19 February 2020 Afternoon Session Analysis

Euro droops amid downbeat economic data.

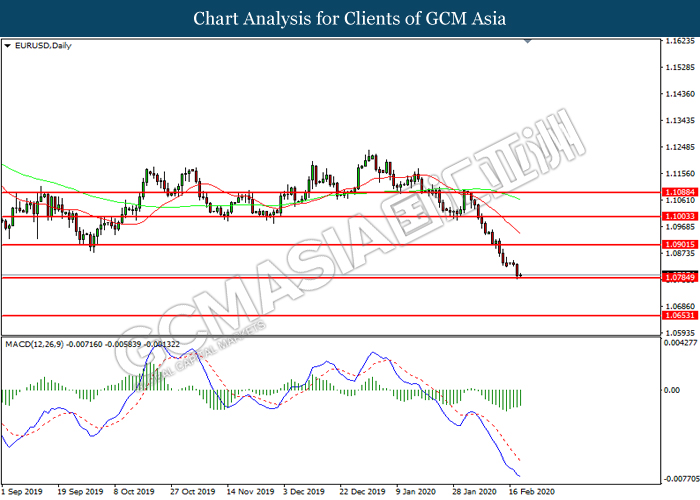

Among all of the major currencies market, euro currency refused ‘wake up’ from bearish, recording the lowest level in two years on yesterday. Euro market sentiment remain pressured as recent lackluster economic data is likely will lead to longer period of subdued growth in EU. According to Center for the European Economic Research, German ZEW economic sentiment data decreased sharply from previous month reading of 26.7 to 8.7 in February, while missing the economist forecast of 21.5. Based on the data, it is obviously indicating that the recent outbreak of coronavirus epidemic in China has triggered a huge negative impact on the global economy, causing significant drop in EU economic condition and enlarged the gap of potential and current underlying inflation pressure. On the other hand, greenback which tracks its value against a basket of major currencies managed to extend its gains yesterday following data shows US business activity in certain region start to pick up in US, showing a good sign of economic recovery. According to Federal Reserve Bank of New York, NY Empire State Manufacturing index rose to 12.90 from previous month of reading at 4.80, even stronger than the reading that forecasted by the economist. As of writing, the pair of EUR/USD notched down 0.01% to 1.0795 while dollar index ticked up 0.01% to 99.30.

In the commodities market, crude oil price appreciated by 0.92% to $52.60 per barrel despite current coronavirus epidemic is getting worst, which shown by increasing death rate. Markets are now eyeing on the upcoming OPEC meeting in order to scrutinize the further direction of crude oil. Besides, gold price rose 0.01% to $1601.80 a troy ounce as market remain pessimistic toward the development of coronavirus epidemic.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:00 USD FOMC Meeting Minutes

(20th)

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 17.30 | GBP – CPI (YoY) (Jan) | 1.3% | 1.6% | – |

| 21.30 | USD – Building Permits (Jan) | 1.420M | 1.450M | – |

| 21.30 | USD – PPI (MoM) (Jan) | 0.2% | 0.1% | – |

| 21.30 | CAD – Core CPI (MoM) (Jan) | -0.4% | – | – |

Technical Analysis

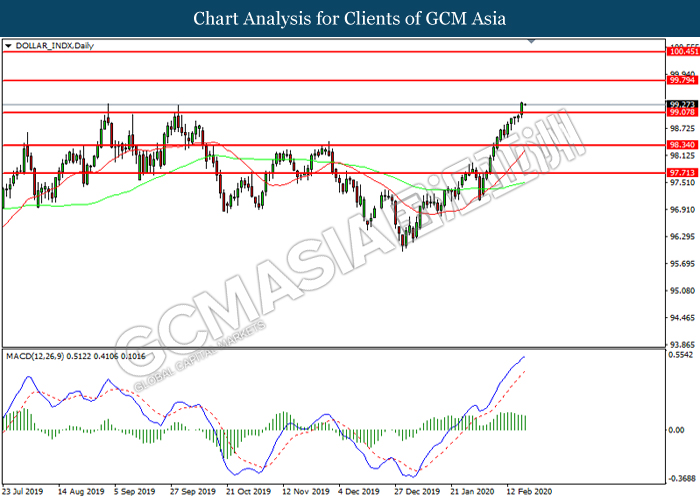

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 99.05. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 99.80, 100.45

