7 November 2019 Morning Session Analysis

Canadian dollar slumps as data disappoints.

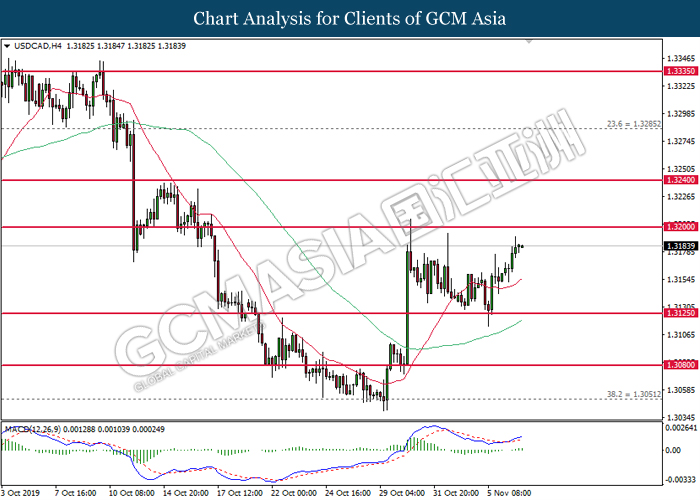

Canadian dollar extended its losses following the release of bearish economic data from yesterday. According to Ivey, its PMI reading which gauge activity level of purchasing managers slumped to 48.2 for the month of October, missing economists’ forecast for a rise to 49.3. Recently, Bank of Canada expresses further dovishness during their policy meeting as they perceive increasing risks and uncertainty due to ongoing trade conflict in the market. As such, the bearish data from yesterday has further affirmed such signals which may eventually lead to further rate cuts if future economic data from Canada remains bleak. On the other hand, dollar index continues to be traded within a tight range due to the lack of major economic data from the United States. Investors remains fixated upon US-China trade negotiation developments as well as future economic data releases from the region in order to gauge US dollar’s near-term trend direction. As of writing, pair of USD/CAD rose 0.04% to 1.3185 while the dollar index fell 0.06% to 97.73.

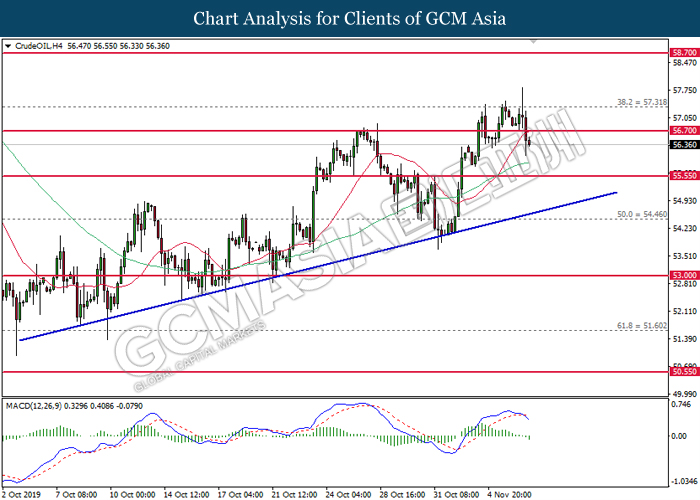

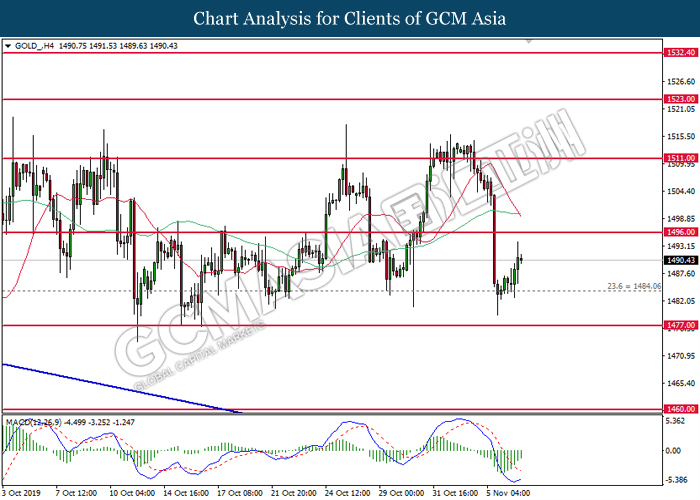

In the commodities market, crude oil price was traded flat at around $56.31 per barrel. Overnight, oil prices slumped sharply after Energy Information Administration reported that US crude oil stocks increased by 7.929 million barrels last week, exceeding forecasted reading of 1.515 million barrels. On the other hand, gold price was flat at around $1,490.37 a troy ounce while market participants wait for more signals in the FX market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE Inflation Report

