18 September 2019 Morning Session Analysis

Greenback trim gains, eyes on FOMC Meeting.

Greenback trims its gains on yesterday while market participants anticipates the release of interest rate decision from the Federal Reserve. As of writing, the dollar index was quoted down 0.40% to 97.73. According to Fed Rate Monitor Tool, investors are currently pricing in at 50.8% chance for a 25-basis point cut from 2.25% to 2.00%. However, most participants would be scrutinizing over Federal Reserve’s economic projection, statement as well as press conference chaired by Jerome Powell in order to gauge the central bank’s outlook upon US economy and future guidance. Substantially, losses on the greenback were limited after Industrial Production for the month of August rose 0.6%, seemingly higher than forecast of 0.2%. On the other hand, pair of GBP/USD ticks up 0.01% to 1.2499 during Asian trading session. On yesterday, the UK Supreme Court concluded its first day of a three days hearing with regards to PM UK Boris Johnson decision to suspend the parliament. The case may not only undermine his position as UK’s Prime Minister, it could also force him to retreat from the current legislative and give way to soft-Brexit supporters to pass through their laws.

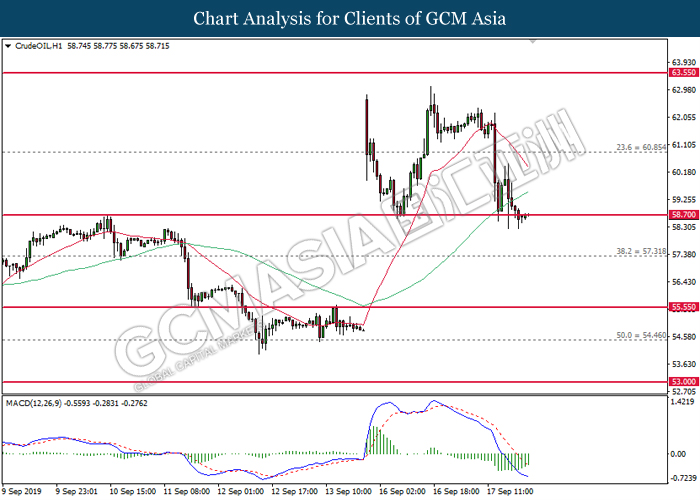

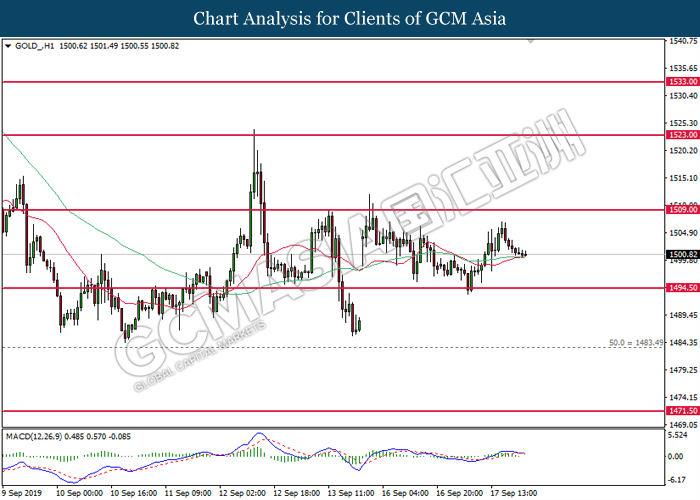

As for commodities market, crude oil price rebounds by 0.17% to $58.87 per barrel. On yesterday, oil prices suffered from a large selloff after Saudi Arabia pledged to increase their oil output capacity up to 11 million barrels per day by the end of September after its facilities were attacked by the Houthi forces. On the other hand, gold price depreciates by 0.04% to $1,500.79 a troy ounce while market participants wait for the results from Federal Reserve policy meeting and interest rate decision.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – CPI (YoY) (Aug) | 2.1% | 1.9% | – |

| 17:00 | EUR – CPI (YoY) (Aug) | 1.0% | 1.0% | – |

| 20:30 | USD – Building Permits (Aug) | 1.317M | 1.300M | – |

| 20:30 | CAD – Core CPI (MoM) (Aug) | 0.3% | – | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -6.912M | -2.889M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index remains traded within a downward channel. MACD which illustrate bearish signal suggests the index to extend its losses, towards the direction of 97.40.

