12 November 2019 Morning Session Analysis

Pound sterling rebounds over positive developments.

Pound Sterling extended gains after Brexit Party claimed that they would not contest previously Conservative held seats in the UK’s upcoming election. The move increases the chances for the Conservative Party to gain a majority at the polls ahead of the 12th December 2019 election, and consequently able to implement the EU withdrawal agreement which secured last month by Prime Minister Boris Johnson. In addition, by increasing the likelihood of a clear victory for the Conservatives, the political uncertainty could be reduced, which further sparkled the demand for the Pound Sterling. However, gains experienced by sterling was limited following the release of bleak economic data from the UK region. According to Office for National Statistics, U.K Gross Domestic Product (GDP) came in at 0.3%, weaker than the economist forecast at 0.4%. Meanwhile the U.K Manufacturing Production for last month came in at -0.4%, lower than the market forecast at -0.3%. Both data spurred concerns over slowing economic momentum, which may prompt a further rate cut in future. As of writing, GBP/USD appreciated by 0.03% to 1.2855. On the other hand, Dollar index slumped 0.14% to 98.00 amid trade uncertainty after US President Donald Trump said on last Friday that he had not agreed to end tariffs on Chinese goods as part of a trade deal.

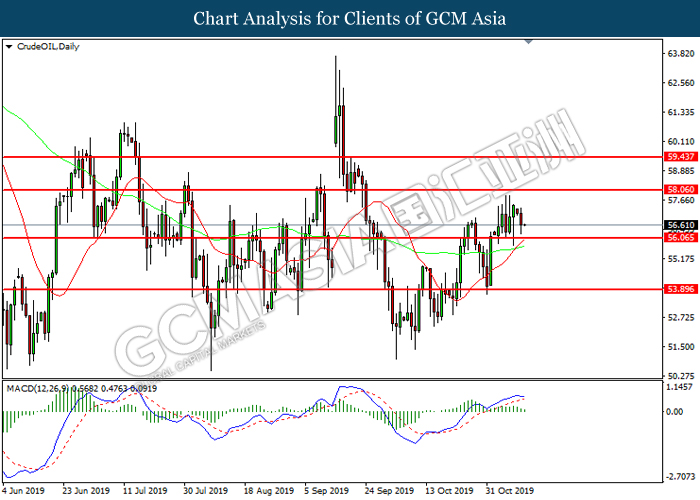

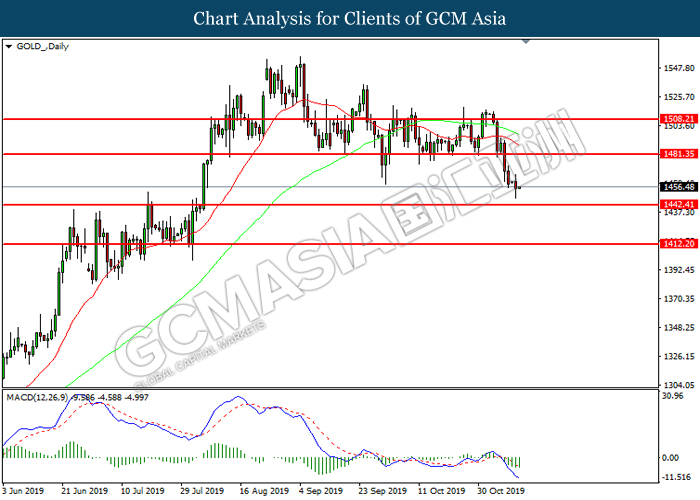

In the commodities market, crude oil price experienced some selloff amid trade uncertainty. Trade war risks spurred higher pessimism among investors as it may possibly increase the risk for global economic slowdown, weighing the demand for crude oil in the future. On the other hand, gold price surged yesterday due to weaker greenback and trade pessimism outlook. As of writing, crude oil price depreciated by 0.23% to $56.77 per barrel while gold price fell 0.02% to $1455.20 per troy ounces.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Average Earnings Index +Bonus (Sep) | 3.8% | 3.8% | – |

| 17:30 | GBP – Claimant Count Change (Oct) | 21.1K | 24.2K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Nov) | -22.8 | -13.2 | – |

Technical Analysis

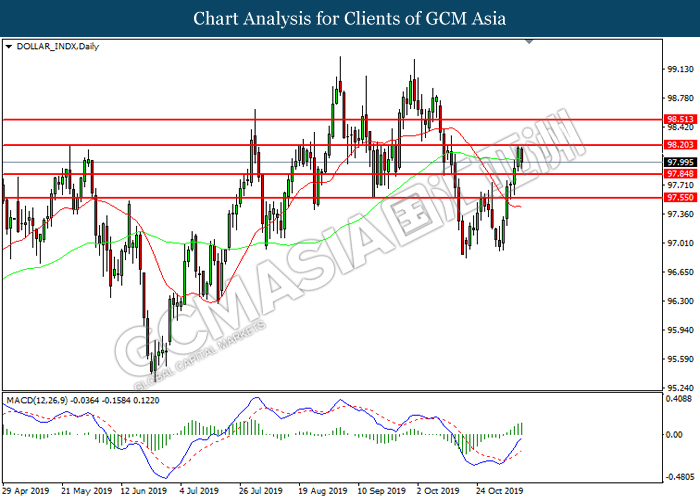

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 98.20. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 98.20, 98.50

