19 February 2020 Morning Session Analysis

Dollar remain strong amid virus concerns.

The dollar index which traded against a basket of six major currency pairs have rose during early Asian trading session following concerns about the damage extent that caused by the coronavirus in China. Following the increasing cases in death and infection, the return of risk aversion have encourage more gains for the greenback. On Tuesday, the number of new Covid-19 cases fell to 1,886 on Monday from 2,048 the day before. However, the World Health Organization cautioned Tuesday that “every scenario is still on the table” in terms of the epidemic’s evolution. The death toll have rose to 1868 while the number of infections stands at 72,436 so far. At the time of writing, dollar index rose 0.02% to 99.29.

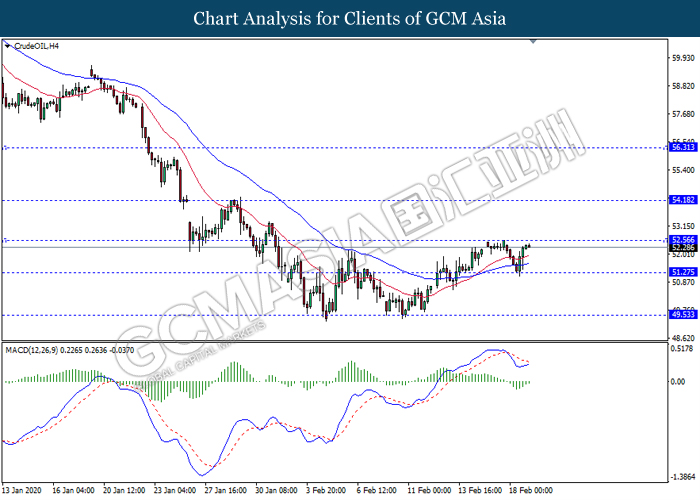

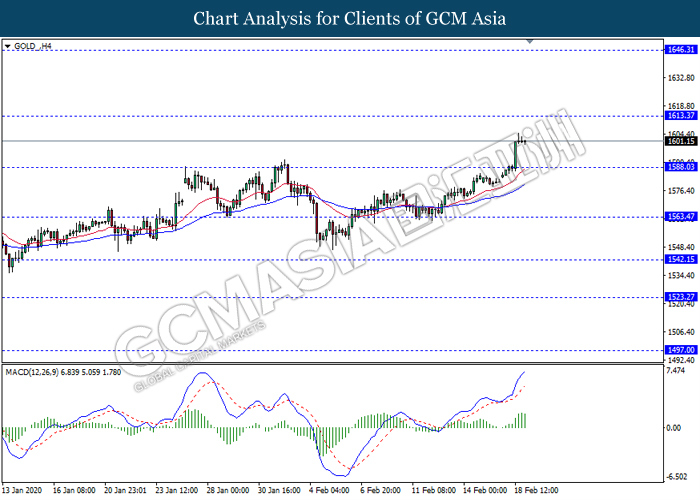

In the commodities market, crude oil price remains weak and slips 0.10% to $51.81 per barrel as of writing as investors continue to feel anxious about how fuel demand will be affected by the impact of China’s deadly coronavirus. Next, gold price soars 0.09% to $1602.05 a troy ounce at the time of writing as coronavirus fears spurs safe-haven demand.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 17.30 | GBP – CPI (YoY) (Jan) | 1.3% | 1.6% | – |

| 21.30 | USD – Building Permits (Jan) | 1.420M | 1.450M | – |

| 21.30 | USD – PPI (MoM) (Jan) | 0.2% | 0.1% | – |

| 21.30 | CAD – Core CPI (MoM) (Jan) | -0.4% | – | – |

| 03.00 (20 Feb) | USD – FOMC Meeting Minutes | – | – | – |

Technical Analysis

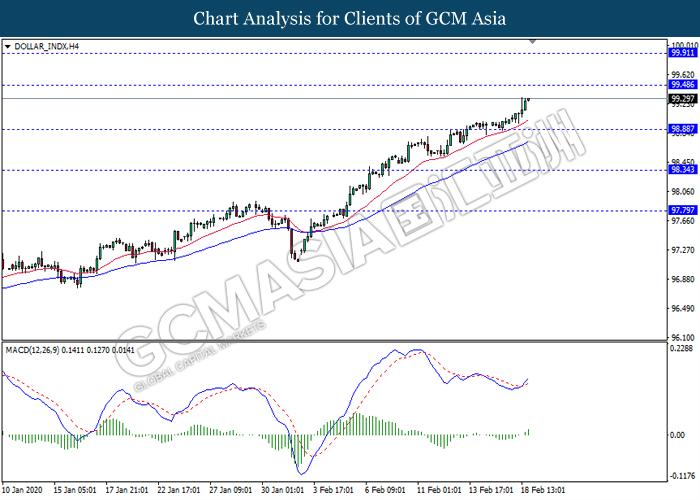

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing near the resistance level 99.50. MACD which illustrate bullish bias signal with the formation of golden cross suggest the dollar to extend its gains after it breaks above the resistance level.

