12 September 2019 Afternoon Session Analysis

Euro slumped, eyes on ECB.

EUR/USD slump in during Asian trading session while investors focus upon European Central Banks’ (ECB) monetary policy later tonight. Weak economy outcome and a rebound in bond yields lately in Europe could increase the expectations that the central bank would deliver quantitative easing policy in today’s meeting which could further lead to further depreciation in EUR/USD. On the other hand, the pound sterling surged due to lower probability of a no-deal Brexit risks after the British parliament approved the legislation and forces Boris Johnson to request a deadline extension from Brussels if he cannot agree on a deal with the EU by mid-October. Analysts predicted that such risk reduction of no-deal Brexit after the law passed could push the value of pound sterling to appreciate further in future. In fact, the Pound Sterling is also supported by better-than-expected economic data in this week, which it confounded earlier expectations that the U.K would fall into recession this quarter. As of writing, EUR/USD appreciated by 0.05% to 1.1013, meanwhile GBP/USD increased 0.04% to 1.2332.

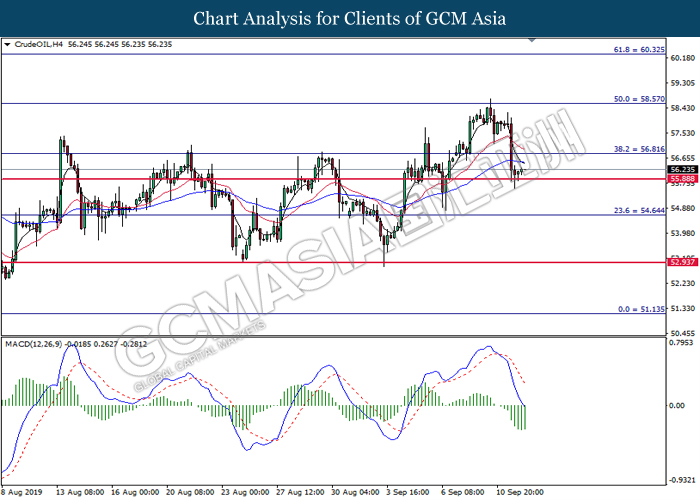

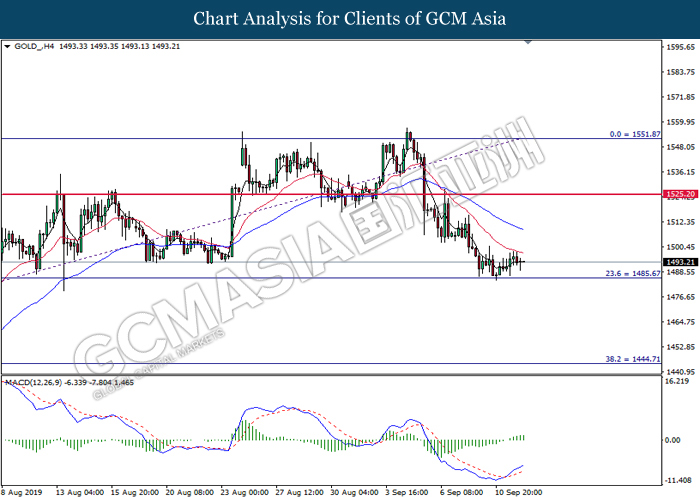

In the commodities market, crude oil rose 0.48% to $56.18 per barrel as the trade tensions between Washington and Beijing was eased and the crude oil inventories fell for a fourth straight week, decreasing 6.9 million barrels from 6th September 2019, more than double of analysts’ expectation. On the other hand, gold price slumped 0.23% to $1493.15 a troy ounce despite there are market expectations for deduction of interest rates by ECB.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

19.45 EUR ECB Monetary Policy Statement

20.30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19.45 | EUR – Deposit Facility Rate (Sep) | -0.50% | -0.40% | – |

| 19.45 | EUR – ECB Interest Rate Decision (Sep) | 0.00% | 0.00% | – |

| 20.30 | USD – Core CPI (MoM) (Aug) | 0.2% | 0.3% | – |

Technical Analysis

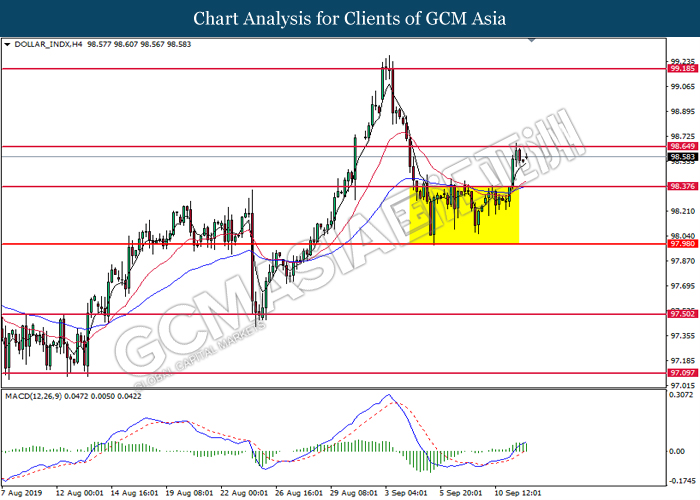

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing near the resistance level at 98.65. However, MACD which illustrate diminishing upward momentum suggests the index to be traded lower in short-term as technical correction.

