17 September 2019 Afternoon Session Analysis

Japanese Yen surged due to risk aversion.

Japanese Yen appreciated against the U.S. dollar as geopolitical tensions escalated in the Middle East after the drone attacked on two major oil facilities in Saudi Arabia and destroyed the global oil supplies. The pre-dawn strikes on Saturday disrupted 5 percent of global oil supply and reduces the output of the crude oil by 5.7 million barrels per day. Yemen’s Houthi rebels claimed the responsibility for the attacks, warning Saudi Arabia that their target will be continually expanded. However, U.S. Secretary of State Mike Pompeo accused Iran of being behind the assault, without providing any evidence. The accused was then rejected by Tehran. Meanwhile, Saudi Arabia has promised to confront and deal with this terrorist aggression. The news intensifies tensions in the Middle East, providing bullish support for the Japanese Yen higher as it considered as safe-haven assets. However, with Bank of Japan is due to meet this week, investors speculate that the central bank may cut its interest rates further into negative territory to boost up the economic growth. On the other hand, EUR/USD slump as higher oil prices hurt the Europe’s balance of payments. As Europe imports most of its oil, rising oil price on a supply shock would increase the cost of import and lead to further depreciation in EUR/USD. As of writing, USD/JPY rose 0.02% to 108.10 and EUR/USD appreciated by 0.12% to 1.1001.

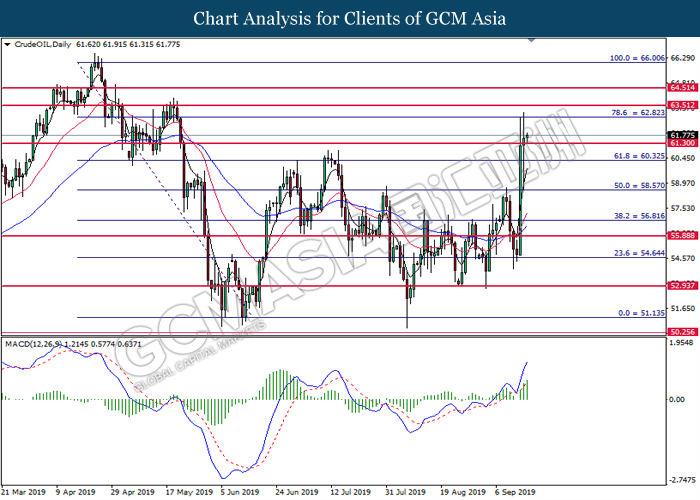

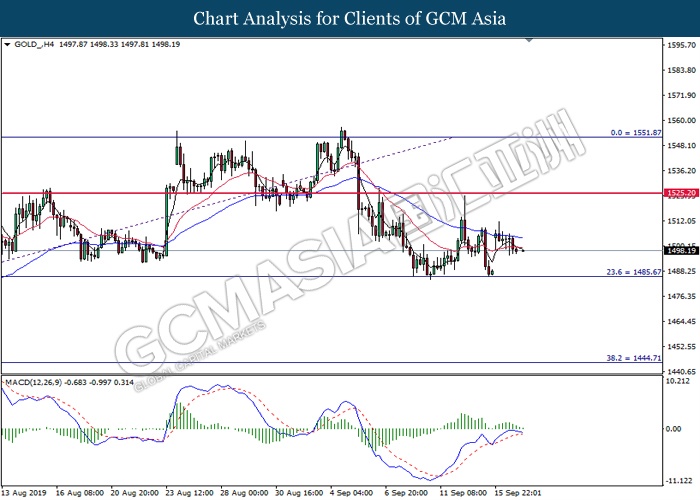

In the commodities market, crude oil price rose 0.23% to $61.72 per barrel as the drone attacks in Saudi Arabia lead to a supply shock in crude oil inventory. On the other hand, gold price rose 0.09% to $1499.32 per ounces as a result of risk aversion due to rising geopolitical tensions.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Sep) | -44.1 | -38.0 | – |