20:00 GBP BoE MPC Meeting Minutes

20:30 GBP BoE Gov Carney Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | GBP – BoE Interest Rate Decision (Nov) | 0.75% | 0.75% | – |

| 21:30 | USD – Initial Jobless Claims | 218K | 215K | – |

Technical Analysis

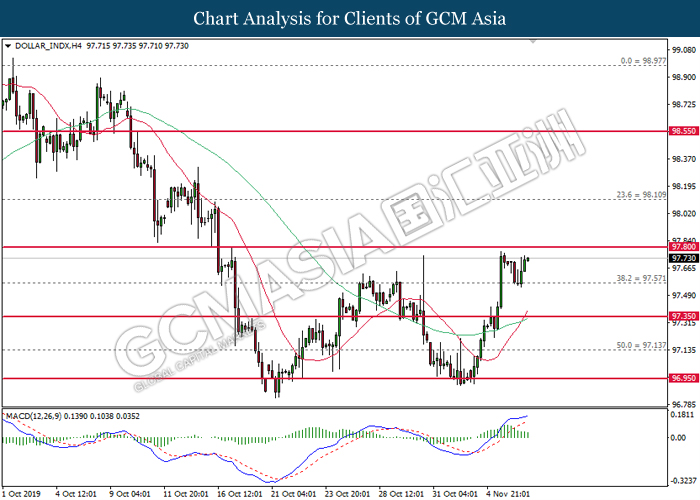

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing near 97.80. MACD which illustrate bullish signal suggest the index to extend its gains after closing above the resistance level.

Resistance level: 97.80, 98.10

Support level: 97.60, 97.35

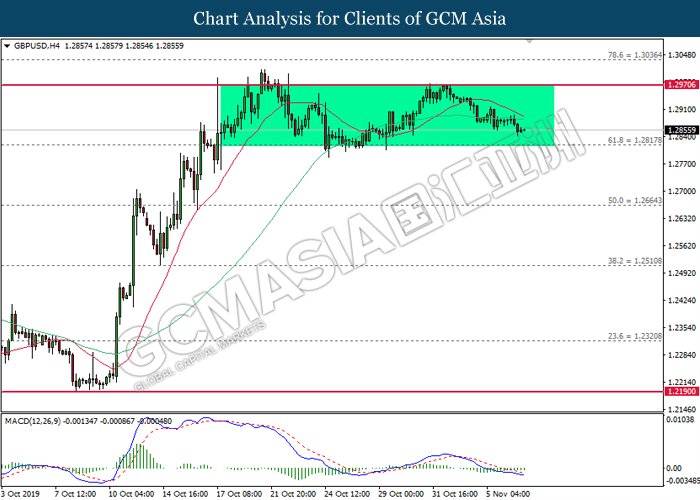

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the lower level. MACD which illustrate diminished downward momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2970, 1.3035

Support level: 1.2820, 1.2665

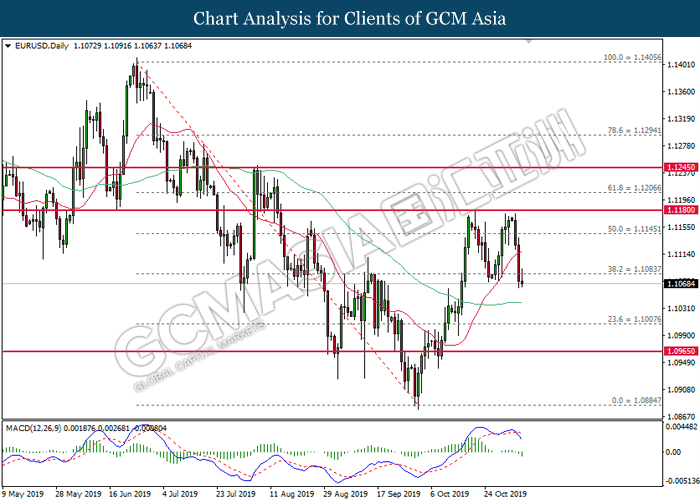

EURUSD, Daily: EURUSD was traded lower after closing below 1.1085. MACD which illustrate bearish signal suggests the pair to extend its losses, towards the direction of 1.1010.

Resistance level: 1.1085, 1.1145

Support level: 1.1010, 1.0965

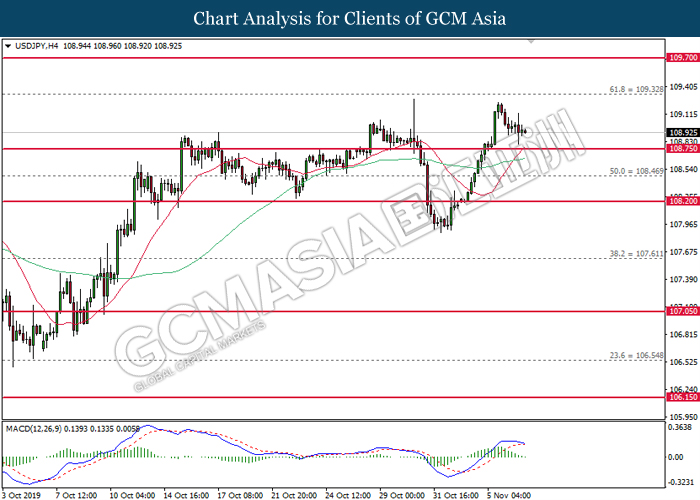

USDJPY, H4: USDJPY was traded lower following prior retrace from its higher levels. MACD which formed a bearish signal suggests the pair to extend its losses in short-term as technical correction.

