13 February 2020 Morning Session Analysis

Yen slumped amid to positive prospect for the coronavirus.

Japanese Yen sagged on yesterday amid diminishing fears upon the coronavirus, which stoked a shift in sentiment toward the riskier asset while weighing on the demand for traditional safe-havens such as the Japanese Yen. According to China Official data, as of Wednesday morning, the growth rate of new coronavirus infections fell to the lowest level since late January. Moreover, China’s National Health Commission (NHC) announced that the recovery rate from infections increased from the preliminary reading of 1.3% on 27th January to 10.6%. Besides that, investors expect that the global central banks are likely to provided further support for the market if the coronavirus continually to destroy the global economy, which further improving the risk appetite sentiment in the FX market. On the other hand, dollar index surged on yesterday following some hawkish statement from the U.S. central bank yesterday. According to Reuters, Federal Reserve Chair Jerome Powell told Congress that the economy growth within the U.S remained strong, despite there is a threat of the coronavirus, however he also reiterated that U.S. would continue to scrutinize the threat of the coronavirus in order to adopt a better policy for the U.S. economy. As of writing, USD/JPY appreciated by 0.01% to 110.07 while the dollar index surged 0.30% to 98.83.

In the commodity market, the crude oil appreciated by 0.15% to $51.75 per barrel. The oil market edged higher amid to positive prospect for the coronavirus. Investors expected that the resolution of the coronavirus would able to boost the world economy while insinuating the further demand on this black-commodity in the future. On the other hand, the gold price depreciated by 0.04% to $1565.95 per troy ounces amid to stronger U.S Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Jan) | 0.1% | 0.2% | – |

Technical Analysis

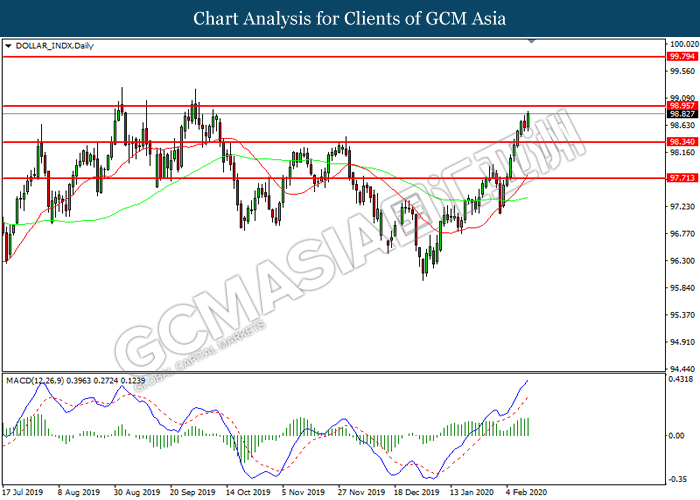

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 98.95. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 98.95, 99.80

Support level: 98.35, 97.70

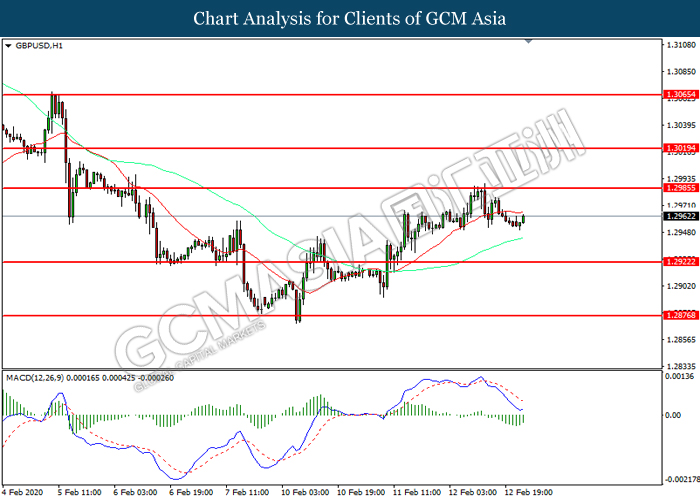

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level at 1.2985. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2985, 1.3020

Support level: 1.2920, 1.2875

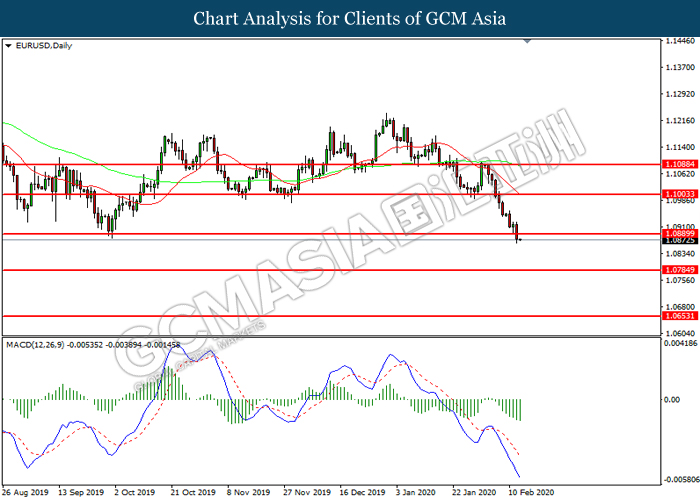

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0890. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.0785.

