28 November 2019 Morning Session Analysis

Greenback surged amid sign of economic recovery.

Dollar index which gauge its value against a basket of six major currencies appreciated to six weeks high level following upbeat data been released in US region on yesterday. In a full of economy data day, US Core Durable Goods Orders and GDP were came in at 0.6% and 2.1% respectively, obviously stronger than the economist forecast of 0.2% and 1.9%. These data showed that US economy growth has started to pick up slightly, and it is noteworthy that the increase in consumer consumption and export are the main components driven up the US third quarter GDP. However, market start to concern over the deadlock of phase 1 trade deal between US and China, as whether it will remain unsolved for an extended period and eventually tamper the global economy growth. Moreover, today early breaking news showed that President Trump has agreed with the decision of congress by signing two bills that backing the Hong Kong protesters. Trump revealed that he signed these bills out of the respect for President Xi, while two countries are still working hard to solve the trade war issue. This unexpected move by Trump will be seen as teasing the relationship between China and Hong Kong as US is interfering the internal affairs of these countries. As of writing, dollar index quoted up 0.06% to 98.25.

In the commodities market, crude oil price quoted down 0.21% to $58.00 per barrel amid EIA data showed a build in US crude oil inventories level at 1.572M, while economist forecast a decline of 0.418M. Moreover, recent sign off on Hong Kong bill escalated the trade tensions and lifted up the uncertainties of future crude oil demand as. On the other hand, gold price appreciated by 0.13% to $1455.85 a troy ounce amid heightening of trade tensions between US and China.

Today’s Holiday Market Close

Time Market Event

All day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

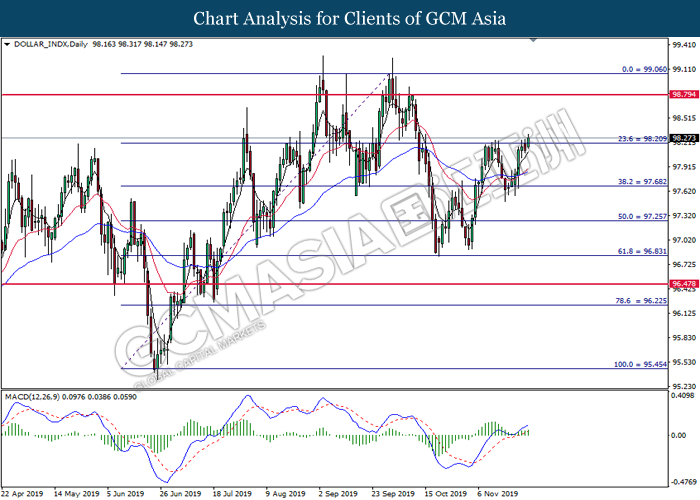

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 98.20. MACD which illustrate bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 98.20

Resistance level: 98.20, 98.80

Support level: 97.70, 97.25

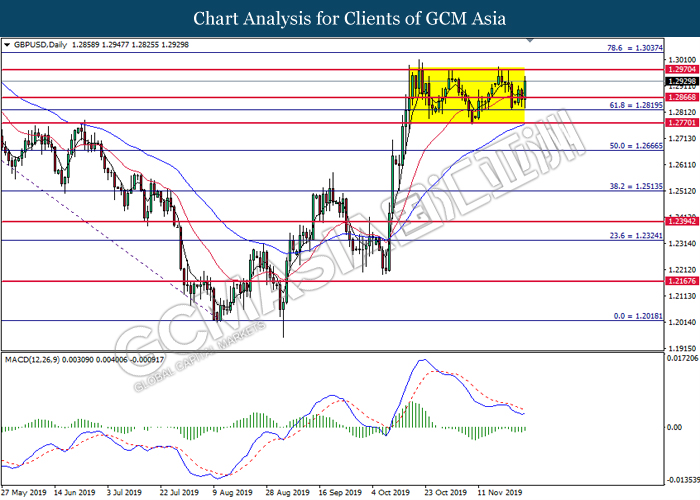

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2865. MACD which illustrated bullish signal suggest the pair to extend its gains toward the resistance level at 1.2970.

