12 September 2019 Morning Session Analysis

Greenback cheers on positive PPI data.

Dollar index have climbed against its basket of six major rival pairs following the positive release of PPI data. According to the latest data from U.S Labor Department, producer price index for final demand remain strong at 0.1%, in line with market forecasts. The data have dimmed some expectation that the FED will cut interest rate aggressively at its meeting next week, thus supporting the dollar. At the same time, U.S President Donald Trump have criticized Federal Reserve once again for not cutting interest rates as much as he would like, stated in a tweet that central bank should cut the rates to zero or less. Dollar index rose 0.31% to 98.55 as of writing. On the other hand, USD/CAD climbs 0.02% to 1.3192 at the time of writing following oil sell-off and political uncertainty. The price of crude oil recently suffered a huge meltdown and Canadian Prime Minister Canadian Prime Minister Justin Trudeau today announced that they will be holding general elections on October 21 which added further uncertainty for the market, dragging lower the commodity-sensitive Loonie.

In the commodities market, crude oil price fell 0.10% to $55.83 as of writing amid lowered demand growth forecast and growing speculation of sanction waive in Iran. According to the monthly report released by OPEC, OPEC have lowered its global oil demand growth forecast by 60,000 barrels per day for 2020, the weakest in nearly a decade. Besides that, oil trader are starting to increase their expectation on Iran and Washington could reaching a deal and easing Iran sanctions after U.S President Donald Trump stated on Wednesday that he believed that Iran wanted to make a deal. Next, gold price fell 0.22% to $1493.57 a troy ounce at the time of writing following a strong dollar amid upbeat data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

19.45 EUR ECB Monetary Policy Statement

20.30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19.45 | EUR – Deposit Facility Rate (Sep) | -0.50% | -0.40% | – |

| 19.45 | EUR – ECB Interest Rate Decision (Sep) | 0.00% | 0.00% | – |

| 20.30 | USD – Core CPI (MoM) (Aug) | 0.2% | 0.3% | – |

Technical Analysis

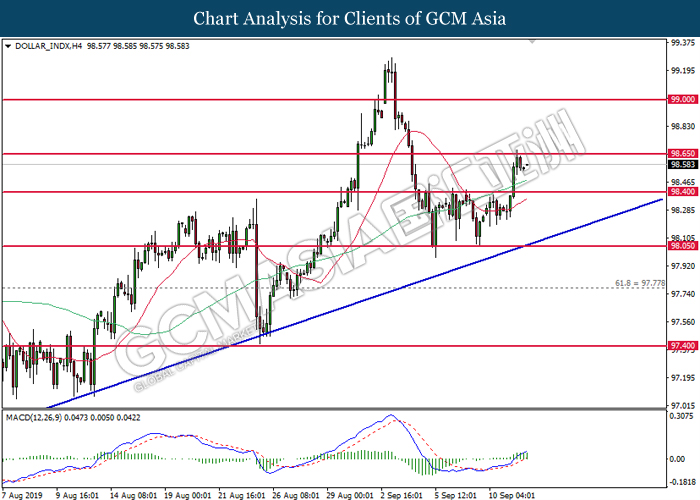

DOLLAR_INDX, H4: Dollar index was traded lower following prior retrace from 98.65. MACD which illustrate diminishing upward momentum suggests the index to be traded lower in short-term as technical correction.

Resistance level: 98.65, 99.00

Support level: 98.40, 98.05

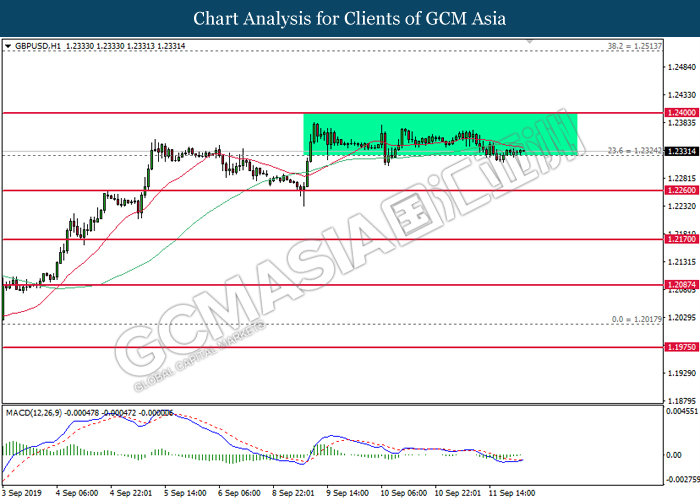

GBPUSD, H1: GBPUSD was traded higher following prior rebound from 1.2325. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term after closing above the 20-MA line (red).

