17 February 2020 Afternoon Session Analysis

Dollar hovered amid inconsistent market sentiment.

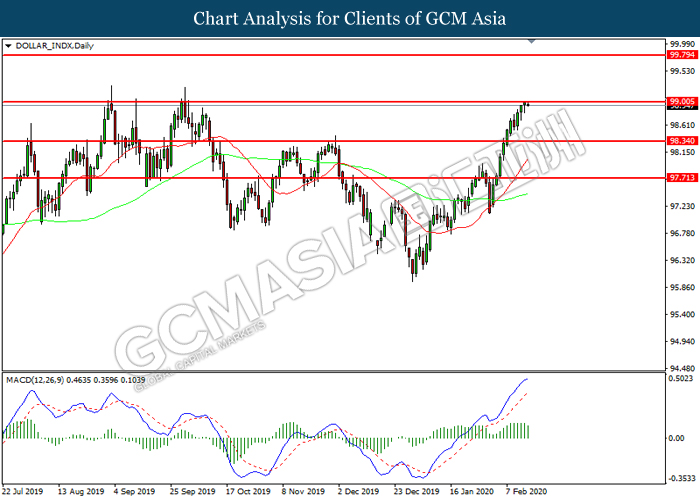

Dollar index which gauge its value against a basket of six major currencies was traded fat near the 4 months high level after US announced a series of positive economic data last Friday. According to US Census Bureau, US Retail Sales data was came in at 0.3% as widely expected, slightly ticked up as compare to last month reading. At the meantime, economists are still having optimistic view toward the US retail sector and forecasting that it is likely able to catch up the economy growth at steady pace in upcoming month. However, the gains of dollar index was limited by the recent coronavirus outbreak as market participants started to brace for the first rate cut by Federal Reserve (Fed). Despite US dollar considered as major safe haven asset, somehow market participants had begun to sell off their dollar’s holding as market bets that the pressure on Federal Reserve for an interest rate cut will heighten further as the global economy is going ‘south’, believing that the coronavirus epidemic would enlarge the gap between target and current inflation rate. As of writing, dollar index notched down 0.01% to 99.10.

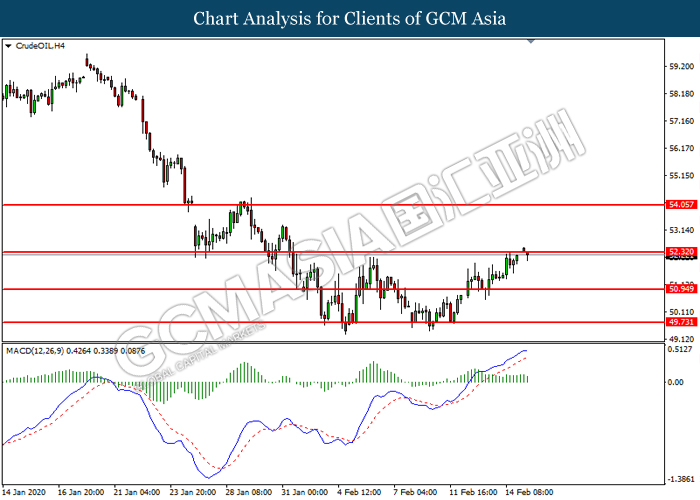

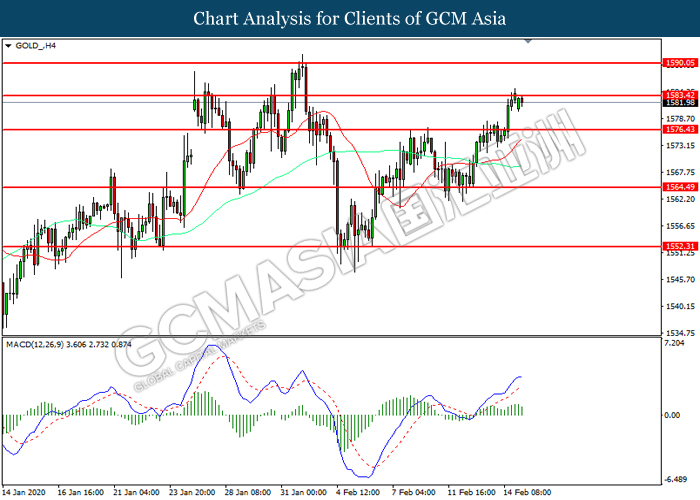

In the commodities market, crude oil price slumped 0.29% to $52.05 per barrel after data showed US added another 2 oil rig to a total of 678 in last week. The oil drilling activity which biased to downside are expected to pick up as investors concern over the negative impact of coronavirus epidemic toward crude oil outlook began to ease. Besides, gold price dropped 0.10% to $1582.75 a troy ounce as market risk-off sentiment dampen.

