070823 Morning Session Analysis

07 August 2023 Morning Session Analysis

Greenback plunged amid US jobs growth deteriorated.

The dollar index, which was traded against a basket of six major currencies, lost its ground of gains as the latest job data showed sign of loosening in July. Last month, the U.S. economy experienced a lower-than-anticipated increase in jobs. However, there were positive signs in the labor market, including solid wage gains and a decrease in the unemployment rate to 3.5%, indicating that the job market remained tight. According to the Labor Department’s survey of households, nonfarm payrolls experienced a growth of 187,000 jobs, falling short of the 200,000 jobs forecasted by economists in Reuters’ survey. The revisions for job growth in May and June showed a slowdown in labor demand, in response to the significant rate hikes implemented by the Federal Reserve. The jobs number, which was softer than expected, had immediate impacts on the financial markets. It halted the surge in Treasury yields that had been happening throughout the week and put a stop to the recent climb of the dollar. Going forward, the investors will eye on the upcoming inflation data in order to gauge the further direction of the dollar index. A surprise jump in inflation may urge the Fed to implement another round of rate hike in the next meeting. As of writing, the dollar index edged down -0.02% to 102.00.

In the commodities market, crude oil prices were up by 1.10% to $82.65 per barrel as the US dollar eased further following the announcement of NFP data, which prompted the investors to rush into the oil market. Besides, gold prices surged by 0.07% to $1944.25 per troy ounce amid the weakness of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day CAD Civic Holiday

Today’s Highlight Events

Time Market Event

20:15 USD FOMC Member Harker Speaks

20:30 USD FOMC Member Bowman Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