Resistance level: 98.65, 99.20

Support level: 98.40, 98.00

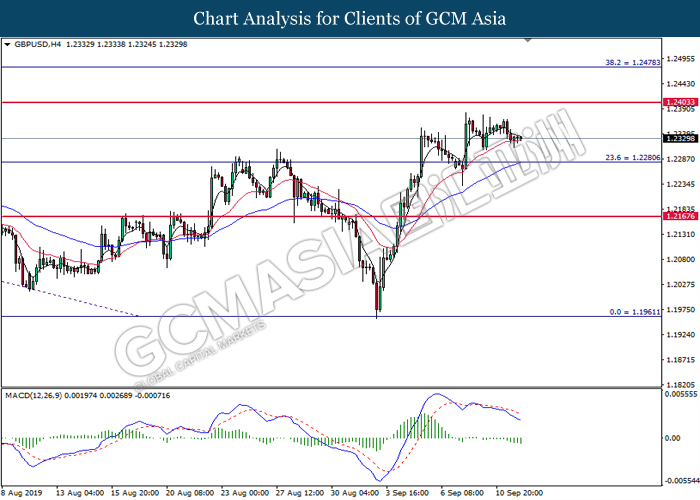

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 20 moving average line (Red). MACD which illustrate bearish signal suggest the pair to extend its losses after successfully breakout below the 20 moving average line (Red).

Resistance level: 1.2405, 1.2480

Support level: 1.2280, 1.2170

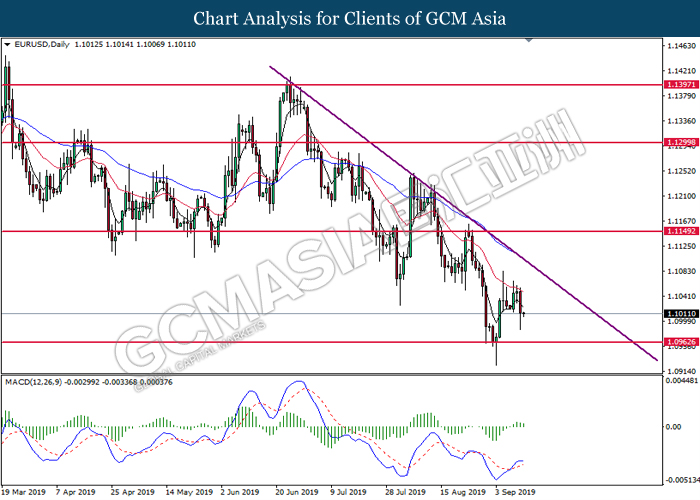

EURUSD, Daily: EURUSD was traded lower following prior retracement from the 20 moving average line (Red). MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement toward the support level at 1.0965.

Resistance level: 1.1150, 1.1300

Support level: 1.0965, 1.0855

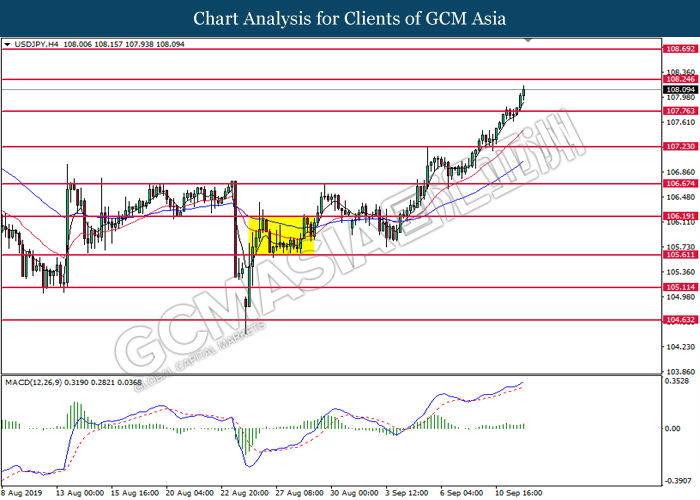

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous support level at 107.75. MACD which illustrate bullish signal suggests the pair to advance further up, towards the direction of 108.25.

Resistance level: 108.25, 108.70

Support level: 107.75, 107.25

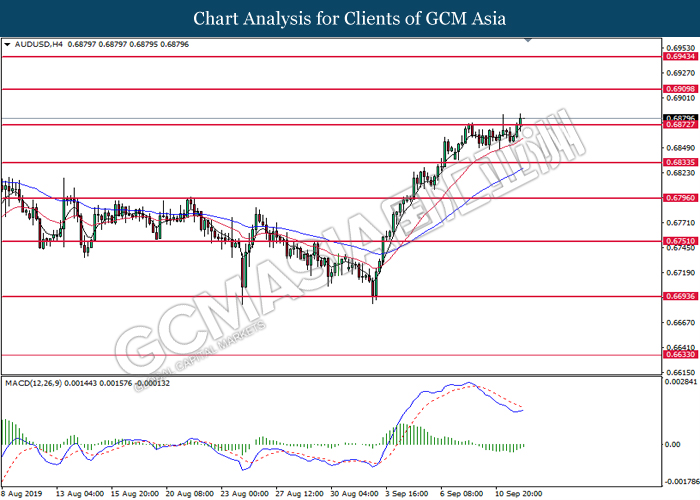

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6875. MACD which illustrate diminishing bearish momentum suggests the pair to extend its gains, towards the direction of 0.6910.