Resistance level: 99.50, 99.90

Support level: 98.90, 98.35

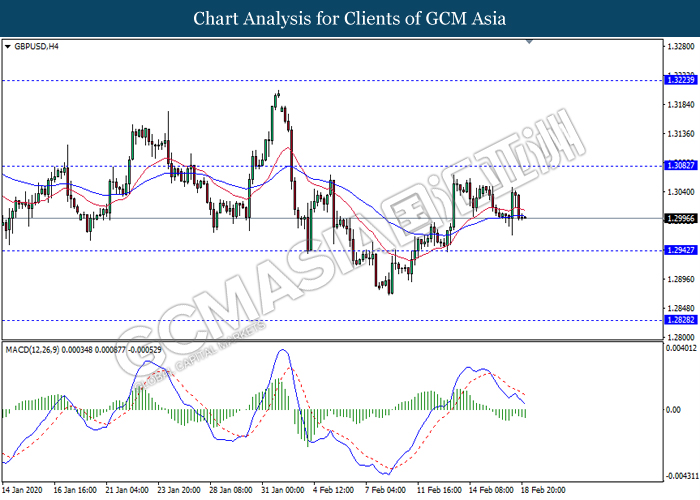

GBPUSD, H4: GBPUSD was traded lower following prior retracement from its high level. MACD which illustrate ongoing bearish momentum suggest the pair to extend its retracement towards the support level 1.2940.

Resistance level: 1.3080, 1.3225

Support level: 1.2940, 1.2830

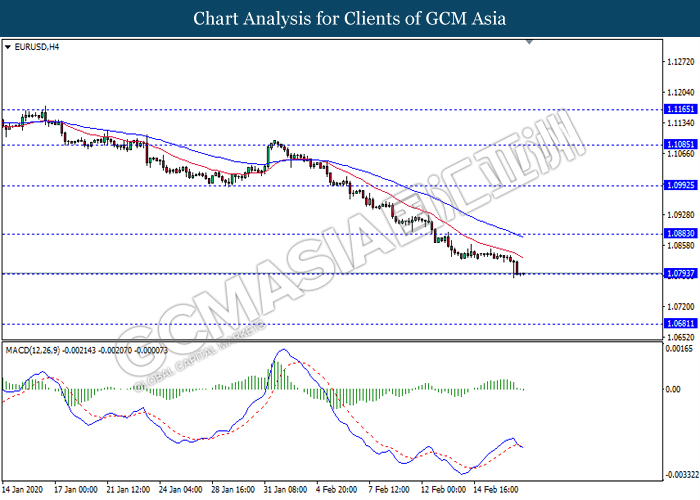

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.0795. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.0885, 1.0990

Support level: 1.0795, 1.0680

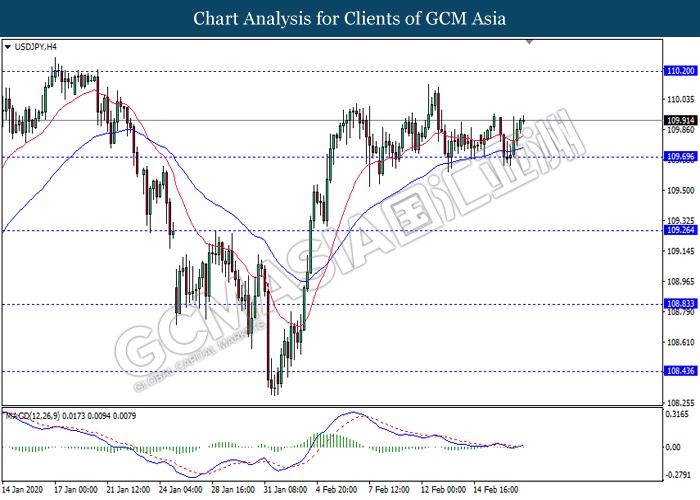

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 109.70. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend it rebound towards the resistance level 110.20.

Resistance level: 110.20, 110.65

Support level: 109.70, 109.25

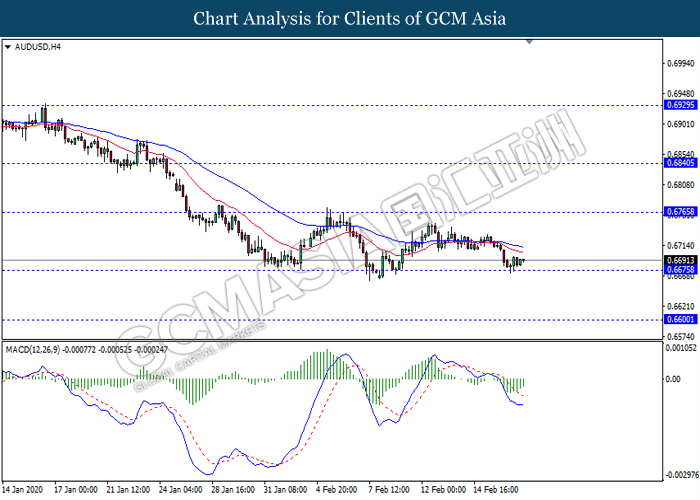

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level 0.6675.However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher as a technical correction towards the resistance level 0.6765.

