29 November 2019 Afternoon Session Analysis

Dollar remains high as Fed cut expectation fade.

Dollar index which measured against a basket of six major currency pairs continue to holding its high ground during late Asian trading session as market scale back their rate cut expectation. Despite recent headlines in trade development between U.S and China, investors remain firm as recent data suggest the economy in U.S remain in a strong footing. Besides that, Fed also recently hinted an upbeat outlook following stronger labor market and a possible turnaround in business investment, thus prompting investors to continue holding their bets of the greenback. As market are expected to be thinly traded due to Thanksgiving Holiday, investors will be waiting for further catalyst to determine the sentiment for the greenback. As of writing, dollar index edge higher 0.02% to 98.20.

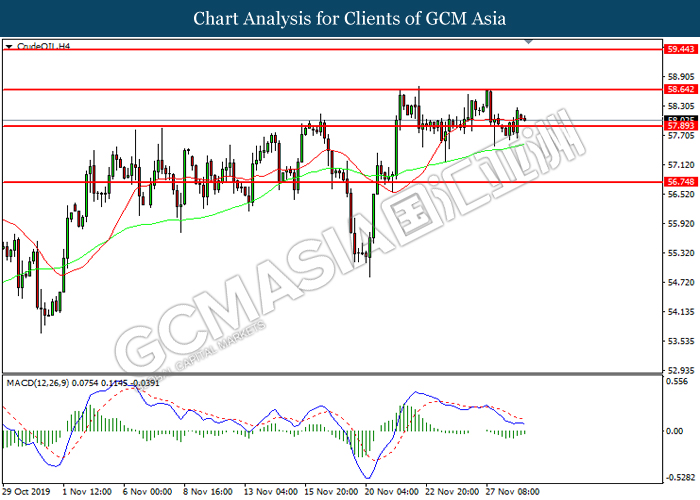

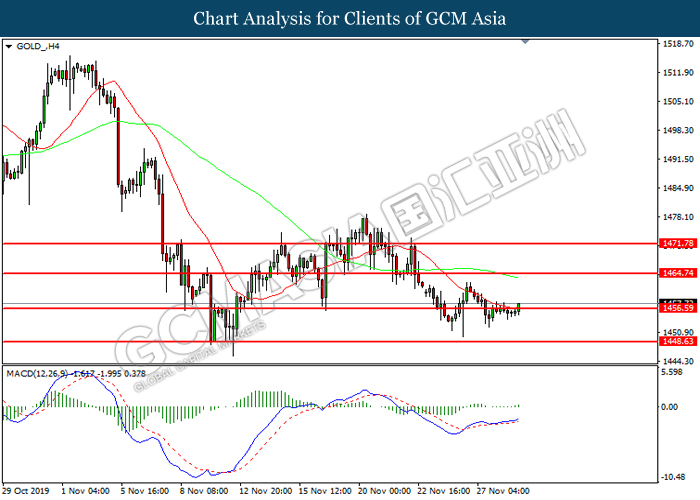

In the commodities market, crude oil price edge lower 0.03% to $58.05 per barrel as the time of writing amid mixed reaction on U.S and China tension over Hong Kong build. Investors are concerned that the move might delay further a preliminary agreement between the United States and China to put an end to their trade war that has slowed global economic growth, and consequently consumption of oil. On the other hand, gold price slips 0.05% to $1457.03 a troy ounce at the time of writing amid stronger dollar and thin market.

Today’s Holiday Market Close

Time Market Event

Early close at 2AM USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change | 6K | 5K | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 0.7% | 0.9% | – |

| 21:30 | CAD – GDP (MoM) (Sep) | 0.1% | 0.1% | – |

Technical Analysis

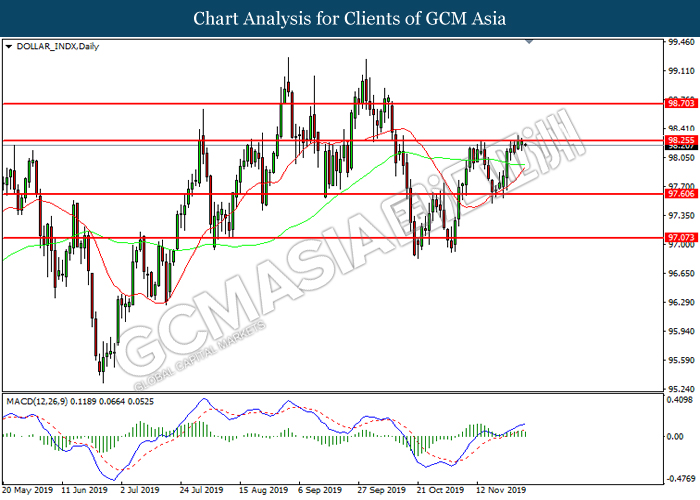

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 98.25. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 98.25, 98.70