Resistance level: 1.0890, 1.1005

Support level: 1.0785, 1.0655

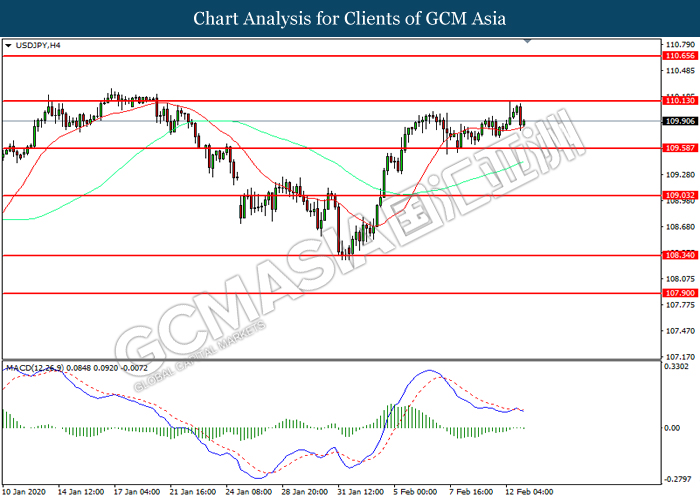

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 110.15. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 110.15, 110.65

Support level: 109.60, 109.05

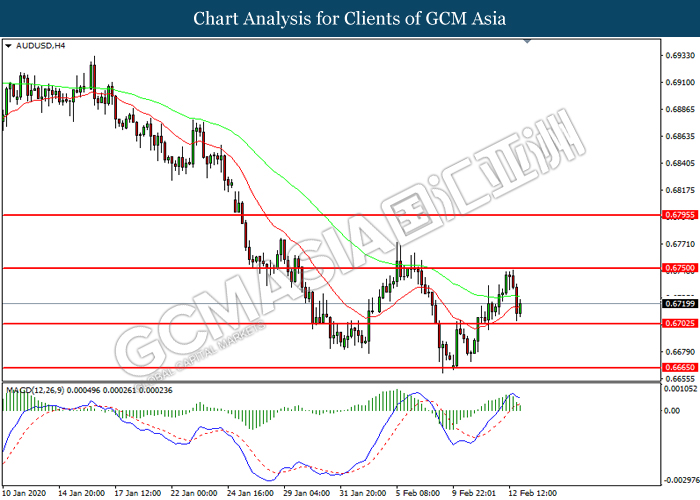

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.6705. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6750, 0.6795

Support level: 0.6705, 0.6665

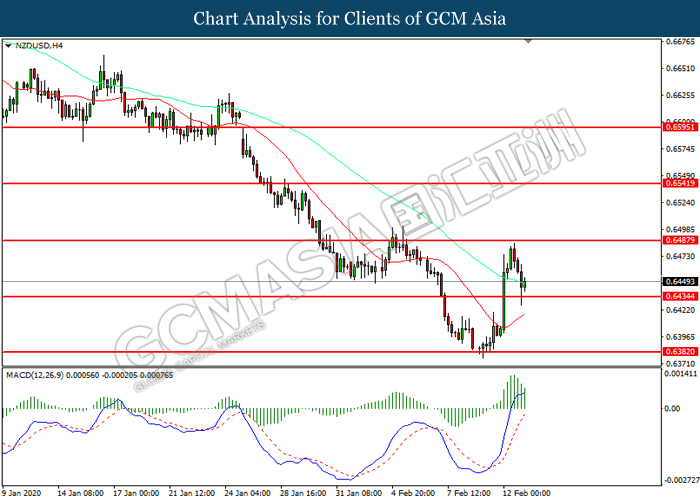

NZDUSD, H4: NZDUSD was traded lower while currently near the support level at 0.6435. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6490, 0.6540