Support level: 97.85, 97.55

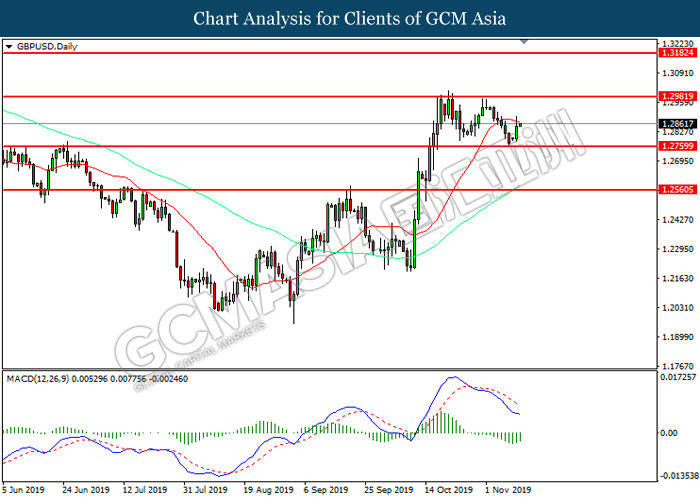

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2760. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2980.

Resistance level: 1.2980, 1.3180

Support level: 1.2760, 1.2560

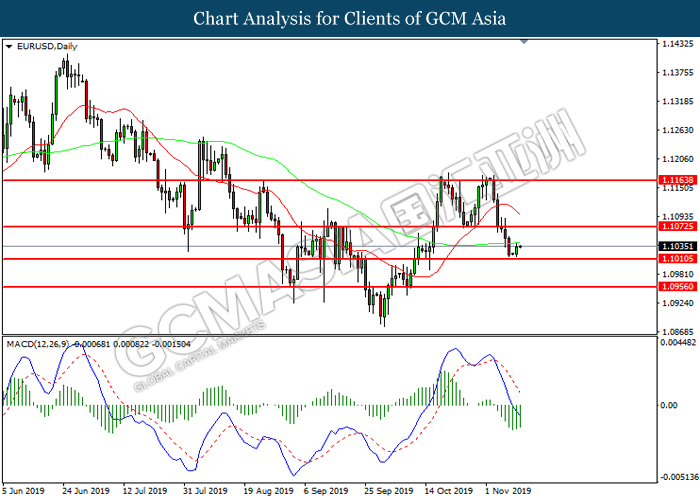

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.1010. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.1075.

Resistance level: 1.1075, 1.1165

Support level: 1.1010, 1.0955

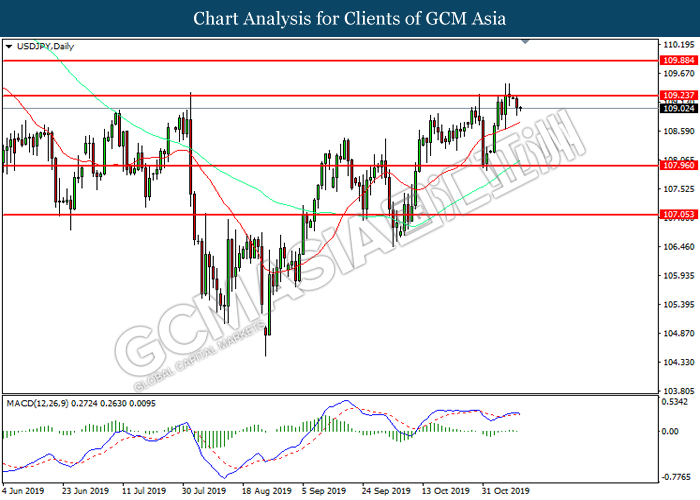

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 109.25. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 109.25, 109.90

