17 February 2020 Morning Session Analysis

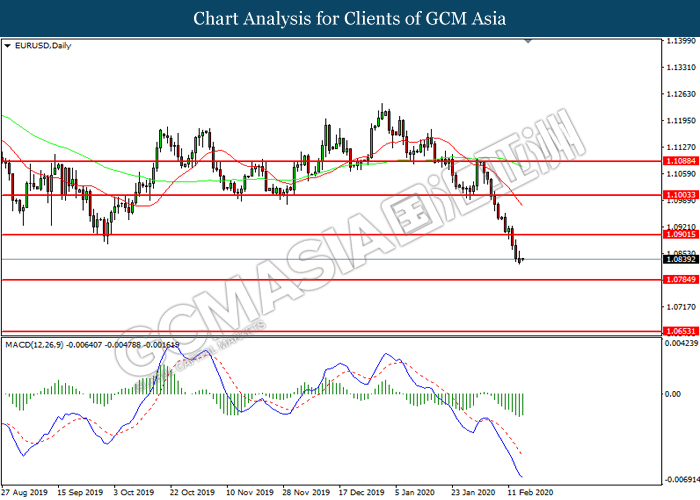

EUR/USD slumped amid to bleak data.

EUR/USD extend its losses on last Friday over the backdrop of the bleak data from the European region. According to Statistisches Bundesamt Deutschland, the Germany Gross Domestic Product (GDP) for last month decrease from the previous reading of 0.2% to 0.0%, missing the economist forecast at 0.1%. Meanwhile, the Eurozone Gross Domestic Product (GDP) for last month notched down from the preliminary reading of 1.2% to 0.9%, weaker than the economist forecast at 1.0%. As both data fared worse than expectation, which dialing down market optimism towards the economic progression in the European Union, while prompting a greater expectation for the European central bank to decrease its interest rate in the future in order to boost back the economic growth. Besides that, the euro received a further bearish momentum as the risk-off sentiment in the FX market due to the fears upon the outbreak of coronavirus. Such negative sentiment had prompted the investors to shift their investment to the safe-haven asset such as Japanese Yen and US Dollar, while spurring a further selloff for the riskier asset such as the euro. According to CNBC, the China’s latest figures showed 68,500 cases of the coronavirus while 1,665 people were killed by the virus. As of writing, EUR/USD appreciated by 0.08% to 1.0837.

In the commodities market, the crude oil priced depreciated by 0.11% to $52.37 per barrel as of writing. However, the oil market was traded higher on last Friday with market hoping for OPEC+ to either deepen or extending oil output cuts in the future. On the other hand, the gold price was traded higher on last Friday amid to the concerns of the coronavirus, insinuating the demand for the safe-haven metal. However, as of writing, the gold price slumped 0.10% to $1581.88 per troy ounces amid to technical correction.

Today’s Holiday Market Close

Time Market Event

All day USD United States- Washington’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

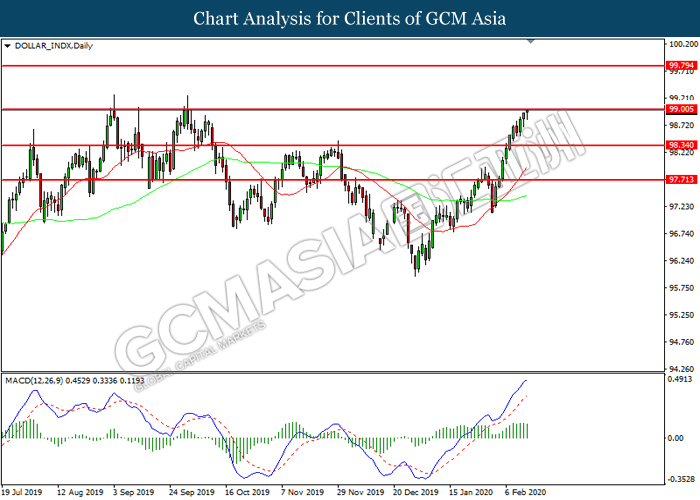

DOLLAR_INDX, Daily:Dollar index was traded higher while currently testing the resistance level at 99.00. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 99.00, 99.80

