21 February 2020 Morning Session Analysis

Yen slumped as rising number of the virus cases in Japan.

The Japanese Yen slumped amid to unease grows about the rising number of the coronavirus cases in Japan, which dialling down the market optimisms toward the economic progression in the Japan. According to CNBC, the Japan’s health authorities confirmed seven new confirmed infections of the coronavirus, pushing the new total number of patients outside the passengers and crew from the ship to over 90 people. In fact, there are fears that the coronavirus could be prompting the Japanese government to cancel the Olympic Games in Tokyo. Moreover, according to Reuters, around $27 billion in net foreign bond was purchased by Japanese investors in the first two weeks of February as they are lack of confidence in domestic investment. On the other hand, Dollar index received bullish momentum over a backdrop of the upbeat data from the United Stated region. According to Federal Reserve Bank of Philadelphia, the U.S. Philadelphia Fed Manufacturing Index notched up from the previous reading of 17.0 to 36.7, exceeding the economist forecast at 12.0, which indicating the business conditions in Philadelphia remained strong while insinuating a greater demand for the US Dollar. As of writing, USD/JPY depreciated by 0.05% to 112.03 while Dollar index surged 0.17% to 99.75.

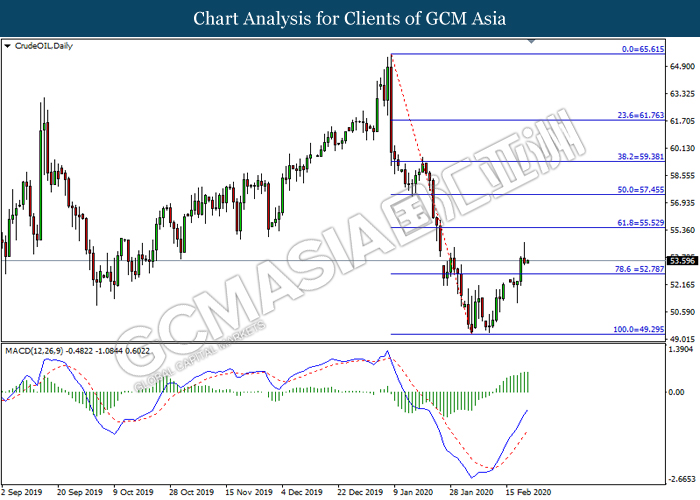

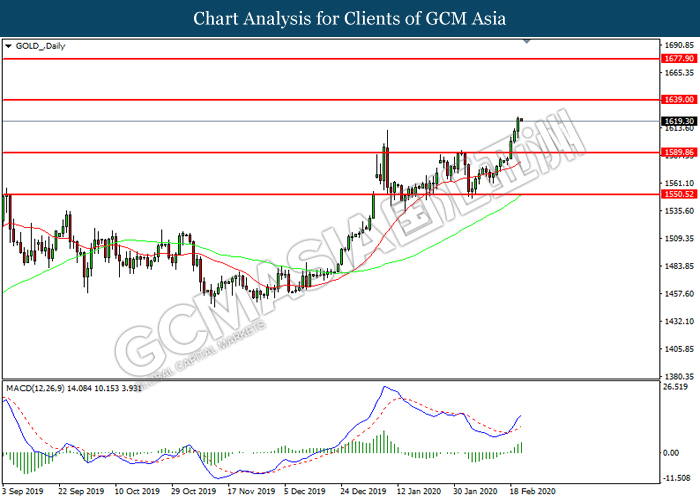

In the commodities market, the crude oil price slumped 0.19% to $53.58 per barrel. However, the oil market edged higher yesterday following the oil inventory data was released. According to Energy Information Administration, the U.S. Crude Oil inventories reduced from the preliminary reading of 7.459M to 0.414M, lower than the market forecast at 2.494M while providing further bullish support for this black commodity. On the other hand, the gold prices appreciated by 0.14% to $1621.35 per troy ounces as diminishing risk appetite in the FX market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 45.3 | 44.8 | – |

| 17:30 | GBP – Composite PMI | 53.3 | – | – |

| 17:30 | GBP – Manufacturing PMI | 50.0 | – | – |

| 17:30 | GBP – Services PMI | 53.9 | – | – |

| 18:00 | EUR – CPI (YoY) (Jan) | 1.4% | 1.4% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | 0.2% | 0.4% | |

