20 February 2020 Afternoon Session Analysis

AUD plunged after China cut interest rates.

Australian dollar plunged to fresh 11-years low after People’s Bank of China (PBOC) announced to cut their interest rates. As of writing, pair of AUD/USD slumped by 0.41% to 0.6647, its lowest level since February 2009. In a largely anticipated move, PBOC announced to cut its interest rate by 10 basis points for 1-year loan prime rate and 5 basis points for 5-year loan prime rate. The decision was made in response to the recent outbreak of coronavirus which has led to a stall in China’s economic momentum. Thus, a lower borrowing cost would help to ease financial strains on companies which were hit by the epidemic. However, Australian dollar managed to limit its losses following the release of optimistic employment data earlier today. Employment Change for the month of January came in higher than expected with 13.5K versus forecast of 10.0K. Likewise, participation rate for January inches up to 66.1% from 66.0%. For the time being, traders will continue to monitor coronavirus infection status in China as well as upcoming economic data in order to received more market signals.

In the commodities market, crude oil price rose 0.45% to $53.73 per barrel. Oil futures received some bullish momentum after PBOC announced to cut their interest rates in order to limit economic impact from coronavirus epidemic. This would also limit its impact upon oil demand from the world’s largest oil importer. On the other hand, gold price slumped 0.15% to $1,609.01 a troy ounce as investor’s anticipate PBOC’s rate cut decision to help limit coronavirus impact in terms of economic momentum.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Retail Sales (MoM) (Jan) | -0.6% | 0.5% | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | 17.0 | 12.0 | – |

| 00:00

(21st) |

CrudeOIL – Crude Oil Inventories | 7.459M | 2.987M | – |

Technical Analysis

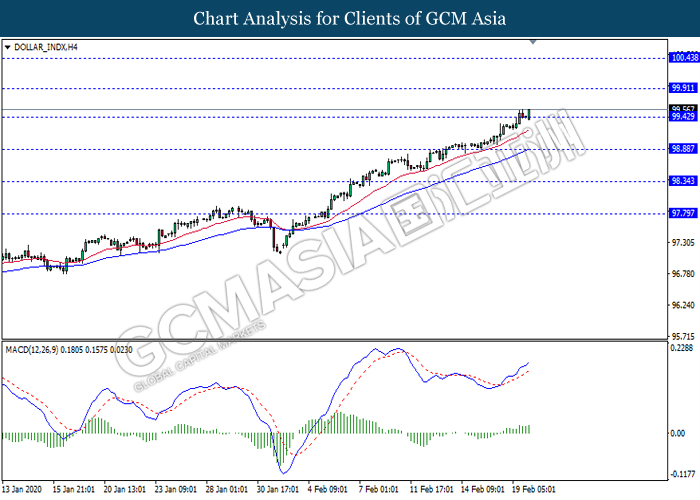

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level 99.40. MACD which illustrate ongoing bullish momentum suggest the dollar to extend its gains towards the resistance level 99.90.

Resistance level: 99.90, 100.45

Support level: 99.40, 98.90

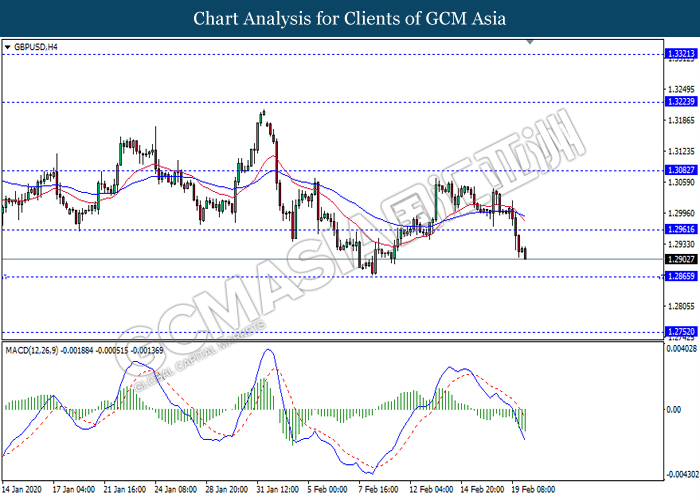

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level 1.2960. MACD which illustrate persistent bearish momentum suggest the pair to extend its losses towards the support level 1.2865.

