26 November 2019 Afternoon Session Analysis

Dollar buoyed amid trade tension eased.

Dollar index which gauge its value against a basket of six major currencies remain scented as recent news shows significant progress in trade talk between two largest economy bodies, US and China. According to Xinhua News, top negotiators from both countries held a phone talks yesterday and had come into consensus in resolving related issues while remaining issue recurring in phase 1 trade deal will continuingly be discussed. The optimism of trade talk continue to lift up the sentiment of greenback as the chance of reaching a trade deal is around the corner. However, greenback gains were limited following a neutral speech given by the chairman of Federal Reserve (Fed) Jerome Powell in the early morning. In the speech, Powell revealed that the first priority commitment of central bank is to meet the inflation goals, which is at 2%. Despite three interest rate cuts were conducted within past few months, however they are still unable to support the US economy growth while their inflation is running well below its potential level. Therefore, an interest rate hikes or cuts is not suitable for their economy yet, current stance of monetary policy is expectedly to remain in place for the time being while eyeing on more economic data. As of writing, dollar index inched down 0.03% to 98.15.

In the commodities market, crude oil price quoted up 0.14% to $57.95 per barrels amid the news of extension on crude oil production cut and progress in trade talk persist to exerted bullish momentum for this black commodity. On the other hand, gold price appreciated 0.01% to $1454.70 a troy ounce amid weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – CB Consumer Confidence (Nov) | 125.9 | 127.0 | – |

| 23:00 | USD – New Home Sales (Oct) | 701k | 709k | – |

Technical Analysis

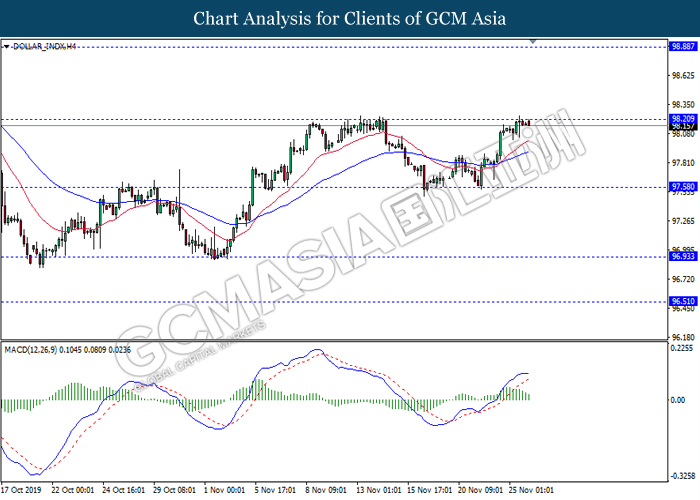

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level 98.20. However, MACD which illustrate diminishing bullish momentum signal suggest the dollar to experience a technical correction towards the support level 97.60

Resistance level: 98.20, 98.90

Support level: 97.60, 96.95

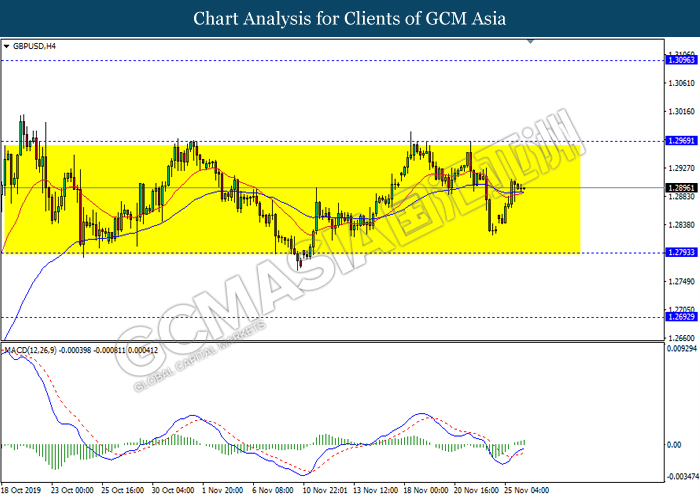

GBPUSD, H4: GBPUSD remain traded in a sideway channel. However, MACD which illustrate bullish bias signal suggest the pair to be traded higher in short term towards the resistance level 1.2970.

Resistance level: 1.2970, 1.3095

Support level: 1.2795, 1.2690

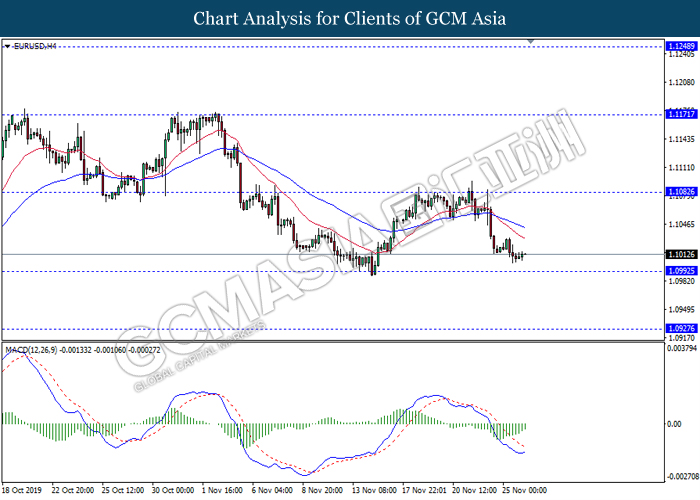

EURUSD, H4: EURUSD was traded lower while currently testing near the support level 1.0990. However, MACD which display diminishing bearish momentum signal suggest the pair to undergo a technical correction towards the resistance level 1.1080.

