27 November 2019 Morning Session Analysis

Dollar sink following downbeat economic data.

Dollar index which gauge its value against a basket of six major currencies fall following bearish signals were given by the negative economic data yesterday. According to the Conference Board, US CB Consumer Confidence data came in at 125.5, weaker than economist forecast at 127.0 while hinting the US economic growth is expected to remain weak in the final quarter of year 2019. Moreover, housing data in US region has also recorded a drop of 0.7% to 733K from previous month reading 738K, and market believes that the recent slowdown in housing sector was mainly due to pause signal in adjusting interest rate by Federal Reserve (Fed). Nonetheless, the latest trade development between US and China has limited the losses of greenback where there are news reporting that both sides are moving closer to achieving on phase one trade deal. Additionally, White House adviser Conway also revealed that there are only few sticking points remain unsolved while talk is still ongoing in order to rule out the possibility of failure in deal. As of writing, dollar index inched down 0.07% to 98.10.

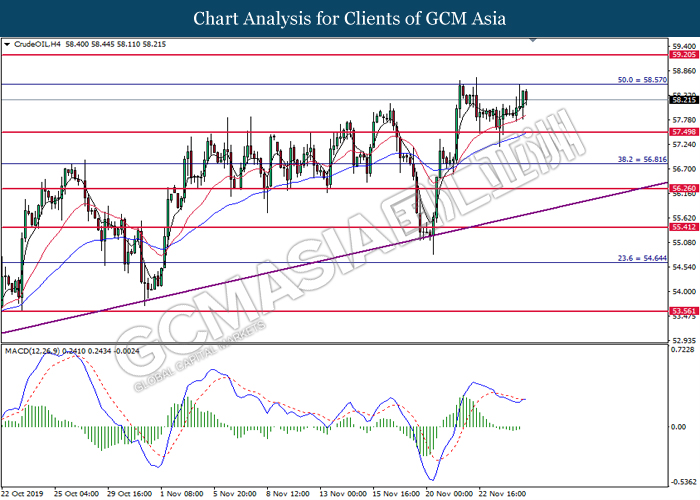

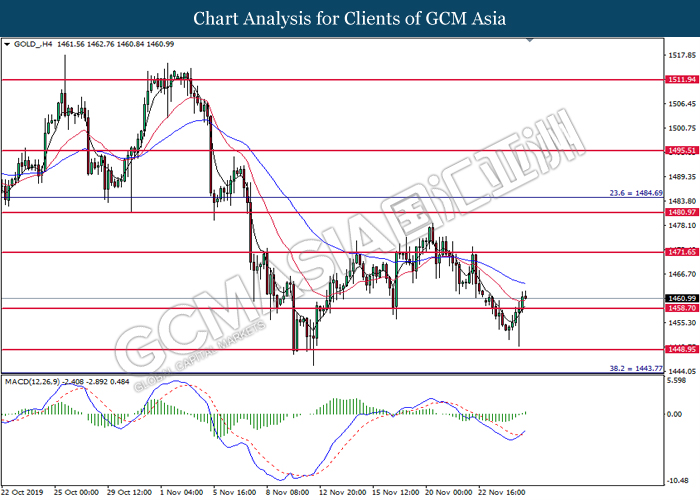

In the commodities market, crude oil price quoted down 0.15% to $58.20 per barrel after hitting recent highest level around $58.60 amid surprise build in crude oil inventories level disappoints the oil market’s sentiment. According to API data, US crude oil inventories level slightly declined from previous month reading of 5.954M to 3.639M. On the other hand, gold price appreciated by 0.04% to $1461.70 a troy ounce amid pessimistic data in US lifted up the market risk aversion behavior.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Oct) | -0.4% | 0.2% | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.0% | 1.9% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Oct) | 1.5% | 0.2% | – |

| 23:30 | USD – Crude Oil Inventories | 1.379M | -0.418M | – |

Technical Analysis

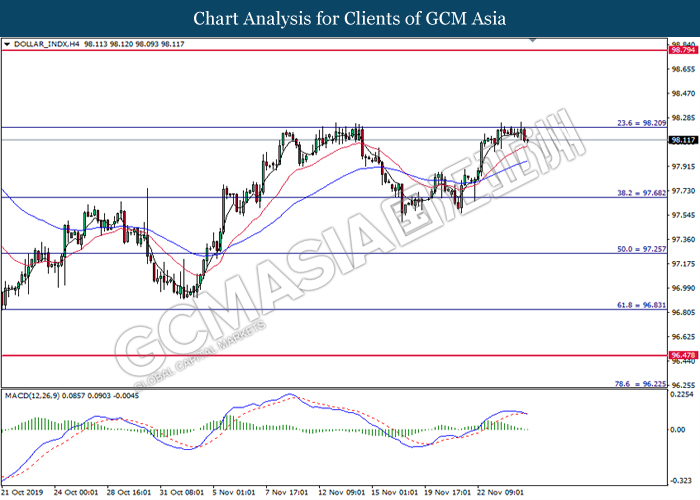

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 98.20. MACD which illustrate diminishing bullish momentum and the formation of death cross suggest the pair to extend its losses toward the support level at 97.70.