Support level: 97.60, 97.05

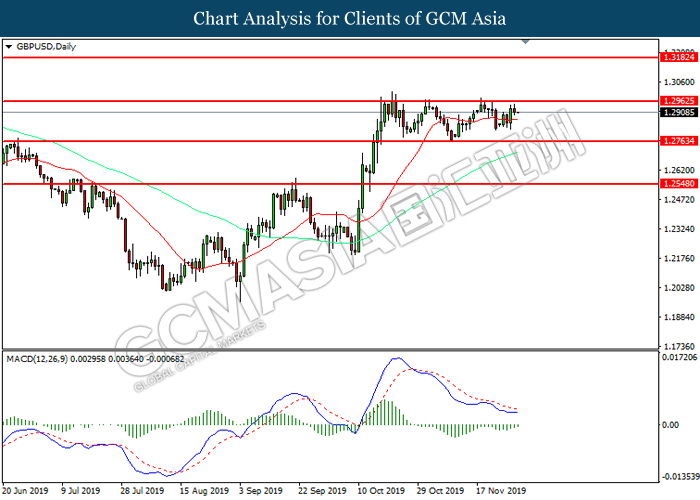

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2965. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2965, 1.3180

Support level: 1.2765, 1.2550

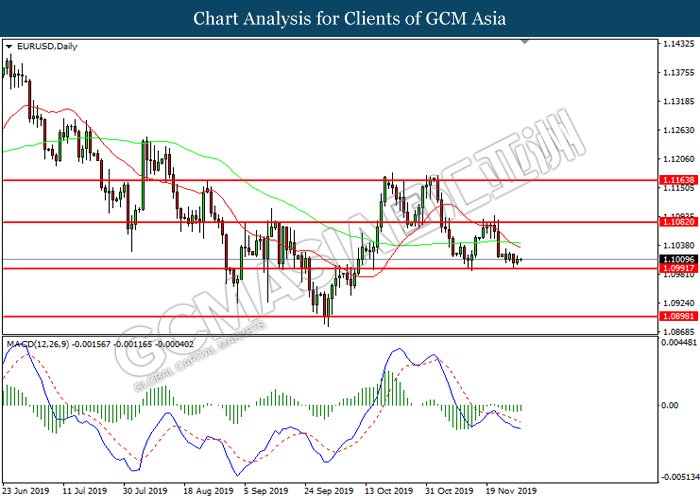

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0990. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1080, 1.1165

Support level: 1.0990, 1.0900

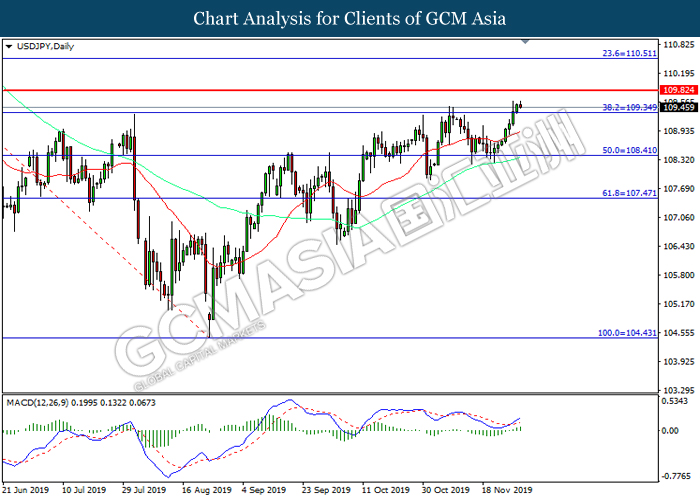

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 109.35. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 109.80.

Resistance level: 109.80, 110.50

Support level: 109.35, 108.40

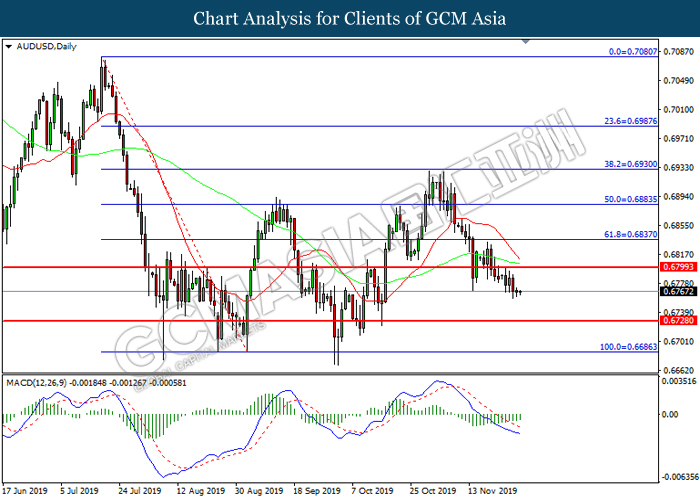

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6800. However, MACD which illustrated diminishing bearish momentum suggest the pair to be trade higher in short-term as technical correction.