Resistance level: 1.1080, 1.1170

Support level: 1.0990, 1.0925

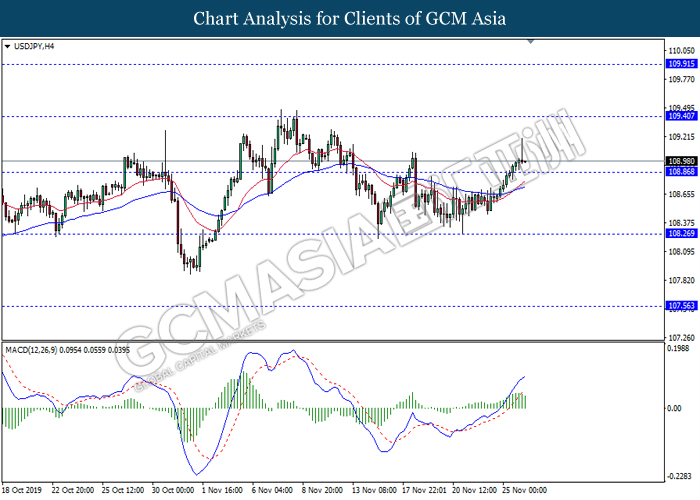

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level 108.85. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction in short term towards the current support level 108.85.

Resistance level: 109.40, 109.90

Support level: 108.85, 108.25

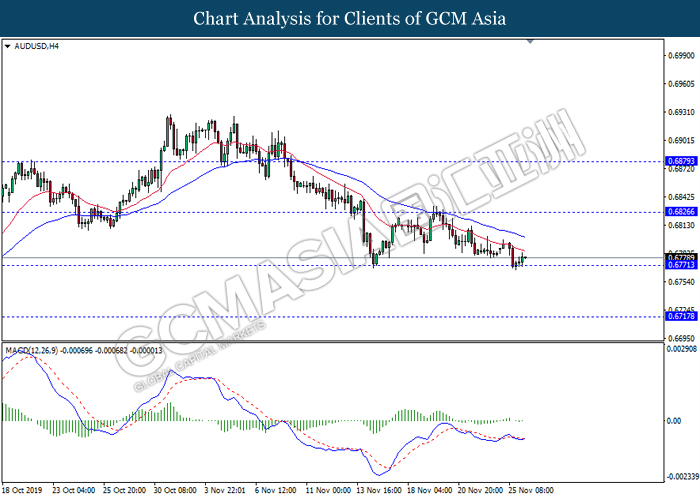

AUDUSD, H4: AUDUSD was traded lower while currently testing near the support level 0.6770. However, MACD which illustrate diminishing bearish bias signal suggest the pair to be traded higher as a technical correction towards the resistance level 0.6825.

Resistance level: 0.6825, 0.6880

Support level: 0.6770, 0.6715

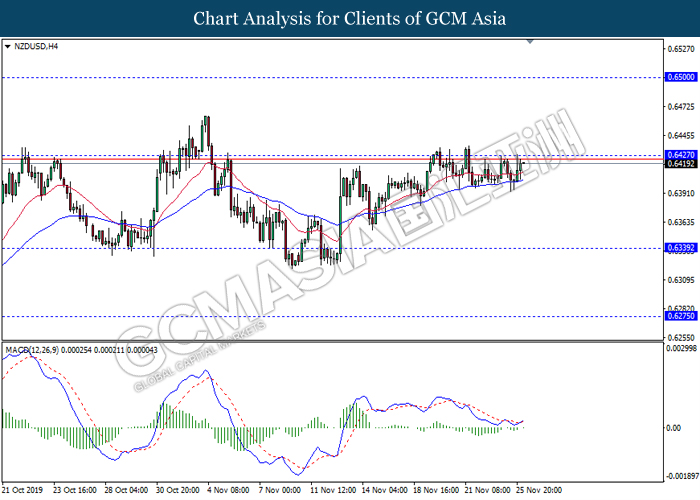

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6425. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level 0.6425.