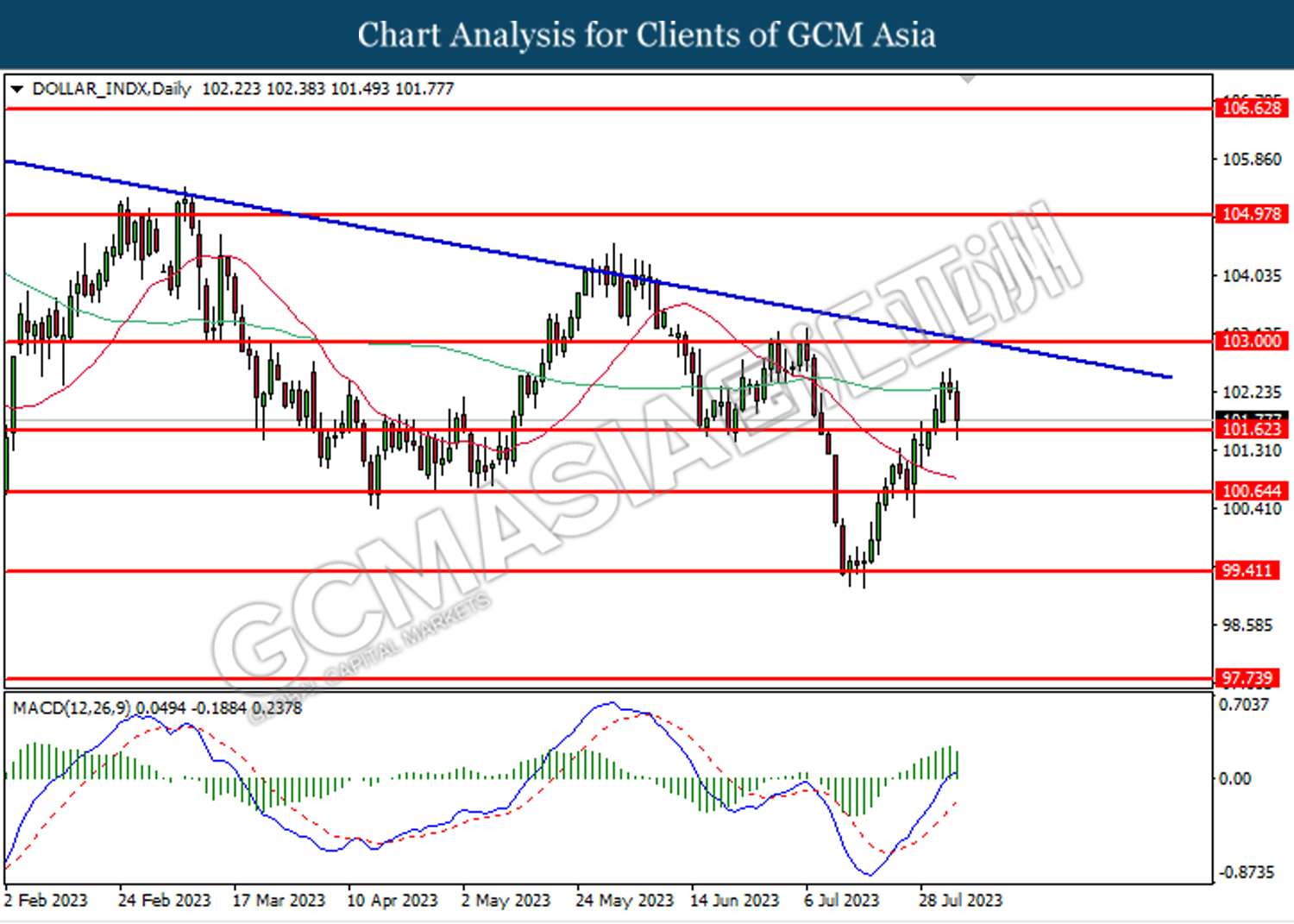

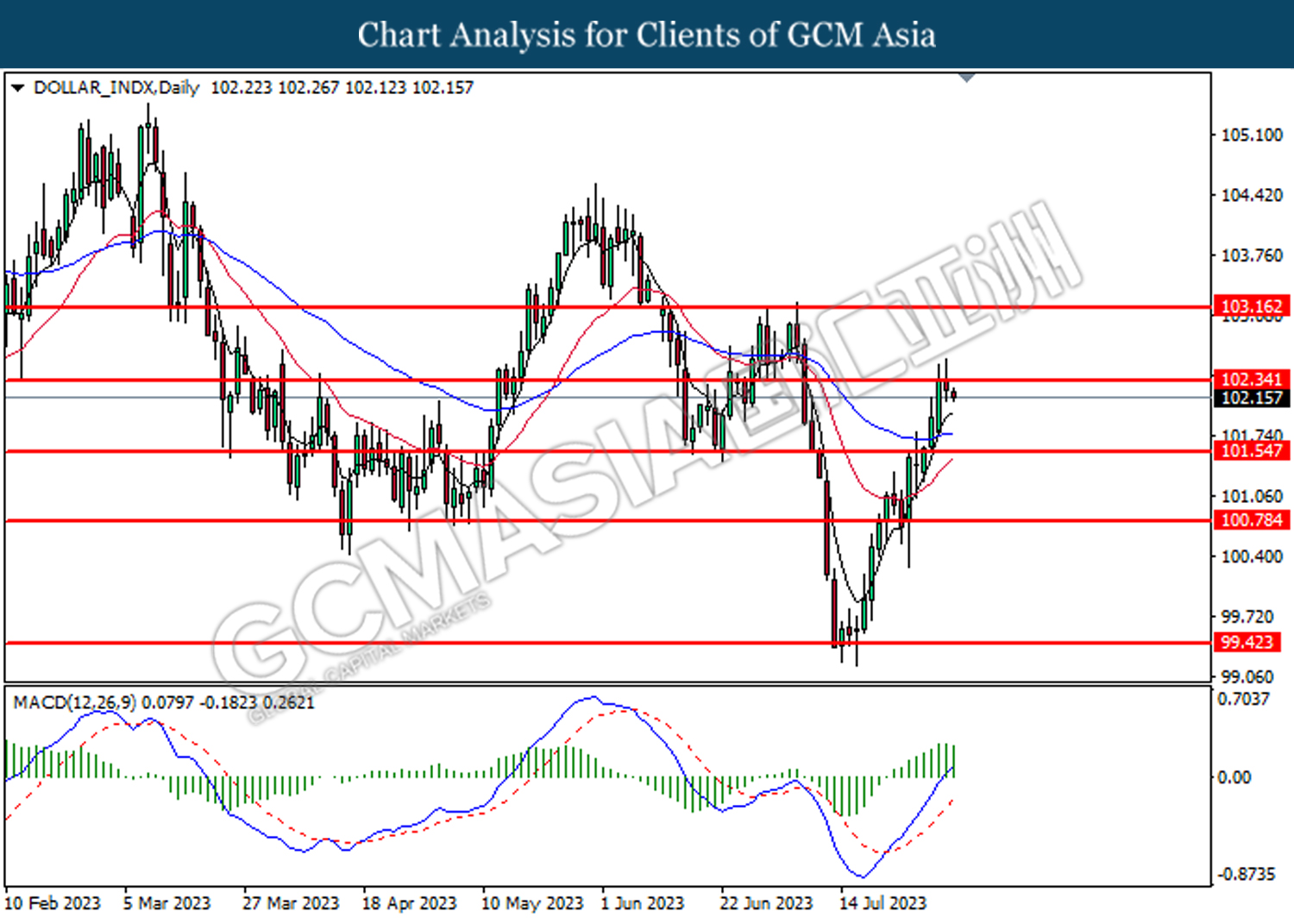

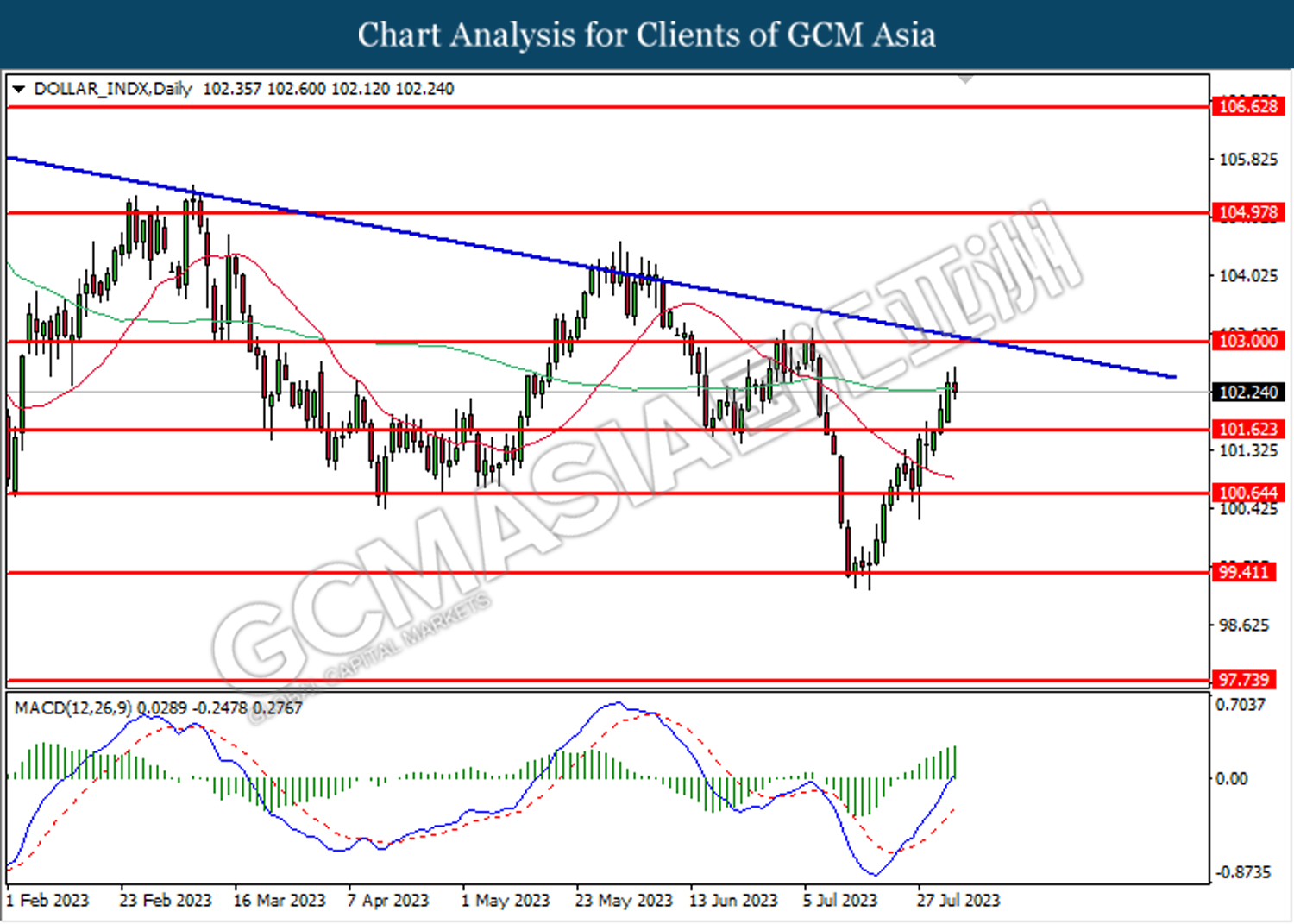

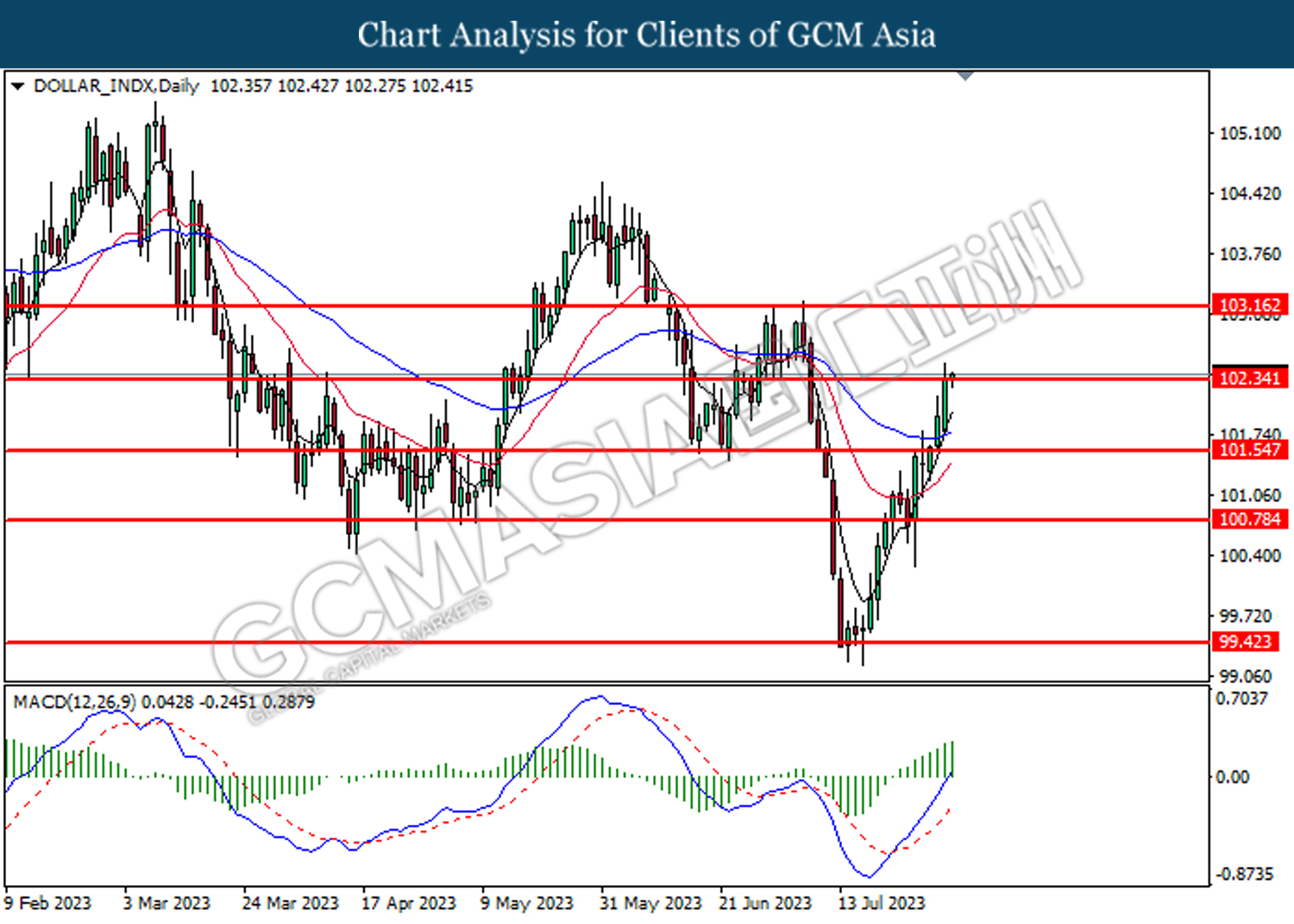

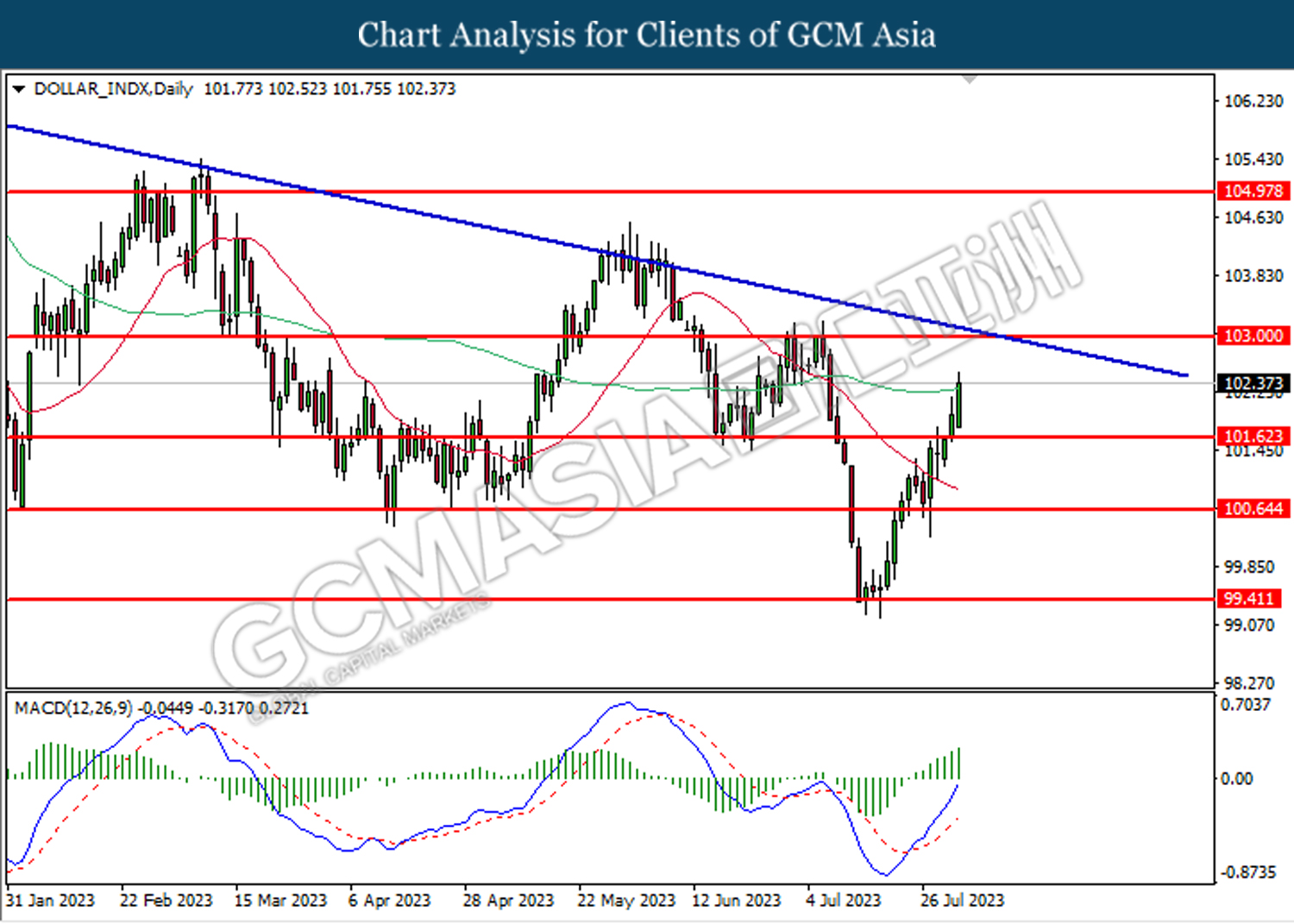

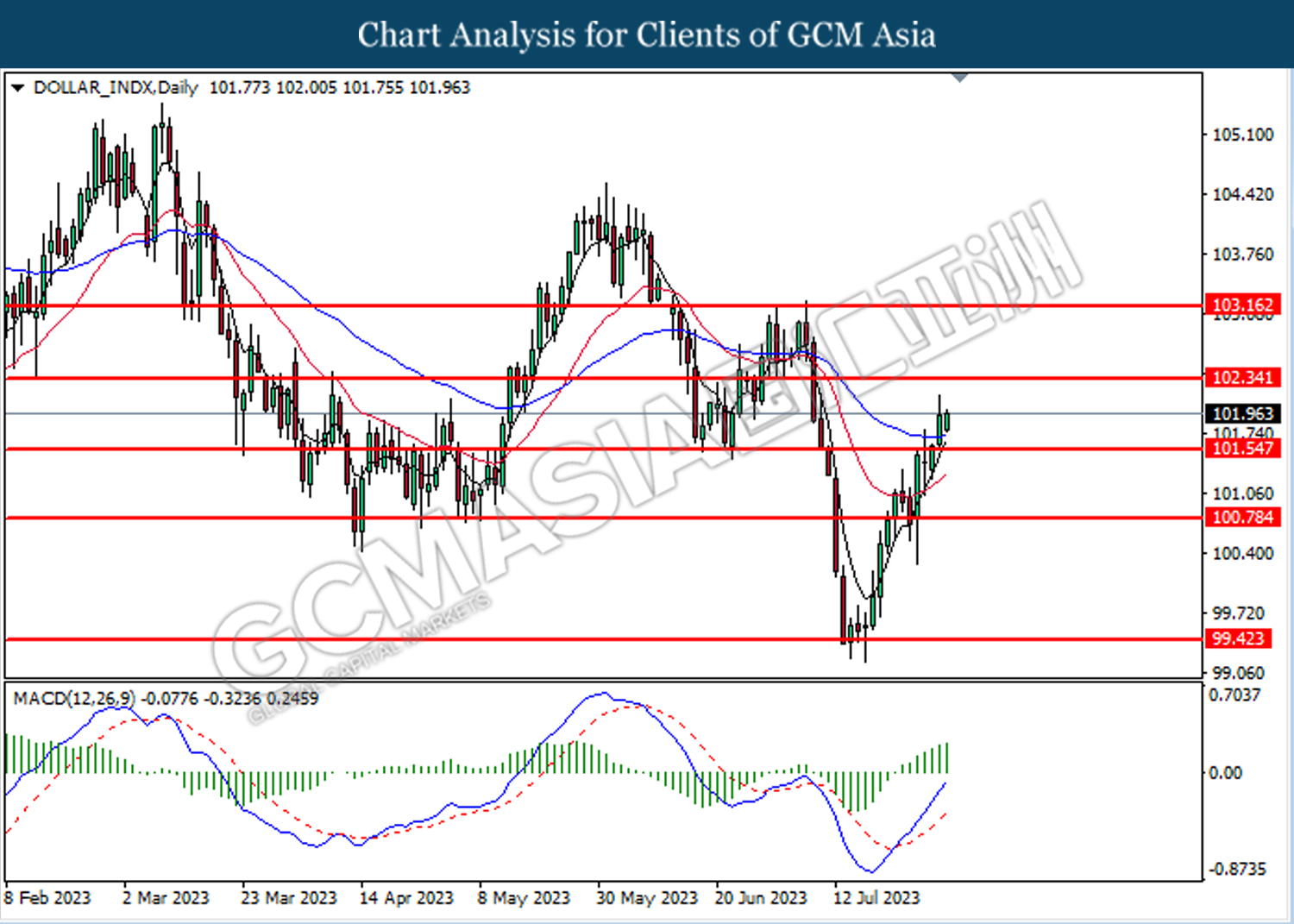

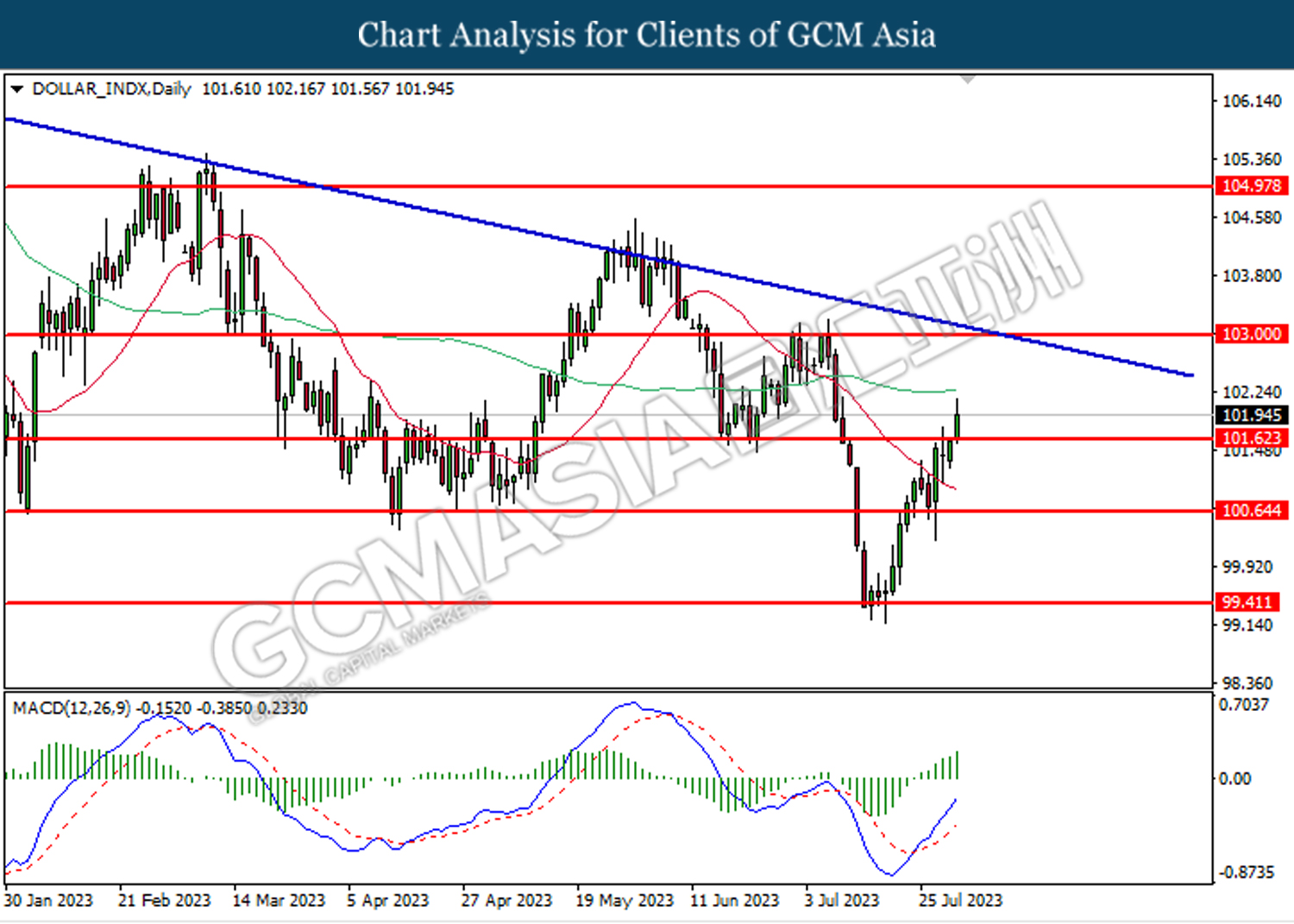

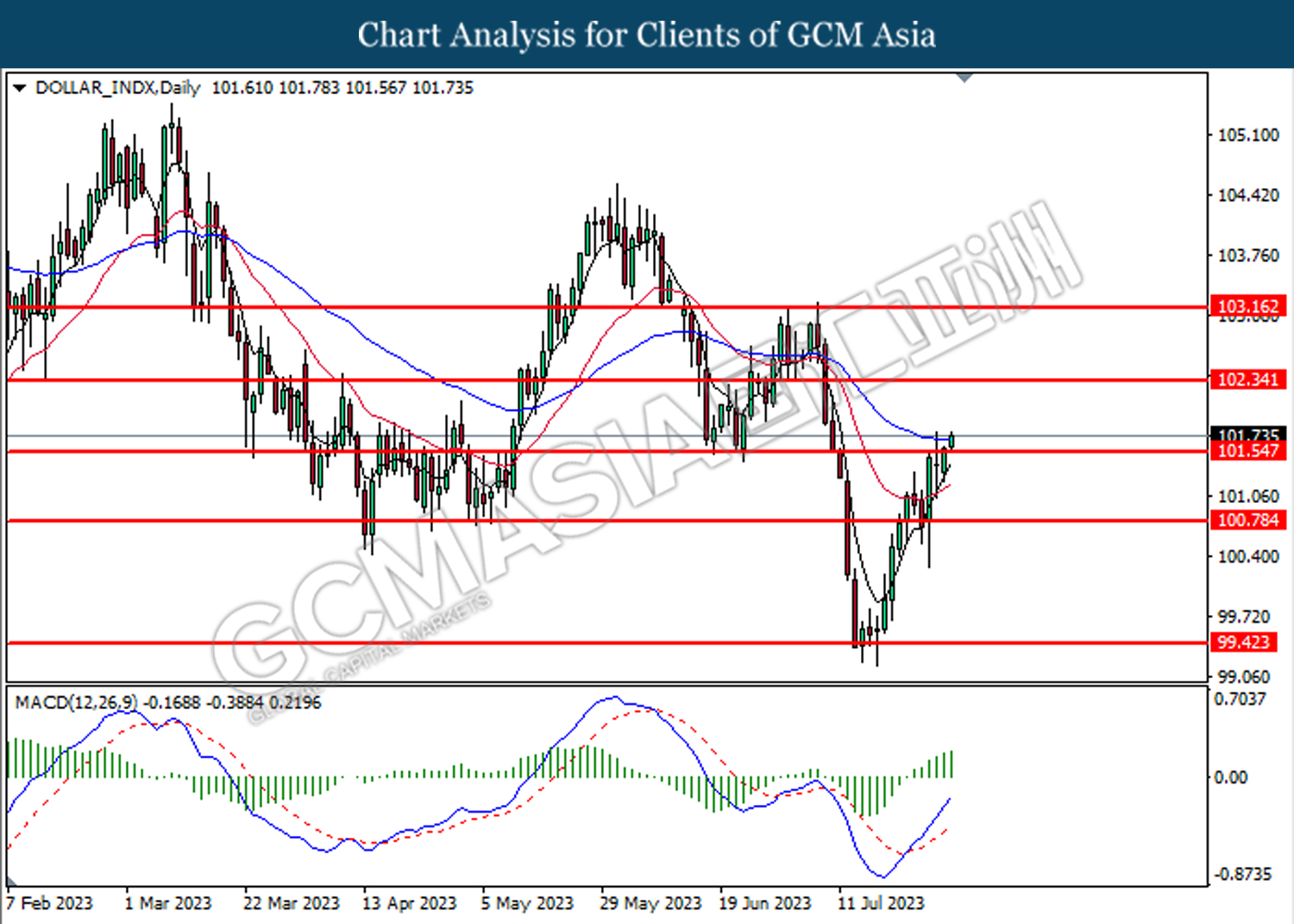

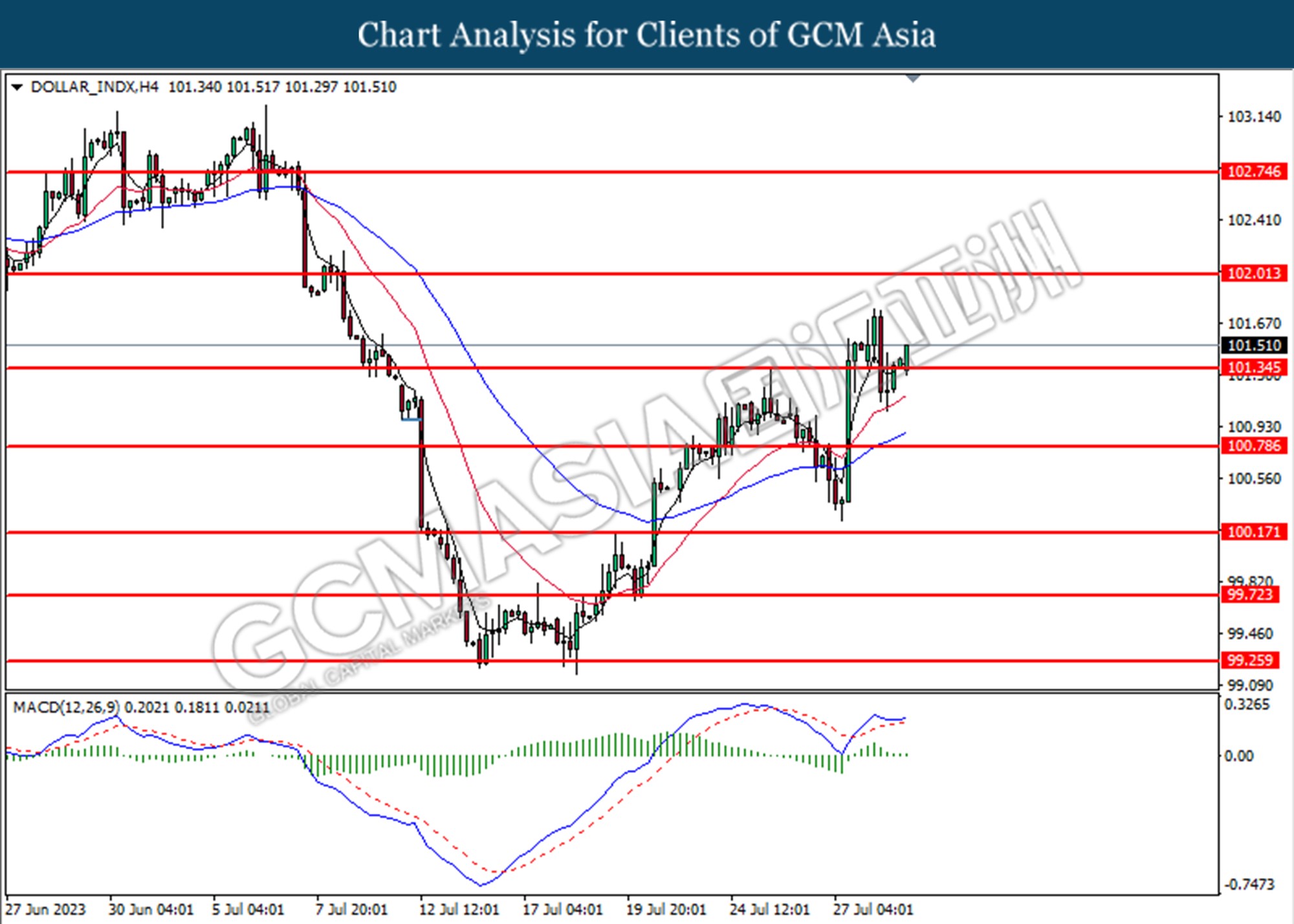

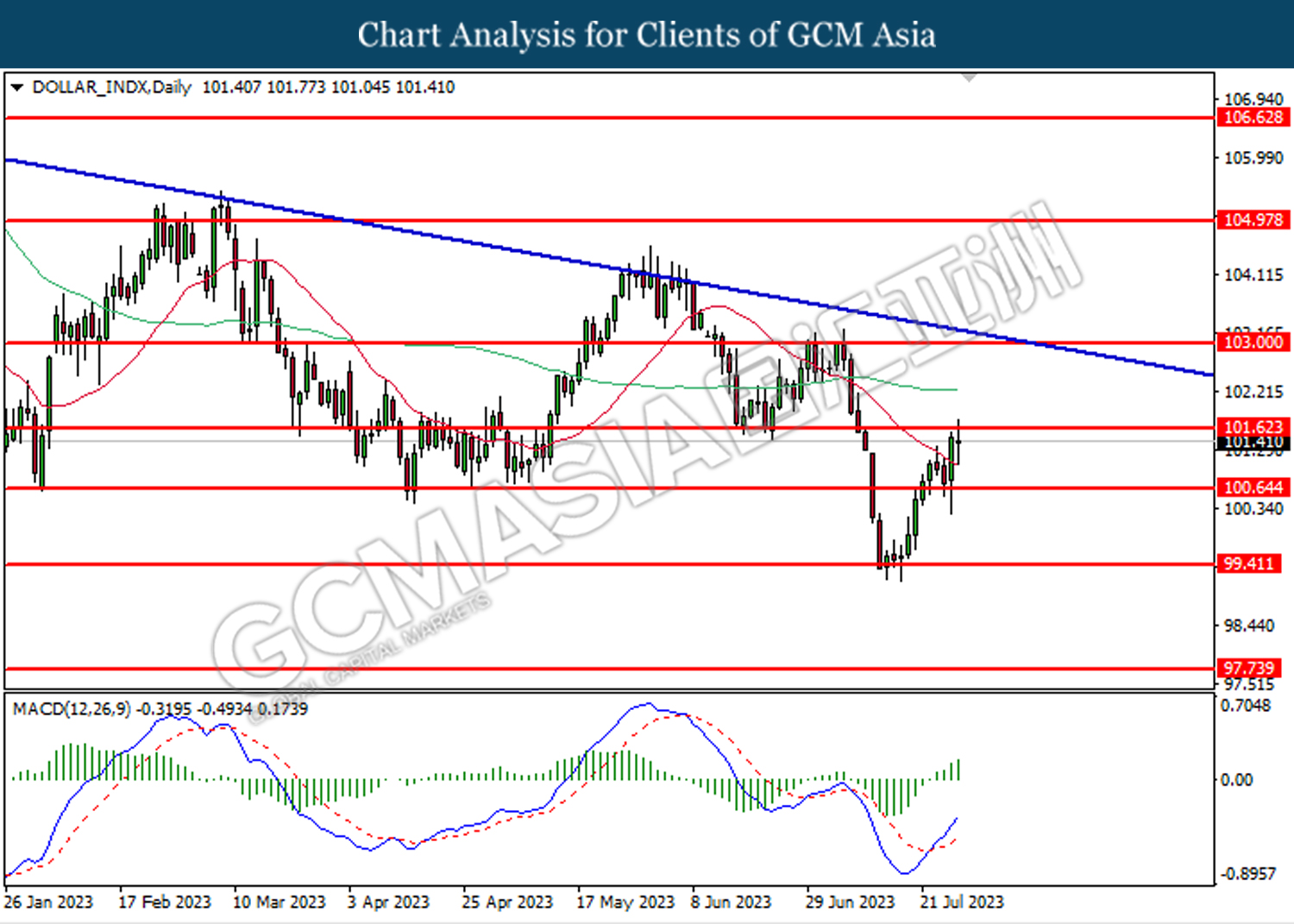

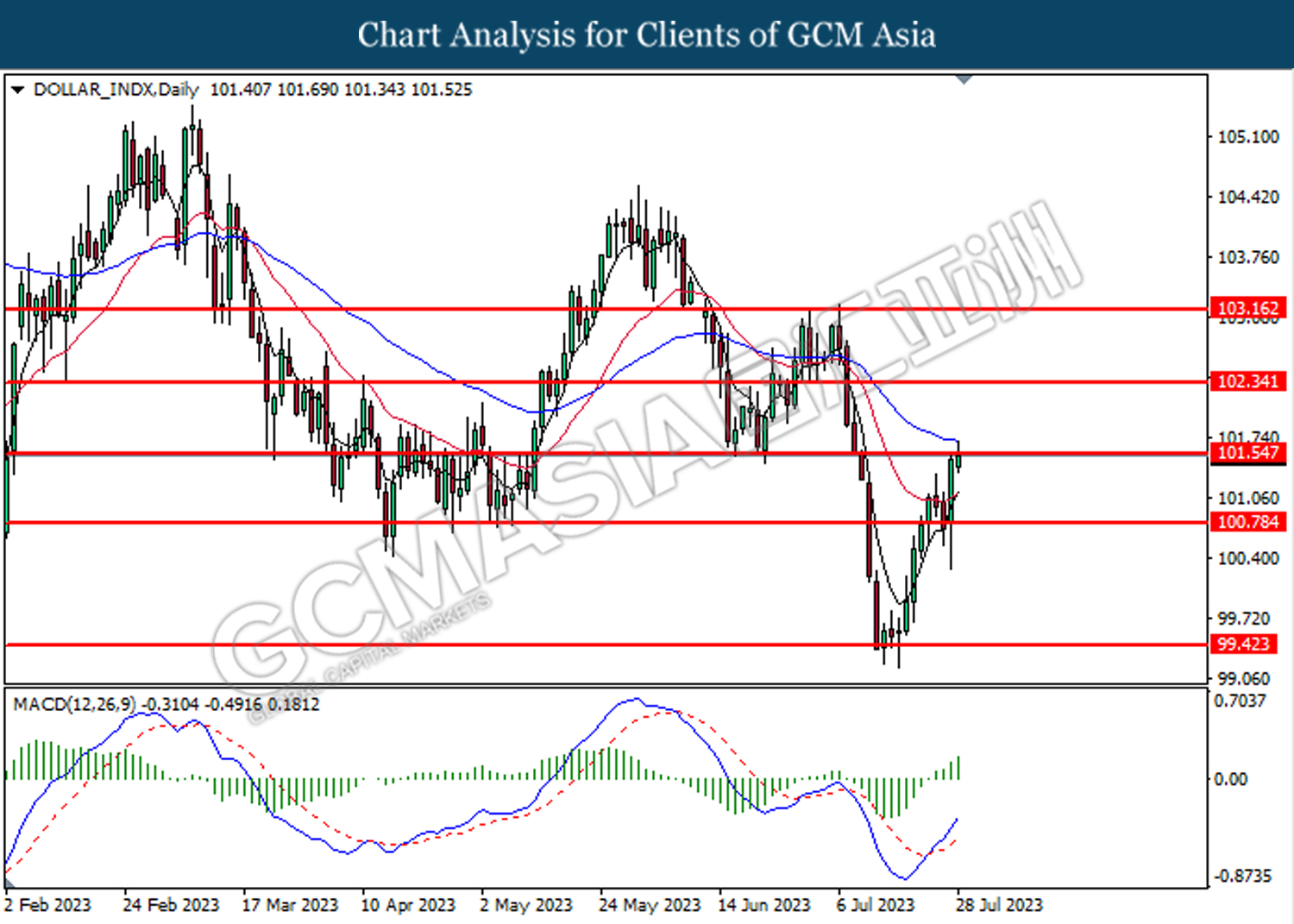

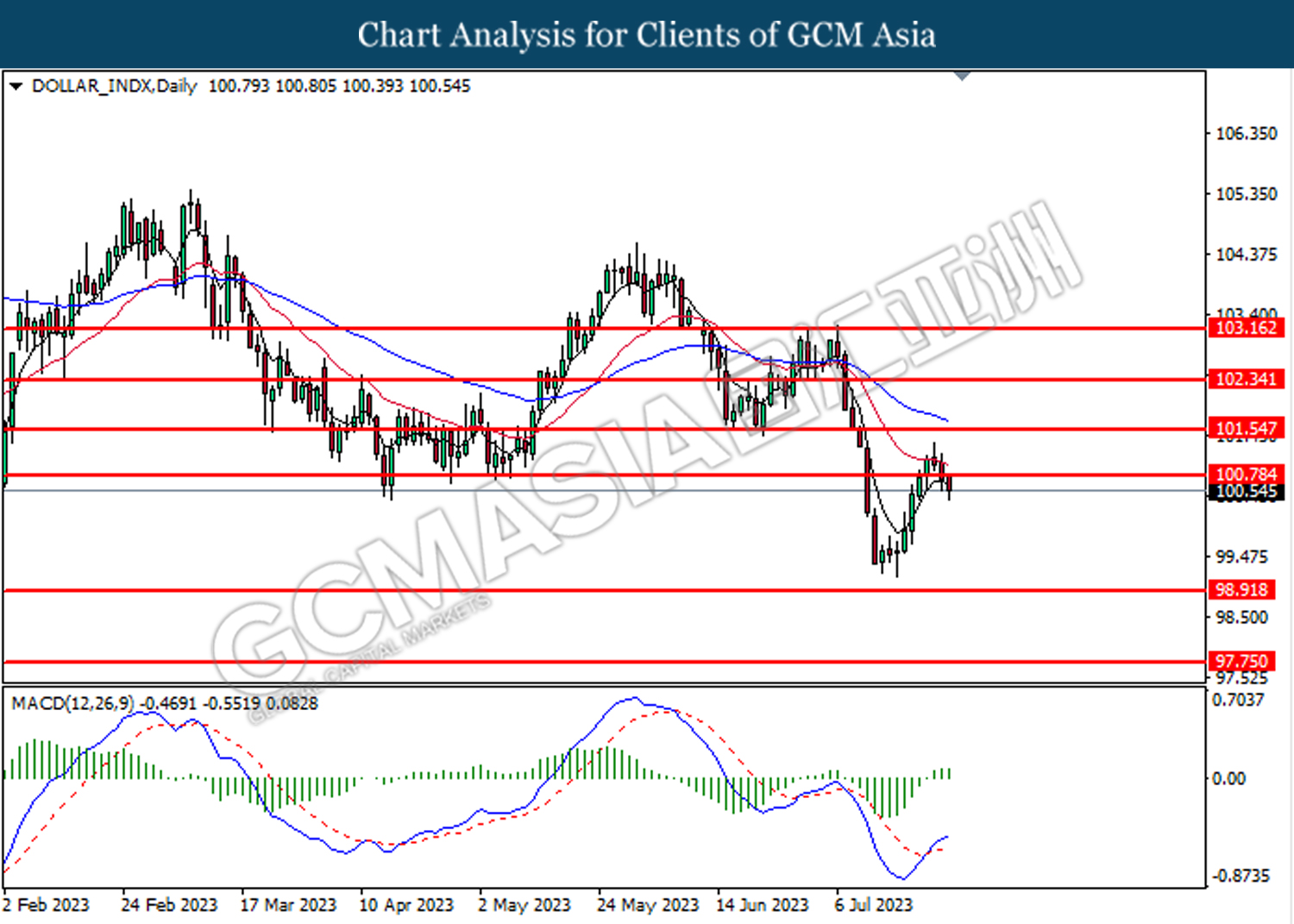

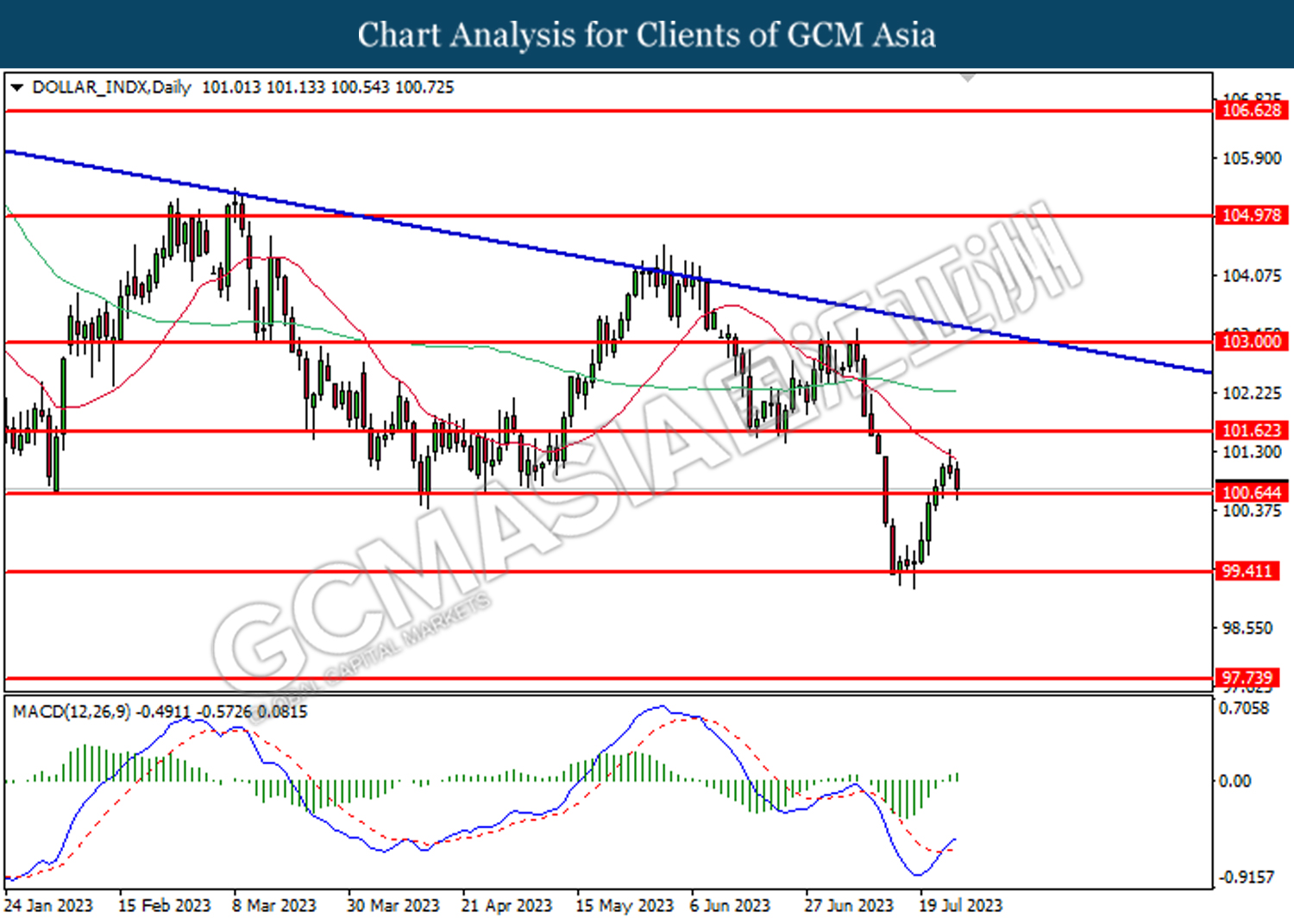

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.00, 105.00

Support level: 101.65, 100.65

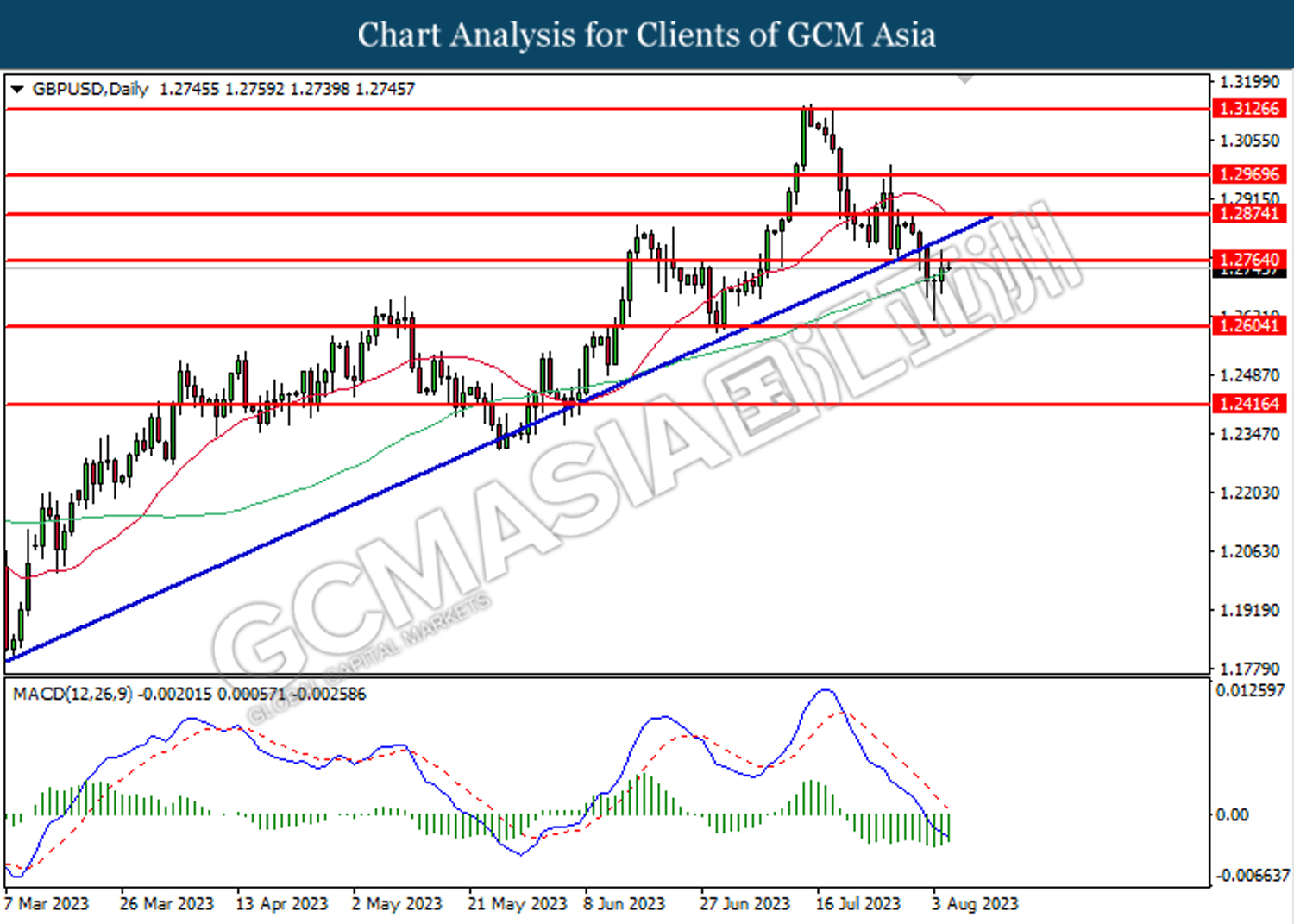

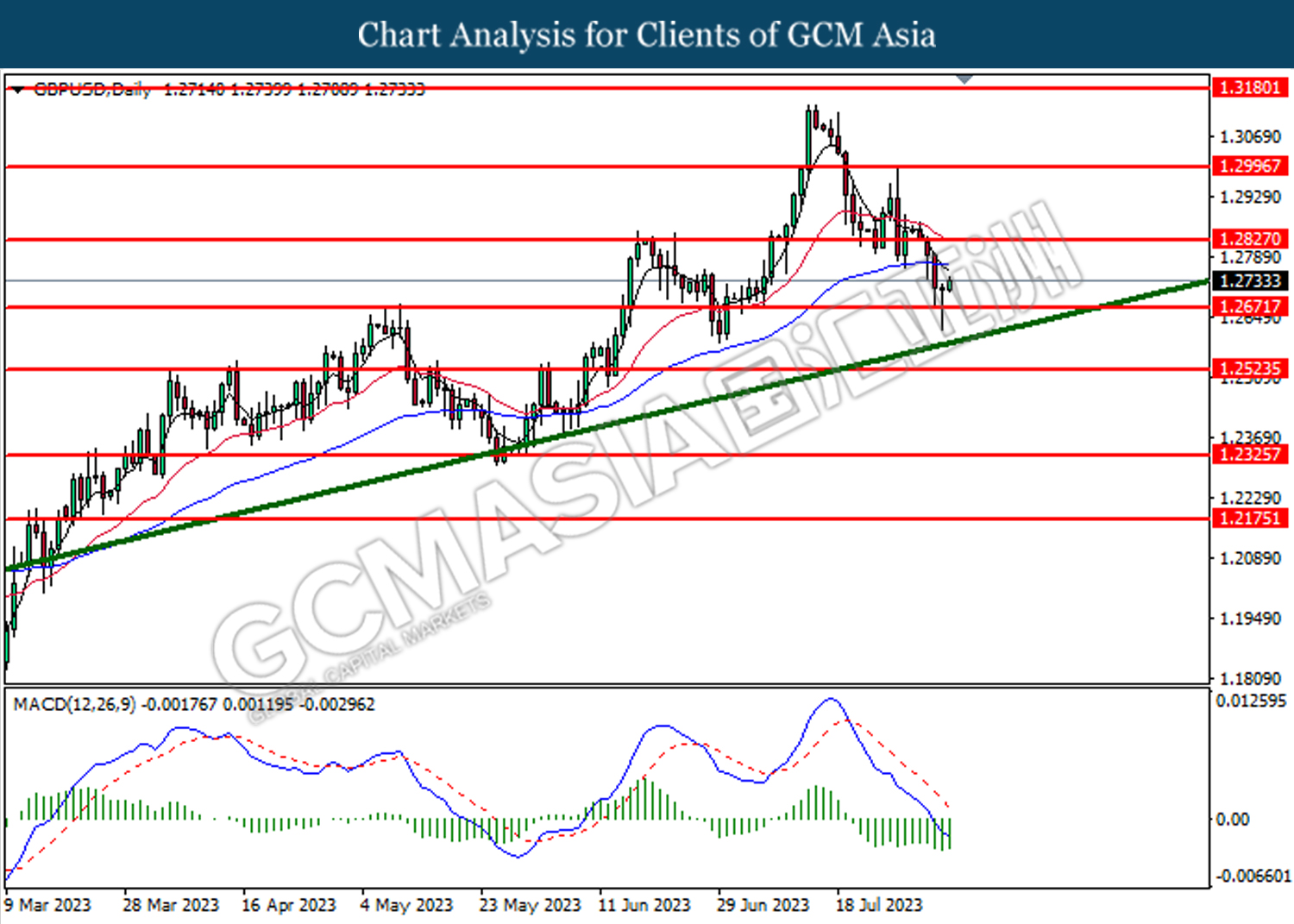

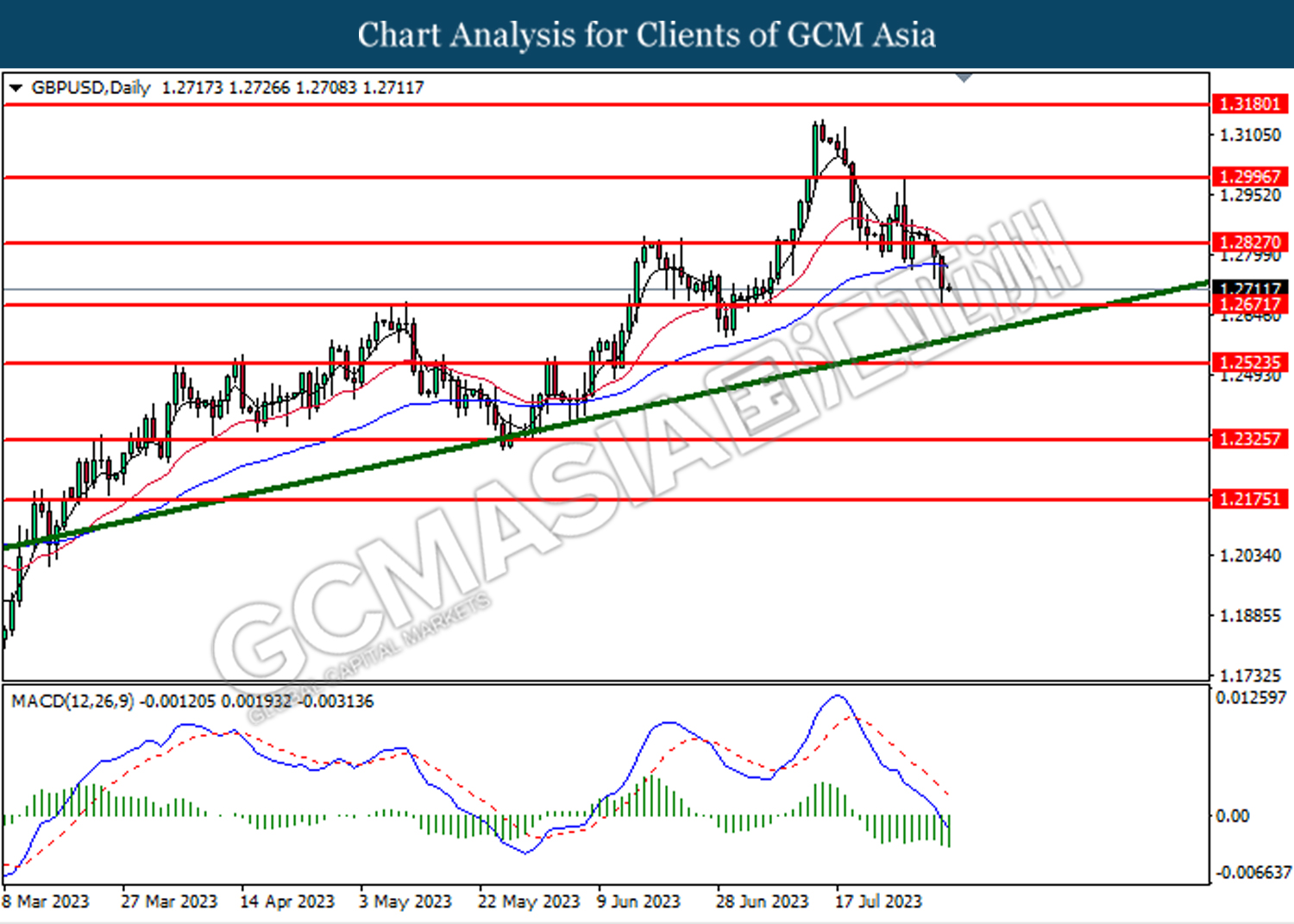

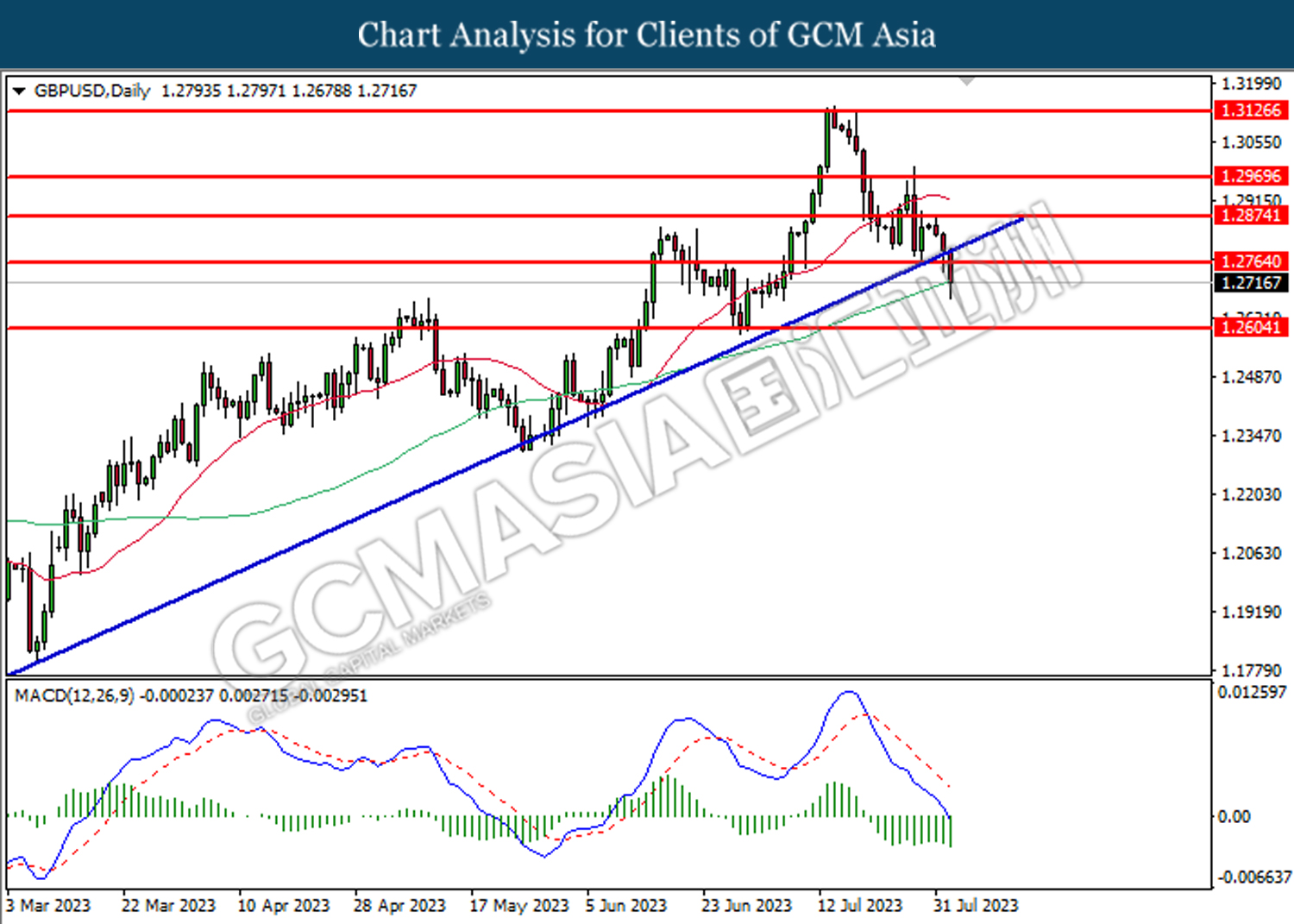

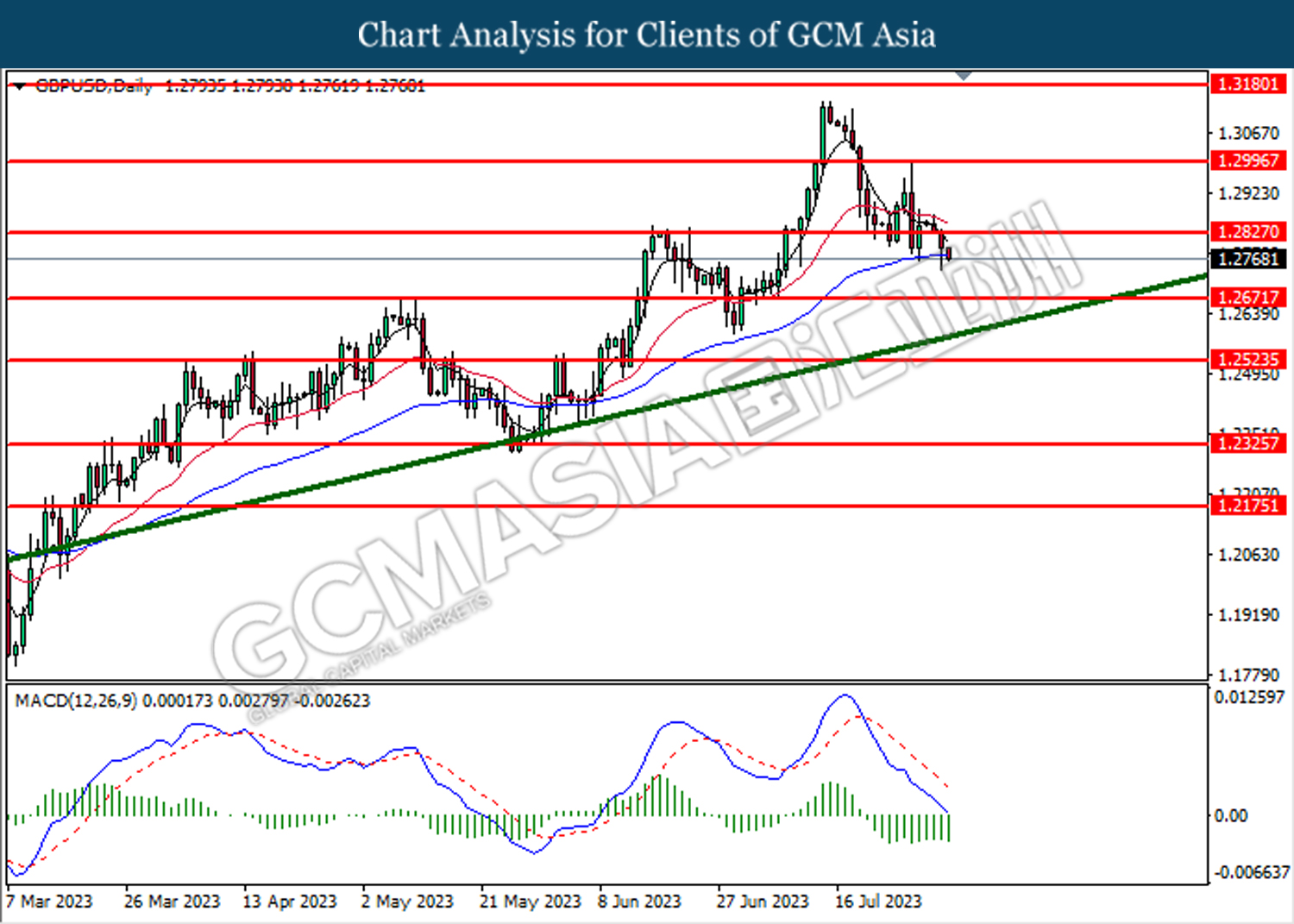

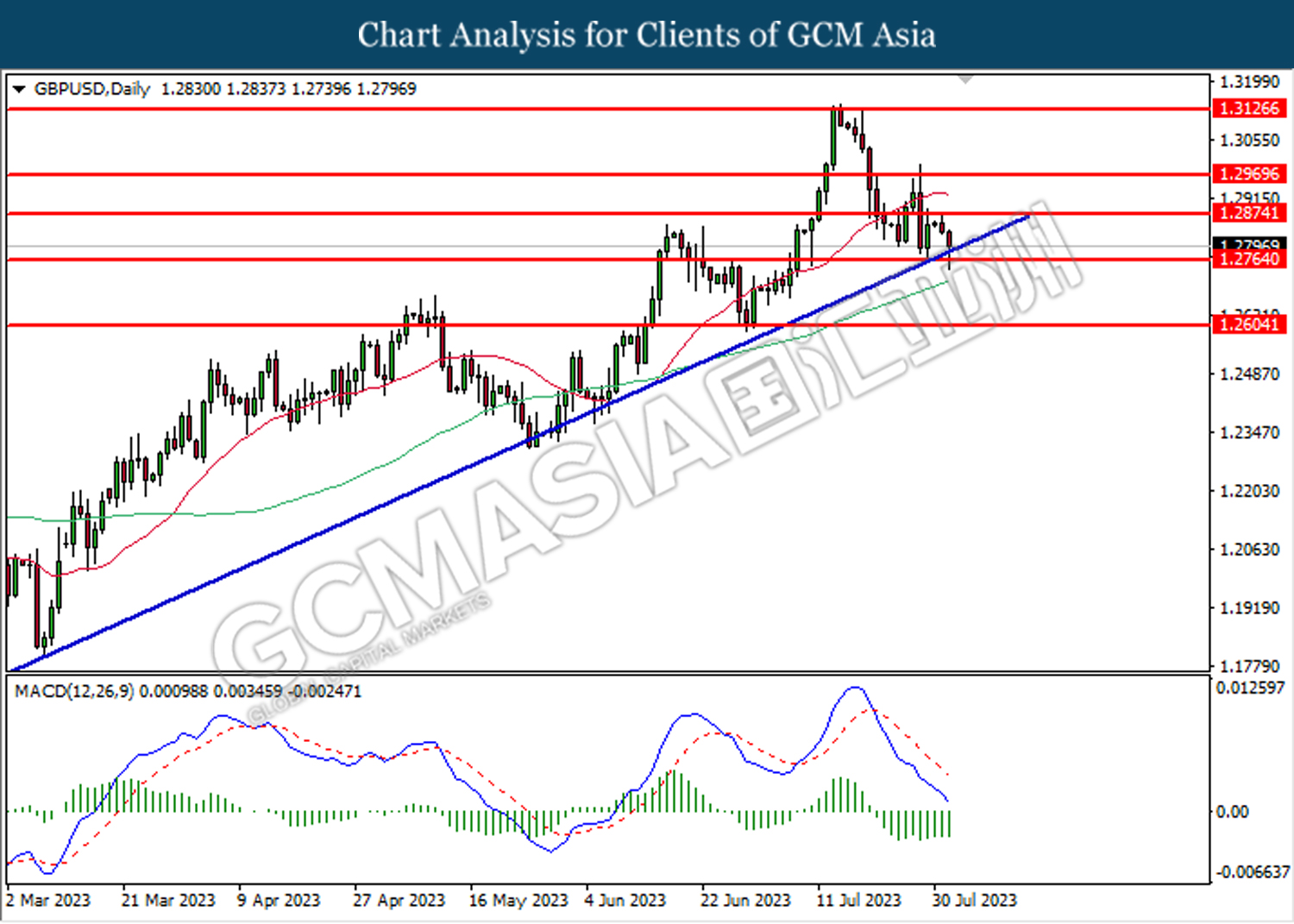

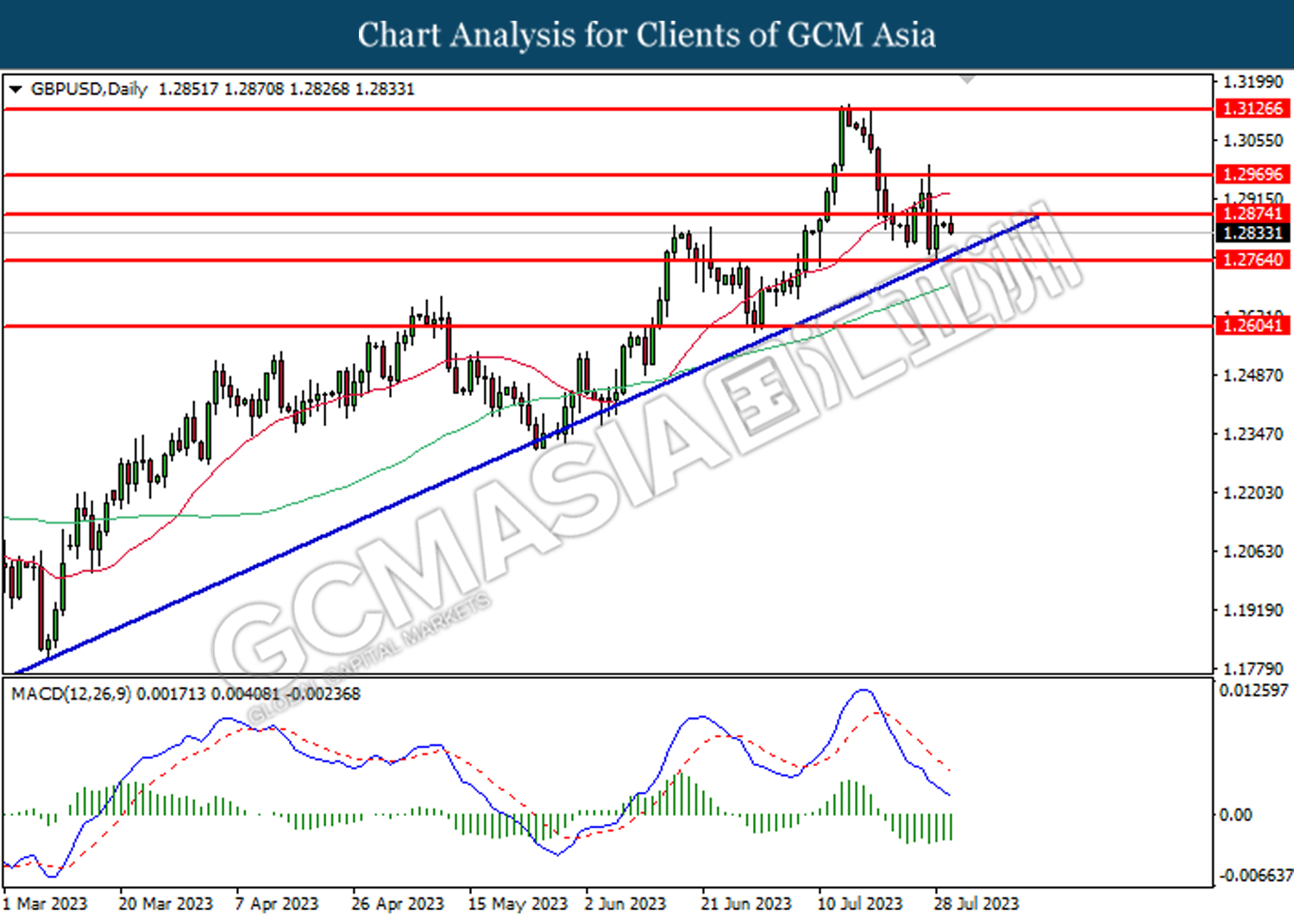

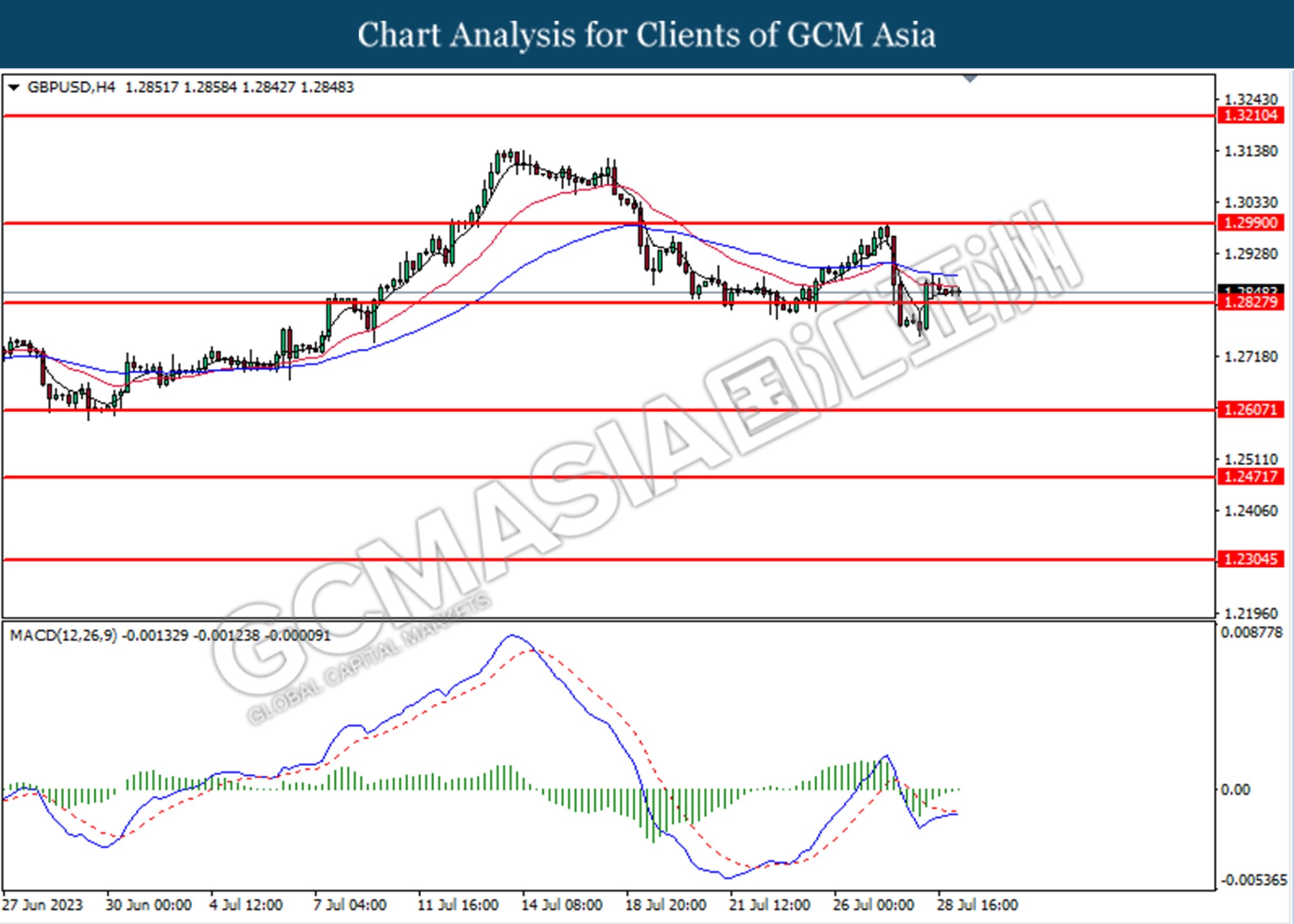

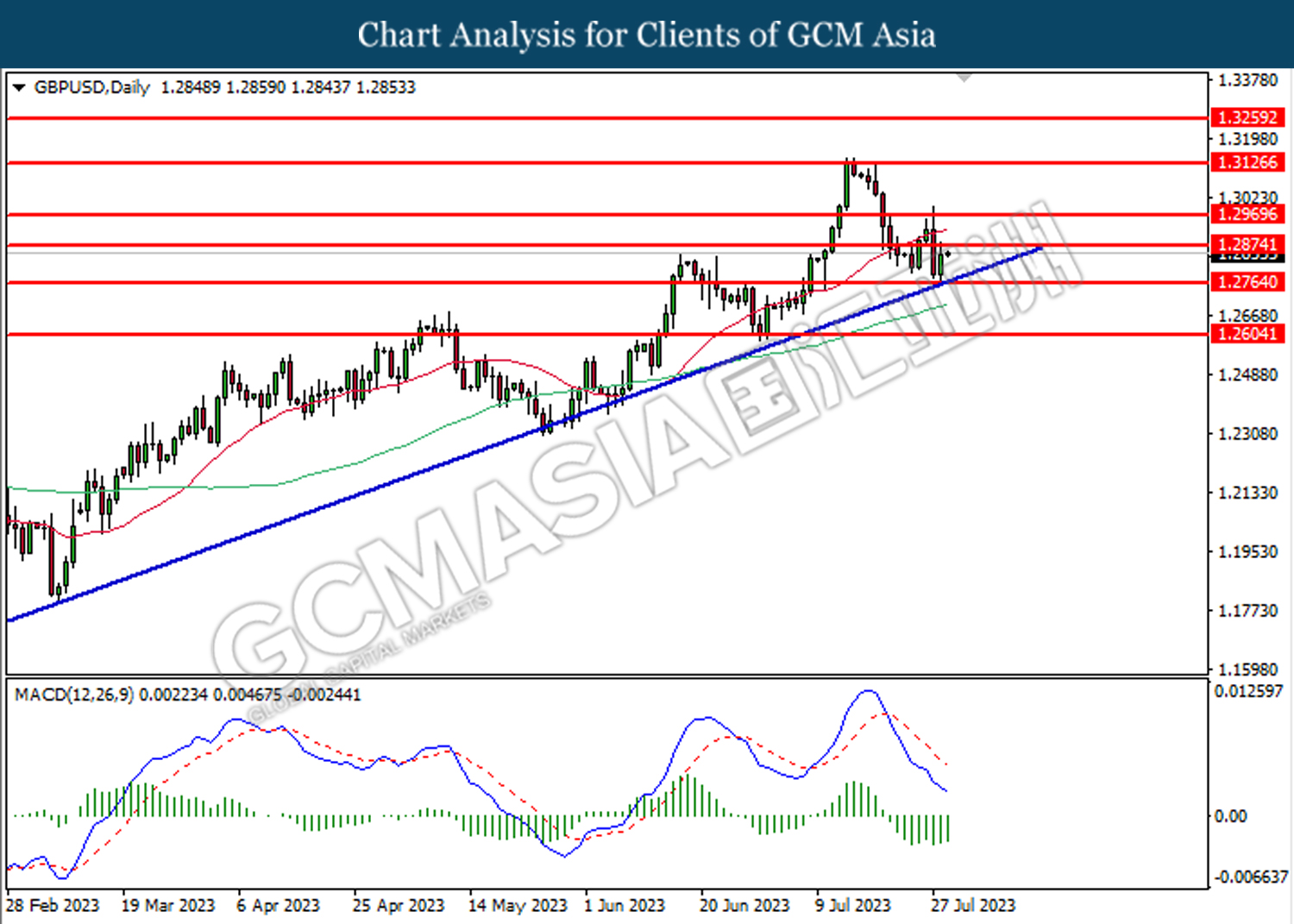

