4 December 2019 Afternoon Session Analysis

Pound remain buoyed ahead of election.

Pound sterling was traded higher, reaching a six month high level amid rising of possibility that Conservative party may win majority of the seats in the upcoming general election, which will be held on 12th December. According to the latest UK election poll, Conservative party which lead by the Prime Minister Boris Johnson rose by 1 point to 44% while the opposition party held steady at 32%. It is noteworthy that if the general election result turns out to be same as the election poll, eventually Boris Johnson may get sufficient amount of vote to support his Brexit deal and leave the European Union by the end of year 2019. However, the gains of pound got restricted by the announcement of UK construction PMI. Despite the data came in at 45.3, slightly higher than economist forecast of 44.5, however a reading lower than 50 indicating that UK construction sector is still remain in contraction territory. It is also hinting that uncertainty over upcoming general election and Brexit deadlock continue haunting the development of UK economy. As of writing, the pair of GBP/USD rose 0.06% to 1.3000. On the other hand, the pair of AUD/USD down 0.20% to 0.6830 amid Australia GDP data misses the economist forecast, 0.4% versus 0.5%. This downbeat data lifted up the market expectation on further rate cut might be taken by Reserve Bank of Australia (RBA) in order to support the economy from recessionary pressures.

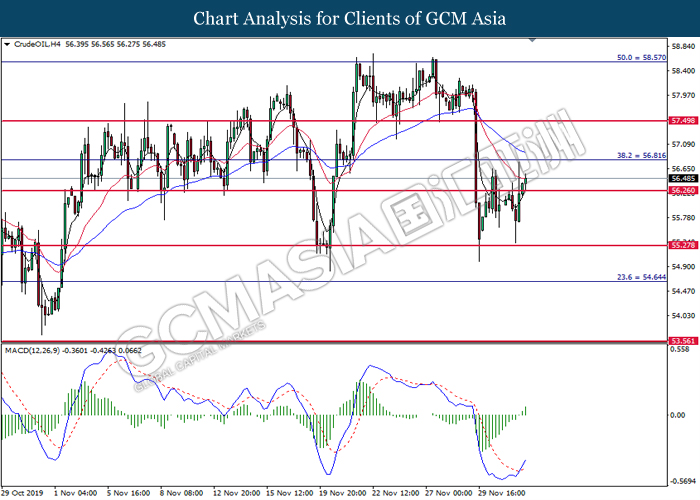

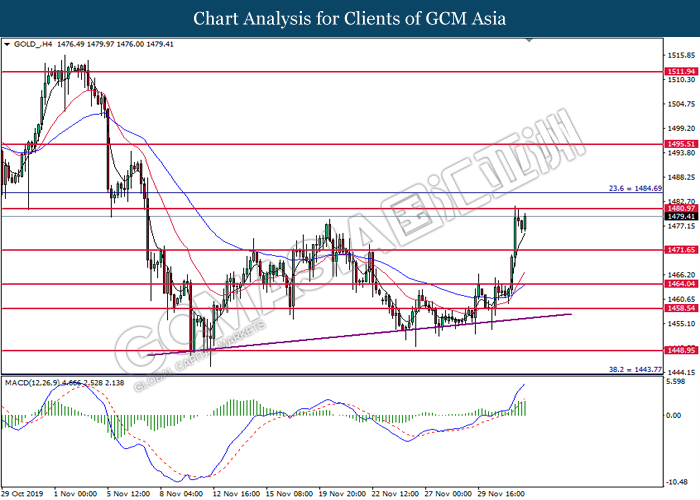

In the commodities market, crude oil price inched up 0.25% to $56.40 per barrel amid investors continue to weigh on the prospect of deepening oil production by OPEC+. However, escalation of trade dispute between China and US tamper the positive sentiment of crude oil market. Besides, gold price quoted up 0.07% to $1478.00 a troy ounce amid rising of market risk aversion.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17.30 | GBP – Composite PMI (Nov) | 48.5 | 50.0 | – |

| 17.30 | GBP – Service PMI (Nov) | 48.6 | 50.0 | – |

| 21.15 | USD – ADP Nonfarm Employment Change (Nov) | 125K | 140K | – |

| 23.00 | USD – ISM Non-Manufacturing PMI | 54.7 | 54.5 | – |

| 23.30 | CrudeOIL – Crude Oil Inventories | 1.572M | -1.734M | – |

Technical Analysis

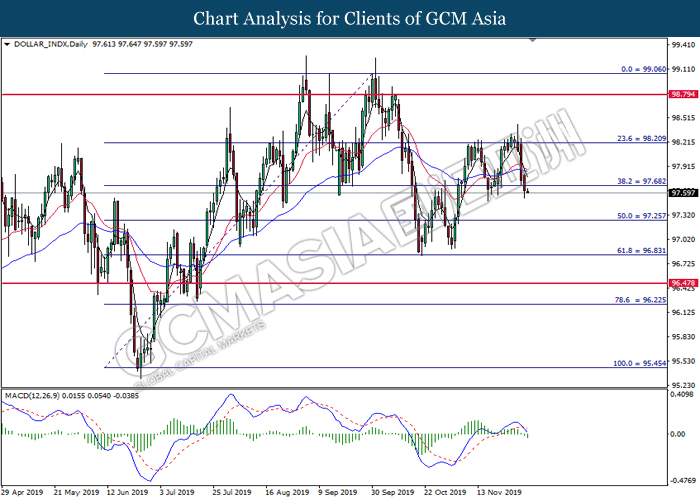

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 97.70. MACD which illustrate bearish momentum suggest the dollar to extend its losses toward the support level at 97.25.