Resistance level: 1.2960, 1.3080

Support level: 1.2865, 1.2750

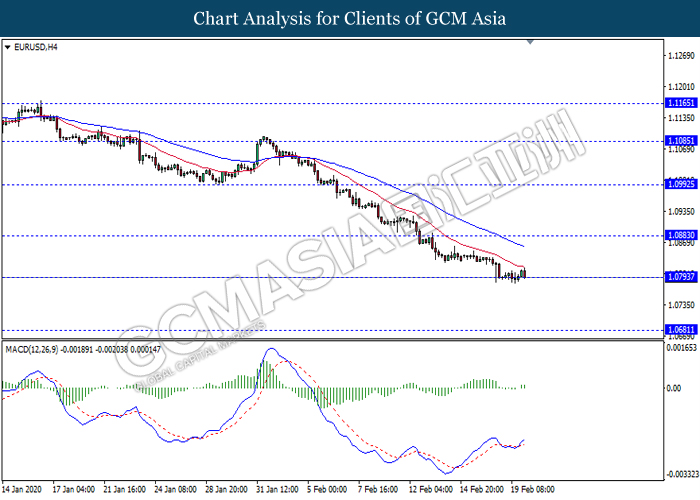

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.0795. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to be traded higher as a technical correction towards the resistance level 1.0885.

Resistance level: 1.0885, 1.0990

Support level: 1.0795, 1.0680

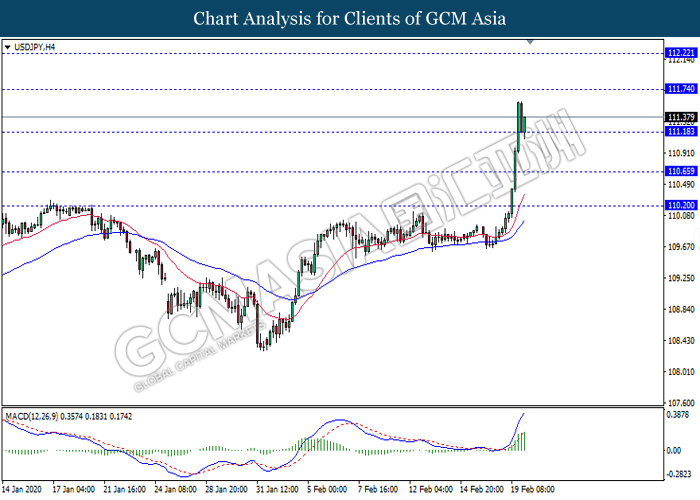

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 111.20. MACD which display ongoing bullish momentum suggest the pair to extend its gains towards the resistance level 111.75.

Resistance level: 111.75, 112.20

Support level: 111.20, 110.65

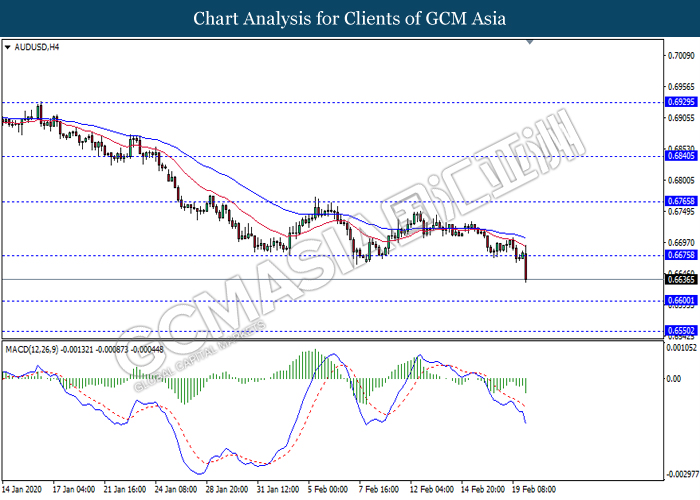

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level 0.6675. MACD which illustrate bearish bias signal suggest the pair to extend its losses towards the support level 0.6600.

Resistance level: 0.6675, 0.6765

Support level: 0.6600, 0.6550

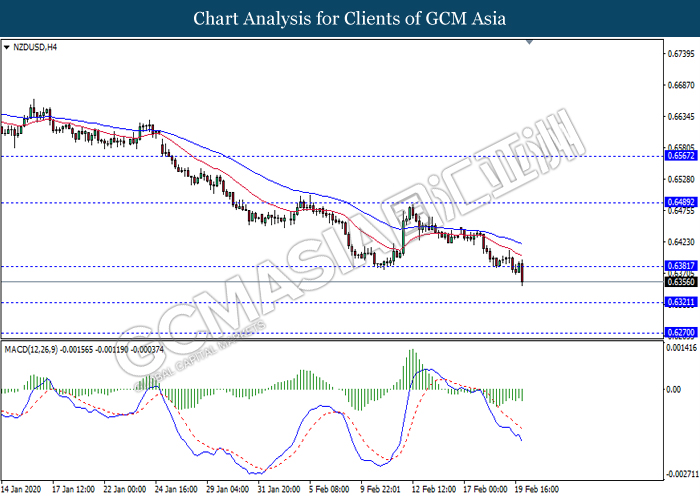

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level 0.6380. MACD which illustrate persistent bearish bias signal suggest the pair to extend its losses towards the support level 0.6320.