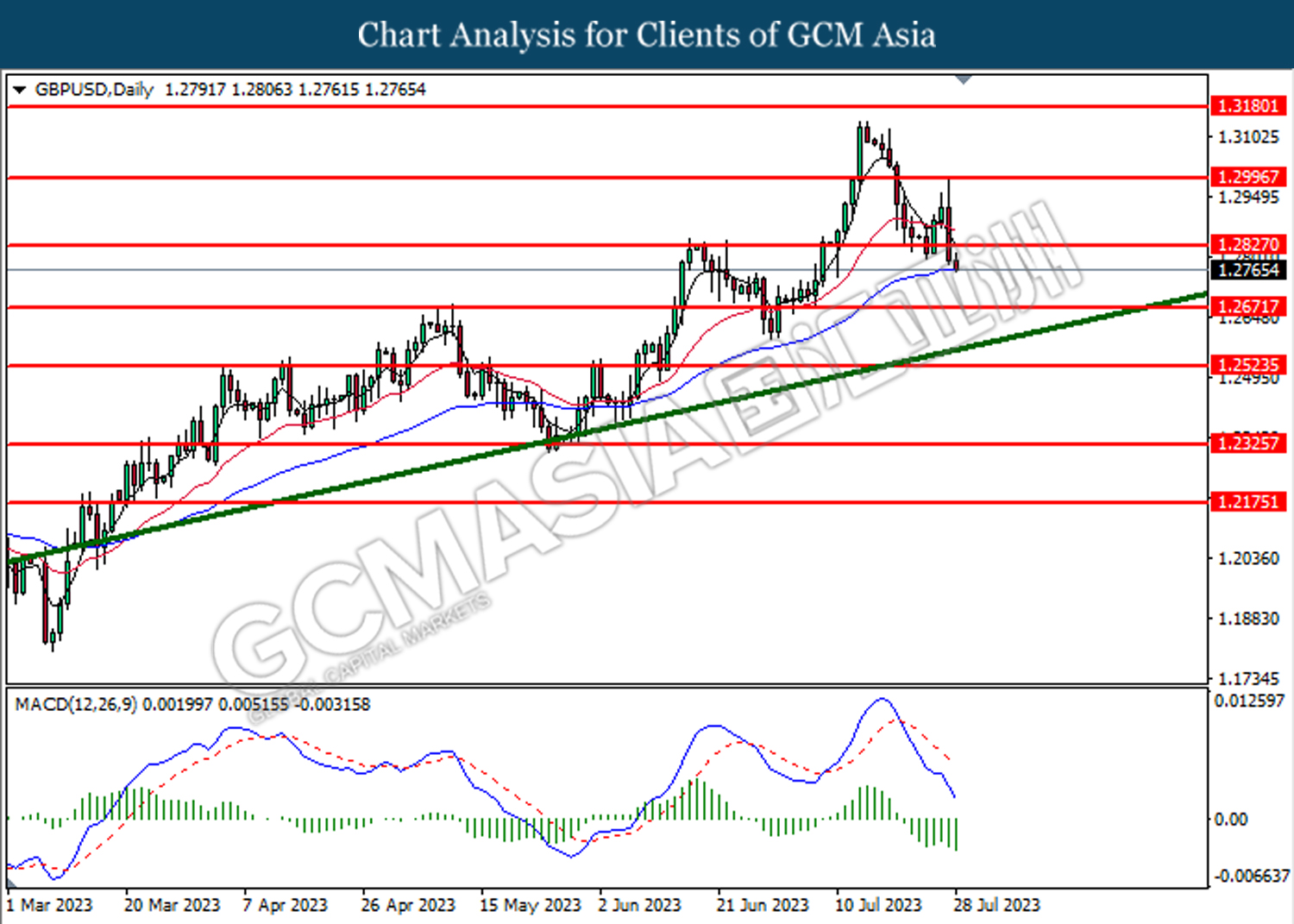

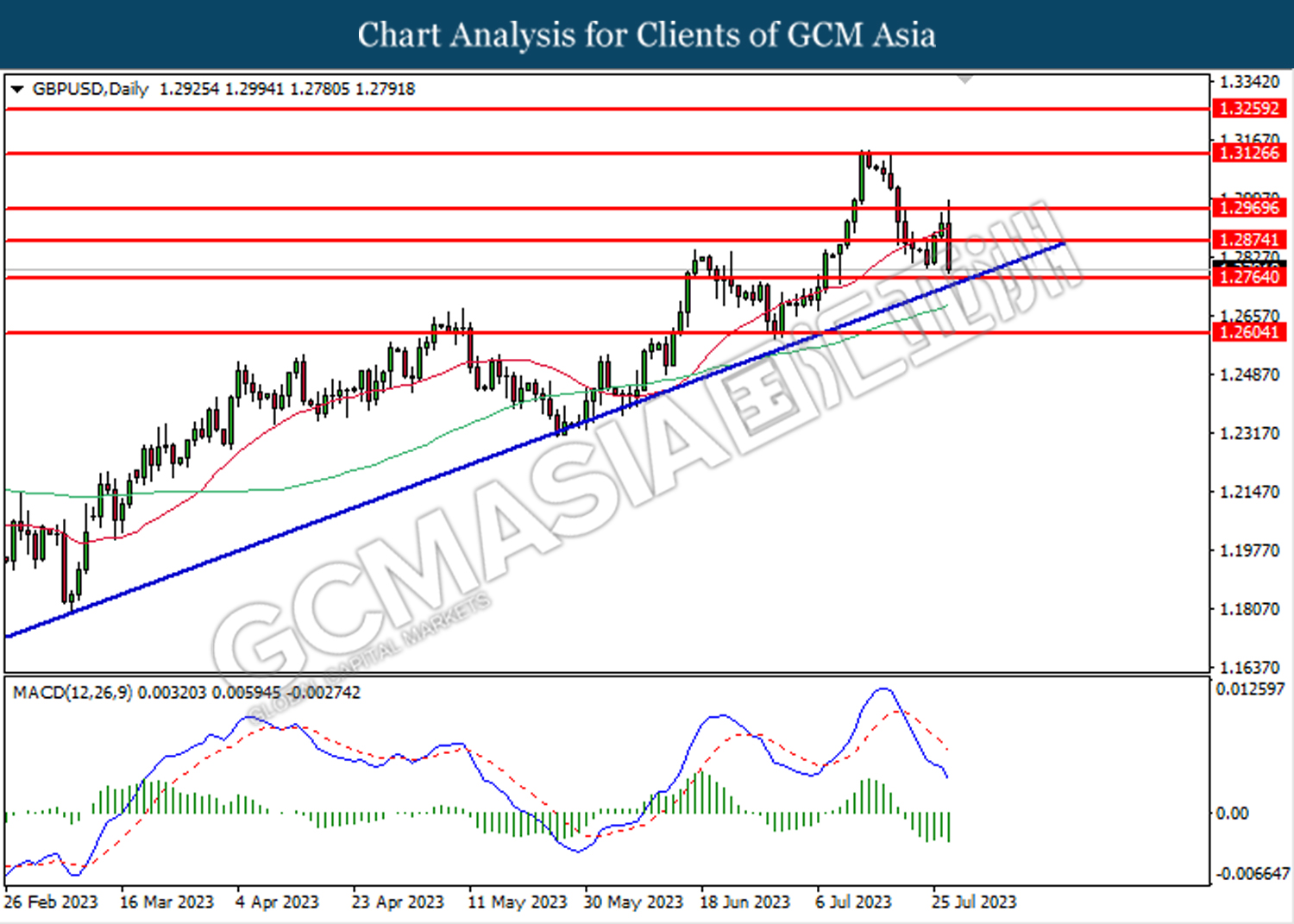

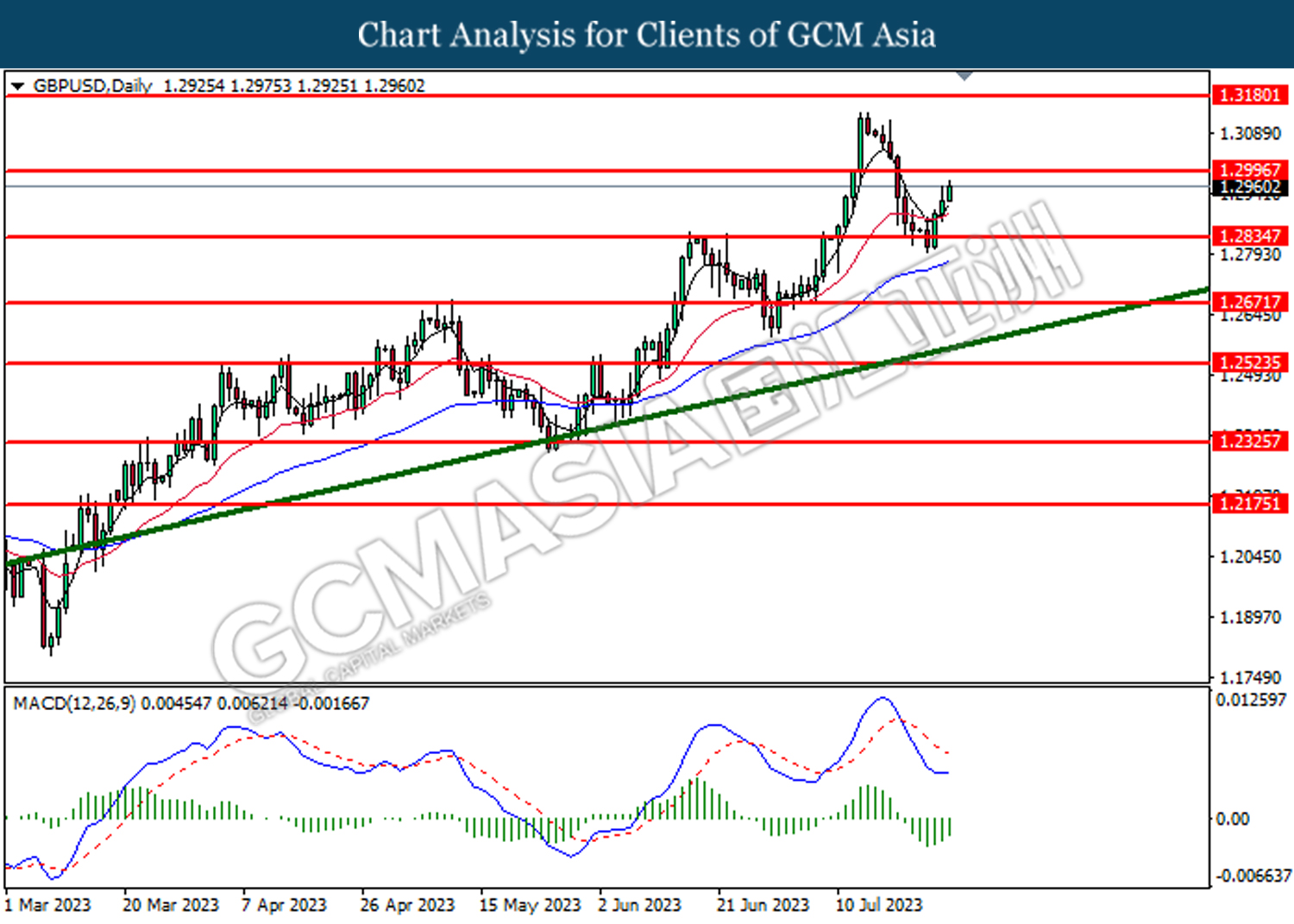

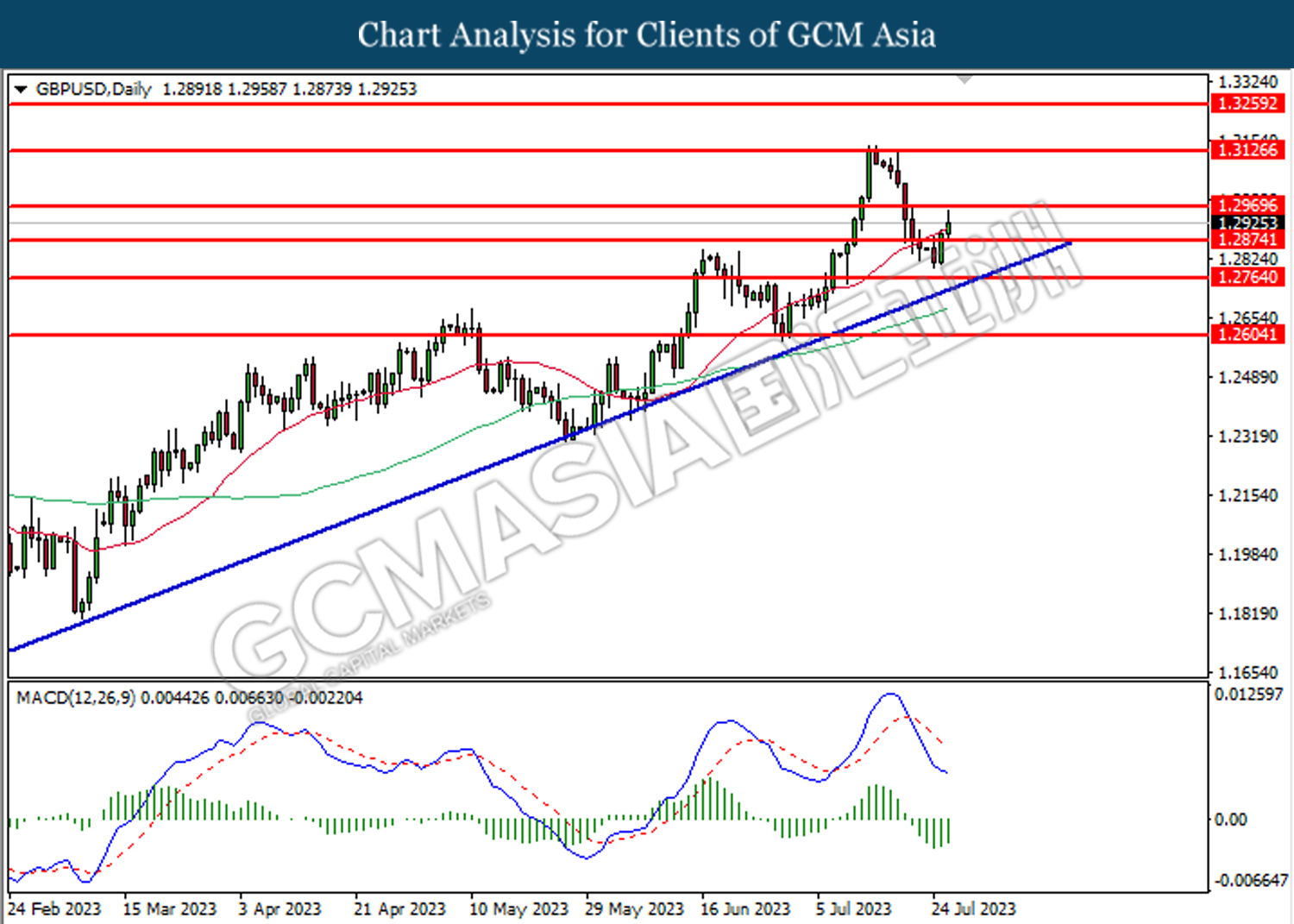

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2765. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2765, 1.2875

Support level: 1.2605, 1.2415

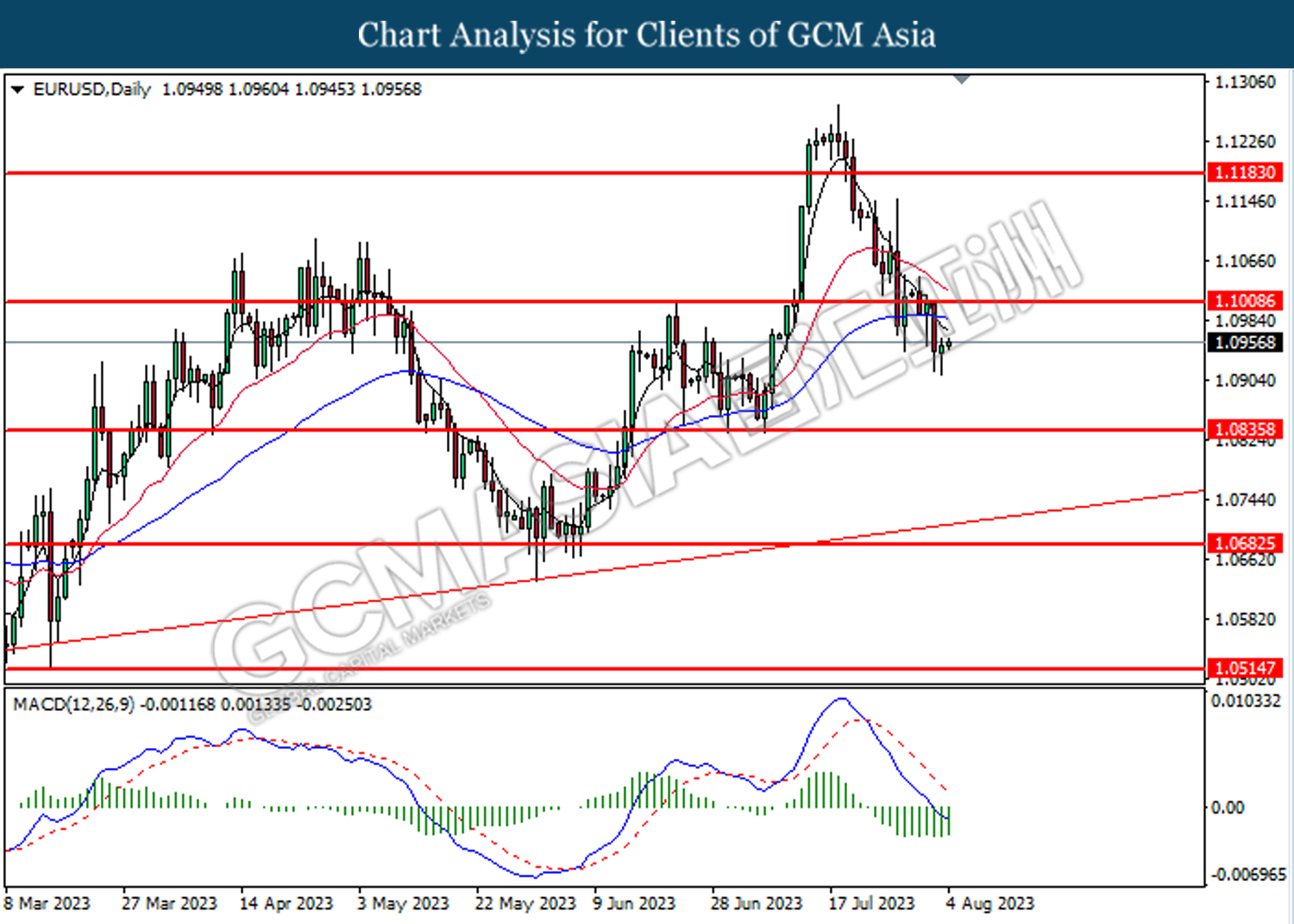

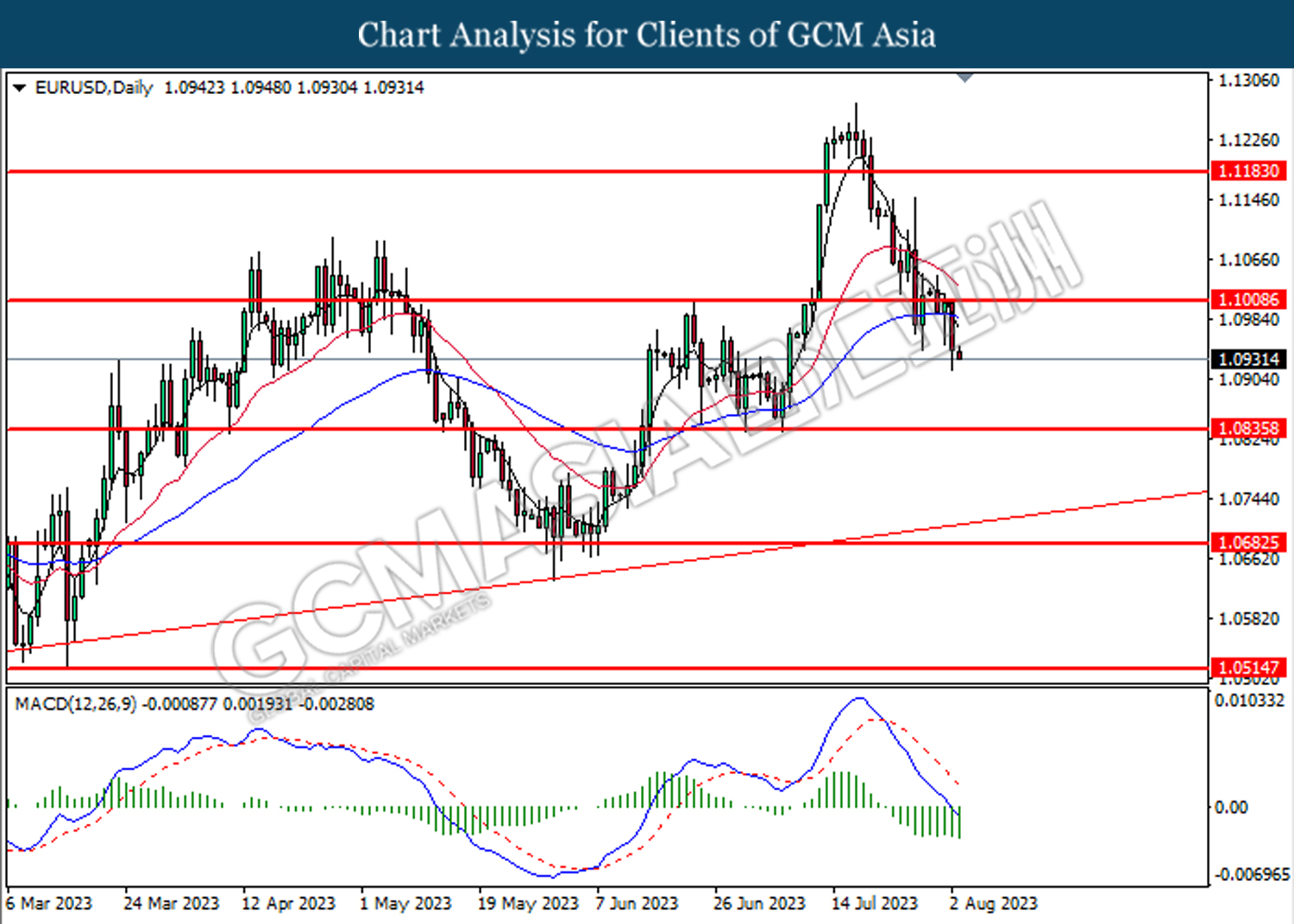

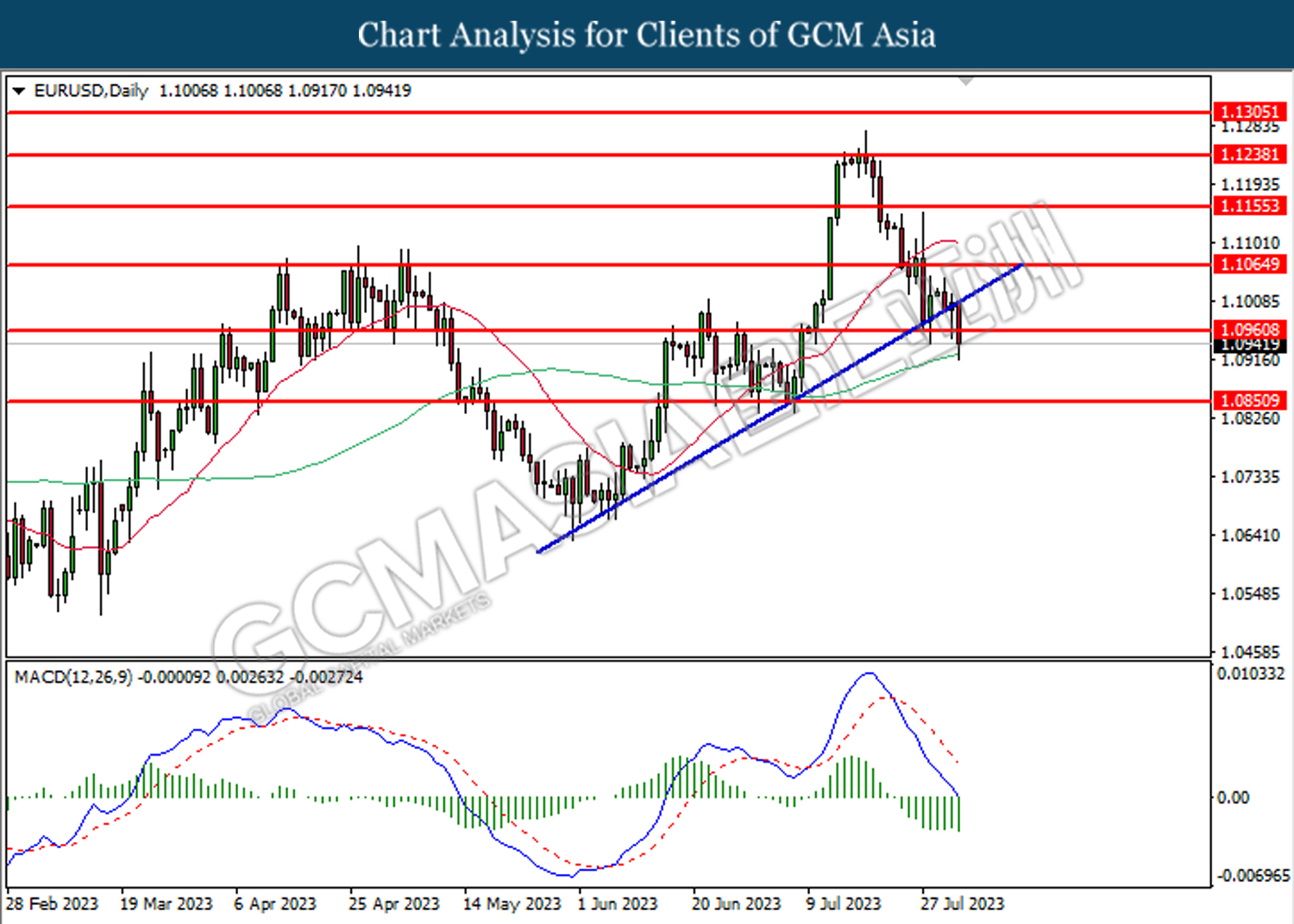

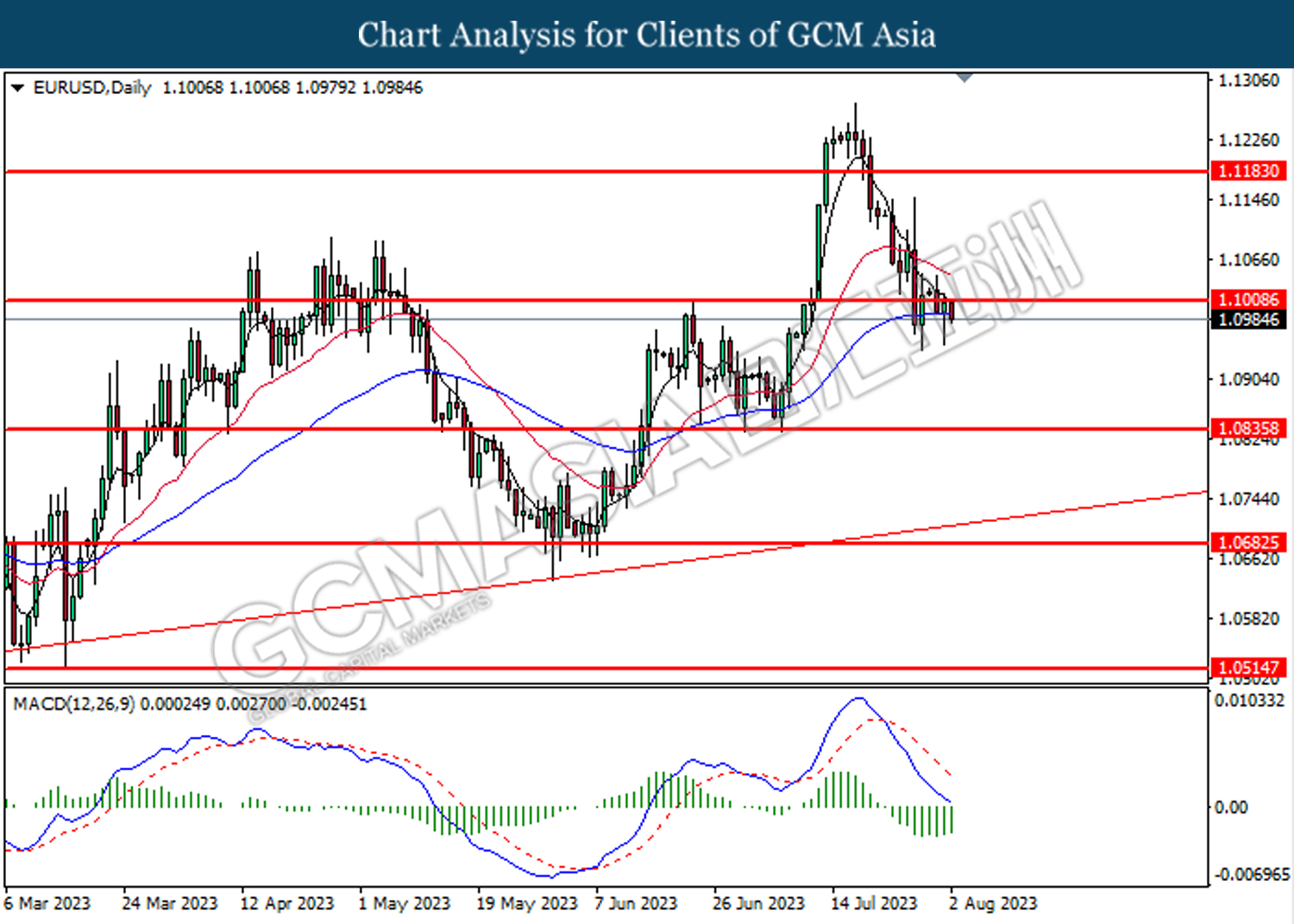

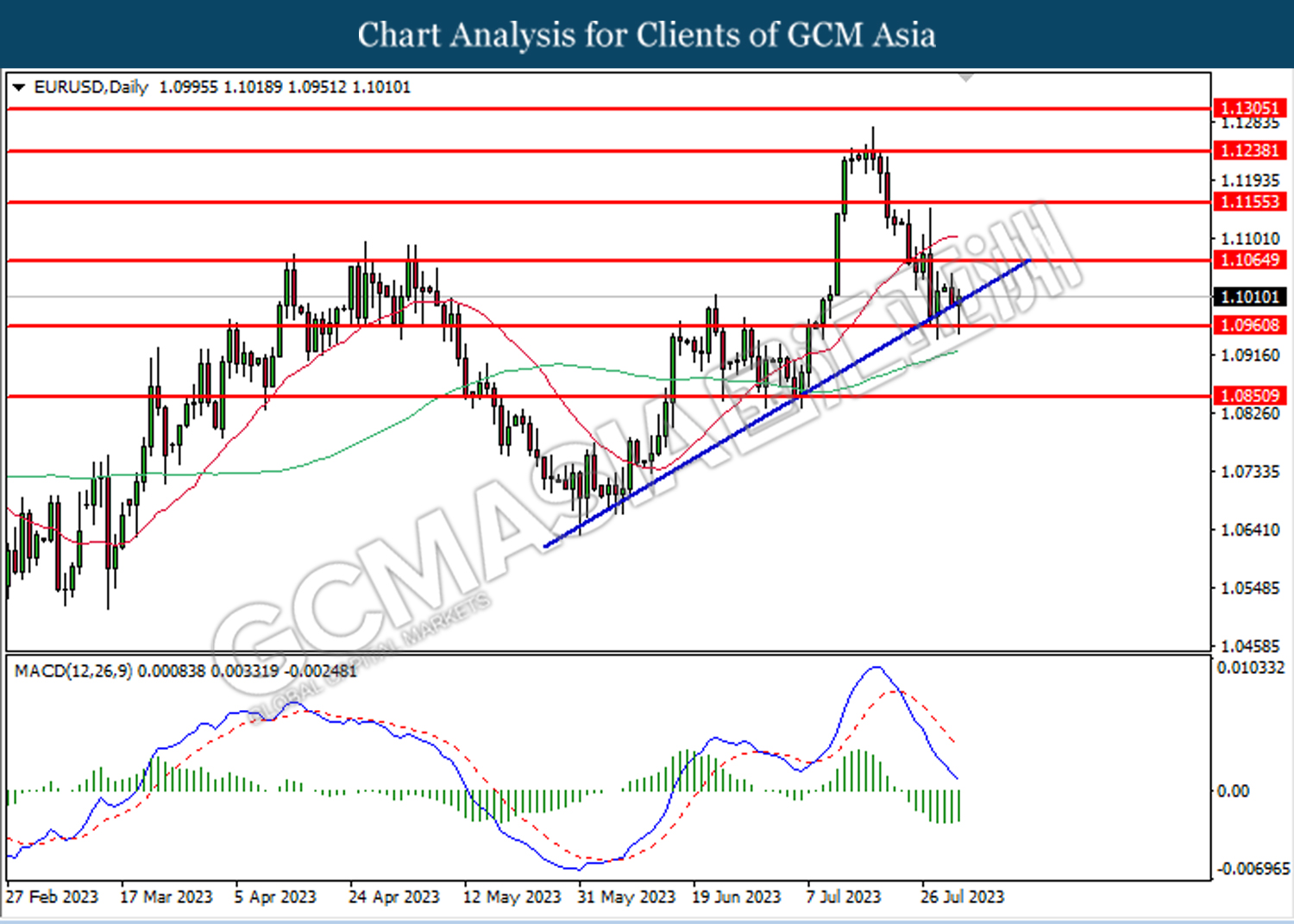

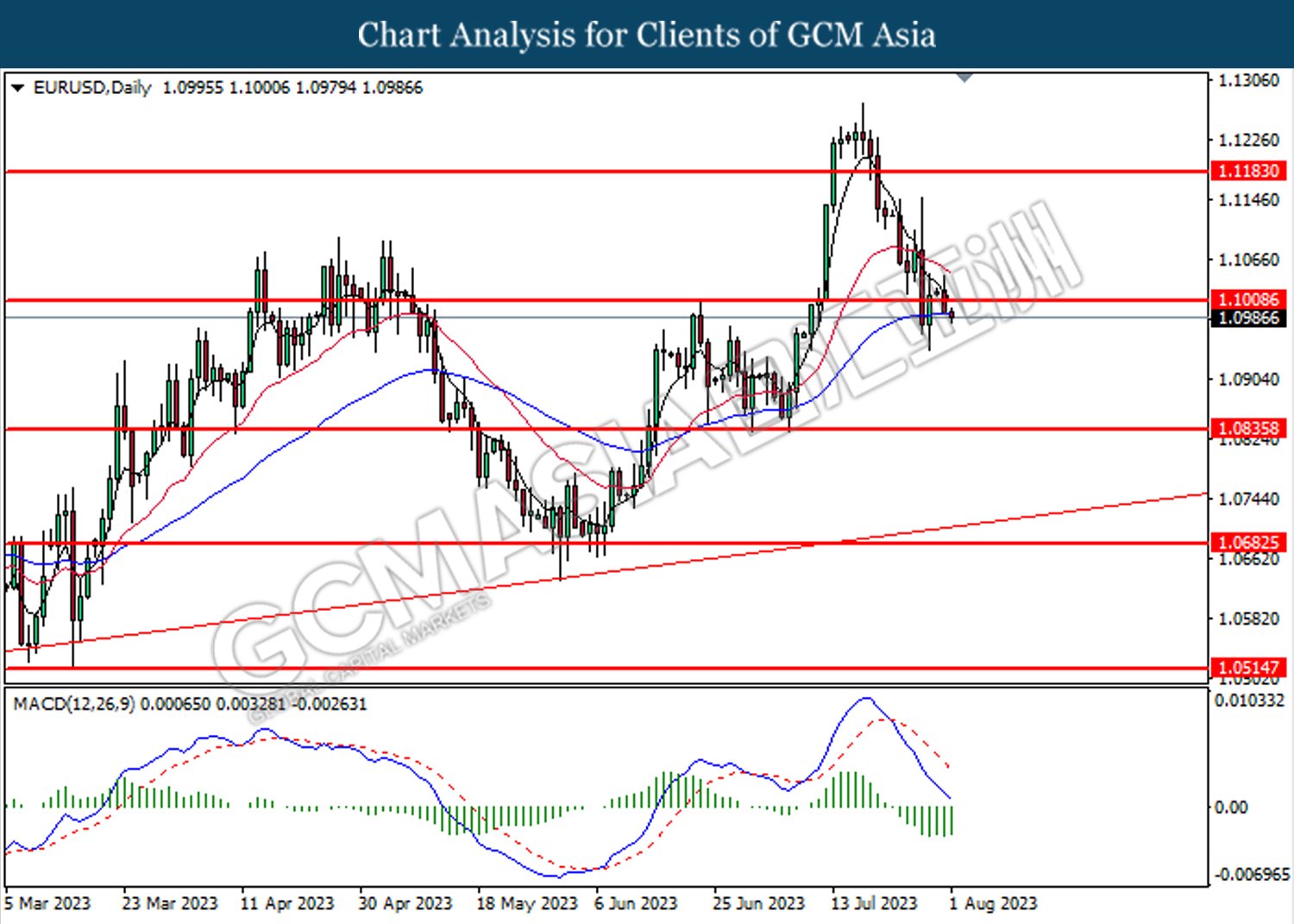

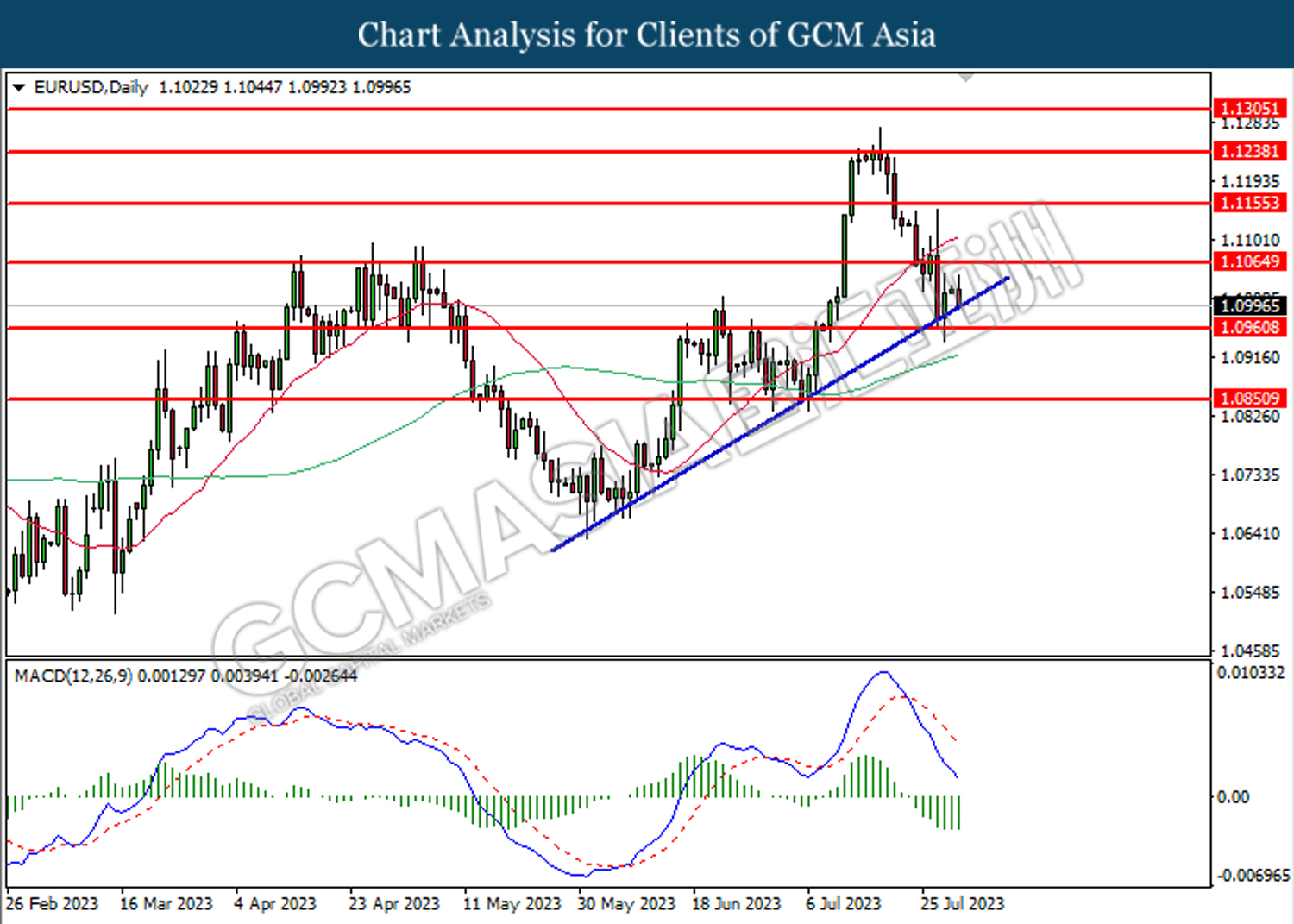

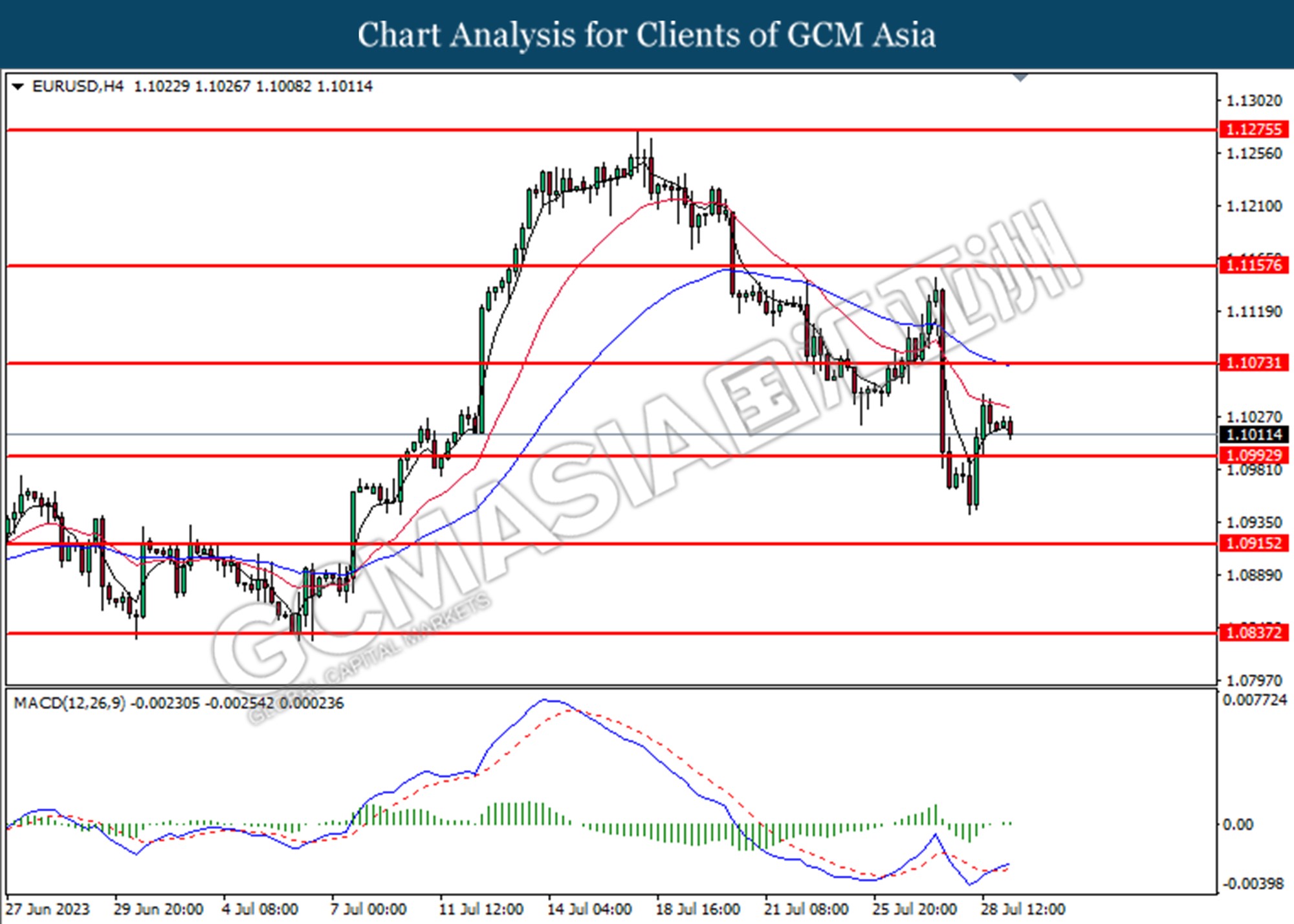

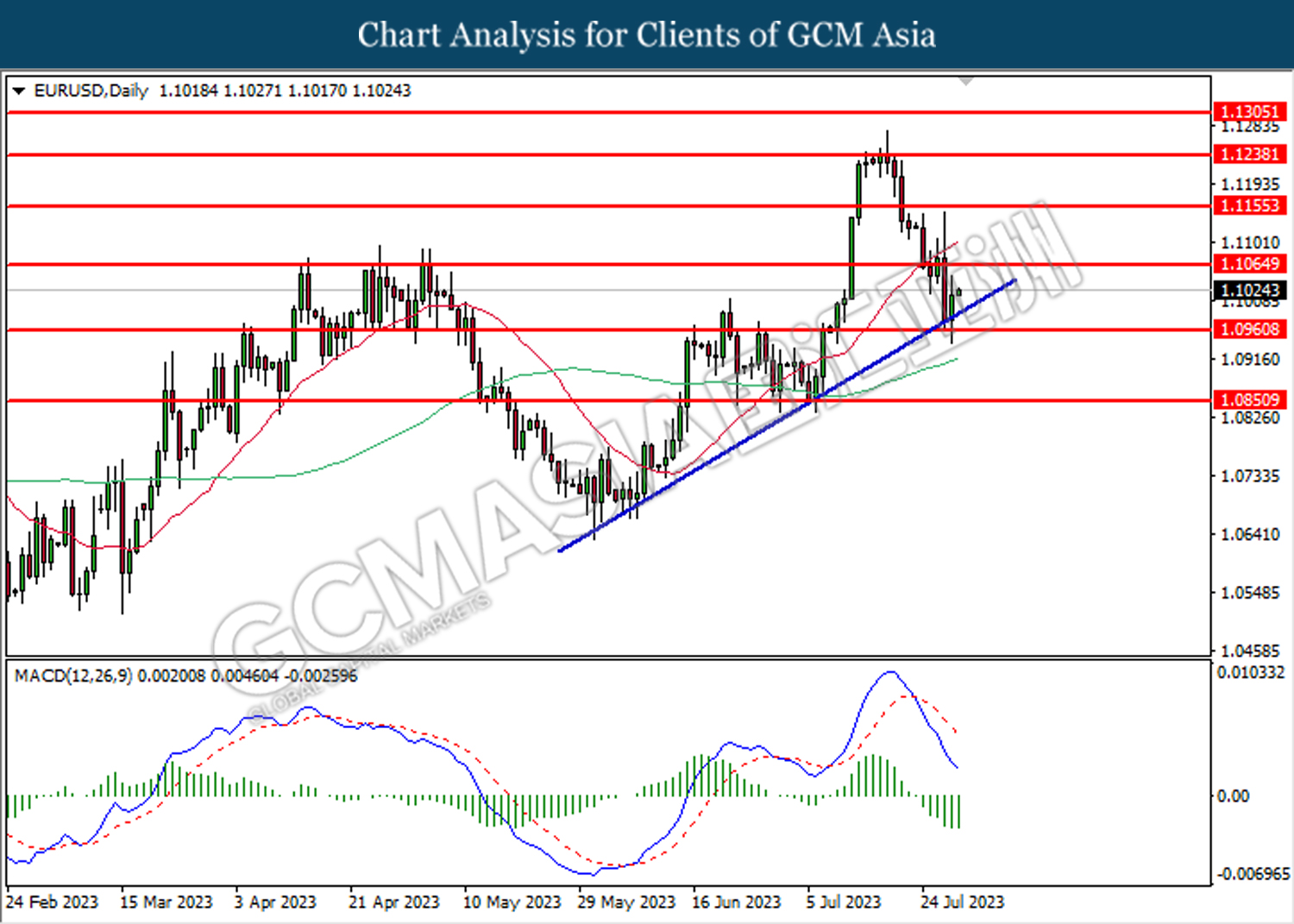

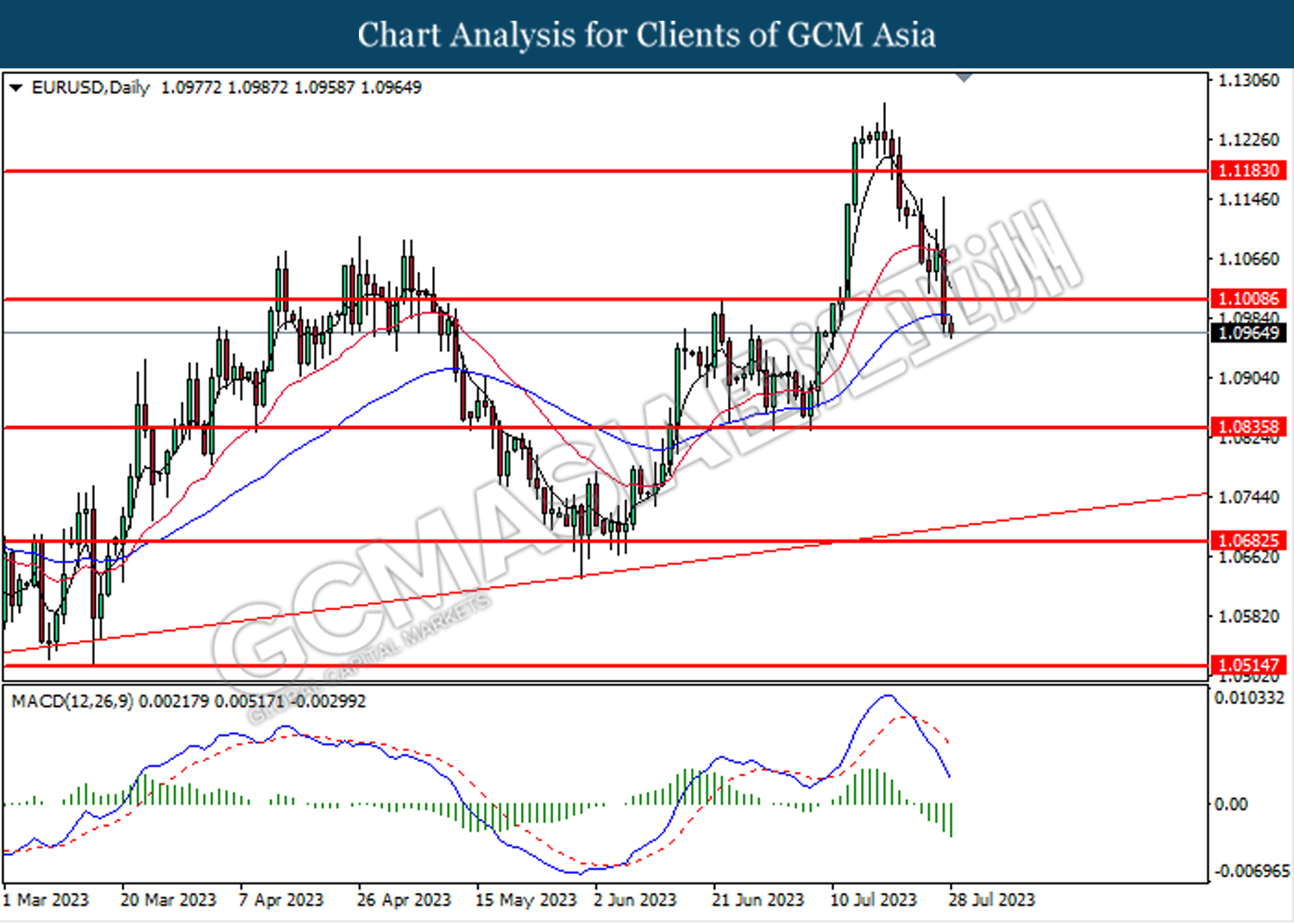

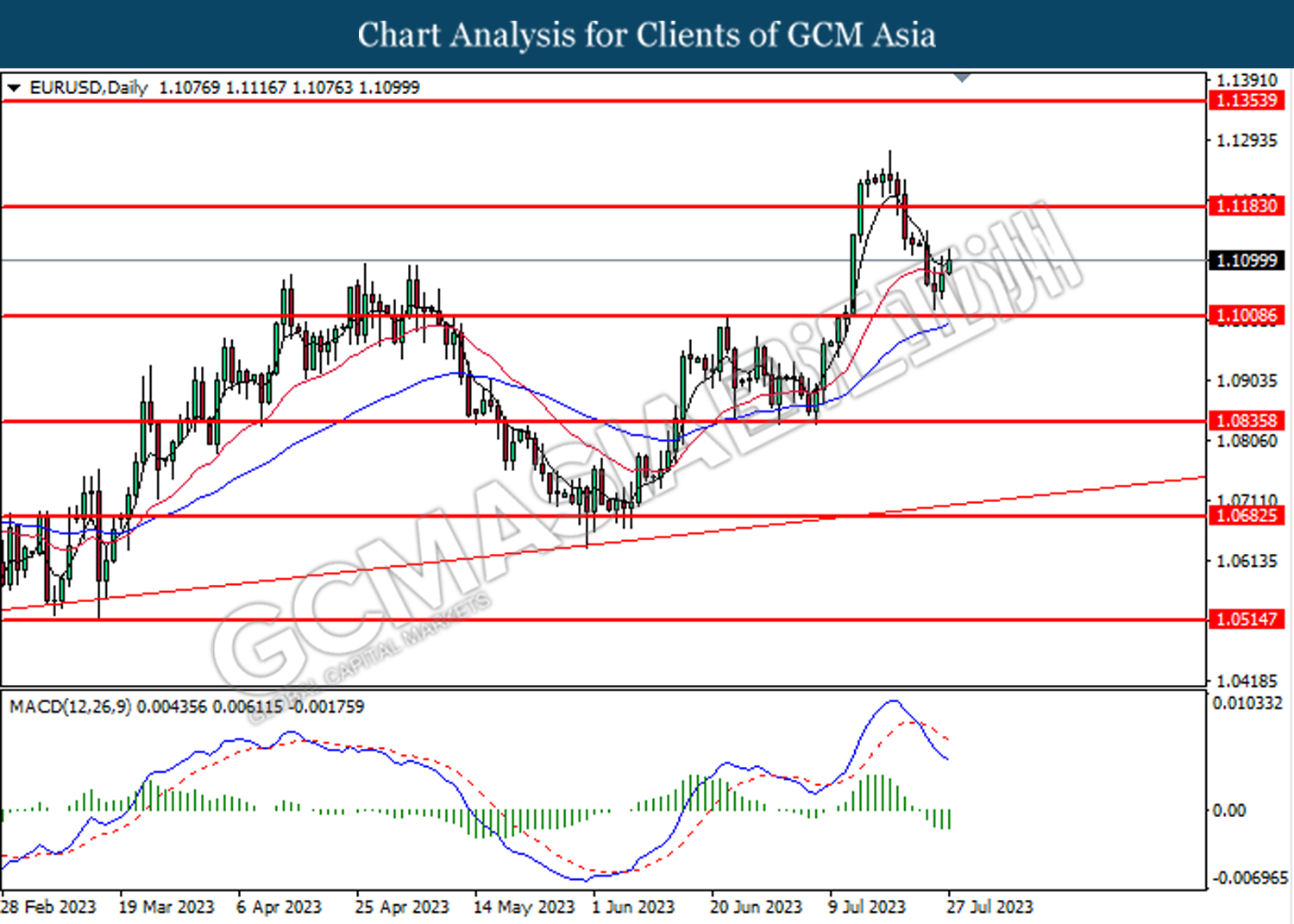

EURUSD, Daily: EURUSD was traded higher following the prior rebound near the support level at 1.0960. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1065.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