| 17:00 | EUR – ZEW Economic Sentiment (Sep) | -43.6 | -37.4 | – |

| 21:15 | USD – Industrial Production (MoM) (Aug) | -0.2% | 0.2% | – |

Technical Analysis

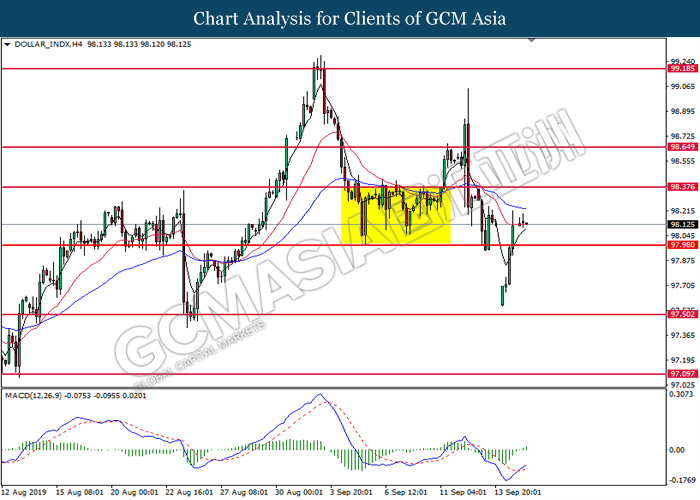

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 98.00. MACD which illustrate bullish signal suggests the index to extend its gains toward the resistance level at 98.40.

Resistance level: 98.40, 98.65

Support level: 98.00, 97.50

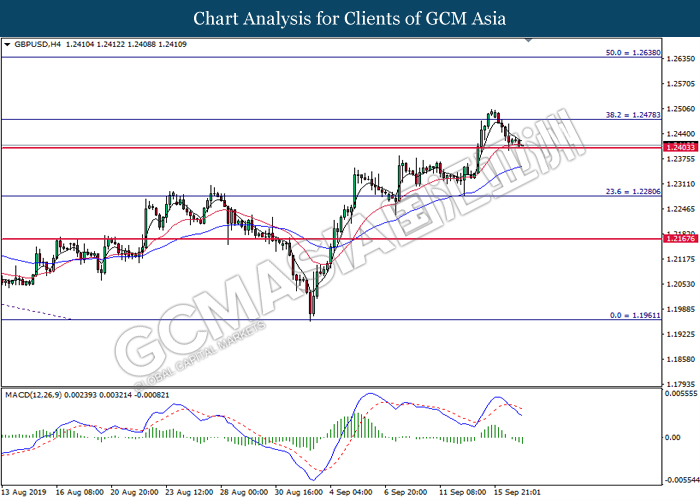

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrate bearish signal suggests the pair to extend its losses after successfully breakout below the support level at 1.2405.

Resistance level: 1.2480, 1.2635

Support level: 1.2405, 1.2280

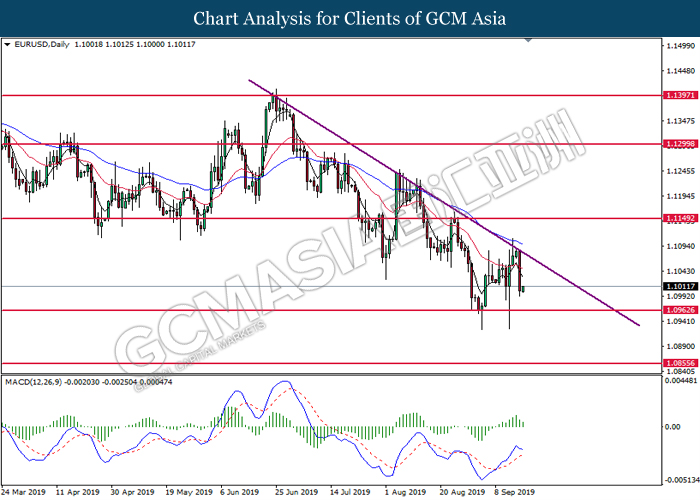

EURUSD, Daily: EURUSD was traded lower following prior retracement from the downward trendline. MACD which illustrate bearish signal suggests the pair to extend its losses, towards the direction of 1.0965.