Support level: 107.95, 107.05

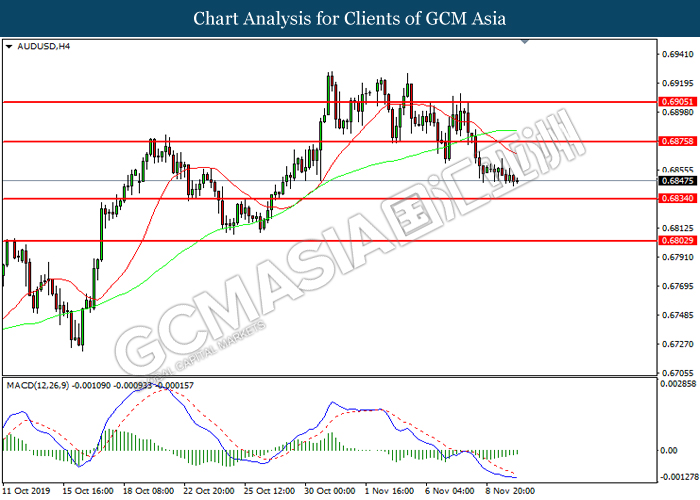

AUDUSD, H4: AUDUSD was traded lower while currently near the support level at 0.6835. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6875, 0.6905

Support level: 0.6835, 0.6805

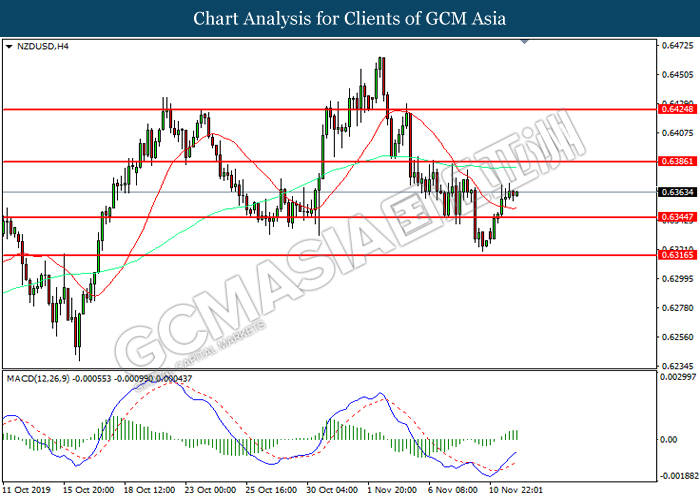

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6345. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6385.

Resistance level: 0.6385, 0.6425

Support level: 0.6345, 0.6315

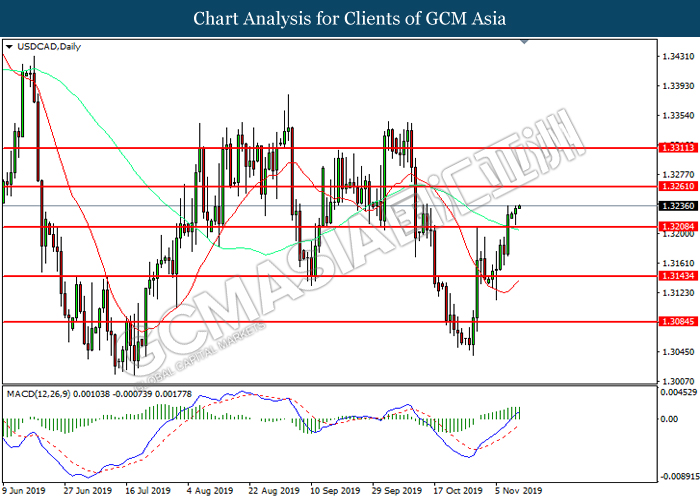

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3210. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3260.

Resistance level: 1.3260, 1.3310

Support level: 1.3210, 1.3145

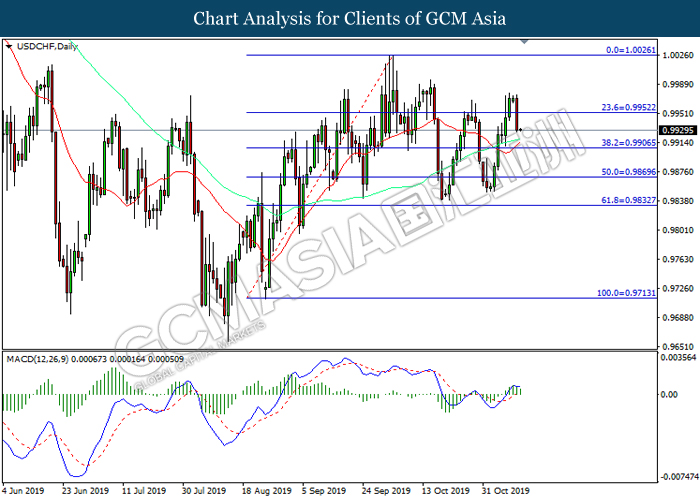

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9950. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9905.

Resistance level: 0.9950, 1.0025

Support level: 0.9905, 0.9870

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 58.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 56.05.

Resistance level: 58.05, 59.45

Support level: 56.05, 53.90

GOLD_ Daily: Gold price was traded lower following prior breakout below the previous support level at 1481.35. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1442.40.

Resistance level: 1481.35, 1508.21

Support level: 1442.40, 1412.20