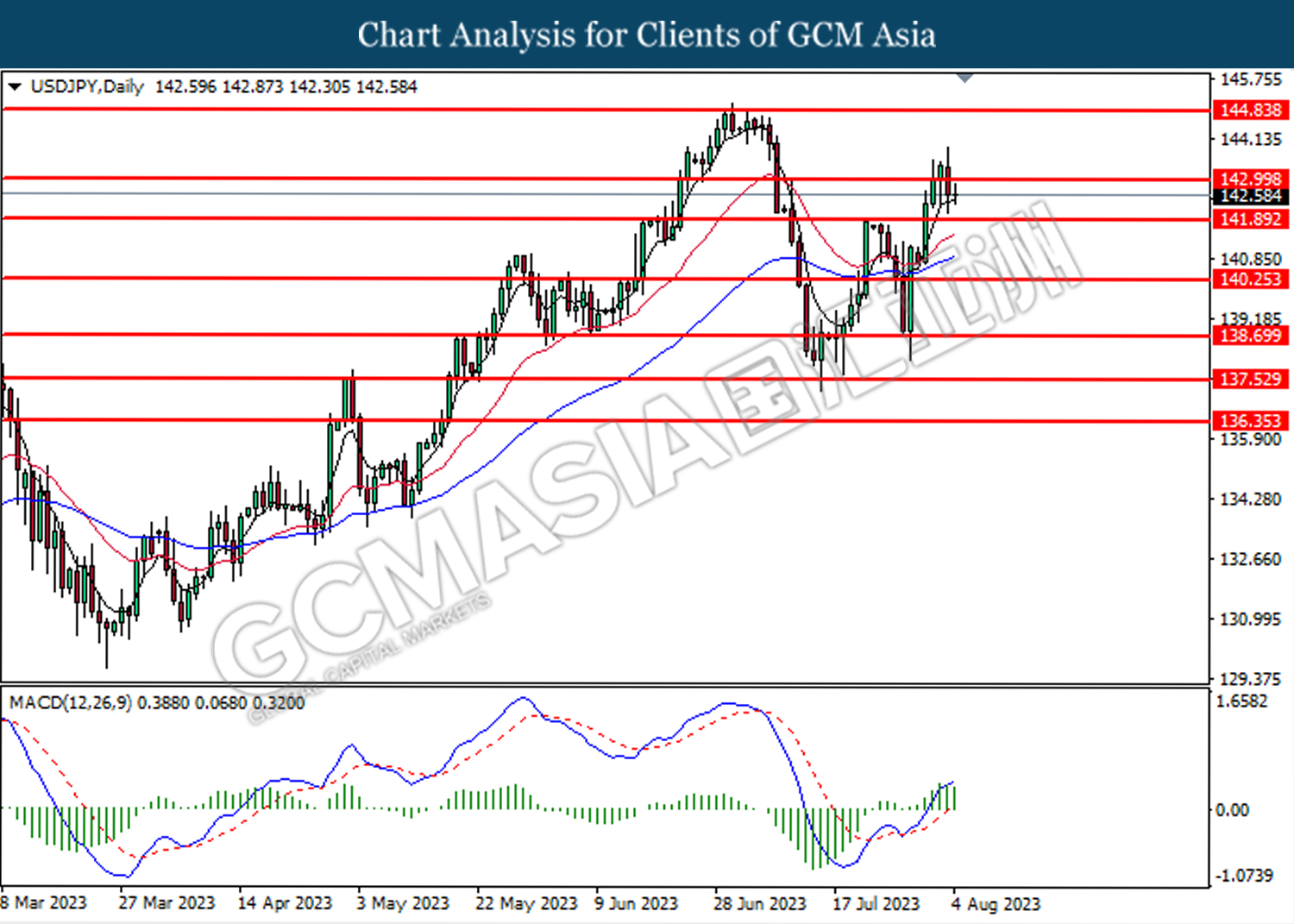

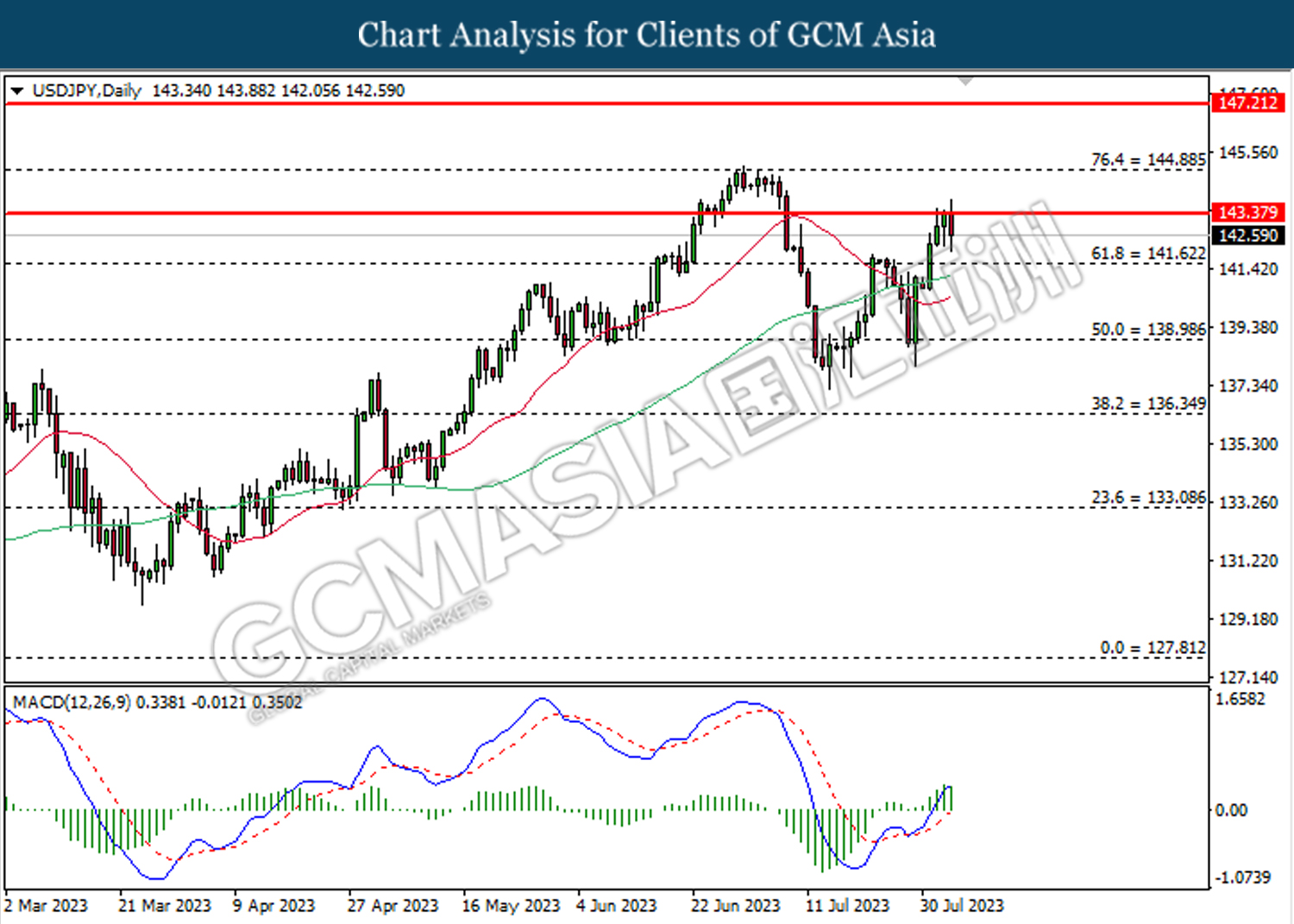

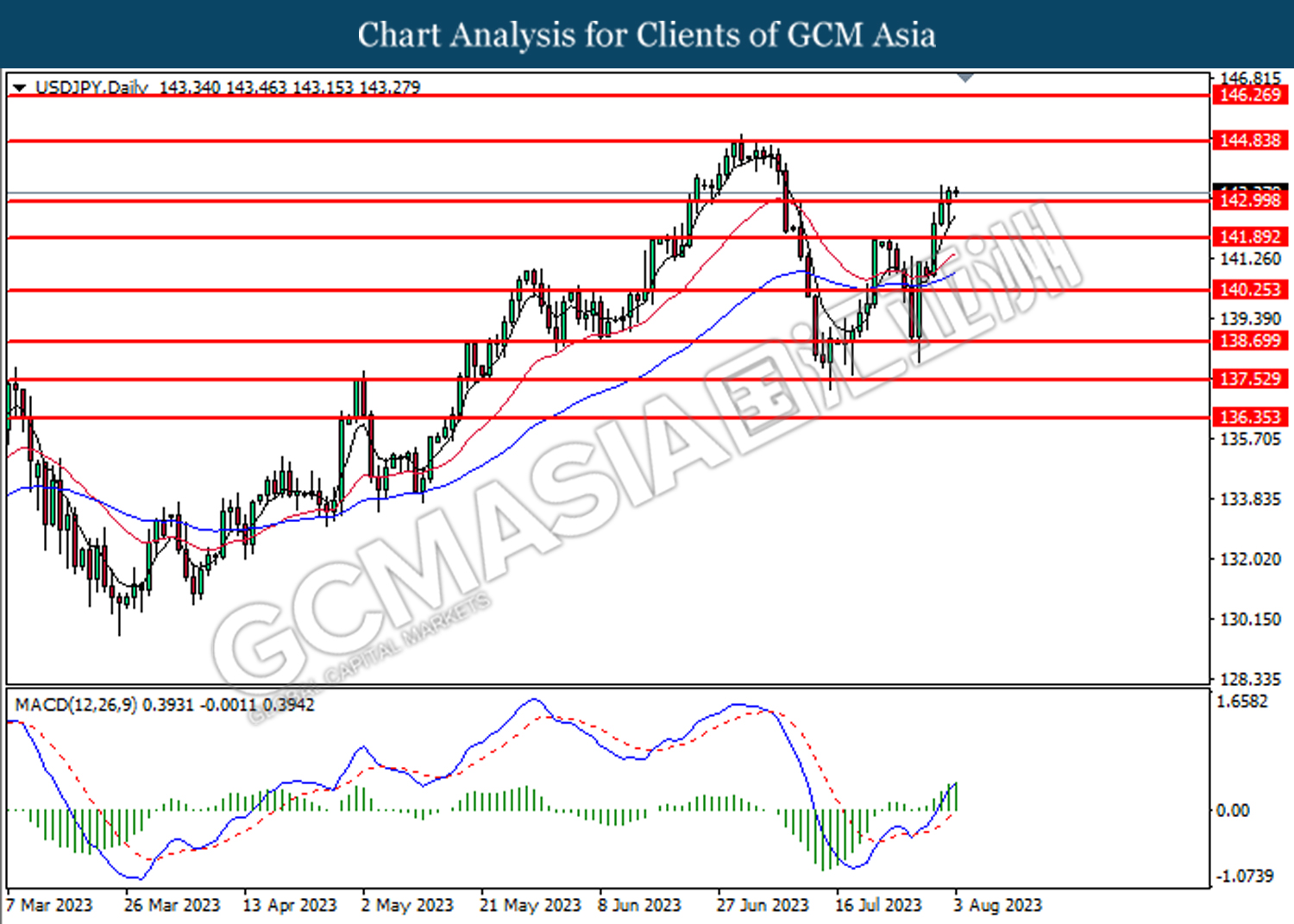

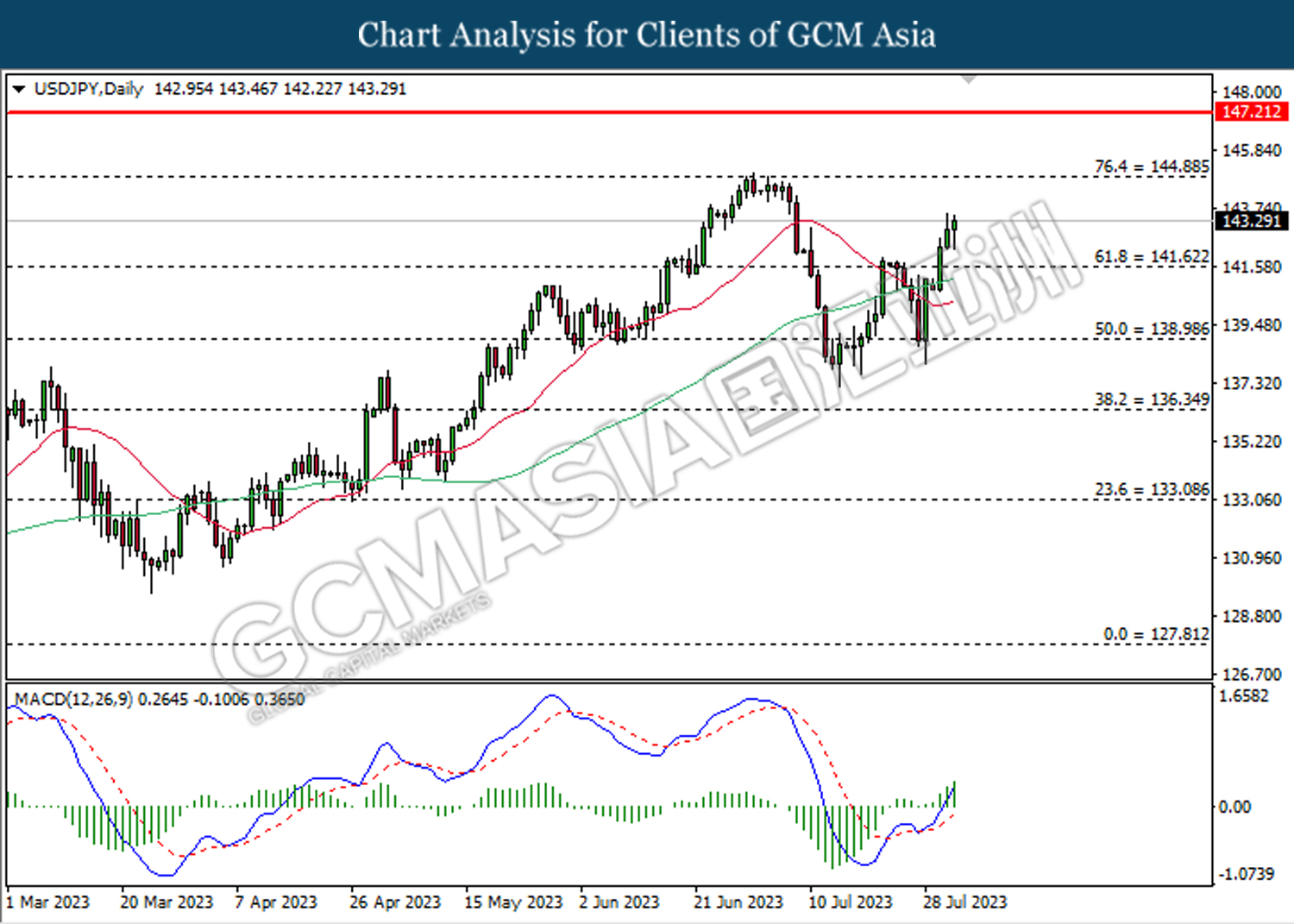

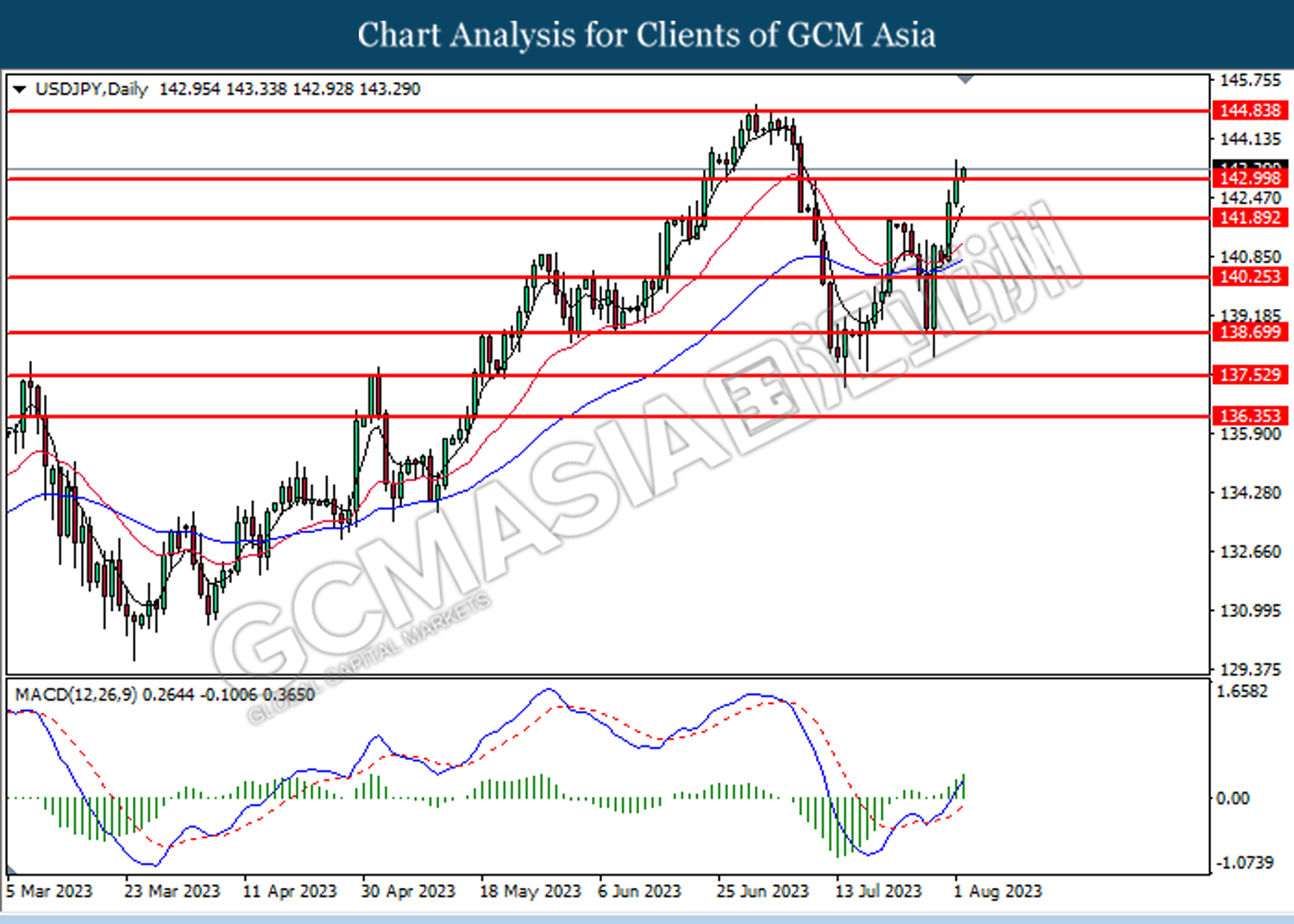

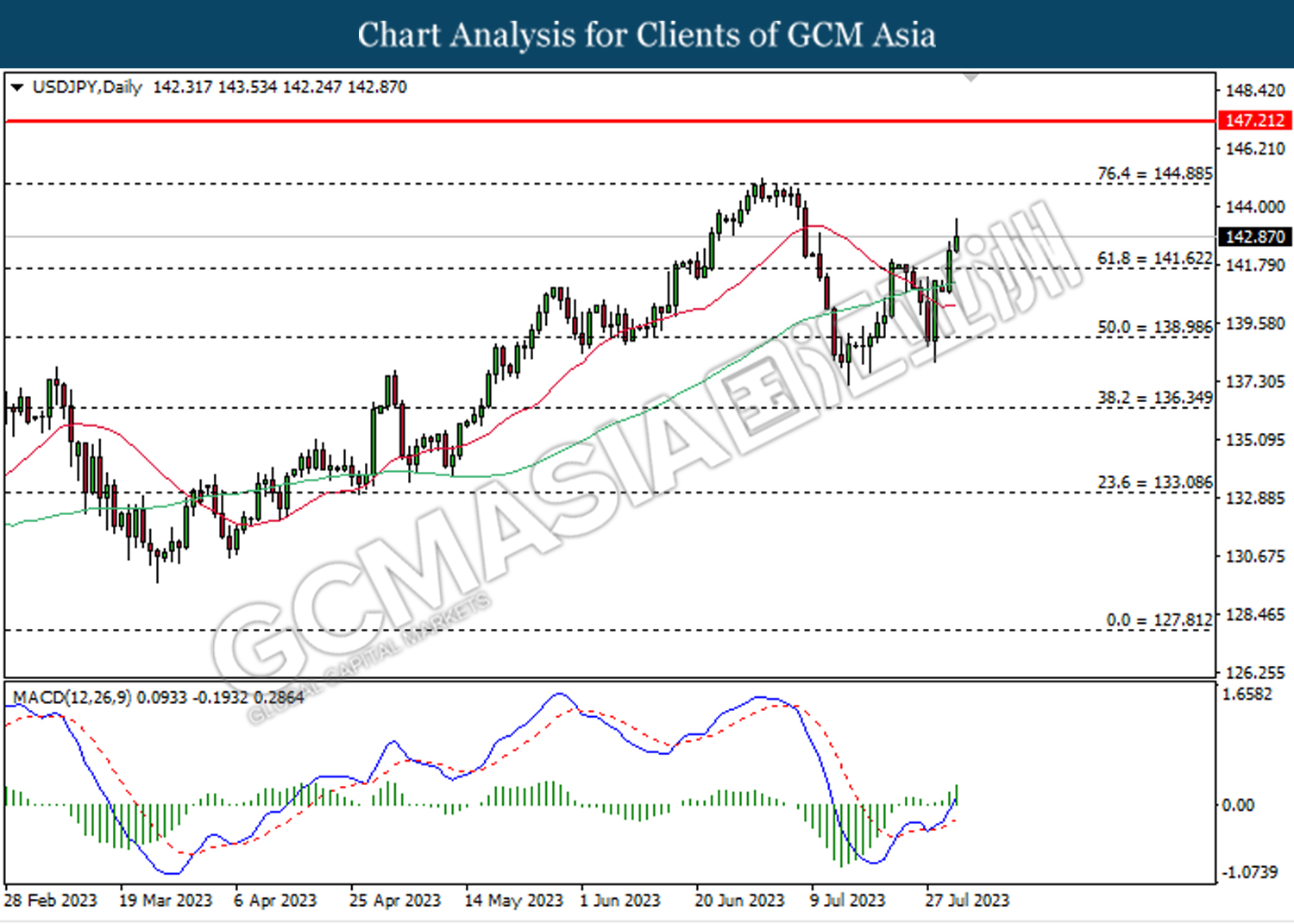

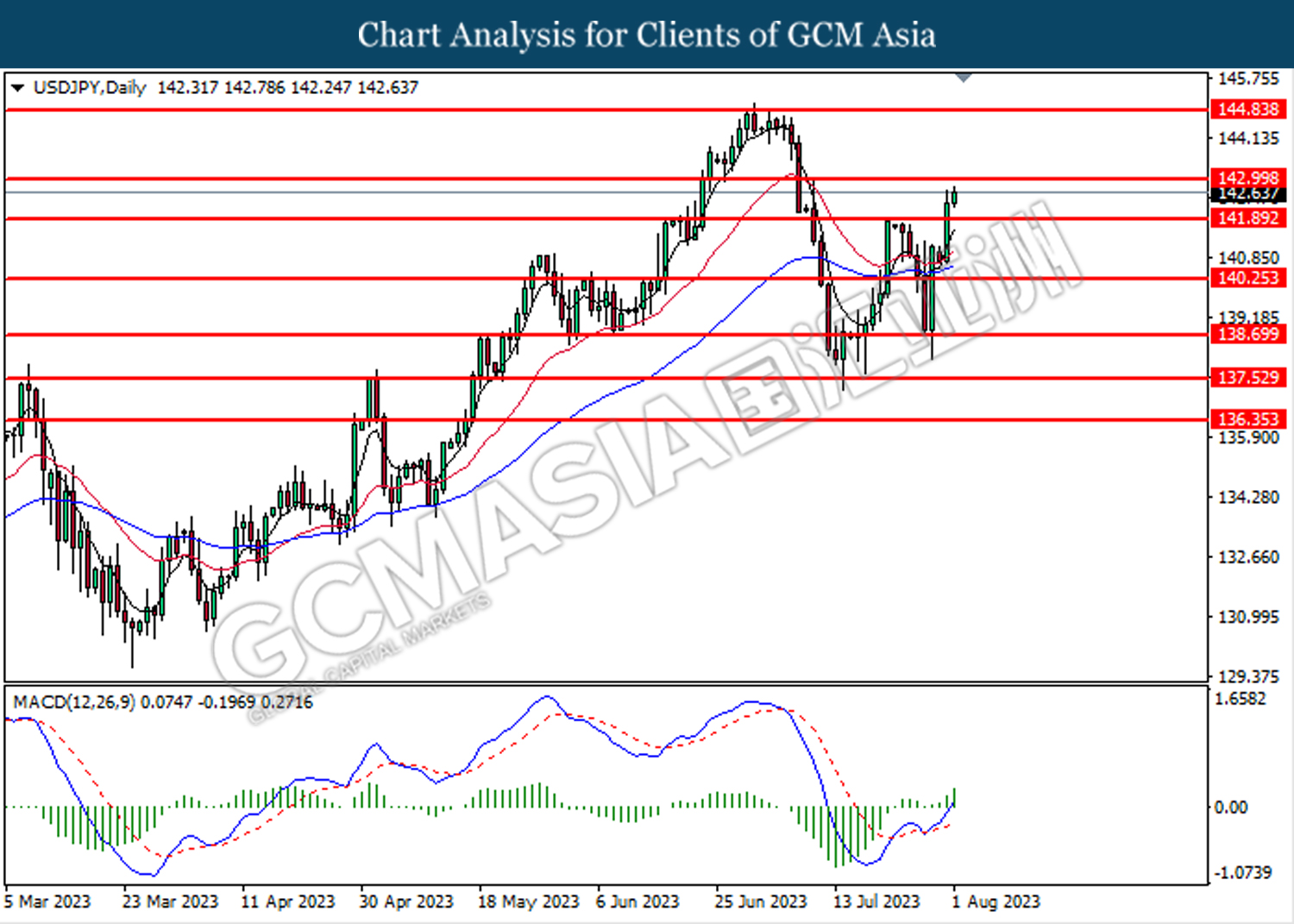

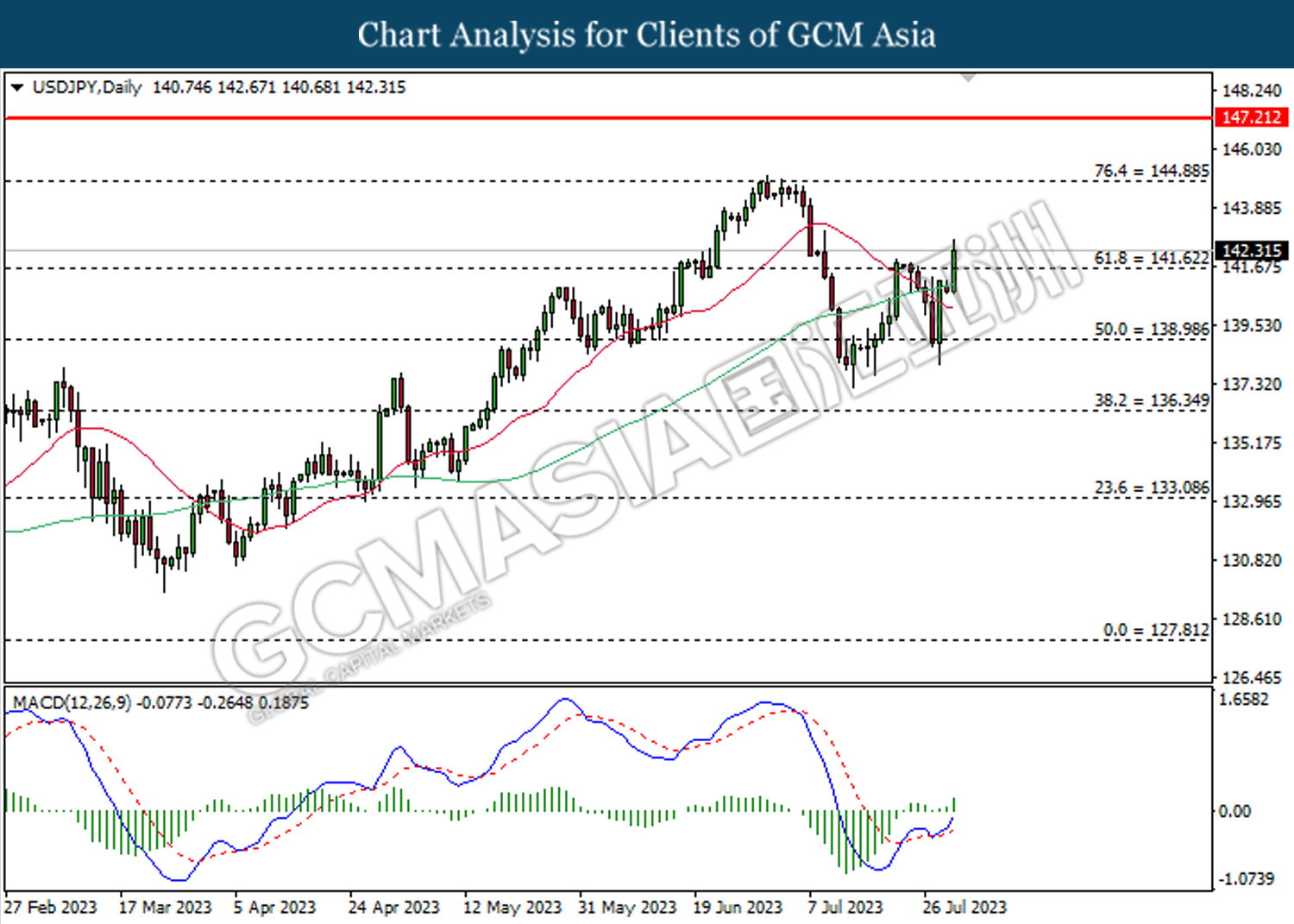

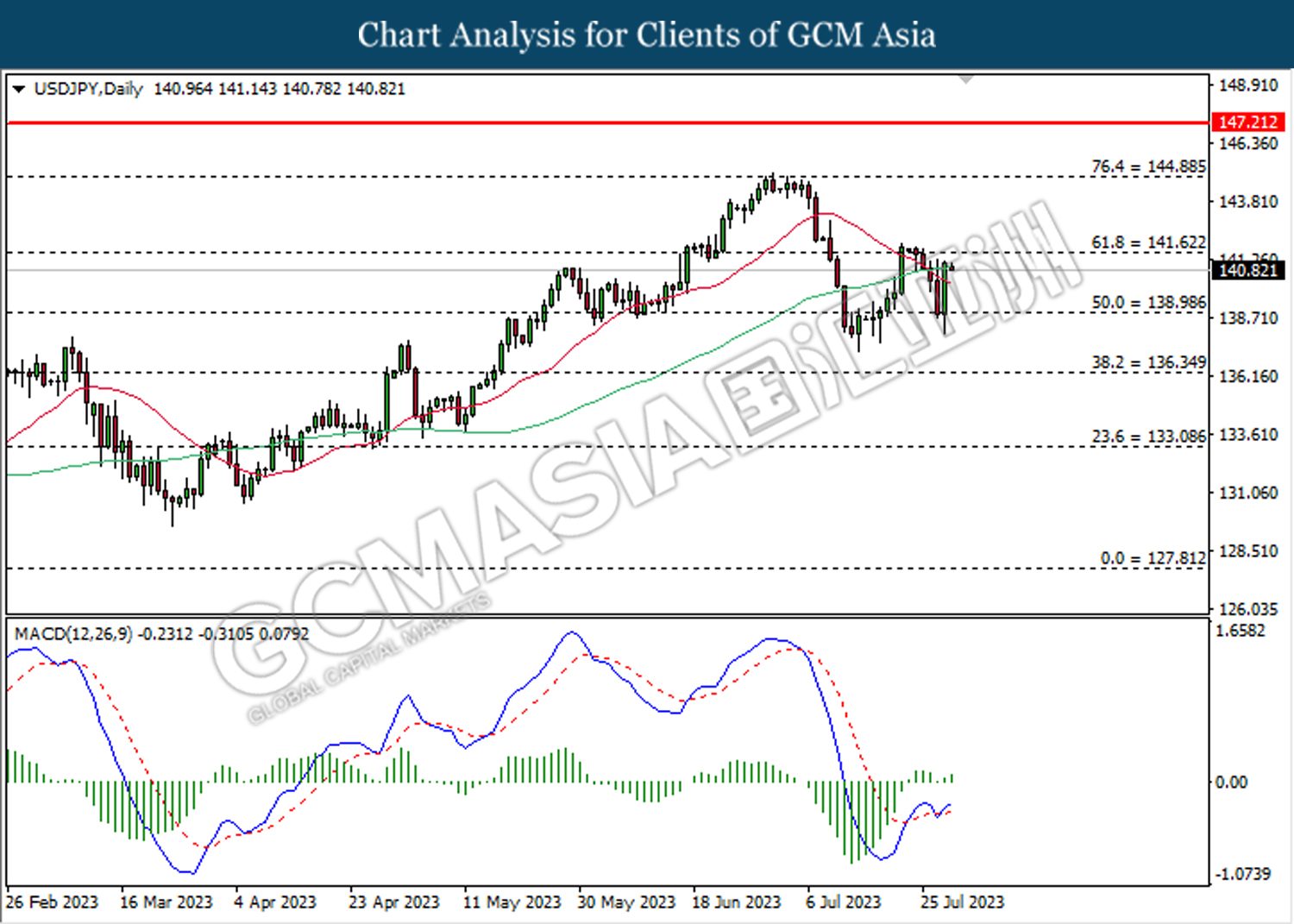

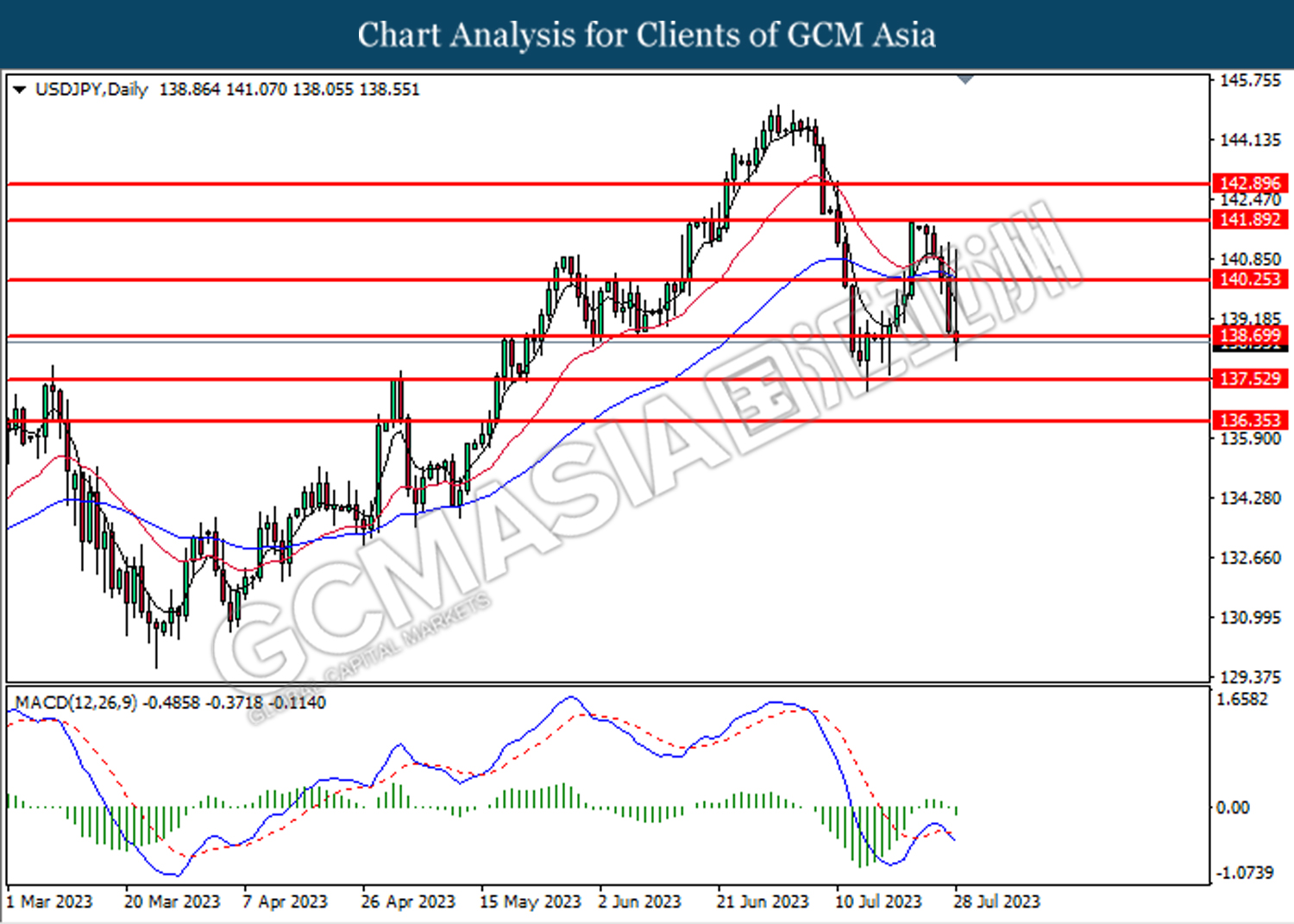

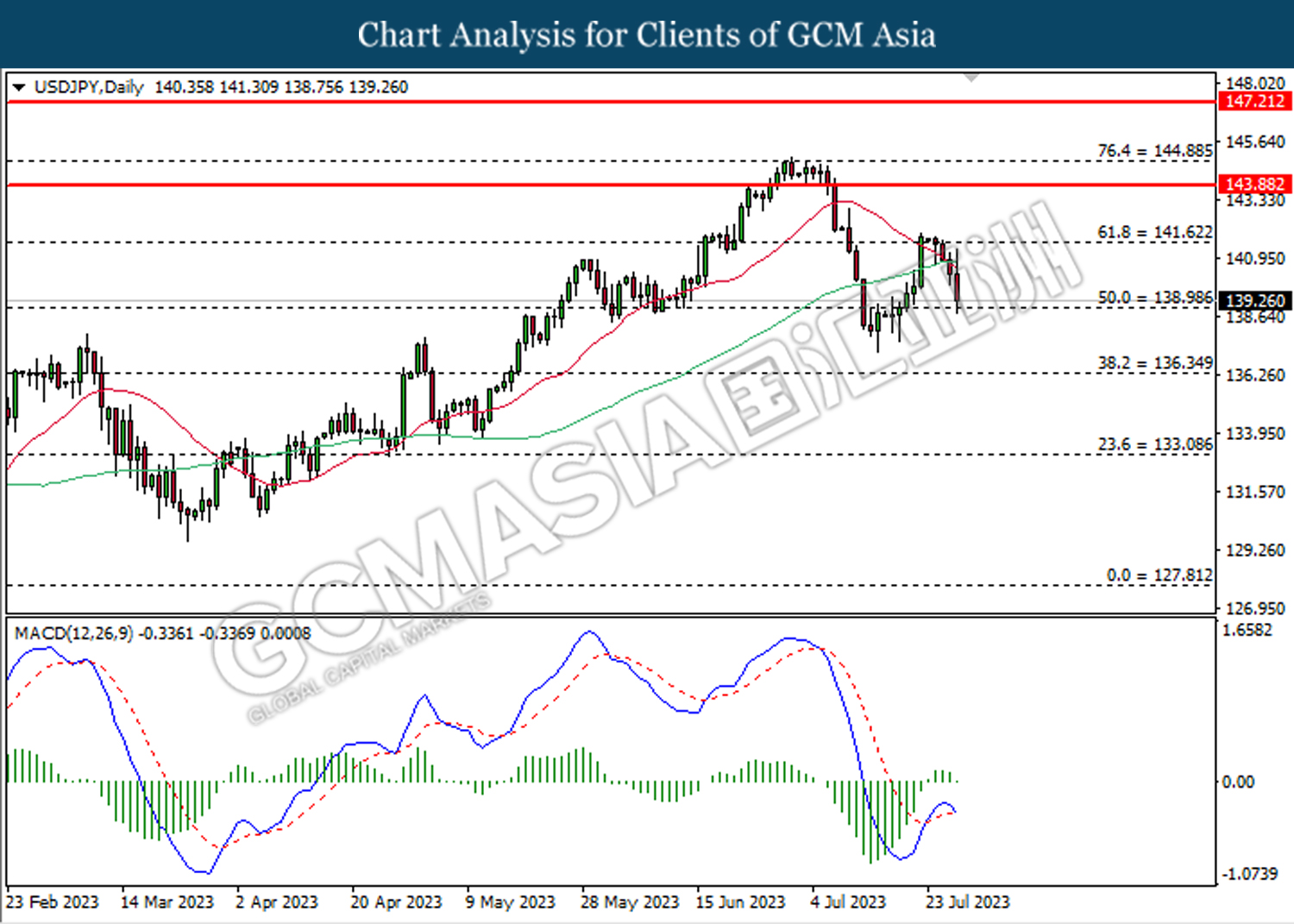

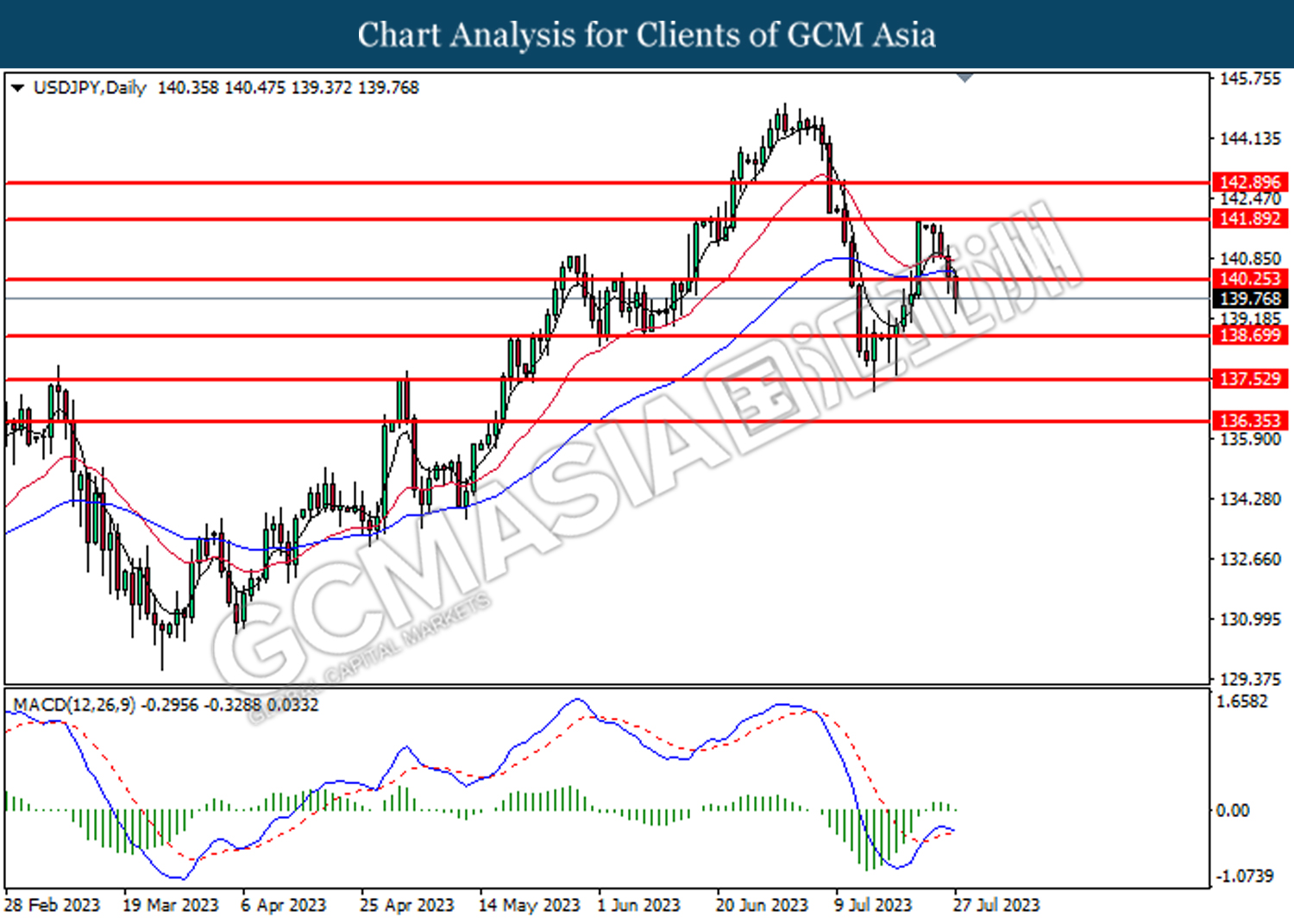

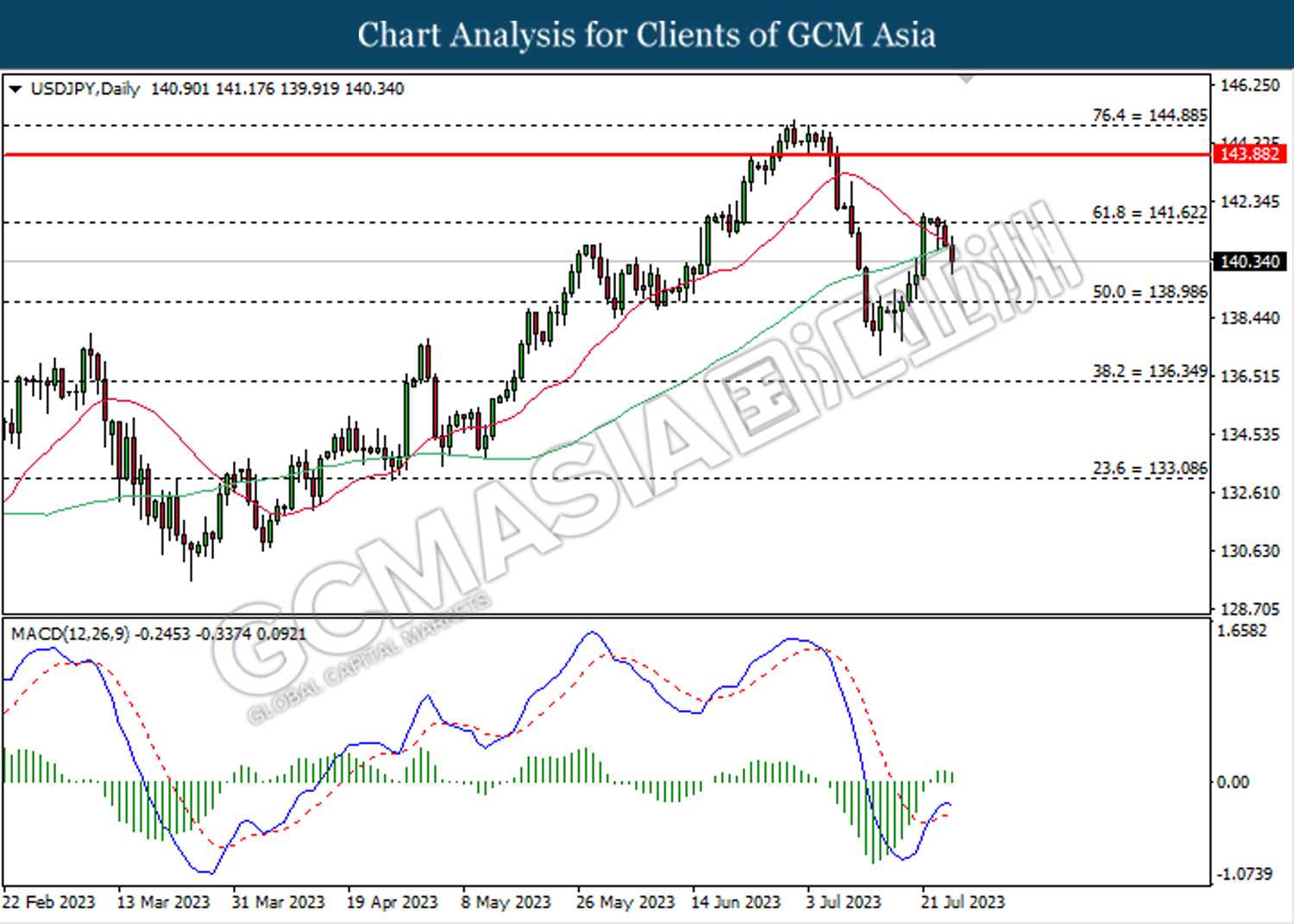

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 141.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 143.40, 144.90