Resistance level: 1.2400, 1.2515

Support level: 1.2325, 1.2260

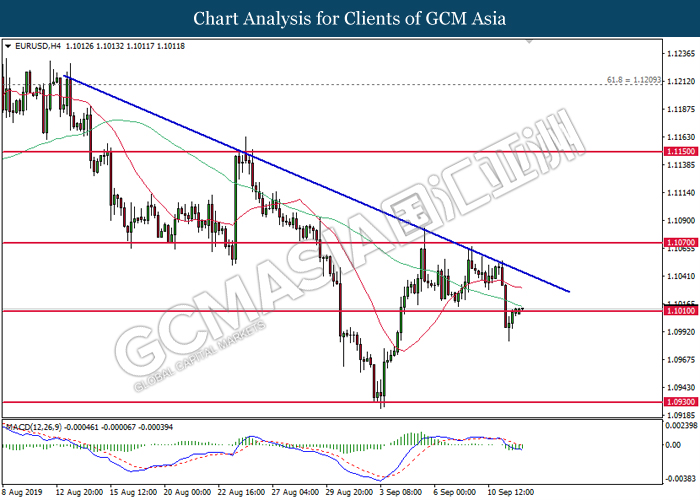

EURUSD, H4: EURUSD was traded higher following prior rebound from the lower level. MACD which illustrate diminishing downward momentum suggests the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1070, 1.1150

Support level: 1.1010, 1.0930

USDJPY, Daily: USDJPY was traded higher following prior breakout from the downward trendline. MACD which illustrate bullish signal suggests the pair to advance further up, towards the direction of 108.70.

Resistance level: 108.70, 109.60

Support level: 107.85, 107.25

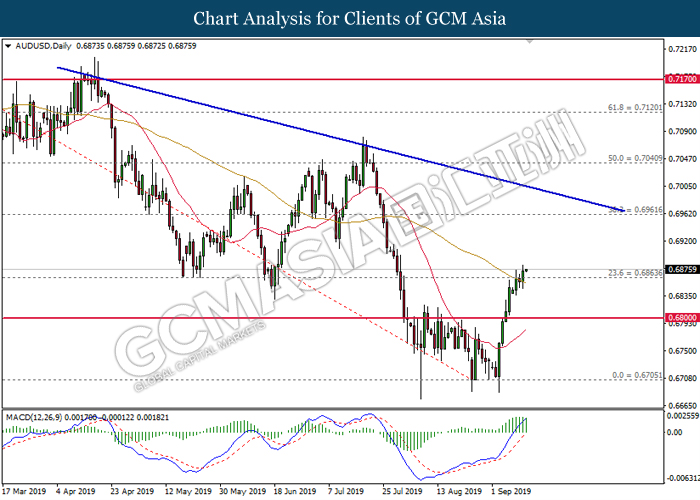

AUDUSD, Daily: AUDUSD was traded higher following prior close above 0.6865. MACD which illustrate bullish signal suggests the pair to extend its gains, towards the direction of 0.6960.

Resistance level: 0.6960, 0.7040

Support level: 0.6865, 0.6800

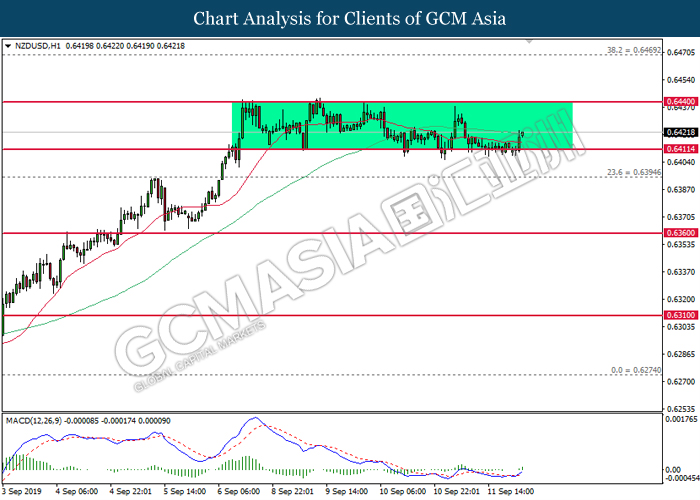

NZDUSD, H1: NZDUSD was traded higher following prior rebound from the support level of 0.6410. MACD which illustrate bullish signal suggests the pair to extend its gains in short-term.