Support level: 98.35, 97.70

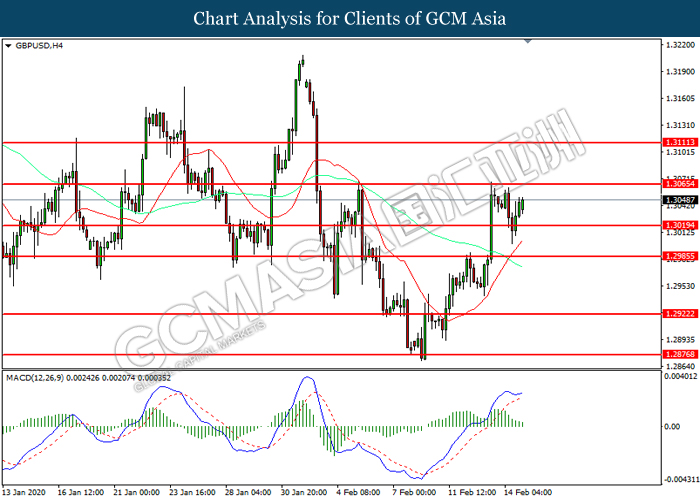

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3020. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3065, 1.3110

Support level: 1.3020, 1.2985

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0900. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0900, 1.1005

Support level: 1.0785, 1.0655

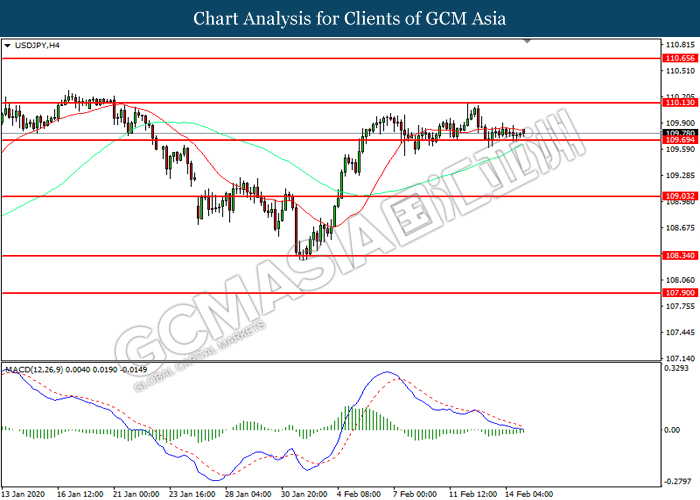

USDJPY, H4: USDJPY was traded within a range while currently testing the resistance level at 109.70. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 110.15, 110.65

Support level: 109.70, 109.05

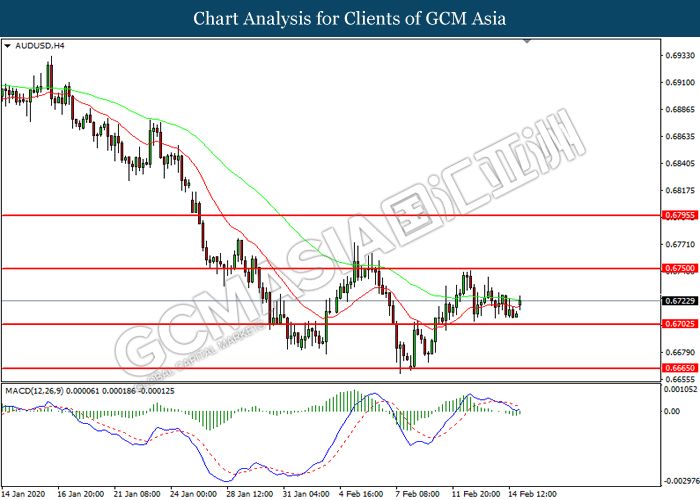

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.6705. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6750.

Resistance level: 0.6750, 0.6795

Support level: 0.6705, 0.6665

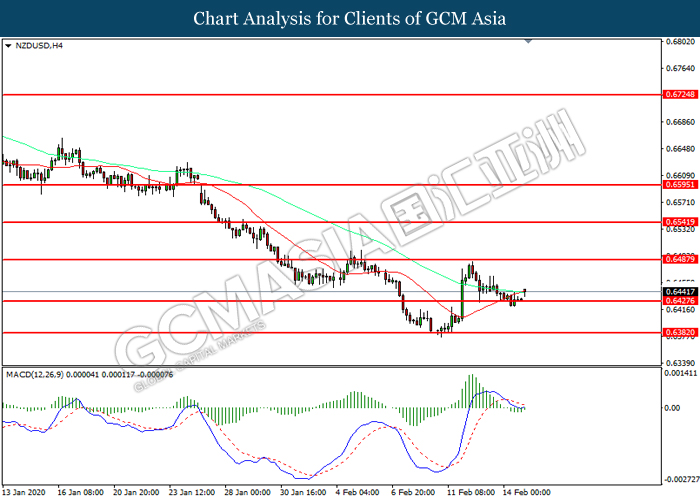

NZDUSD, H4: NZDUSD was traded lower while currently testing near the support level 0.6425. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6490, 0.6540

