded. According to Financial Times, China and United States were struggling to reach a “phase one” deal and may not settle ahead of 15th December 2019, when U.S. tariffs on Chinese goods are set to go into effect. In addition, US dollar received a further pressure following the bleak Initial Jobless Claims data was published. According to Department of Labor, U.S. Initial Jobless Claims notched up to 225k, prior to 211k, lower than the economist forecast of 215k. However, the losses experienced by the US dollar was limited as US Producer Price index came in better than expectation, bolstering the Federal Reserve’s stance that it will probably not decrease its interest rates again in short-term. On the other hand, Pound Sterling surged despite bleak data from the UK region was released, mostly due to positive prospect for the Brexit issue. According to Bloomberg, expectations that Britain’s ruling Conservative Party might win a majority in 12th December 2019 election, further enhanced the investors’ optimism that the Brexit impasse will finally end and sparkled the demand for the Pound Sterling. However, according to the Office for National Statistics, U.K Retail Sales for last month came in at -0.1%, weaker than the economist forecast at 0.2%, limited the gains experienced by the Pound Sterling. As of writing, the Dollar Index depreciated by 0.23% to 97.97 while GBP/USD surged 0.01% to 1.2880.

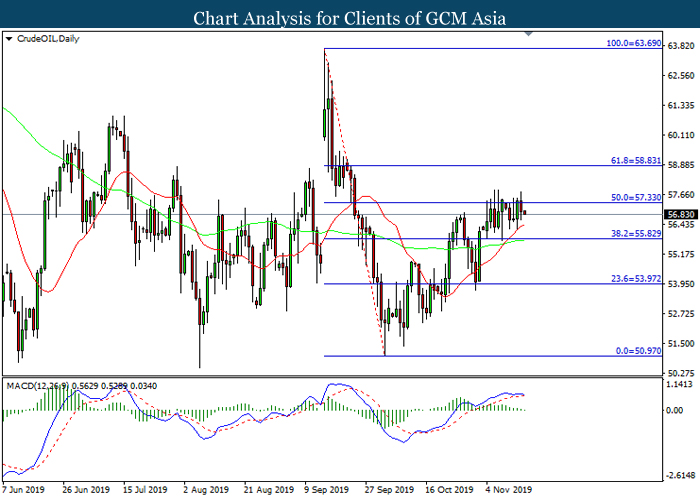

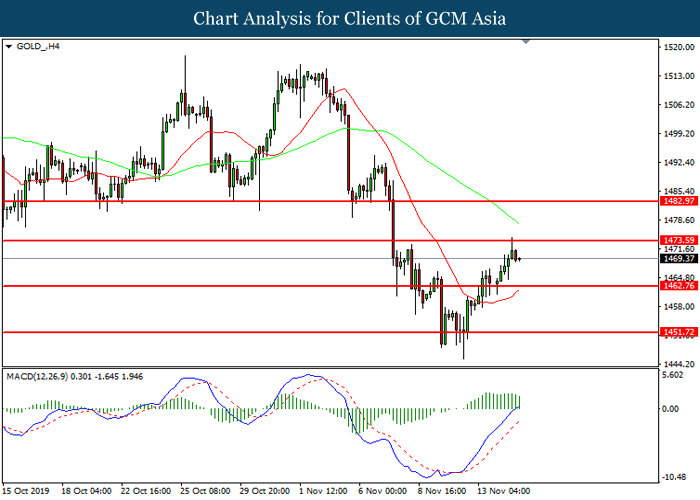

In the commodities market, crude oil price slumped yesterday amid to an increase in crock piles in the U.S. According to Energy Information Administration, US Crude Oil inventories came in at 2.219M, exceeding the economist forecast at 1.649M. On the other hand, gold price rose amid to weaker greenback and the escalation of trade tension. As of writing, crude oil price traded flat at $56.85 per barrel, while gold price appreciated by 0.01% to $1470.82 per troy ounces.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

10:45 CAD BoC Gov Poloz Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 0.7% | 0.7% | – |

| 21:30 | US – Core Retail Sales (MoM) (Oct) | -0.1% | 0.4% | – |

| 21:30 | US – Retail Sales (MoM) (Oct) | -0.3% | 0.2% | – |

| 02:00 (16th) | CrudeOIL – U.S. Baker Hughes Oil Rig Count | 684 | – |

Technical Analysis

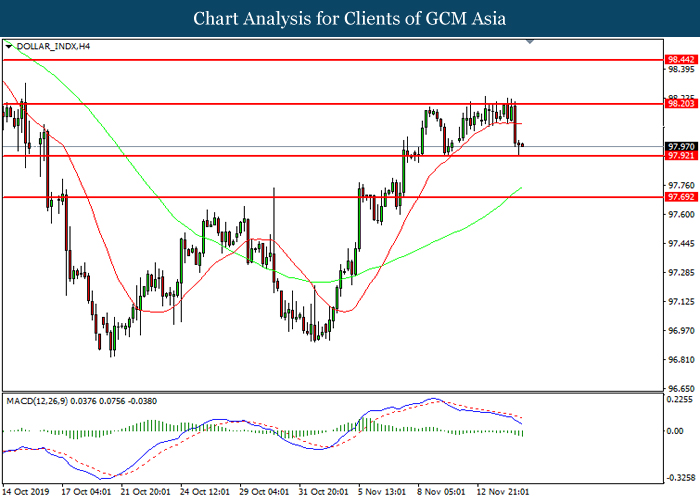

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 97.90. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 98.20, 98.45