Resistance level: 1.1150, 1.1300

Support level: 1.0965, 1.0855

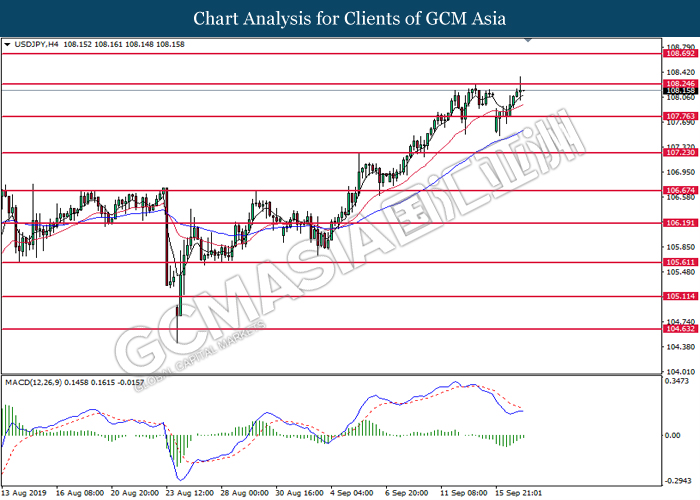

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 108.25. MACD which illustrate diminished downward momentum suggests the pair to extend its gains after successfully breakout above the resistance level at 108.25.

Resistance level: 108.25, 108.70

Support level: 107.75, 107.25

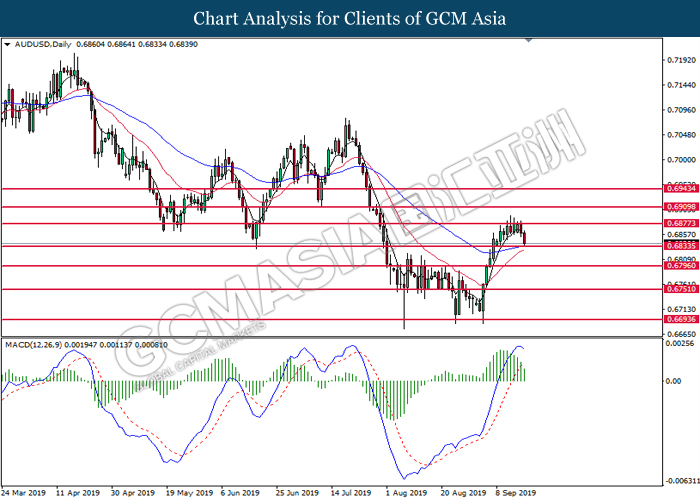

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6835. MACD which illustrate diminished upward momentum suggests the pair to extend its losses after successfully breakout below the support level at 0.6835.

Resistance level: 0.6875, 0.6910

Support level: 0.6835, 0.6795

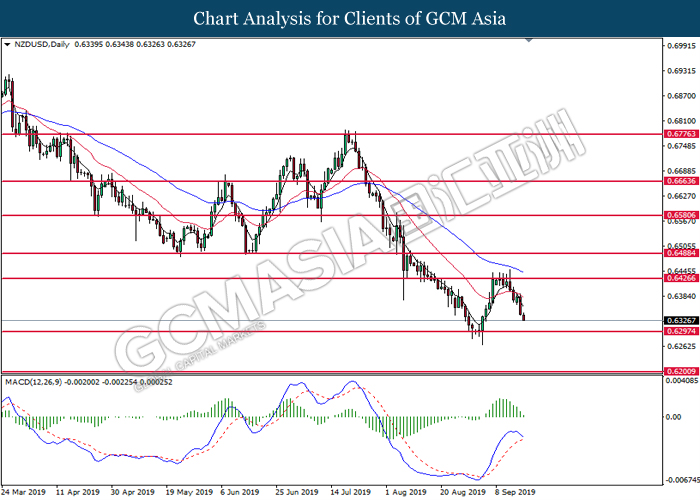

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6425. MACD which illustrate bearish signal suggests the pair to advance further down, towards the direction of 0.6295.