Resistance level: 97.80, 98.05

Support level: 97.40, 96.95

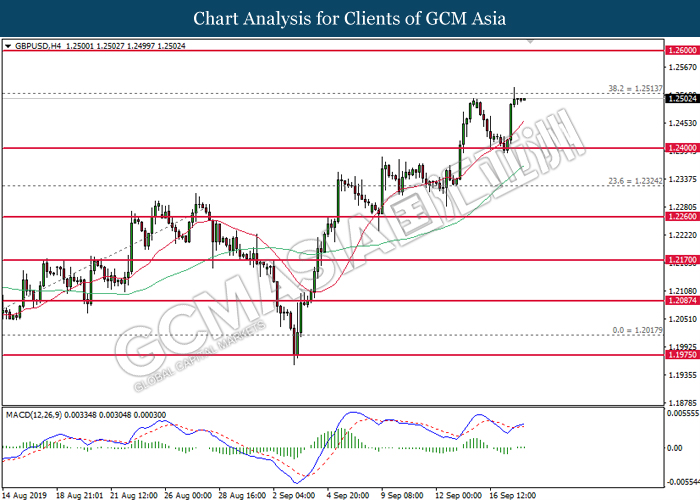

GBPUSD, H4: GBPUSD was traded higher while currently testing at the resistance of 1.2515. MACD which illustrate bullish signal suggests the pair to extend its gains after closing above 1.2515.

Resistance level: 1.2515, 1.2600

Support level: 1.2400, 1.2325

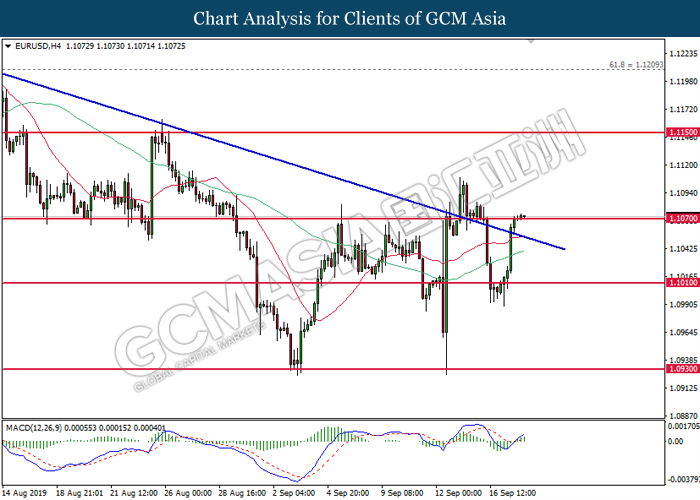

EURUSD, H4: EURUSD was traded higher following prior breakout from the downward trendline. MACD which illustrate bullish signal suggests the pair to extend its gains, towards the direction of 1.1150.

Resistance level: 1.1150, 1.1210

Support level: 1.1070, 1.1010

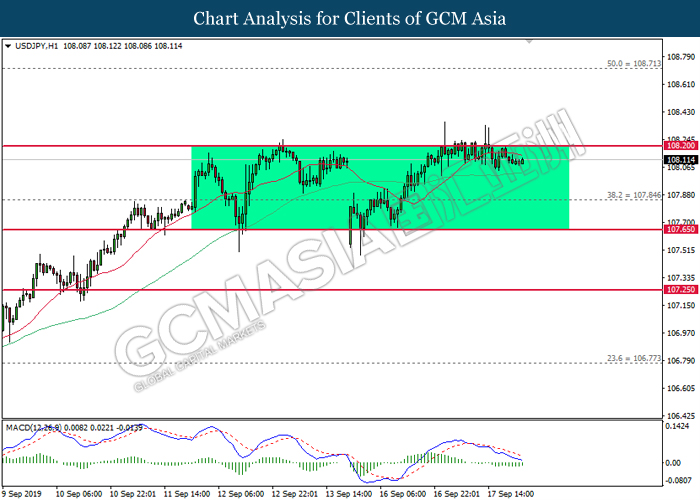

USDJPY, H1: USDJPY remains traded within a sideways channel formation. Due to the lack of signal from MACD and price action, it is suggested to wait for a breakout before entering the market.

