11 November 2019 Morning Session Analysis

Trump spurs higher uncertainty in the market.

US dollar extended its gains last Friday, touching three-week high against other major currencies following higher risk appetite for higher yielding assets in the market. As of writing, the dollar index notched up 0.26% to 98.16. Last Friday, US President Donald Trump spurred higher uncertainty upon US-China trade resolution after he said that he has not agreed to roll back tariffs. His comment came a day after US and China reportedly agreed to roll back tariffs on each other in order to achieve phase one of trade deal. However, a separate report also contradicts with the news whereby the rollback aces fierce internal opposition within the White House and other advisors. Overall, market sentiment remains supportive for risky assets as efforts has been made by both countries in order to achieve a trade agreement which will substantially diminishes recessive risk upon the global economy. On the other hand, pair of USD/CAD ticked up 0.01% to 1.3229. Canadian dollar undergoes further selloff after Canada’s job market data stagnated in October, losing 1,800 net positions, missing economists’ forecast of generating 15,900 net positions.

In the commodities market, crude oil price slumped 0.47% to $57.09 per barrel. Oil futures experienced some selloff pressure as investors began to liquidate their holdings and take profit from the recent rally in oil prices. On the other hand, gold price rose 0.13% to $1,460.37 a troy ounce following rising uncertainty with regards to US-China trade negotiation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – GDP (QoQ) (Q3) | -0.2% | 0.4% | – |

| 17:30 | GBP – Manufacturing Production (MoM) (Sep) | -0.7% | -0.3% | – |

Technical Analysis

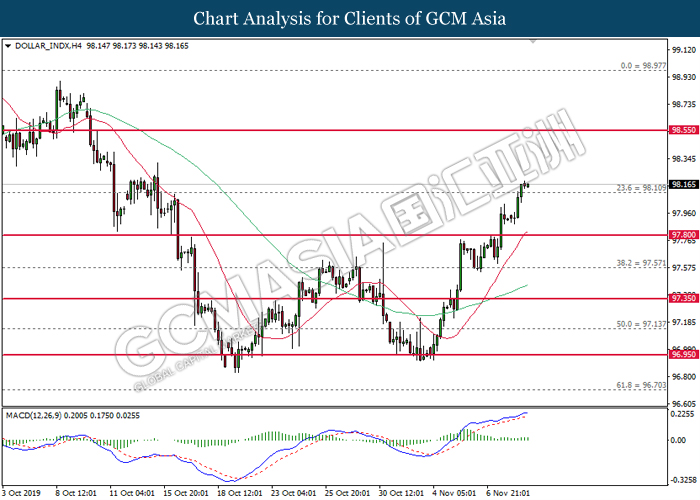

DOLLAR_INDX, H4: Dollar index was traded higher following prior close above 98.10. MACD which illustrate bullish signal suggests the index to extend its gains, towards the direction of 98.55.

Resistance level: 98.55, 99.00

Support level: 98.10, 97.80

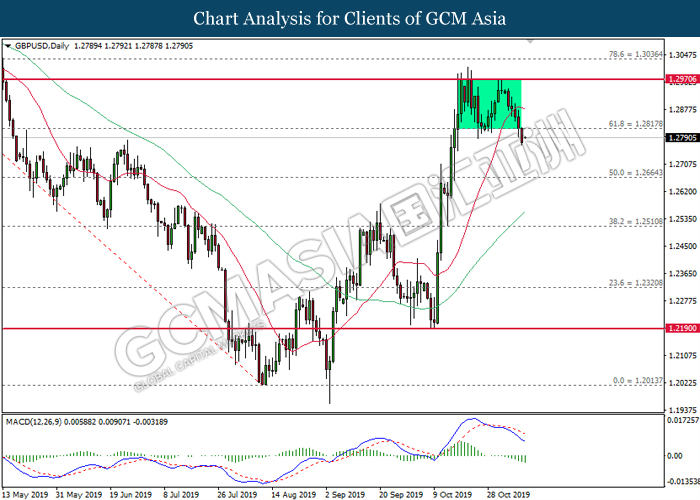

GBPUSD, Daily: GBPUSD was traded lower following prior close below 1.2820. MACD which illustrate bearish signal suggests the pair to be traded lower, towards the direction of 1.2665.

Resistance level: 1.2820, 1.2970

Support level: 1.2665, 1.2510

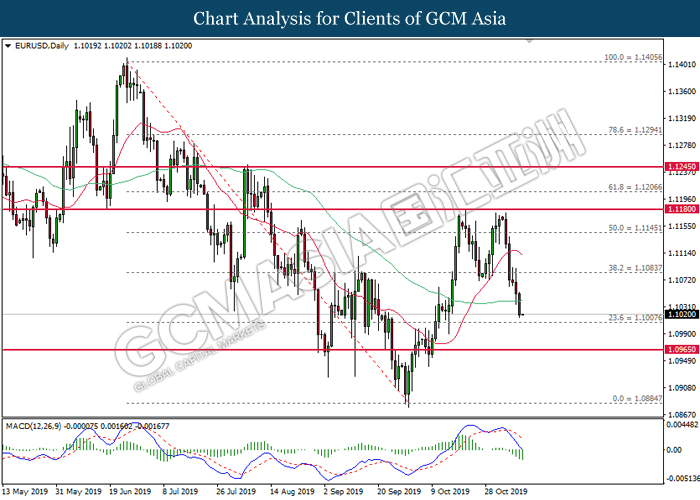

EURUSD, Daily: EURUSD was traded lower while currently testing the support at 1.1010. MACD which illustrate bearish signal suggests the pair to extend its losses after closing below the support level.