Resistance level: 1.2970, 1.3035

Support level: 1.2865, 1.2820

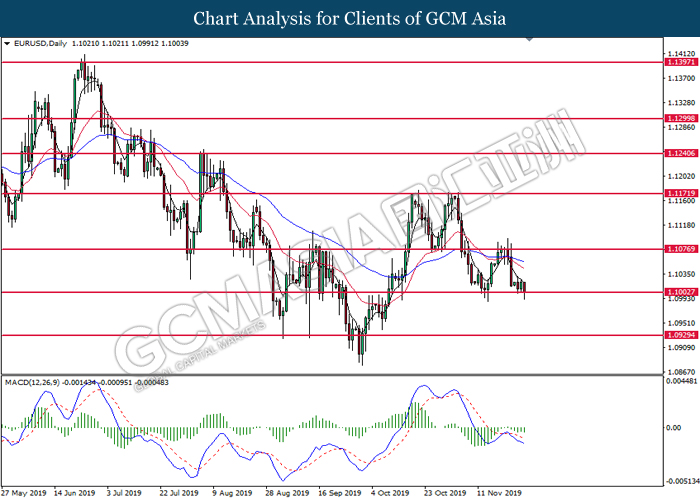

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1075, 1.1170

Support level: 1.1000, 1.0930

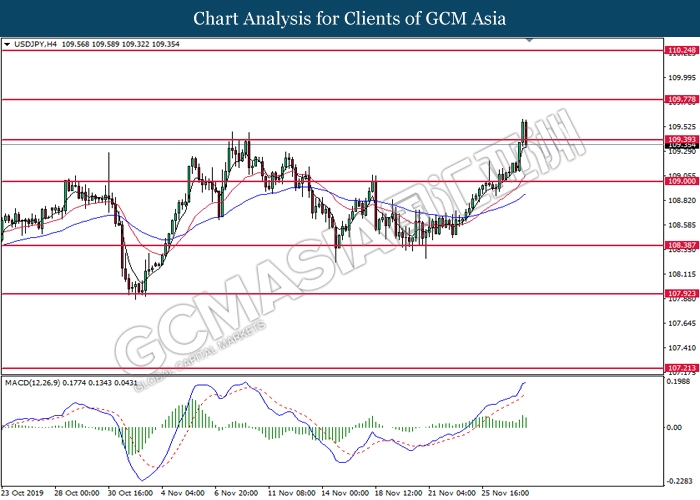

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 109.40. However, MACD which illustrated bullish bias momentum suggest the pair to undergo short term technical correction toward the higher level.

Resistance level: 109.80, 110.25

Support level: 109.40, 109.00

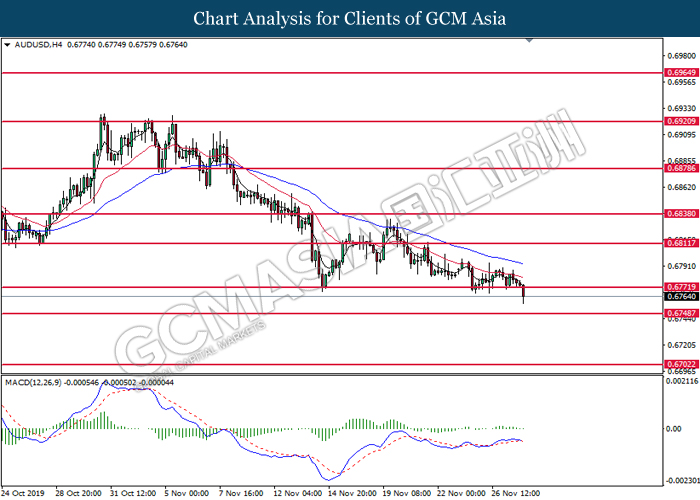

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6770. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6810, 0.6840

Support level: 0.6770, 0.6750

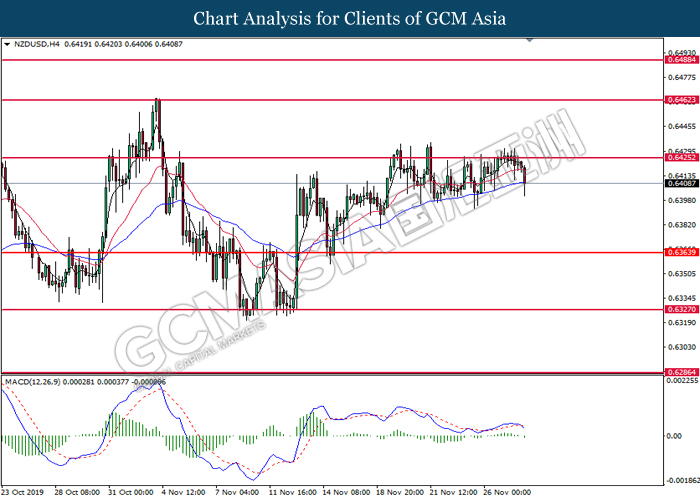

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.6425. MACD which illustrate diminishing bullish momentum and the formation of death cross suggest the pair to extend its losses toward the support level at 0.6365.