Support level: 0.6425, 0.6380

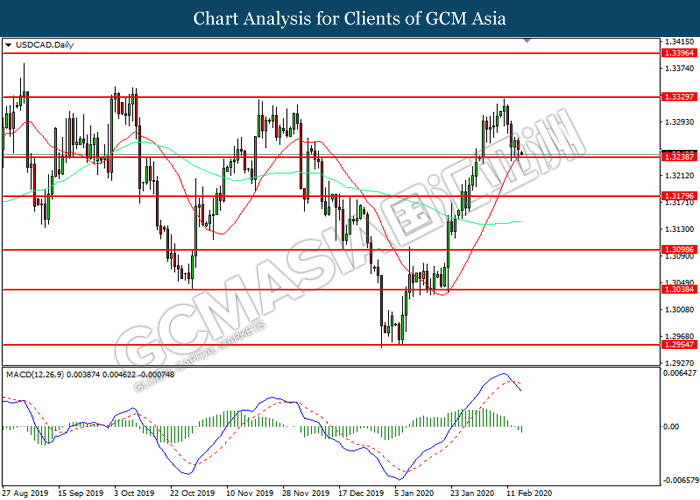

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3240. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout below the support level.

Resistance level: 1.3330, 1.3395

Support level: 1.3240, 1.3180

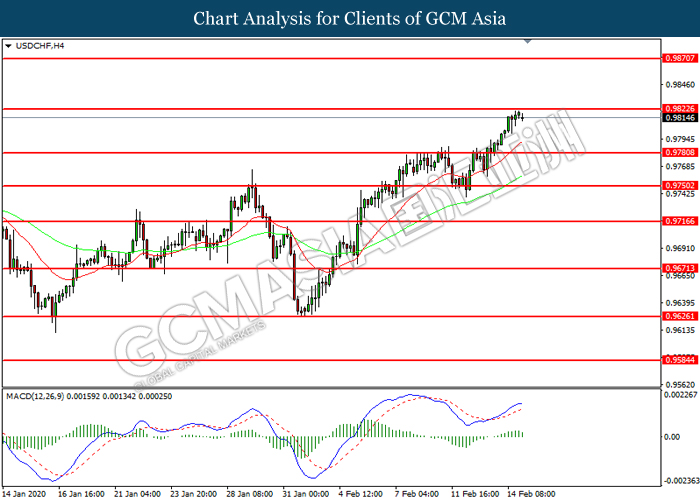

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9825. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9825, 0.9870

Support level: 0.9780, 0.9750

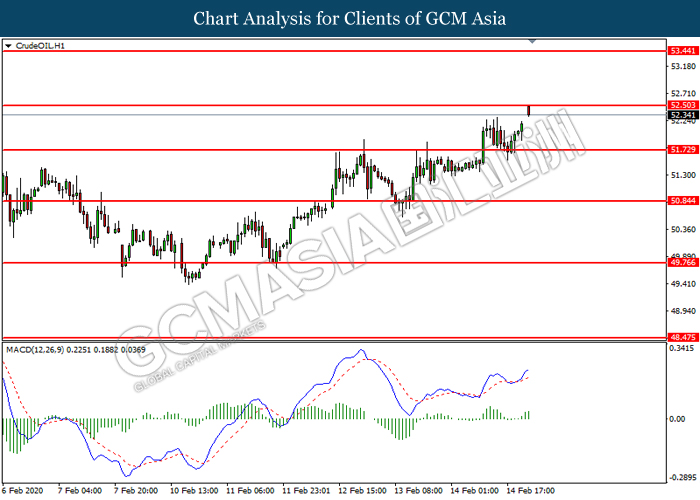

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 52.50. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 52.50, 53.45

Support level: 51.75, 50.85

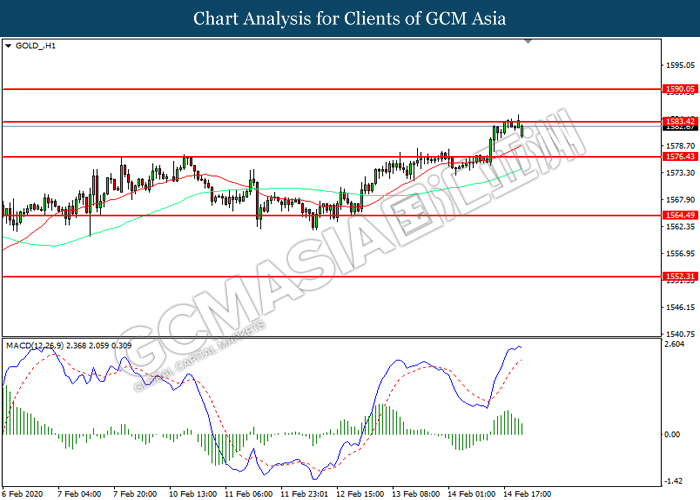

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1583.45. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1583.40, 1590.05

Support level: 1576.45, 1564.50