Resistance level: 1.1085, 1.1145

Support level: 1.1010, 1.0965

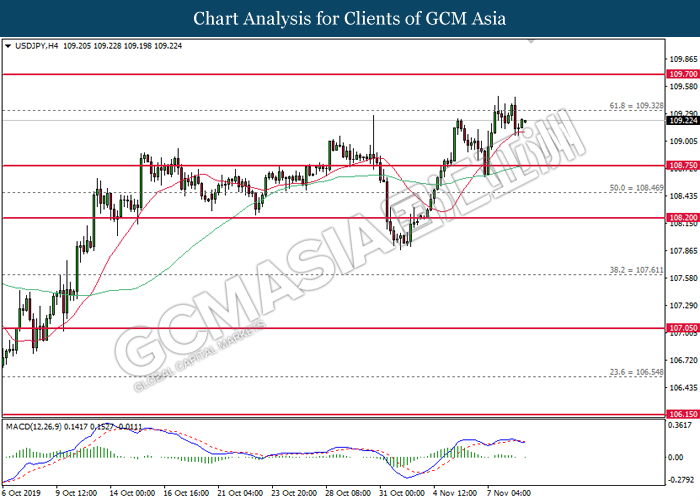

USDJPY, H4: USDJPY was traded higher following prior rebound from its lower level. MACD which has formed a bullish signal suggest the pair to extend its gains after closing above 109.30.

Resistance level: 109.30, 109.70

Support level: 108.75, 108.45

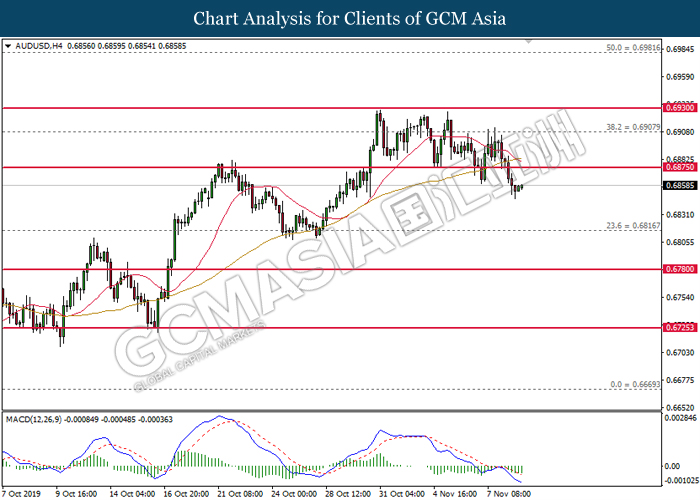

AUDUSD, H4: AUDUSD was traded higher following prior rebound from its lower levels. MACD which illustrate diminished downward momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6875, 0.6910

Support level: 0.6815, 0.6780

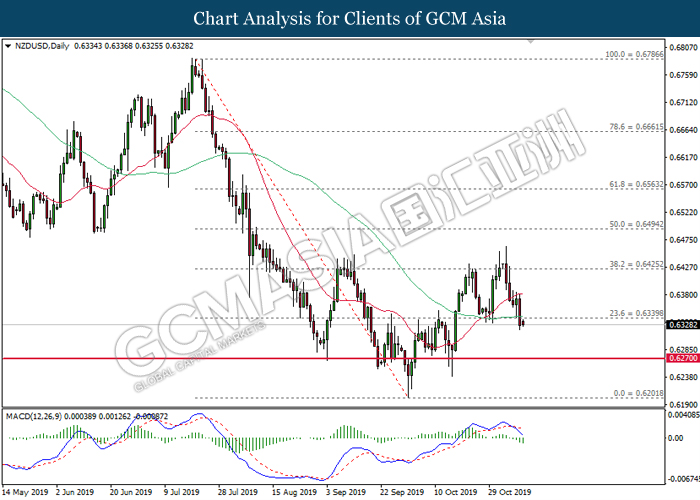

NZDUSD, Daily: NZDUSD was traded lower following prior closure below 0.6340. MACD which illustrate bearish signal suggest the pair to extend its losses, towards the direction of 0.6270.