Resistance level: 0.6910, 0.6945

Support level: 0.6875, 0.6835

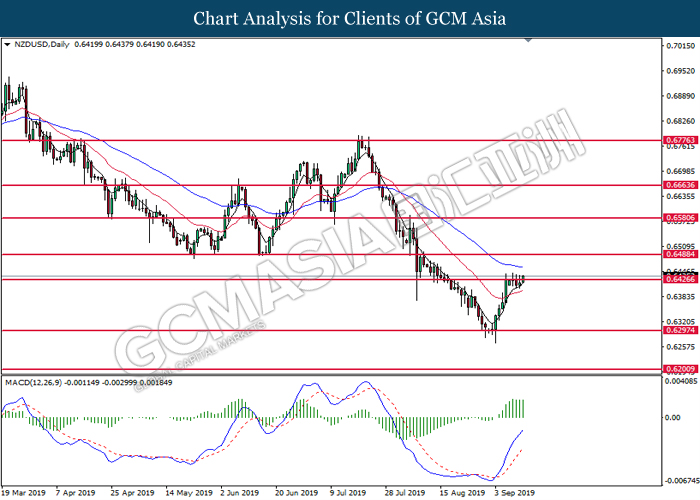

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6425. MACD which illustrate bullish bias signal suggests the pair to extend its gains after successfully breakout above the resistance level at 0.6425.

Resistance level: 0.6425, 0.6490

Support level: 0.6295, 0.6200

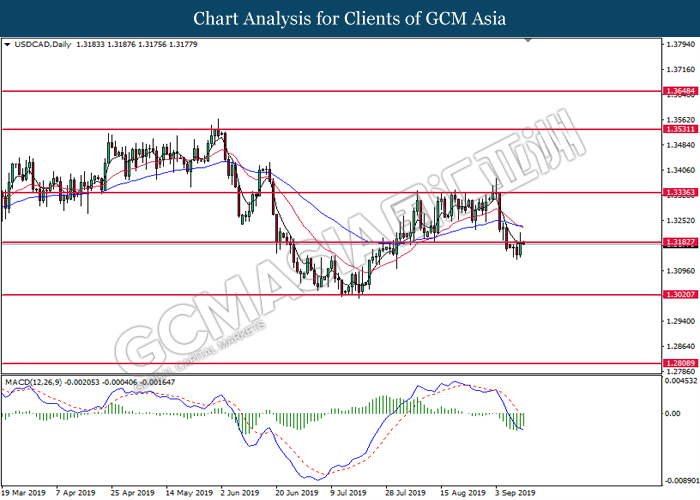

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3185. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains after successfully breakout above the resistance level at 1.3185.

Resistance level: 1.3185, 1.3335

Support level: 1.3020, 1.2810

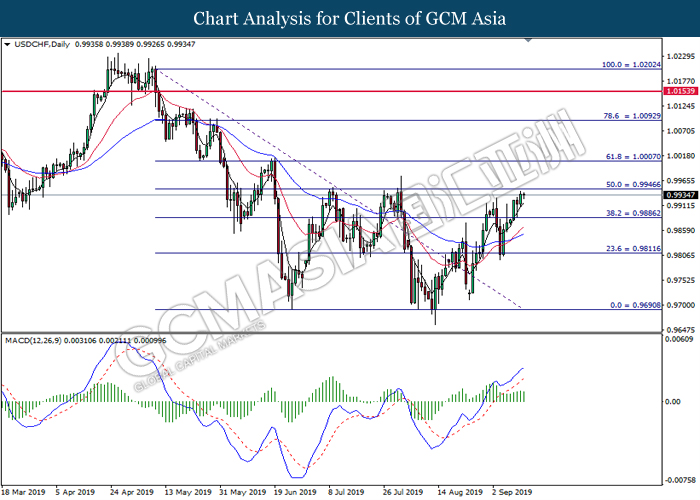

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9945. MACD which illustrate bullish bias momentum suggest the pair to extend its gains after successfully breakout above the resistance level at 0.9945.

Resistance level: 0.9945, 1.0070

Support level: 0.9885, 0.9810

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support of 55.90. MACD which illustrate diminishing downward momentum suggests its price to extend its rebound toward the next resistance level a 56.80.

Resistance level: 56.80, 58.55

Support level: 55.90, 54.65

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1485.65. MACD which illustrate bullish bias momentum suggest the commodity to extend its gains toward the next resistance level at 1525.20.

Resistance level: 1525.20, 1551.90

Support level: 1485.65, 1444.70