Resistance level: 0.6800, 0.6835

Support level: 0.6730, 0.6685

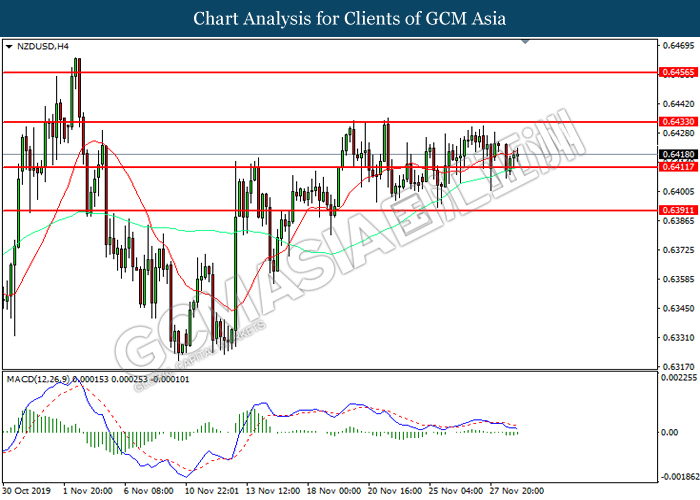

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6410. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6435.

Resistance level: 0.6435, 0.6455

Support level: 0.6410, 0.6390

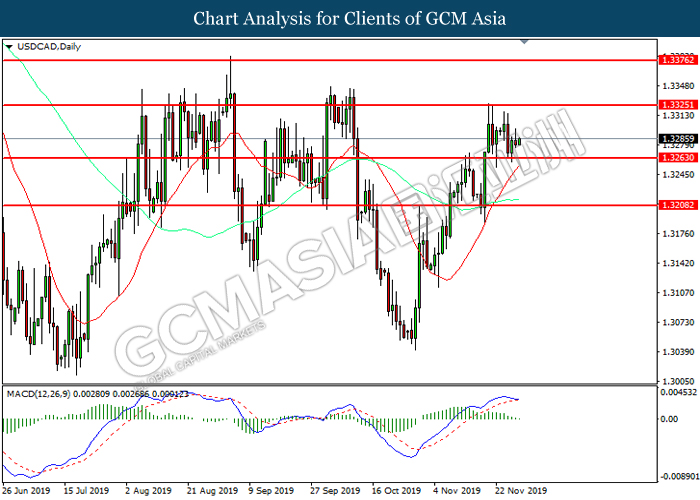

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3265. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3325, 1.3375

Support level: 1.3265, 1.3210

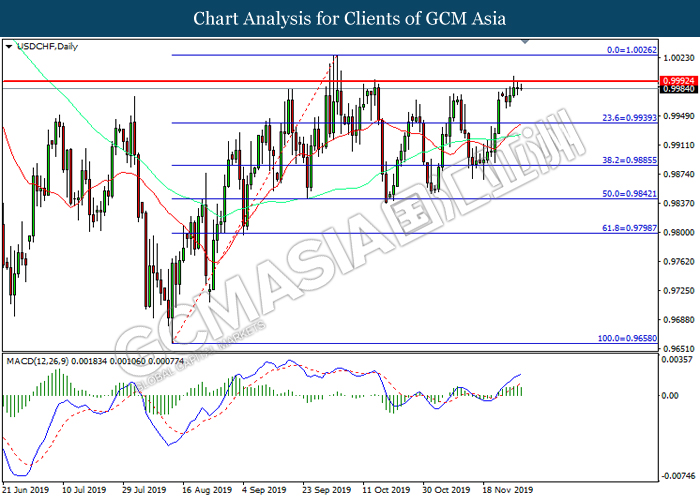

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9990. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9990, 1.0025

Support level: 0.9940, 0.9885

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 57.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 58.65.

Resistance level: 58.65, 59.45

Support level: 57.90, 56.75

GOLD_, H4: Gold price was traded within a range while currently testing the support level at 1456.60. MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher toward resistance level at 1464.75.

Resistance level: 1464.75, 1471.80

Support level: 1456.60, 1448.65