21 February 2020 Afternoon Session Analysis

Pound sterling recovers as Retail Sales delivers.

Pound sterling managed to recoup its losses on yesterday following the release of bullish data from United Kingdom. As of writing, pair of GBP/USD rose 0.05% to 1.2885. According to Office for National Statistics, Retail Sales for the month of January came in at 0.9%, slightly higher than forecast of 0.7%. The data shows that consumer spending is still resilient despite ongoing Brexit risk which continues to cast a shadow upon UK’s future economic outlook. On the other hand, CBI reported that its Industrial Trends Orders came in slightly higher at -18, better than forecast with -19. The data shows that expectation towards manufacturing companies in UK has recovered slightly as they expect output to recover in the next three months due to an improvement in domestic economic condition.

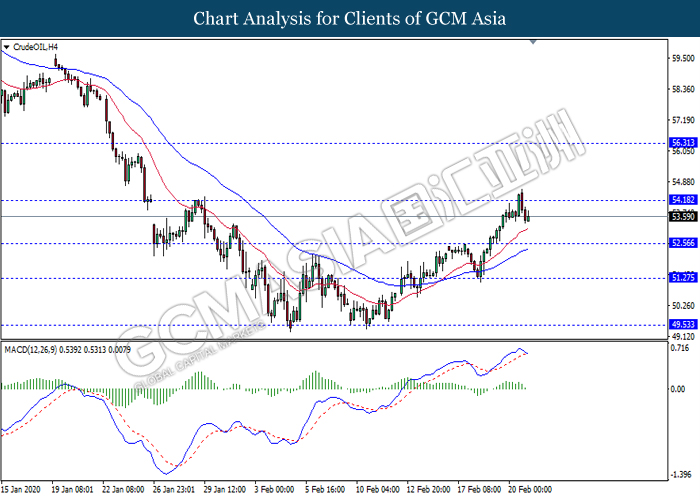

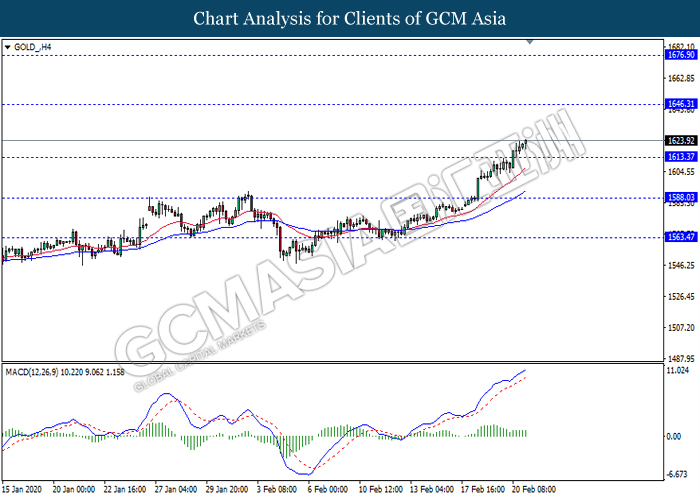

As for commodities market, crude oil price slumped 0.21% to $53.34 per barrel. Oil futures remains under bearish pressure as worries over coronavirus impact upon global oil demand continues to linger. On the other hand, gold price extended gains by 0.16% to $1,621.69 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 45.3 | 44.8 | – |

| 17:30 | GBP – Composite PMI | 53.3 | – | – |

| 17:30 | GBP – Manufacturing PMI | 50.0 | – | – |

| 17:30 | GBP – Services PMI | 53.9 | – | – |

| 18:00 | EUR – CPI (YoY) (Jan) | 1.4% | 1.4% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | 0.2% | 0.4% | |

| 23:00 | USD – Existing Home Sales (Jan) | 5.54M | 5.45M | |

| 02:00

(22nd) |

CrudeOIL – U.S. Baker Hughes Oil Rig Count | 678 | – | – |

Technical Analysis

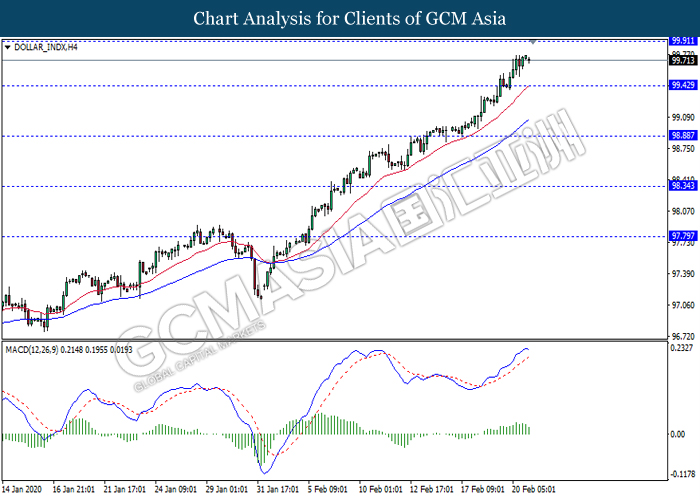

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level 99.40. However, MACD which illustrate diminishing bullish momentum suggest the dollar to experience a technical correction in short term towards the support level 99.40.