Resistance level: 97.70, 98.20

Support level: 97.25, 96.85

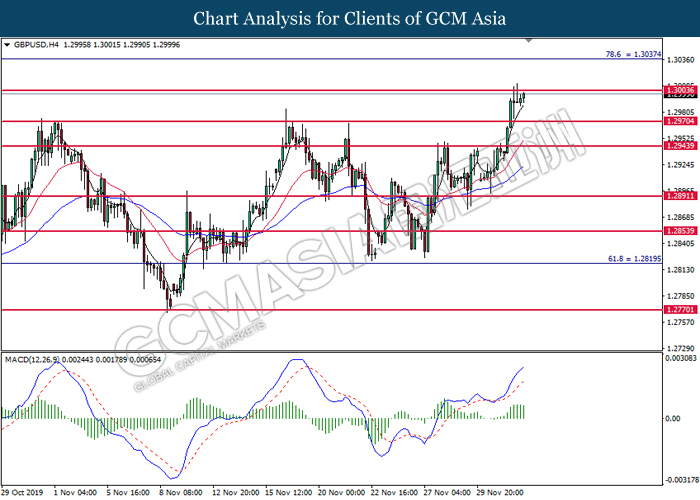

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level 1.2970. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 1.3005.

Resistance level: 1.3005, 1.3035

Support level: 1.2970, 1.2945

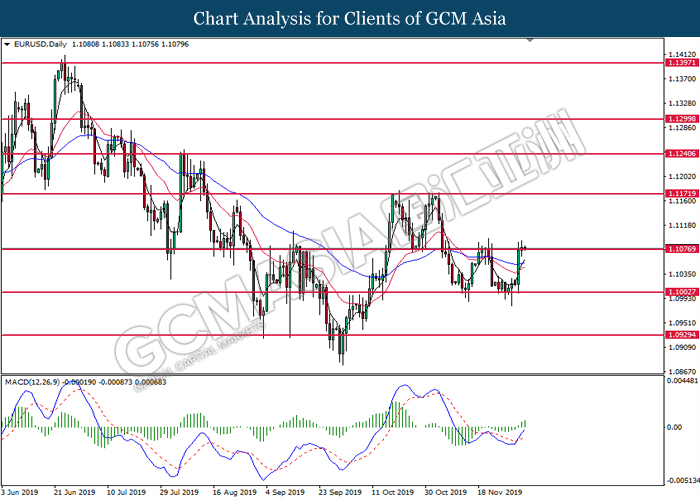

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level 1.1075. MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it successfully breakout above the resistance level 1.1075.

Resistance level: 1.1075, 1.1170

Support level: 1.1005, 1.0930

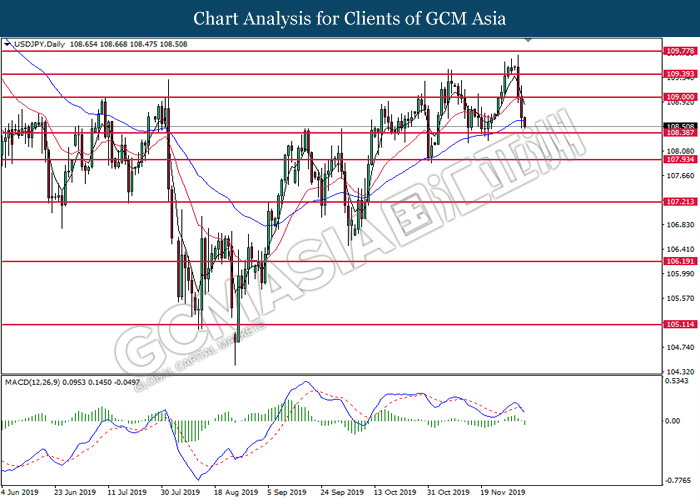

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 109.00. MACD which illustrate bearish momentum and the formation of death cross suggest the pair to extend its losses toward the support level at 108.40.

Resistance level: 109.00, 109.40

Support level: 108.40, 107.95

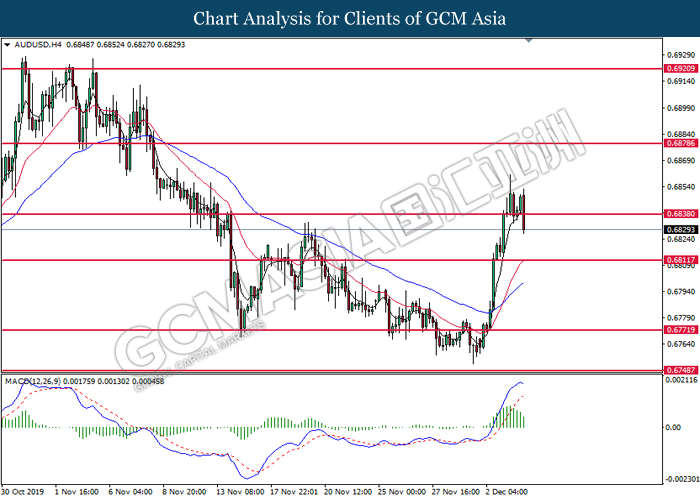

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6840. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after its candle successfully close below the support level.