Support level: 99.05, 98.35

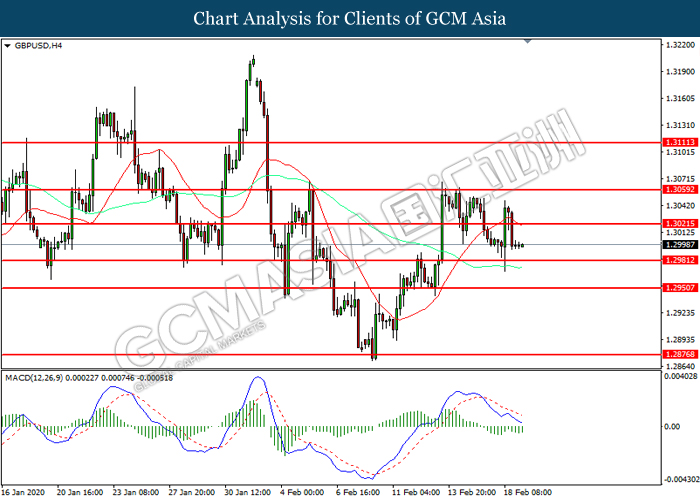

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3020. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3020, 1.3060

Support level: 1.2980, 1.2950

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0785. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0900, 1.1005

Support level: 1.0785, 1.0655

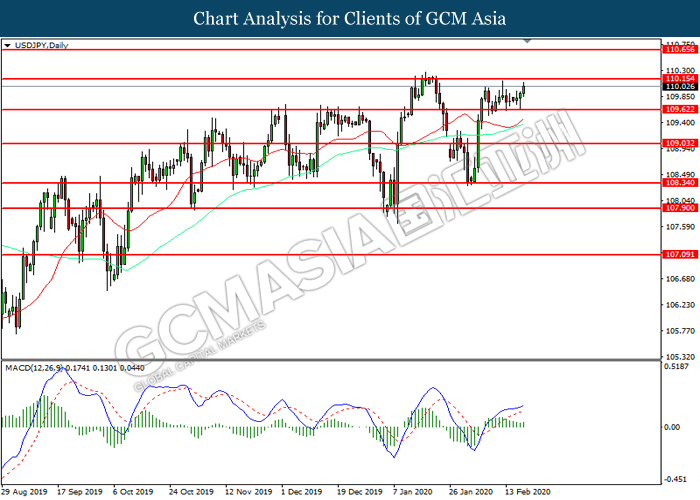

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 110.15. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 110.15, 110.65

Support level: 109.60, 109.05

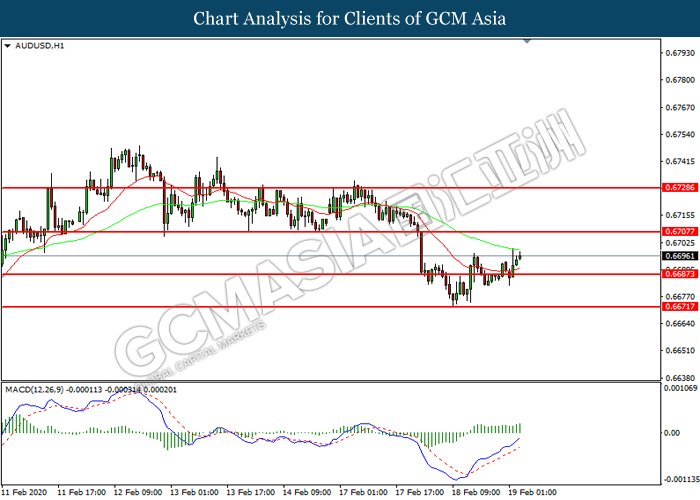

AUDUSD, H1: AUDUSD was traded higher following prior rebound from the support level at 0.6685. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6705.

Resistance level: 0.6705, 0.6730

Support level: 0.6685, 0.6670

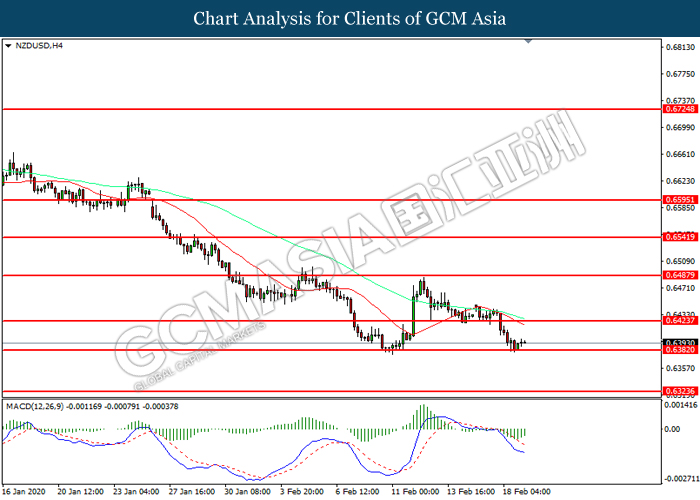

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6380. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6425, 0.6490

