20 February 2020 Morning Session Analysis

Dollar index surged as positive economic data.

Dollar index surged over a backdrop of the positive data from the United Stated region. According to Census Bureau, U.S. Building Permits for last month notched up from the preliminary reading of 1.420M to 1.551M, exceeding the economist forecast at 1.450M. Besides that, U.S. Producer Price Index (PPI) for last month increased from the previous reading of 0.2% to 0.5%, which also better than the economist forecast at 0.1%. As the data both came in better than expectation, which increasing the market optimisms toward the economic progression in the United Stated. Indeed, according to the FOMC meeting minutes, the members viewed the current stance of the monetary policy is remain appropriate for now to support the sustained expansion of economic activity, strong labour market conditions and also U.S. inflation rate, minimizing the expectations of further rate cut by the U.S. central bank in future. Such hawkish statement had further spurred some significant demand for the dollar index. As of writing, dollar index appreciated by 0.15% to 99.44.

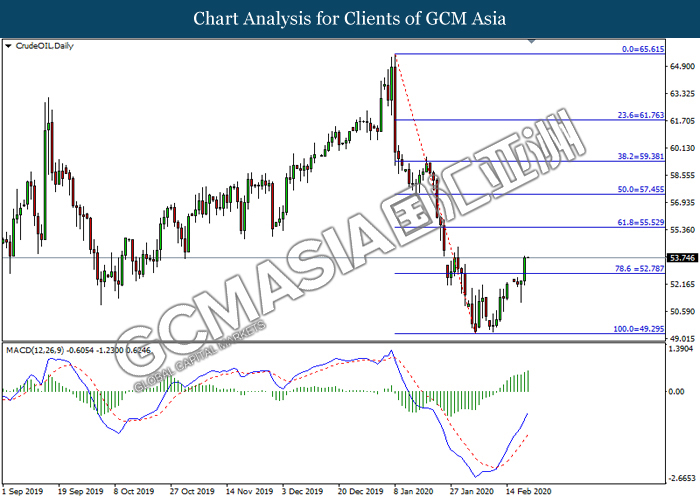

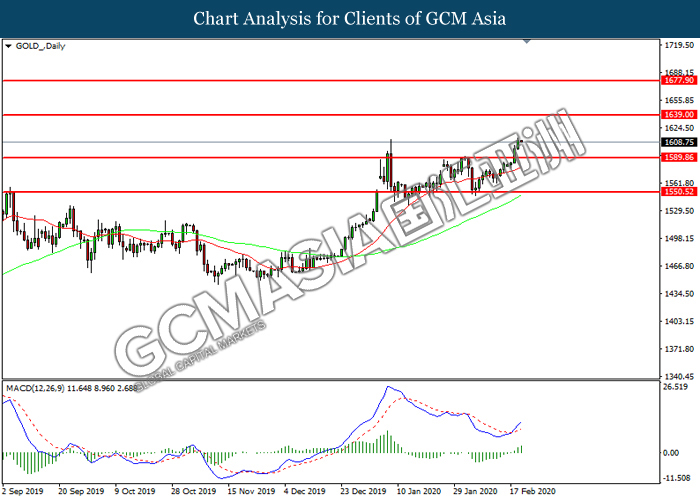

In the commodities market, crude oil price slumped 0.13% to $53.65 per barrel. However, the oil market edged higher yesterday amid the escalating tensions in Libya, which further threatening the global crude oil supply in future. The latest attack in Libya forced authorities to evacuate tankers carrying gasoline and liquefied petroleum gas before they had unloaded, which prompting the nation’s crude output dropped to around 123,000 barrels a day from the previous reading of 1.2 million a day, according to National Oil Corp. On the other hand, as of writing the gold price surged 0.06% to $1612.05 per troy ounces, buoyed by the risk-off sentiment in the FX market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Retail Sales (MoM) (Jan) | -0.6% | 0.5% | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | 17.0 | 12.0 | – |

| 00:00

(21th) |

CrudeOIL – Crude Oil Inventories | 7.459M | 2.987M | – |

Technical Analysis

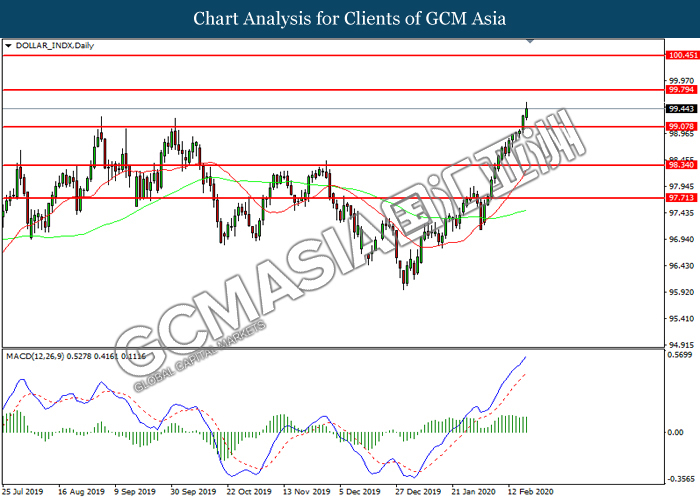

DOLLAR_INDX, Daily:Dollar index was traded higher following prior breakout above the previous resistance level at 99.10. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 99.80.