Support level: 0.6435, 0.6380

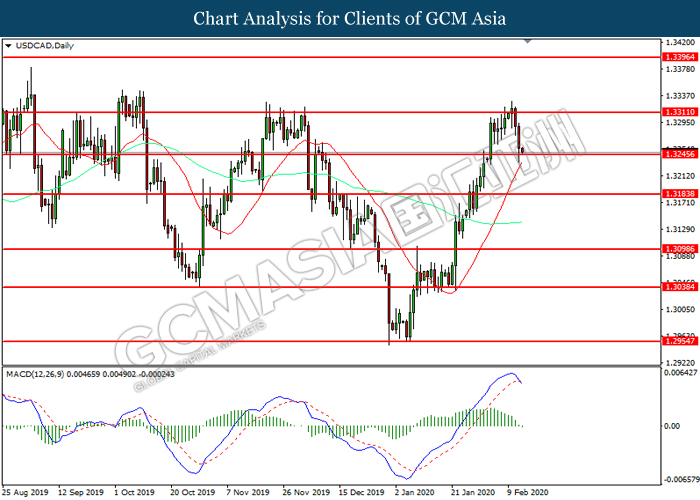

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3245. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3319, 1.3395

Support level: 1.3245, 1.3185

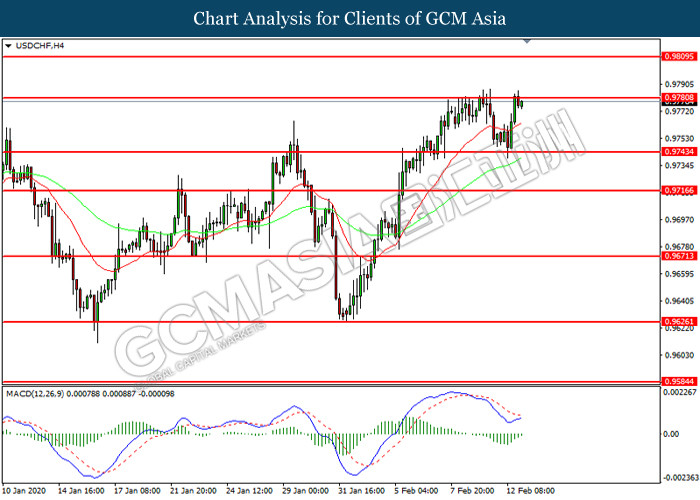

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9780. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9780, 0.9810

Support level: 0.9745, 0.9715

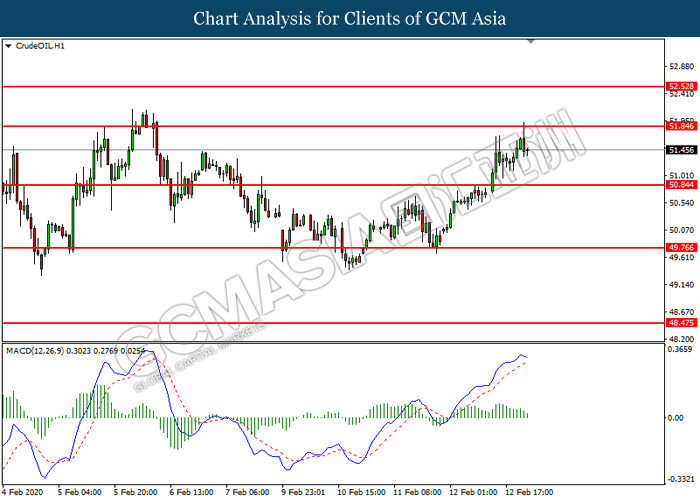

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 51.85. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 50.85.

Resistance level: 51.85, 52.55

Support level: 50.85, 49.75

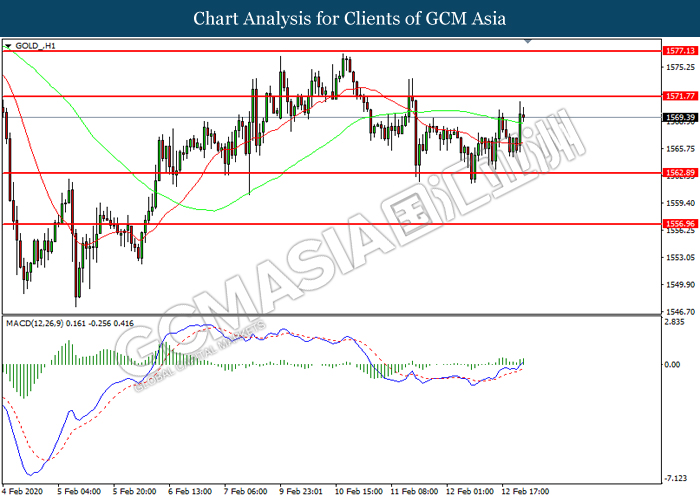

GOLD_, H1: Gold price was higher while currently near the resistance level at 1571.75. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1571.75, 1577.15

Support level: 1562.90, 1556.95