20 September 2019 Afternoon Session Analysis

Swiss Franc soars despite dovish statement.

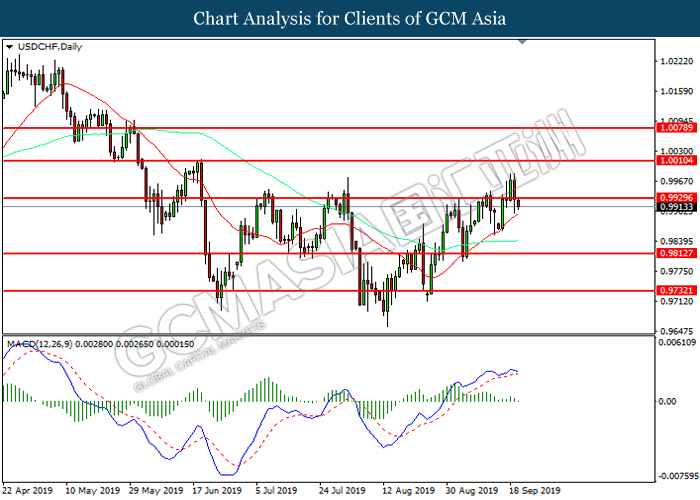

The USD/CHF pair retreated sharply from three-month tops and dropped to fresh session low as the pair suffered aggressive long-unwinding trade after the SNB announced its latest monetary policy decision and set the deposits rate unchanged at -0.75. In the accompanying statement, the central bank claimed that implementation of expansionary monetary policy is necessary if the economy performance weaker than expected. In fact, the SNB also reiterated the willingness to intervene the Forex Market if necessary and lowered its inflation and GDP forecast for 2019. On the other hand, USD/JPY quoted down after hitting almost one month highest level to its highest level since early August after the Federal Reserve refrained from providing any hints regarding the next policy movement despite announcing a 25 basis point interest rate cut. Earlier yesterday, the Bank of Japan (BoJ) kept its interest rate unchanged at -0.10% as expected. However, BoJ Governor Kuroda also claimed that they would not hesitate to implement a further rate cut if there is a risk that for the economy to suffer recessions and unable to achieve its price goal. Besides, according to Statistics Bureau, the Japan National Core Consumer Price Index (CPI) came in at 0.5%, weaker than the previous month reading of 0.6%. Hence, a decrease in CPI could put the Japanese Yen under bearish pressure as it would cause investors to start pricing a dovish shift in the BoJ’s monetary policy. As of writing, USD/CHF slump 0.16% to 0.9909 and USD/JPY depreciated by 0.07% to 107.910.

In the commodities market, crude oil price rose 0.27% to $58.770 per barrel after Saudi-led coalition launched a military operation in the north of Yemen’s port city of Hodeidah, and United States worked with Middle East and European nations to build a coalition to deter Iranian threats after the Saudi attack. On the other hand, gold price rose 0.33% to 1503.78 per troy ounces as a result of risk aversion due to escalation of global tensions.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Jul) | 0.1% | -0.2% | – |

| 01:00

(21th) |

CrudeOIL – U.S. Baker Hughes Oil Rig Count | 733 | – | – |

Technical Analysis

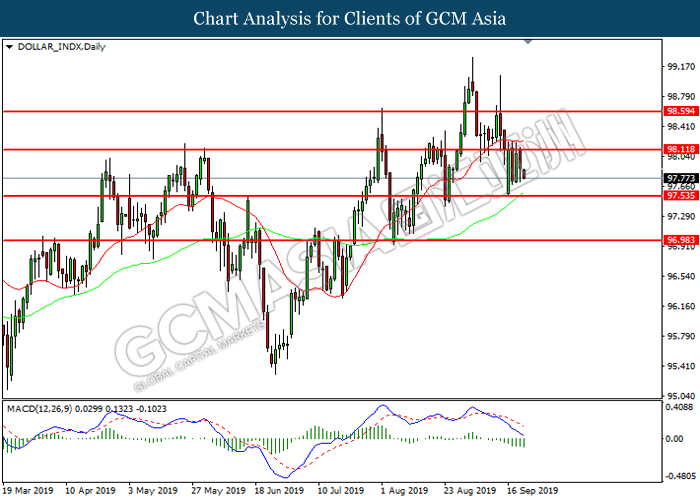

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 98.10. MACD which illustrated increasing bearish momentum suggests the pair to be traded lower toward support level at 97.55.

Resistance level: 98.10, 98.60

Support level: 97.55, 96.95

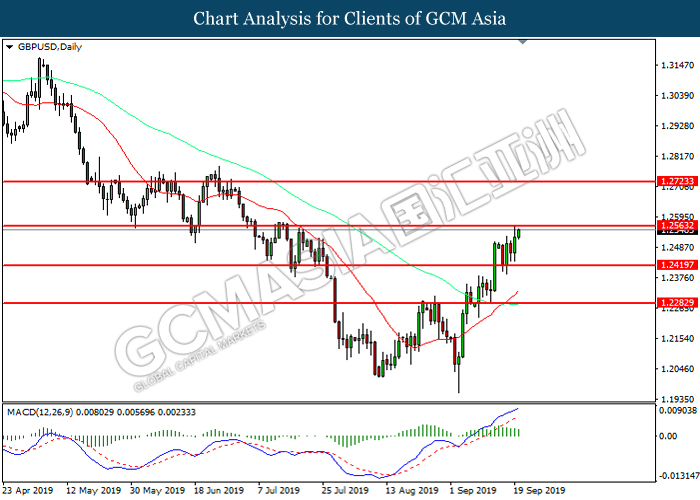

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level 1.2565. However, MACD which illustrated diminishing bullish momentum suggests the pair to be traded lower in short-run as technical correction.