Resistance level: 99.80, 100.45

Support level: 99.10, 98.35

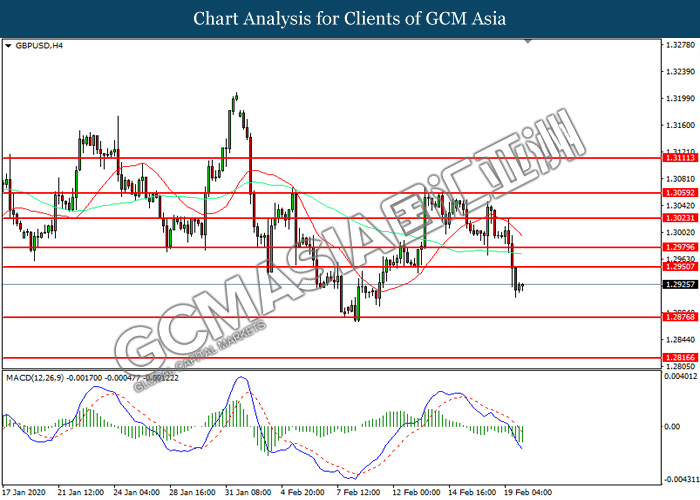

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.2950. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.2875.

Resistance level: 1.2950, 1.2980

Support level: 1.2875, 1.2815

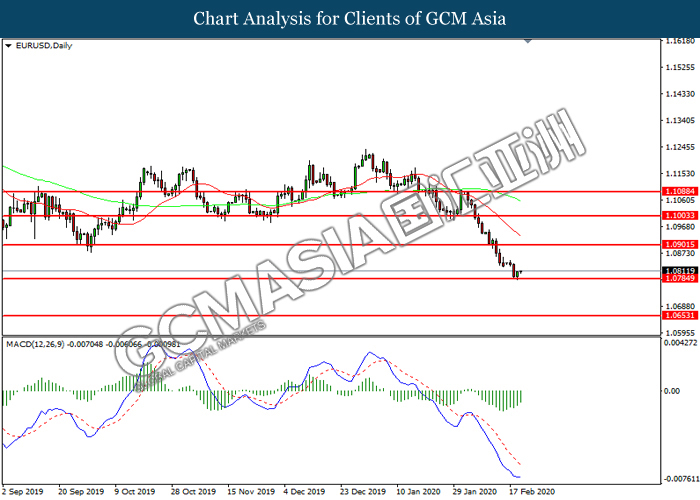

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0785. However, MACD which illustrated diminishing bearish momentum suggest pair to be traded higher in short-term as technical correction.

Resistance level: 1.0900, 1.1005

Support level: 1.0785, 1.0655

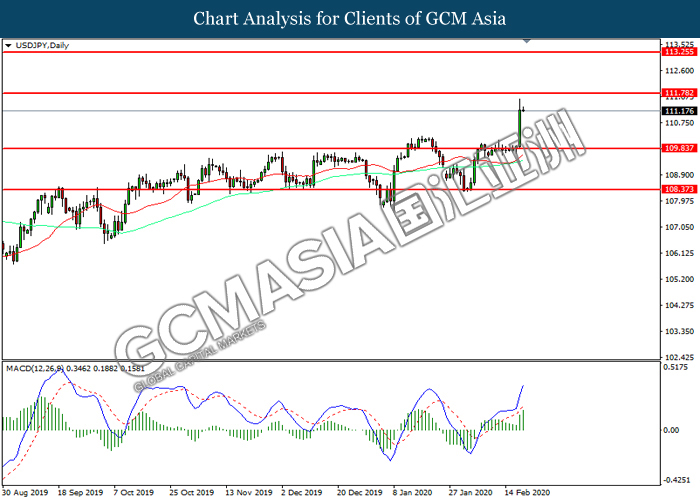

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 109.85. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 111.80.