Resistance level: 0.6425, 0.6500

Support level: 0.6340, 0.6275

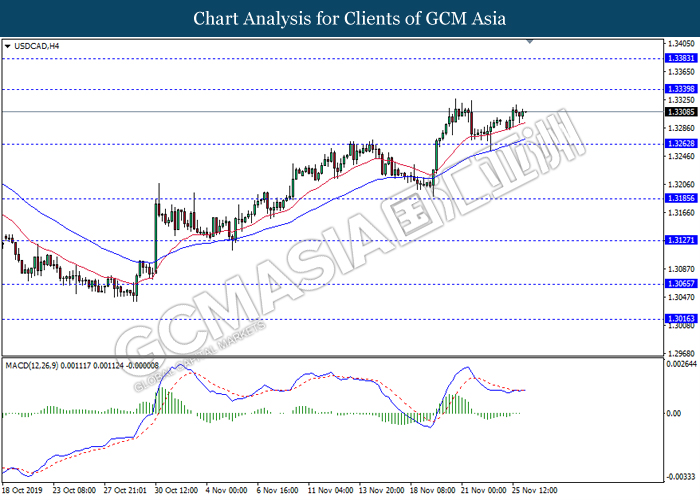

USDCAD, H4: USDCAD was traded higher following prior rebound from the MA line 20 (red). MACD which illustrate diminishing bearish bias signal suggest the pair to extend its gains towards the resistance level 1.3340.

Resistance level: 1.3340, 1.3385

Support level: 1.3260, 1.3185

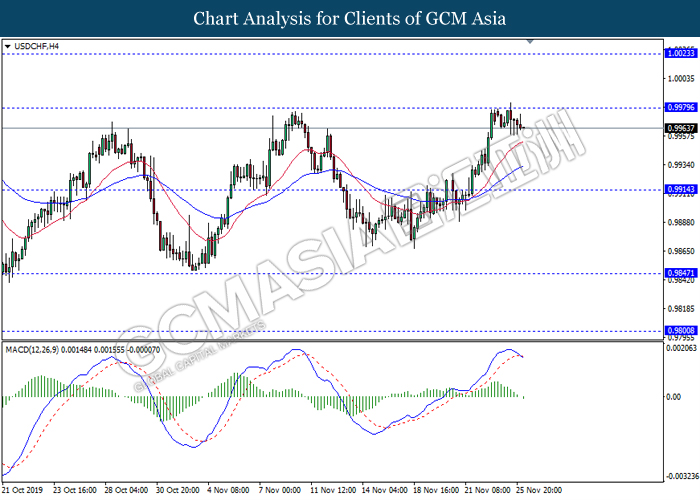

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 0.9980. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its retracement towards the support level 0.9915.

Resistance level: 0.9980, 1.0025

Support level: 0.9915, 0.9845

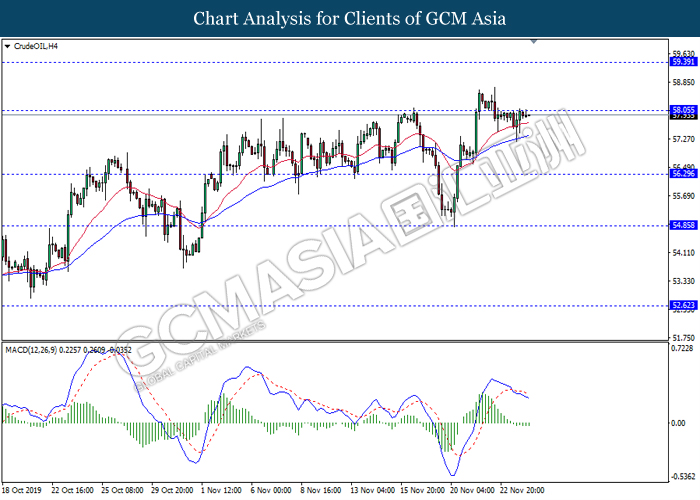

CrudeOIL, H4: Crude oil price was traded flat while currently testing the resistance level 58.05. However, MACD which illustrate bearish momentum signal with the formation of death cross suggest the commodity to be traded lower towards the support level 56.30.

Resistance level: 58.05, 59.40

Support level: 56.30, 54.85

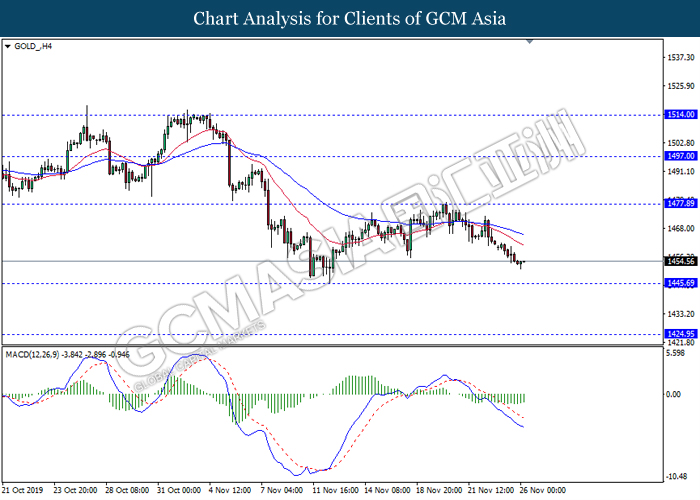

GOLD_ H4: Gold price was traded lower while currently testing near the support level 1445.70. However, MACD which display diminishing bearish momentum signal suggest the commodity to experience a technical correction towards the resistance level 1477.90.

Resistance level: 1477.90, 1497.00

Support level: 1458.50, 1445.70