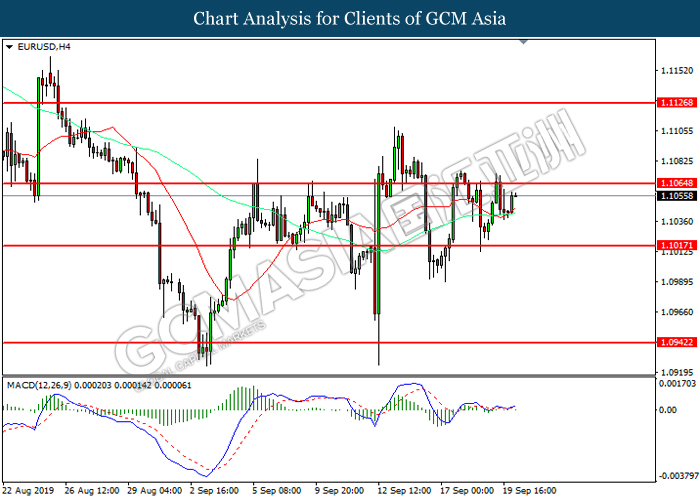

EURUSD, H4: EURUSD was traded higher following prior rebound from the 20 MA line (red). MACD which illustrate increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.1065.

Resistance level: 1.1065, 1.1125

Support level: 1.1015, 1.0940

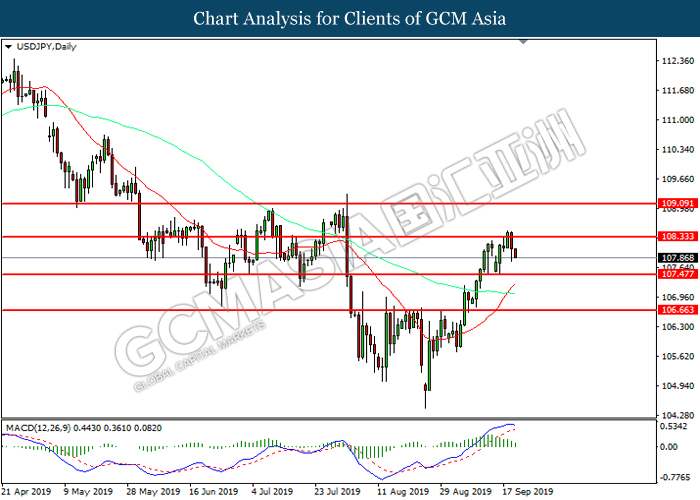

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 108.35. MACD which illustrated diminishing bullish momentum suggests its pair to be traded lower toward support level at 107.50.

Resistance level: 108.35, 109.10

Support level: 107.50, 106.65

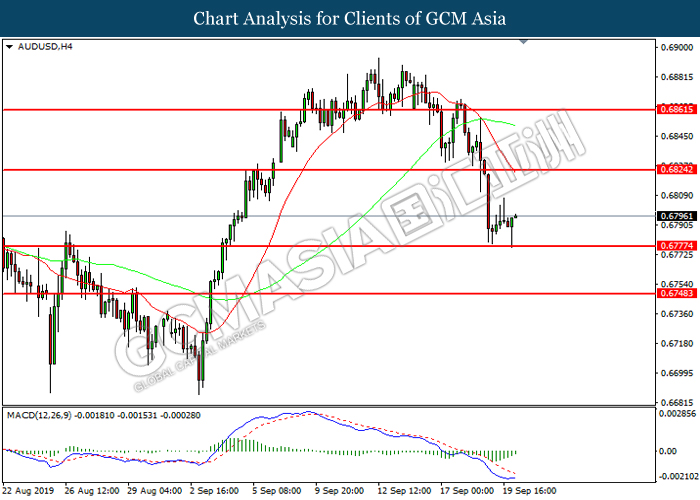

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.6780. MACD which illustrates diminishing bearish momentum suggests the pair to be traded higher toward resistance level at 0.6825.