Resistance level: 0.6440, 0.6470

Support level: 0.6410, 0.6395

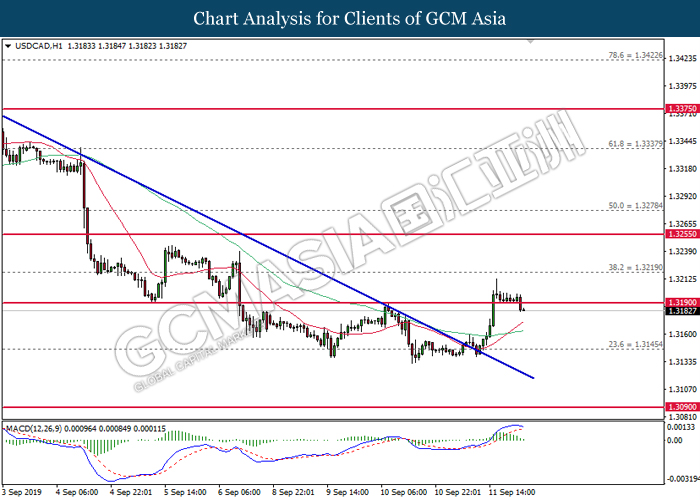

USDCAD, H1: USDCAD was traded lower following prior closure below 1.3190. MACD which begins to form a bearish signal suggests the pair to be traded lower in short-term, towards the direction of 1.3145.

Resistance level: 1.3190, 1.3220

Support level: 1.3145, 1.3090

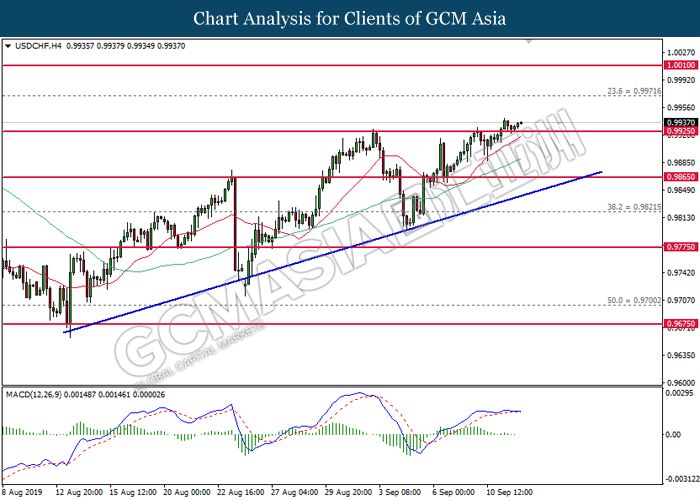

USDCHF, H4: USDCHF was traded higher following prior closure above 0.9925. However, MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9970, 1.0010

Support level: 0.9925, 0.9865

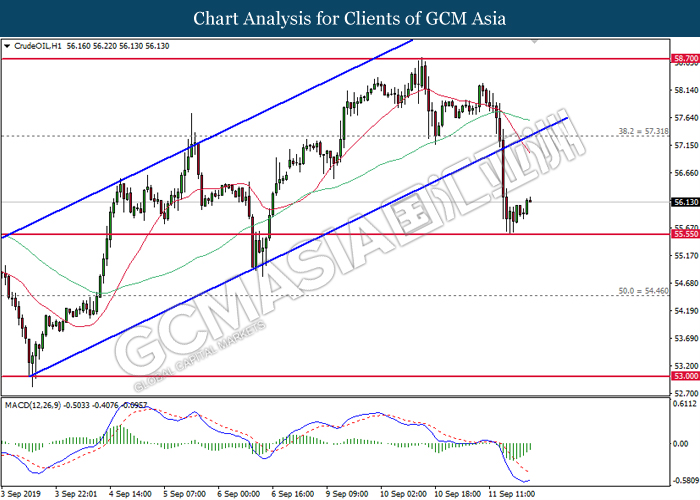

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support of 55.55. MACD which illustrate diminishing downward momentum suggests its price to be traded higher, towards the direction of 57.30.

Resistance level: 57.30, 58.70

Support level: 55.55, 54.45

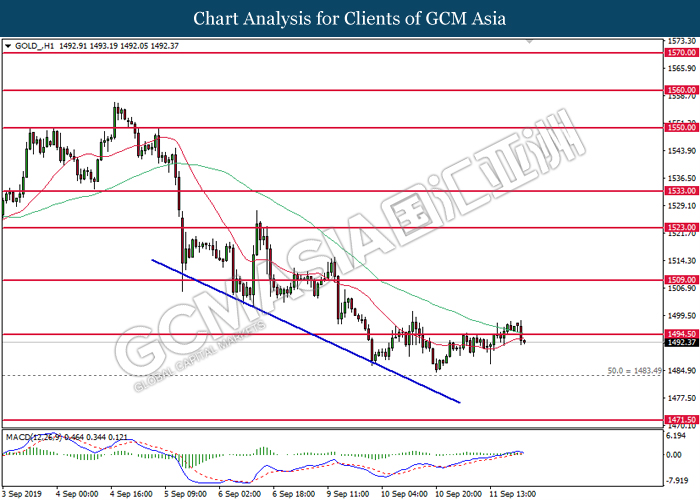

GOLD_, H1: Gold price was traded lower following prior closure below 1494.50. MACD which illustrate diminished upward momentum suggests its price to be traded lower in short-term.

Resistance level: 1494.50, 1509.00

Support level: 1483.50, 1471.50