12 February 2020 Afternoon Session Analysis

New Zealand dollar soars amid hawkish stance from RBNZ.

Among all the majority currencies, New Zealand dollar skyrocketed to one week high level following Reserve Bank New Zealand remain its unfolding monetary policy unchanged in this morning. Earlier today, RBNZ board members decided to keep its interest rate unchanged at 1.00% as widely expected while giving hawkish statement regarding to the future outlook of New Zealand. In the monetary policy statement, RBNZ revealed that their labor market is still remain resilient, growing near the maximum sustainable level. Besides, RBNZ chairman Adrian Orr also emphasized that the underlying inflation pressure in their country is remain intact while it getting nearer to the inflation target, which is at 2%. Therefore, low interest rate would never be changed in the meantime unless some course of event lead to longer period of subdued growth in New Zealand, such as recent outbreak of coronavirus. During Asian trading session, the pair of NZD/USD rose 0.95% to 0.6460.

In the commodities market, crude oil price rose 1.44% to $50.62 per barrel after China reported its lowest daily number of new coronavirus since late January. Recently, the growth rate of coronavirus has started to slow down, lifting up the investor hopes over oil demand may begin to recover from the outbreak of virus. Besides, gold price inched up 0.04% to $1568.00 a troy ounce amid weakening of dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP Autumn Budget

23.00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23.30 | CrudeOIL – Crude Oil Inventories | -0.3% | – | – |

Technical Analysis

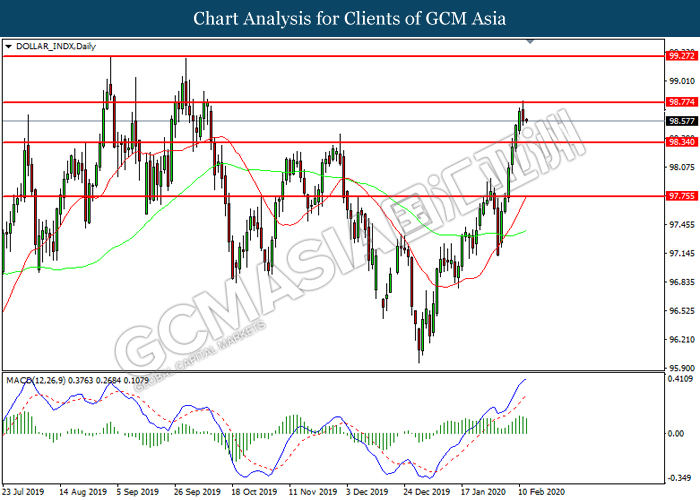

DOLLAR_INDX, Daily:Dollar index was traded lower following prior retracement from the resistance level at 98.75. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level at 98.35.

Resistance level: 98.75, 99.25

Support level: 98.35, 97.75

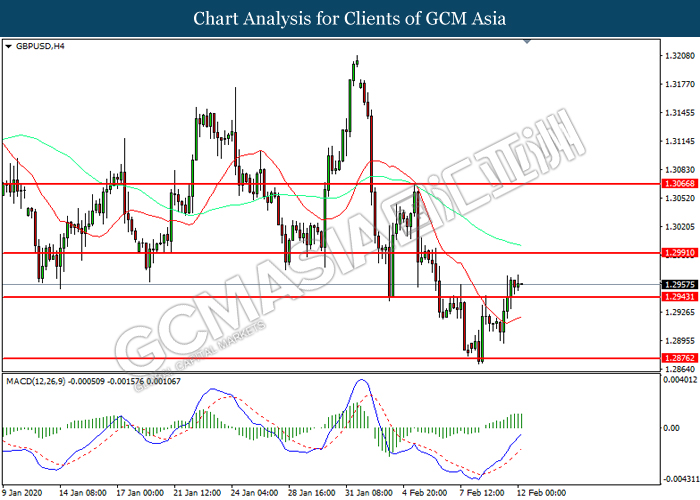

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2945. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2990.

Resistance level: 1.2990, 1.3065

Support level: 1.2945, 1.2875

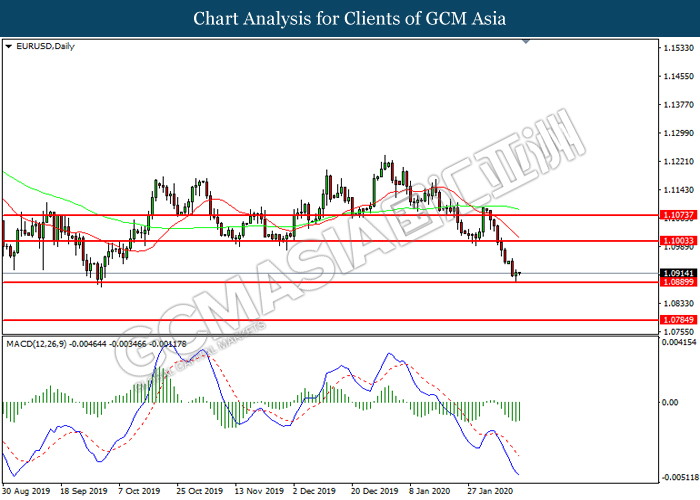

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0890. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1005, 1.1075