Resistance level: 108.20, 108.70

Support level: 107.85, 107.65

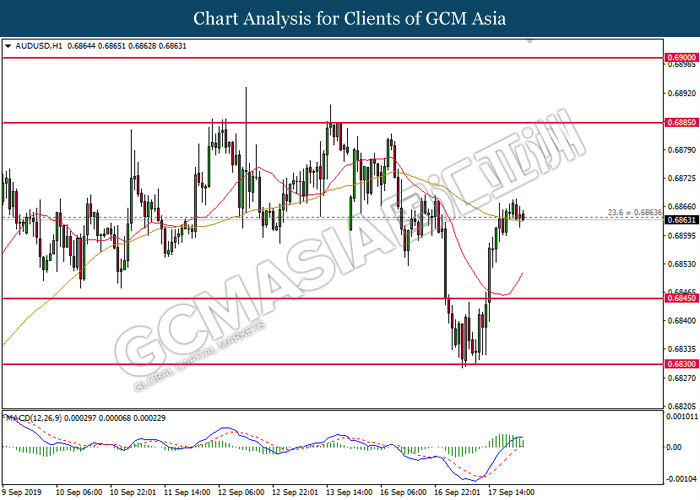

AUDUSD, H1: AUDUSD was traded lower while currently testing at the support of 0.6865. MACD which illustrate diminished upward momentum suggest the pair to extend its losses after closing below 0.6865.

Resistance level: 0.6885, 0.6900

Support level: 0.6865, 0.6845

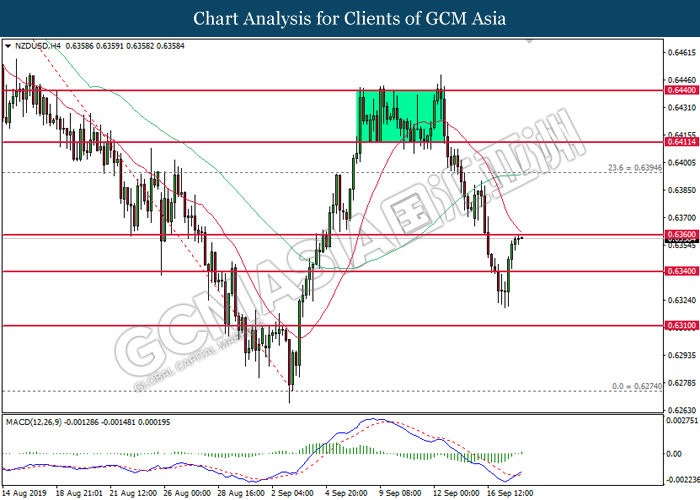

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance of 0.6360. MACD which illustrate bullish signal suggests the pair to extend its gains after closing above 0.6360.

Resistance level: 0.6360, 0.6395

Support level: 0.6340, 0.6310

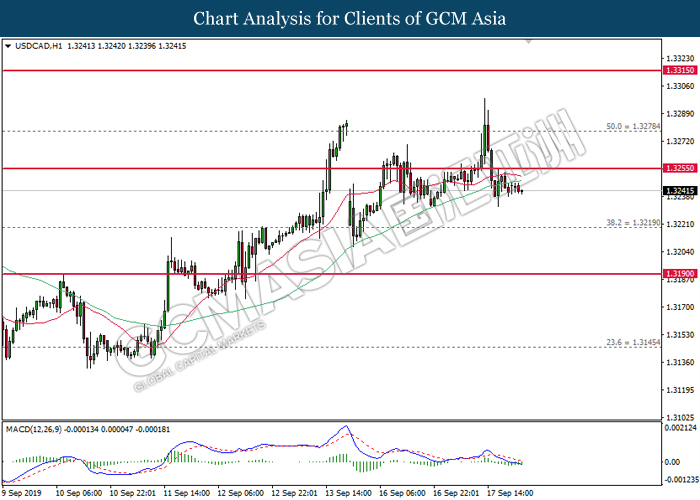

USDCAD, H1: USDCAD was traded lower following prior retrace from the upper level. MACD which illustrate bearish signal suggests the pair to be traded lower, towards the direction of 1.3220.

Resistance level: 1.3255, 1.3280

Support level: 1.3220, 1.3190

USDCHF, H4: USDCHF was traded lower while currently testing at the support of 0.9925. MACD which illustrate diminished upward momentum suggests the pair to be traded lower after closing below 0.9925.

Resistance level: 0.9970, 1.0010

Support level: 0.9925, 0.9865

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance of 58.70. MACD which illustrate diminished downward momentum suggests its price to be traded higher after closing above 58.70.

Resistance level: 58.70, 60.85

Support level: 57.30, 55.55

GOLD_, H1: Gold price remains traded within a sideways formation. Due to the lack of signal from MACD and price action, it is suggested to wait for a breakout before entering the market.

Resistance level: 1509.00, 1523.00

Support level: 1494.50, 1483.50