Resistance level: 0.6380, 0.6490

Support level: 0.6320, 0.6270

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.3250. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to experience a short term technical correction towards the resistance level 1.3250.

Resistance level: 1.3250, 1.3325

Support level: 1.3170, 1.3095

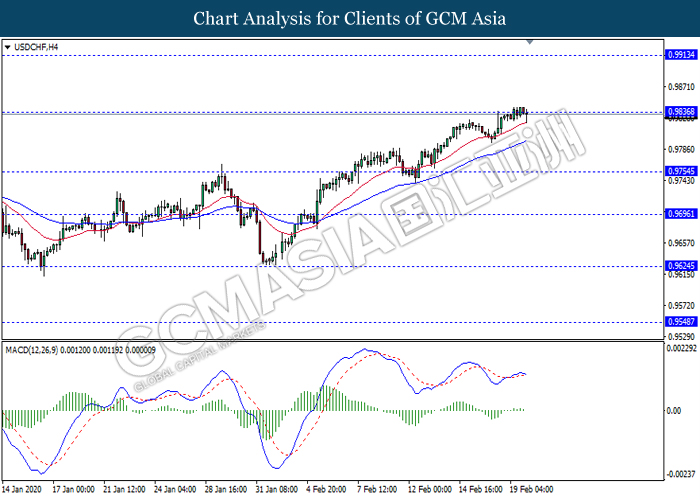

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9835. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower as a technical correction towards the support level 0.9755.

Resistance level: 0.9835, 0.9915

Support level: 0.9755, 0.9695

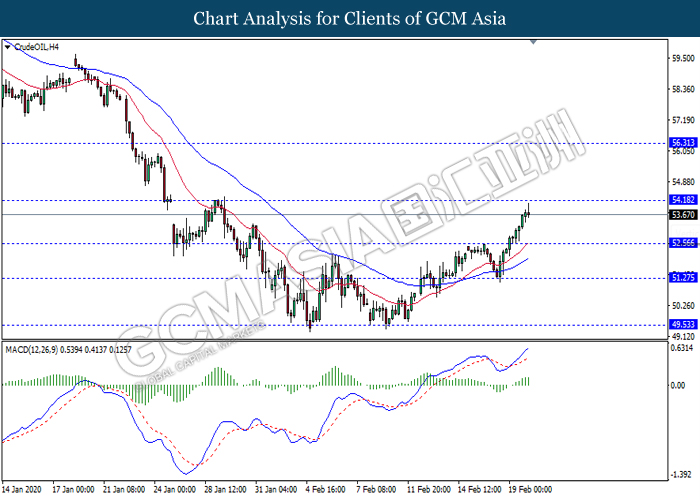

CrudeOIL, H4: Crude oil was traded higher while currently testing near the resistance level 54.20. MACD which illustrate ongoing bullish momentum signal suggest the commodity to extend its gains after it breaks above the resistance level.

Resistance level: 54.20, 56.30

Support level: 52.55, 51.25

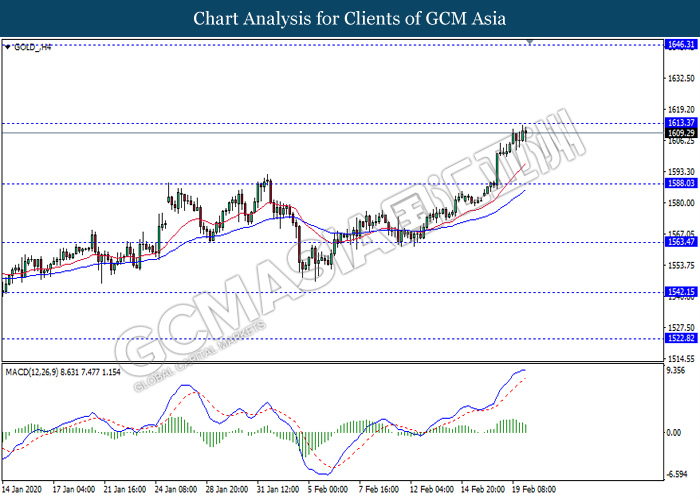

GOLD_, H4: Gold price was traded higher while currently testing near the resistance level 1613.35. MACD which illustrate diminishing bullish momentum signal suggest the commodity to experience a technical correction towards the support level 1588.05.

Resistance level: 1613.35, 1646.30

Support level: 1588.05, 1563.45