Support level: 97.90, 97.70

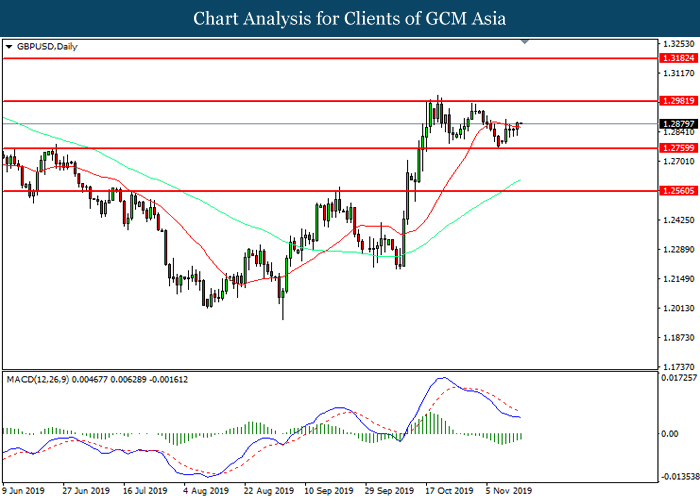

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2760. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2980.

Resistance level: 1.2980, 1.3180

Support level: 1.2760, 1.2560

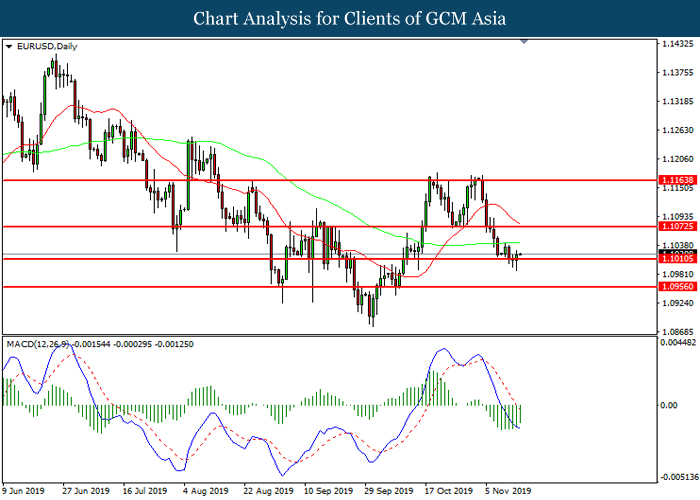

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1010. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1075, 1.1165

Support level: 1.1010, 1.0955

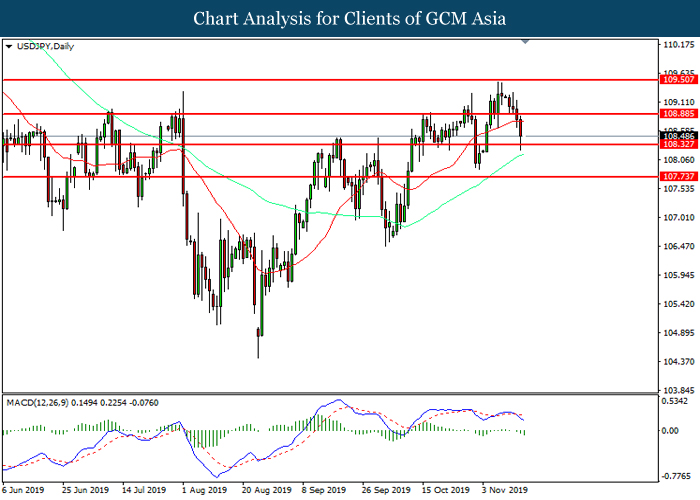

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 108.90. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 108.35.