Support level: 141.60, 139.00

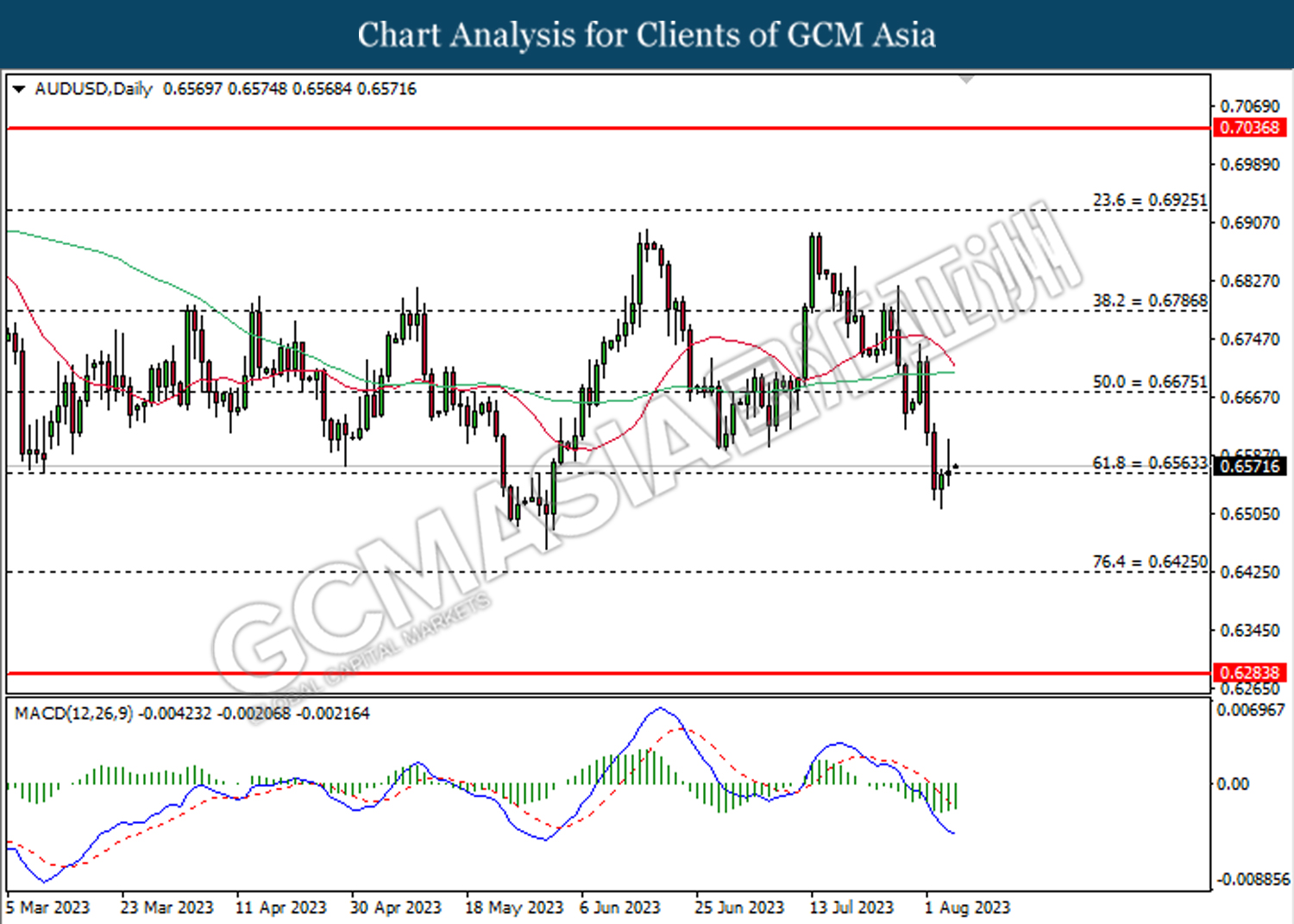

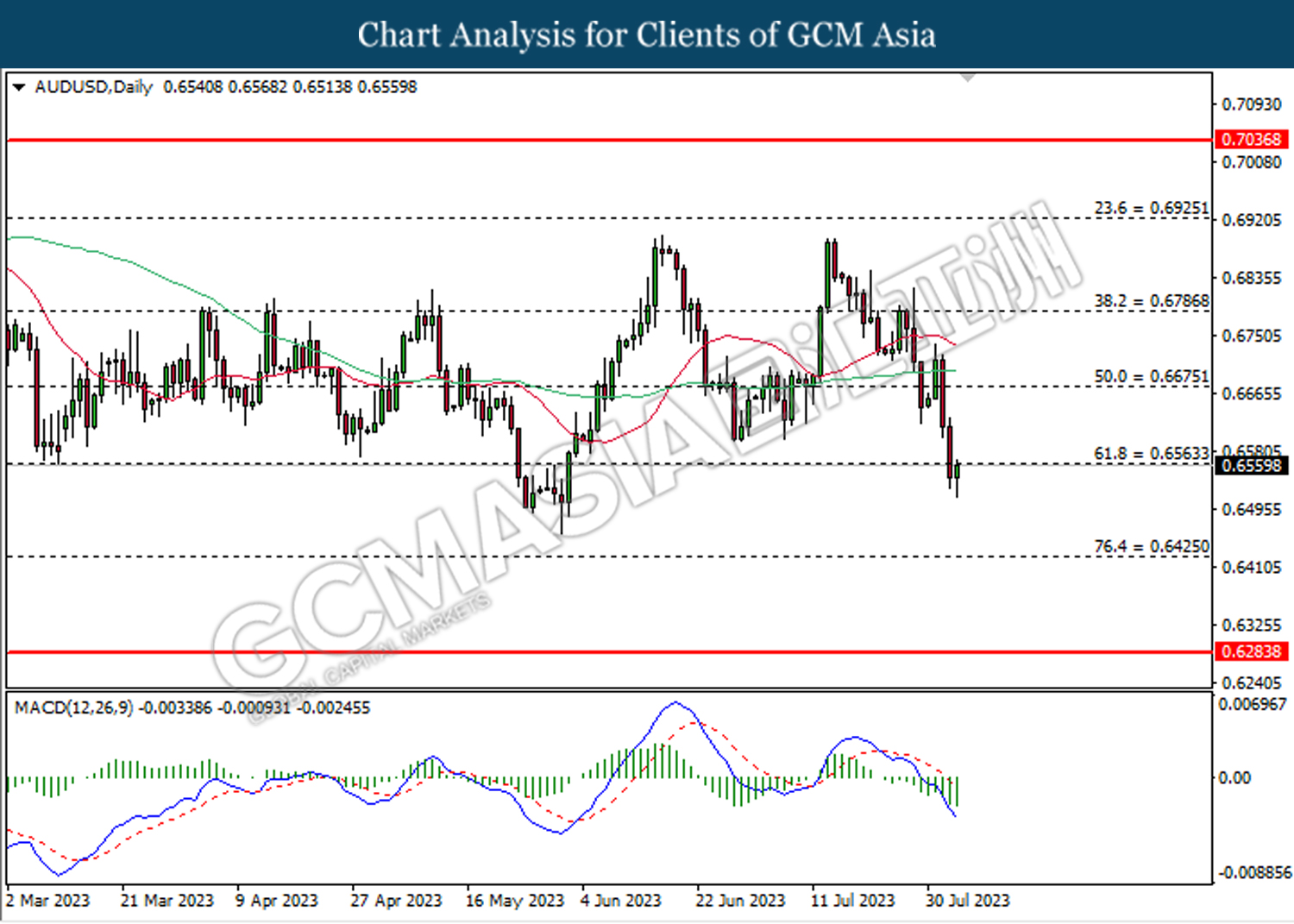

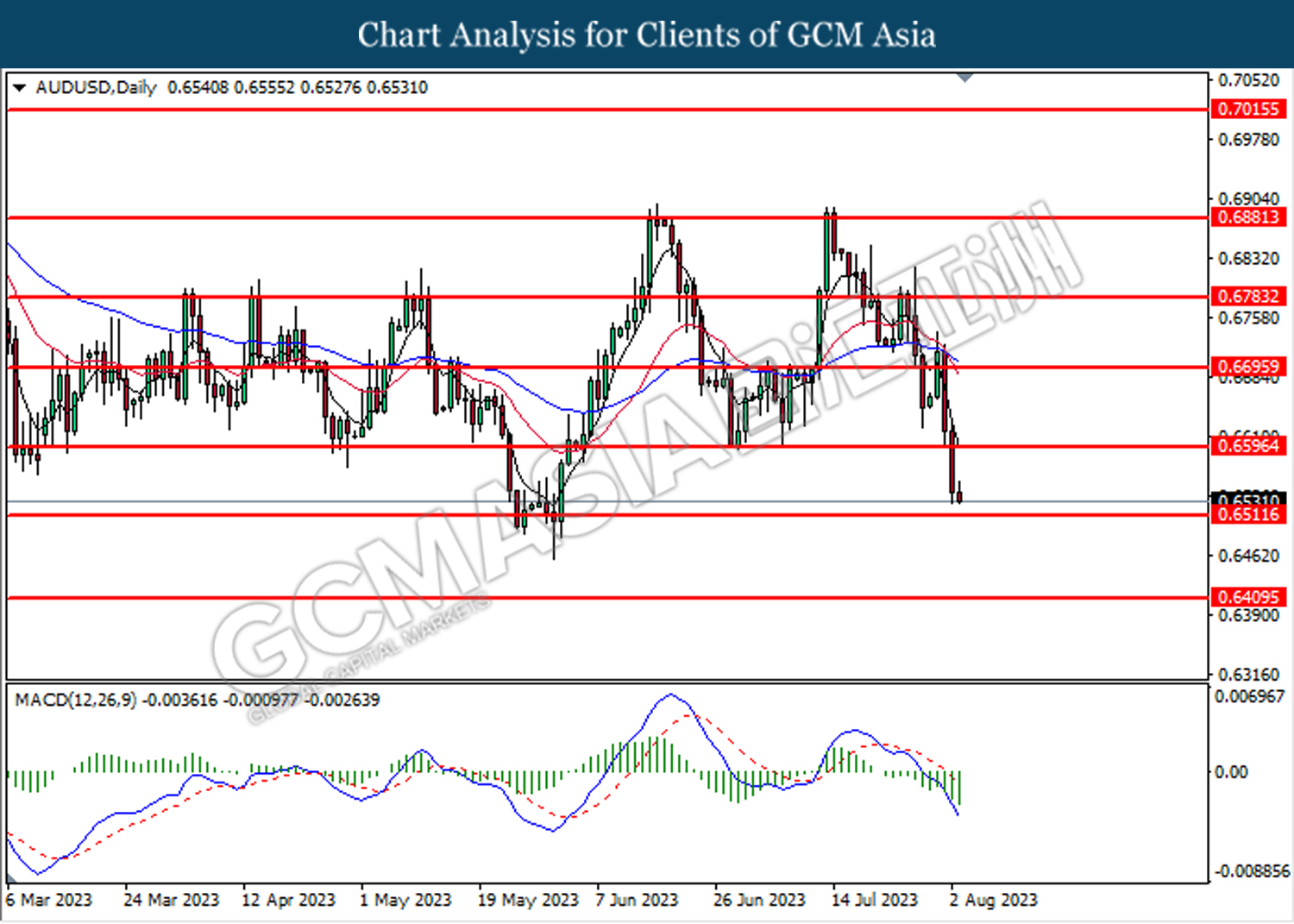

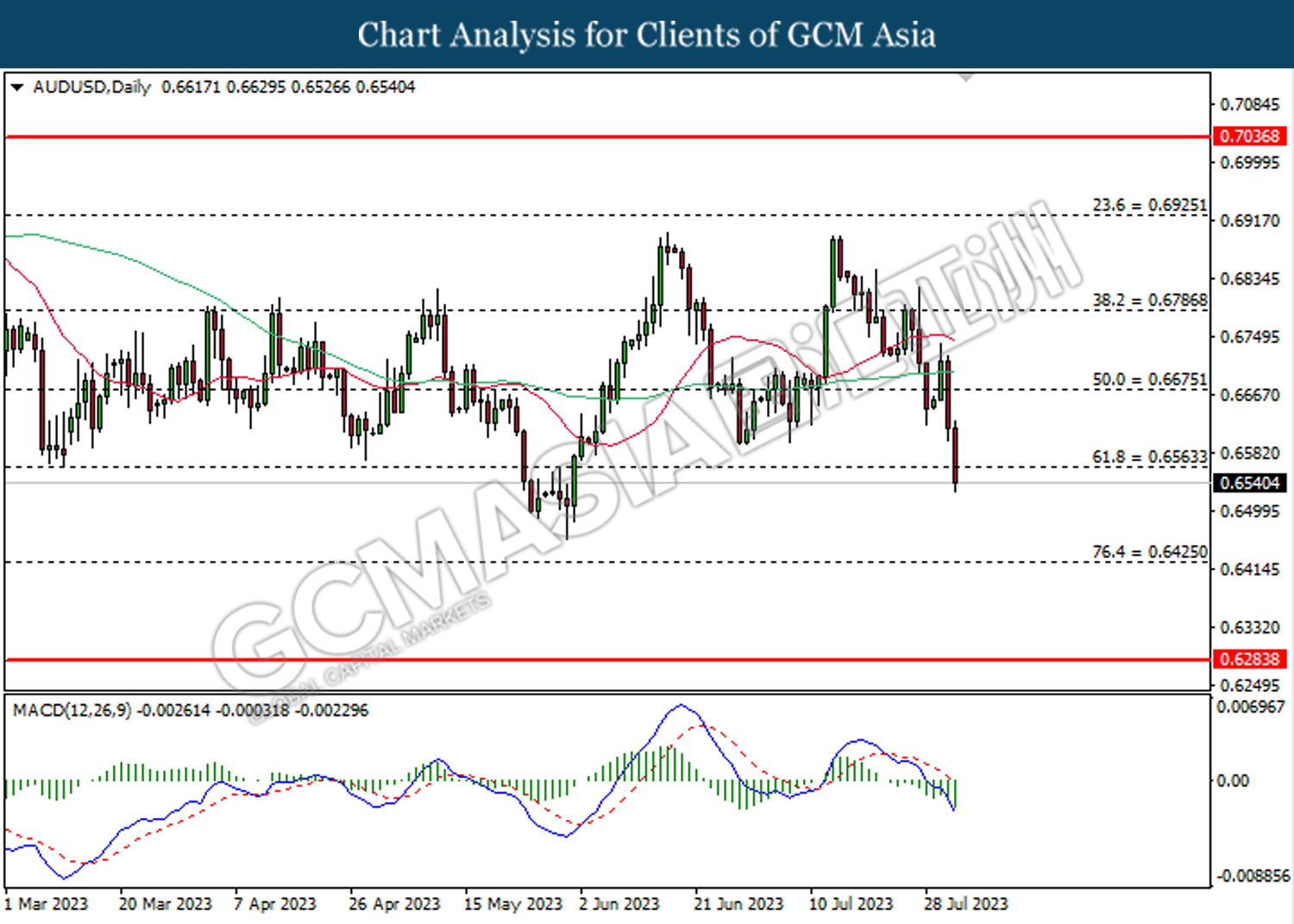

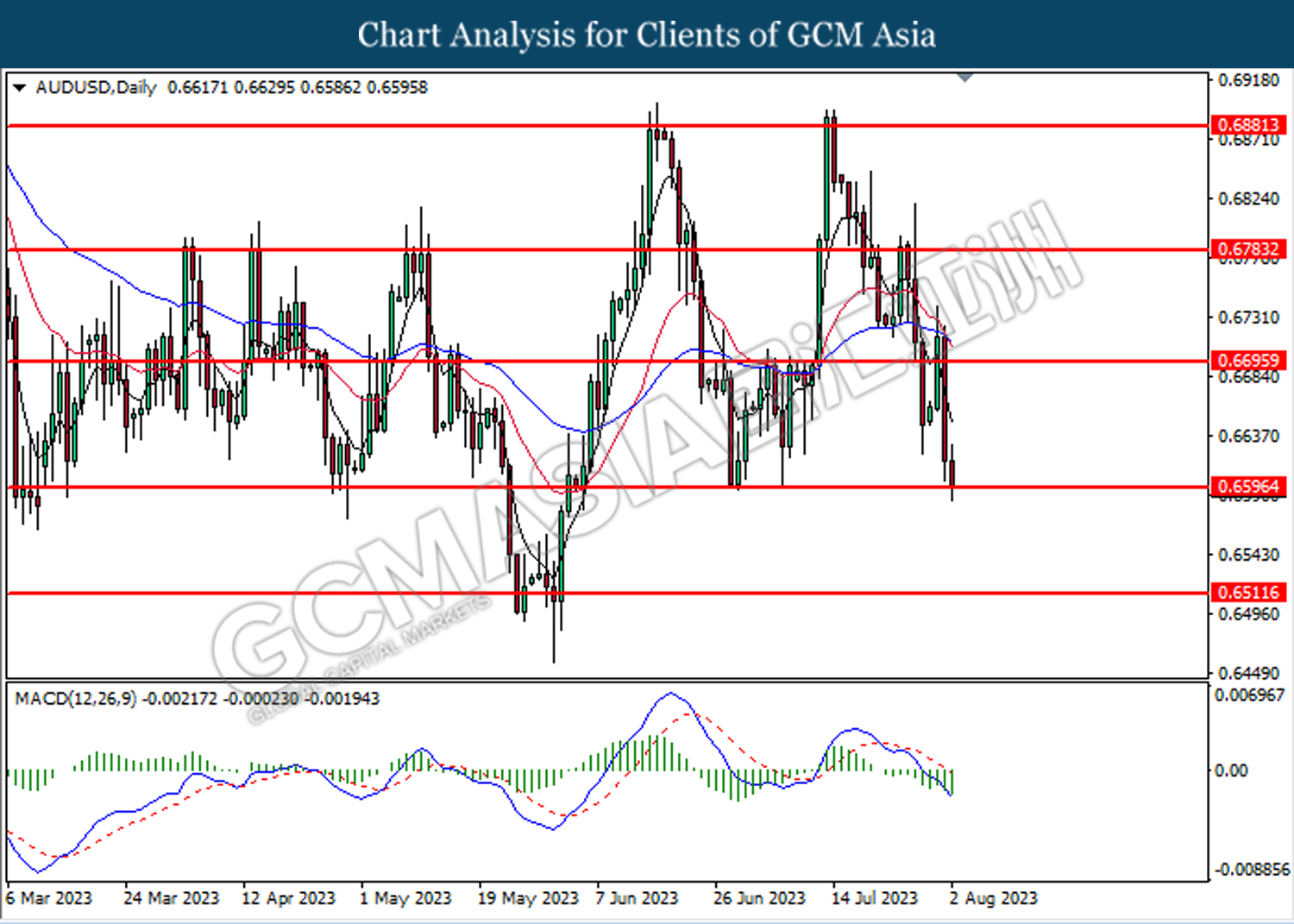

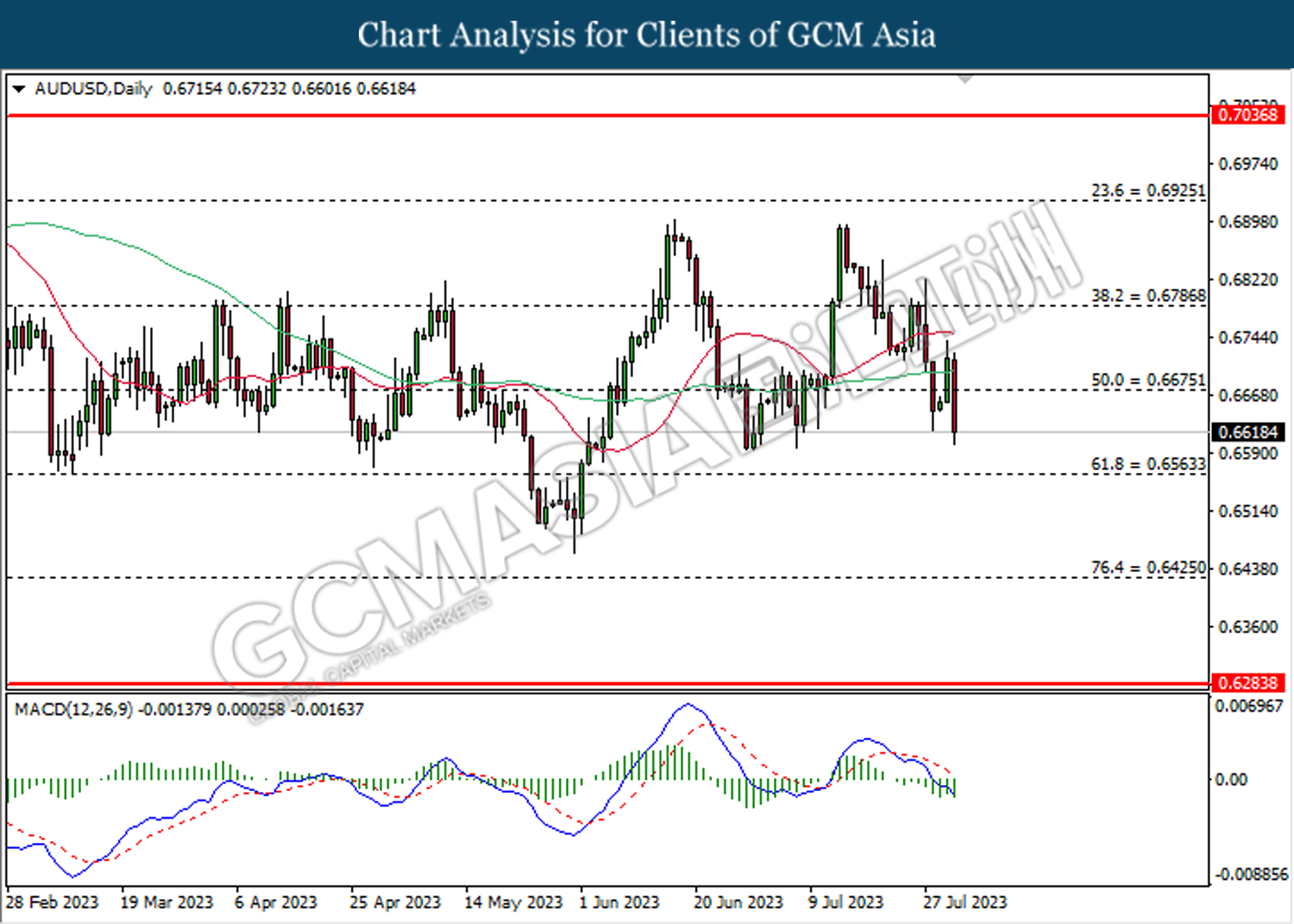

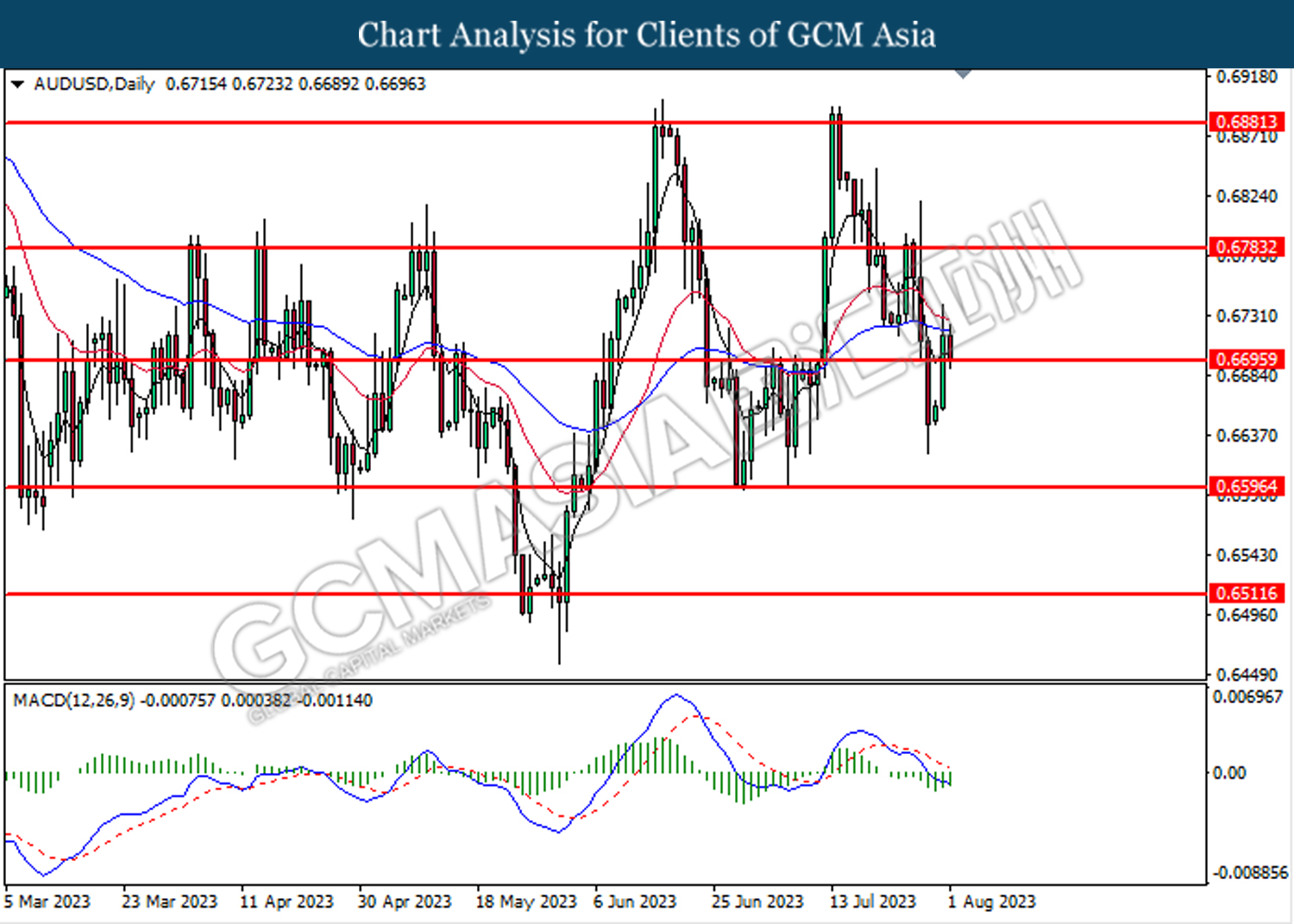

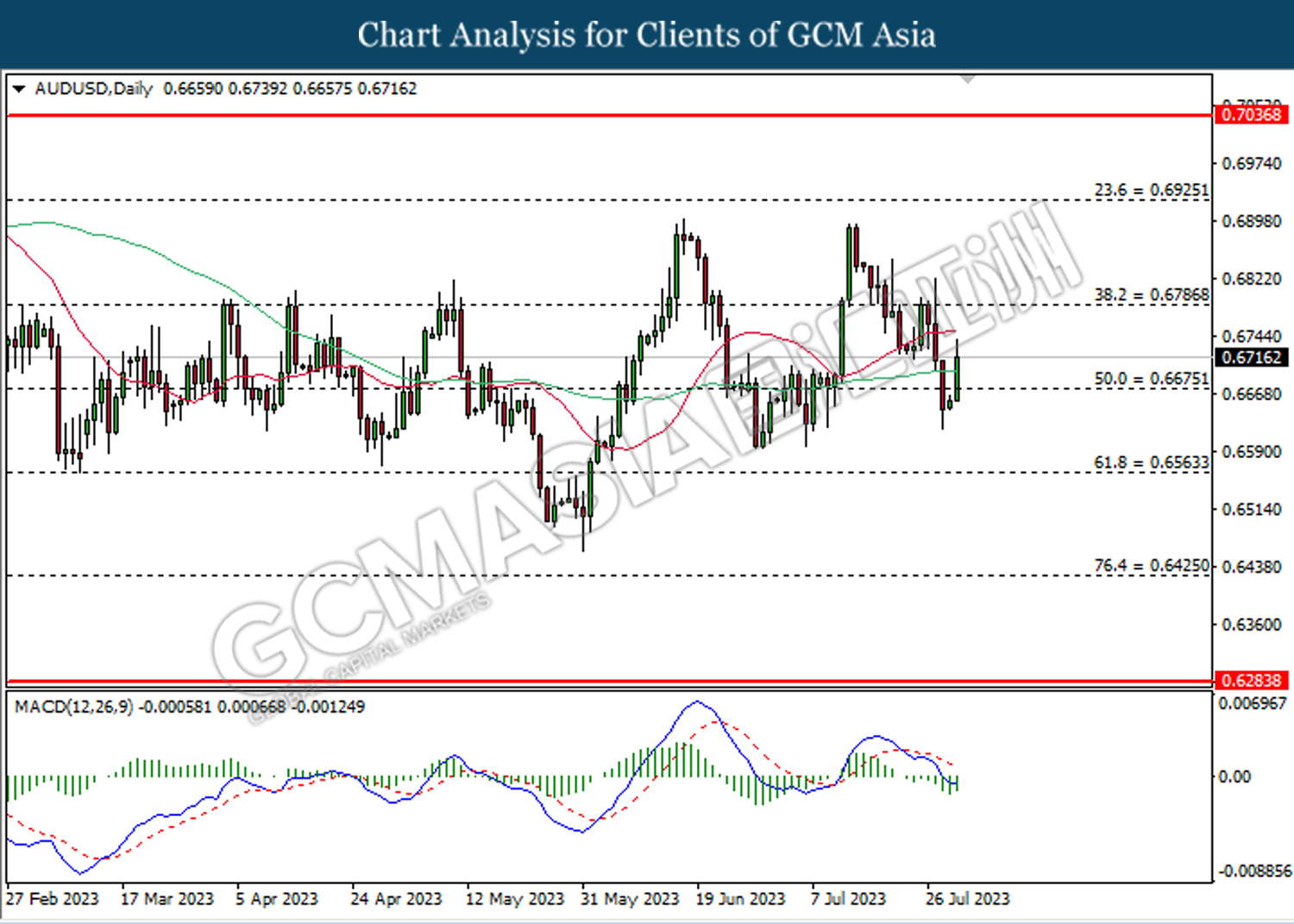

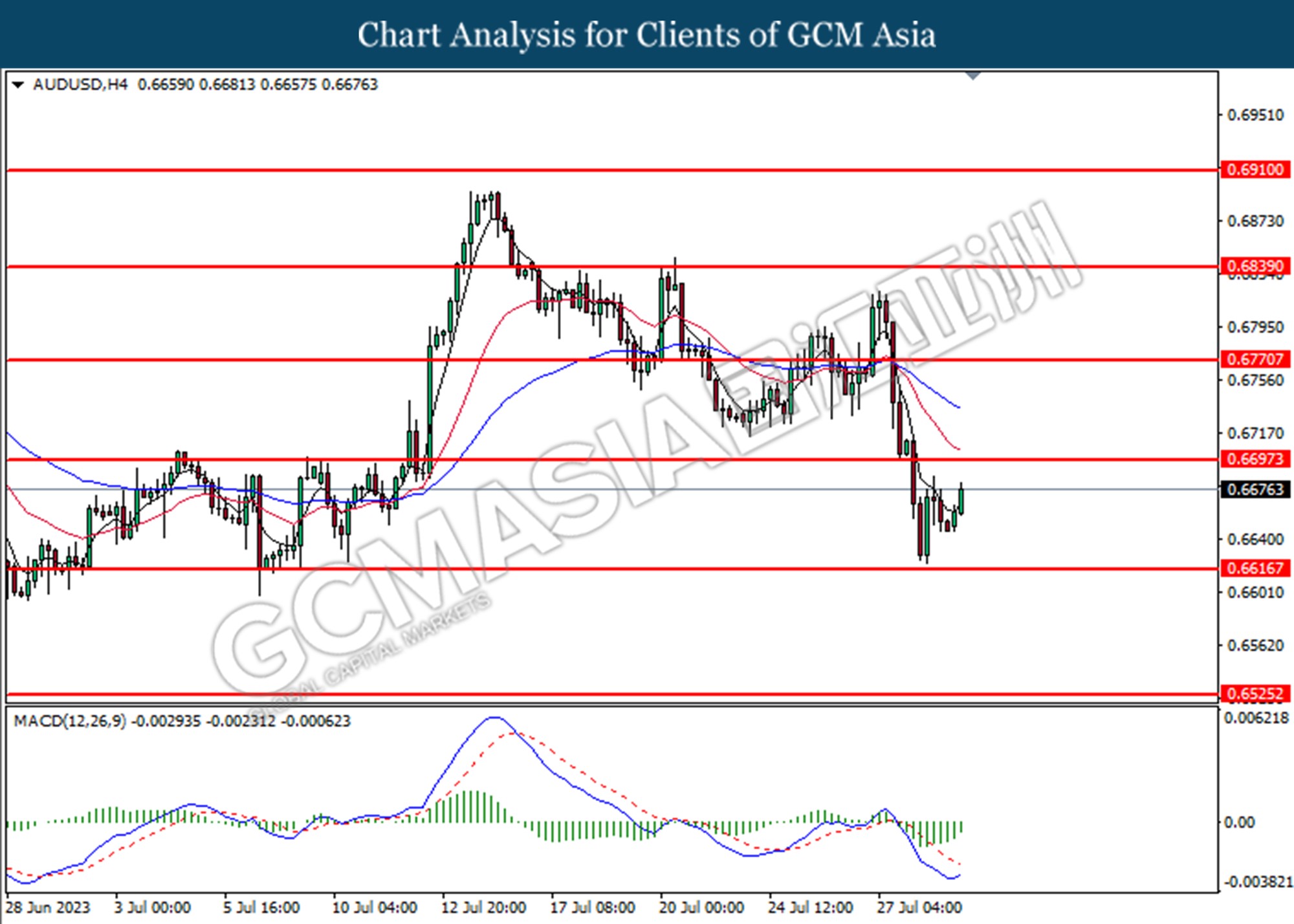

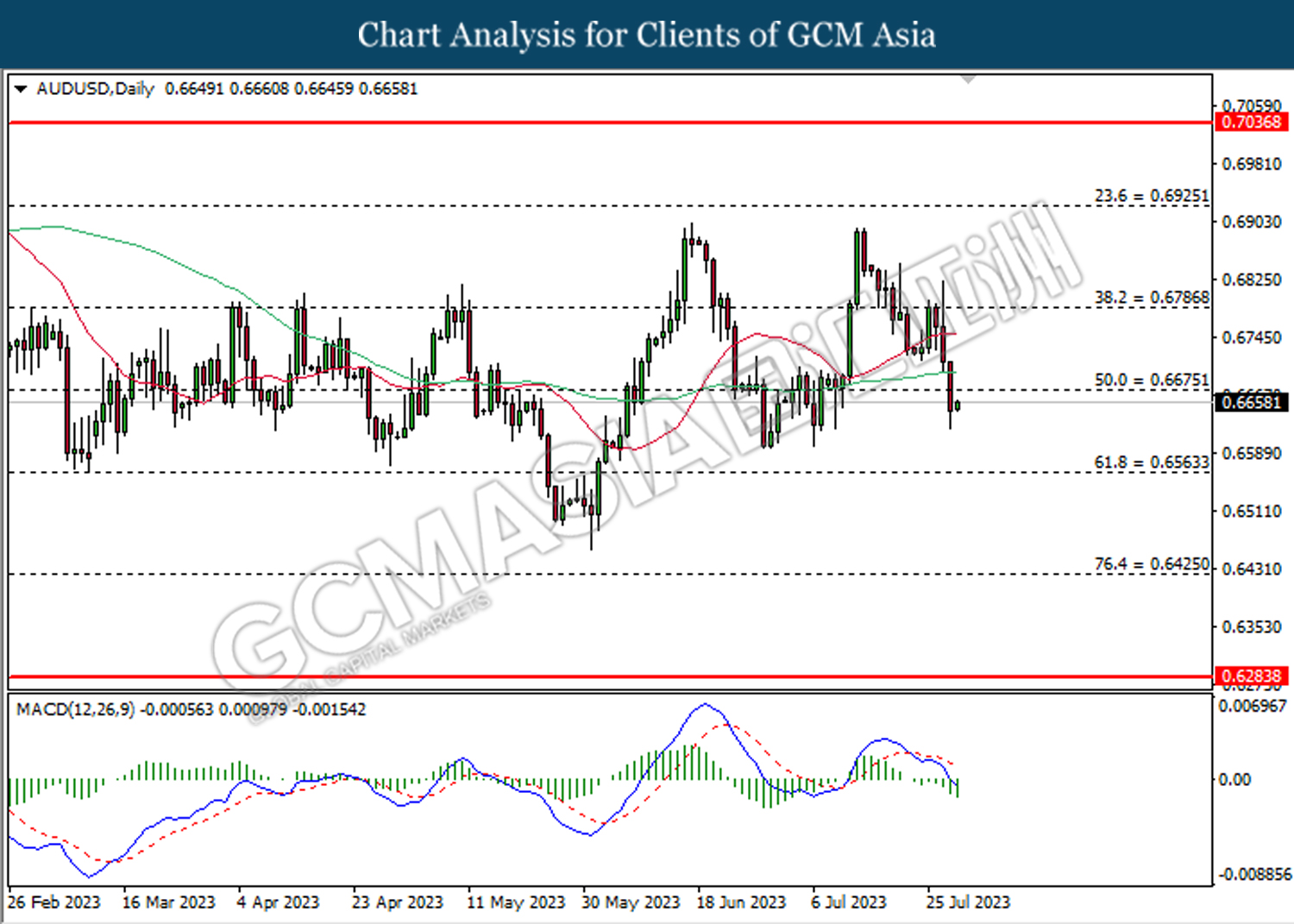

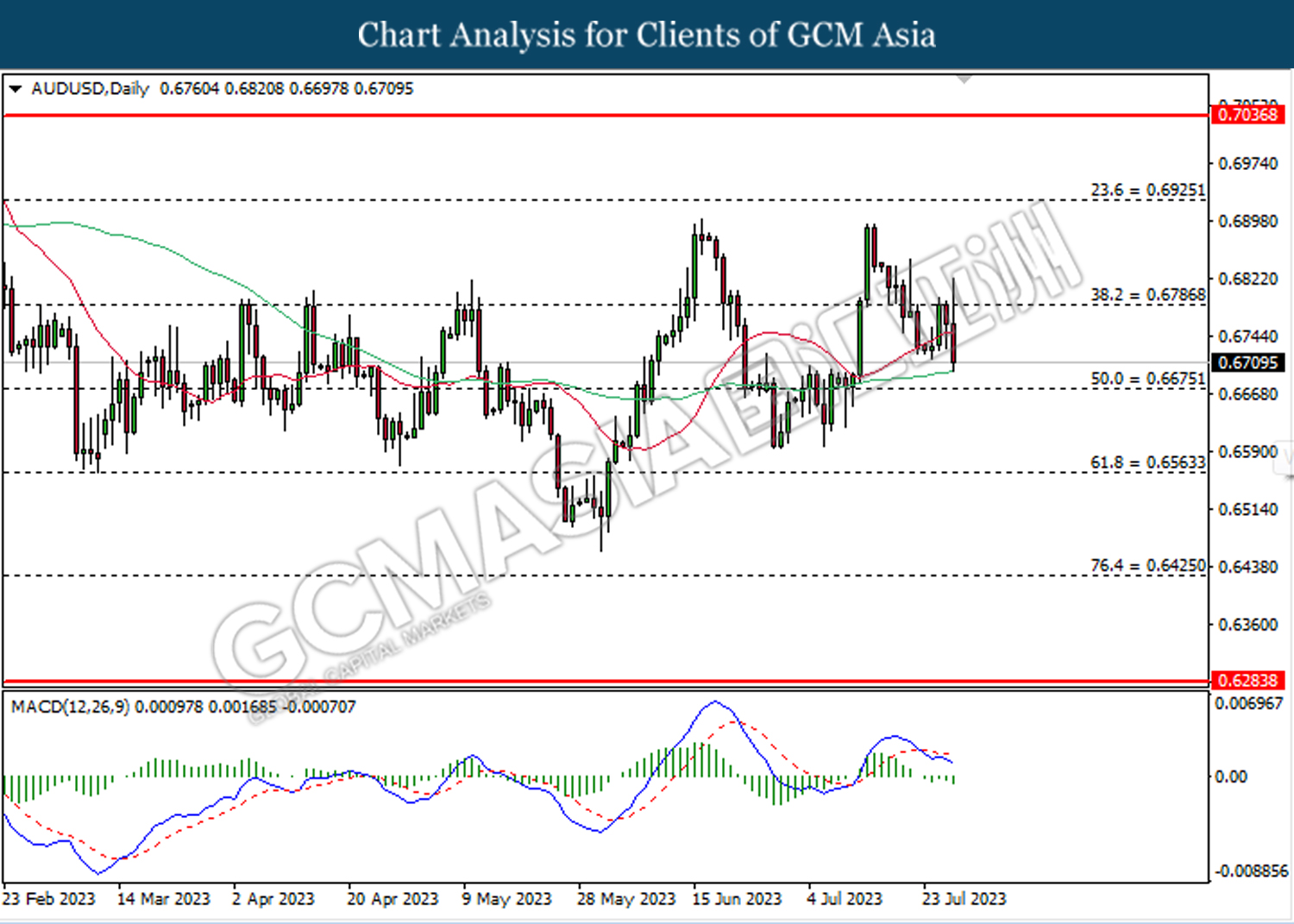

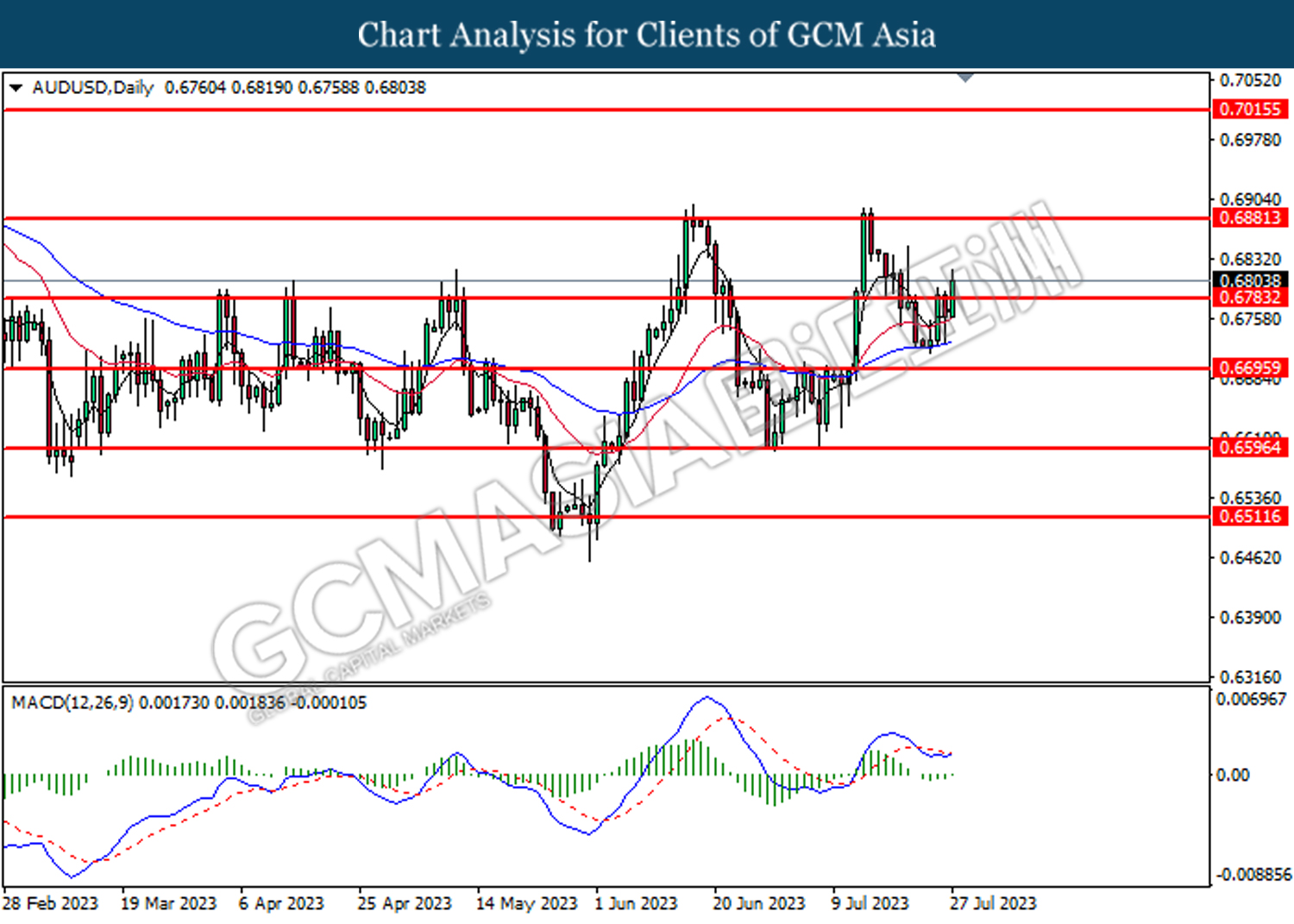

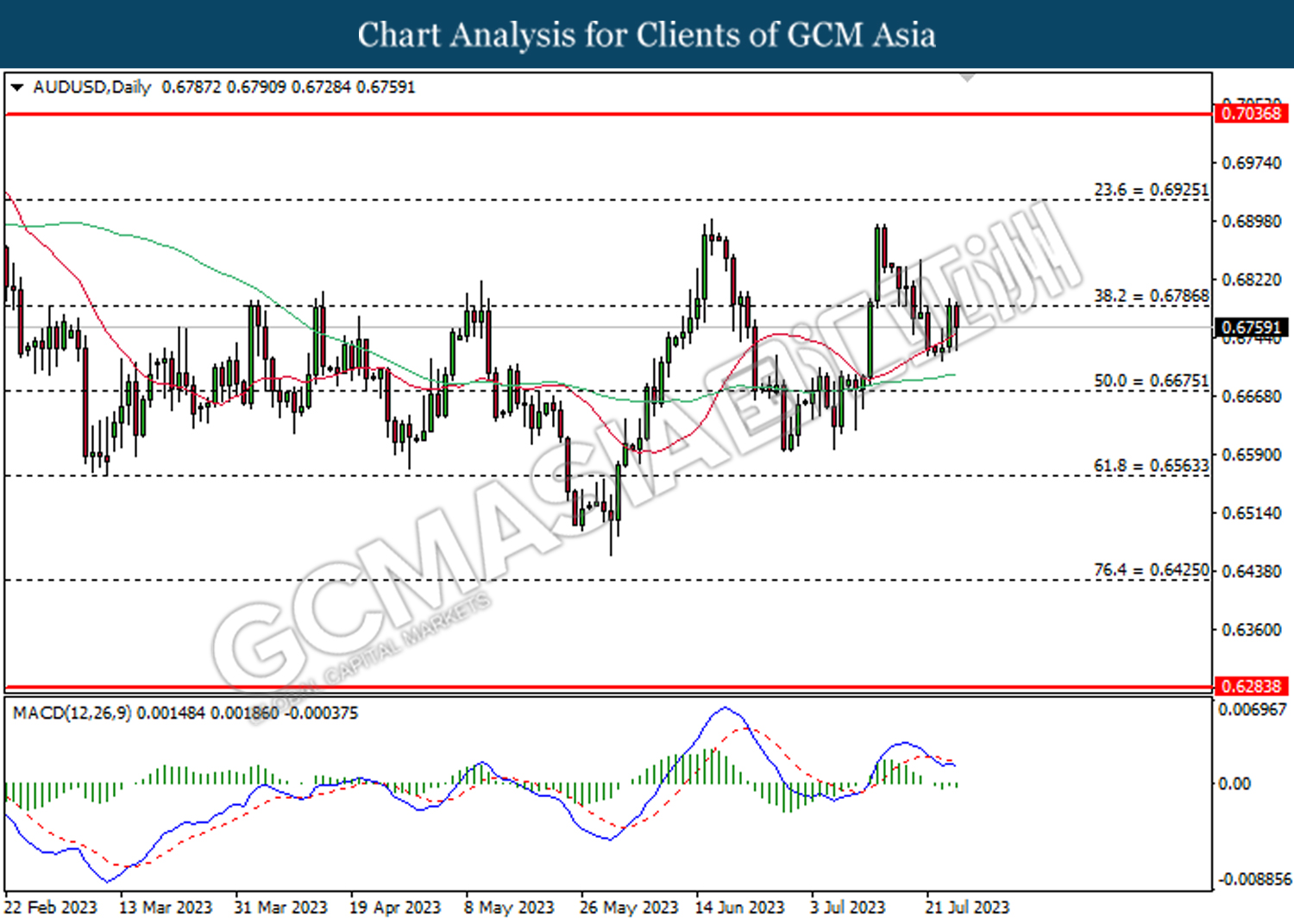

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6565. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