Support level: 1.0890, 1.0785

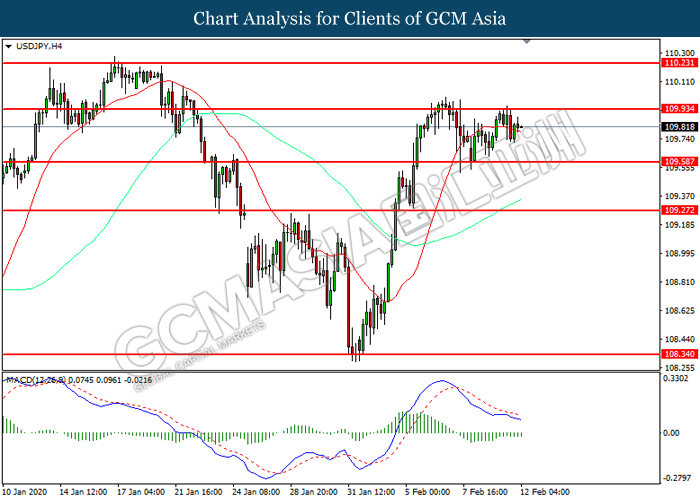

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 109.95. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 109.95, 110.25

Support level: 109.60, 109.25

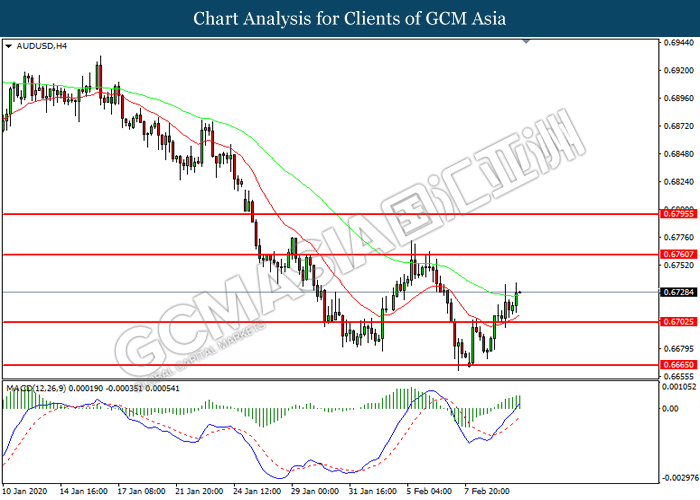

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6705. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6760.

Resistance level: 0.6760, 0.6795

Support level: 0.6705, 0.6665

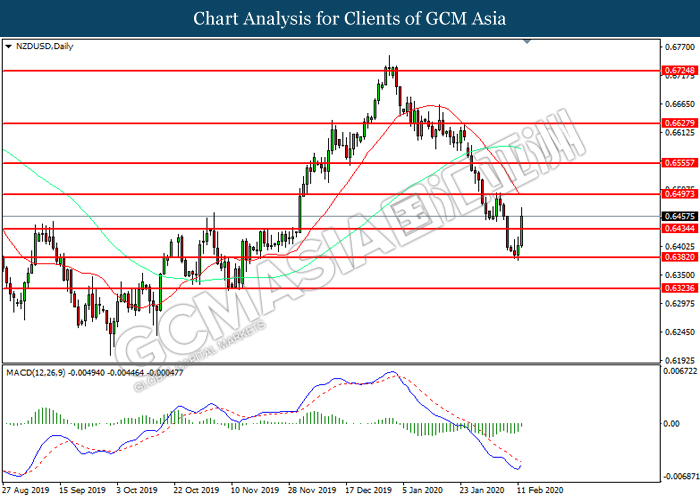

NZDUSD, Daily: NZDUSD was higher following prior breakout above the previous resistance level at 0.6435. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6495.