Resistance level: 108.90, 109.50

Support level: 108.35,107.75

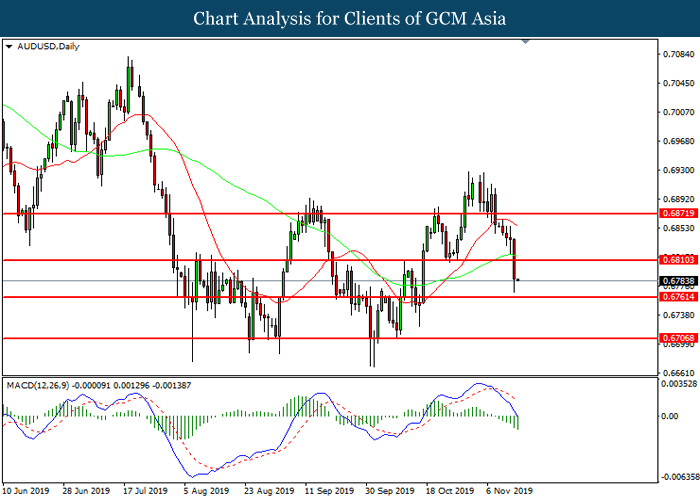

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6810. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6760.

Resistance level: 0.6810, 0.6880

Support level: 0.6760, 0.6705

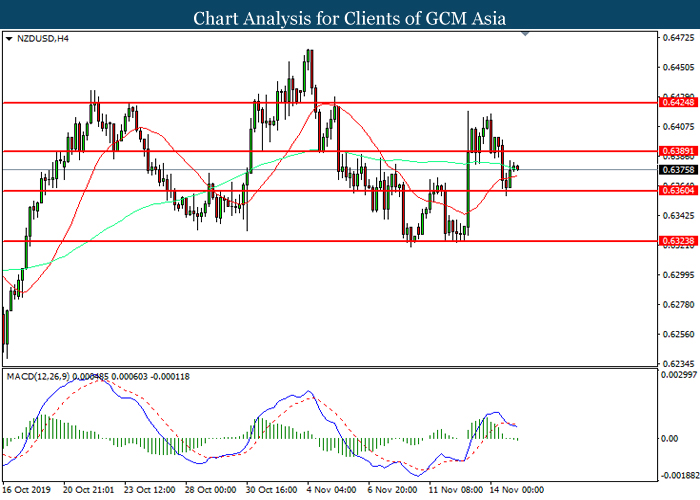

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6360. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6390, 0.6425

Support level: 0.6360, 0.6325

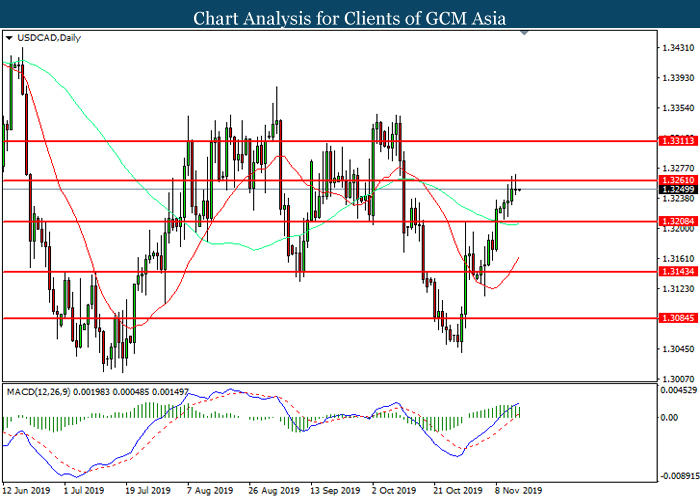

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3260. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3260, 1.3310

Support level: 1.3210, 1.3145

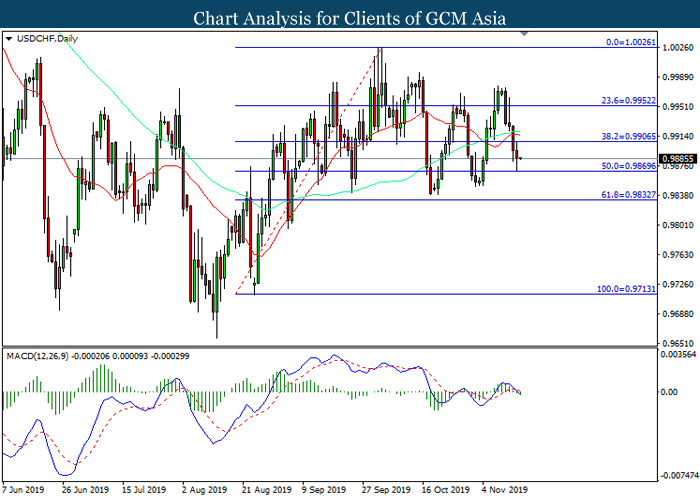

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9905. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9870.

Resistance level: 0.9905, 0.9950

Support level: 0.9870, 0.9835

CrudeOIL, Daily: Crude oil price was lower following prior retracement from the resistance level at 57.35. MACD which illustrated diminishing bullish momentum suggest its prices to extend its losses toward support level at 55.85.

Resistance level: 57.35, 58.85

Support level: 55.85, 53.95

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1473.60. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 1462.75.

Resistance level: 1473.60, 1482.95

Support level: 1462.75, 1451.70