Resistance level: 0.6425, 0.6460

Support level: 0.6365, 0.6325

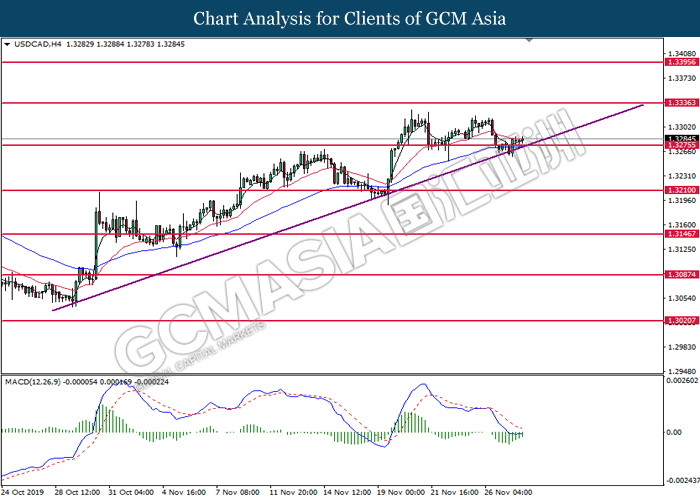

USDCAD, H4: USDCAD was traded higher following prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3335.

Resistance level: 1.3335, 1.3395

Support level: 1.3275, 1.3210

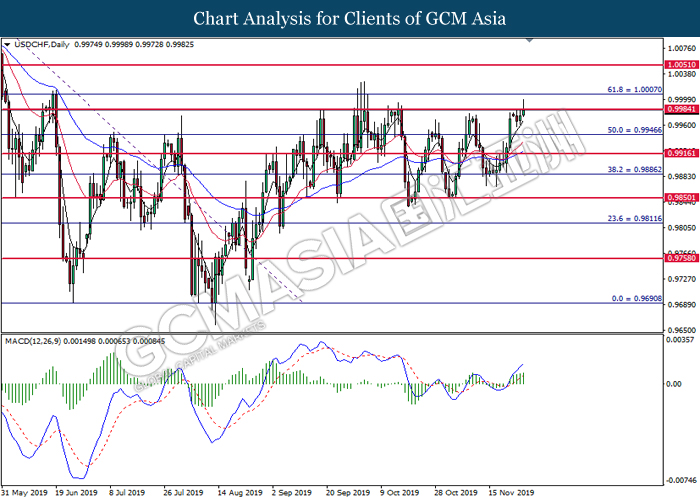

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after successfully breakout above the resistance level at 0.9985.

Resistance level: 0.9985, 1.0005

Support level: 0.9945, 0.9915

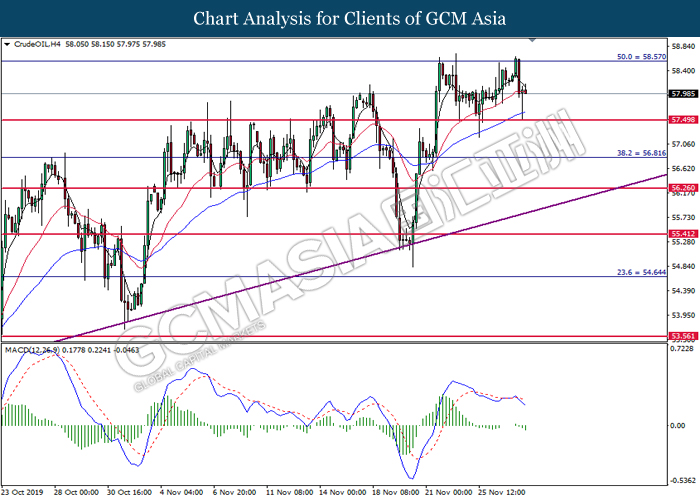

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 58.55. MACD which illustrated diminishing of bearish momentum suggest the commodity to extend its losses toward the support level at 57.50.

Resistance level: 58.55, 59.20

Support level: 57.50, 56.80

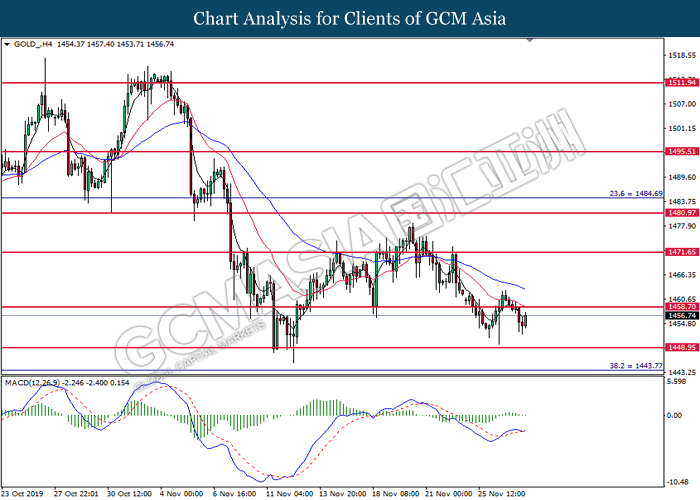

GOLD_, H4: Gold price traded higher following prior rebound from the lower level. Due to lack of signal from MACD, it is suggested to wait for further signal appear before entering the market.

Resistance level: 1458.70, 1471.65

Support level: 1448.95, 1443.75