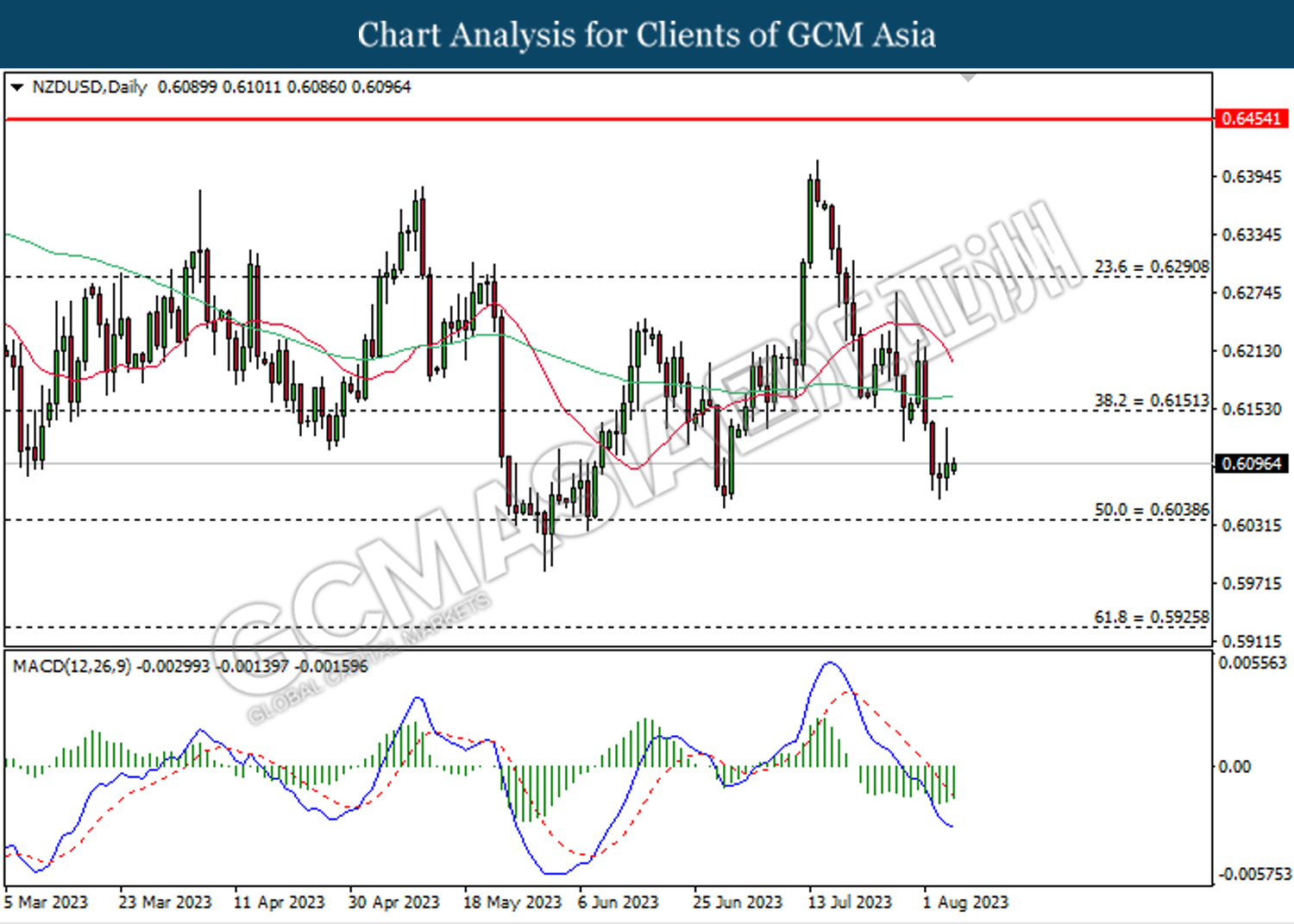

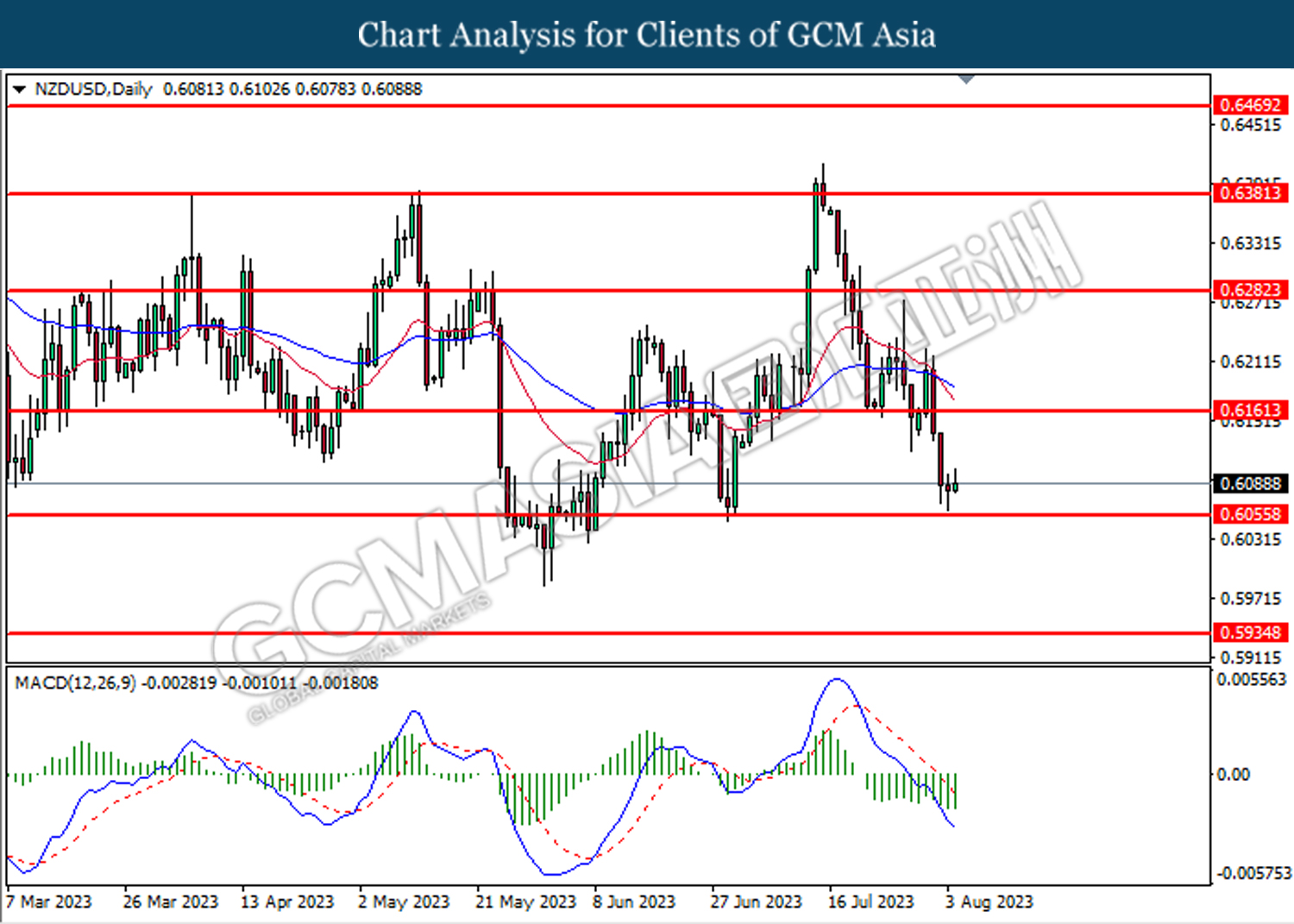

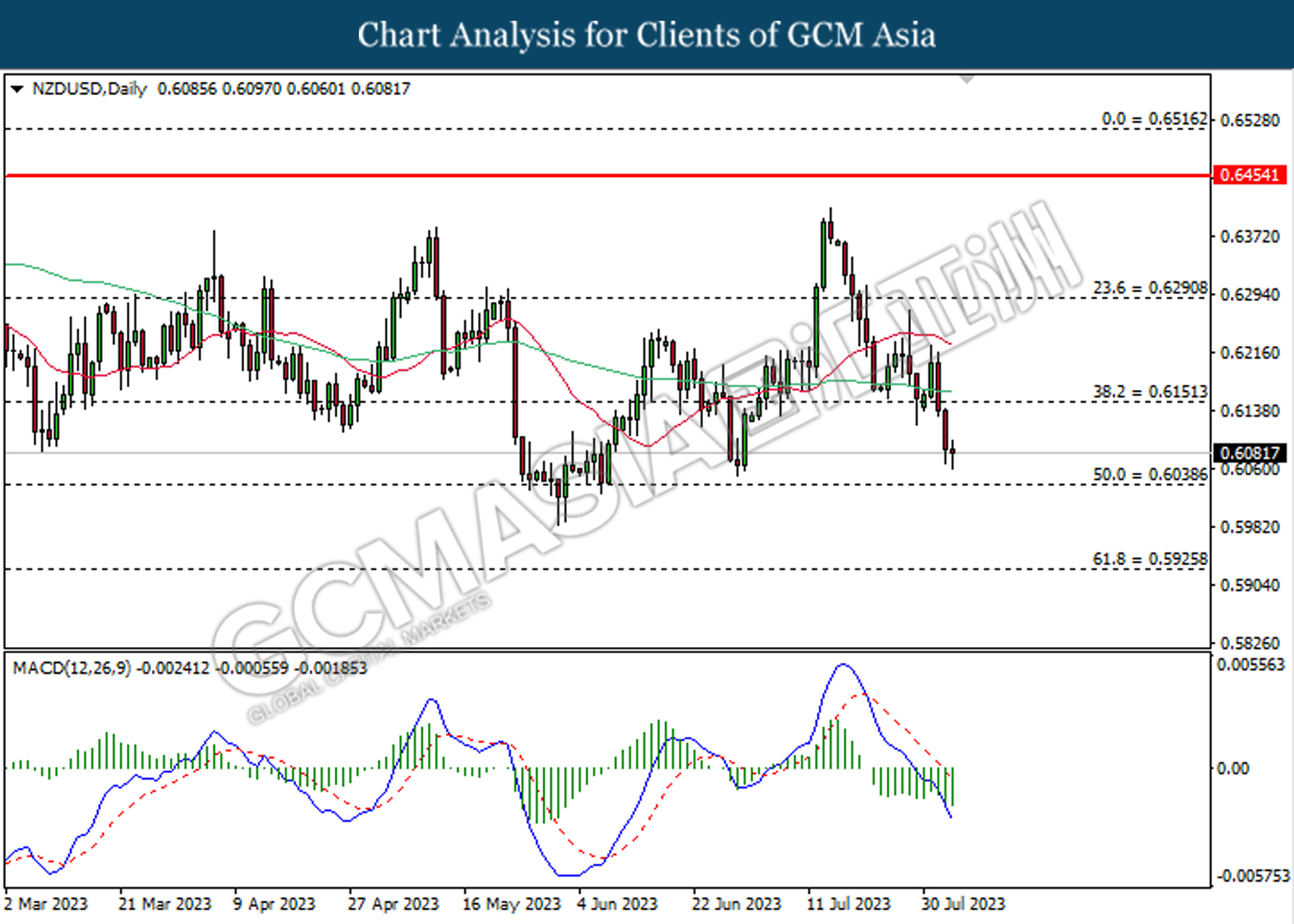

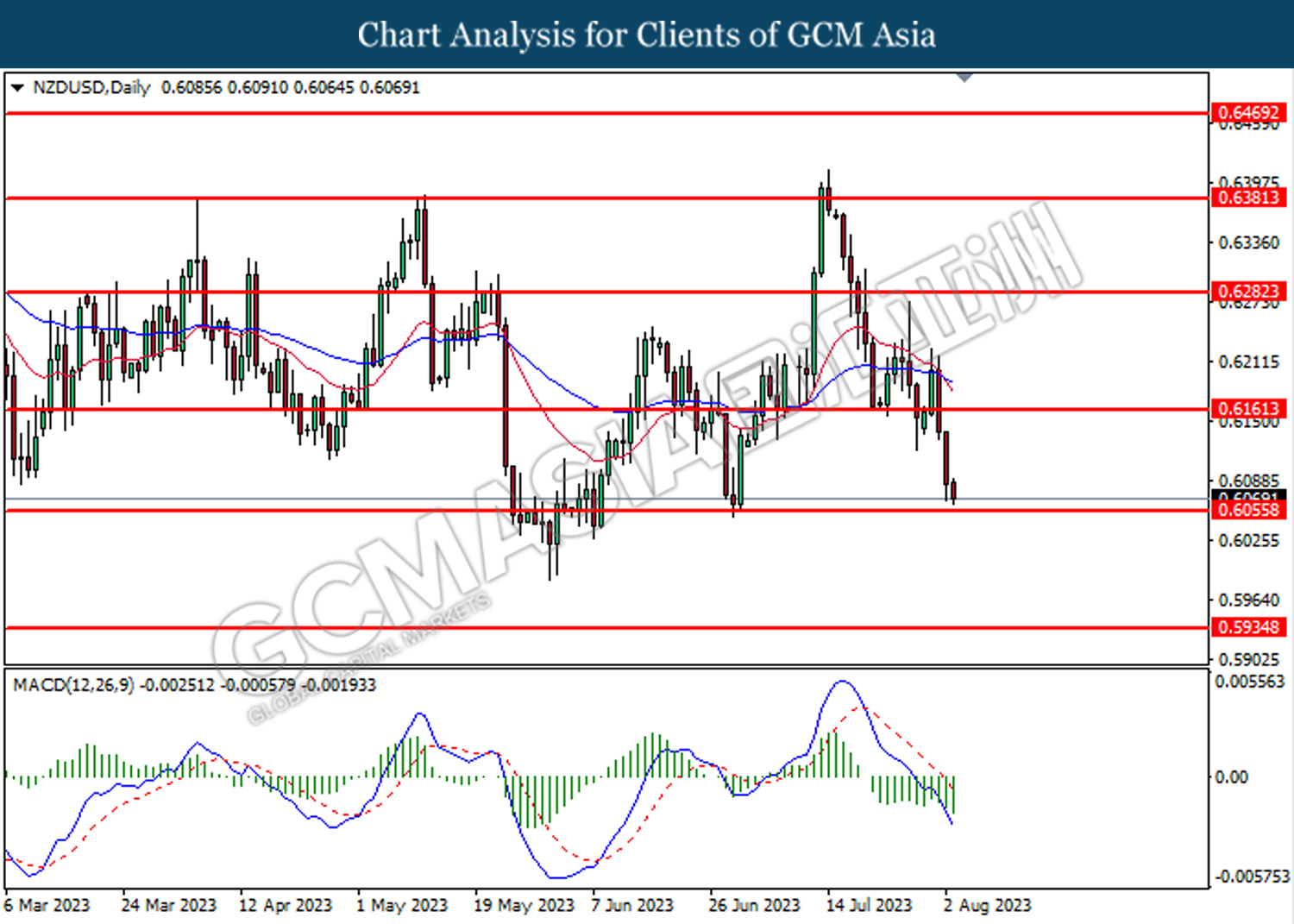

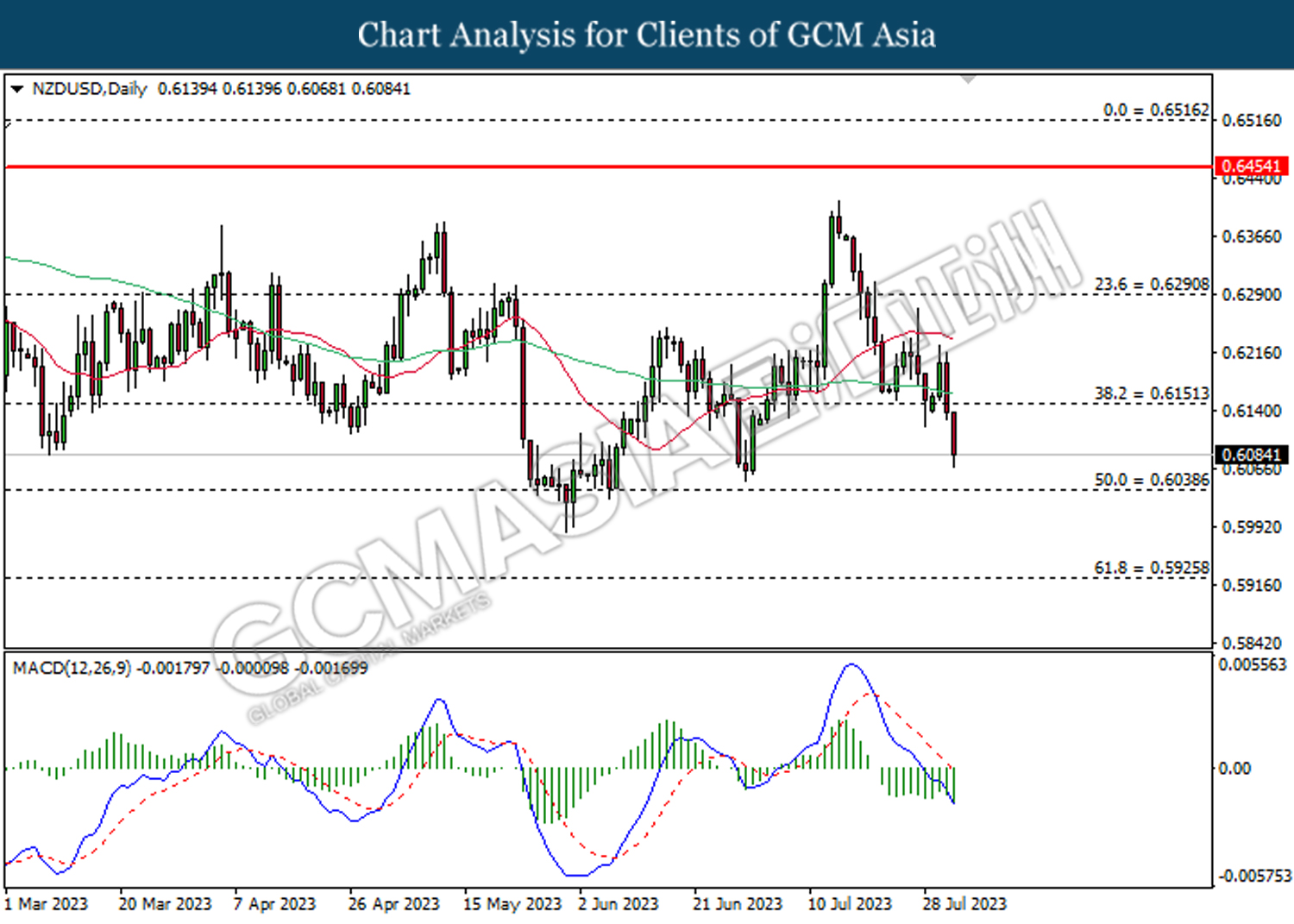

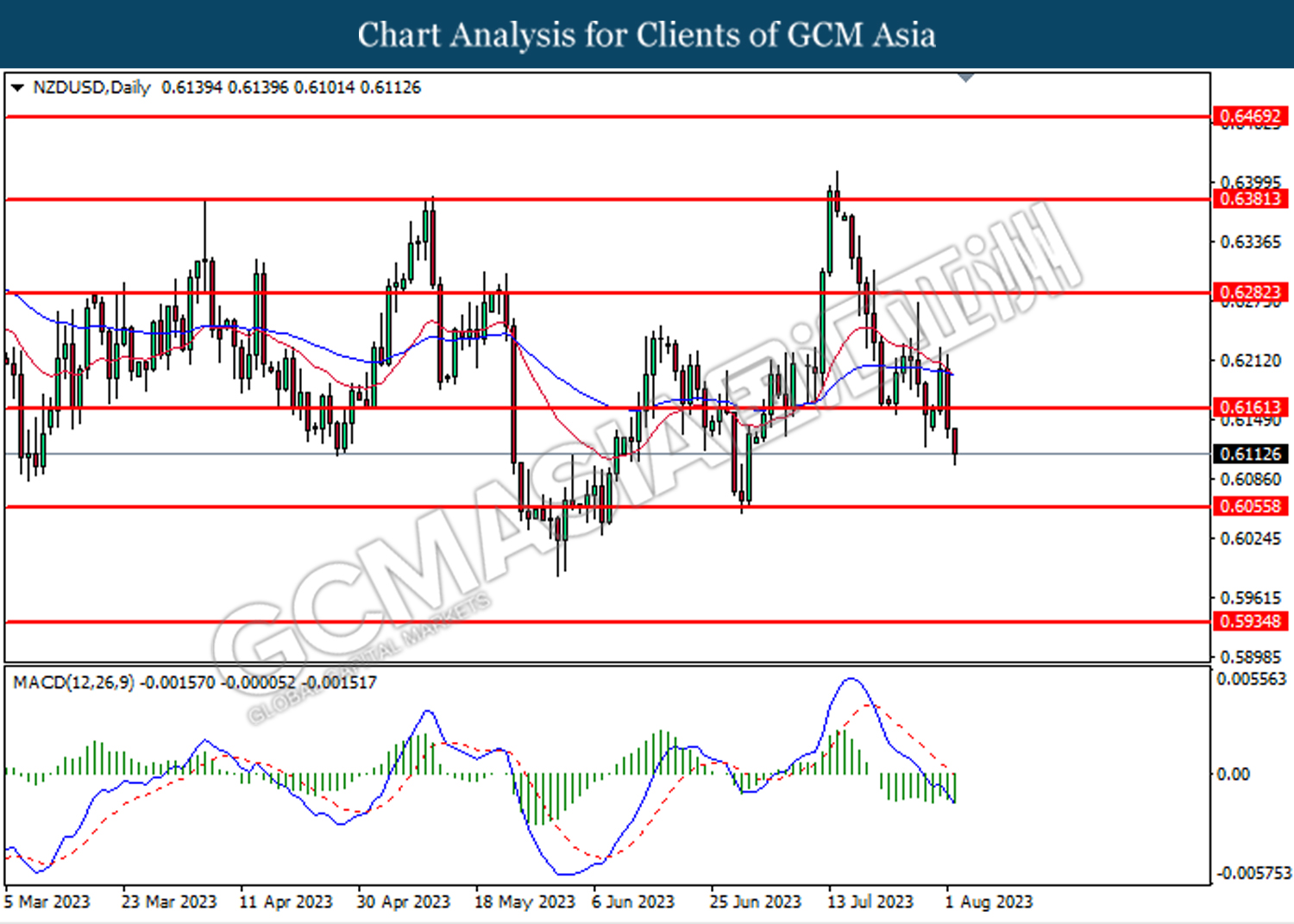

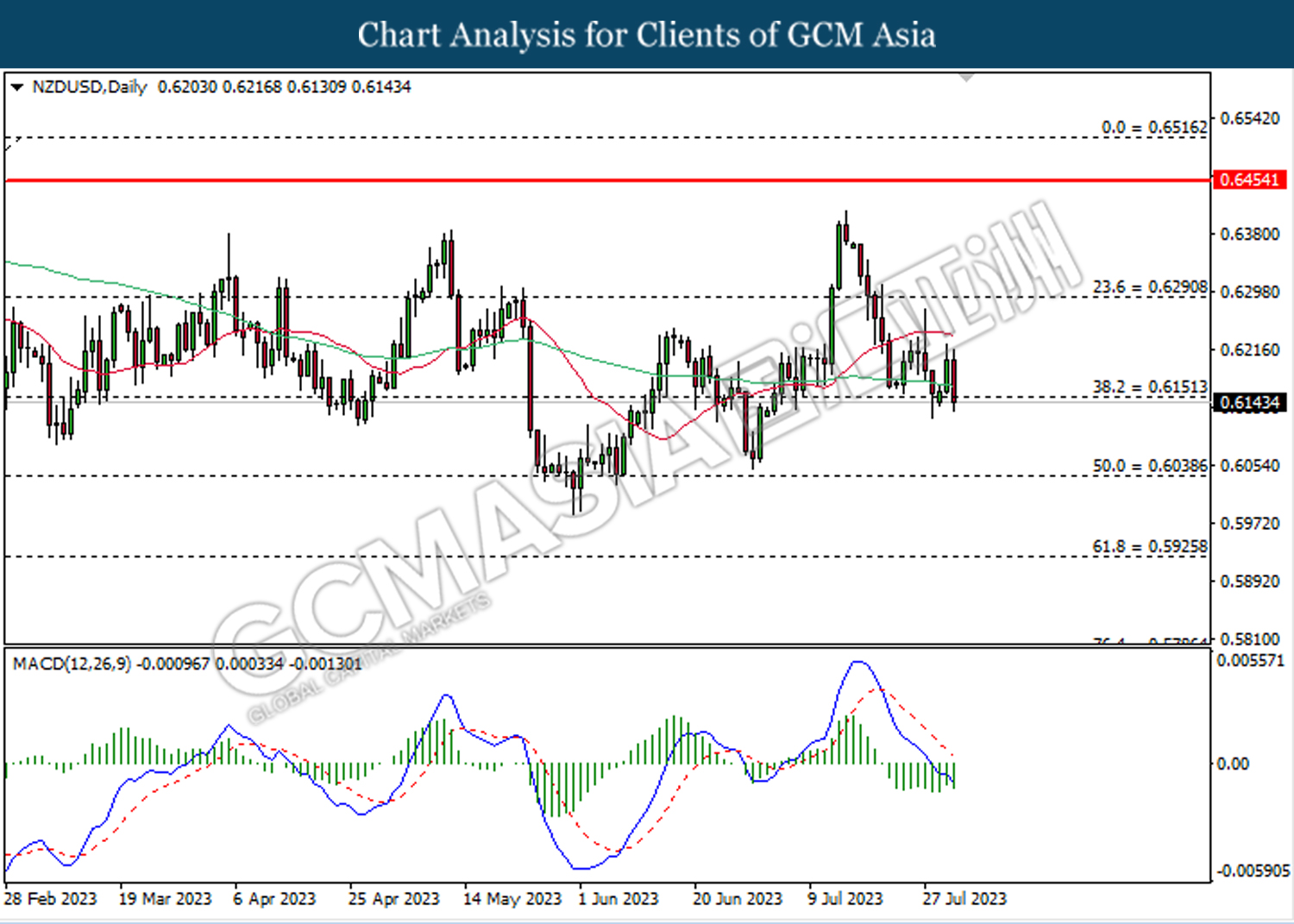

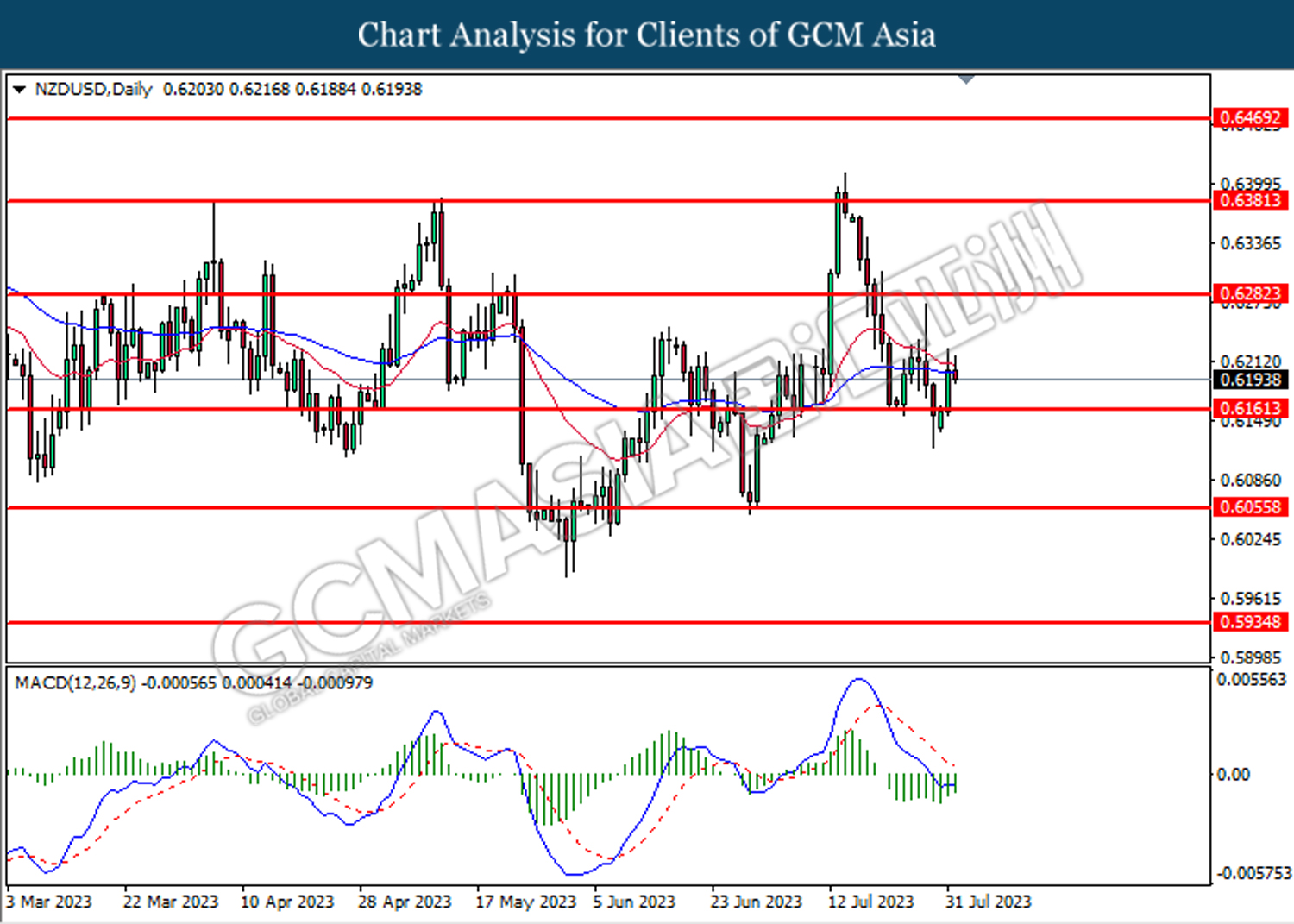

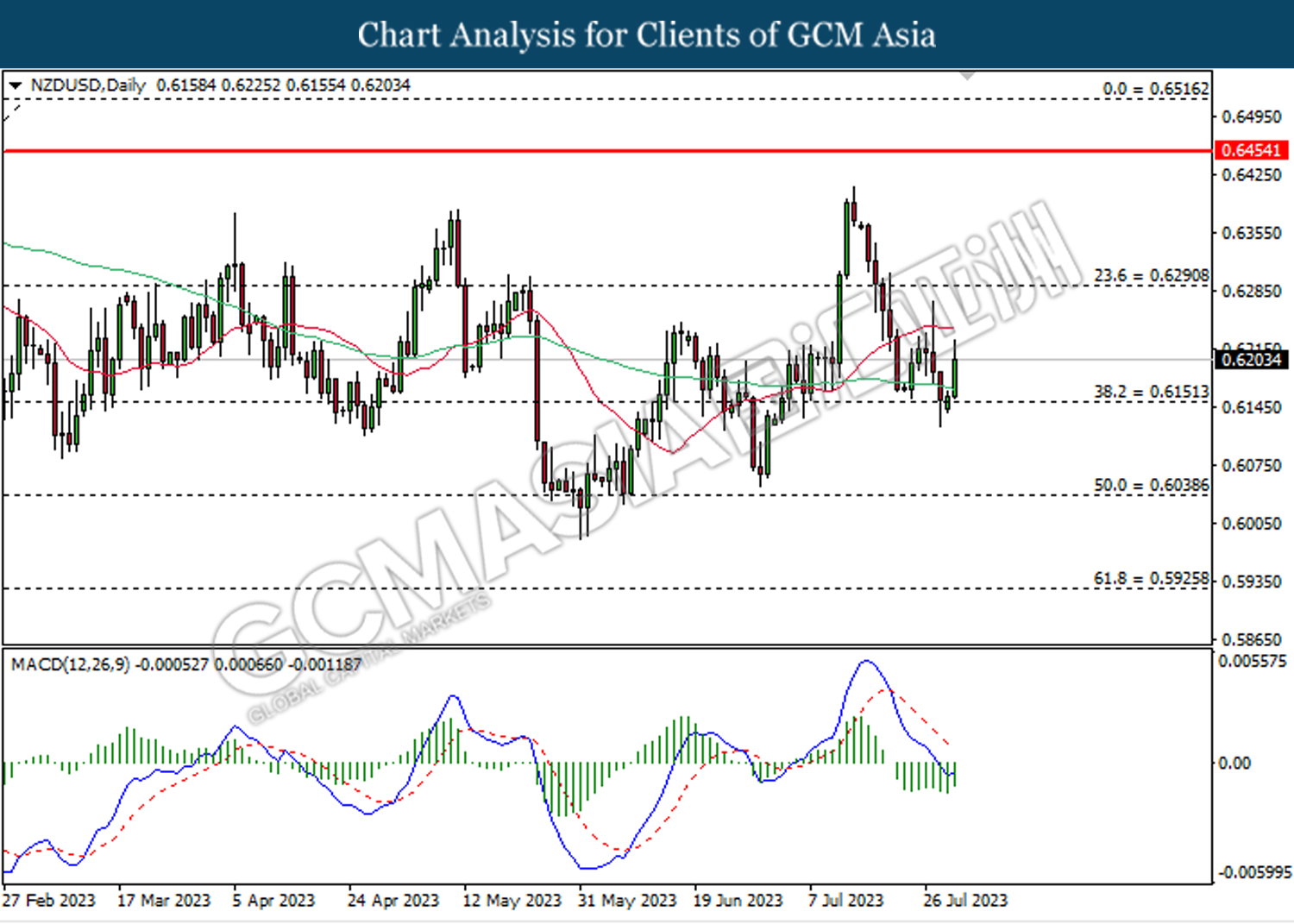

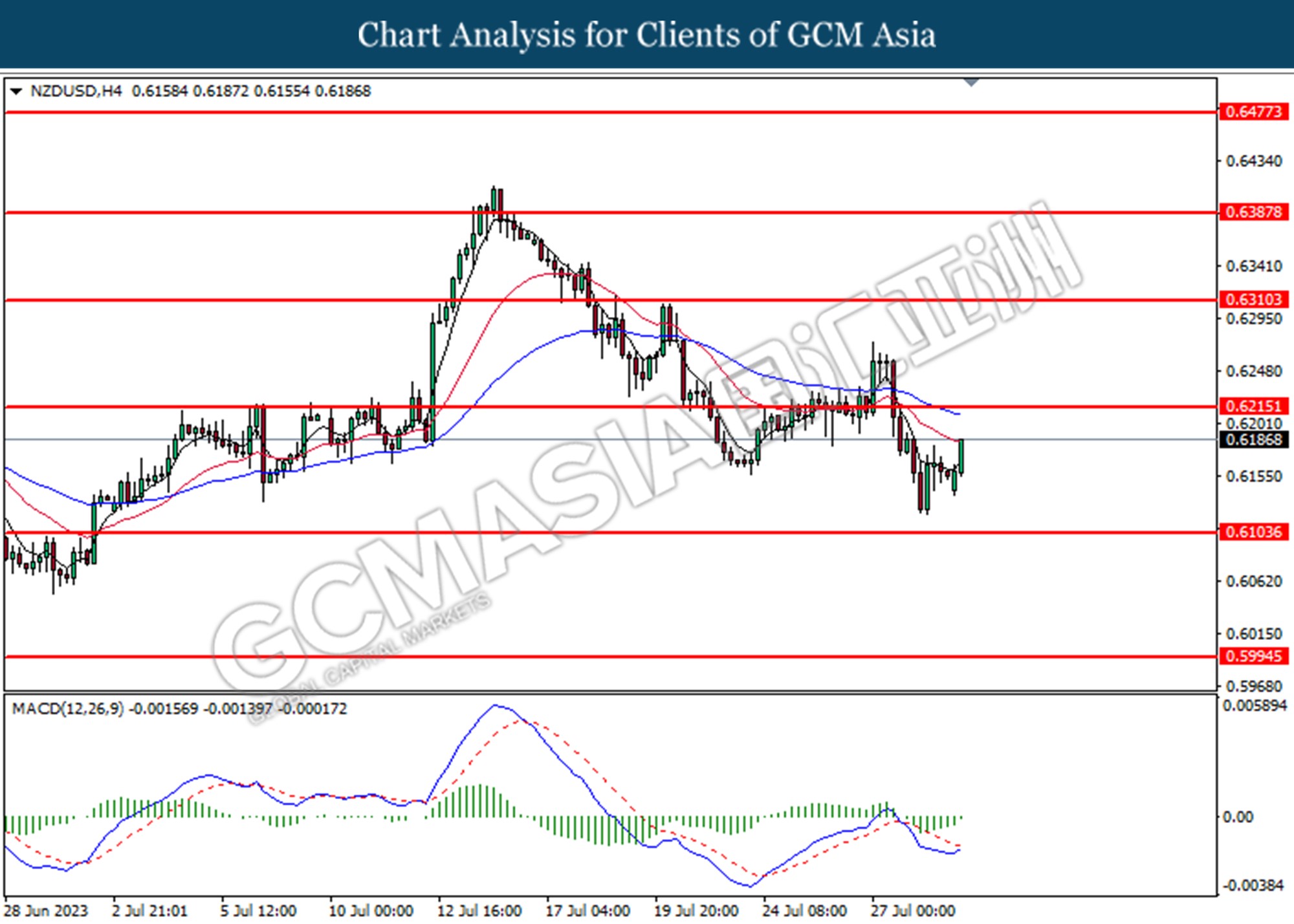

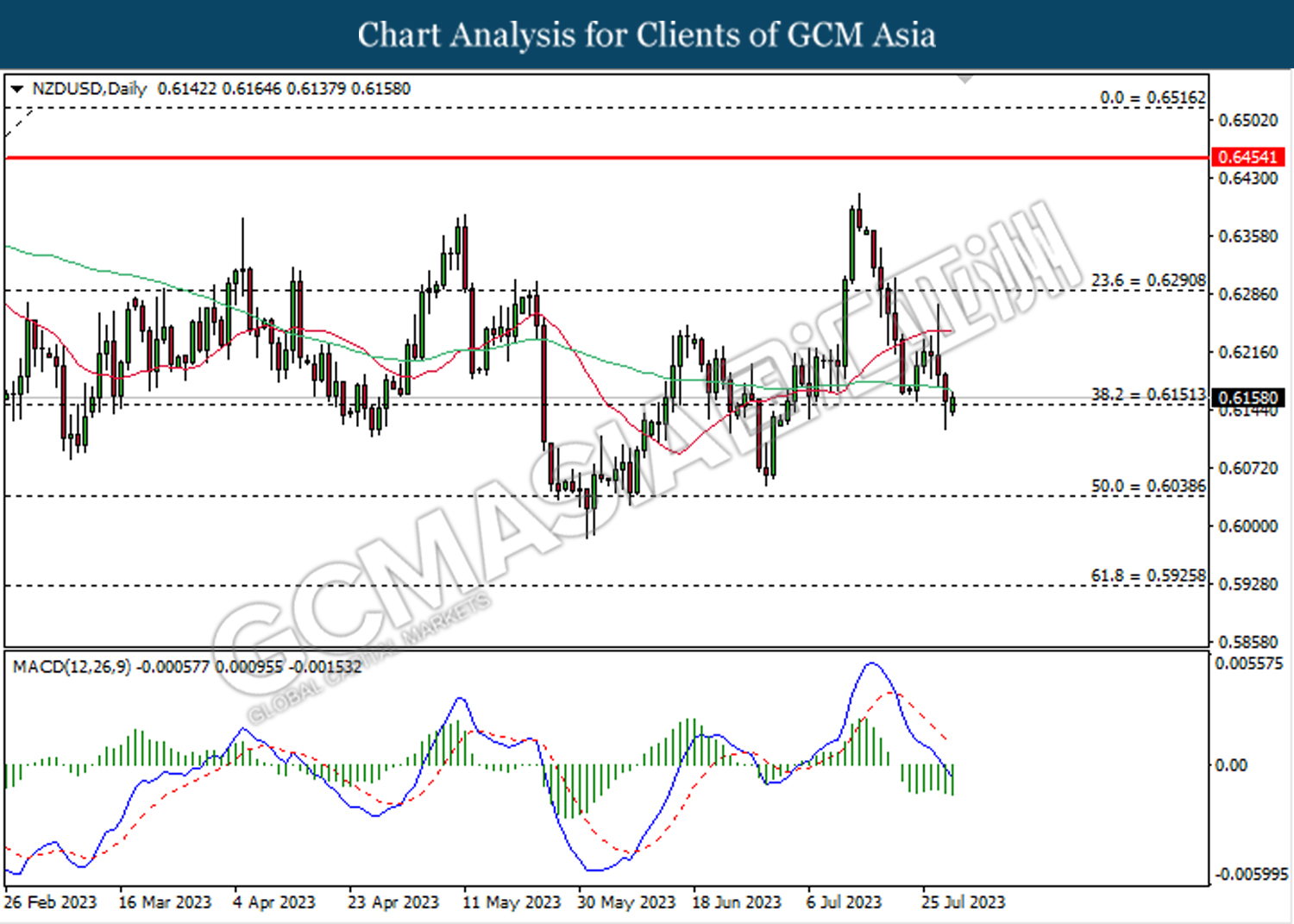

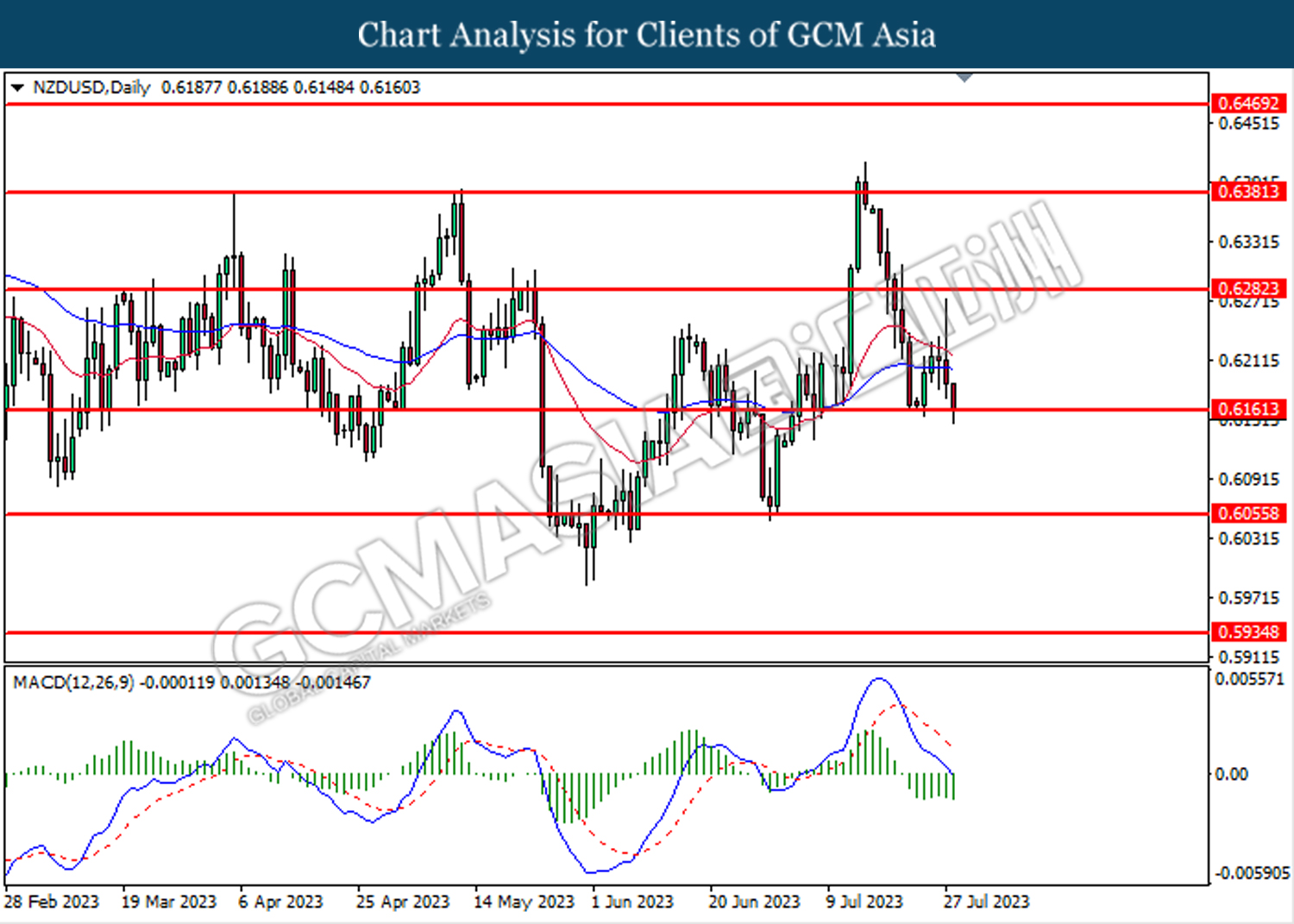

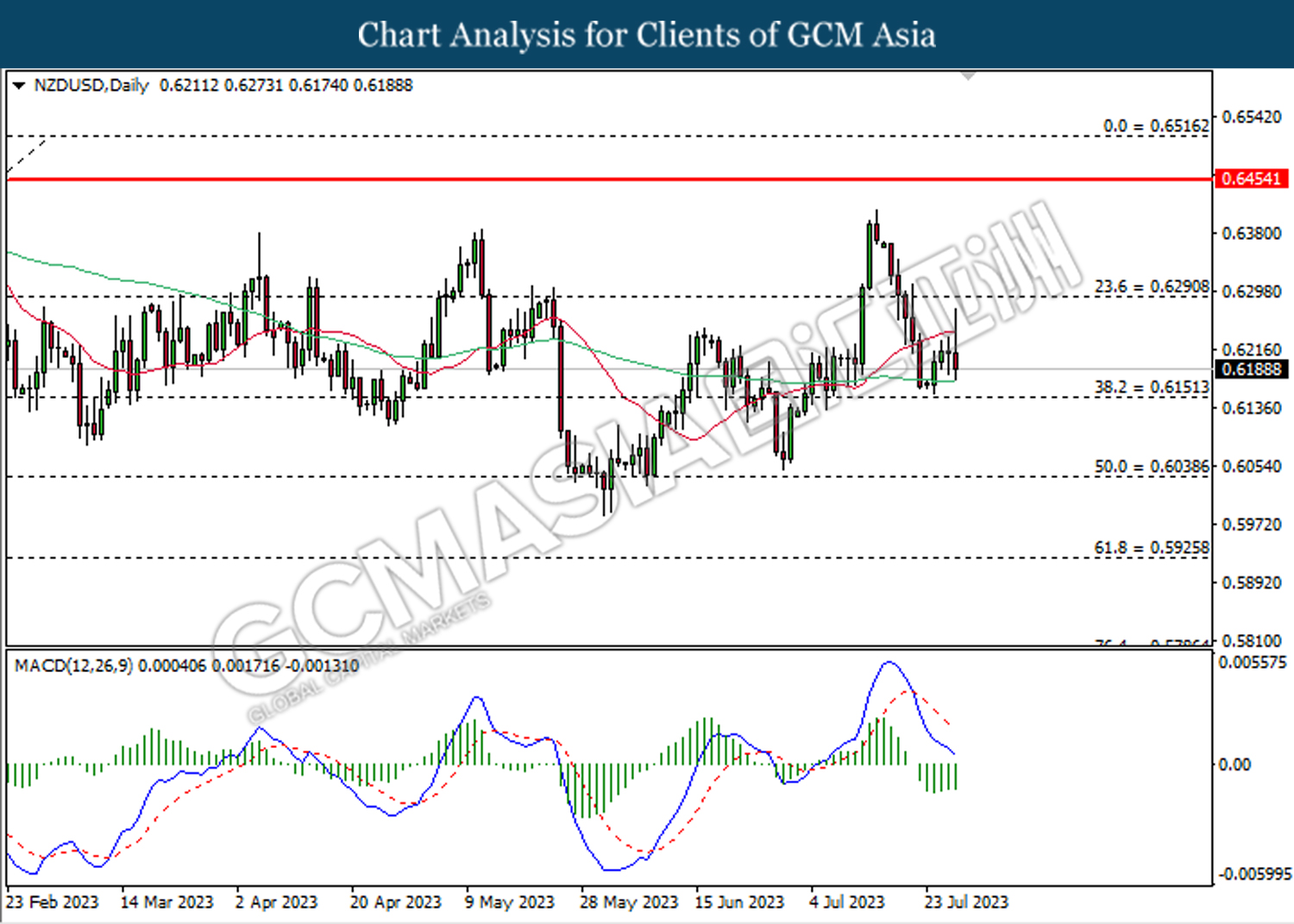

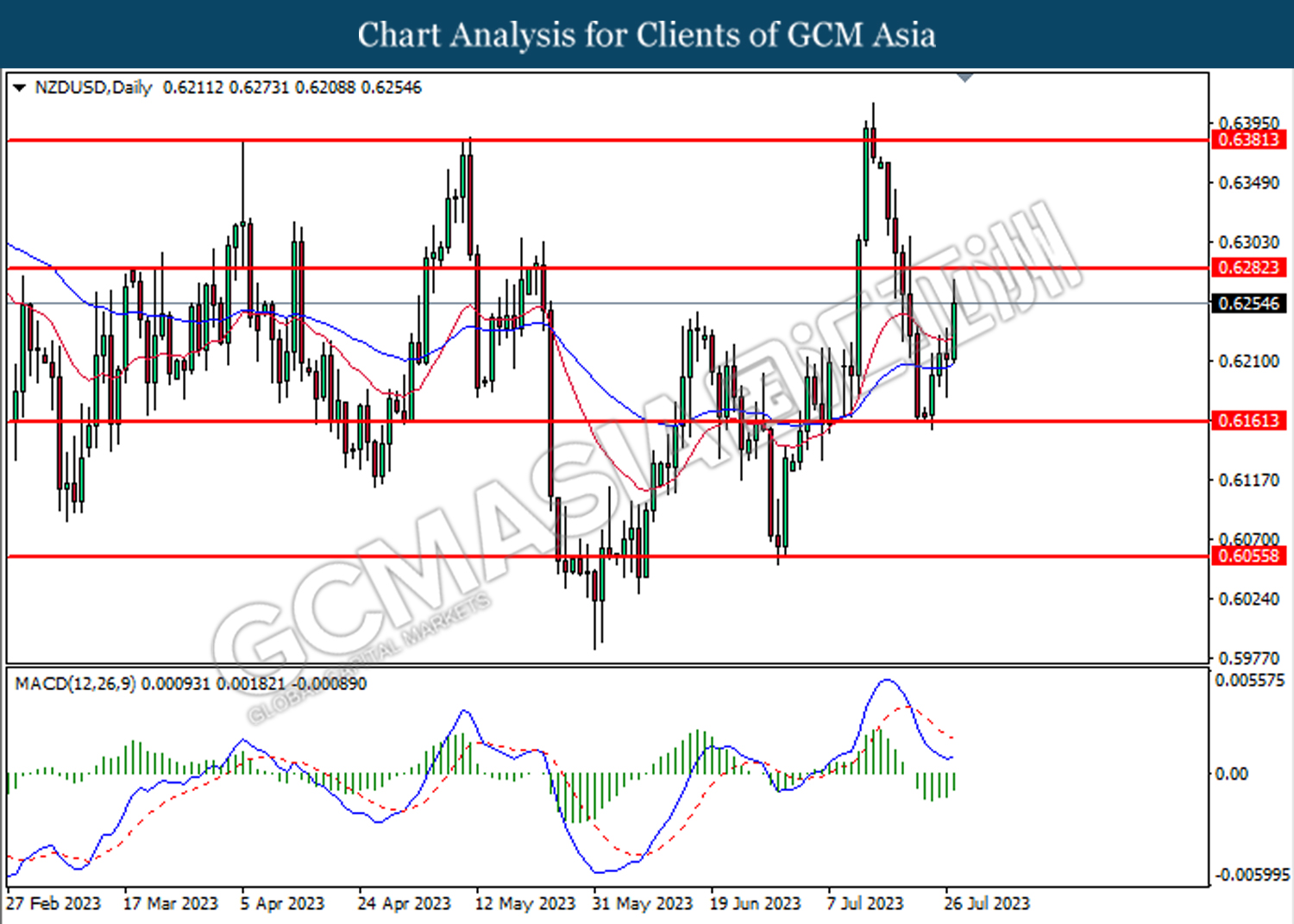

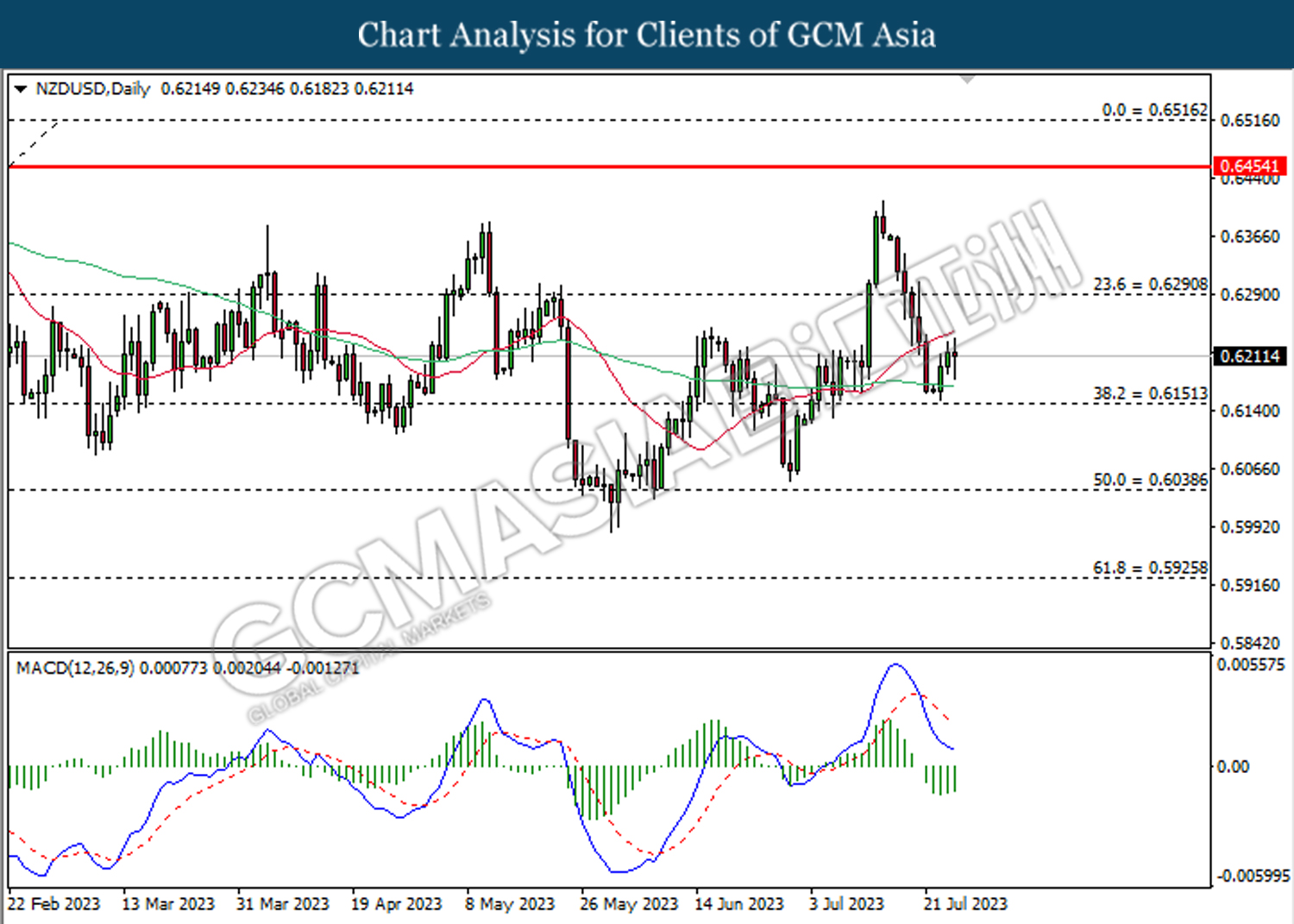

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

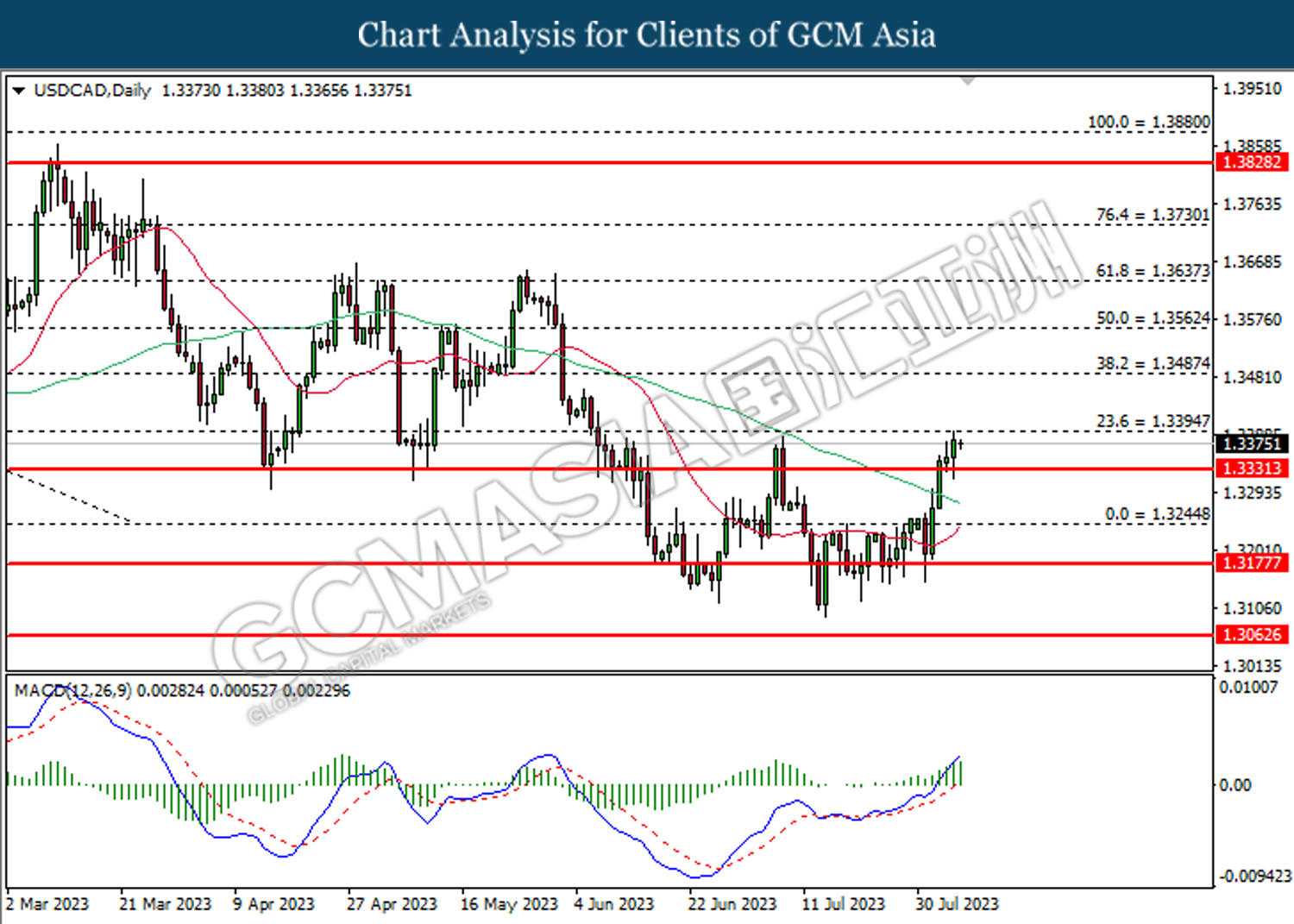

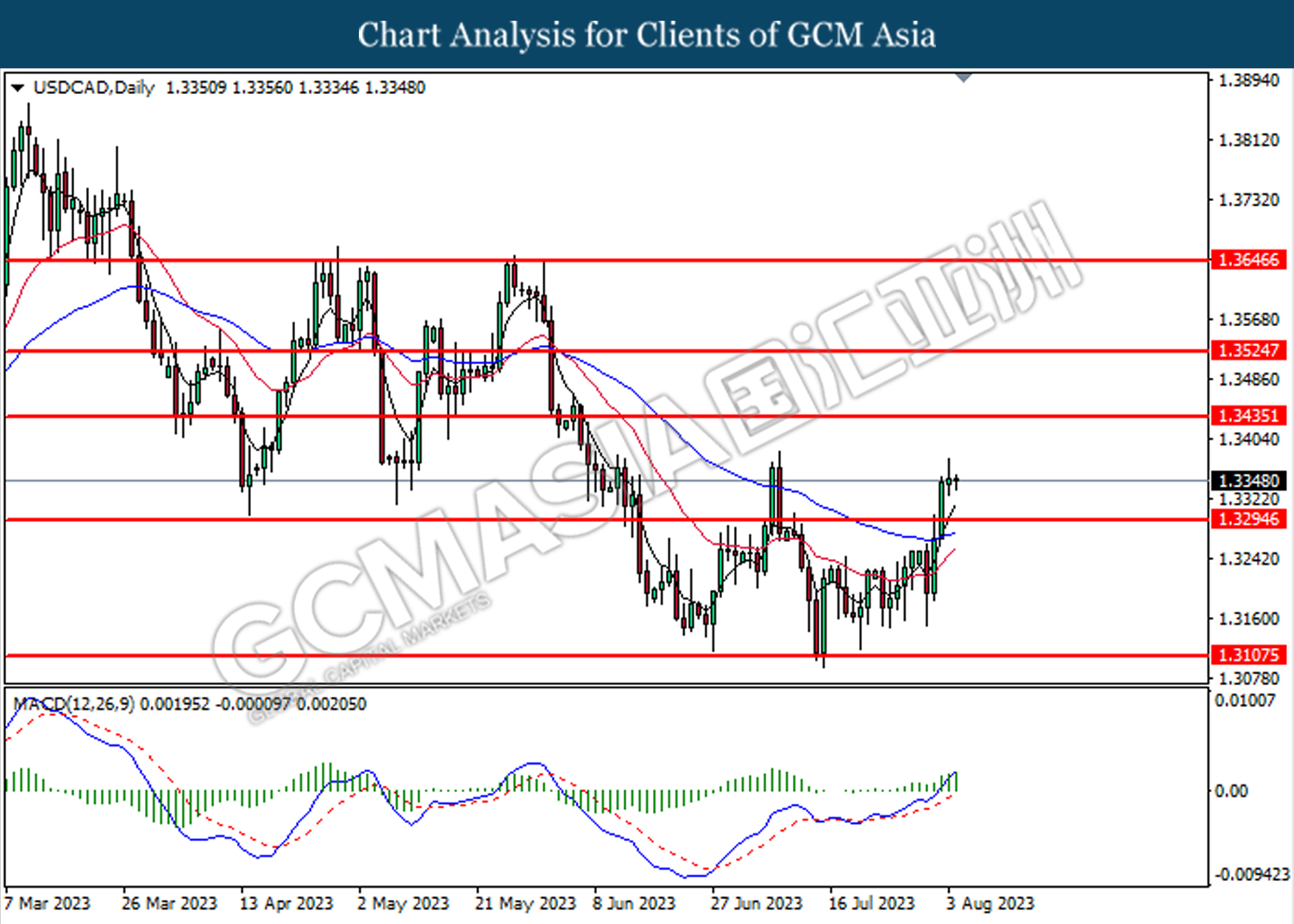

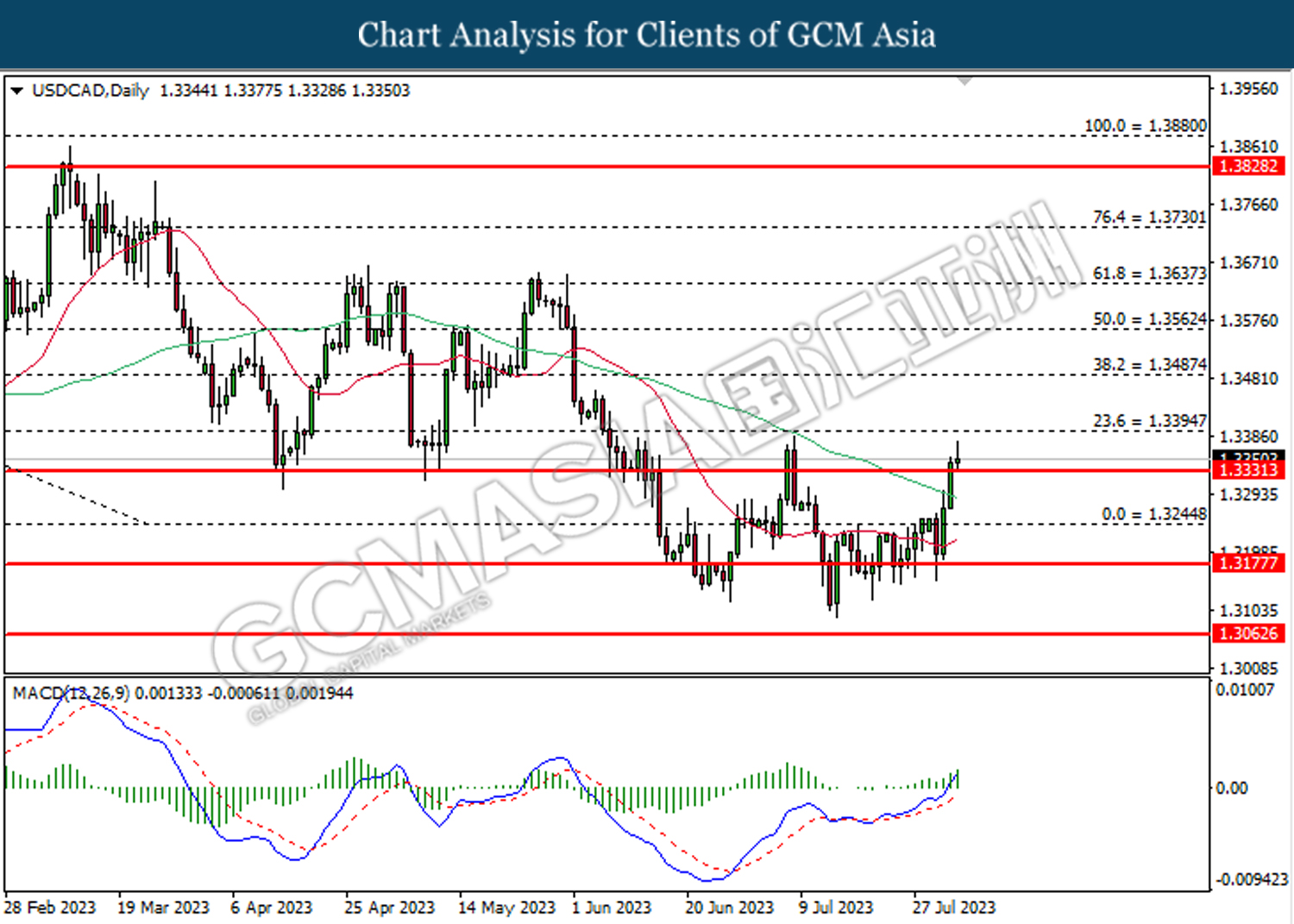

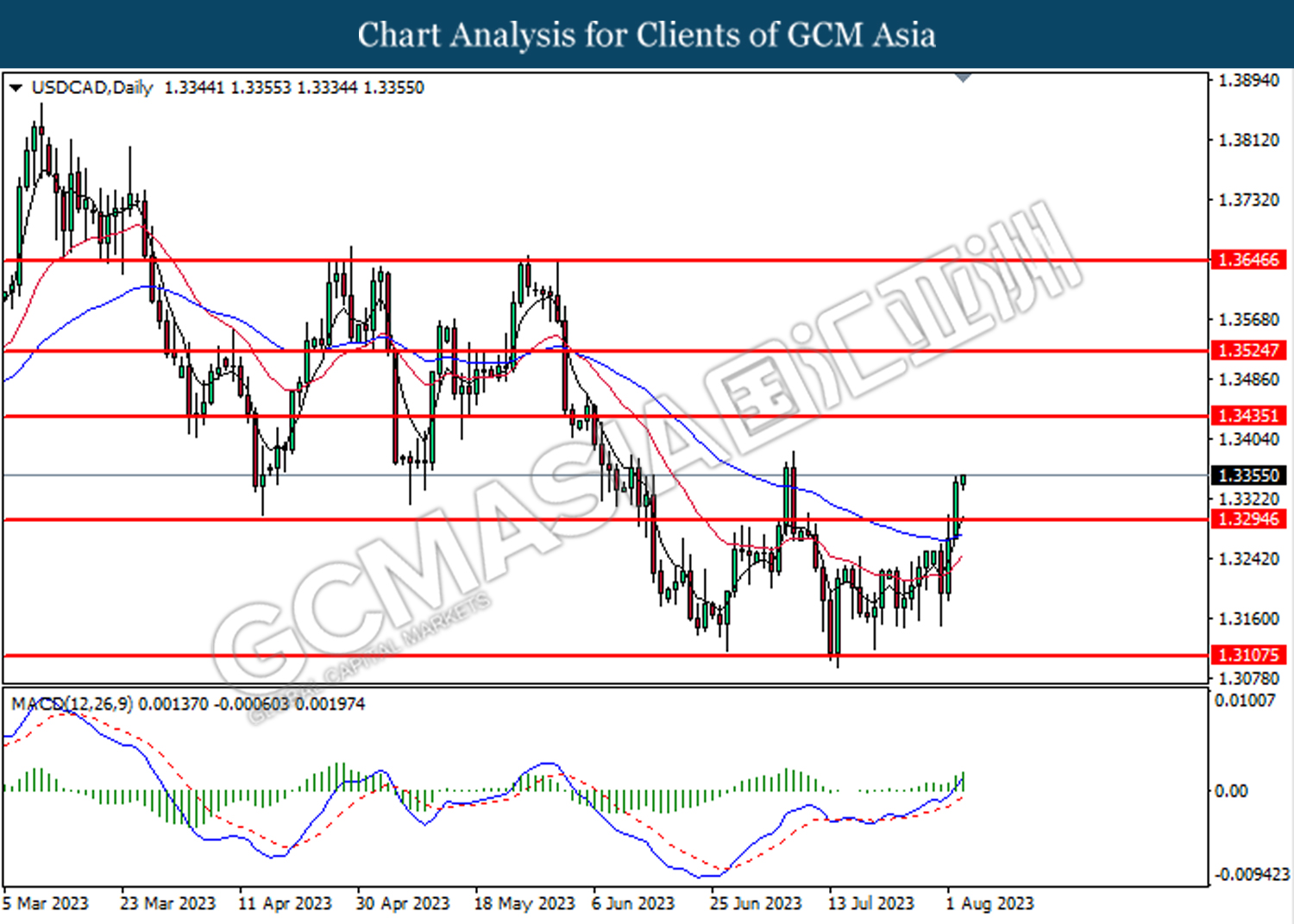

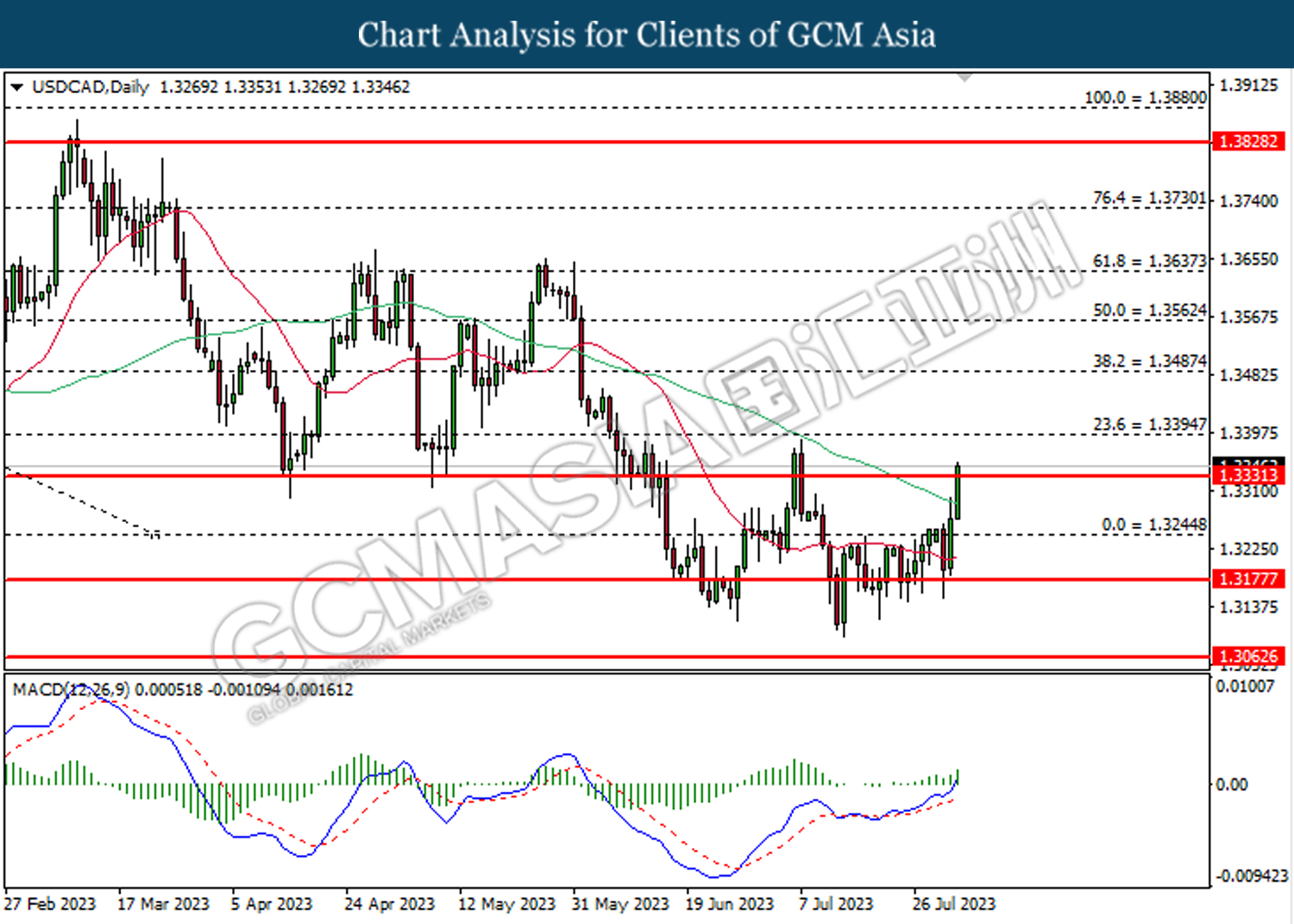

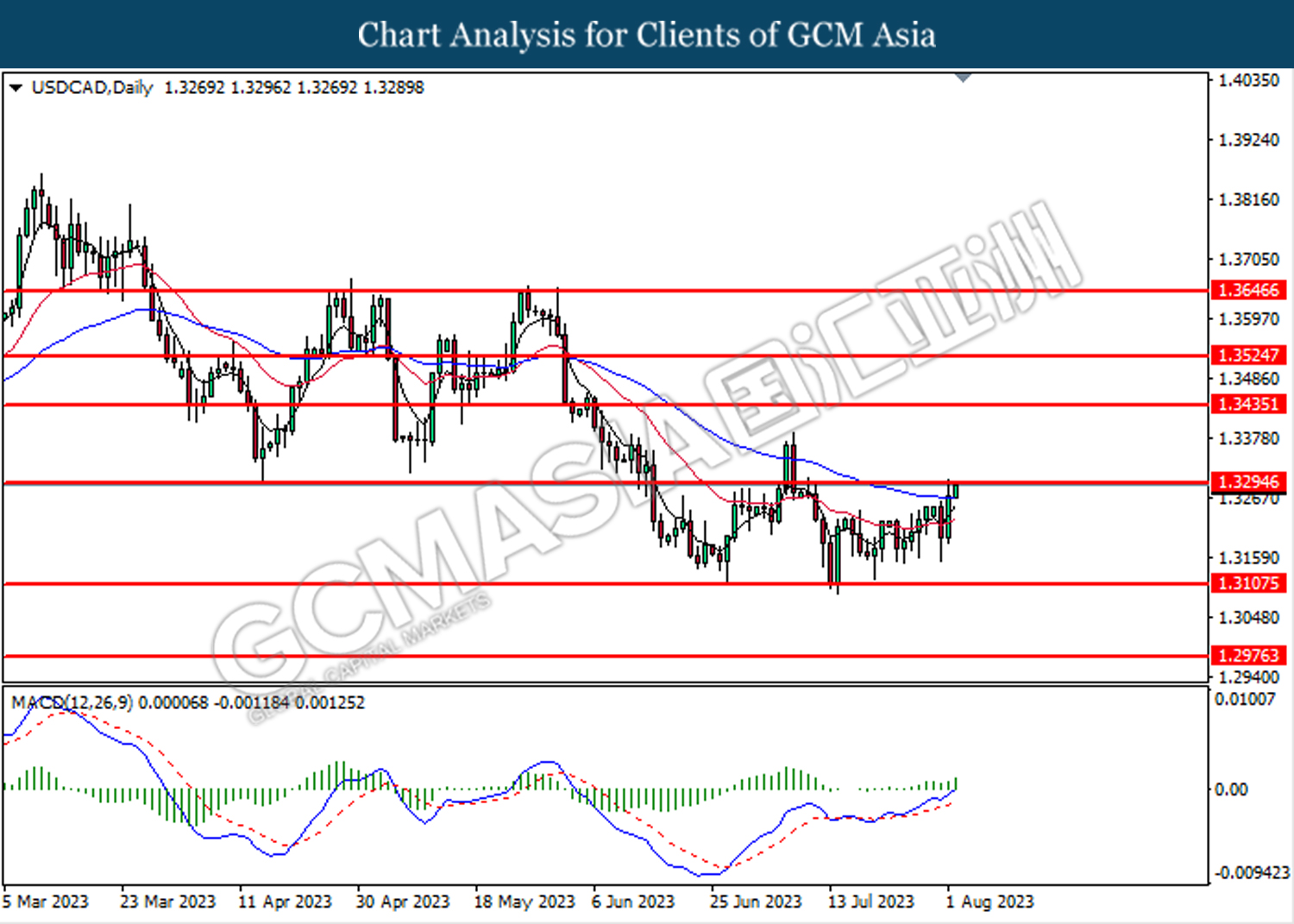

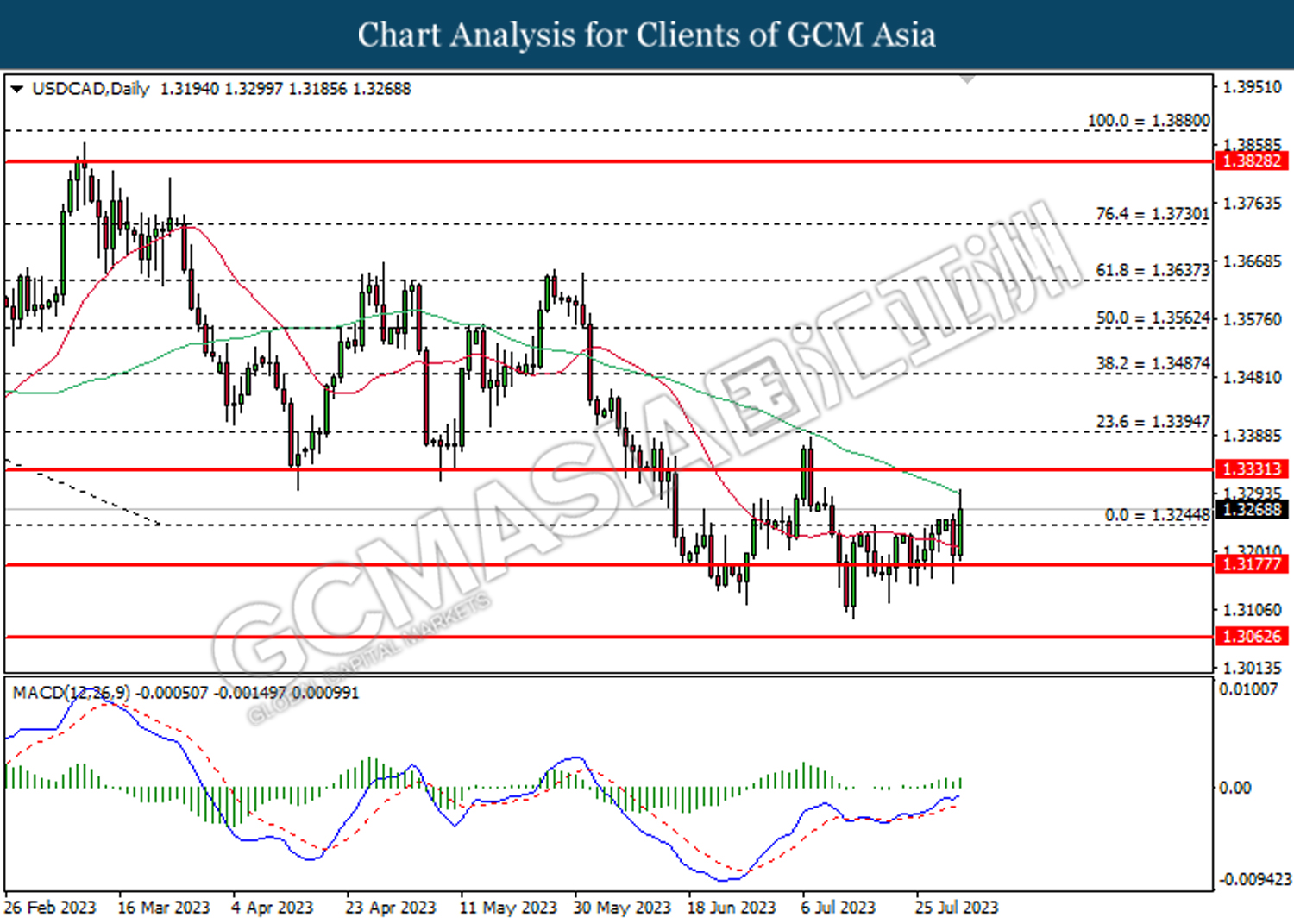

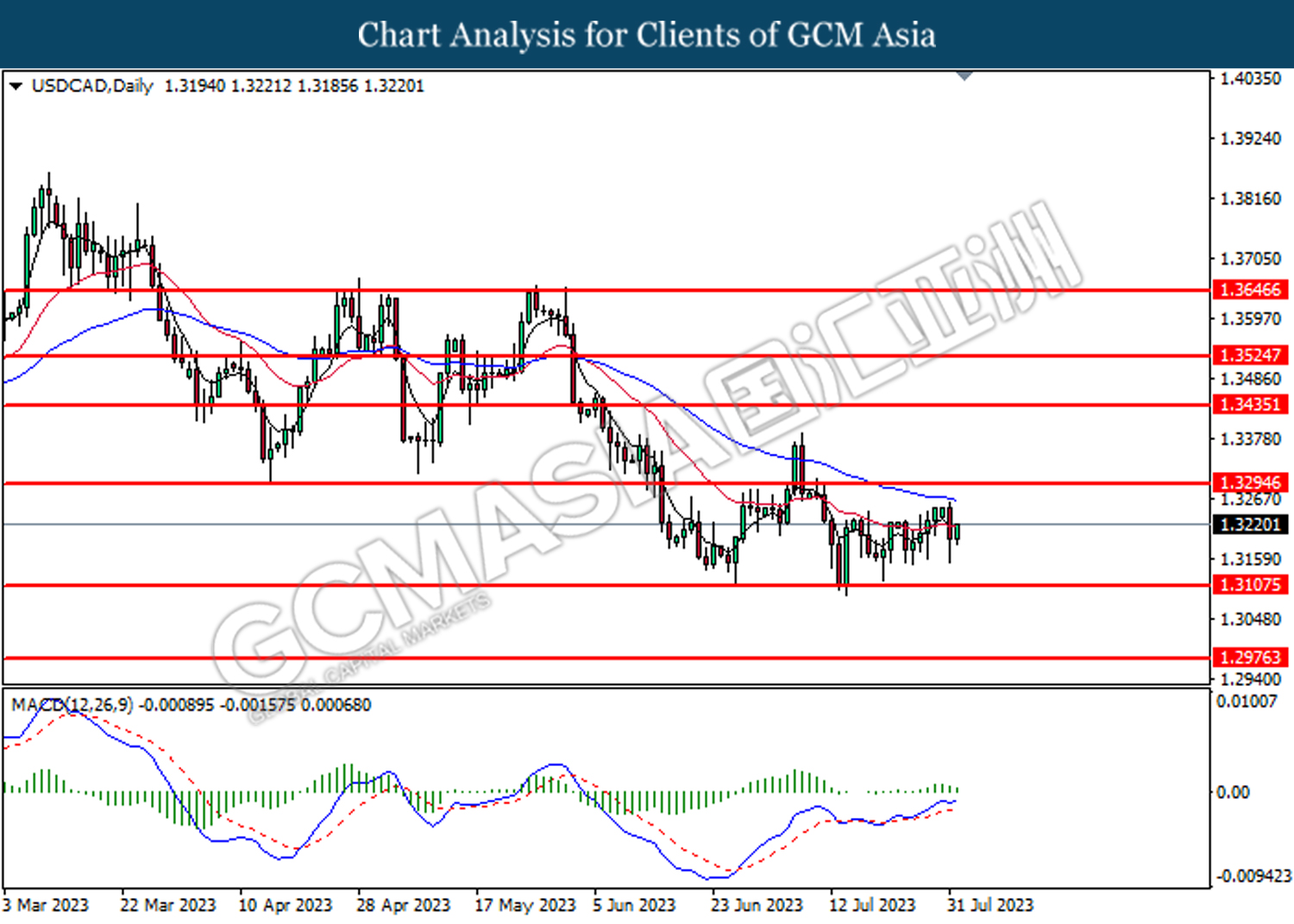

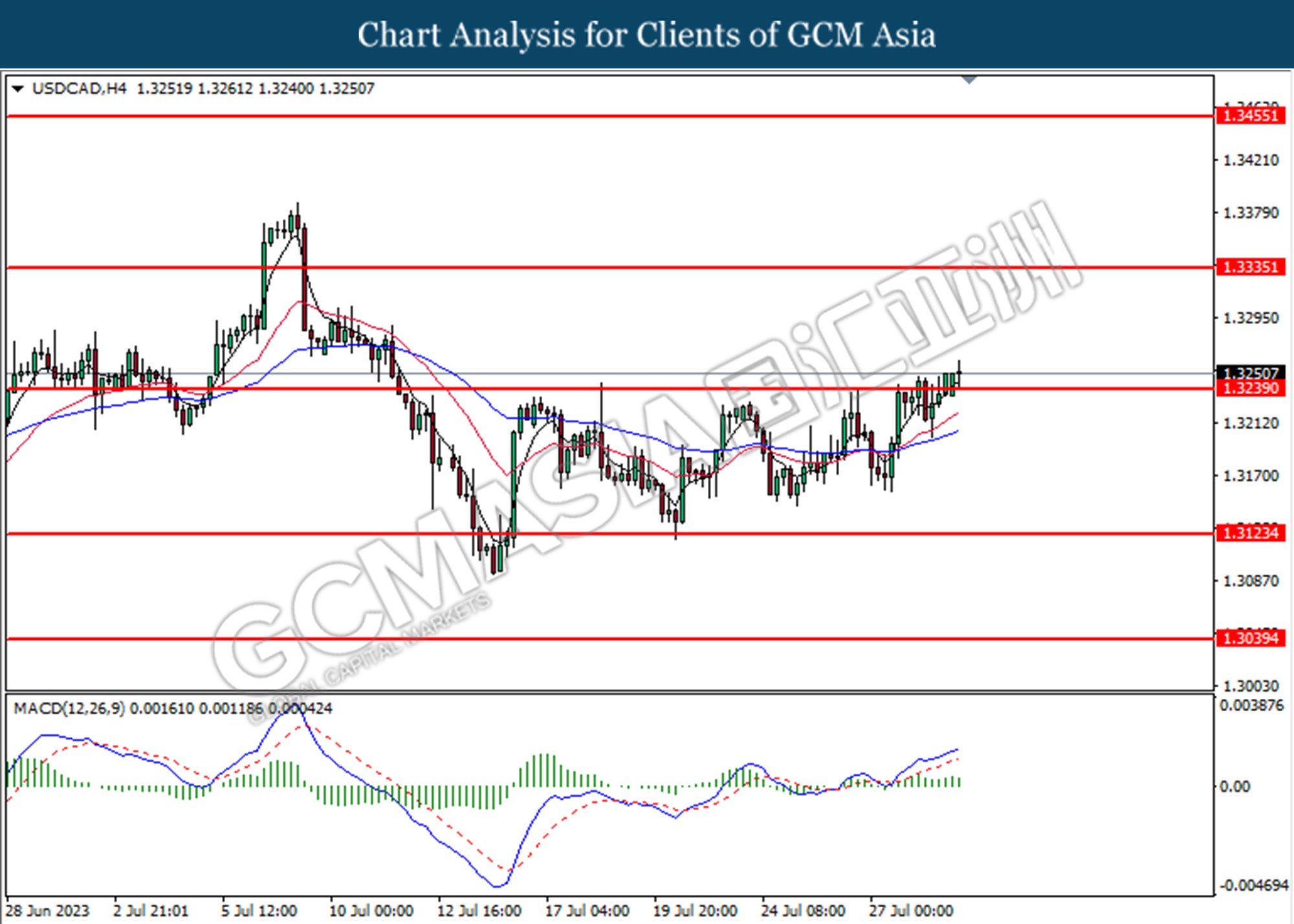

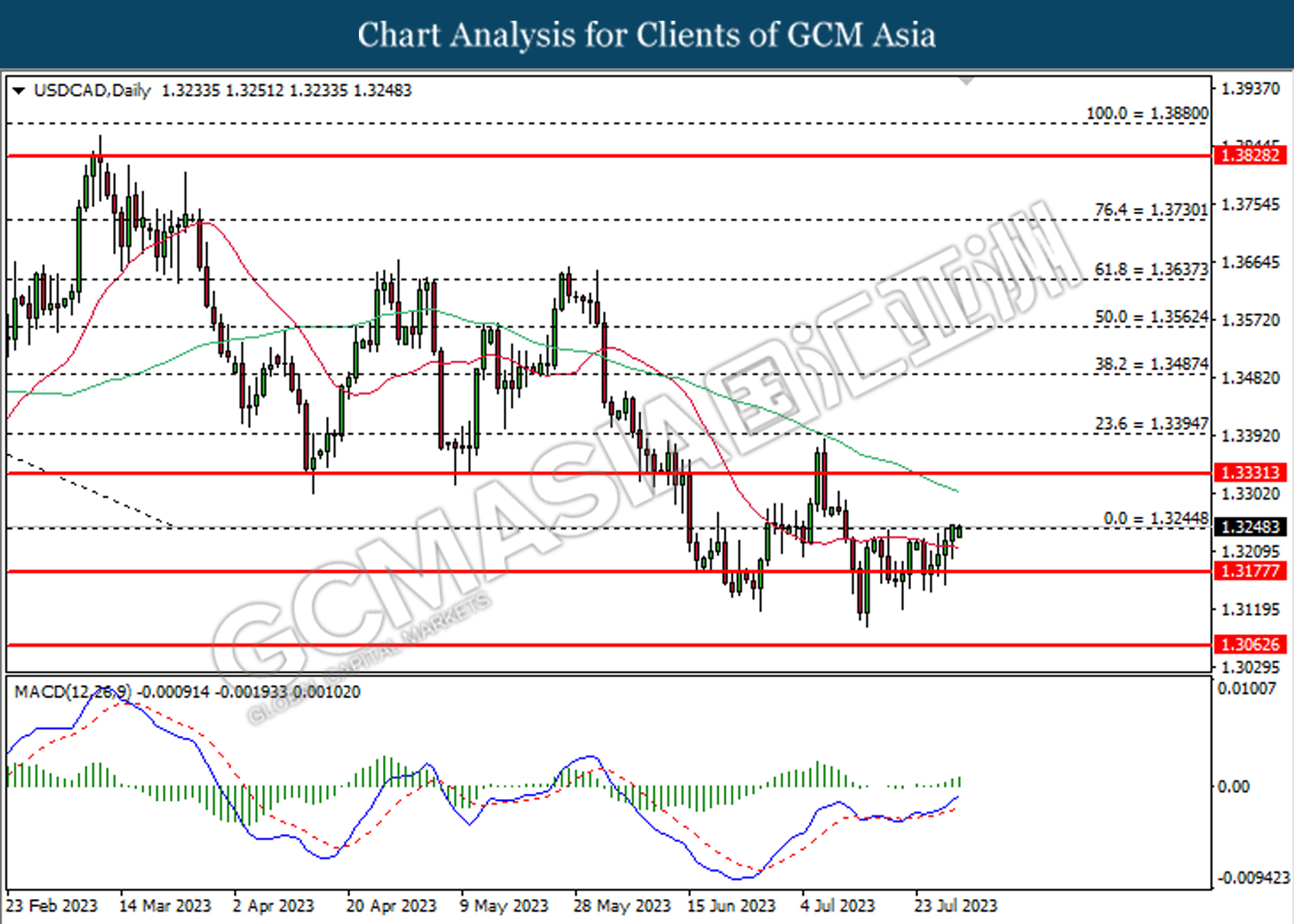

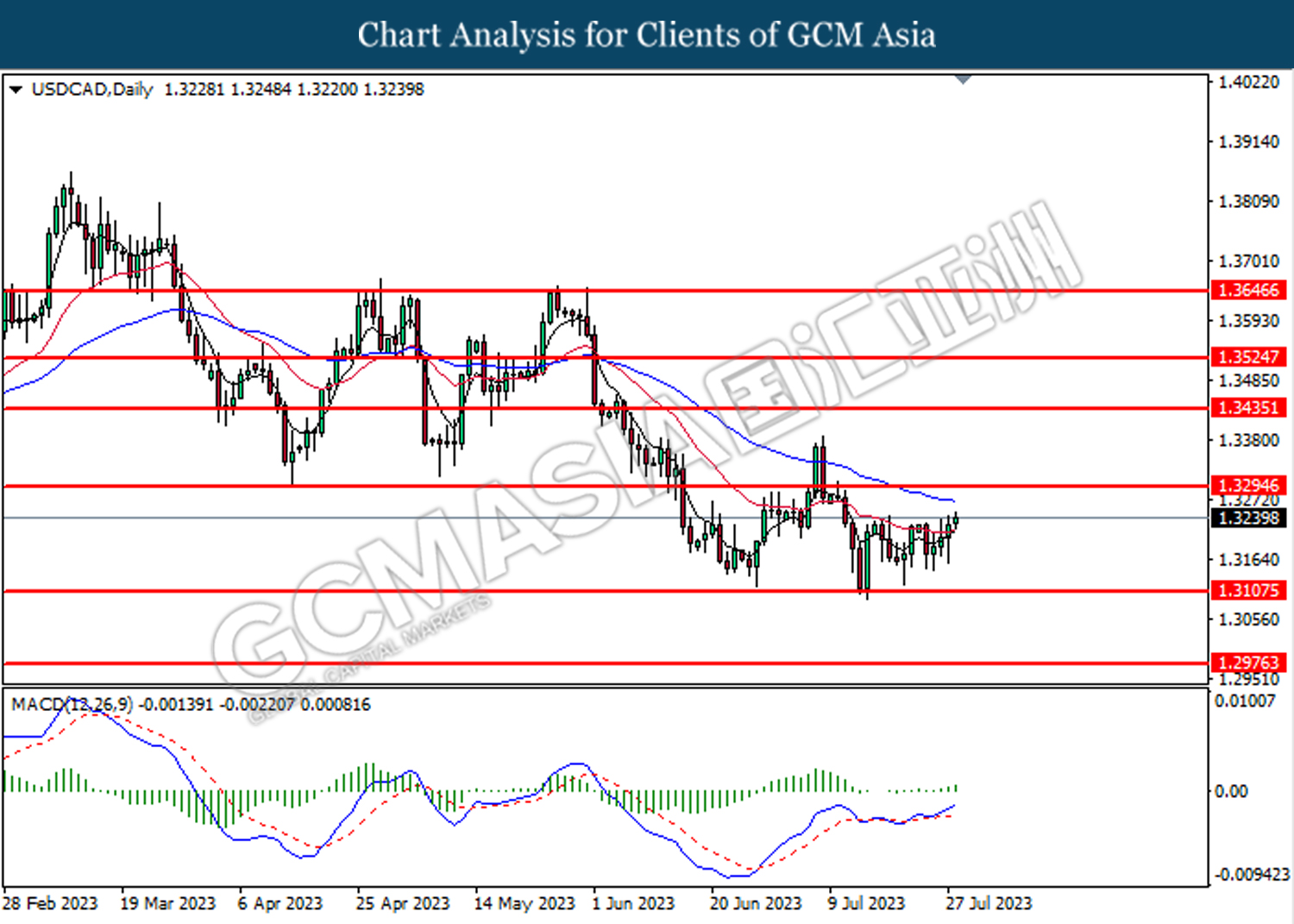

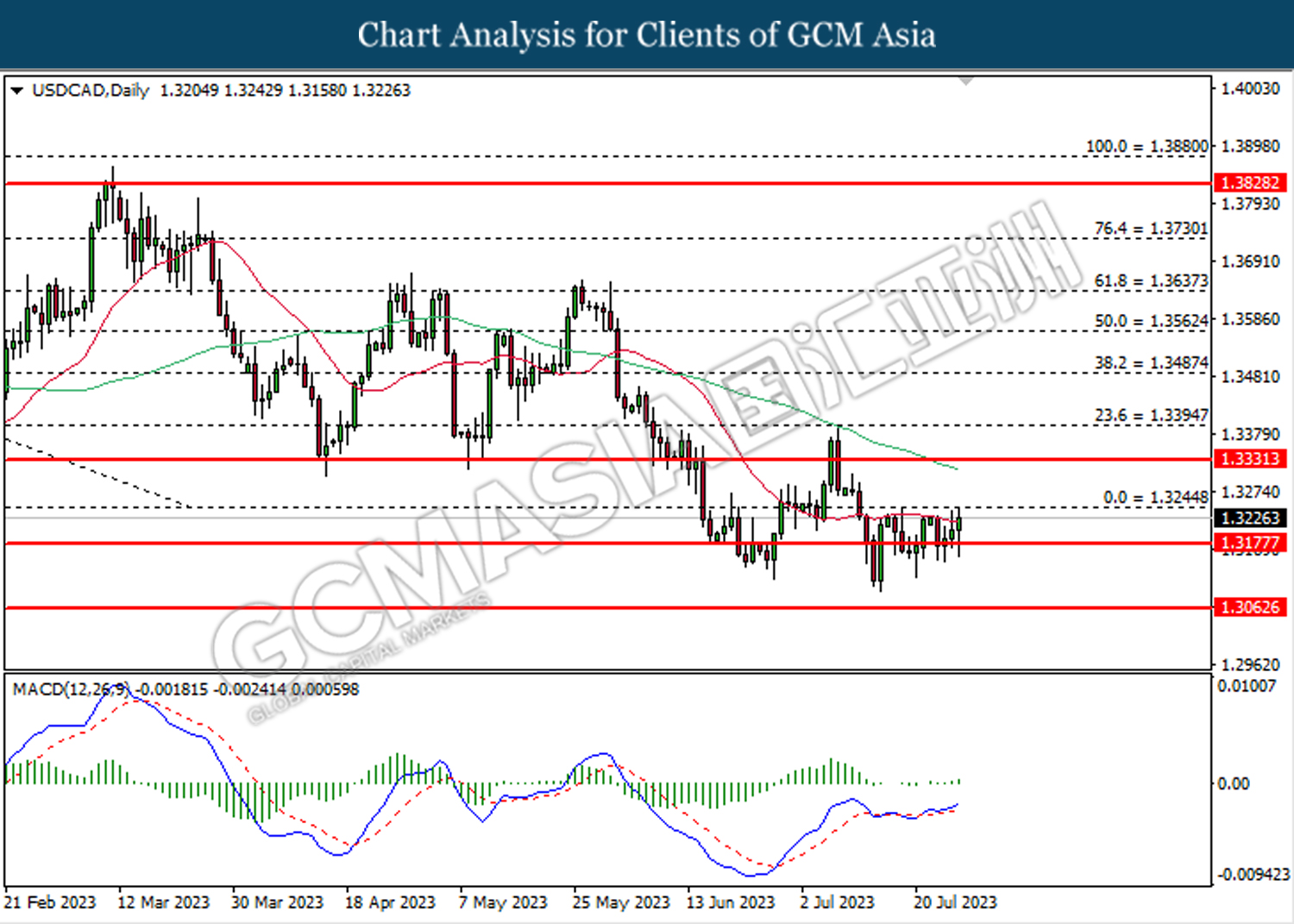

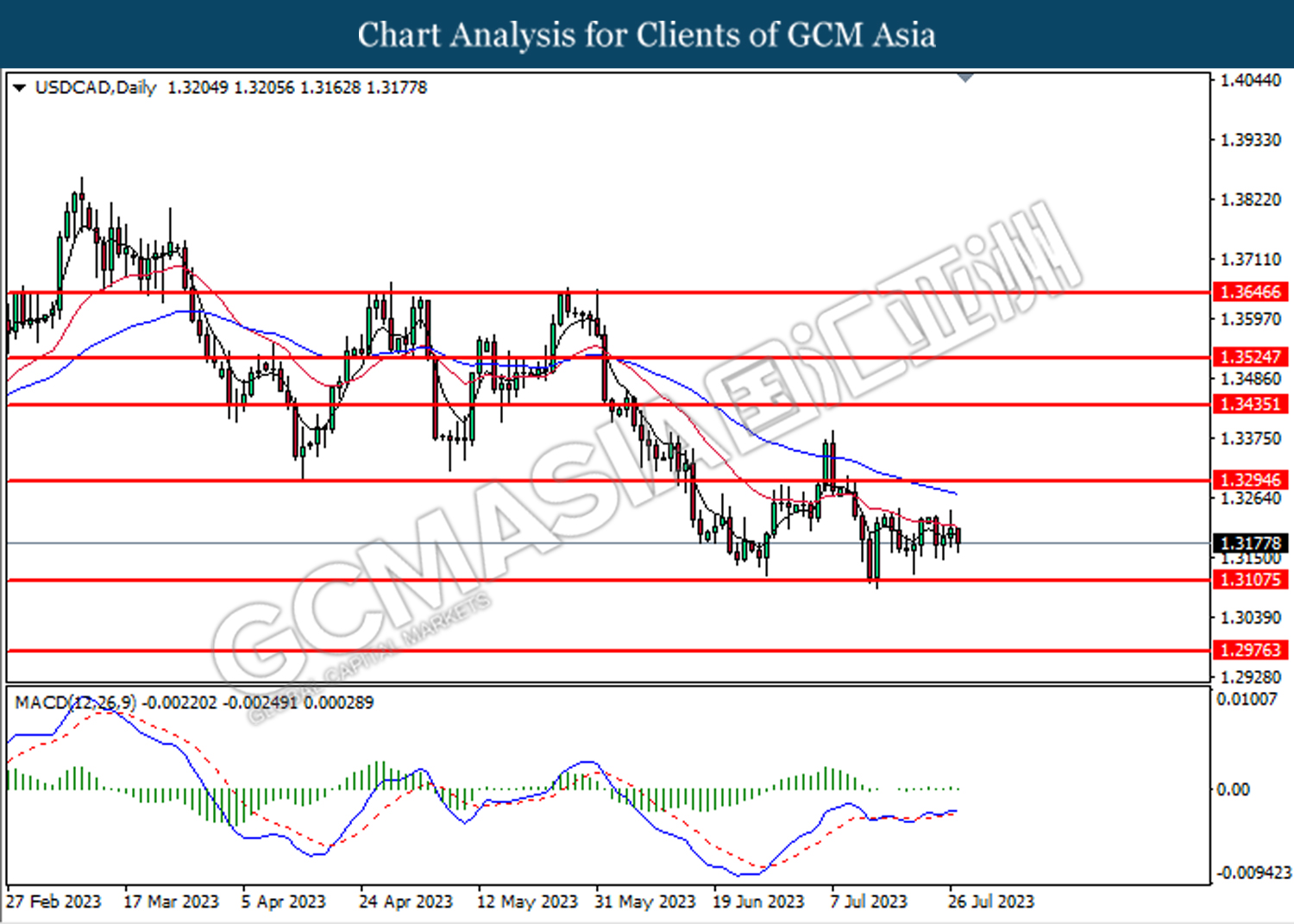

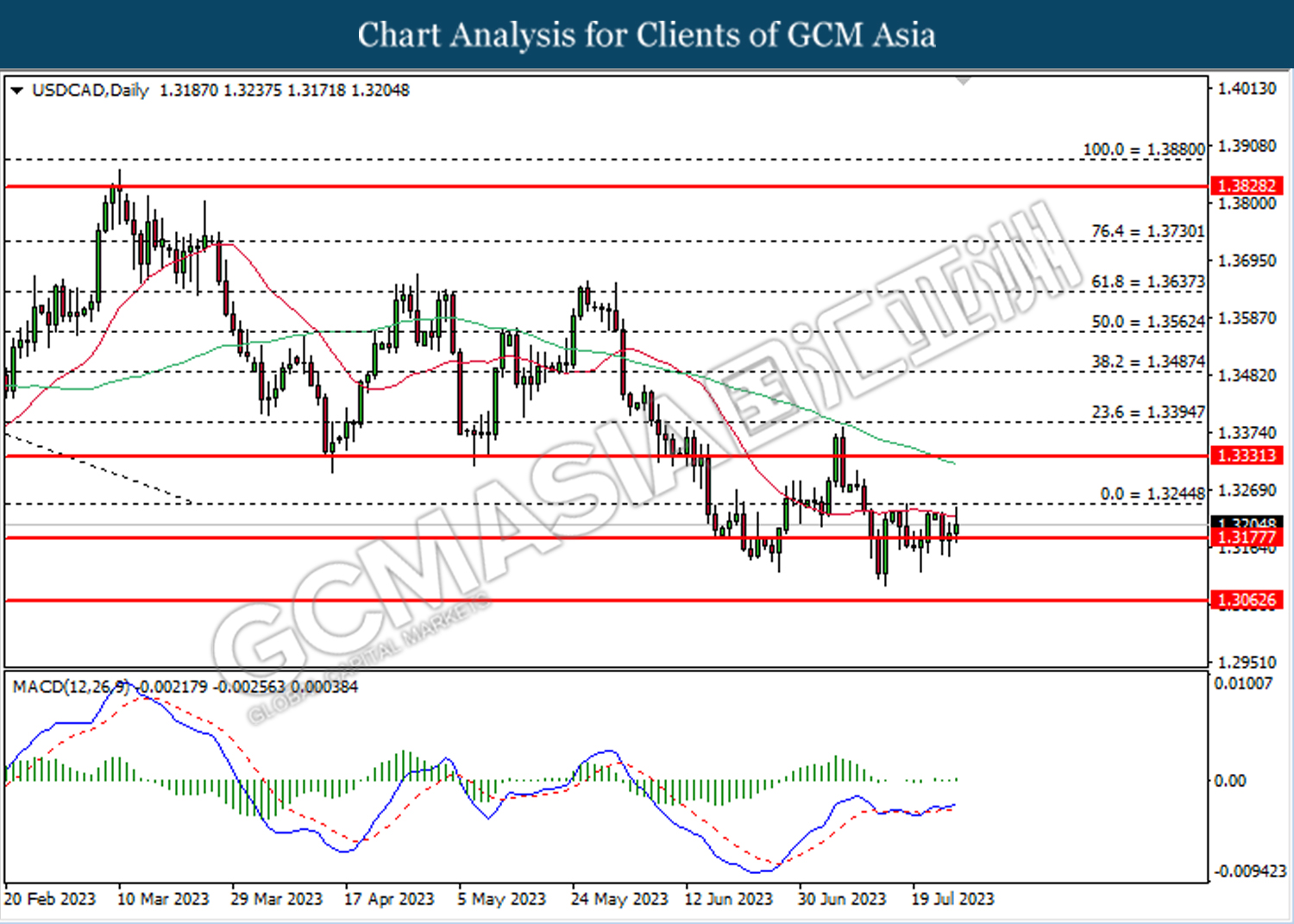

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3330. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3395.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