Resistance level: 109.30, 109.70

Support level: 108.75, 108.45

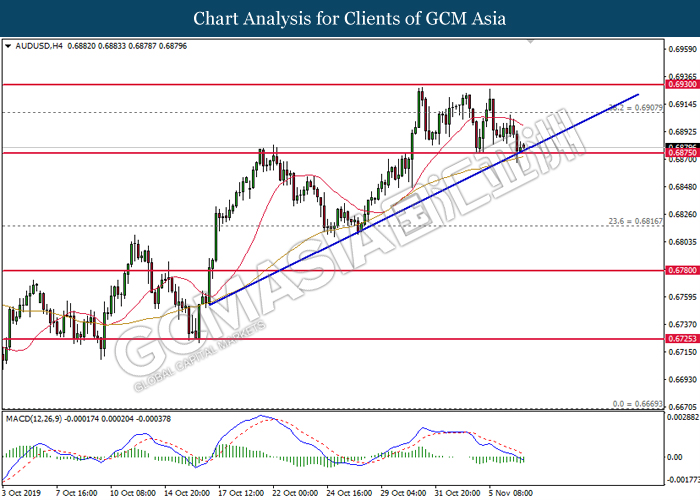

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the lower level. MACD which illustrate diminished downward momentum suggests the pair to be traded higher in short-term.

Resistance level: 0.6910, 0.6930

Support level: 0.6875, 0.6815

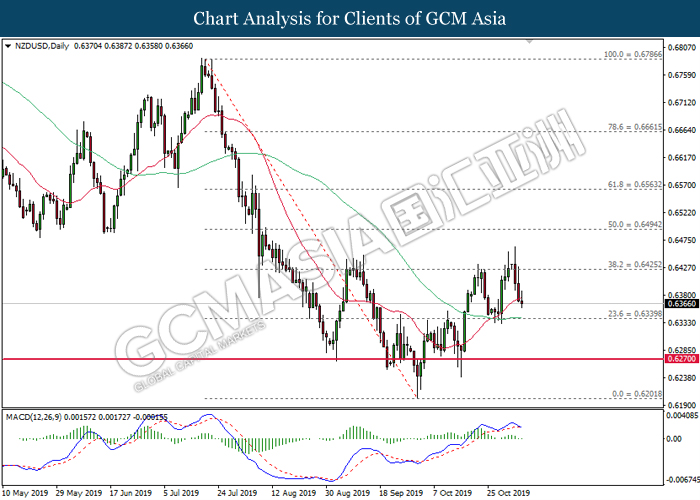

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher levels. MACD which illustrate bearish signal suggests the pair to extend its losses, towards the direction of 0.6340.

Resistance level: 0.6425, 0.6495

Support level: 0.6340, 0.6270

USDCAD, H4: USDCAD was traded higher while currently testing near the resistance of 1.3200. MACD which illustrate bullish signal suggests the pair to extend its gains after closing above the resistance level.

Resistance level: 1.3200,1.3240

Support level: 1.3125, 1.3000

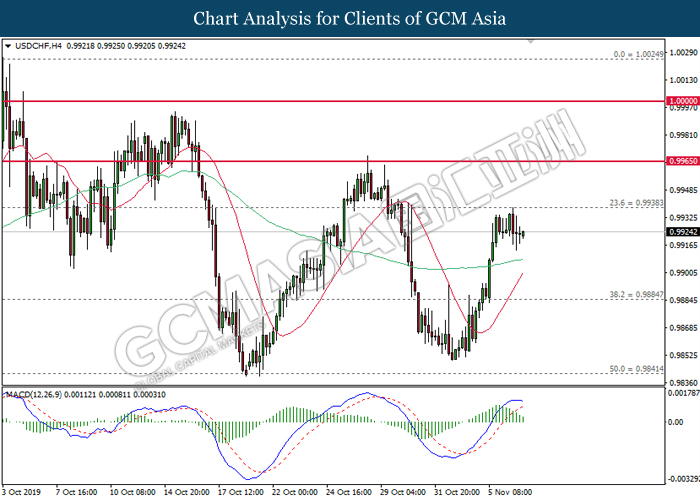

USDCHF, H4: USDCHF was traded lower following prior retrace from the resistance of 0.9940. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term.

Resistance level: 0.9940, 0.9965

Support level: 0.9885, 0.9840

CrudeOIL, H4: Crude oil price was traded lower following prior closure below 56.70. MACD which illustrate bearish signal suggests its price to be traded lower in short-term as technical correction.

Resistance level: 56.70, 57.30

Support level: 55.55, 54.45

GOLD_, H4: Gold price was traded higher following prior rebound from the lower level. MACD which illustrate diminished downward momentum suggests its price to be traded higher in short-term.

Resistance level: 1496.00, 1511.00

Support level: 1484.05, 1477.00