| 23:00 | USD – Existing Home Sales (Jan) | 5.54M | 5.45M | |

| 02:00

(22nd) |

CrudeOIL – U.S. Baker Hughes Oil Rig Count | 678 | – | – |

Technical Analysis

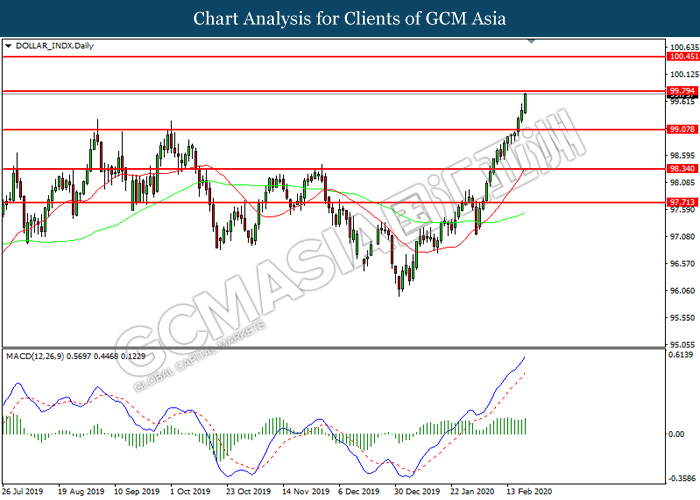

DOLLAR_INDX, Daily:Dollar index was traded higher while currently testing the resistance level at 99.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 99.80, 100.45

Support level: 99.05, 98.35

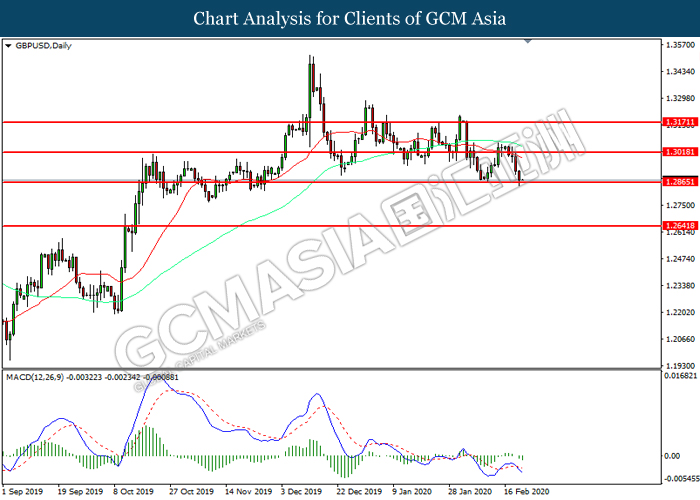

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2865. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3020, 1.3070

Support level: 1.2865, 1.2640

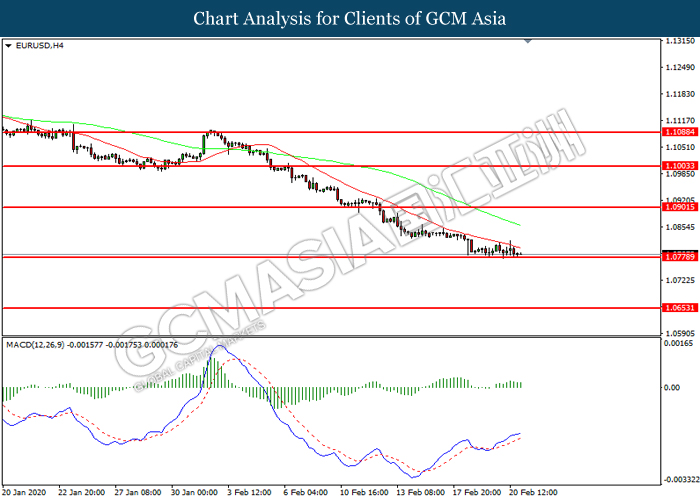

EURUSD, H4: EURUSD was traded within a range while currently testing the support level at 1.0780. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0900, 1.1005

Support level: 1.0780, 1.0655

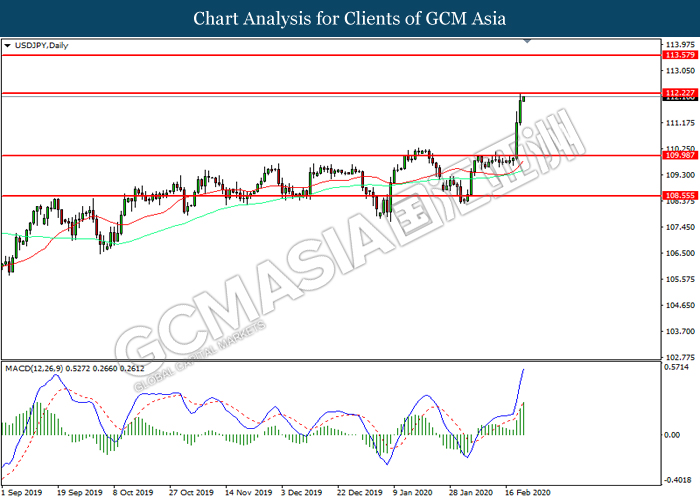

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 112.25. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 112.20, 113.55