Resistance level: 0.6495, 0.6555

Support level: 0.6435, 0.6380

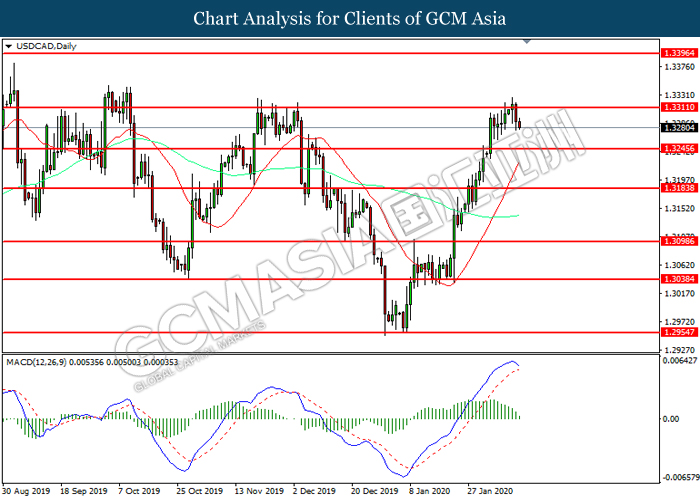

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.3245.

Resistance level: 1.3310, 1.3395

Support level: 1.3245, 1.3185

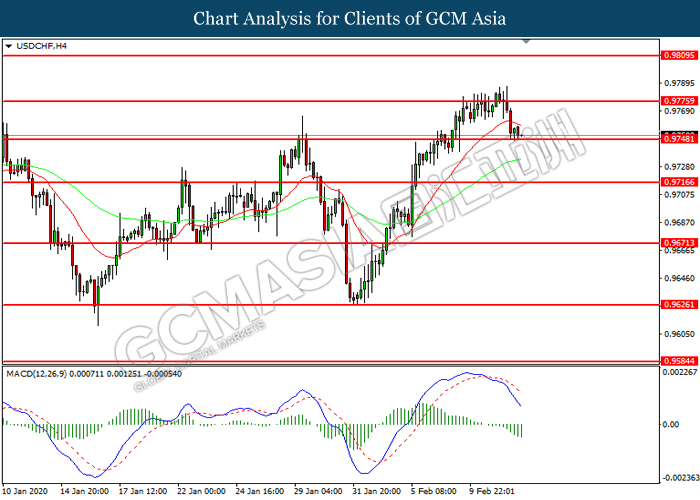

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9750. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9775, 0.9810

Support level: 0.9750, 0.9715

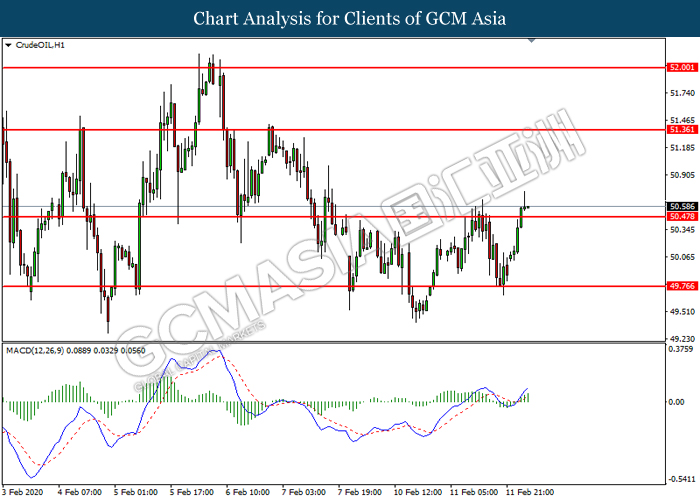

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level at 50.45. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward the resistance level at 51.35.

Resistance level: 51.35, 52.00

Support level: 50.45, 49.75

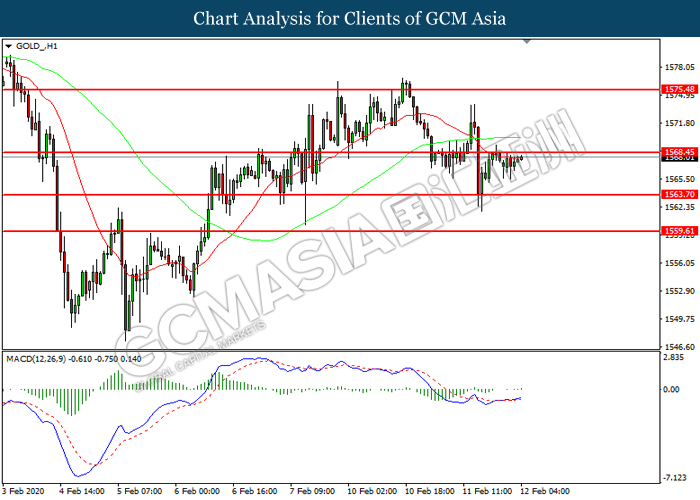

GOLD_, H1: Gold price was higher while currently testing the resistance level at 1568.45. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1568.45, 1575.50

Support level: 1563.70, 1559.60