Resistance level: 0.6340, 0.6425

Support level: 0.6270, 0.6200

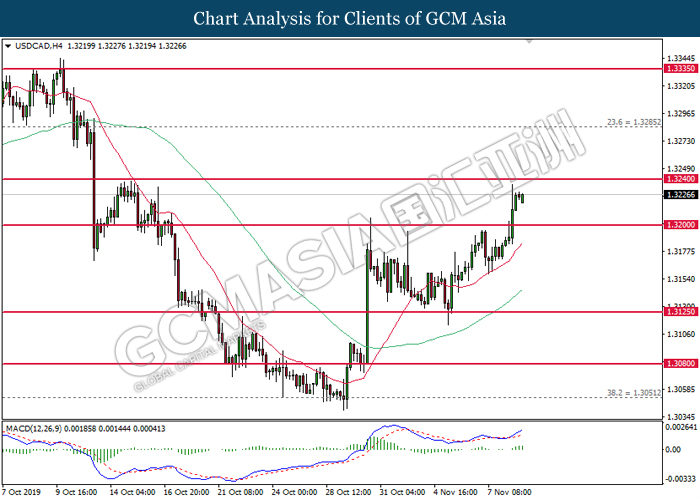

USDCAD, H4: USDCAD was traded higher while currently testing the resistance of 1.3240. MACD which illustrate bullish signal suggests the pair to extend its gains after closing above the resistance level.

Resistance level: 1.3240, 1.3285

Support level: 1.3200, 1.3125

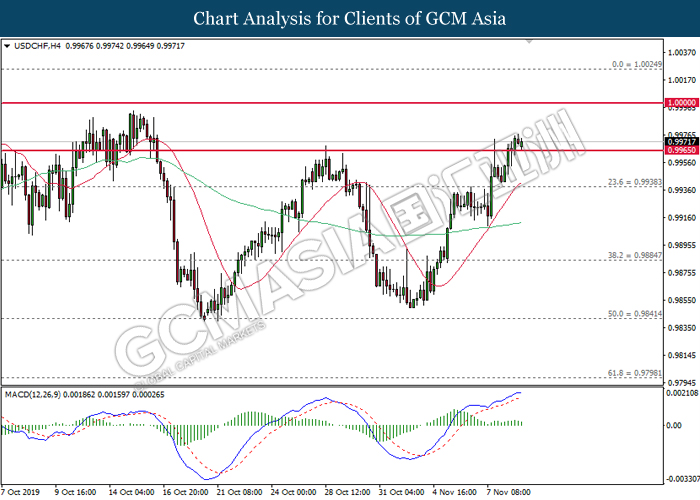

USDCHF, H4: USDCHF was traded higher following prior closure above 0.9965. However, MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 1.0000, 1.0025

Support level: 0.9965, 0.9940

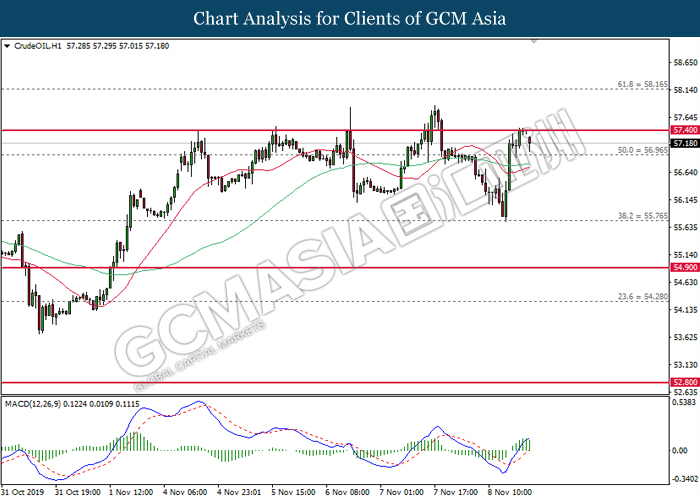

CrudeOIL, H1: Crude oil price was traded lower following prior retrace from 57.40. MACD which illustrate diminished upward momentum suggests its price to be traded lower in short-term.

Resistance level: 57.40, 58.15

Support level: 56.95, 55.75

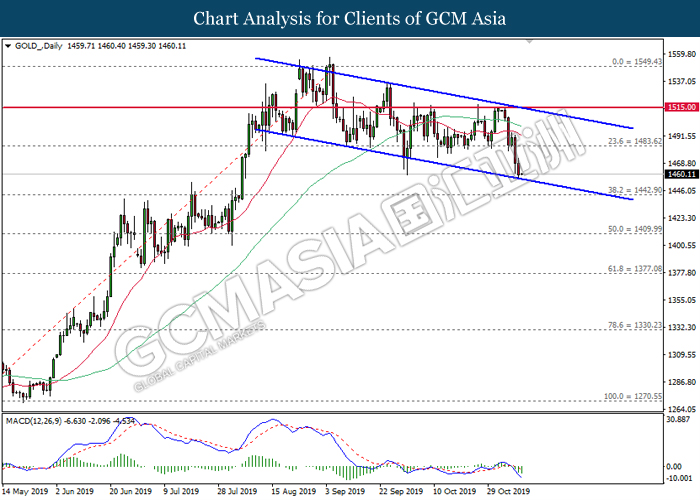

GOLD_, Daily: Gold price remains traded within a downward channel while currently testing at the bottom level. MACD which illustrate bearish signal suggests its price to extend its losses after breaking the bottom level.

Resistance level: 1483.60, 1515.00

Support level: 1442.90, 1410.00