Resistance level: 98.20, 98.80

Support level: 97.70, 97.25

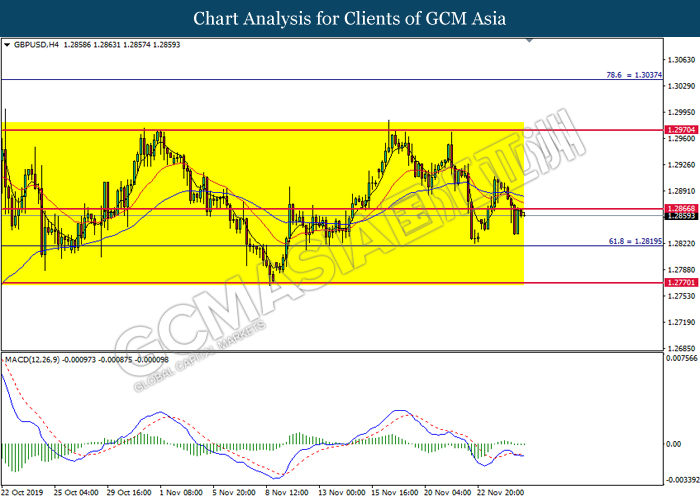

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2865. MACD which illustrated bearish signal suggest the pair to extend its losses toward the support level at 1.2820.

Resistance level: 1.2865, 1.2970

Support level: 1.2820, 1.2770

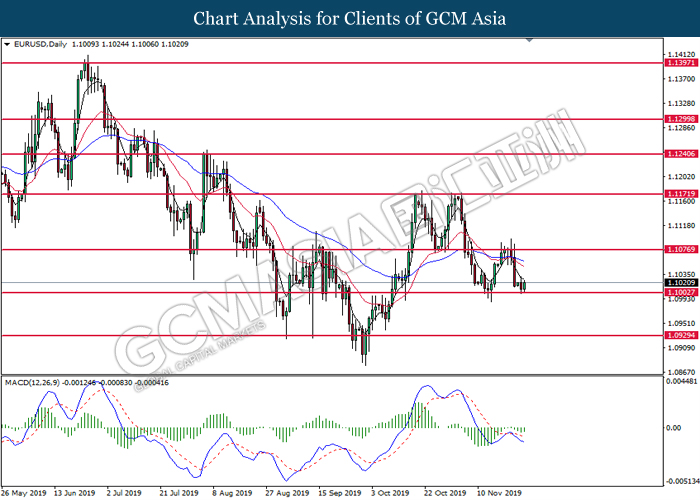

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1075, 1.1170

Support level: 1.1000, 1.0930

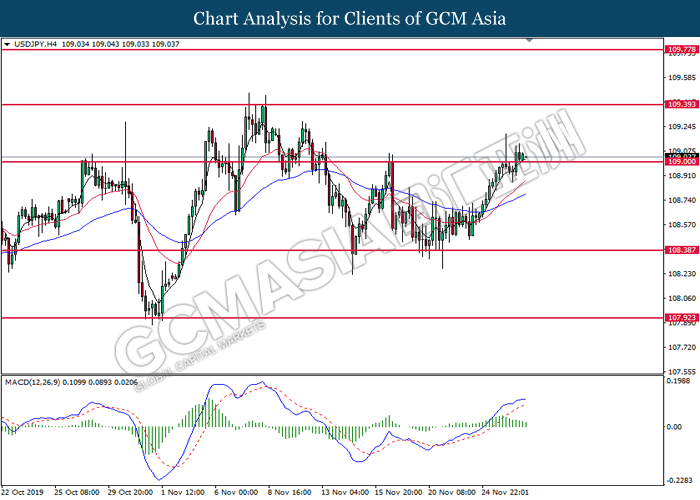

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 109.00. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 109.40.

Resistance level: 109.40, 109.80

Support level: 109.00, 108.40

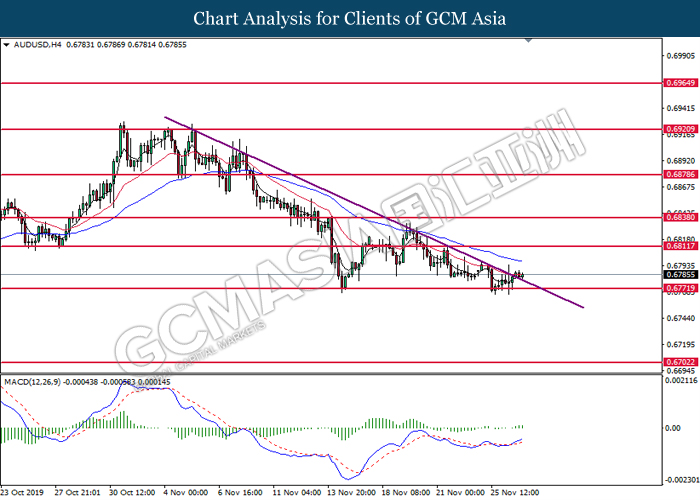

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the downward trend line. MACD which illustrated bullish signal suggest the pair to extend its gains toward the resistance level at 0.6810.

