17 September 2019 Morning Session Analysis

Greenback gains status as safe-haven asset.

US dollar recovered its losses on yesterday following its status as an alternative safe-haven asset. As of writing, the dollar index was quoted up 0.04% to 98.13 during Asian trading session. Following last Saturday’s Houthi drone attack on Saudi Arabia as well as recent risk aversion in GBP and Euro, investors flock into safe-haven assets such as the US dollar and Japanese yen in order to safe guard their capital from further losses. However, gains on the greenback remains limited as the Federal Reserve is expected to cut its interest rates by 25 basis points during its monetary policy meeting this Thursday. In addition, recent release of NY Empire State Manufacturing Index shows further depreciation from 4.80 to 2.00 for the month of September has placed further bearish pressure to cap off any substantial gains. On the other hand, pair of GBP/USD ticked down 0.01% to 1.2426. Pound sterling retraces from its prior high level after UK Prime Minister failed to show up at a joint media session with Luxembourg Prime Minister on yesterday. The move has sparked higher concern that it may jeopardize Brexit term negotiation in between UK and EU and thus sparked significant selloff upon the pound sterling.

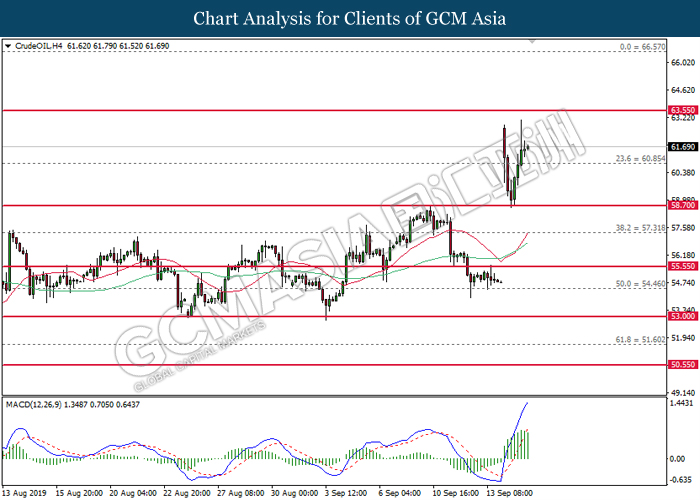

As for commodities, crude oil price extended gains by 0.03% to $61.87 per barrels. Oil prices continues to surge after Saudi oil company, Aramco commented that the recovery process on its oil facilities may take longer time than expected. Such signals suggest that oil production from Saudi Arabia may be jeopardize for a longer period of time. Otherwise, gold price was traded flat at $1,498.24 a troy ounce as investors wait for more signals from Fed interest rate decision this coming Thursday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Sep) | -44.1 | -38.0 | – |

| 17:00 | EUR – ZEW Economic Sentiment (Sep) | -43.6 | -37.4 | – |

| 21:15 | USD – Industrial Production (MoM) (Aug) | -0.2% | 0.2% | – |

Technical Analysis

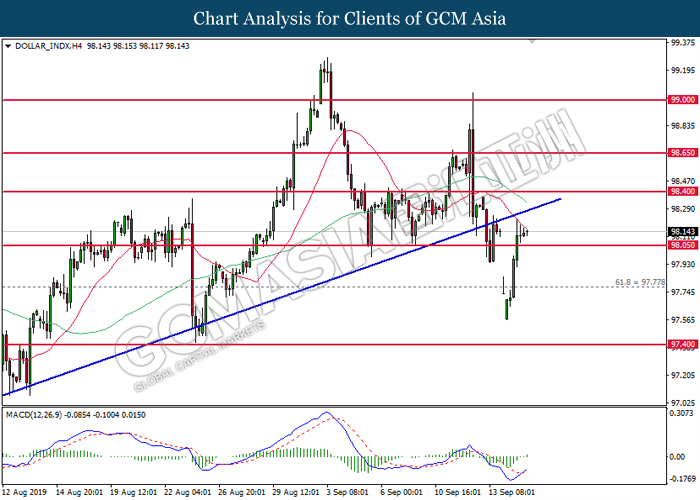

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the lower level. MACD which illustrate bullish signal suggests the index to extend its gains after closing above the 20-MA line (Red).