Support level: 109.95, 108.55

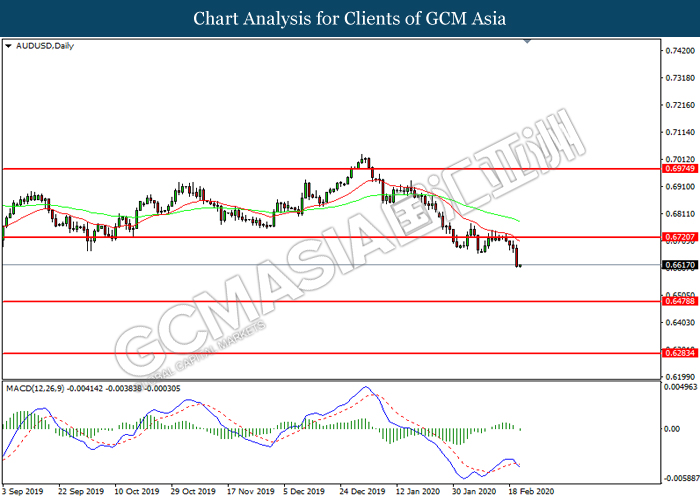

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6720. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6480.

Resistance level: 0.6720, 0.6975

Support level: 0.6480, 0.6285

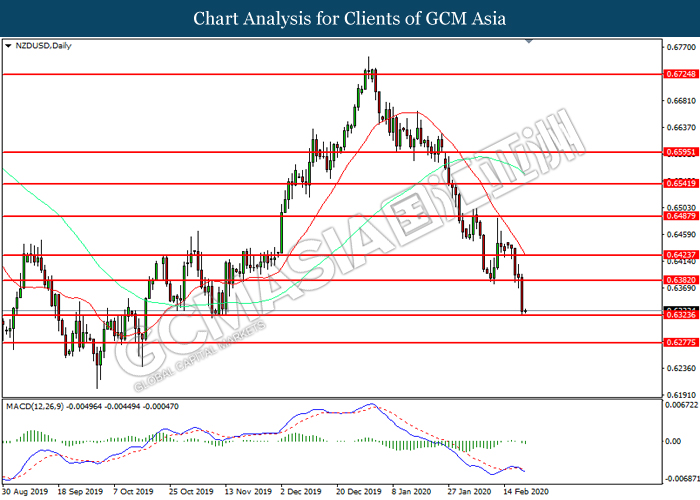

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6325. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6380, 0.6425

Support level: 0.6325, 0.6275

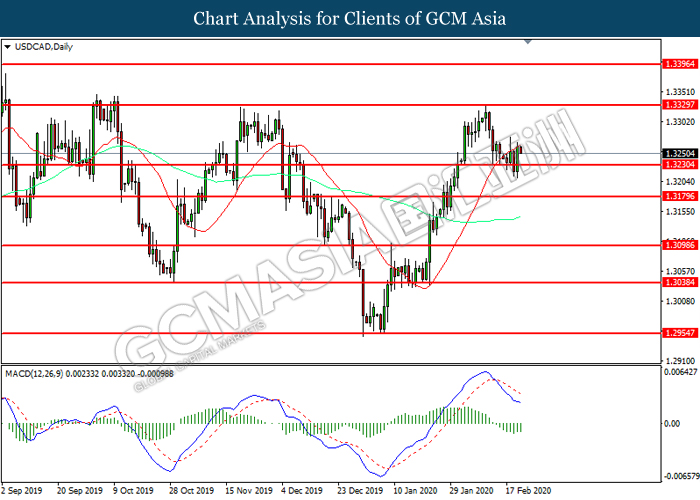

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3230. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3330.

Resistance level: 1.3330, 1.3395

Support level: 1.3230, 1.3180

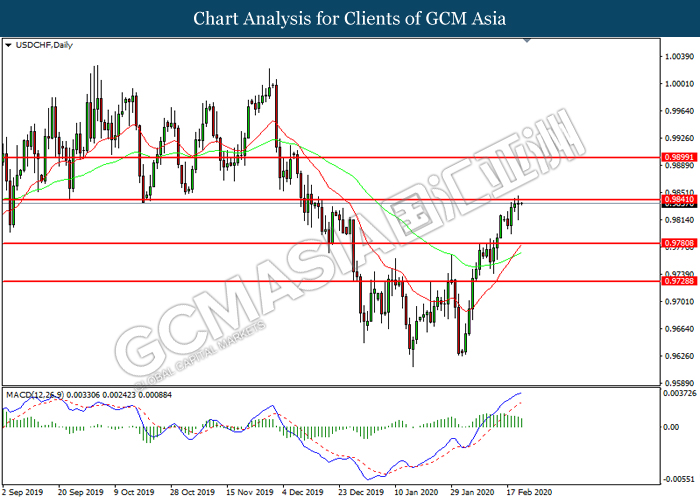

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9840. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9840, 0.9900

Support level: 0.9780, 0.9730

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 52.80. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 55.55.

Resistance level: 55.55, 57.45

Support level: 52.80, 49.30

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1589.85. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1639.00.

Resistance level: 1639.00, 1677.90

Support level: 1589.85, 1550.50