Resistance level: 111.80, 113.25

Support level: 109.85, 108.35

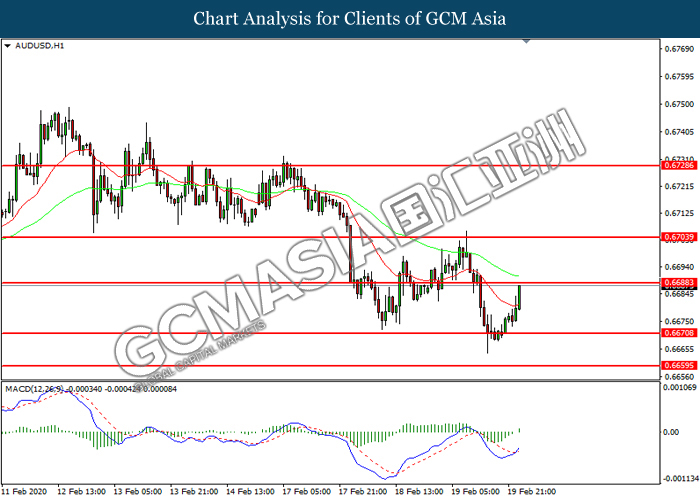

AUDUSD, H1: AUDUSD was traded higher while currently testing the resistance level at 0.6690. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6690, 0.6705

Support level: 0.6670, 0.6660

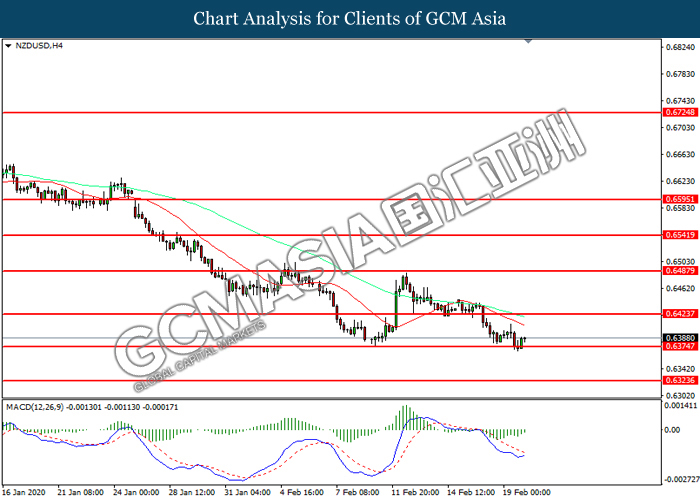

NZDUSD, H4: NZDUSD was traded lower while currently testing near the support level at 0.6375. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6425, 0.6890

Support level: 0.6375, 0.6325

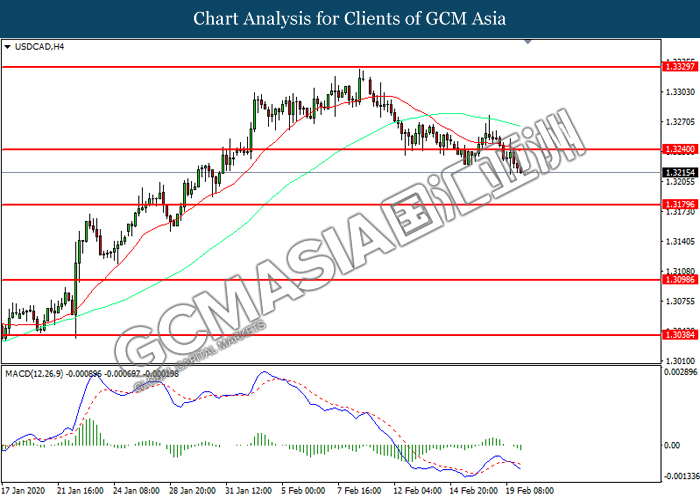

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3240. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3180.

Resistance level: 1.3240, 1.3330

Support level: 1.3180, 1.3100

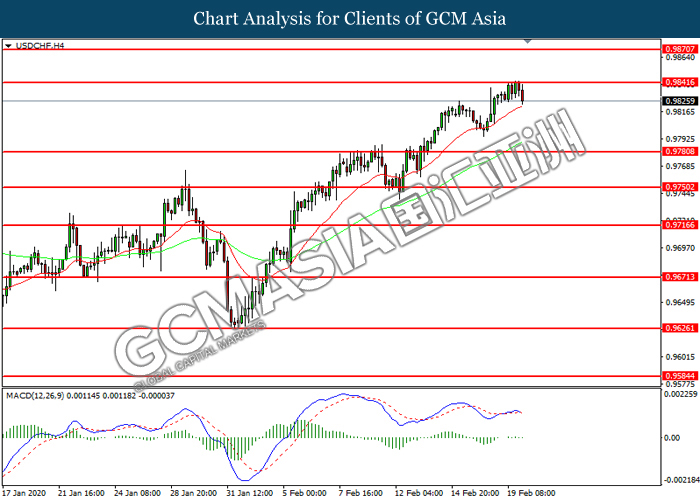

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9840. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9780.

Resistance level: 0.9840, 0.9870

Support level: 0.9780, 0.9750

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 52.80. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 55.55.

Resistance level: 55.55, 57.45

Support level: 52.80, 49.30

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1589.85. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1639.00.

Resistance level: 1639.00, 1677.90

Support level: 1589.85, 1550.50