Resistance level: 98.40, 98.65

Support level: 98.05, 97.80

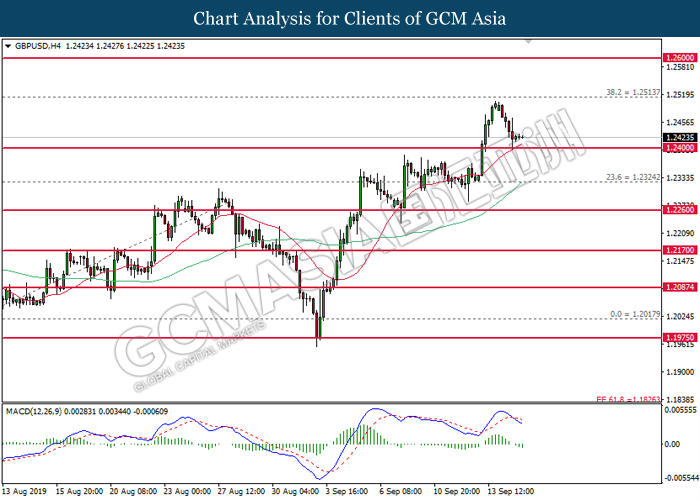

GBPUSD, H4: GBPUSD was traded lower following prior retrace from the upper level. MACD which illustrate bearish signal suggests the pair to extend its losses after closing below the support of 1.2400.

Resistance level: 1.2515, 1.2600

Support level: 1.2400, 1.2325

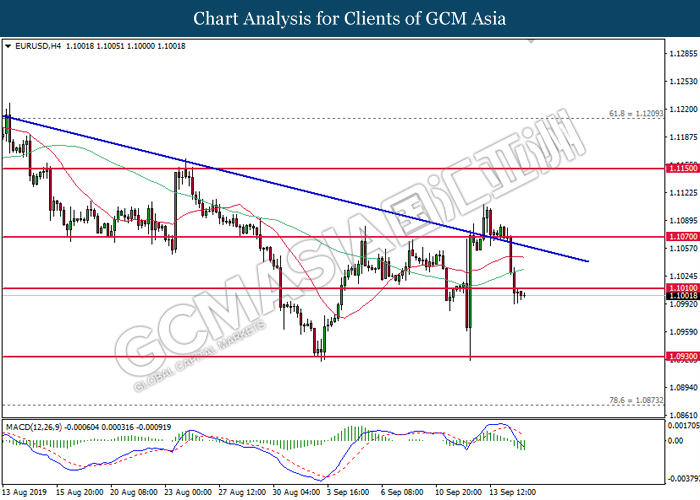

EURUSD, H4: EURUSD was traded lower following prior retrace from the downward trendline. MACD which illustrate bearish signal suggests the pair to extend its losses, towards the direction of 1.0930.

Resistance level: 1.1010, 1.1070

Support level: 1.0930, 1.0870

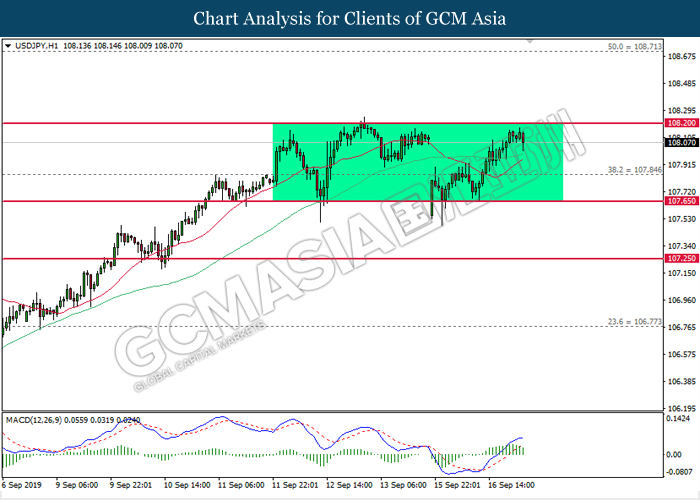

USDJPY, H1: USDJPY remain traded within a sideways channel formation. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 108.20, 108.70

Support level: 107.85, 107.65

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from its higher levels. MACD which illustrate diminished upward momentum suggests the pair to be traded lower after closing below 0.6865.

Resistance level: 0.6900, 0.6960

Support level: 0.6865, 0.6800

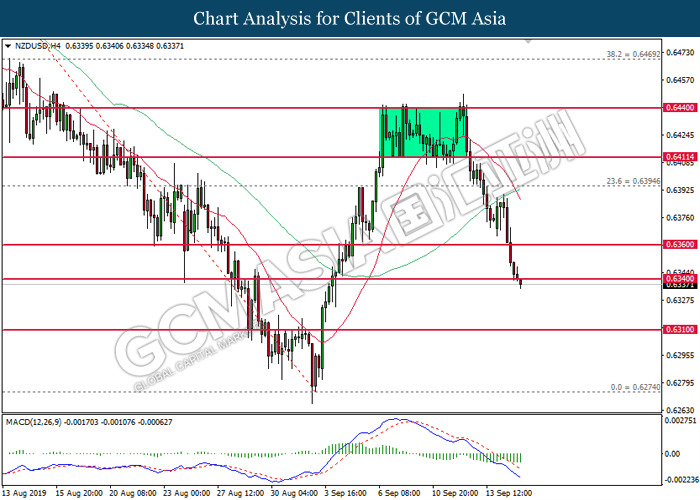

NZDUSD, H4: NZDUSD extended its losses after closing below 0.6340. MACD which illustrate bearish signal suggests the pair to advance further down, towards the direction of 0.6310.