Resistance level: 99.90, 100.45

Support level: 99.40, 98.90

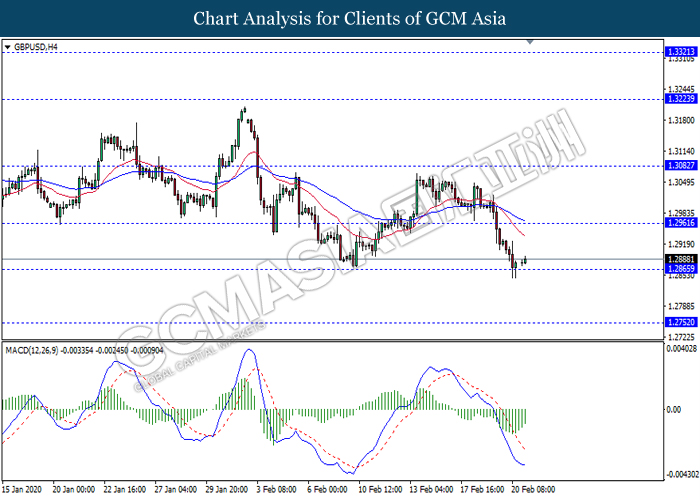

GBPUSD, H4: GBPUSD was traded lower while currently testing near the support level 1.2865. However, MACD which illustrate diminishing bearish momentum suggest the pair to experience a technical correction towards the resistance level 1.2960.

Resistance level: 1.2960, 1.3080

Support level: 1.2865, 1.2750

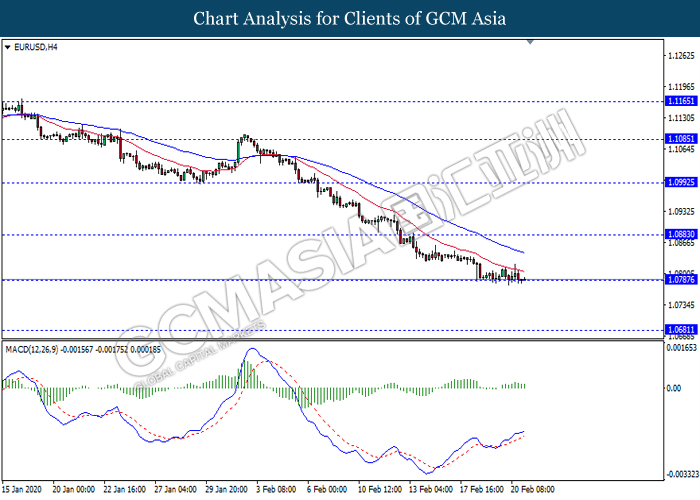

EURUSD, H4: EURUSD was traded flat while currently testing the support level 1.0795. However, MACD which illustrate bullish momentum signal suggest the pair to be traded higher as a technical correction towards the resistance level 1.0885.

Resistance level: 1.0885, 1.0990

Support level: 1.0795, 1.0680

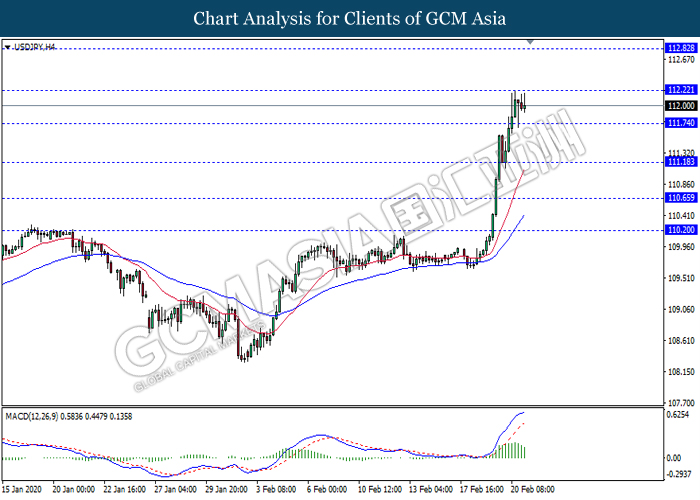

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level 112.20. MACD which illustrate diminishing bullish momentum suggest the pair to experience a technical correction towards the support level 111.75.

Resistance level: 112.20, 112.80

Support level: 111.75, 111.20

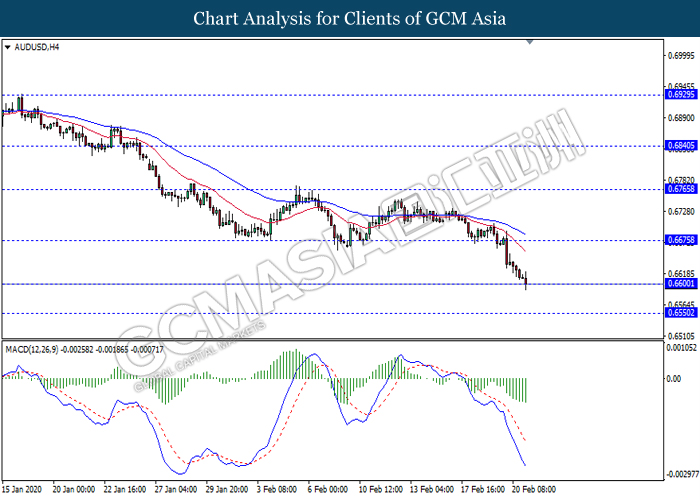

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level 0.6600. MACD which illustrate ongoing bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6675, 0.6765