Resistance level: 0.6825, 0.6860

Support level: 0.6780, 0.6750

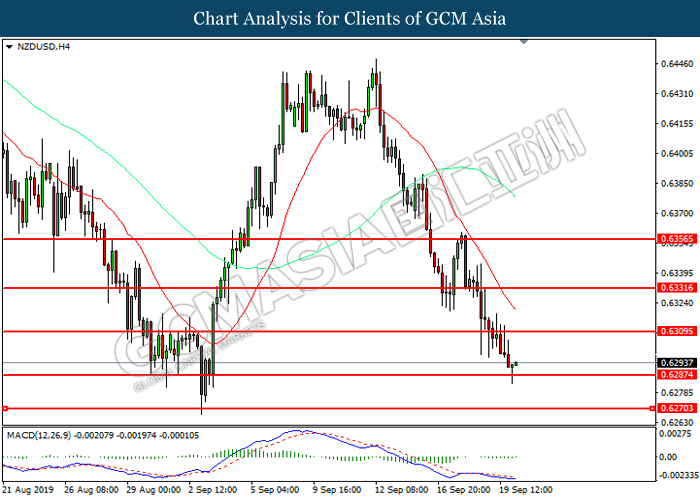

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6290. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gain toward resistance level at 0.6310.

Resistance level: 0.6310, 0.6330

Support level: 0.6290, 0.6270

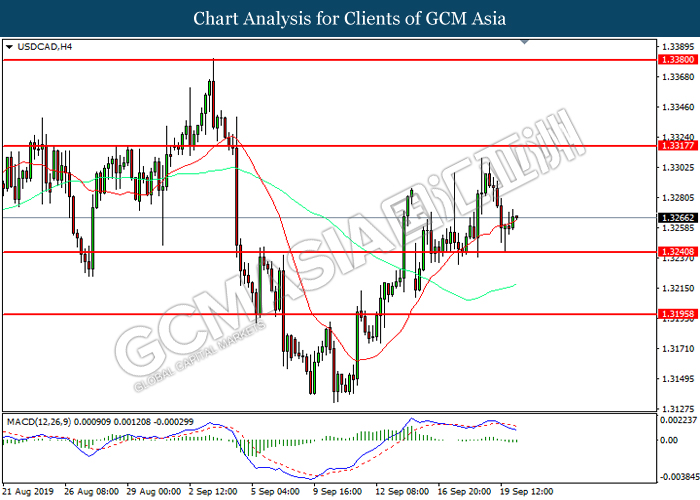

USDCAD, H4: USDCAD was traded higher following prior rebound from support level at 1.3240. MACD which illustraded diminishing bearish momentum suggests the pair to extend its gain toward resistance level at 1.3320.

Resistance level: 1.3320, 1.3380

Support level: 1.3240, 1.3195

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level 0.9930. MACD which illustrate diminishing bullish momentum suggests the pair to extend its losses toward support level at 0.9815.

Resistance level: 0.9930, 1.0010

Support level: 0.9815, 0.9730

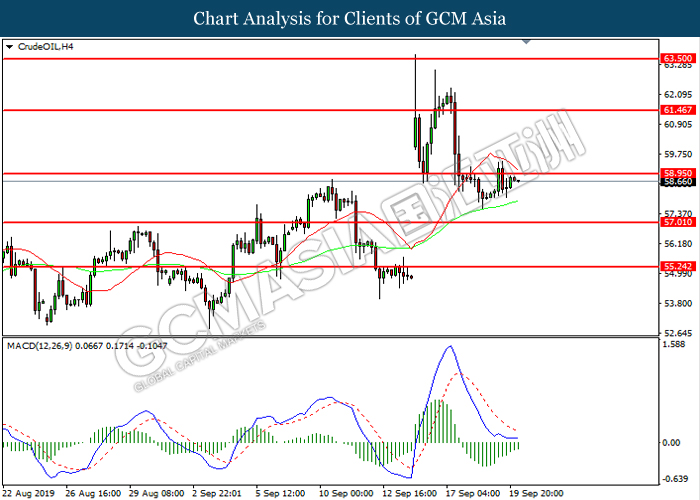

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the resistance level at 58.95. MACD which illustrated diminishing bearish momentum suggests the pair to be traded higher after it successfully breakout above the resistance level.

Resistance level: 58.95, 61.45

Support level: 57.00, 55.25

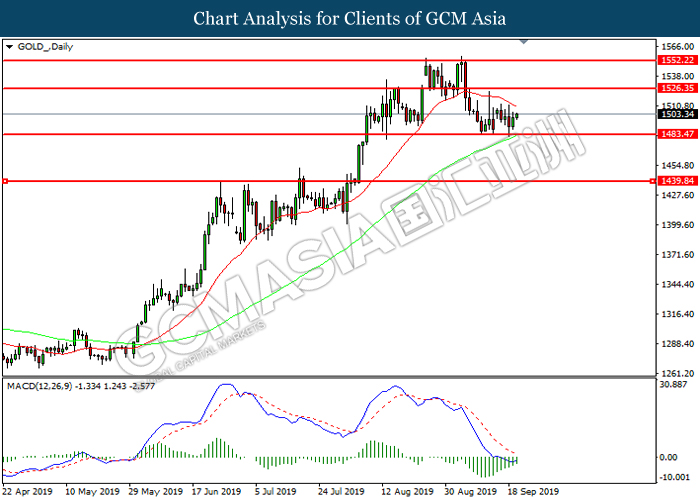

Gold_, Daily: Gold price was traded higher following prior rebounded from support level at 1483.50. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gain toward resistance level at 1526.35.

Resistance level: 1526.35, 1552.25

Support level: 1483.50, 1439.85