Support level: 0.6380, 0.6325

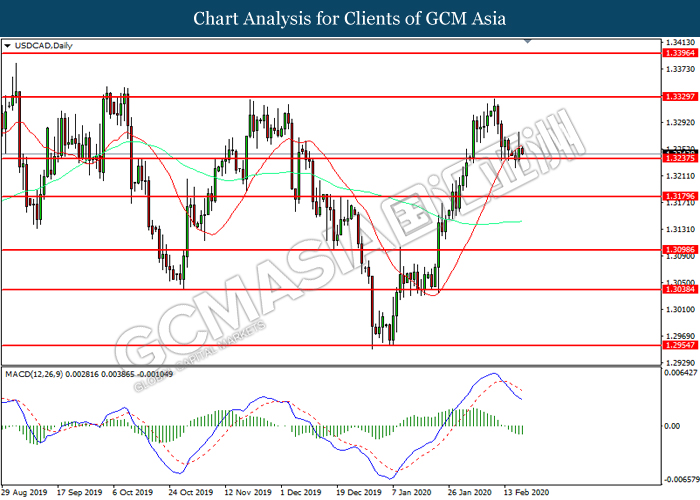

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3180. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3330, 1.3395

Support level: 1.3240, 1.3180

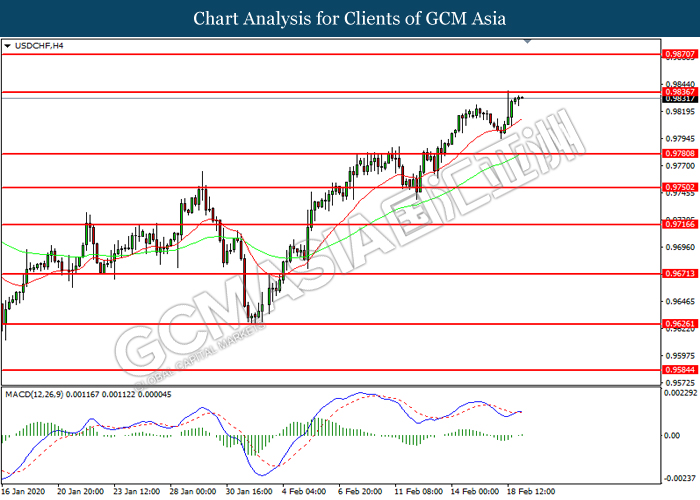

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9835. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9835, 0.9870

Support level: 0.9780, 0.9750

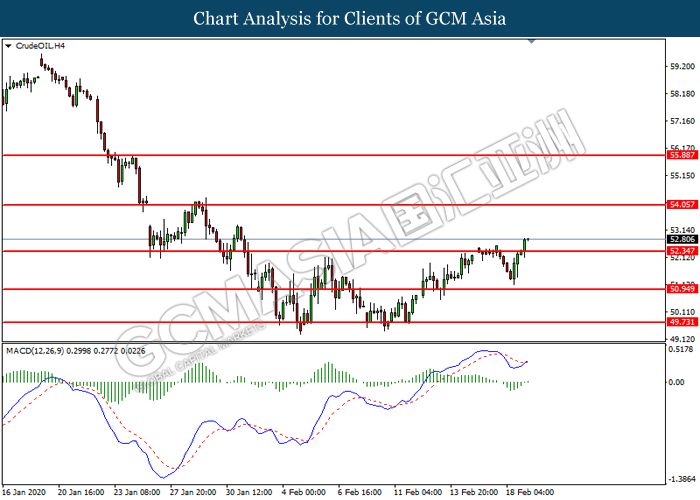

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 52.35. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 54.05.

Resistance level: 54.05, 55.90

Support level: 52.35, 50.95

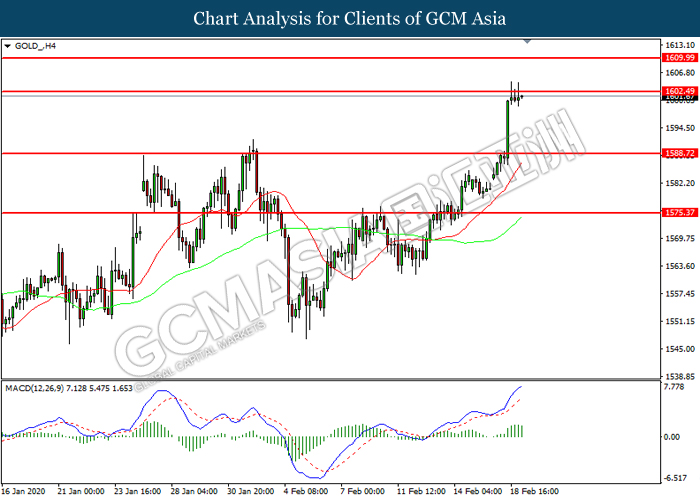

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1602.50. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1602.50, 1610.00

Support level: 1588.70, 1575.35