Support level: 0.6600, 0.6550

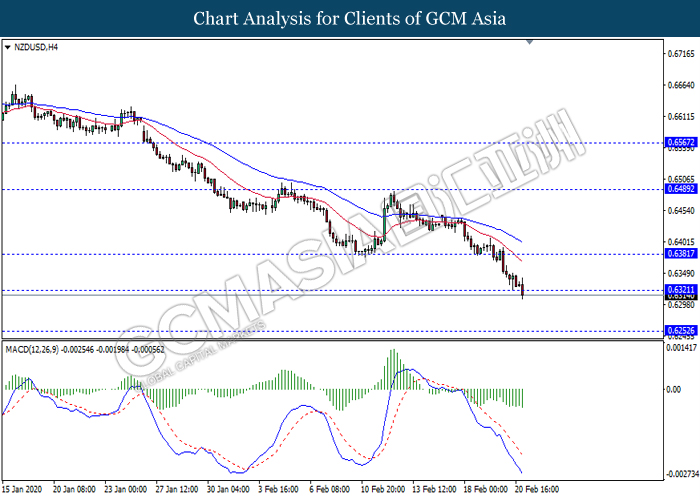

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6600. MACD which illustrate ongoing bearish bias signal suggest the pair to extend its losses after it breaks below the support level

Resistance level: 0.6380, 0.6490

Support level: 0.6320, 0.6250

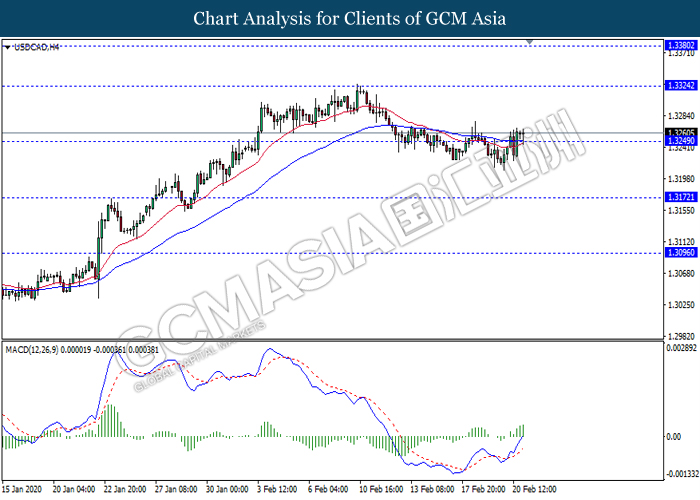

USDCAD, H4: USDCAD was traded flat near the support level 1.3250. However, MACD which illustrate bullish momentum signal suggest the pair to be traded higher towards the resistance level 1.3325.

Resistance level: 1.3325, 1.3380

Support level: 1.3250, 1.3170

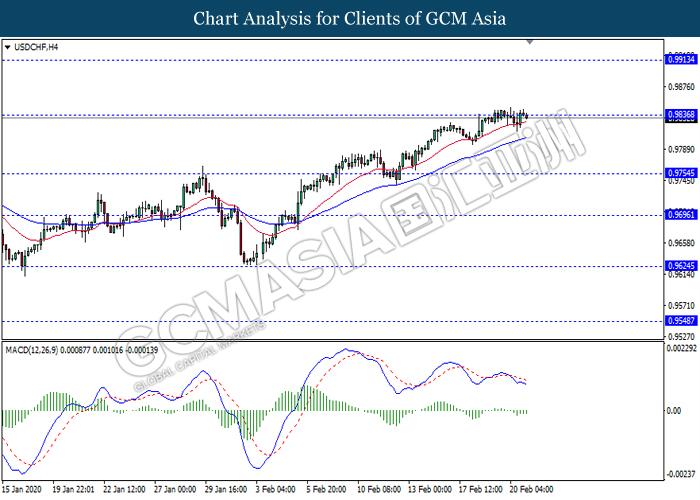

USDCHF, H4: USDCHF was traded flat while currently testing the resistance level 0.9835. However, MACD which illustrate bearish momentum signal suggest the pair to be traded lower towards the support level 0.9755.

Resistance level: 0.9835, 0.9915

Support level: 0.9755, 0.9695

CrudeOIL, H4: Crude oil was traded lower following prior retracement from the resistance level 54.20. MACD which illustrate diminishing bullish momentum suggest the commodity to extend its retracement towards the support level 52.55.

Resistance level: 54.20, 56.30

Support level: 52.55, 51.25

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level 1613.35. MACD which illustrate ongoing bullish momentum signal suggest the commodity to extend its gains towards the resistance level 1646.30

Resistance level: 1646.30, 1676.90

Support level: 1613.35, 1588.05