Resistance level: 0.6425, 0.6490

Support level: 0.6295, 0.6200

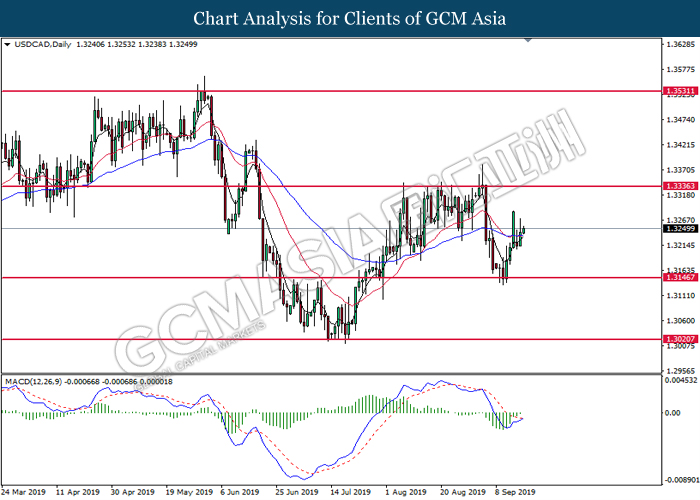

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3145. MACD which illustrate diminished downward momentum suggests the pair to extend its gains toward the resistance level at 1.3335.

Resistance level: 1.3335, 1.3530

Support level: 1.3145, 1.3020

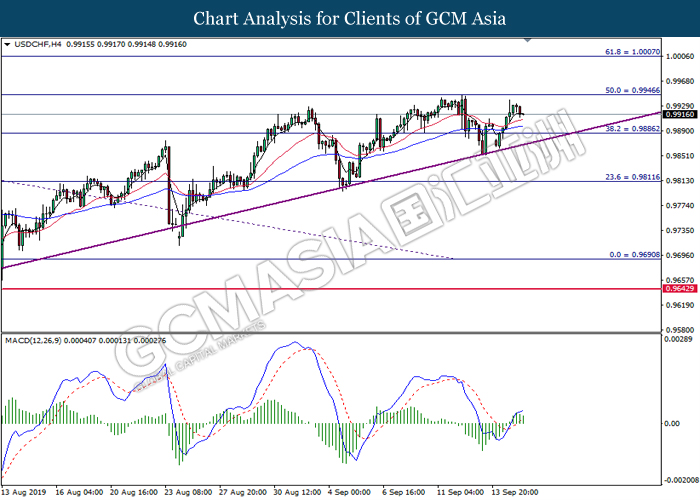

USDCHF, H4: USDCHF was traded lower following prior retrace from its higher levels. MACD which illustrate diminished upward momentum suggests the pair to extend its losses toward the support level at 0.9885.

Resistance level: 0.9945, 1.0005

Support level: 0.9885, 0.9810

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 61.30. MACD which illustrate persistent upward momentum suggests the commodity to extend its gains toward the resistance level at 62.80.

Resistance level: 62.80, 63.50

Support level: 61.30, 60.35

GOLD_, H4: Gold price was traded lower following prior retracement from the 50 moving average line (Blue). MACD which illustrate diminishing upward momentum suggest the commodity to extend its losses toward the support level at 1485.65.

Resistance level: 1525.20, 1551.85

Support level: 1485.65, 1444.70