Resistance level: 0.6810, 0.6840

Support level: 0.6770, 0.6705

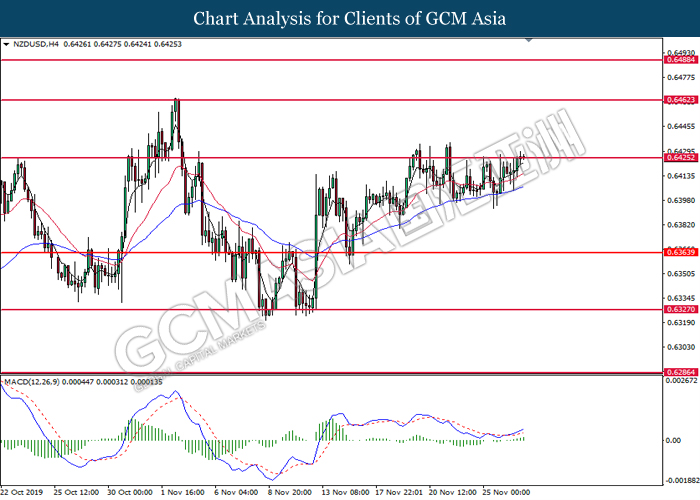

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6425. MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6425, 0.6460

Suppo rt level: 0.6365, 0.6325

rt level: 0.6365, 0.6325

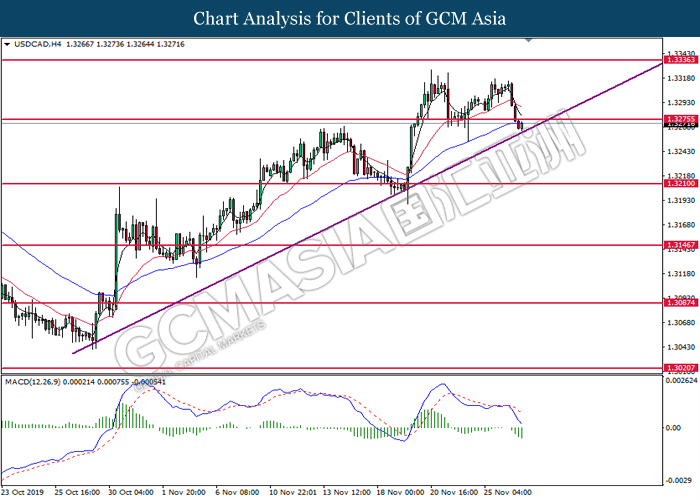

USDCAD, H4: USDCAD was traded lower while currently testing the upward trend line. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the trend line.

Resistance level: 1.3375, 1.3335

Support level: 1.3210, 1.3145

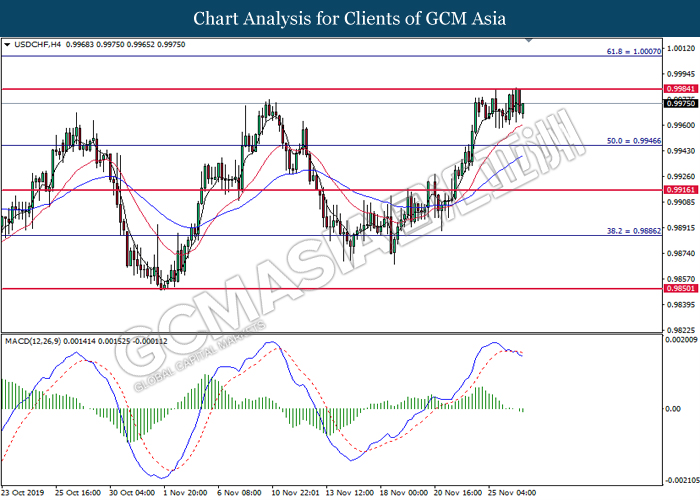

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9985. MACD which illustrated bearish momentum and the formation of death cross suggest the pair to extend its losses toward support level at 0.9945.

Resistance level: 0.9985, 1.0005

Support level: 0.9945, 0.9915

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 58.55. MACD which illustrated diminishing of bearish momentum and the formation of golden cross suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 58.55, 59.20

Support level: 57.50, 56.80

GOLD_, H4: Gold price traded higher following prior breakout above the previous resistance level at 1458.70. MACD which illustrated bullish momentum suggest the commodity to extend its gains toward the next resistance level at 1471.65.

Resistance level: 1471.65, 1480.95

Support level: 1458.70, 1448.95