Resistance level: 0.6880, 0.6920

Support level: 0.6840, 0.6810

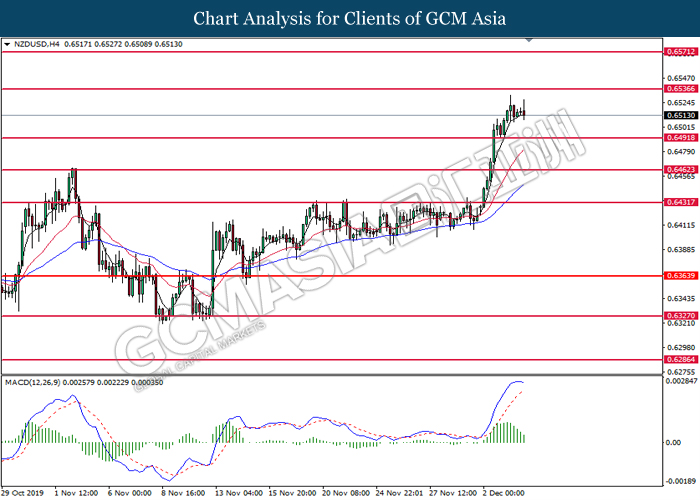

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower toward the support level at 0.6490.

Resistance level: 0.6535, 0.6570

Support level: 0.6490, 0.6460

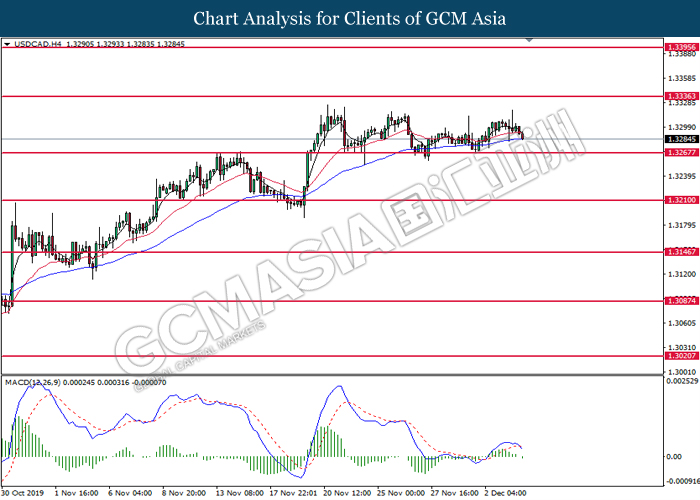

USDCAD, H4: USDCAD was traded lower while currently testing the 50 moving average line (Blue). MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it successfully breakout below the moving average line.

Resistance level: 1.3335, 1.3395

Support level: 1.3265, 1.3210

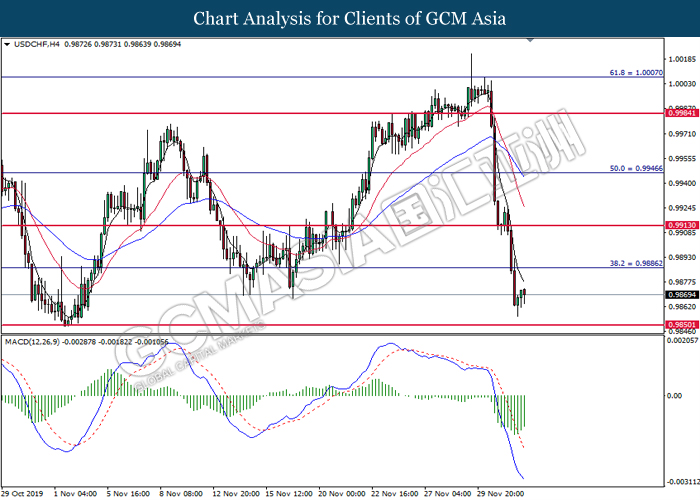

USDCHF, H4: USDCHF was traded higher following prior rebound from the lower level. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound toward the resistance level at 0.9885.

Resistance level: 0.9885, 0.9915

Support level: 0.9850, 0.9810

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 56.25. MACD which illustrate bullish bias signal with the formation of golden cross suggest the commodity to extend its gains toward the resistance level at 56.80.

Resistance level: 56.80, 57.50

Support level: 56.25, 55.30

GOLD_, H4: Gold price was traded higher while currently testing near the resistance level at 1480.95. MACD which illustrate bullish bias momentum signal suggest the commodity to extend its gains after successfully breakout above the resistance level at 1480.95.

Resistance level: 1480.95, 1484.70

Support level: 1471.65, 1464.05