Today’s Holiday Market Close

Time Market Event

All day USD United States- Washington’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily:Dollar index was traded higher while currently testing the resistance level at 99.00. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 99.00, 99.80

Support level: 98.35, 97.70

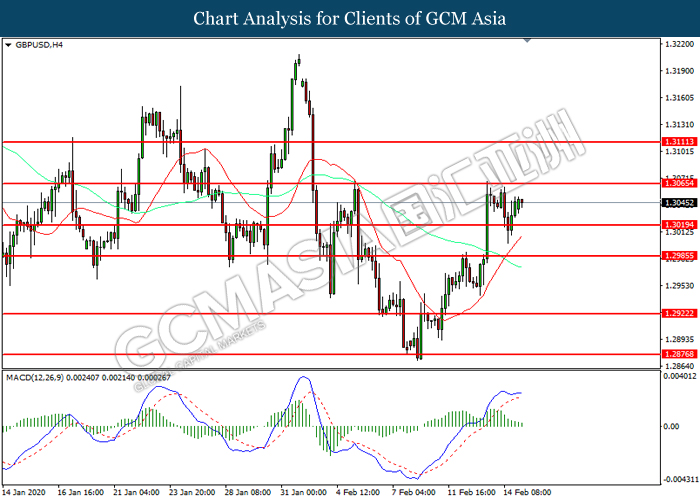

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3020. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3065, 1.3110

Support level: 1.3020, 1.2985

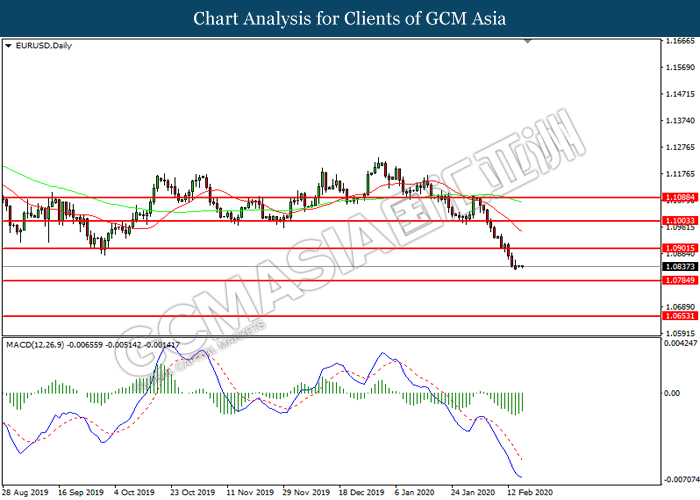

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0900. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0900, 1.1005

Support level: 1.0785, 1.0655

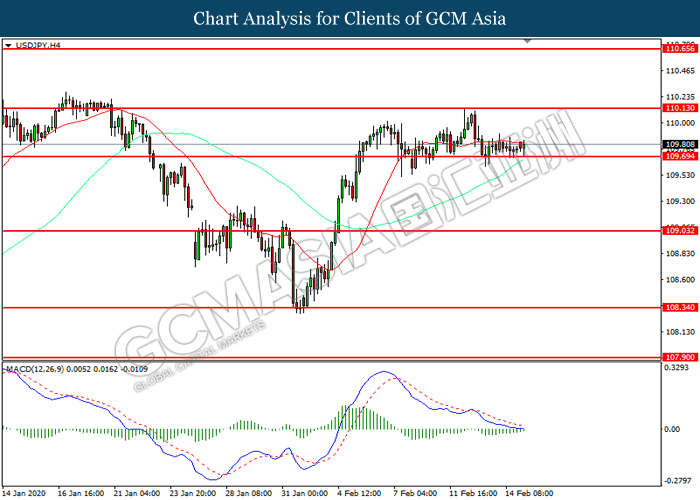

USDJPY, H4: USDJPY was traded within a range while currently testing the resistance level at 109.70. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 110.15, 110.65

Support level: 109.70, 109.05

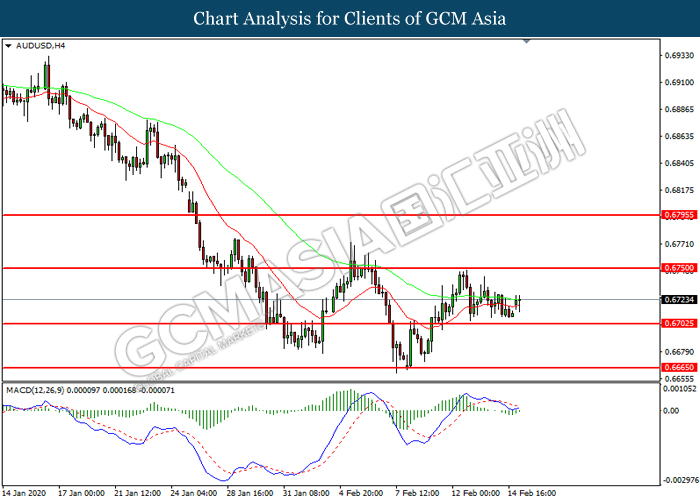

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.6705. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6750.