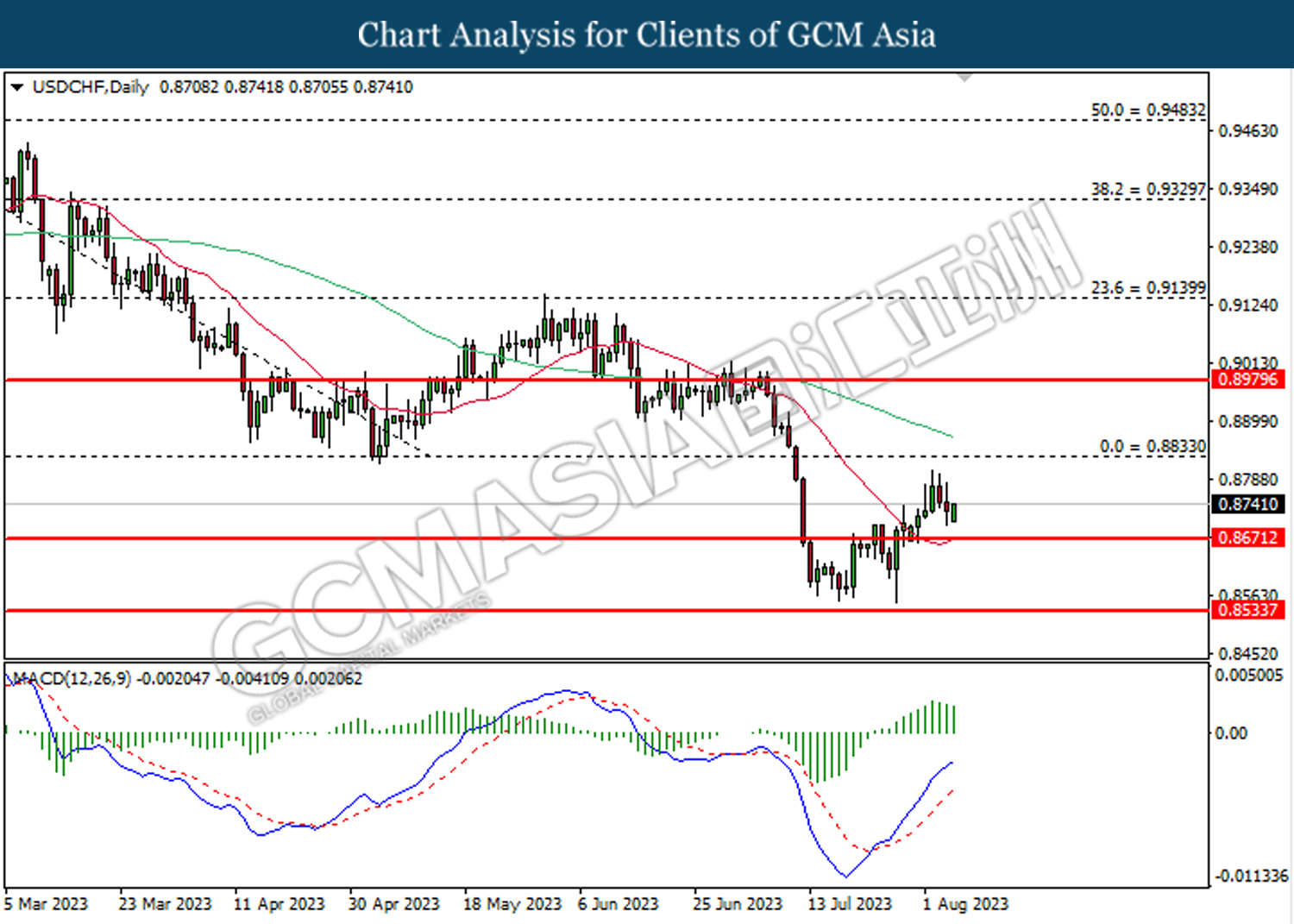

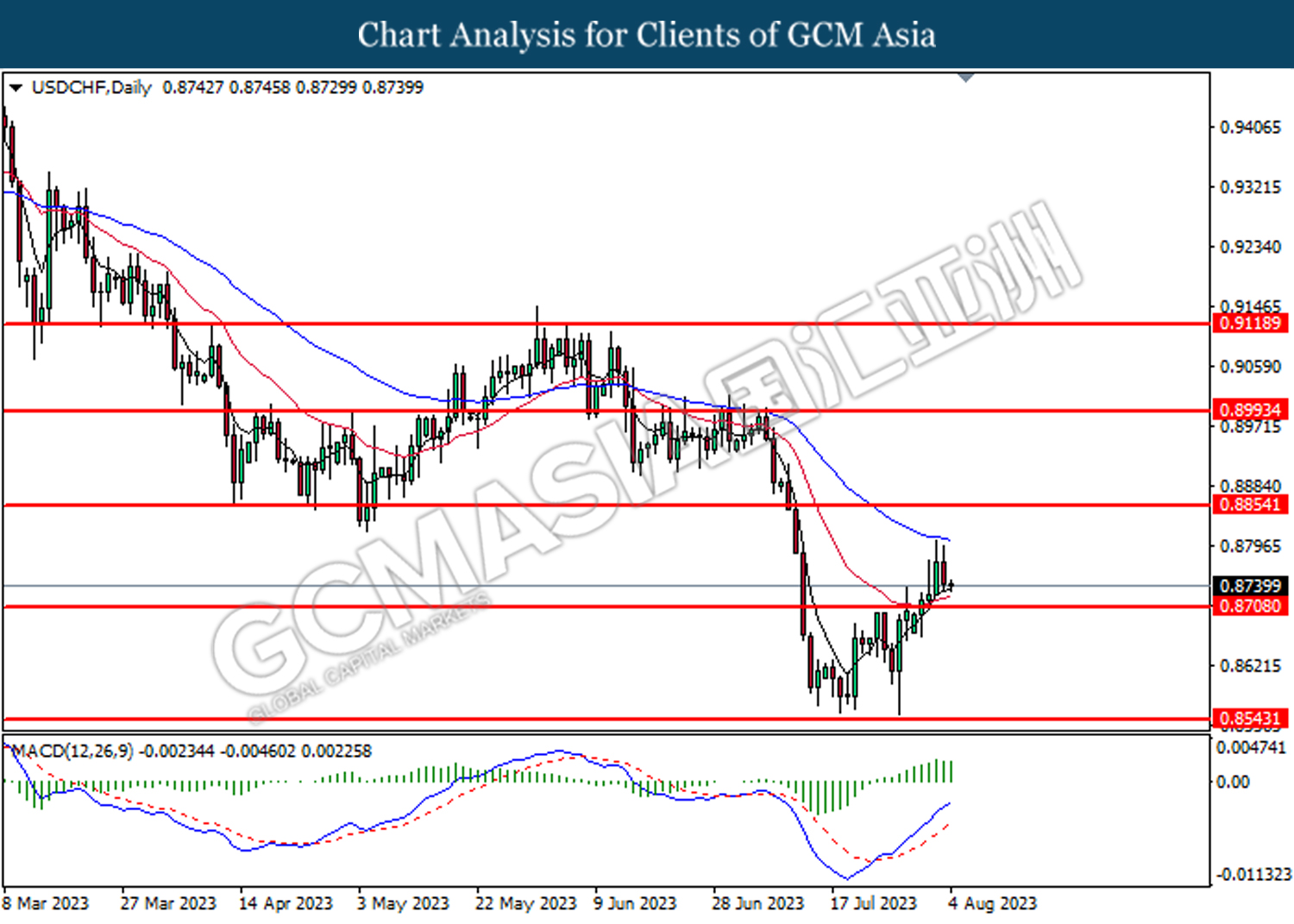

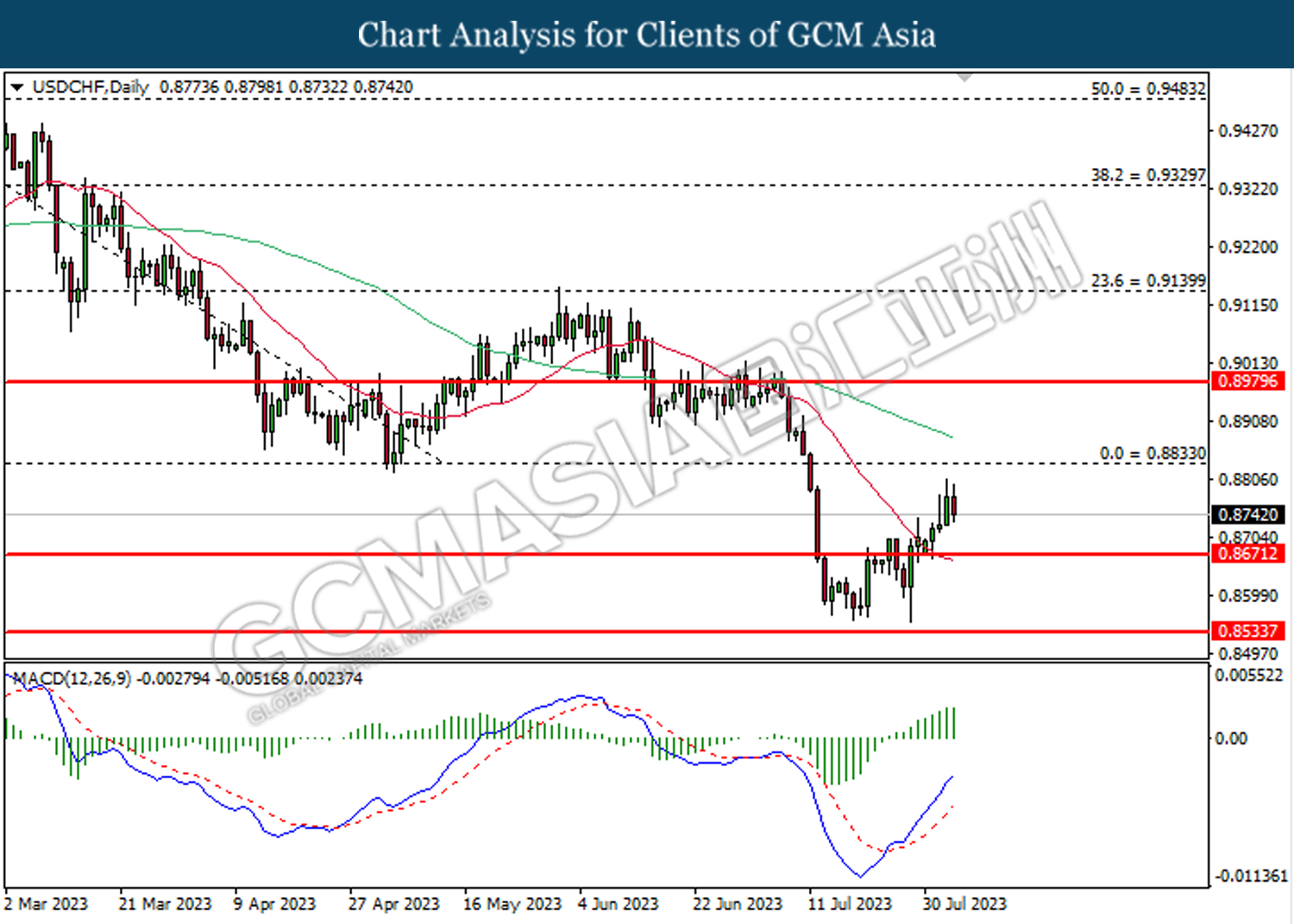

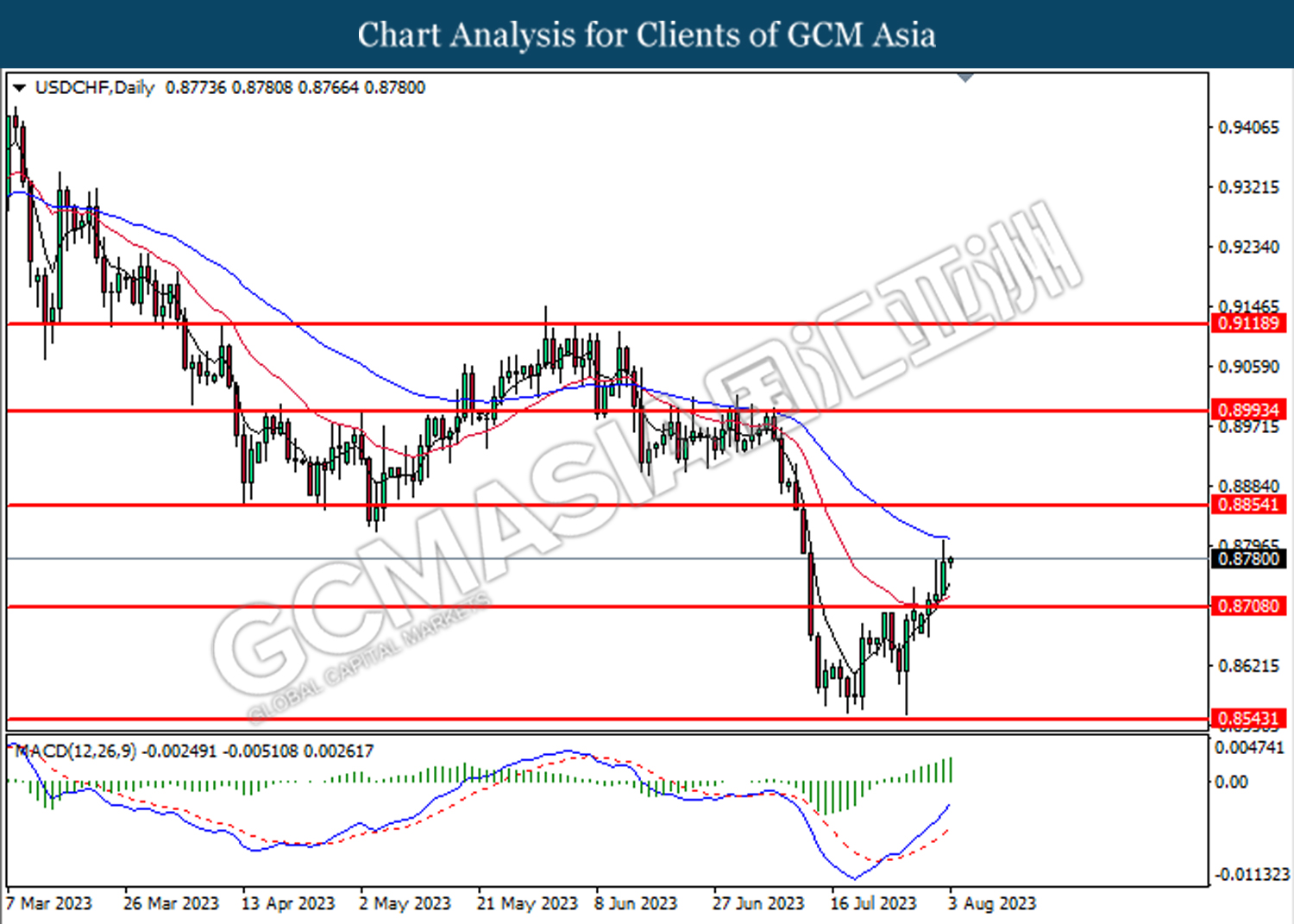

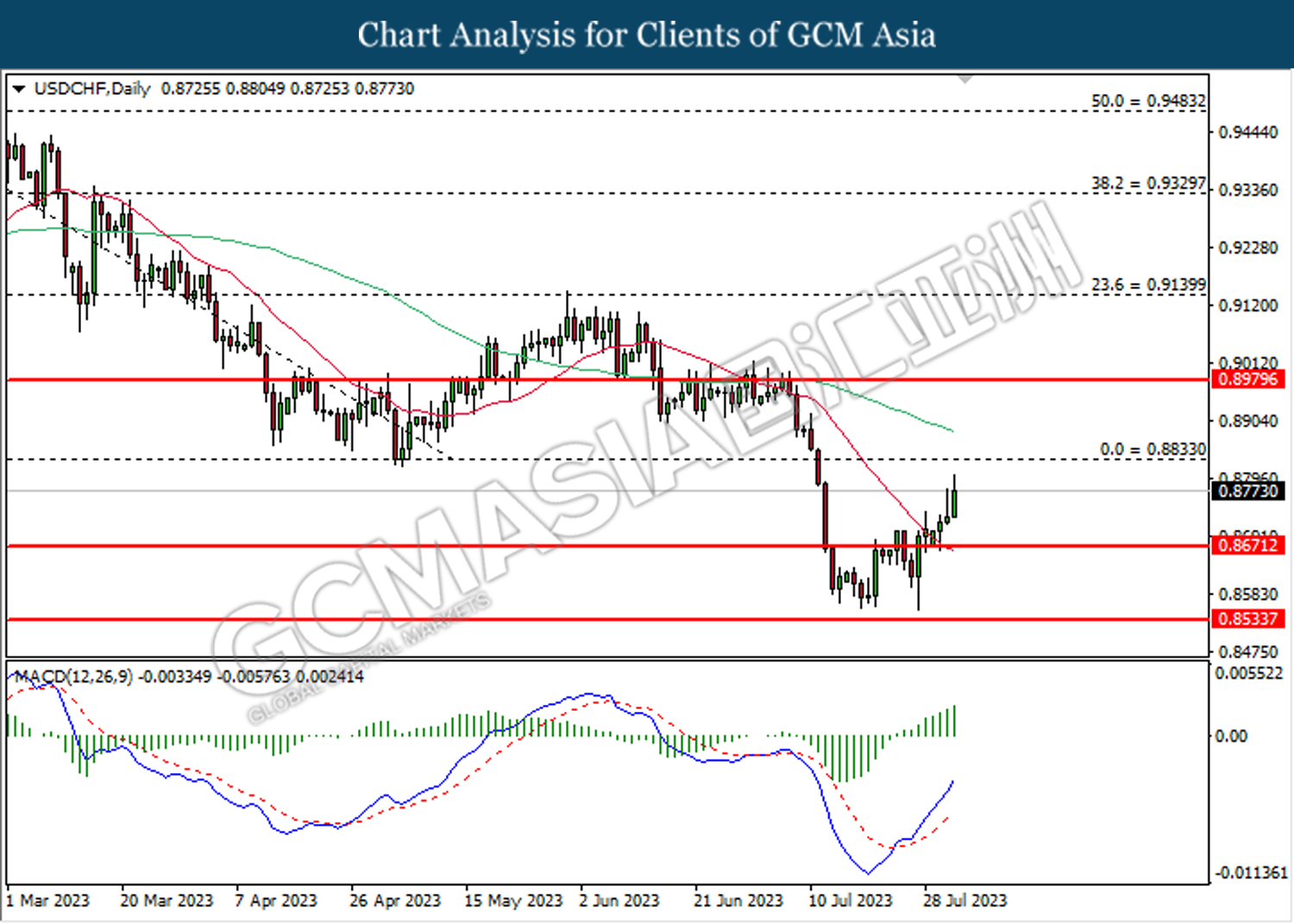

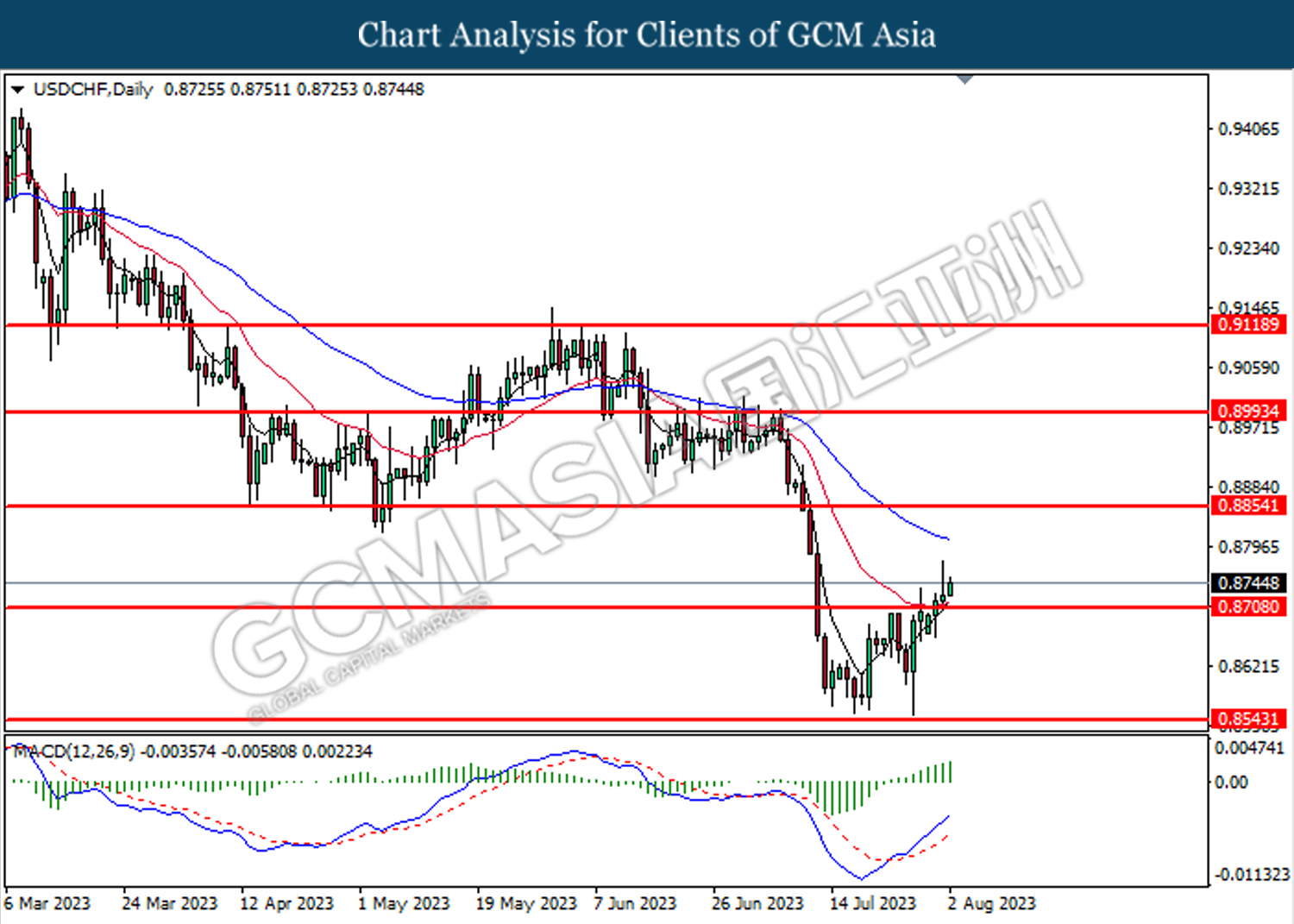

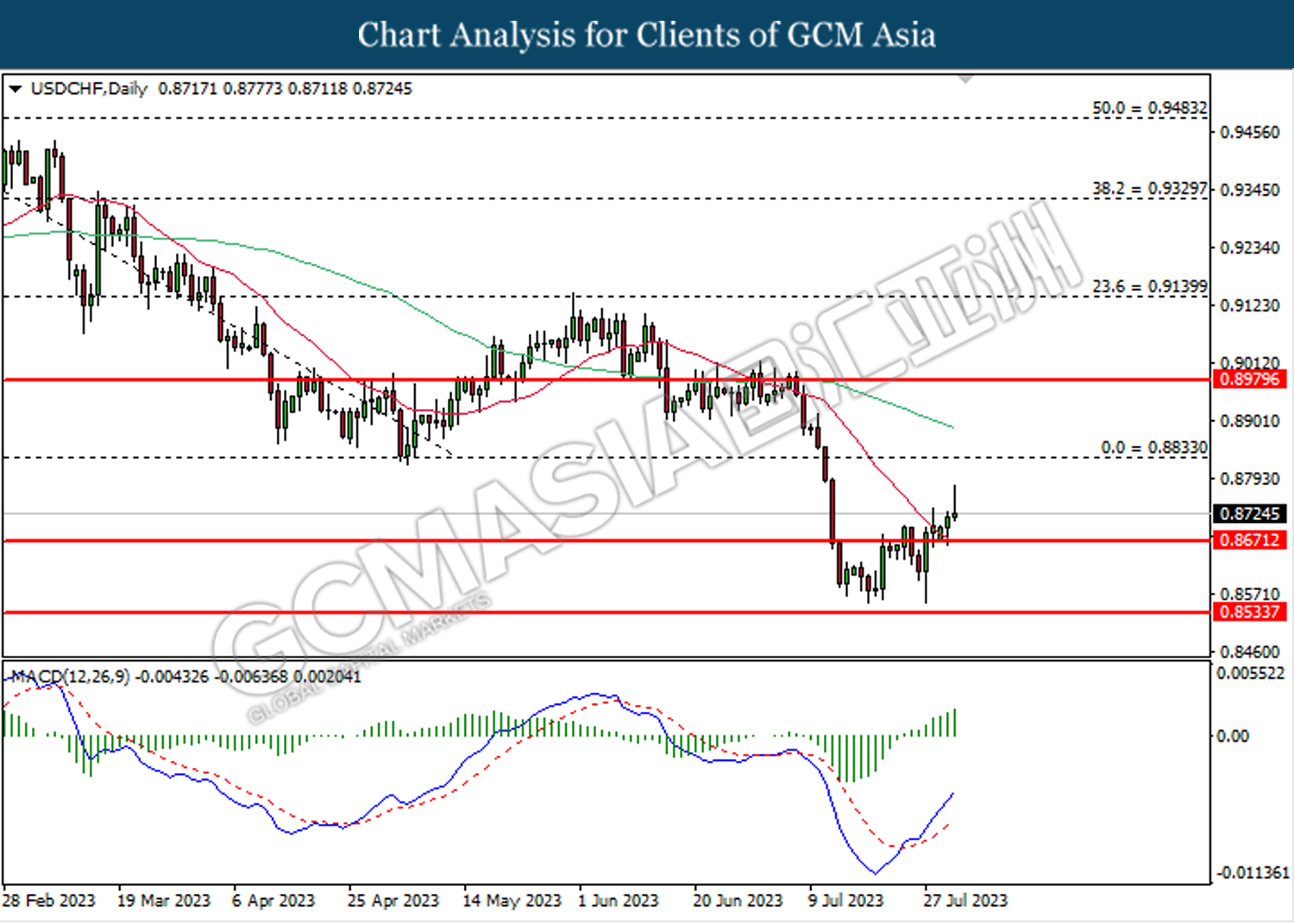

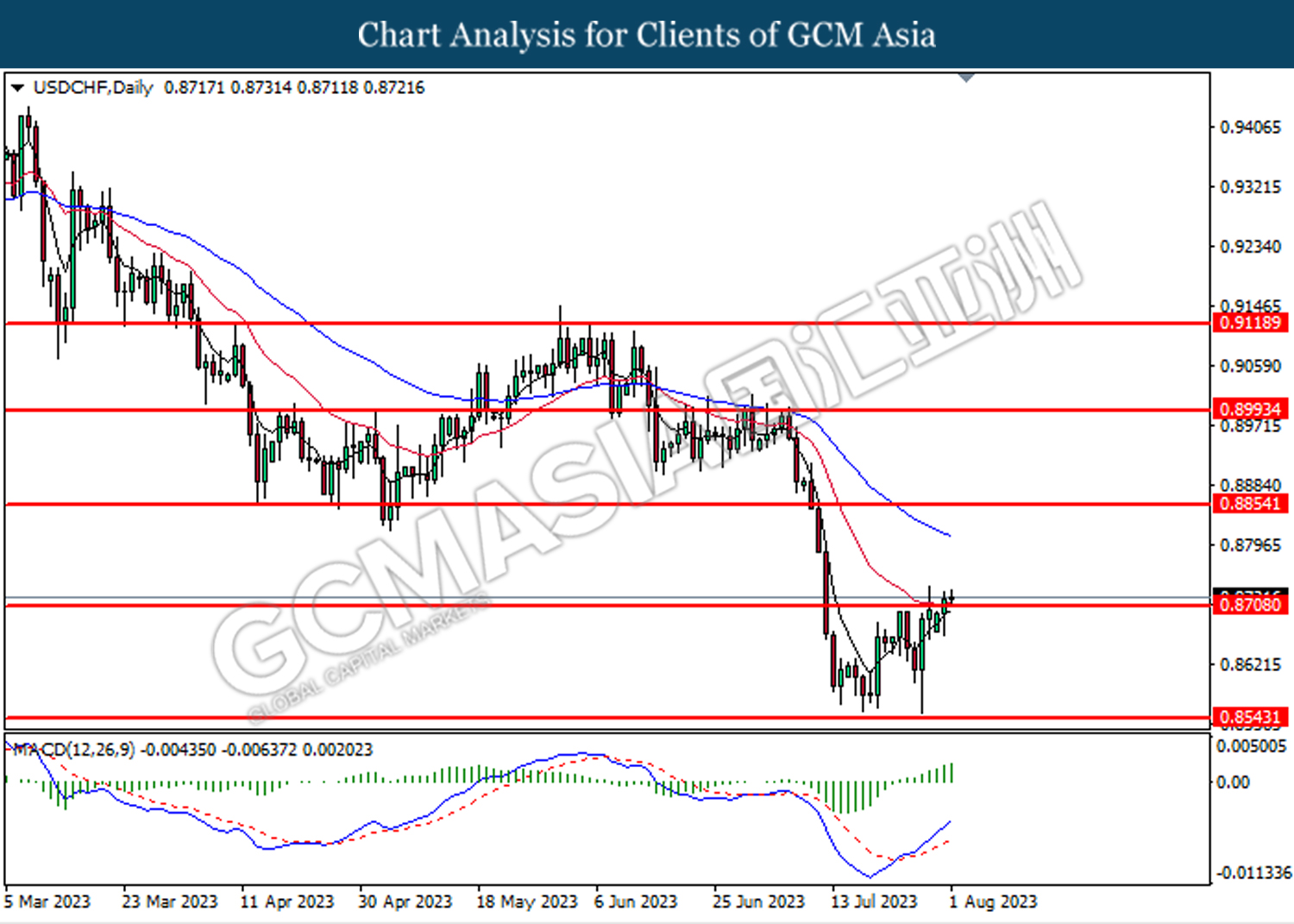

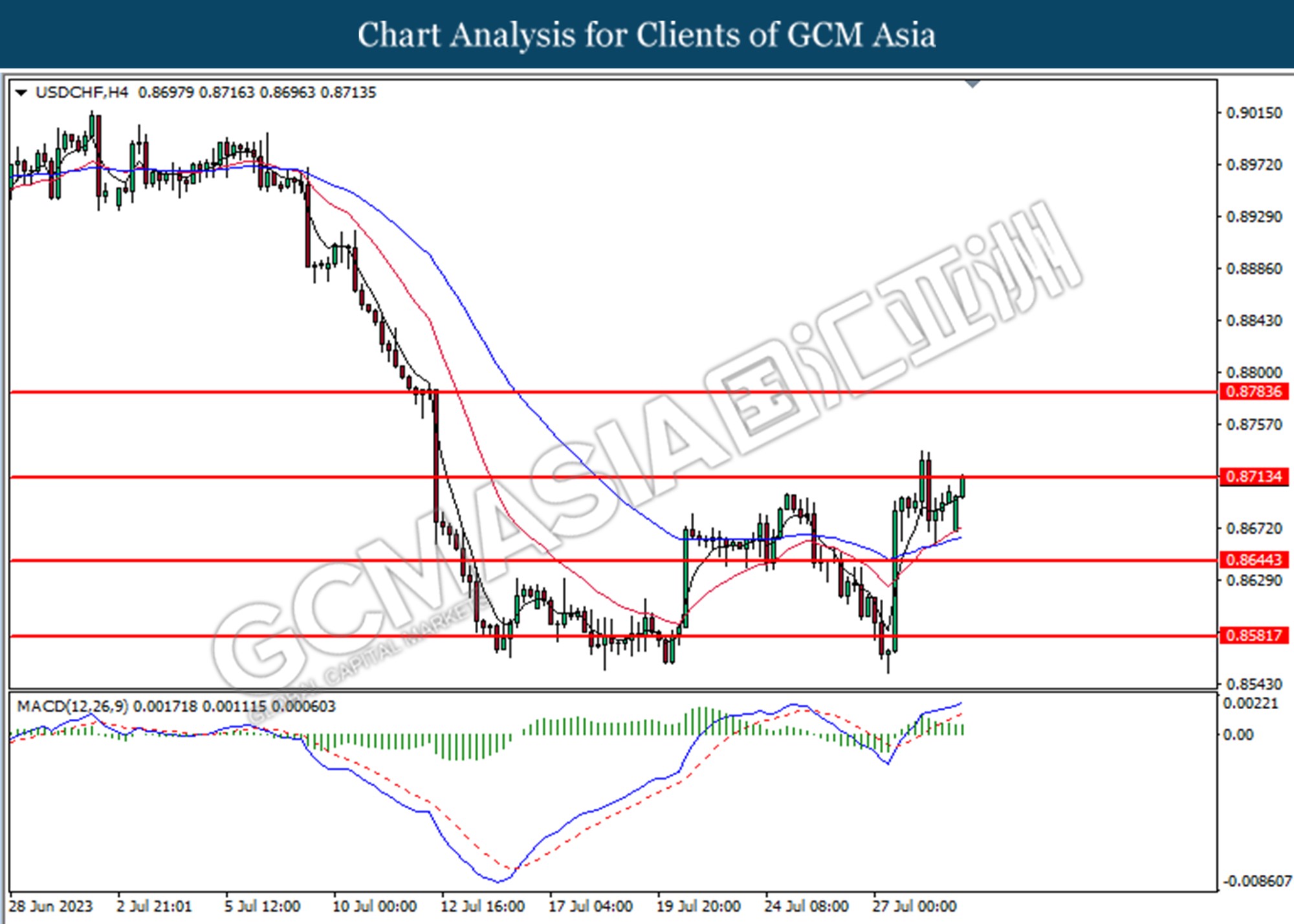

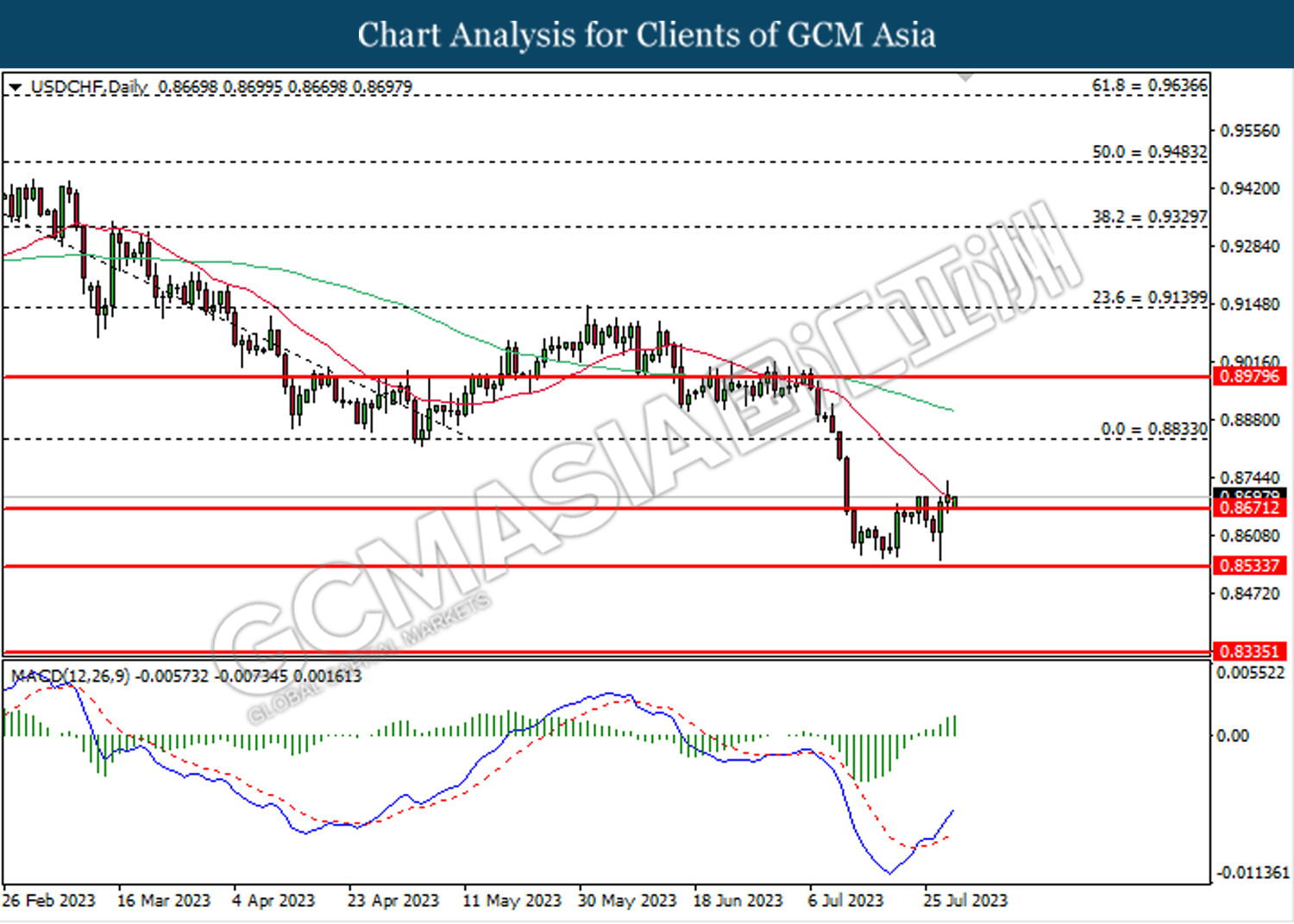

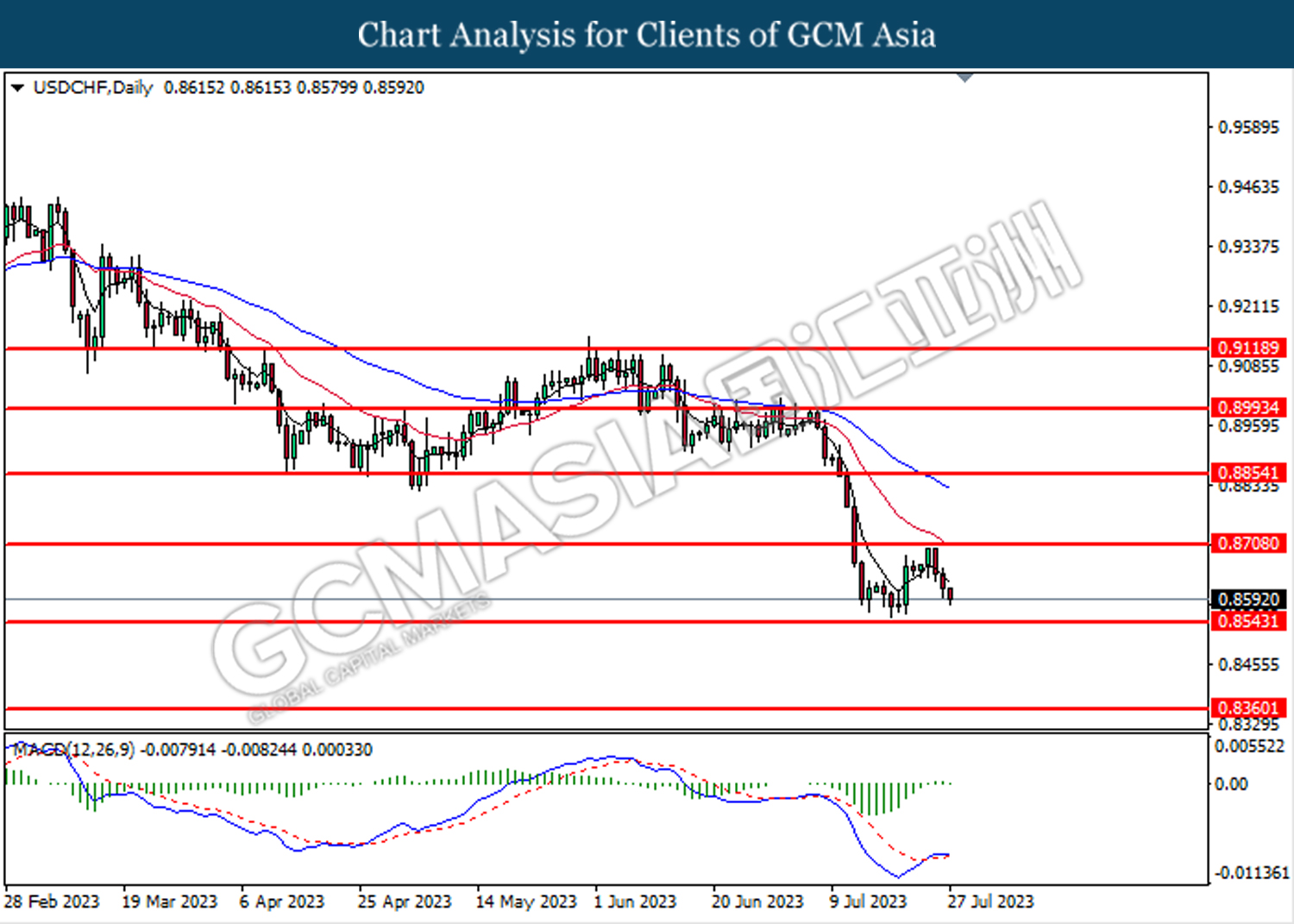

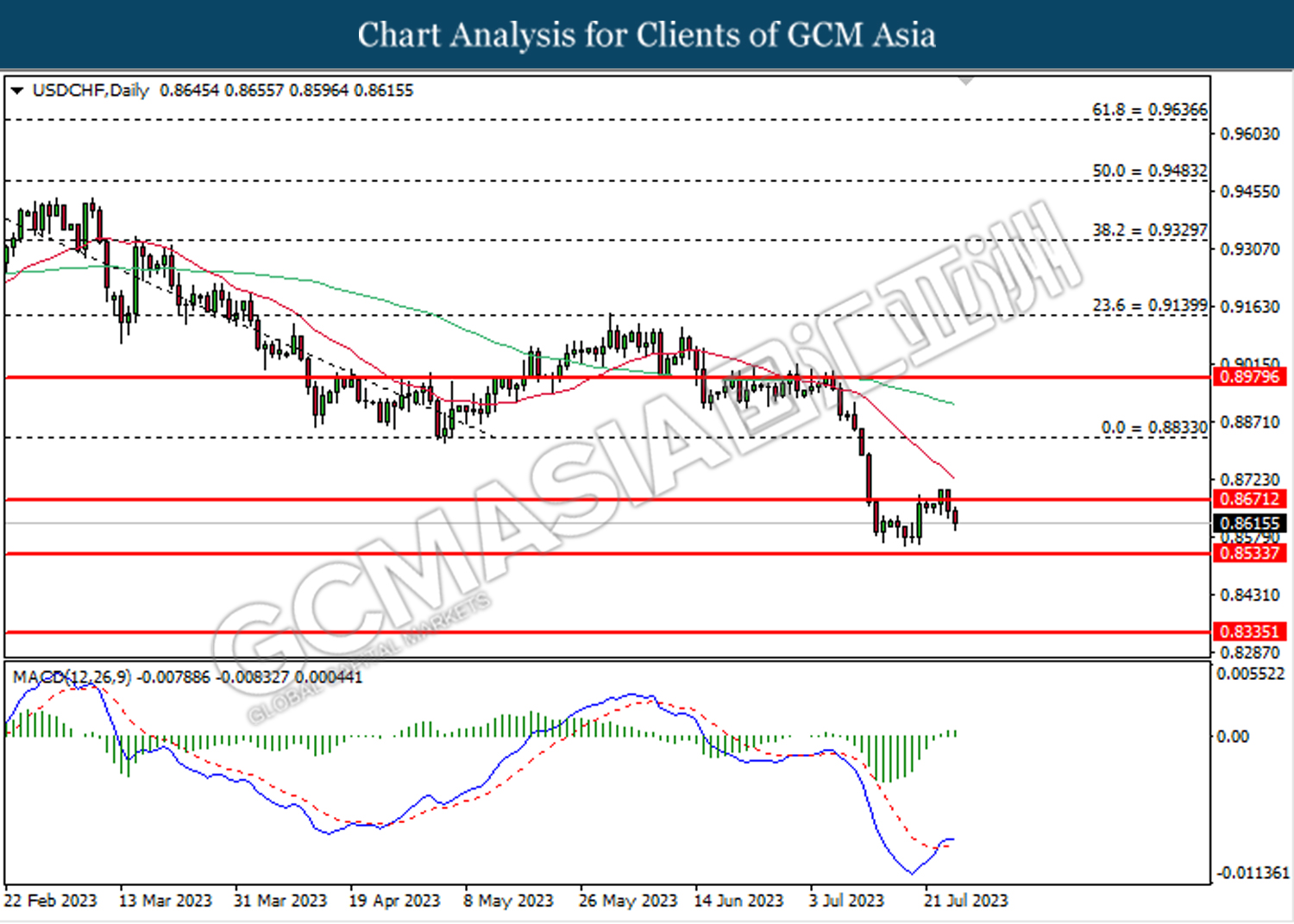

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

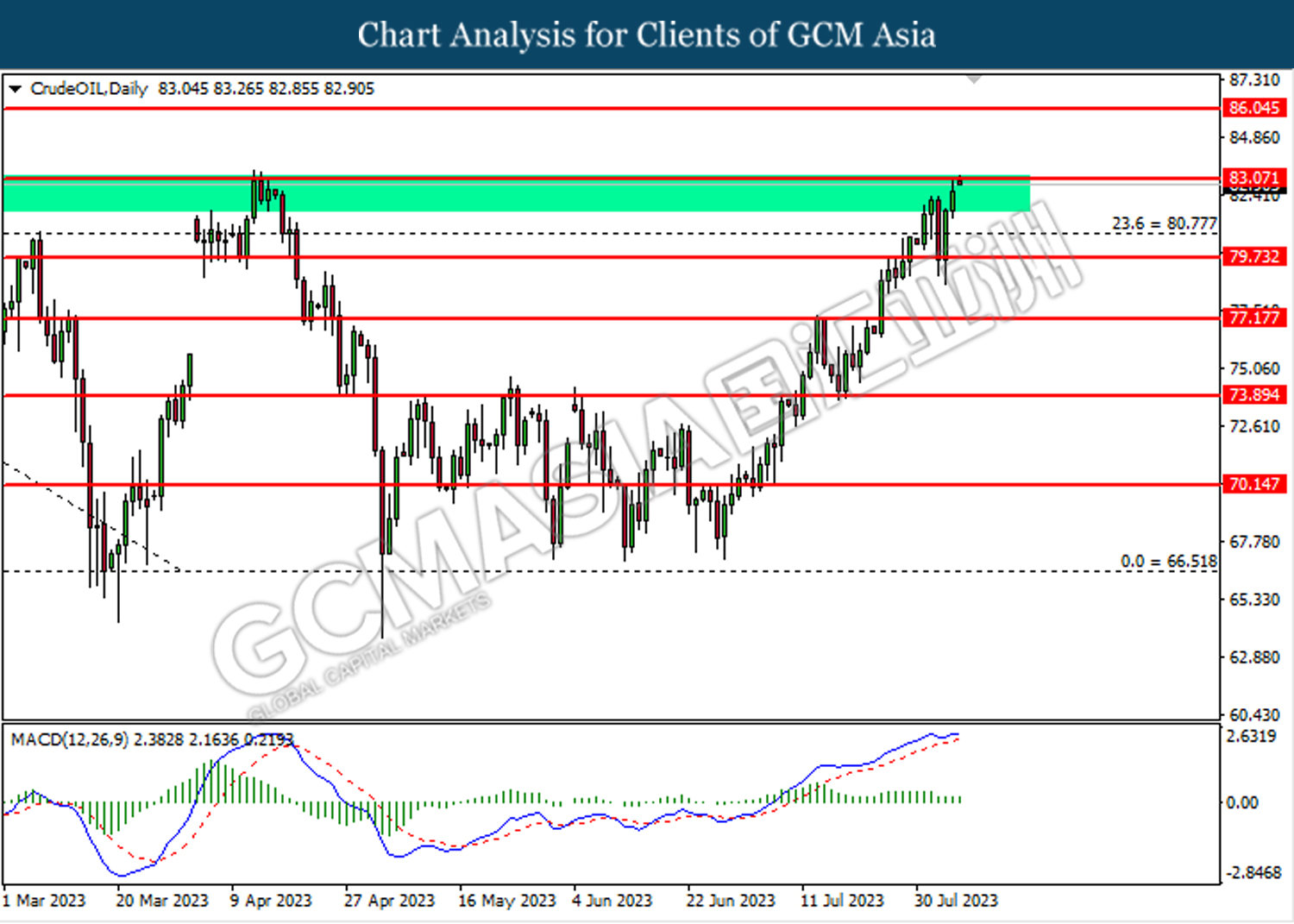

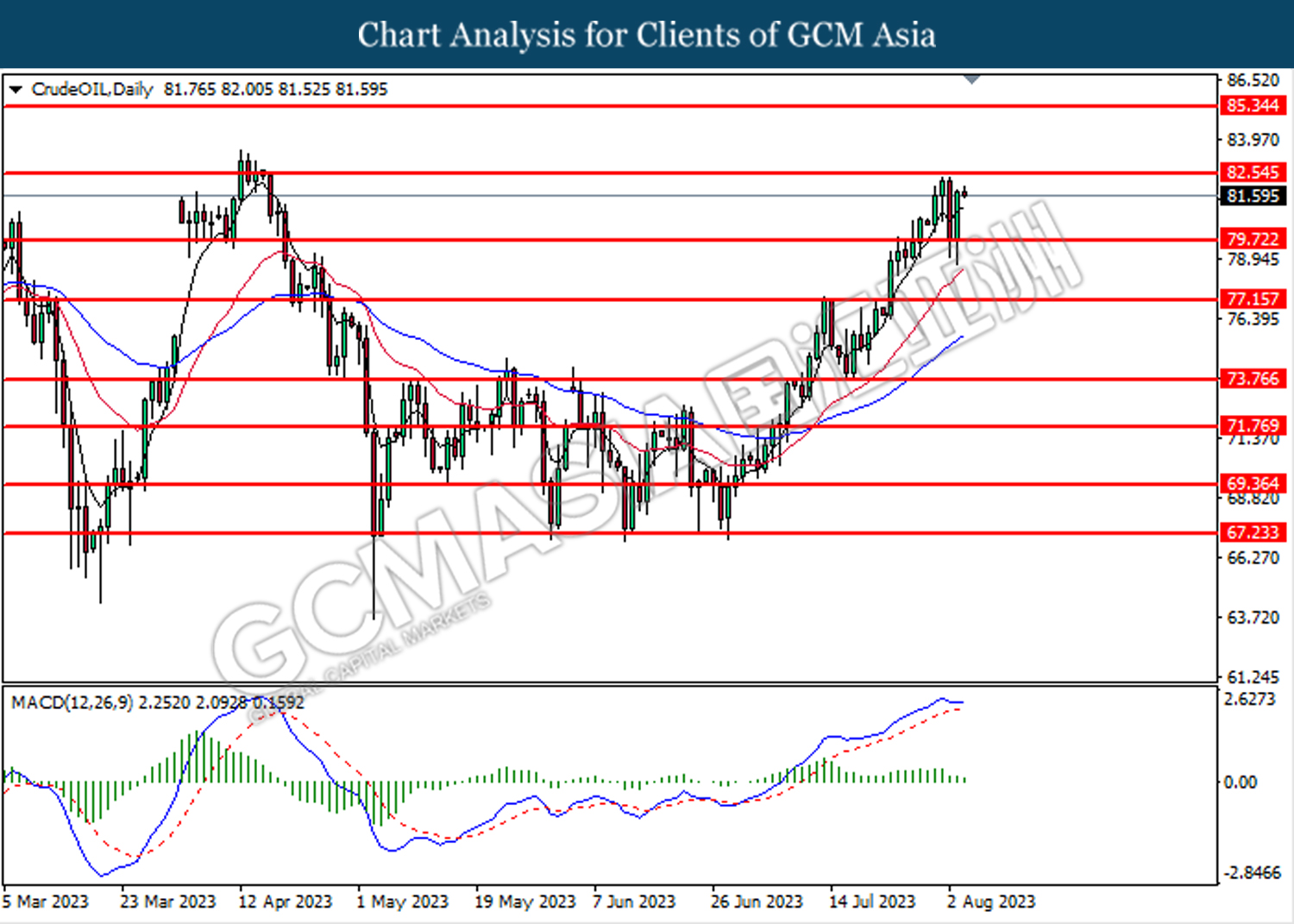

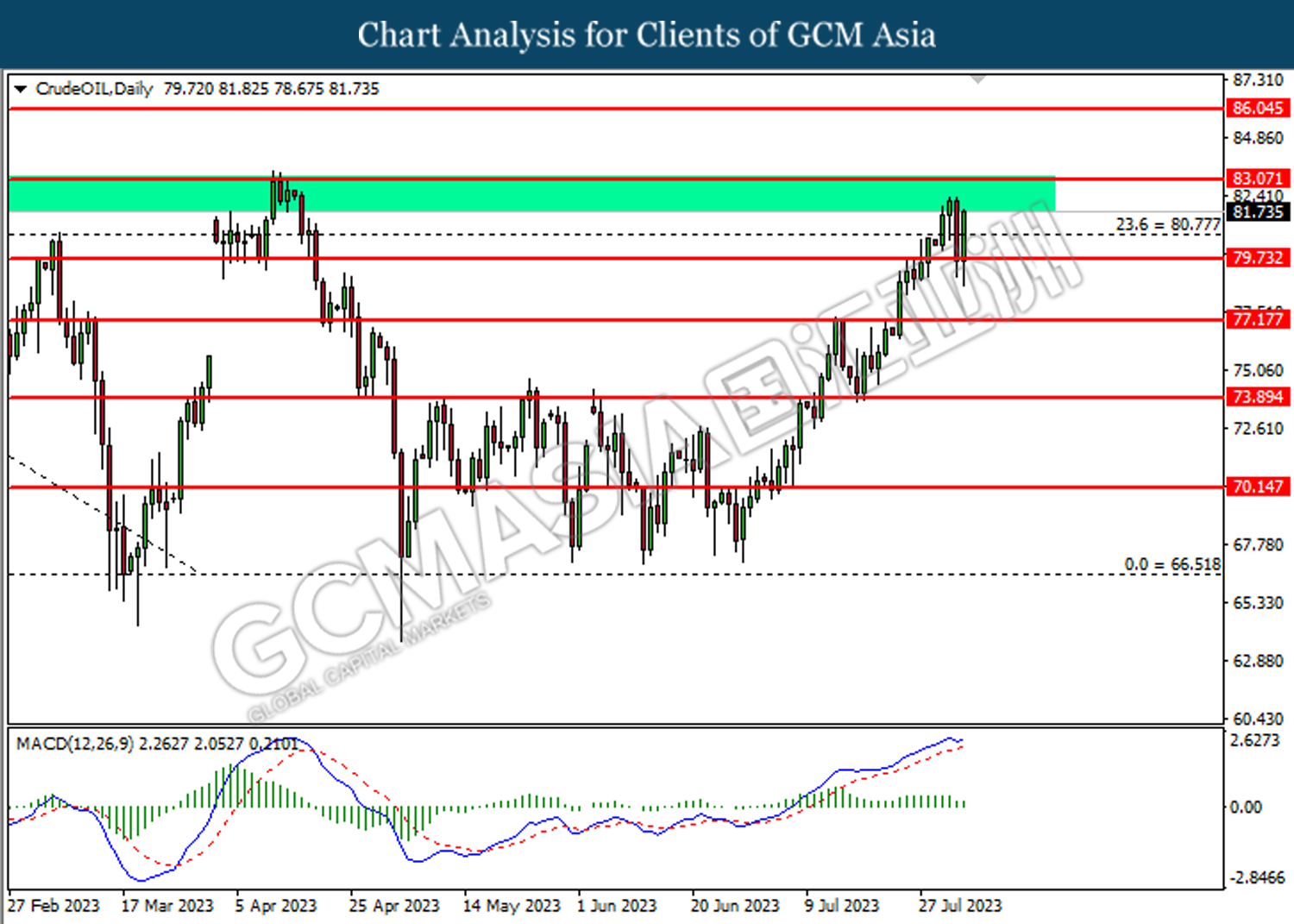

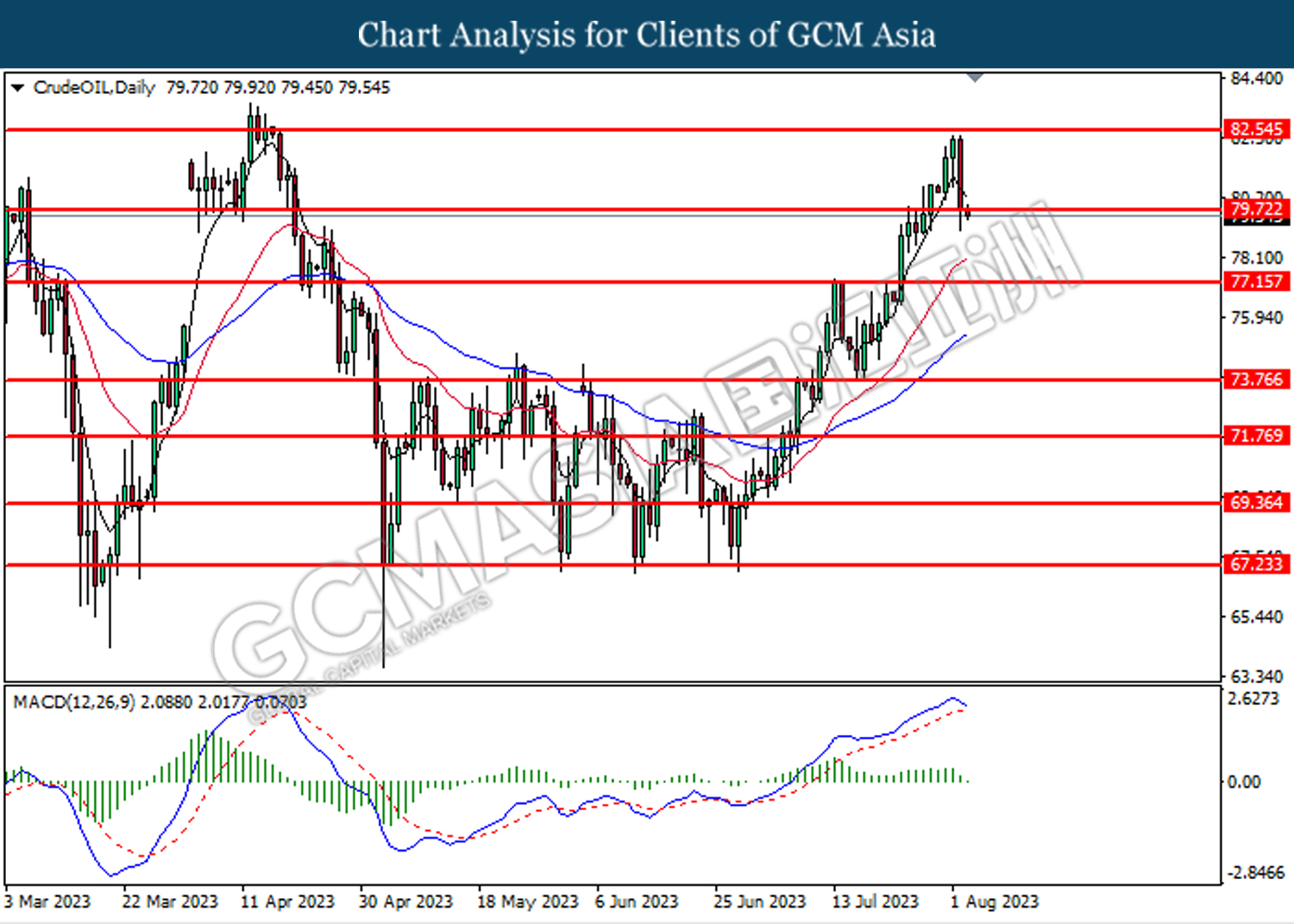

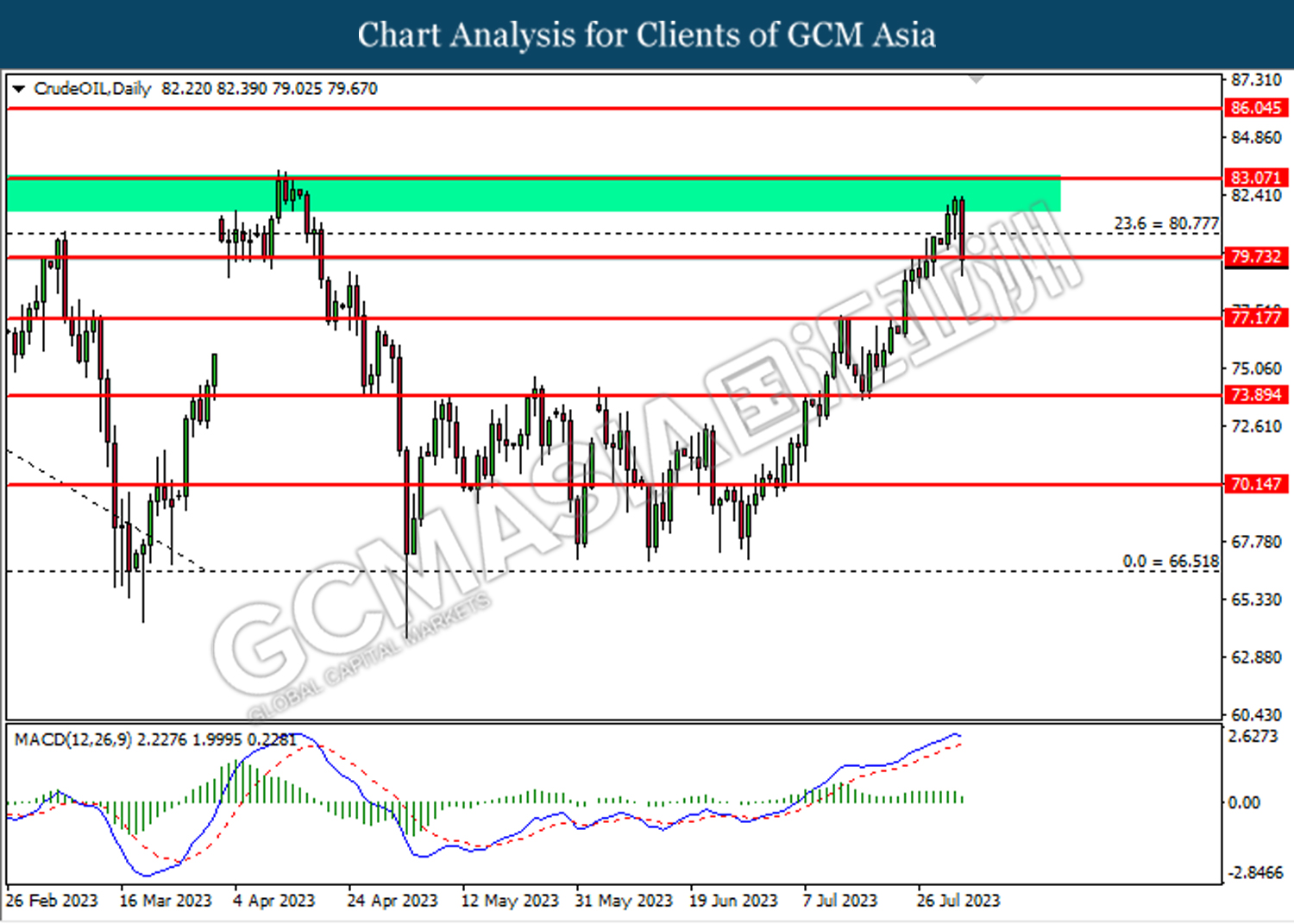

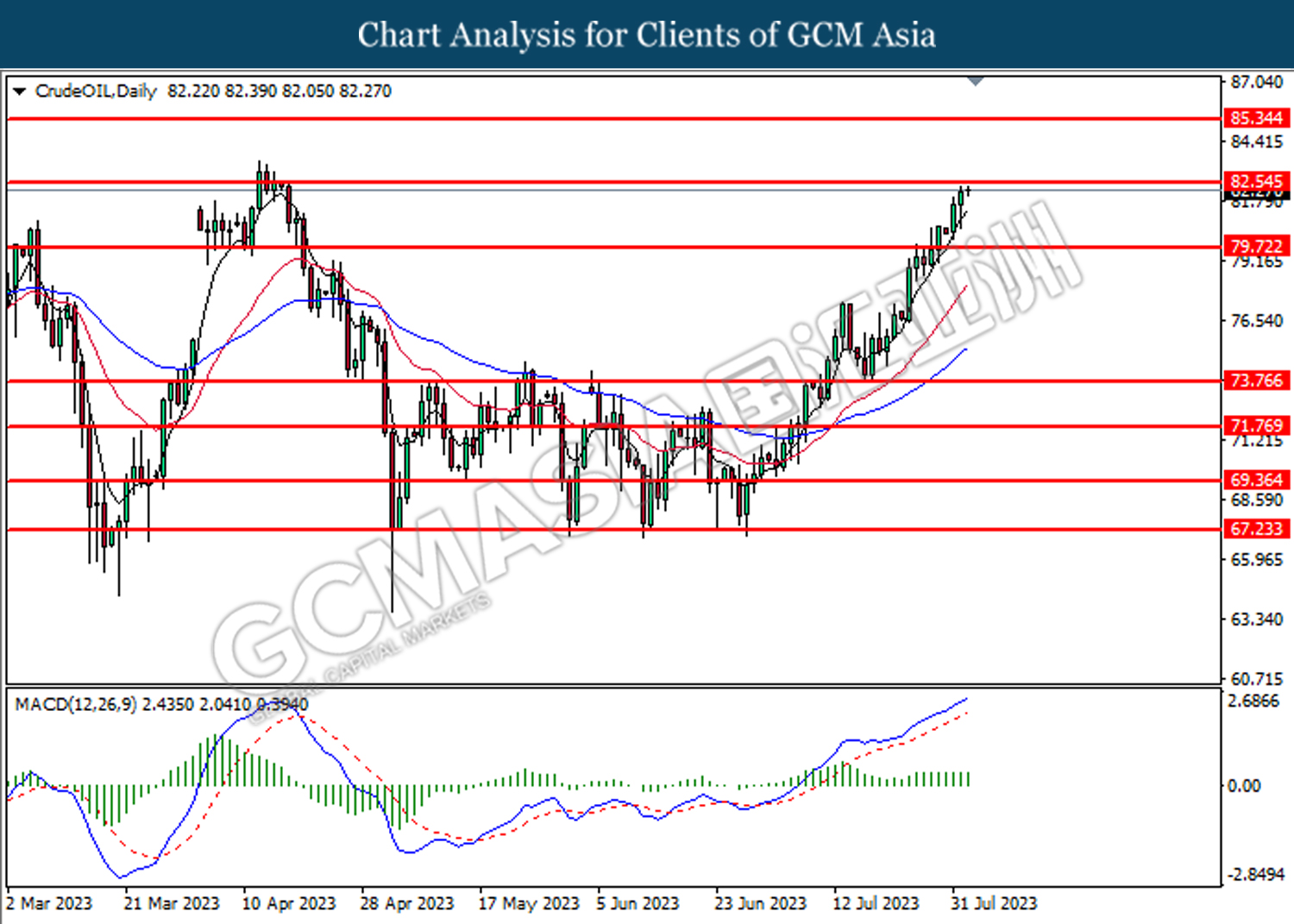

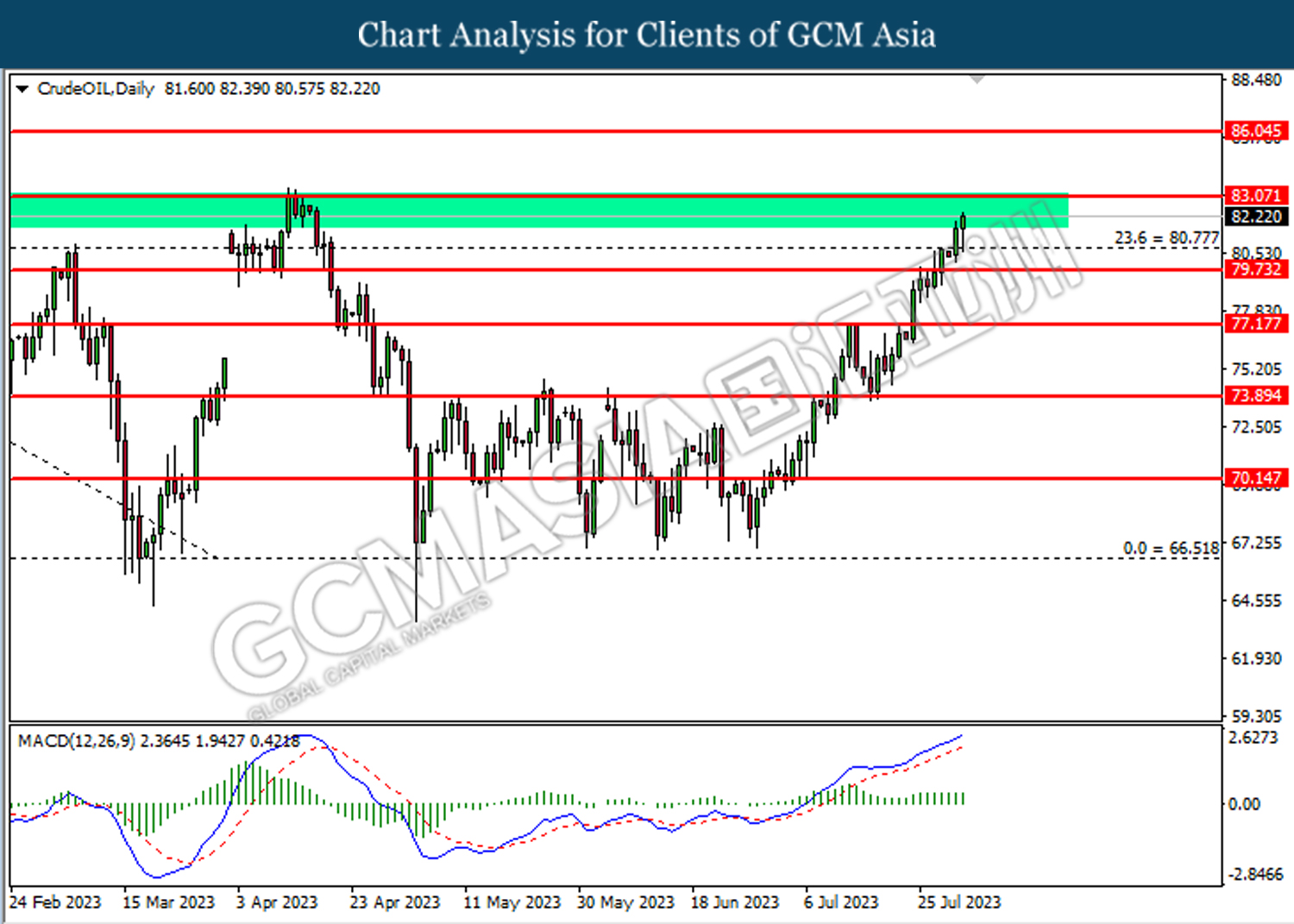

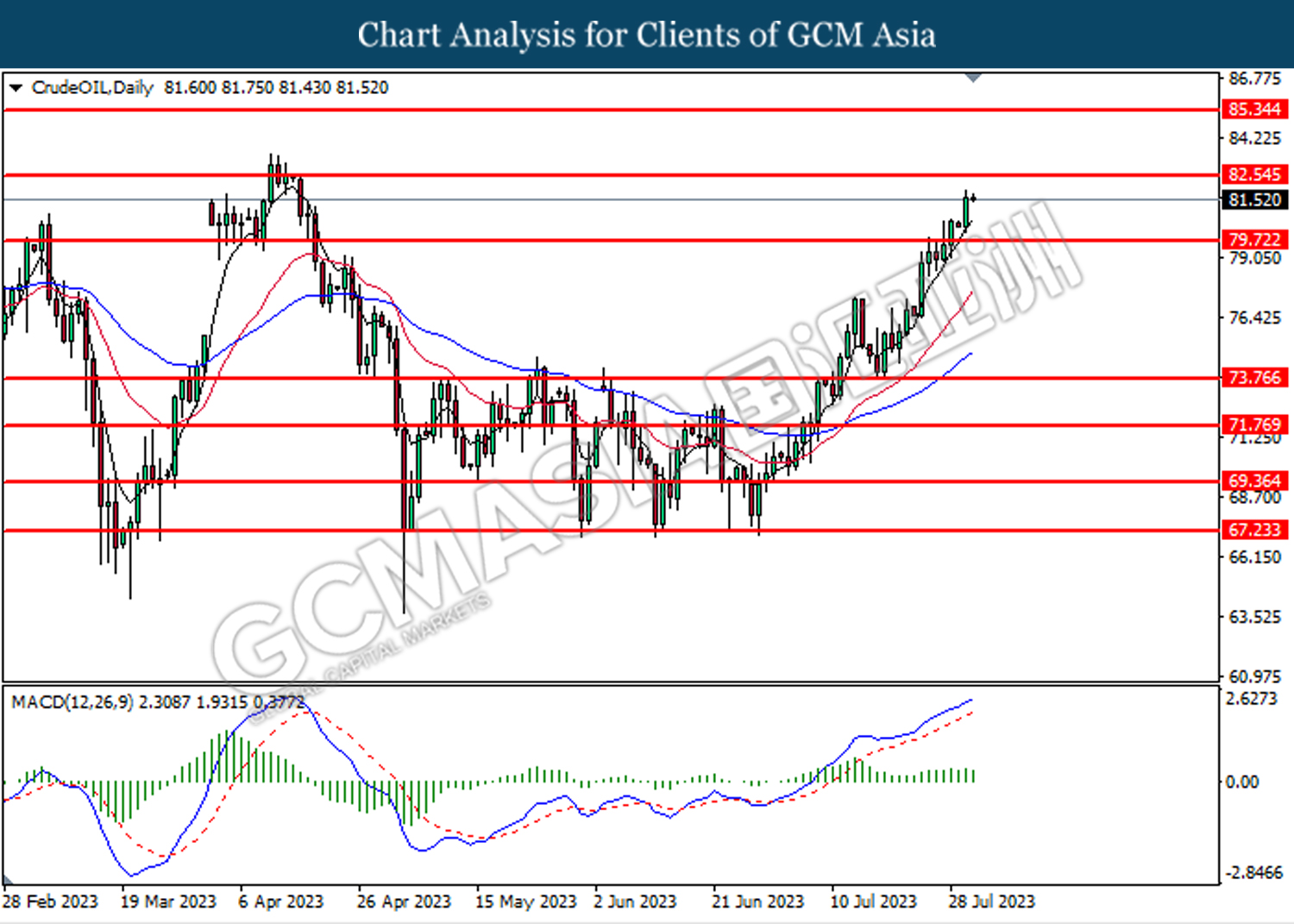

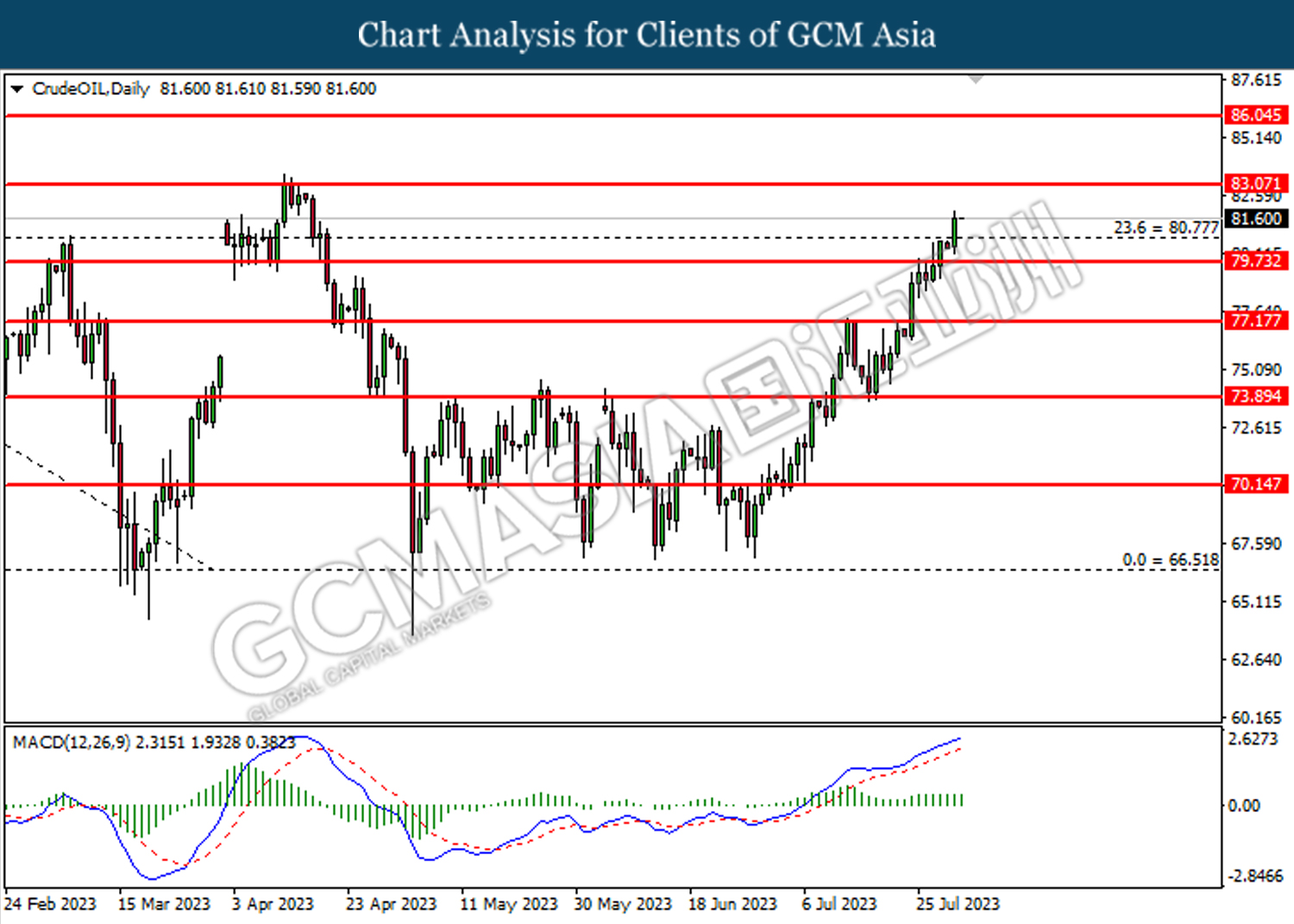

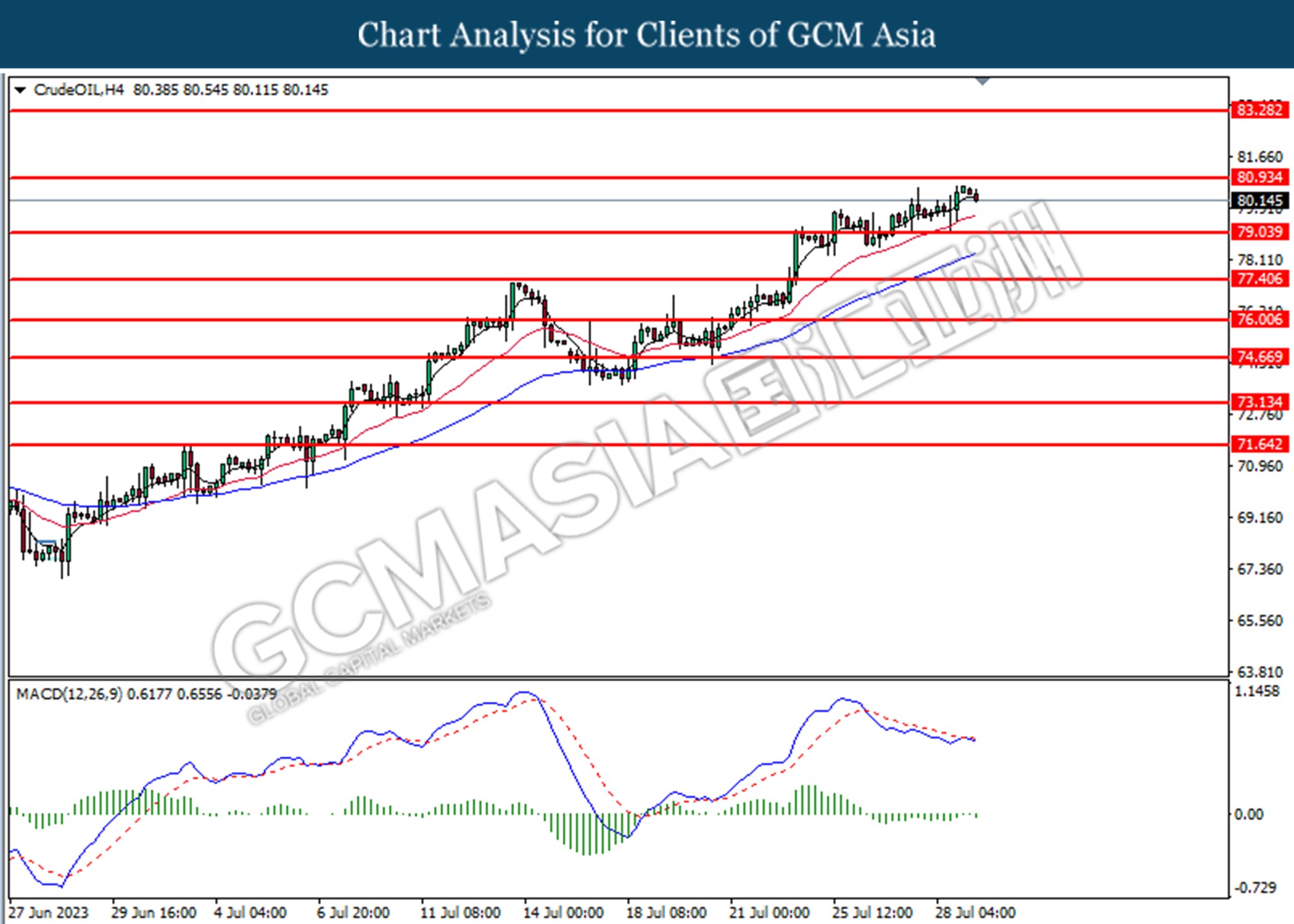

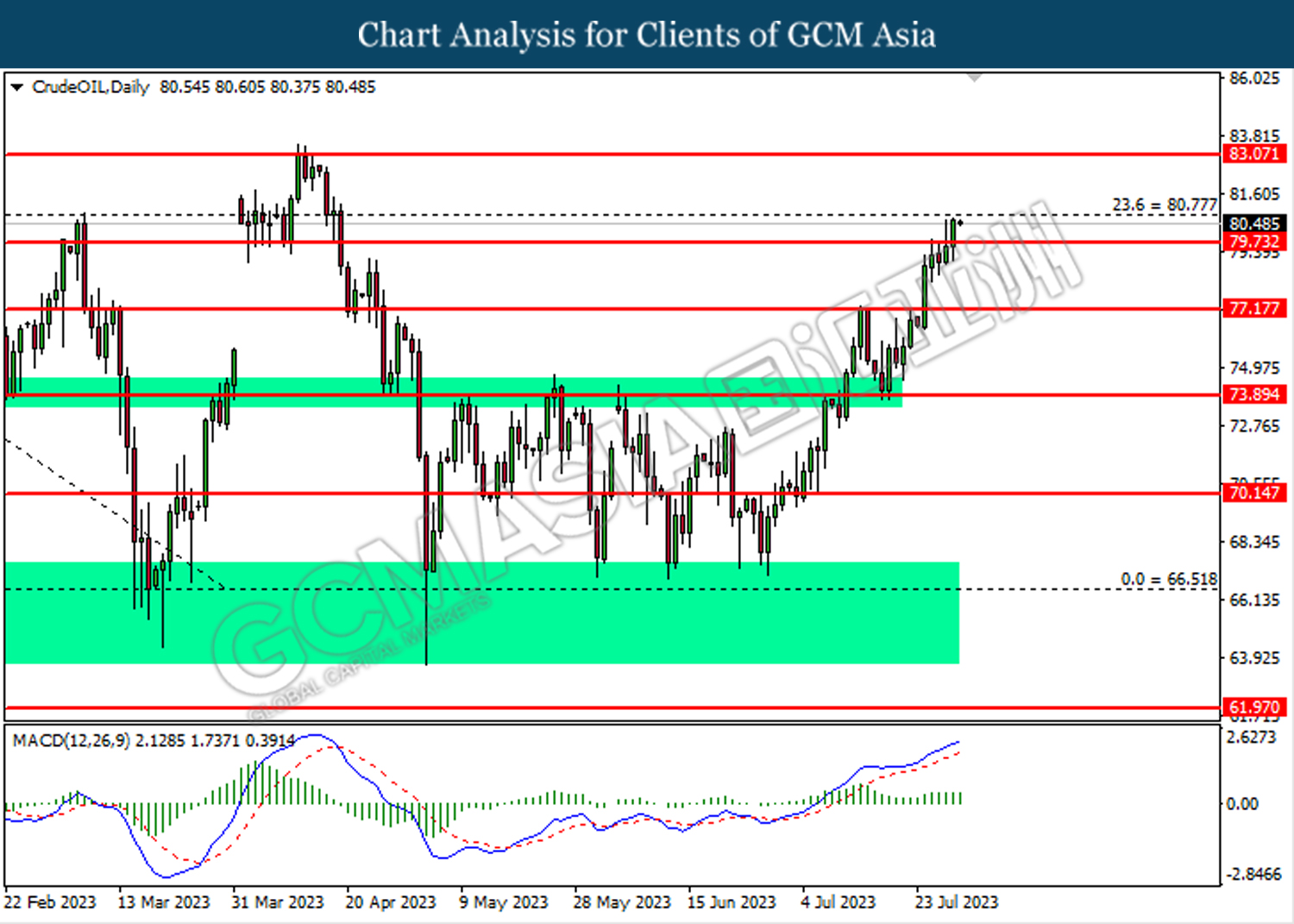

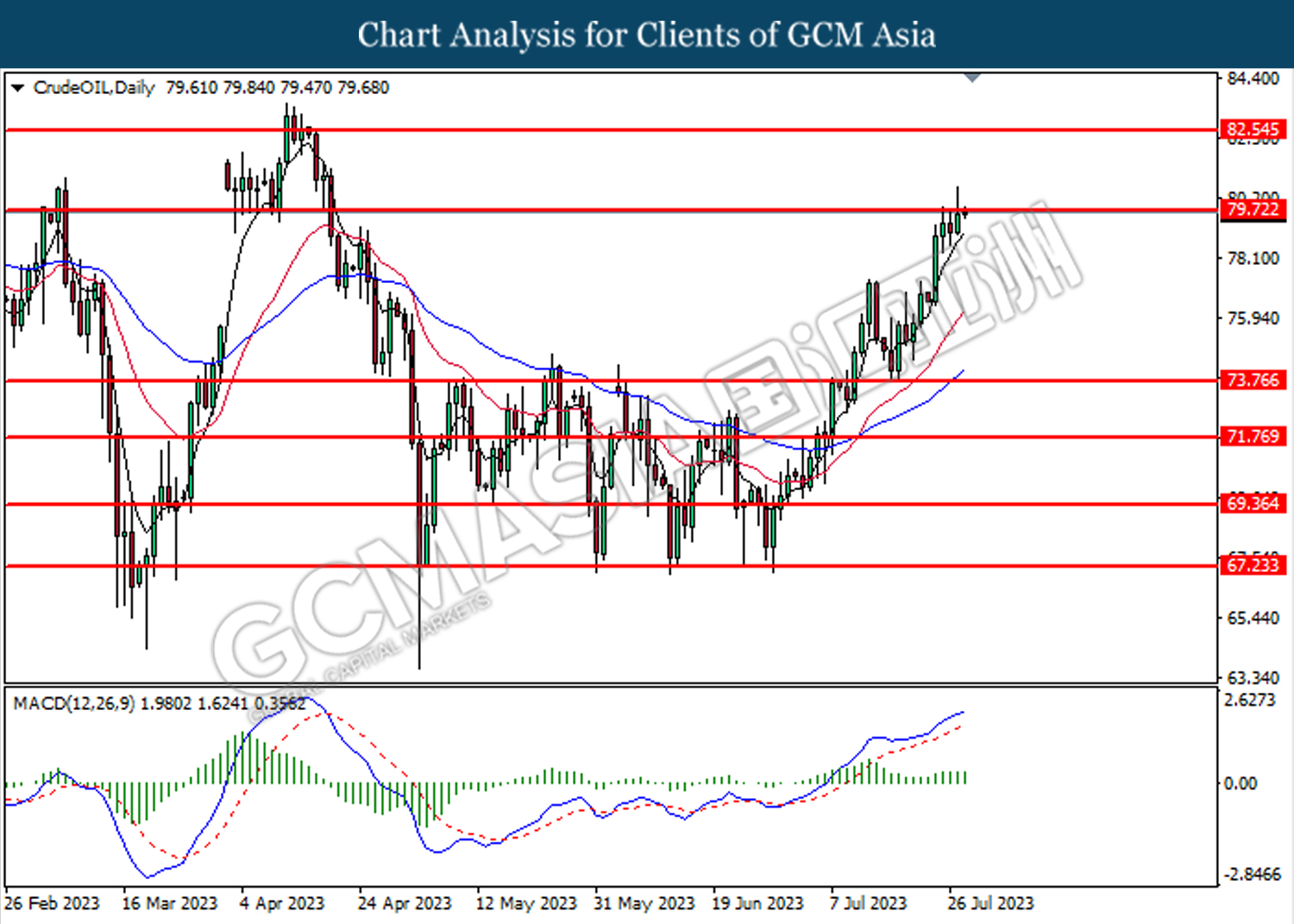

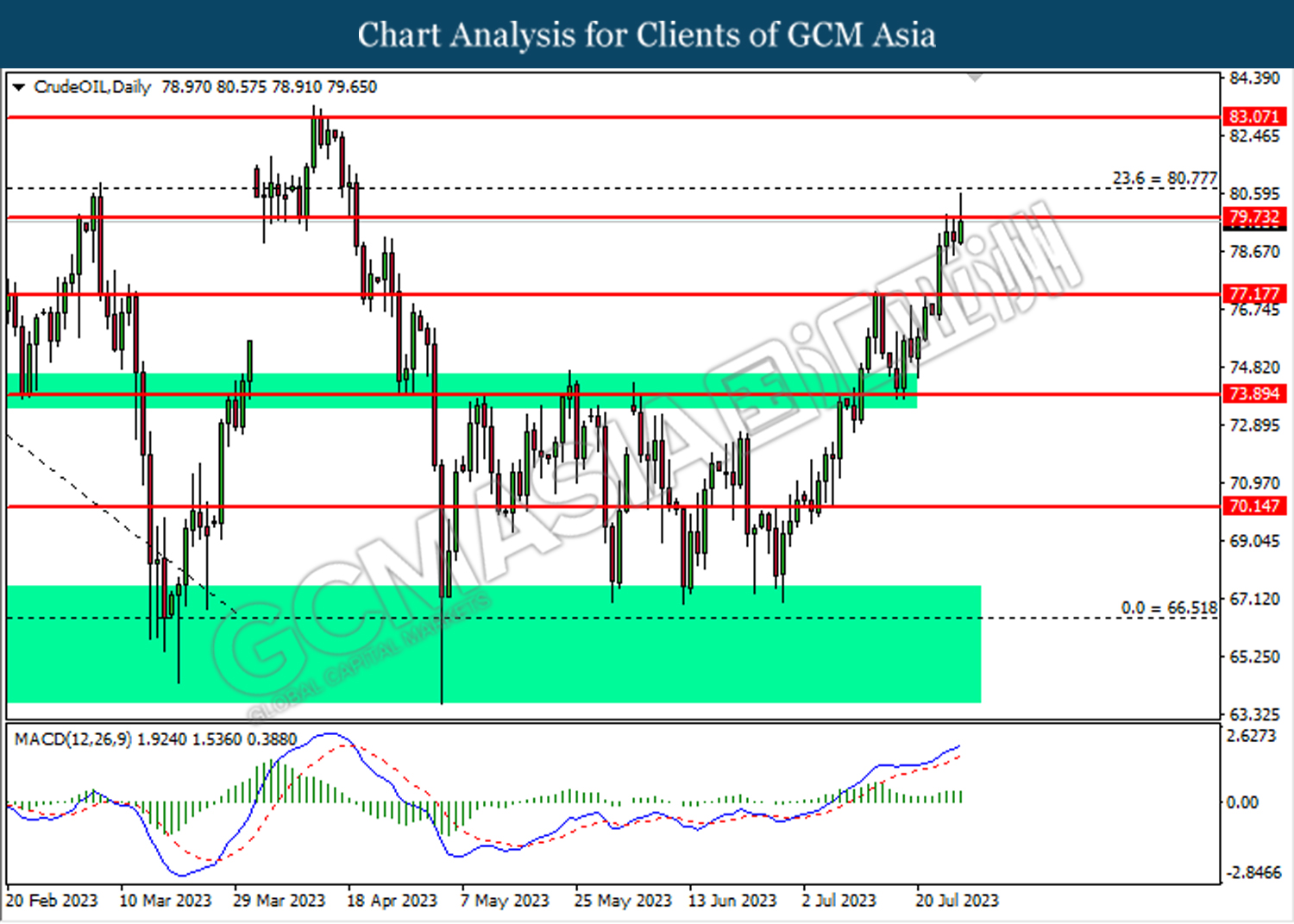

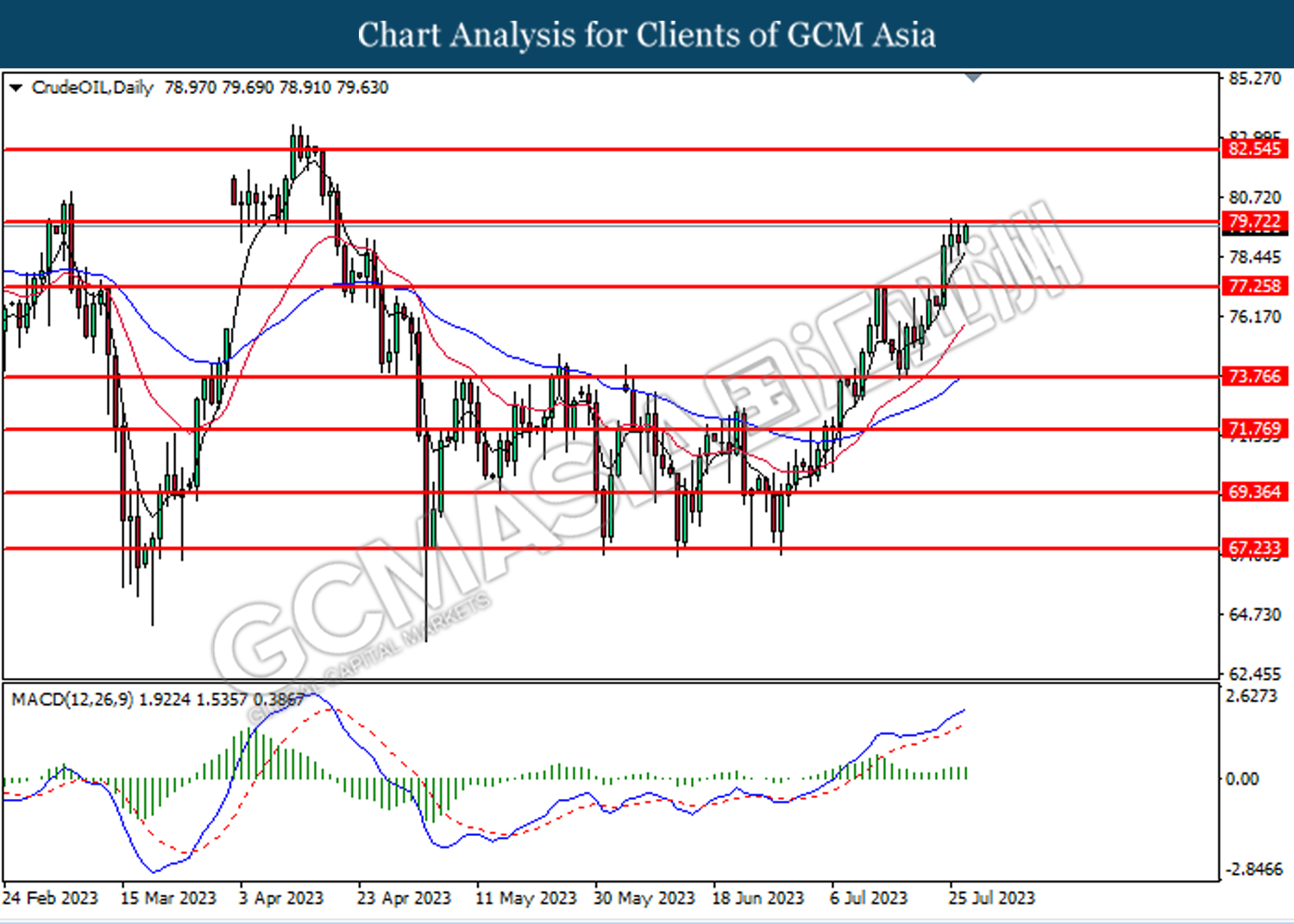

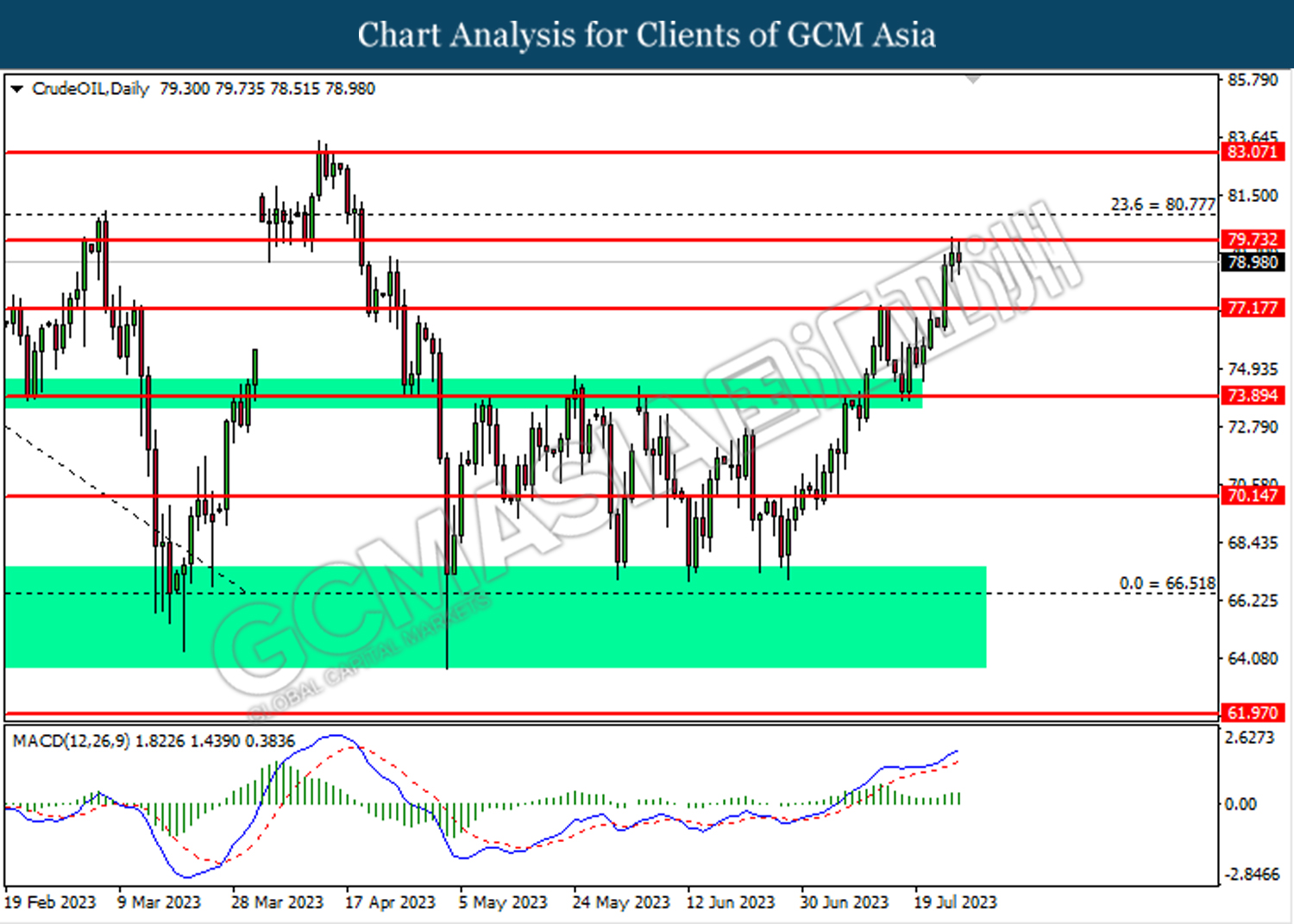

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 83.05. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 83.05, 86.05