Resistance level: 0.6340, 0.6360

Support level: 0.6310, 0.6275

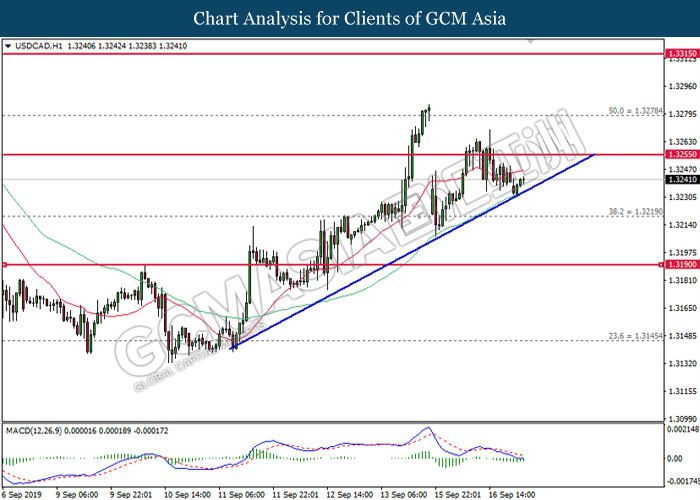

USDCAD, H1: USDCAD was traded higher following prior rebound from the upward trendline. MACD which illustrate diminished downward momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.3255, 1.3280

Support level: 1.3220, 1.3190

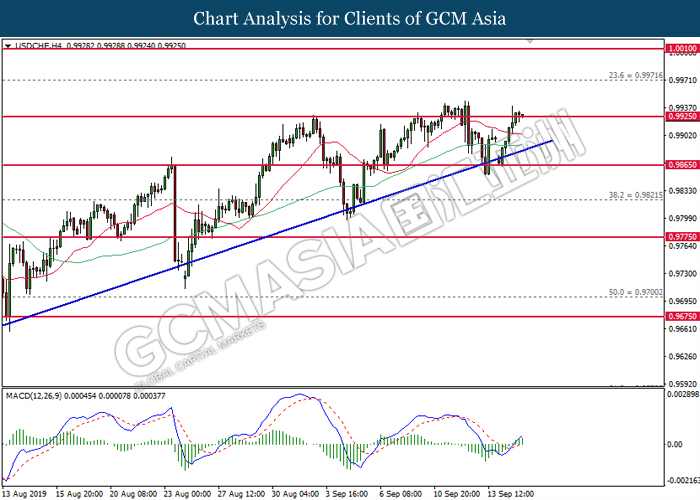

USDCHF, H4: USDCHF was traded lower following prior retrace from its higher levels. MACD which illustrate diminished upward momentum suggests the pair to be traded lower after closing below 0.9925.

Resistance level: 0.9970, 1.0010

Support level: 0.9925, 0.9865

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the lower level. However, MACD which illustrate diminished upward momentum suggests its price to be traded lower in short-term as technical correction.

Resistance level: 63.55, 66.60

Support level: 60.85, 58.70

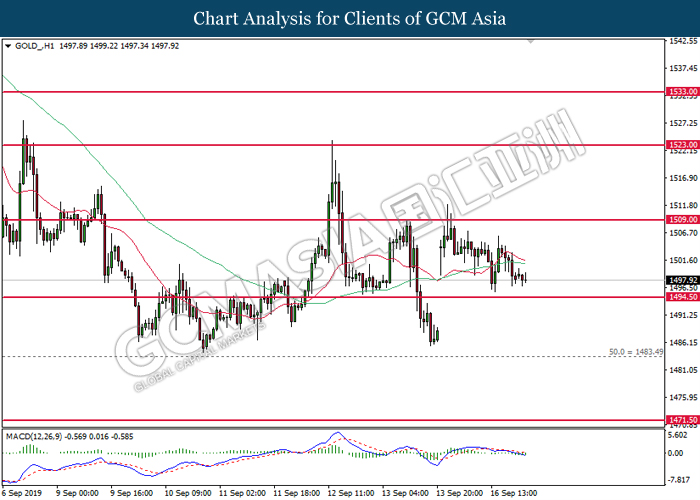

GOLD_, H1: Gold price remains traded within a sideways channel formation. Due to the lack of signal from MACD and price action, it is suggested to wait for a breakout before entering the market.

Resistance level: 1509.00, 1523.00

Support level: 1494.50, 1483.50