Resistance level: 0.6750, 0.6795

Support level: 0.6705, 0.6665

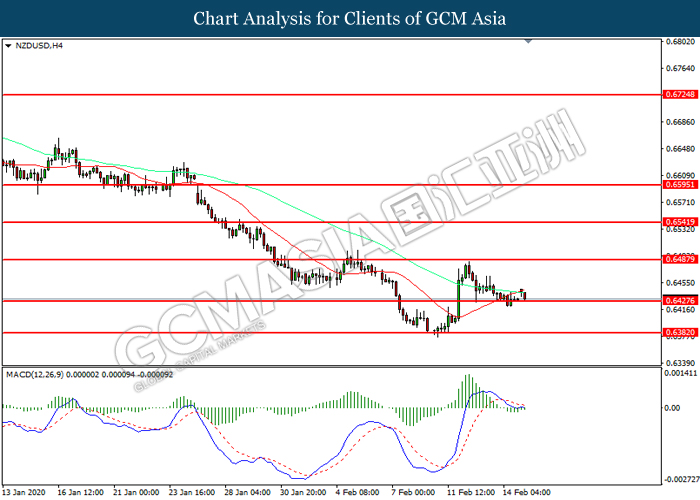

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6425. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6490, 0.6540

Support level: 0.6425, 0.6380

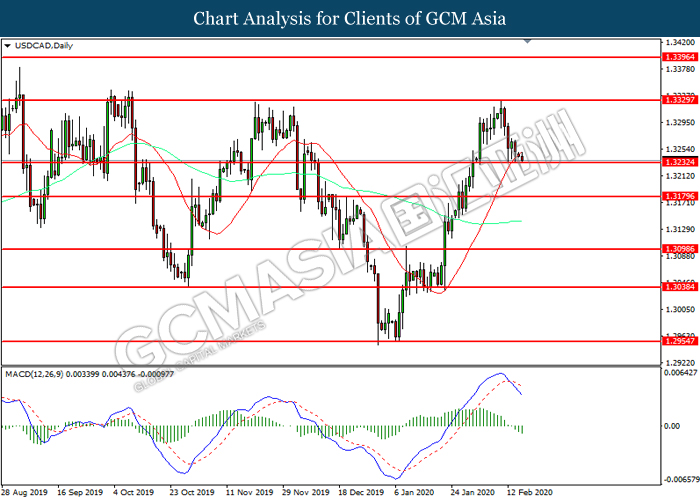

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3240. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout below the support level.

Resistance level: 1.3330, 1.3395

Support level: 1.3240, 1.3180

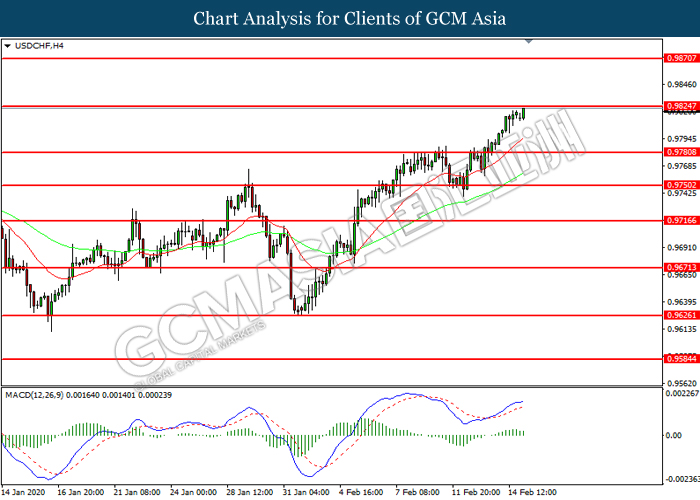

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9825. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9825, 0.9870

Support level: 0.9780, 0.9750

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 52.30. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 52.30, 54.05

Support level: 50.95, 49.75

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1583.40. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1583.40, 1590.05

Support level: 1576.45, 1564.50