Support level: 80.75, 79.75

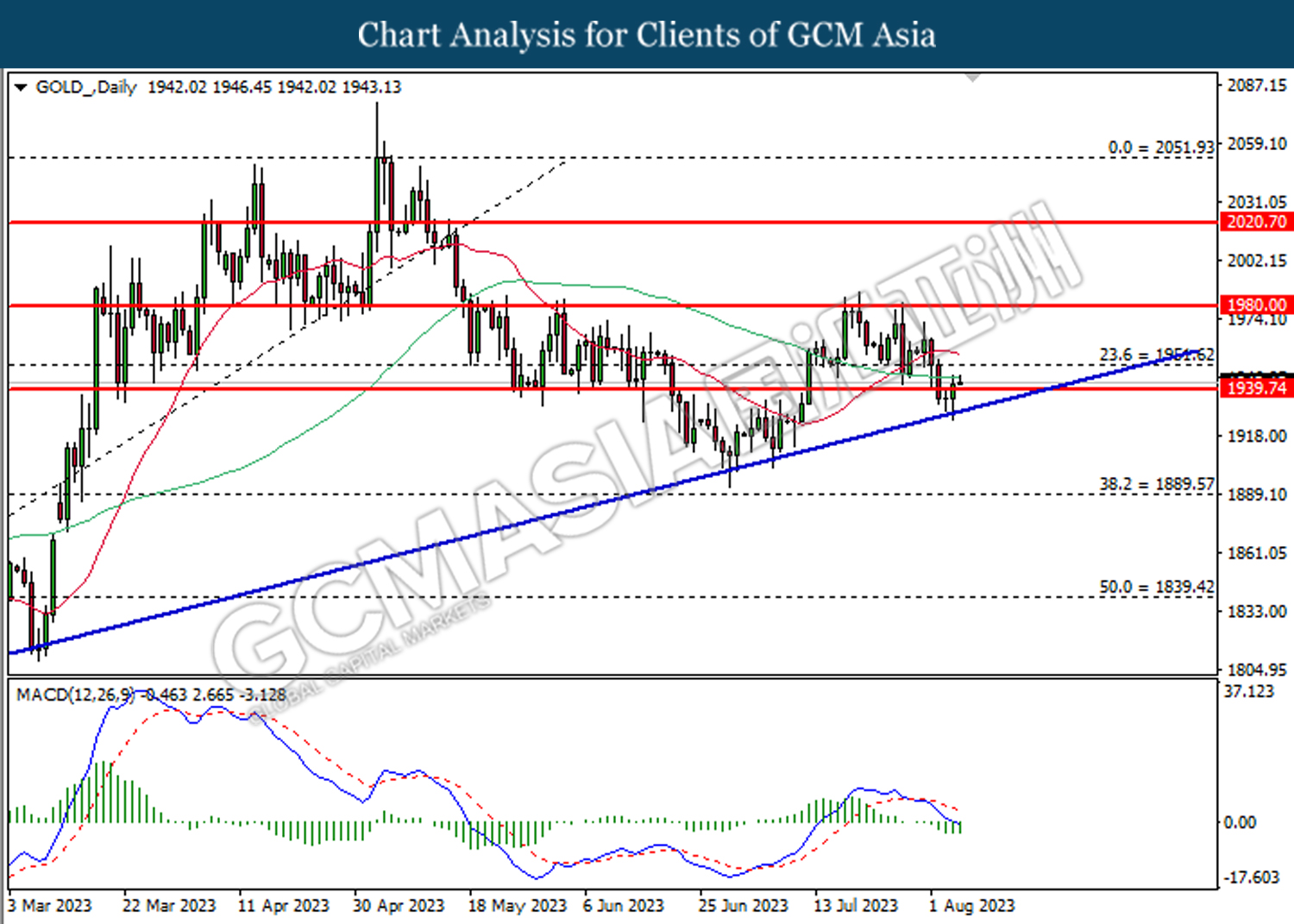

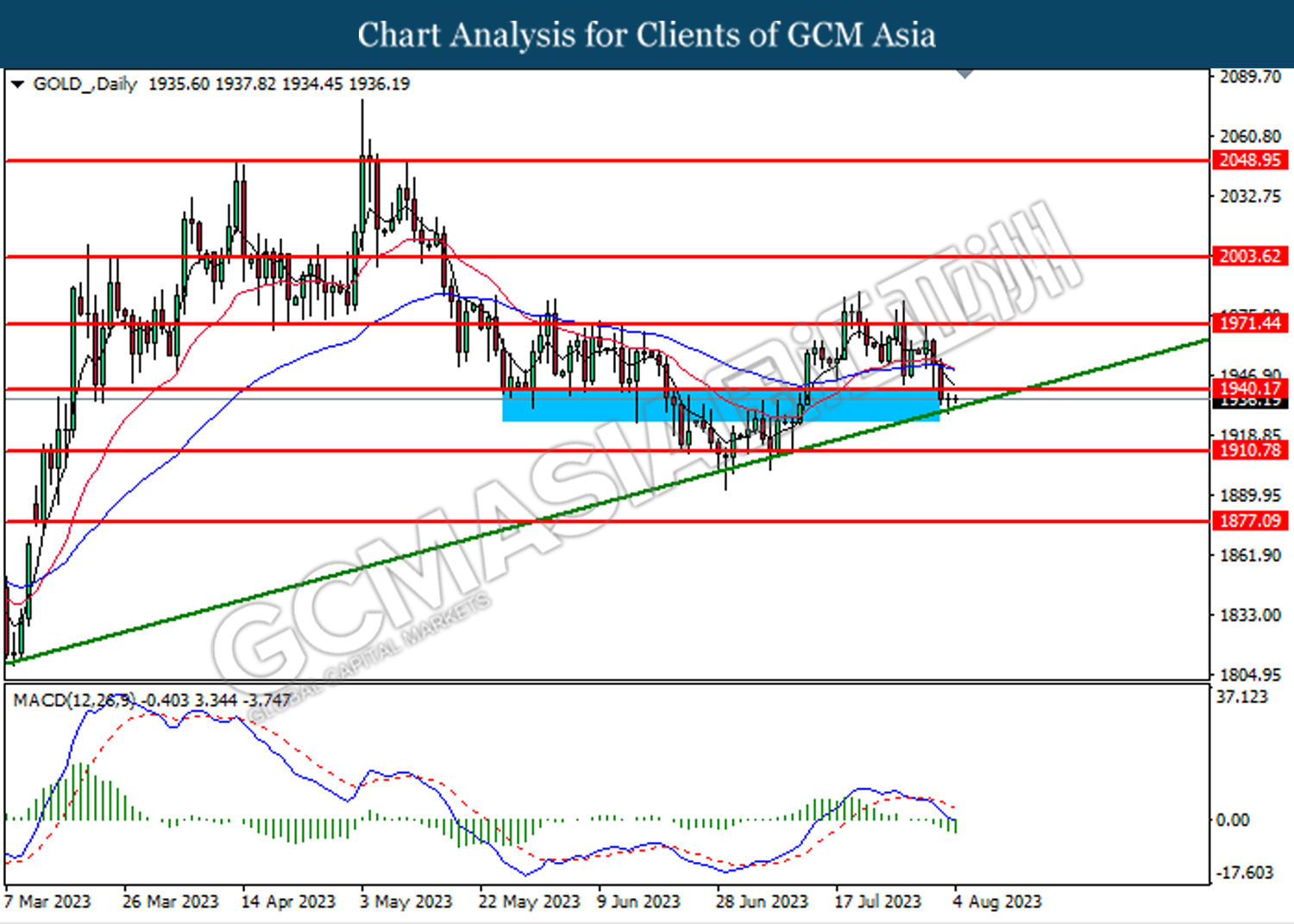

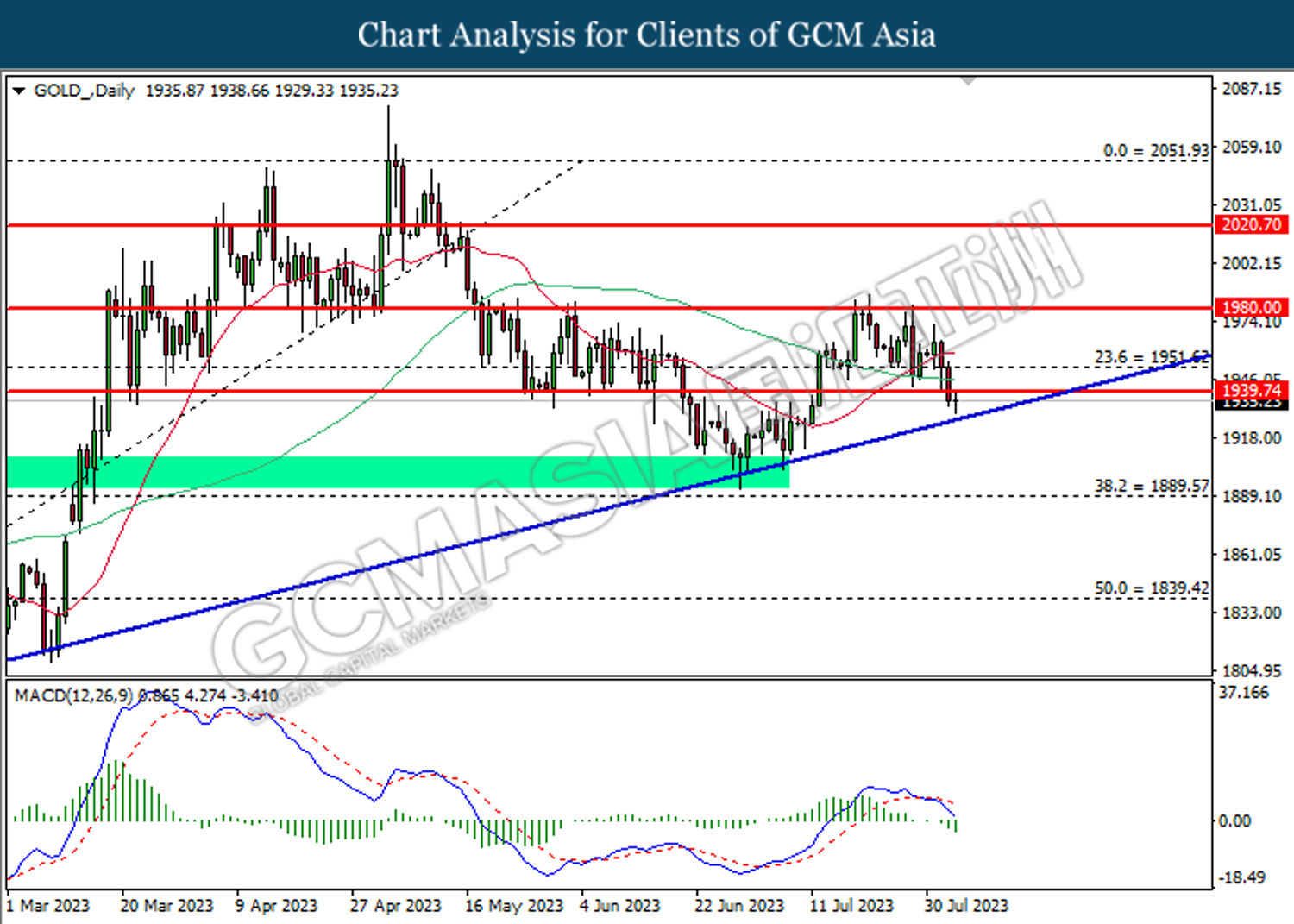

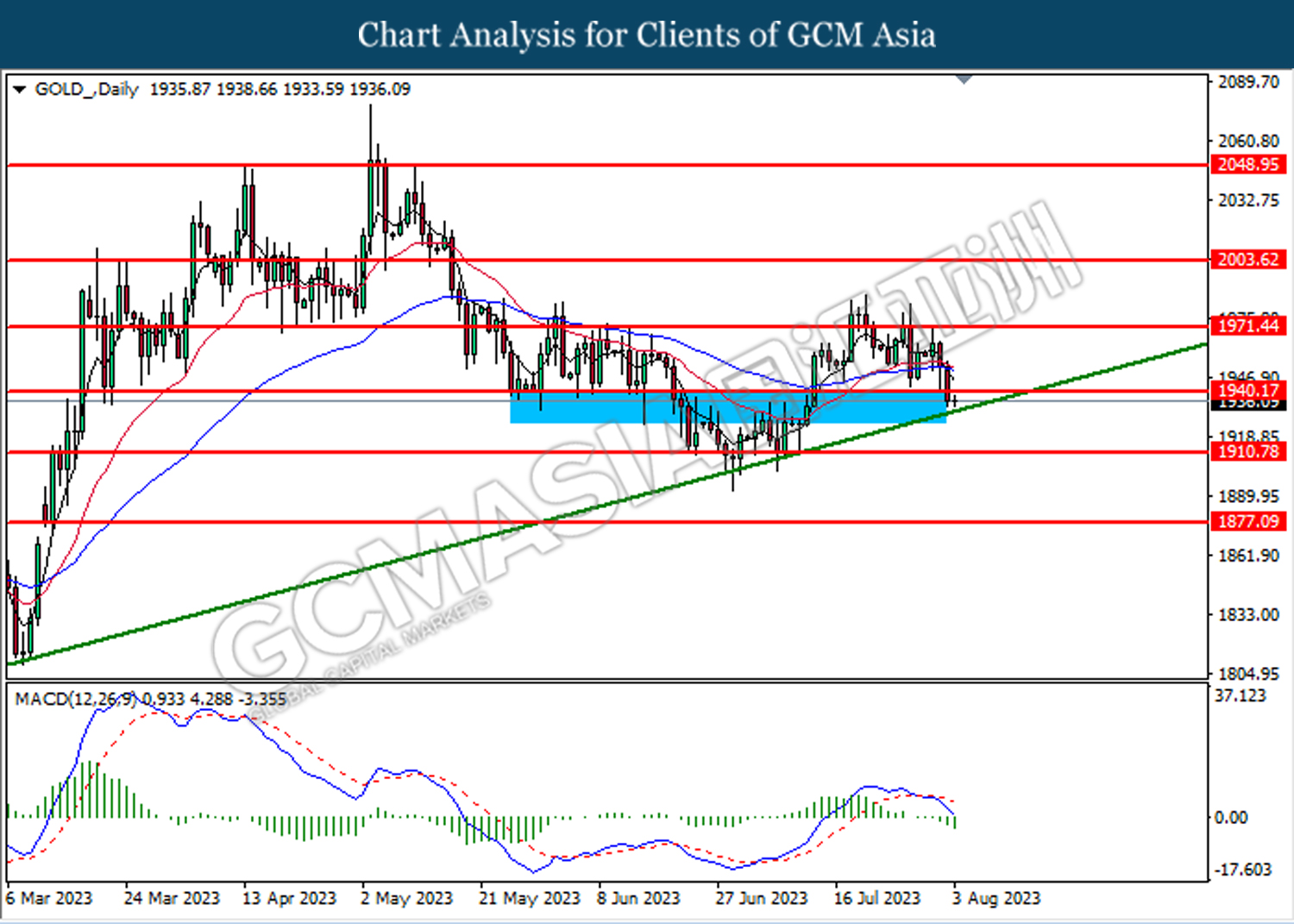

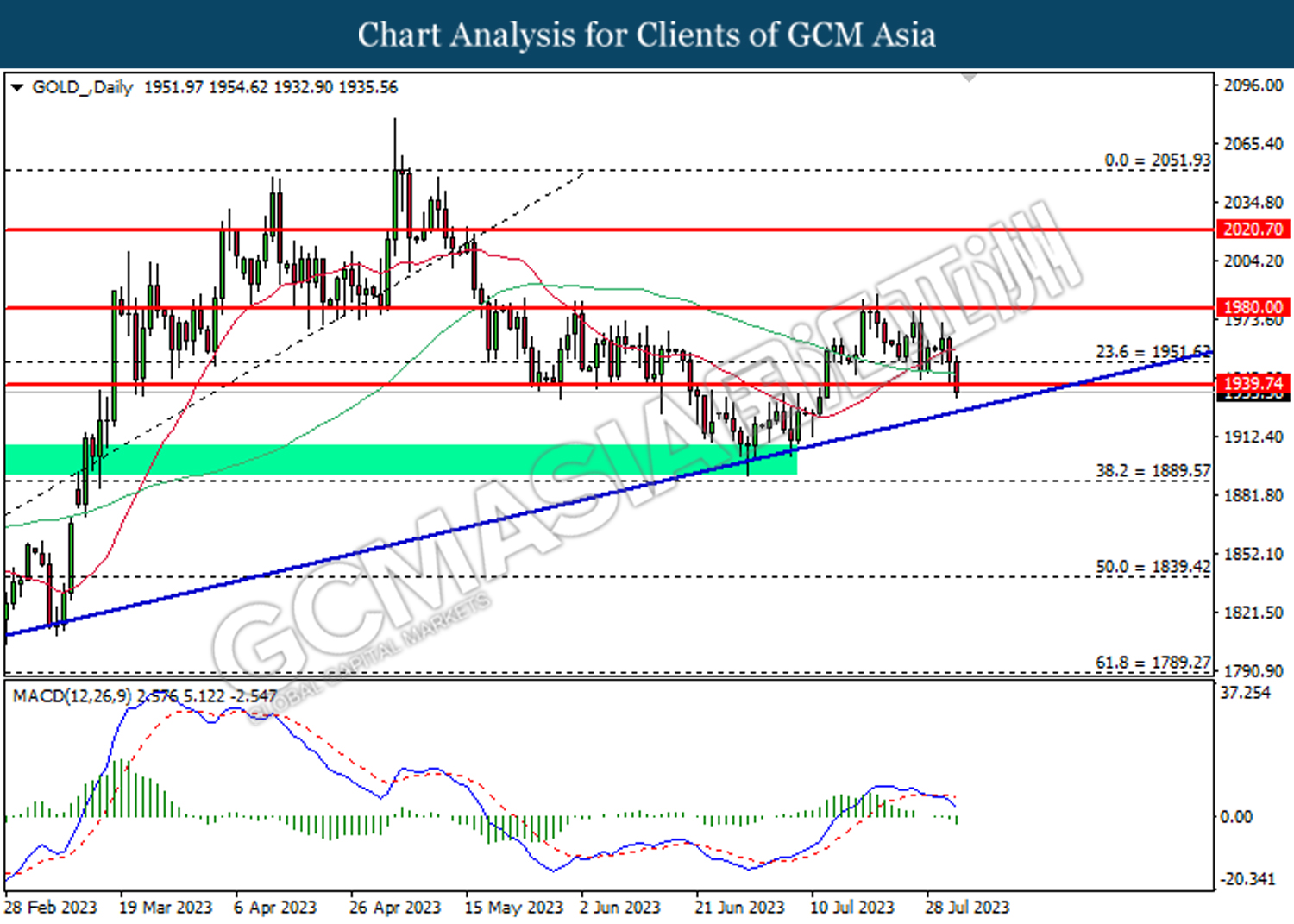

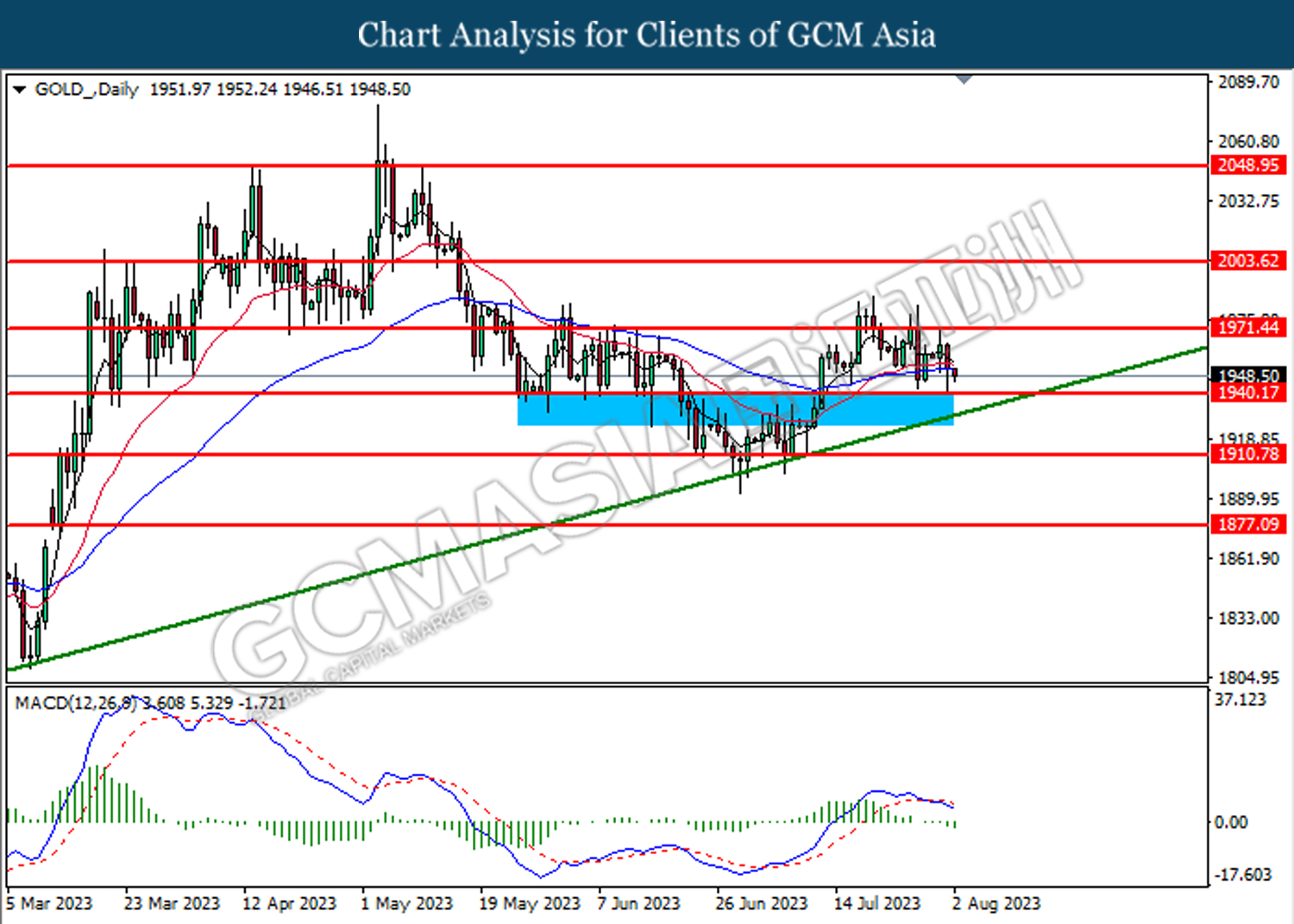

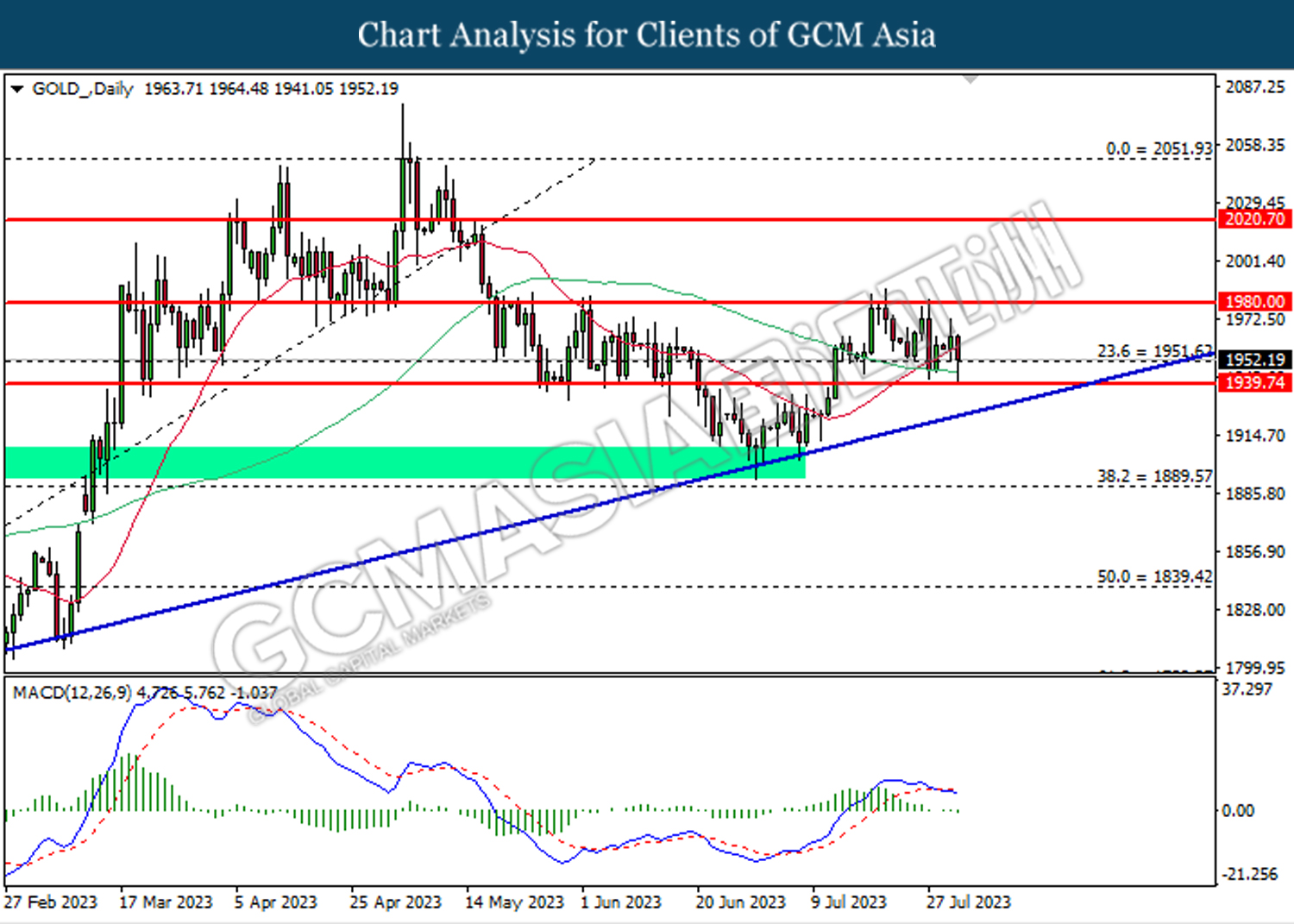

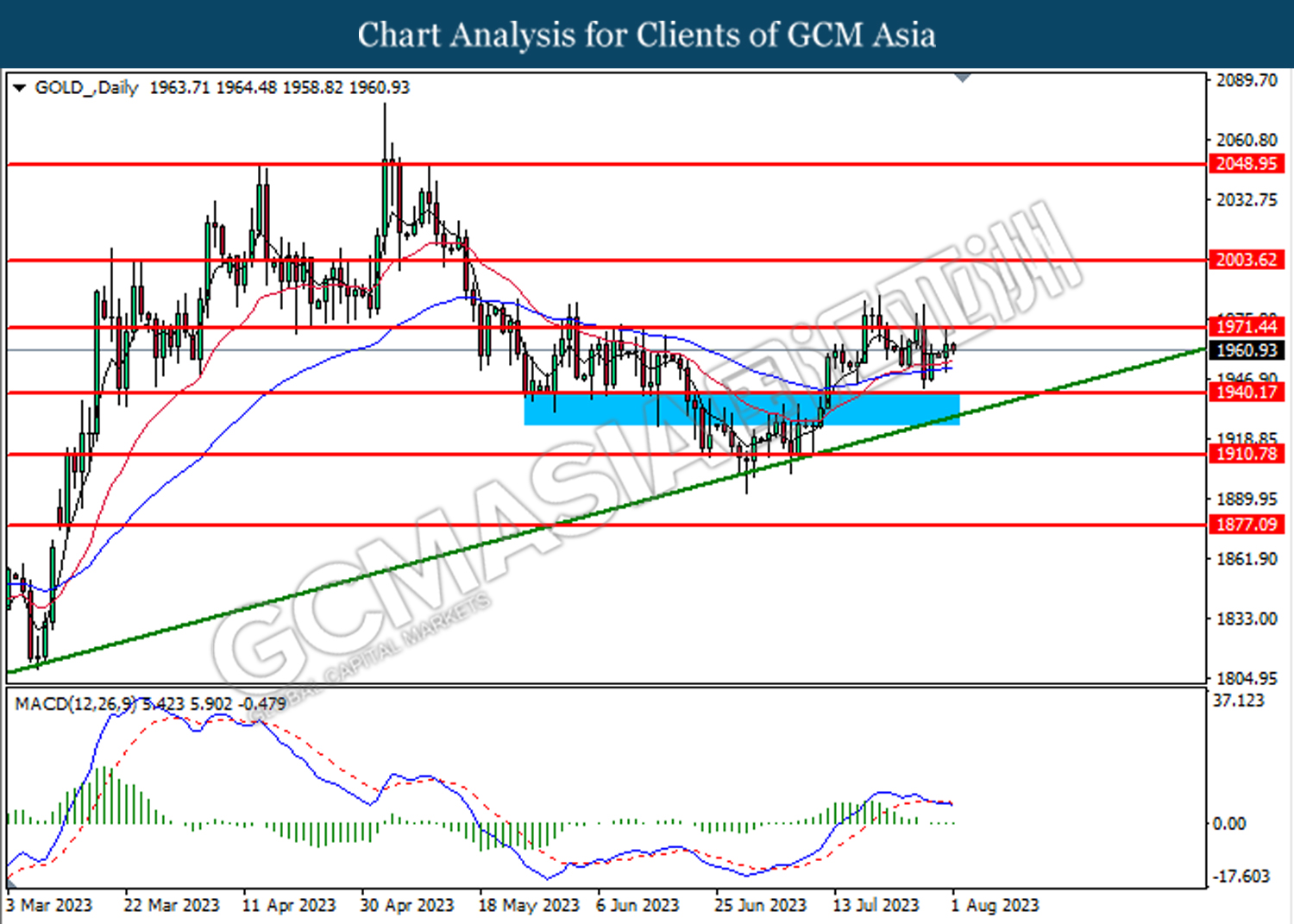

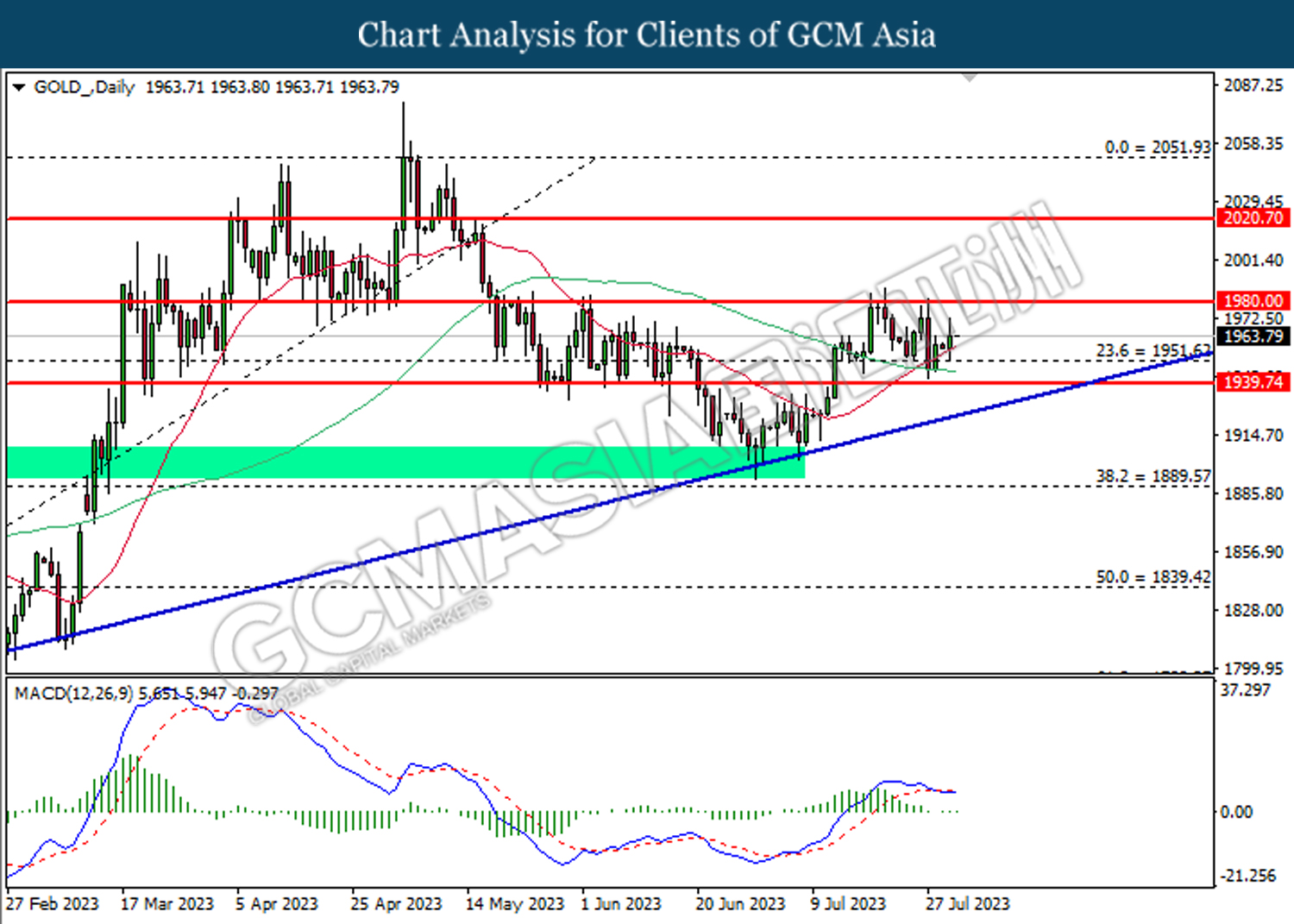

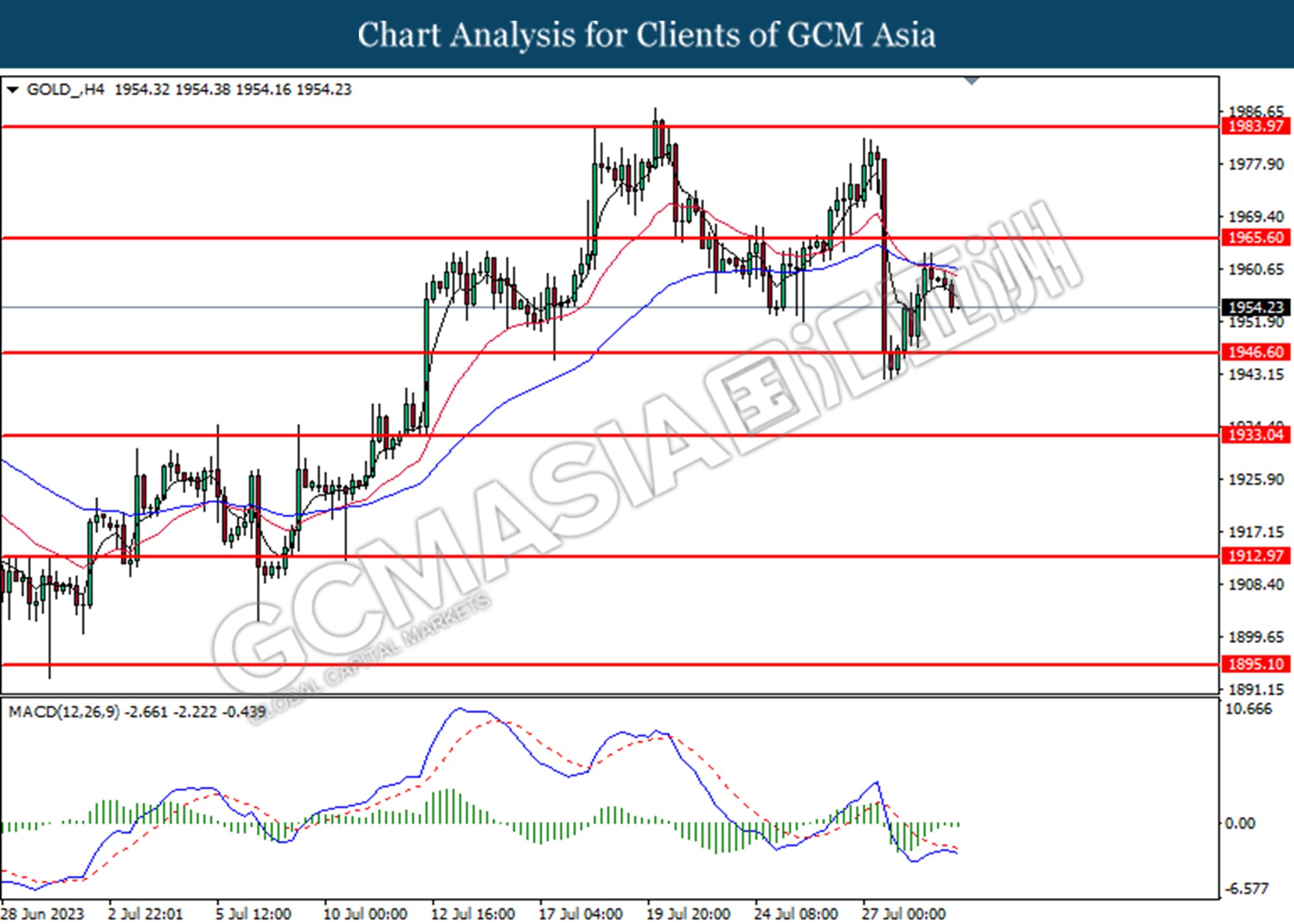

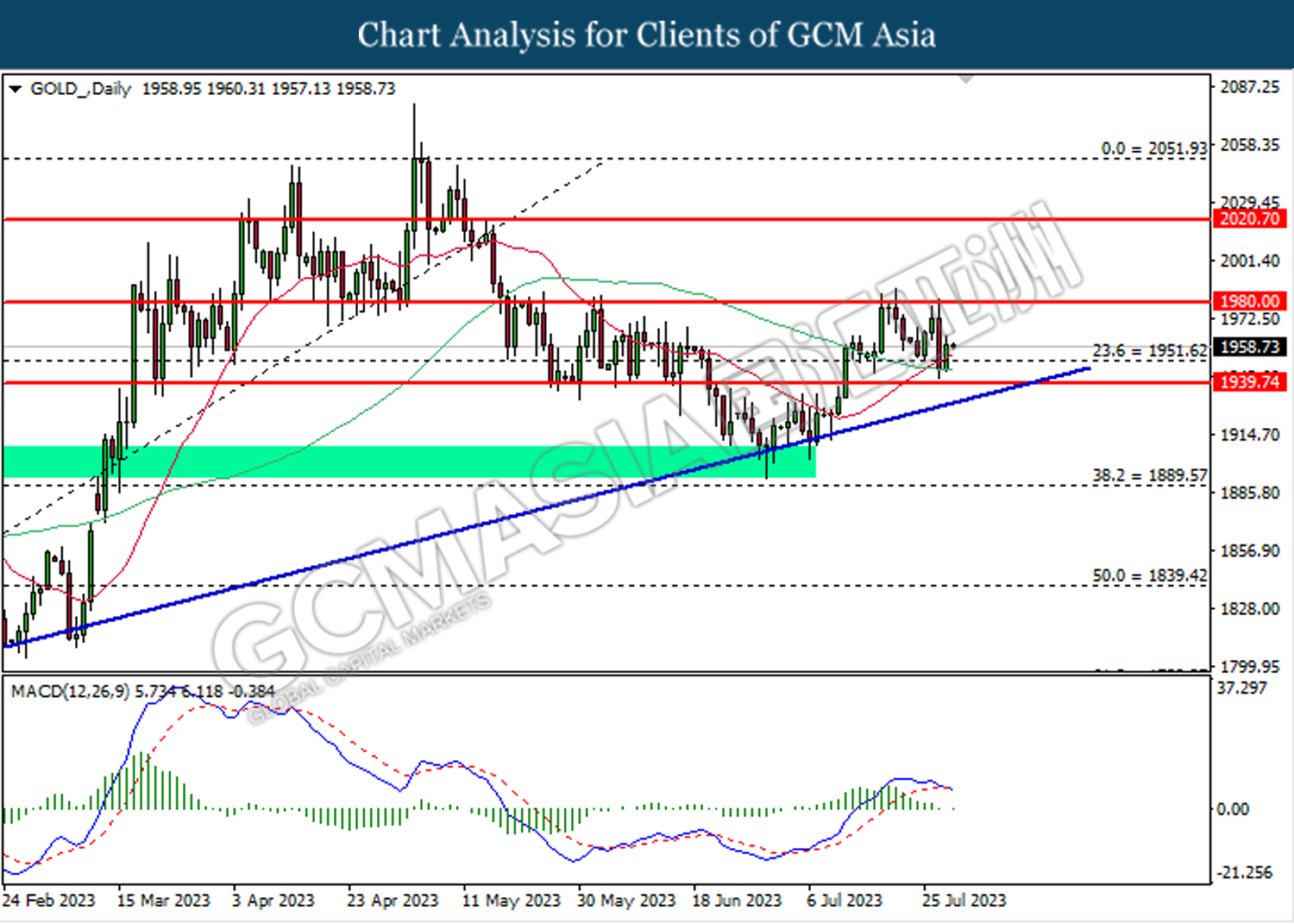

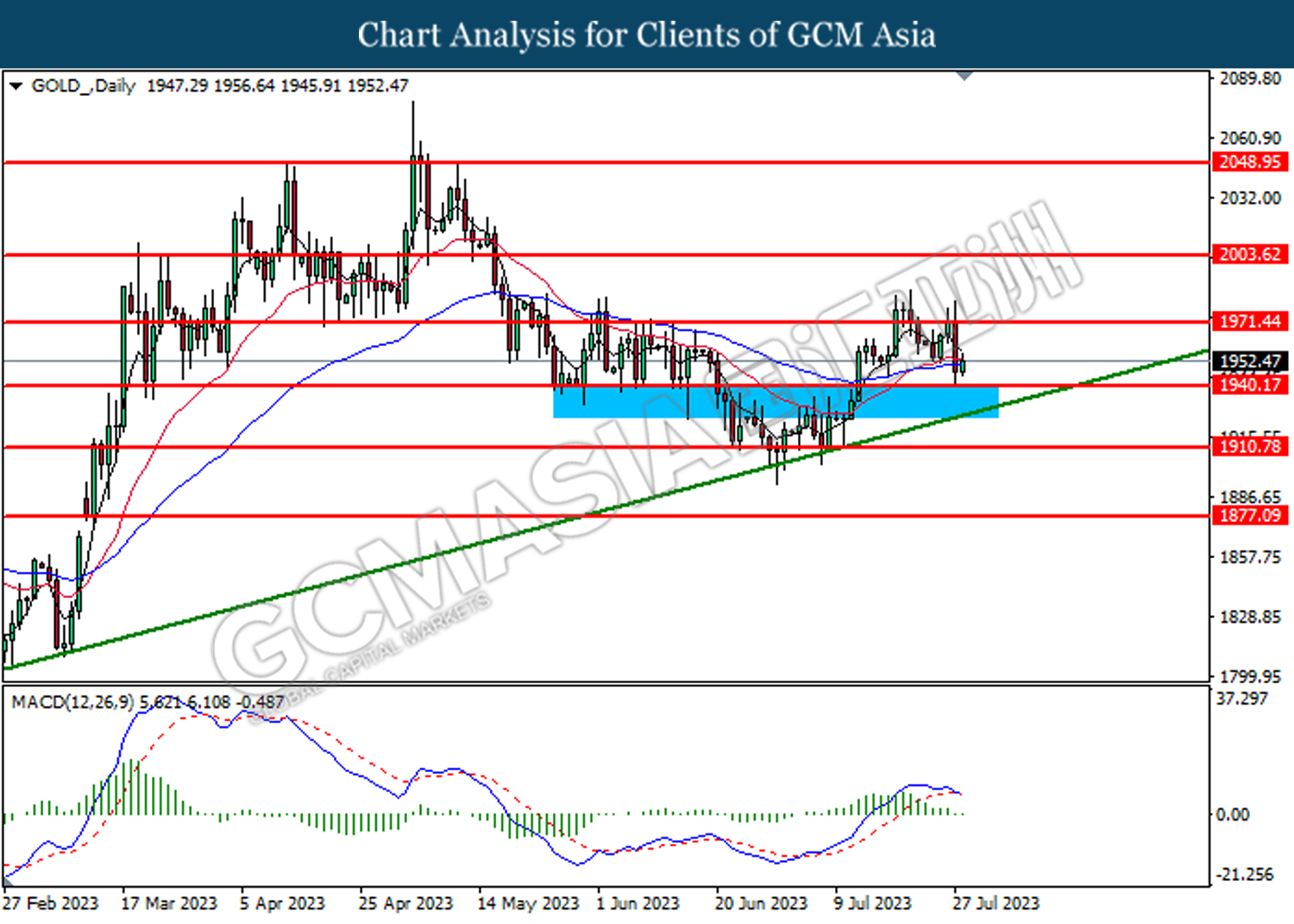

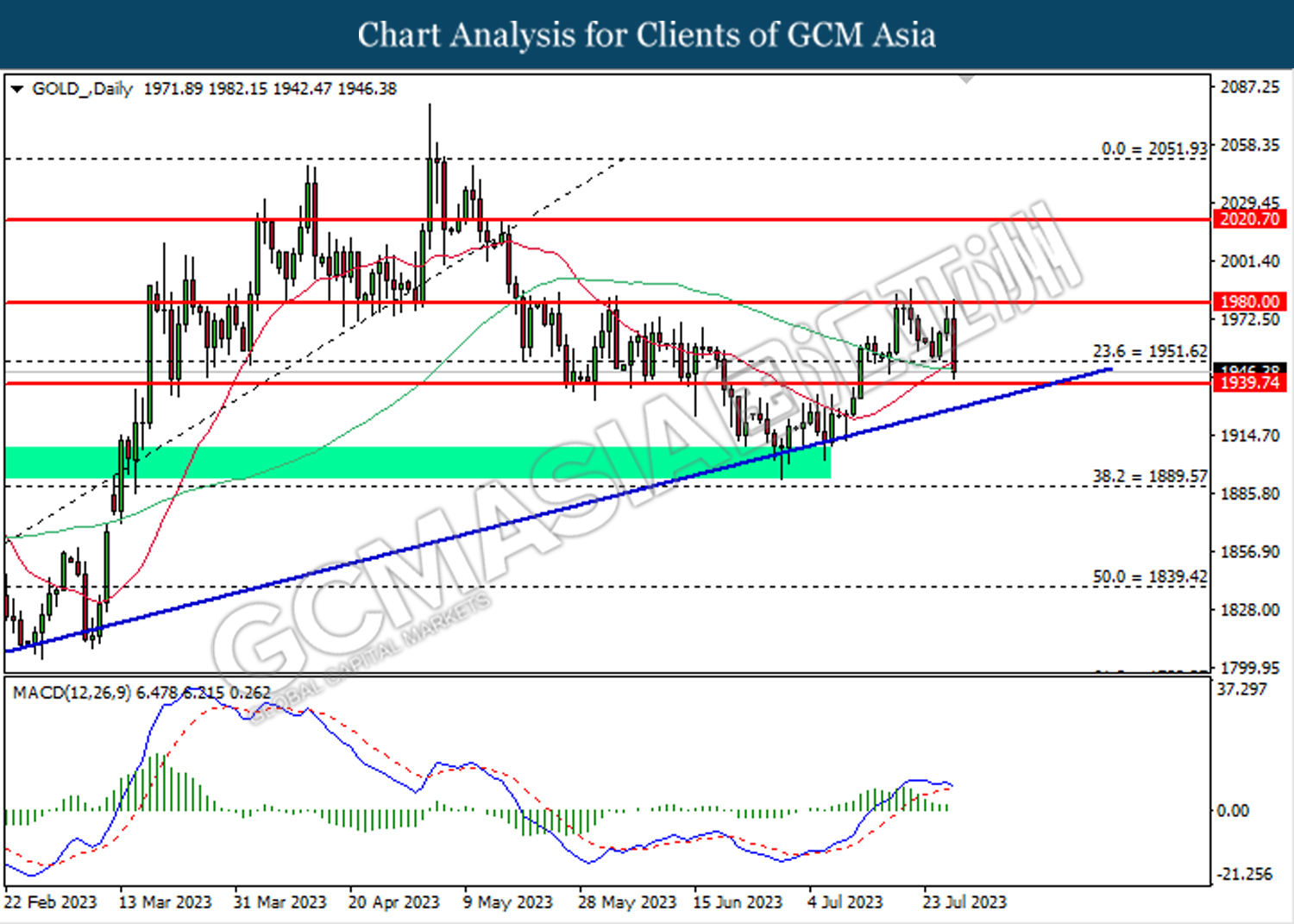

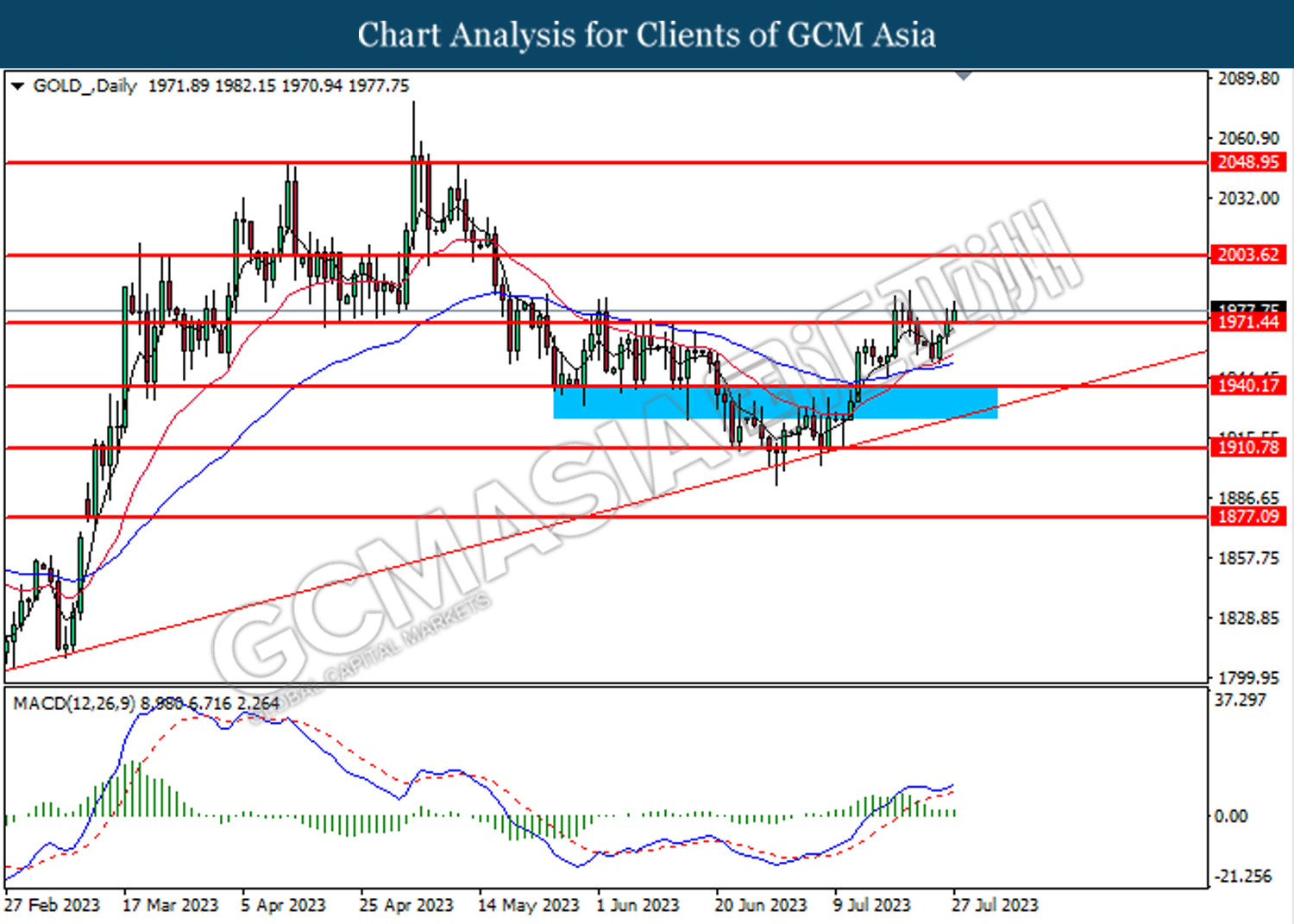

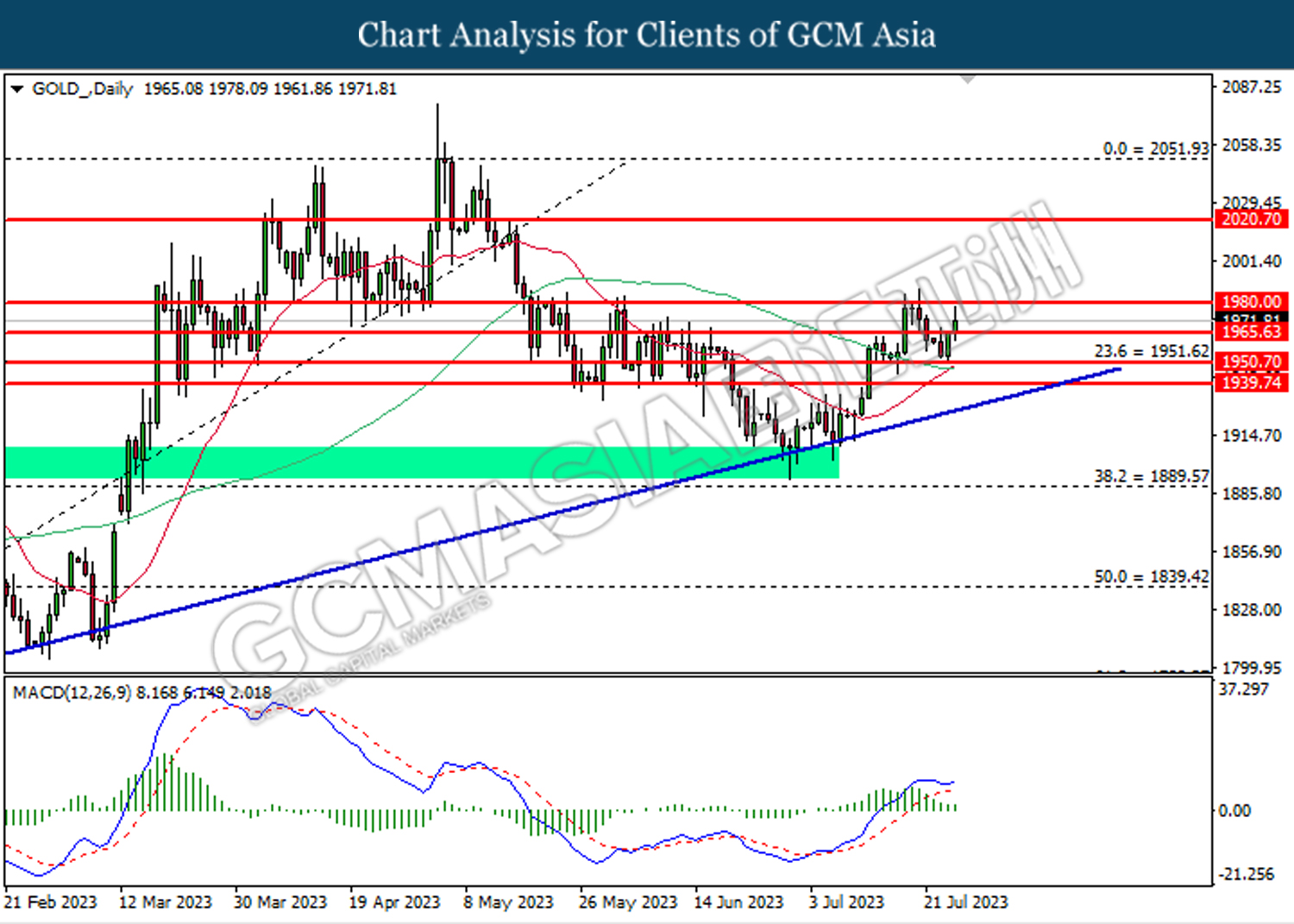

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1939.75. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1951.60.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55

040823 Afternoon Session Analysis

4 August 2023 Afternoon Session Analysis

GBP rose as BoE hike interest rate to 5.25%.

Pound Sterling (GBP), which was widely traded by global investors, rose after the Bank of England (BoE) decided to hike 25 basis points (bps) of interest rate. Yesterday, BoE has decided to raise the interest rate by 25 bps decision from 5.0% to 5.25%, matched with market forecast. Since the inflation is dropping faster than expected, therefore the interest rate decision only raised by 25 bps instead of 50 bps. BoE expects that the inflation in October will fall to around 5%. After that, the BoE Governor Andrew Bailey has mentioned the upcoming interest rate decision will have no presumed path, which means that the upcoming interest rate decision will still depend on economic data. Besides that, in the labor market, Andrew Bailey stated that other parts of the labor market were softening, but wage inflation was persistent. Although the unemployment rate remained very low at 4.0%, the wage paid remained high since May, and the pay growth is notably stronger than standard models would have suggest. BoE remained their inflation target at 2% and they expect recession will not happened. As of writing, GBP/USD rose 0.22% to 1.2740.

In the commodities market, crude oil prices rose 0.21% to 81.70 per barrel amid Russia also followed Saudi Arabia to continue the oil production cut plan to September of 300,000 barrels per day. Besides, gold prices rose 0.08% to 1936.00 per troy amid investors’ disappointment with the recent US economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (Jul) | 0.4% | 0.3% | – |

| 20:30 | USD – Nonfarm Payrolls (Jul) | 209K | 200K | – |

| 20:30 | USD – Unemployment Rate (Jul) | 3.6% | 3.5% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while following the prior retracement from the resistance level at 102.35. MACD which illustrated decreasing bullish momentum suggests the index to extend its losses toward the support level at 101.55.

Resistance level: 102.35, 103.15

Support level: 101.55, 100.80

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from lower level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2830.

Resistance level: 1.2830, 1.3000

Support level: 1.2670, 1.2525

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.0835.

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 143.00. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses toward the support level at 141.90.

Resistance level: 143.00, 144.85

Support level: 141.90, 140.25

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6510. However, MACD which illustrated increasing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6595, 0.6695

Support level: 0.6510, 0.6410

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6055. However, MACD which illustrated increasing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6160, 0.6280

Support level: 0.6055, 0.5935

USDCAD, Daily: USDCAD was traded higher following the prior after breakout above the previous resistance level at 1.3295. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3425.

Resistance level: 1.3435, 1.3525

Support level: 1.3295, 1.3110

USDCHF, Daily: USDCHF was traded lower following the prior retracement from higher level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 0.8710.

Resistance level: 0.8855, 0.8995

Support level: 0.8710, 0.8545

CrudeOIL, Daily: Crude oil price was traded following the prior rebound form the support level at 79.70. However, MACD which illustrated decreasing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 82.55, 85.35

Support level: 79.70, 73.80

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1940.20. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1910.80.

Resistance level: 1940.20, 1971.45

Support level: 1910.80, 1877.10

040823 Morning Session Analysis

4 August 2023 Morning Session Analysis

The dollar’s bull hit a wall amid disappointing economic data.

The dollar index, which was traded against a basket of six major currencies, lingered near the recent high level as a series of downbeat data hold back the index from further gains. Last week, the number of Americans filing new claims for unemployment benefits increased slightly. The Department of Labor reported that the unemployment claims rose by 6,000 to 227,000, aligning with market estimates while the previous week’s level remained unchanged at 221,000. Besides, the Institute for Supply Management (ISM) reported that the non-manufacturing Purchasing Managers’ Index (PMI) fell to 52.7 last month, down from 53.9 in June. Despite a 525 basis point increase in interest rates by the Federal Reserve since March 2022, the current level of non-manufacturing PMI indicates that the economy continues to progress. Services are seeing sustained demand due to a shift in consumer spending away from goods. The US activity data has demonstrated remarkable resilience compared to other parts of the world, which is why the dollar index managed to remain steady despite the disappointing data. On Friday, the government is set to release its highly anticipated employment report for July. According to economists polled by Reuters, an increase of 200,000 jobs is expected for the month following a rise of 209,000 in June. The unemployment rate is forecasted to remain unchanged at 3.6%. As of now, the dollar index dropped -0.12% to 102.45.

In the commodities market, crude oil prices were up by 0.07% to $81.80 per barrel as Saudi Arabia announced a further extension of 1 million barrels voluntary oil cut for another month. Besides, the gold prices rebounded 0.05% to $1935.05 per troy ounce amid the weakness of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (Jul) | 0.4% | 0.3% | – |

| 20:30 | USD – Nonfarm Payrolls (Jul) | 209K | 200K | – |

| 20:30 | USD – Unemployment Rate (Jul) | 3.6% | 3.5% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 105.00

Support level: 101.65, 100.65

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2765. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2605.

Resistance level: 1.2765, 1.2875

Support level: 1.2605, 1.2415

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0960. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0850.

Resistance level: 1.0960, 1.1065

Support level: 1.0850, 1.0775

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 143.40。 MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 143.40, 144.90

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded higher while currently retesting the resistance level at 0.6565. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6565, 0.6675

Support level: 0.6425, 0.6285

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3330. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3395.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.75, 83.05

Support level: 79.75, 77.15

GOLD_, Daily: Gold price was traded lower while currently testing near the upward trend line. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

030823 Afternoon Session Analysis

3 August 2023 Afternoon Session Analysis

Eurozone’s PMI fell for 6th consecutive month in July, EUR plunged.

Euro (EUR), which was widely traded by global investors, dropped after the Eurozone manufacturing PMI data was released. Eurozone’s manufacturing PMI has been fell for six consecutive month in July, decreased from 43.4 to 42.7, matched with the market forecast. This is the thirteenth month in a row that PMI data remained below 50, which represented there were around 1 year that the Eurozone manufacturing sector has stopped expanding. Besides that, according to Eurostat, the unemployment rate remained the same at 6.4%, below the market forecast of 6.5%. Although the unemployment rate were decreasing, but the labor market pressure eased. On the other hand, Germany, as the Eurozone’s largest economic country, released disappointing HCOB PMI, where it decreased from 40.6 to 38.8, matched with the market forecast. The German’s manufacturing sector weakened further amid the deterioration of demand, quantity of new order declined sharply. As the European Central Bank (ECB) stated that they will be open-minded to decide the upcoming interest decision, all these underperformed economic data may lead ECB member to shift its stance from hawkish to dovish. As of writing, EUR/USD dropped -0.03% to 1.0930.

In the commodities market, crude oil prices rose 0.33% to 79.70 per barrel amid by the EIA crude oil inventories has decreased to -17 million, below the market forecast. Besides, gold prices rose 0.12% to 1936.90 per troy amid the investors gained confident for US dollar following the release of outstanding economic data, therefore investors chose to leave the “safe heaven” asset and invest into dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE MPC Meeting Minutes

19:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 19:00 | GBP – BoE Interest Rate Decision (Aug) | 5.00% | 5.25% | – |

| 20:30 | USD – Initial Jobless Claims | 221K | 227K | – |

| 21:45 | USD – S&P Global US Services PMI (Jul) | 52.4 | 52.4 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 53.9 | 53.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while testing the resistance level at 102.35. MACD which illustrated increasing bullish momentum suggests the index to extend its gains after it breakout the resistance level.

Resistance level: 102.35, 103.15

Support level: 101.55, 100.80

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2830. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.2670.

Resistance level: 1.2830, 1.3000

Support level: 1.2670, 1.2525

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.0835.

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 143.00. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 144.85

Resistance level: 144.85, 146.25

Support level: 143.00, 141.90

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6595. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6510.

Resistance level: 0.6595, 0.6695

Support level: 0.6510, 0.6410

NZDUSD, Daily: NZDUSD was traded lower while testing the support level at 0.6055. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses after breakout the support level.

Resistance level: 0.6160, 0.6280

Support level: 0.6055, 0.5935

USDCAD, Daily: USDCAD was traded higher following the prior after breakout above the previous resistance level at 1.3295. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3425.

Resistance level: 1.3435, 1.3525

Support level: 1.3295, 1.3110

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8710. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.8855

Resistance level: 0.8855, 0.8995

Support level: 0.8710, 0.8545

CrudeOIL, Daily: Crude oil price was traded lower while testing the support level at 79.70. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses after breakout the support level.

Resistance level: 79.70, 82.55

Support level: 77.15, 73.80

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1940.20. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1910.80.

Resistance level: 1940.20, 1971.45

Support level: 1910.80, 1877.10

030823 Morning Session Analysis

3 August 2023 Morning Session Analysis

Unstoppable bull in US dollar market amid strong economic data.

The dollar index, which was traded against a basket of six major currencies, extended its rallies yesterday amid the announcement of upbeat labor data. On Wednesday, the dollar experienced an upward surge as investors seemed unfazed by Fitch’s decision to downgrade the U.S. credit rating. According to the agency, there is a possibility that the fiscal situation may deteriorate in the next three years, while the ongoing negotiations regarding the debt ceiling, taking place at the last minute, pose a threat to the government’s capacity to honor its debt obligations. Although Fitch’s downgrade from AAA to AA+ on Tuesday sparked anger from the White House and surprised investors, it had only a minor impact on the world’s most-traded currency, the dollar. This suggests that the market is currently more focused on the encouraging employment data and less affected by the credit rating change. The greenback received a boost from encouraging data, indicating a larger-than-expected increase of 324,000 jobs in the private sector in July, according to the ADP National Employment report. Economists had previously forecasted a more modest increase of 189,000 jobs. This positive employment report serves as further evidence of the resilience of the U.S. labor market, despite the Federal Reserve’s efforts to slow the economy and tackle inflation. The strong job growth may act as a safeguard for the nation’s economy, potentially shielding it from a possible recession. As of writing, the dollar index rose 0.29% to 102.60.

In the commodities market, crude oil prices were down by -3.15% to $79.65 per barrel following the profit-taking activities in the market despite a huge draw in US crude stocks. Besides, the gold prices rebounded 0.09% to $1936.65 per troy ounce following a sharp drop amid the release of strong ADP data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE MPC Meeting Minutes

19:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:00 | GBP – BoE Interest Rate Decision (Aug) | 5.00% | 5.25% | – |

| 20:30 | USD – Initial Jobless Claims | 221K | 227K | – |

| 21:45 | USD – S&P Global US Services PMI (Jul) | 52.4 | 52.4 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 53.9 | 53.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 105.00

Support level: 101.65, 100.65

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

EURUSD, Daily: EURUSD was traded lower while currently retesting the support level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3330. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3175

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 79.75. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 80.75, 83.05

Support level: 79.75, 77.15

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1939.75 MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55

020823 Afternoon Session Analysis

2 August 2023 Afternoon Session Analysis

AUD weaken after surprise RBA interest rate decisions made

Aussie Dollar (AUD), which was widely traded by global investors, dropped after the announcement of maintaining interest rate decisions. According to the Reserve Bank of Australia (RBA), they decided to maintain the interest rate at 4.10%, but the market forecasted a hike of 25 basis points (bps) to 4.35%. The different results for market forecast and actual outcome caused the AUD to experience a drop as a correction. The recent Australian CPI data proved that inflation is cooling down, while the RBA is trying to prevent a recession in Australia. The condition of the labor market in Australia remains tight, although it eased a fair bit recently. On the other hand, the US has reported a series of outstanding economic data, such as US GDP and initial jobless claims. Although the recent PMI data did not exceed the market forecast but still performed better than the previous month. In the current situation, the US economic conditions are much better than Australia, dragging the currencies pair AUD/USD downward. As of writing, AUD/USD dropped -0.06% to 0.6605.

In the commodities market, crude oil prices spiked 1.06% to 82.25 per barrel amid by the API weekly crude oil stock showed a huge draw, therefore investors forecast the coming EIA inventories report will be negative too. Besides, gold prices rose 0.17% to 1947.40 per troy amid the US government credit rating has downgraded made investors lost confident on US dollar then dollar index dropped.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Jul) | 497K | 188K | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.600M | -0.071M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.55. MACD which illustrated increasing bullish momentum suggests the index to extend its gains toward the resistance level at 102.35.

Resistance level: 102.35, 103.15

Support level: 101.55, 100.80

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2830. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.2670.

Resistance level: 1.2830, 1.3000

Support level: 1.2670, 1.2525

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. However, MACD which illustrated decreasing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

USDJPY, Daily: USDJPY was traded higher while testing the resistance level at 143.00. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout the resistance level.

Resistance level: 143.00, 144.85

Support level: 141.90, 140.25

AUDUSD, Daily: AUDUSD was traded lower while testing the support level at 0.6695. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses after it breakout the support level.

Resistance level: 0.6785, 0.6880

Support level: 0.6695, 0.6595

NZDUSD, Daily: NZDUSD was traded lower following the prior after breakout below the previous support level at 0.6160. MACD which illustrated decreasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6055.

Resistance level: 0.6160, 0.6280

Support level: 0.6055, 0.5935

USDCAD, Daily: USDCAD was traded higher while testing the resistance level at 1.3295. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains after breakout the resistance level.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8710. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.8855

Resistance level: 0.8855, 0.8995

Support level: 0.8710, 0.8545

CrudeOIL, Daily: Crude oil price was traded higher while testing the resistance level at 85.35. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains after breakout the resistance level.

Resistance level: 82.55, 85.35

Support level: 79.70, 77.25

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1971.45. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1940.20.

Resistance level: 1971.45, 2003.60

Support level: 1940.20, 1910.80

020823 Morning Session Analysis

2 August 2023 Morning Session Analysis

US Dollar hangs tough despite disappointing economic data.

The dollar index, which was traded against a basket of six major currencies, managed to hold its foot of gains, while lingering near the recent high level despite the nation has released downbeat economic data yesterday’s night. On 1st August, the Institute for Supply Management released its report on the ISM Manufacturing PMI for July. The data showed a slight improvement as the PMI increased from 46 in June to 46.4 in July. However, this figure was slightly lower than the analyst consensus of 46.8. Despite the uptick in the PMI, the U.S. manufacturing sector continued to contract in July for the 9th consecutive month. The overall demand remained weak, although there was a marginal improvement compared to June. Production was hampered by a lack of work, and suppliers still had available capacity. In regards to employment, the U.S. Bureau of Labor Statistics (BLS) reported that on the last business day of June, there were 9.58 million job openings. This number was a decline from the 9.82 million openings recorded in May and fell slightly below the market’s expectation of 9.62 million. Even though job openings reached their lowest level in over two years in June, they still suggested tight labor market conditions. As a result, there may be implications for the Federal Reserve’s interest rate decisions, with the possibility of keeping rates elevated for a prolonged period. Hence, these downbeat data failed to ‘stop the bull’ in dollar market, leaving the currency at high level. As of writing, the dollar index rose 0.10% to 101.96.

In the commodities market, crude oil prices were up by 0.12% to $82.35 per barrel following a huge draw in US oil inventories throughout the entire past one week. According to the API, the US oil inventories level declined by -15.400M, far lower than the analyst consensus at -0.900M. Besides, gold prices ticked up by 0.30% to $1950.00 per troy ounce as market risk aversion heightened after Fitch downgraded the US Long term ratings to AA+ from AAA.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Jul) | 497K | 188K | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.600M | -0.071M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support upward trend line. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trend line.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

EURUSD, Daily: was traded lower while currently retesting the upward trend line. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trend line.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 80.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 83.05.

Resistance level: 83.05, 86.05

Support level: 80.75, 79.75

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75

010823 Afternoon Session Analysis

1 August 2023 Afternoon Session Analysis

EUR dropped as CPI and GDP data released.

Euro (EUR), which was widely traded by global investors, dropped after Euro released CPI and GDP data. According to Eurostat, the EU CPI has decreased from 5.5% to 5.3%, matched with the market forecast. With that, it shows that the inflation in Euro zone is surely cooling down but still remain far away from the European Central Bank (ECB) target of 2%. However, there are no any firm ideas if ECB will increase or maintain its interest rate in September’s interest rate decision due to ECB members carry open minded attitude toward the interest rate decisions. Besides that, Europe GDP has increased from 0.0% to 0.3%, higher than the market forecast of 0.2%. These economic data showed that Euro consumer spending still remained at high level, although the manufacturing activities declined further last month. On the other hand, US has reported a series of outstanding economic data, such as US GDP and initial jobless claim. Initially, the market forecasted US GDP will provide a downbeat result, but it turned out a surprisingly good result, which has eventually led to a spike in dollar index. In term of the current economic condition, US economy is performing far better than Eurozone’s, dragging the currency pair EUR/USD downward. As of writing, the EUR/USD dropped -0.06% by 1.0985.

In the commodities market, crude oil prices dropped -0.12% to $81.65 per barrel as a short-term retracement following a spike caused by the better-than-expected China PMI data. Besides, gold prices dropped -0.23% to $1960.90 per troy amid the strengthening of US Dollar with the backdrop of upbeat economic data.

Today’s Holiday Market Close

Time Market Event

All Day CHF National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 15:55 | EUR – HCOB Germany Manufacturing PMI (Jul) | 40.6 | 38.8 | – |

| 16:30 | GBP – S&P Global/CIPS UK Manufacturing PMI (Jul) | 46.5 | 45.0 | – |

| 16:30 | CrudeOIL – API Weekly Crude Oil Stock | 1.319M | – | – |

| 17:00 | EUR – Unemployment Rate (Jun) | 6.5% | 6.5% | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 46.0 | 46.5 | – |

| 22:00 | USD – JOLTs Job Openings (Jun) | 9.824M | 9.620M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.55. MACD which illustrated increasing bullish momentum suggests the index to extend its gains toward the resistance level at 102.35.

Resistance level: 102.35, 103.15

Support level: 101.55, 100.80

GBPUSD, Daily: GBPUSD was traded lower while testing the support level at 1.2827. However, MACD which illustrated decreasing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2827, 1.3000

Support level: 1.2670, 1.2525

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. However, MACD which illustrated decreasing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

USDJPY, Daily: USDJPY was traded higher following the prior after breakout above the previous resistance level at 141.90. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 143.00.

Resistance level: 141.90, 143.00

Support level: 140.25, 138.70

AUDUSD, Daily: AUDUSD was traded lower while testing the support level at 0.6695. However, MACD which illustrated decreasing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6785, 0.6880

Support level: 0.6695, 0.6595

NZDUSD, Daily: NZDUSD was traded higher following the prior after breakout the previous resistance level at 0.6160. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6280

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

USDCAD, Daily: USDCAD was traded flat above the support level at 1.3110. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 1.3110.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8710. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.8855

Resistance level: 0.8855, 0.8995

Support level: 0.8710, 0.8545

CrudeOIL, Daily: Crude oil price was traded higher following the prior after breakout above the previous resistance level at 79.70. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 85.35.

Resistance level: 82.50, 85.35

Support level: 79.70, 77.25

GOLD_, Daily: Gold price was traded flat above the support level at 1940.20. MACD are lack of signal due to the momentum are weak, recommend wait for the signal appear only entry the market.

Resistance level: 1971.45, 2003.60

Support level: 1940.20, 1910.80

010823 Morning Session Analysis

1 August 2023 Morning Session Analysis

US dollar flat as traders await for more economic data.

The dollar index, which was traded against a basket of six major currencies, hovered near the recent high as the market participants were waiting for a series of economic data before taking a move. Looking ahead, among all the important economic data, the upcoming non-farm payrolls report on Friday will play a crucial role in shaping the Federal Reserve’s interest rate decision in late September. The data from the U.S. will determine whether the economy continues to display resilience. If it does, this could provide support to the dollar, at least allowing it to maintain its current position. Besides, the dollar managed to hold its ground as a Fed’s survey revealed that U.S. banks reported implementing stricter credit standards and experiencing reduced loan demand in the second quarter. This indicates that the increasing interest rates are impacting the economy. The survey, known as the Senior Loan Officer Opinion Survey (SLOOS), covers both businesses and consumers, and it further indicated that banks anticipate tightening their lending standards throughout the remainder of 2023. In a higher interest rate environment, it is expected to observe a tightening of lending standards and a decrease in loan demand. As a result, the market risk averse sentiment heightened, urging the safe haven currency, such as US dollar, spiked up early today. As of writing, the dollar index edged up by 0.24% to 101.85.

In the commodities market, crude oil prices were up by 1.14% to $81.65 per barrel, supported by the factor of tightening global supply and rising demand, especially from China. Besides, gold prices ticked down by -0.06% to $1964.35 per troy ounce as dollar strengthened further.

Today’s Holiday Market Close

Time Market Event

All Day CHF National Day

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Aug) | 4.10% | 4.35% | – |

| 15:55 | EUR – HCOB Germany Manufacturing PMI (Jul) | 40.6 | 38.8 | – |

| 16:30 | GBP – S&P Global/CIPS UK Manufacturing PMI (Jul) | 46.5 | 45.0 | – |

| 16:30 | CrudeOIL – API Weekly Crude Oil Stock | 1.319M | – | – |

| 17:00 | EUR – Unemployment Rate (Jun) | 6.5% | 6.5% | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 46.0 | 46.5 | – |

| 22:00 | USD – JOLTs Job Openings (Jun) | 9.824M | 9.620M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2875. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

EURUSD, Daily: was traded lower while currently retesting the upward trend line. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trend line.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 141.60.

Resistance level: 141.60, 144.90

Support level: 139.00, 136.35

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3175. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 80.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 83.05.

Resistance level: 83.05, 86.05

Support level: 80.75, 79.75

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1951.60. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75

310723 Afternoon Session Analysis

31 July 2023 Afternoon Session Analysis

The EUR strengthened after France and Spain boosted their economies.

The EUR strengthened against the dollar index last Friday after the French and Spanish second displayed unexpected resilience in the second quarter but the German economy remains weak in the eurozone. French’s GDP recorded a 0.5% upbeat estimation of 0.1% while the Spanish GDP grew by 0.4% in line with market expectations. Data from France and Spanish, the bloc’s second and fourth larger economies, grew at a sustained pace in the second quarter and was driven by stronger exports and tourism led the growth. However, German GDP stagnated in the second quarter as the reading recorded -0.2% for two consecutive quarters and lower than expected 0.1%. Due to manufacturing and service slowing down, the German economy pointed to a weakness in the second quarter. Consumers tightened their purses as high inflation caused weak purchasing power. Therefore, the industrial order book was slowing after a soft purchasing power in German. Other economic data released on the same data showed that Spanish and German price pressure remains elevated as the yearly CPI remains at a higher pace. The Spanish July CPI in yearly reading grew to 2.3% from 1.9%m higher than 1.5%, and Germany slightly decreased to 6.2% from 6.4%. Both countries’ CPI is still far from the European Central Bank’s (ECB) 2% to 3% long-term target. It also increases the pressure on ECB to choose whether to further tighten or pause its tightening moves. As of writing the EURUSD traded lower by -0.01% to 1.1014.

In the commodities market, the crude oil price slipped by -0.41% to 80.25 as weak China PMI weighed on crude oil prices. On the other hand, the gold prices dipped by -0.20% to 1955.30 after the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jul) | 5.5% | 5.3% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior breaks above from the previous resistance level at 101.35. However, MACD which illustrated diminishing bullish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 102.00, 102.75

Support level: 101.35, 100.80

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.2990, 1.3210

Support level: 1.2830, 1.2610

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.1075, 1.1160

Support level: 1.0990, 1.0915

USDJPY, H4: USDJPY was traded higher following the prior breaks above the previous resistance level at 141.40. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the next resistance level at 142.70

Resistance level: 142.70, 143.90

Support level: 141.40, 140.20

AUDUSD, H4: AUDUSD was traded higher following the prior rebound for the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6700.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6215.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior breaks above the previous resistance level at 1.3240. MACD illustrated bullish momentum suggests the pair extended its gains toward the next resistance level at 1.3335.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3125

USDCHF, H4: USDCHF was traded higher while currently testing for the resistance level at 0.8715. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.8715, 0.8785

Support level: 0.8645, 0.8580

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 80.95, 83.30

Support level: 79.05, 77.40

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 1965.60, 1984.00

Support level: 1946.60, 1933.05

310723 Morning Session Analysis

31 July 2023 Morning Session Analysis

The US dollar dipped amid further signs that inflation is easing.

The dollar index, which was traded against a basket of six major currencies, failed to extend its prior rallies as the latest US inflation data showed a further sign of easing. In June, the annual U.S. inflation saw its smallest increase in over two years, with underlying price pressures showing moderation. If this trend continues, it might bring the Federal Reserve closer to ending its aggressive interest rate hike cycle. The positive outlook on inflation was reinforced by additional data on Friday, indicating that labor costs experienced their smallest rise in two years during the second quarter, with wage growth cooling down. This aligns with previous reports this month, highlighting the economy’s shift towards disinflation, with consumer prices moderating notably in June and producer inflation remaining subdued. Excluding volatile food and energy components, the PCE price index saw a 0.2% increase after rising 0.3% in the previous month. This led to a year-on-year rise of 4.1% in the core PCE price index, marking the smallest increase since September 2021. In May, the annual core PCE price index had climbed by 4.6%. The decelerating trends in inflation, wages, and expected slowdown in spending all support the belief that the recent rate hike is likely the last one for now. As of writing, the dollar index dropped -0.07% to 101.70.

In the commodities market, crude oil prices were up by 1.08% to $80.70 per barrel as the US dollar eased further following the announcement of inflation data, which prompted the investors to rush into the oil market. Besides, gold prices surged by 0.05% to $1960.05 per troy ounce amid positive outlook on easing of inflation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jul) | 5.5% | 5.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2875. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

EURUSD, Daily: was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 139.00. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 141.60.

Resistance level: 141.60, 144.90

Support level: 139.00, 136.35

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.75, 83.05

Support level: 79.75, 77.15

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1951.60. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75

280723 Afternoon Session Analysis

28 July 2023 Afternoon Session Analysis

Euro slumped following a rate hike as investors expected.

Euro, which was widely traded by global investors, slumped after European Central Bank (ECB) hiked interest rate and ECB Press Conference. ECB raised its policy rates by 25 basis points (bps) from 4.0% to 4.25%, matched as the market forecast at 4.25%. Although there was a hike on interest rate, but due to German and French are Euro largest economic countries and their economic conditions were underperformed, the Euro economic condition might be unable to support this high level of interest rate, and eventually the investors lost confidents on Euro. Besides that, during the ECB Press Conference, President Lagarde said “We have an open mind as to what the decisions will be in September and in subsequent meetings,” which means the coming September interest rate could be a further hike or hold. Current Europe inflation rate still remain too high for ECB target – 2% of inflation until mid-2025. Investors are keeping their eyes on today’s French and German GDP data to scrutinize the future direction of the single currency. As of writing, EUR/USD dropped -0.06% to 1.0965.

In the commodities market, crude oil prices dropped -0.52% to $79.65 per barrel as a temporary correction. However, the long term prospect of the oil market remains decent amid ongoing OPEC oil production cut and hopes of China recovery. Besides, gold prices rose 0.48% to $1954.82 per troy after a slump of around $35 amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q2) | -0.3% | 0.1% | – |

| 21:00 | EUR – German CPI (MoM) (Jul) | 0.3% | 0.3% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Jun) | 4.6% | 4.2% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Jul) | 64.4 | 72.6 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while testing the resistance level at 101.55. MACD which illustrated increasing bullish momentum suggests the index to extend its gains after breakout the resistance level.

Resistance level: 101.55, 102.35

Support level: 100.80, 99.40

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2827. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.2670.

Resistance level: 1.2835, 1.3000

Support level: 1.2670, 1.2525

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated increasing bearish momentum suggest the pair to extend its gains toward the support level at 1.0835

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

USDJPY, Daily: USDJPY was traded lower while testing the support level at 138.70. MACD which illustrated a turn from bullish momentum to bearish momentum suggest the pair to extend its losses after breakout the support level.

Resistance level: 140.25, 141.90

Support level: 138.70, 137.55

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6695. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the support level at 0.6595

Resistance level: 0.6695, 0.6785

Support level: 0.6595, 0.6510

NZDUSD, Daily: NZDUSD was traded lower while testing the support level at 0.6160. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses after it breakout the support level.

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3295.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

USDCHF, Daily: USDCHF was traded higher while testing the resistance level at 0.8710. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains after it breakout the resistance level.

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

CrudeOIL, Daily: Crude oil price was traded higher while testing the resistance level at 79.70. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains after it breakout the resistance level.

Resistance level: 79.70, 82.55

Support level: 77.25, 73.75

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1940.20. However, MACD which illustrated decreasing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1971.45, 2003.60

Support level: 1940.20, 1910.80

280723 Morning Session Analysis

28 July 2023 Morning Session Analysis

US dollar skyrocketed amid upbeat economic data and Euro’s weakness.

The dollar index, which was traded against a basket of six major currencies, jumped to the highest level since a month ago as the weakness of Euro and robust macroeconomic data releases from the United States. According to the initial estimate from the US Bureau of Economic Analysis on Thursday, the real Gross Domestic Product (GDP) of the US expanded at an annualized rate of 2.4% in the second quarter. This growth surpassed market expectations of 1.8%, following a 2% growth recorded in the first quarter. Additionally, the US Department of Labor reported on Thursday that initial jobless claims totaled 221,000 for the week ending July 22, marking the lowest reading in five months. This figure came in below market expectations of 235,000 and showed improvement compared to the previous week’s unrevised 228,000 claims. On the other side, the European Central Bank (ECB) announced a new rate increase of a quarter percentage point, raising its main rate to 4.25%. Despite stating that inflation was expected to decline, the ECB expressed concerns that it would remain elevated for an extended period. However, recent business activity data from Germany and France, the eurozone’s largest economies, indicated declines, raising concerns about further rate hike might triggers the possibility of recession in the euro area later in the year. As of writing, the dollar index rose 0.80% to 101.70.

In the commodities market, crude oil prices were up by 0.02% to $79.80 per barrel amid tighter supplies and growing hopes of China’s stimulus plan. Besides, gold prices edged down by -0.05% to $1946.60 per troy ounce amid upbeat economic data from the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

14:00 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | -0.10% | – |

| 16:00 | EUR – German GDP (QoQ) (Q2) | -0.3% | 0.1% | – |

| 21:00 | EUR – German CPI (MoM) (Jul) | 0.3% | 0.3% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Jun) | 4.6% | 4.2% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Jul) | 64.4 | 72.6 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

EURUSD, Daily: was traded lower while currently retesting the support level at 1.0960. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 139.00. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.60, 143.90

Support level: 139.00, 136.35

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3245.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 79.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 79.75, 80.75

Support level: 77.15, 73.90

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55

270723 Afternoon Session Analysis

27 July 2023 Afternoon Session Analysis

Aussie dollar slipped after inflation cooling down.

Aussie (AUD), which was widely traded by global investors, slipped as CPI data fell more than the market forecast. According to the Australian Statistician, the second quarter CPI decreased from 7.0% to 6.0%, below the market forecast of 6.2%. The Australian economy was softening dramatically, the pace of inflation has peaked and is moderating quickly, and the Reserve Bank of Australia (RBA) targets 2-3% of inflation by mid-2025. The economic condition for Australia is complicated due to consumers and businesses are losing confidences, but the labor market still remains tight. In the next RBA meeting, investors expect the central bank might raise another 25 basis points (bps) before rate pause in the future. With that being said, the pair of AUD/USD rebounded significantly following the US FOMC Press Conference. Yesterday, the Fed raised interest rate by 25 bps as market forecasted. Also, Jerome Powell said the coming interest rate decision would be data-dependent, while the Fed will still bias toward prolonged ‘hawkish hold’. The FOMC statement showed the assessment of the economic activity is at “moderate pace”, compared to June’s “modest” pace. As of writing, AUD/USD rose 0.70% to 0.6800.

In the commodities market, crude oil prices rose 1.19% to $79.65 per barrel due to crude inventories drew by 600,000 barrels last week and the weakening of the US Dollar. Besides, gold prices rose 0.34% to $1978.60 per troy amid the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

|

Time |

Event | Previous | Forecast | Actual |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | 4.00% | 4.25% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jun) | 0.6% | 0.1% | – |

| 20:30 | USD – GDP (QoQ) (Q2) | 2.0% | 1.7% | – |

| 20:30 | USD – Initial Jobless Claims | 228K | 235K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Jun) | -2.7% | -0.6% |

– |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout the previous support level at 100.80. However, MACD which illustrated increasing bullish momentum suggests the index to undergo technical correction in short term.

Resistance level: 100.80, 101.55

Support level: 98.90, 97.75

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2835. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3000.

Resistance level: 1.3000, 1.3180

Support level: 1.2835, 1.2670

EURUSD, Daily: EURUSD was traded higher following the prior rebounded from the support level at 1.1010. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1185.

Resistance level: 1.1185, 1.1355

Support level: 1.1010, 1.0835

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 140.25. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses toward the support level at 138.70

Resistance level: 140.25, 141.90

Support level: 138.70, 137.55

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6880

Resistance level: 0.6880, 0.7015

Support level: 0.6785, 0.6695

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6160. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6280.

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

USDCAD, Daily: USDCAD was traded flat above the support level at 1.3110. Due to lack of signal for MACD it is recommended to wait for the signal only entry the market order.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8710. However, MACD which illustrated increasing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

CrudeOIL, Daily: Crude oil price was traded higher while testing the resistance level at 79.70. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains after it breakout the resistance level.

Resistance level: 79.70, 82.55

Support level: 77.25, 73.75

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1971.45. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 2003.60.

Resistance level: 2003.60, 2048.95

Support level: 1971.45, 1940.20

270723 Morning Session Analysis

27 July 2023 Morning Session Analysis

Greenback dipped amid Powell’s less-hawkish statement.

The dollar index, which was traded against a basket of six major currencies, took a breath from its prior rallies after the long-waited Fed’s meeting in the early morning. In line with market expectations, the Federal Reserve increased the benchmark borrowing rate by 25 basis point. This move marks the 11th rate increase in the current rate-hiking cycle and brings the benchmark rate to a range of 5.25% to 5.5%, reaching its highest level since 2001. Regarding future rate increases, Chair Powell stated that the Federal Open Market Committee (FOMC) did not provide explicit guidance. Depending on upcoming economic data, the central bank may choose to raise rates again or keep them steady in their next meeting. However, Powell emphasized that the Federal Reserve intends to maintain a restrictive policy stance until they are confident that inflation is sustainably moving towards their target of 2%. They are also prepared to further tighten monetary policy if necessary. Despite some recent indications of a cooling in price increases, Powell expressed that the Fed is not yet fully convinced that inflation is under control, particularly considering that core inflation remains above 3%. The central bank will be taking a cautious approach and closely monitors the latest economic data before making any decisions. As of writing, the dollar index dropped -0.32% to 101.05.

In the commodities market, crude oil prices edged down by -0.67% to $78.85 per barrel followed by data showing a smaller-than-expected drop in U.S. crude inventories and the Federal Reserve raised its interest rates by 25 basis points. Besides, gold prices edged up by 0.10% to $1974.05 per troy ounce amid the weakness of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | 4.00% | 4.25% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jun) | 0.6% | 0.1% | – |

| 20:30 | USD – GDP (QoQ) (Q2) | 2.0% | 1.7% | – |

| 20:30 | USD – Initial Jobless Claims | 228K | 235K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Jun) | -2.7% | -0.6% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. However, MACD which illustrated bullish bias momentum suggests the index to undergo technical correction in short term.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2970. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2970, 1.3125

Support level: 1.2875, 1.2765