Resistance level: 0.6765, 0.6840

Support level: 0.6675, 0.6600

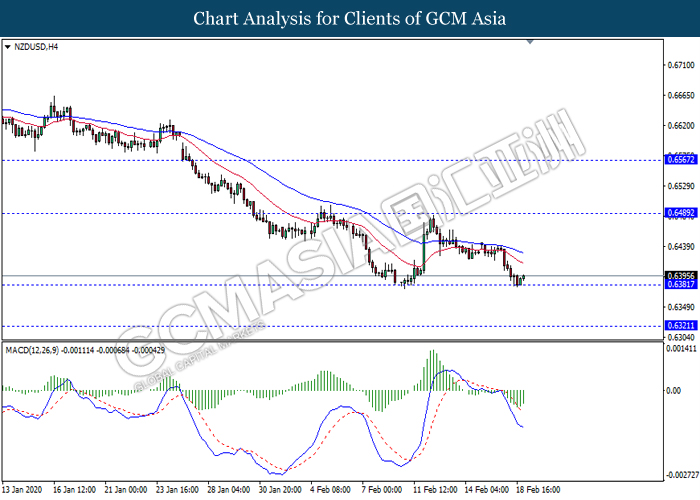

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6380. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 0.6490.

Resistance level: 0.6490, 0.6565

Support level: 0.6380, 0.6320

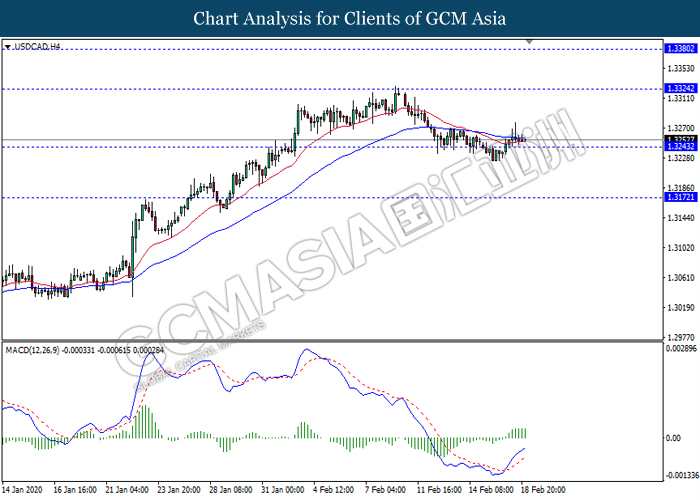

USDCAD, H4: USDCAD was traded flat near the support level 1.3245. However, MACD which illustrate bullish momentum signal with the recent formation of golden cross suggest the pair to be traded higher towards the resistance level 1.3325.

Resistance level: 1.3325, 1.3380

Support level: 1.3245, 1.3170

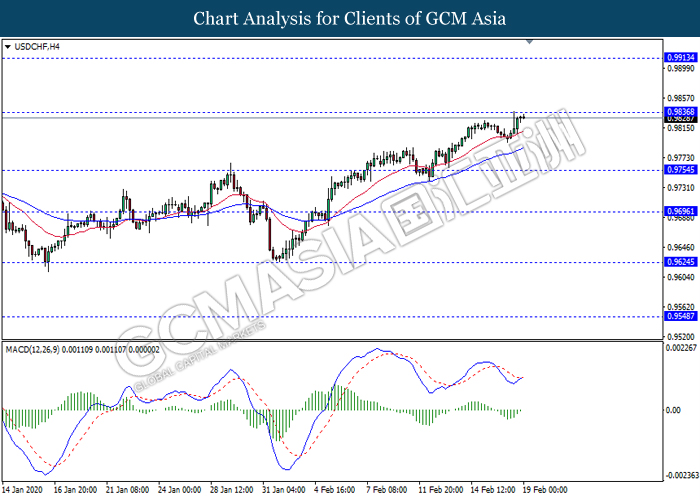

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9835. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.9835, 0.9915

Support level: 0.9755, 0.9695

CrudeOIL, H4: Crude oil was traded in a tight range while currently testing near the resistance level 52.55. However, MACD which illustrate diminishing bearish momentum signal suggest the commodity to be traded higher after it breaks above the resistance level.

Resistance level: 52.55, 54.20

Support level: 51.25, 49.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level 1588.05. MACD which illustrate ongoing bullish momentum suggest the commodity to extend its gains towards the resistance level 1613.35.

Resistance level: 1613.35, 1646.30

Support level: 1588.05, 1563.45