18 February 2020 Afternoon Session Analysis

AUD slips after RBA adopts dovish stance.

Australian dollar slipped against the US dollar following the release of Reserve Bank of Australia’s (RBA) meeting minutes during Asian trading session. According to the minutes, policymakers reiterates that an extended period of low interest rates is required in Australia in order to attain full employment and inflation target. However, the central bank remains cautious over the impact of coronavirus epidemic which poses significant risk to China’s economy as it is Australia’s major trading partner. Subsequently, policymakers signaled to loosen their monetary policy if necessary, in order to support their economy. Traders were anticipating for hawkish signals from RBA after Governor Philip Lowe expresses his optimism that Australia’s economy could overcome the impact of coronavirus. Despite receding pace of the epidemic, investors remain cautious as its impact over global economy continues to linger. As of writing, pair of AUD/USD depreciates by 0.39% to 0.6687.

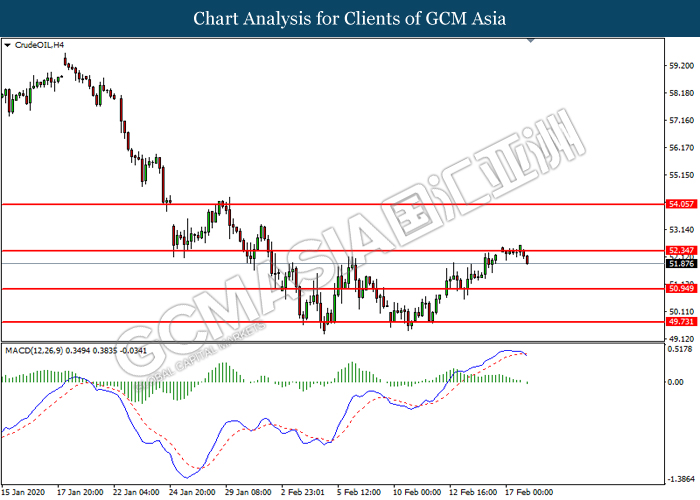

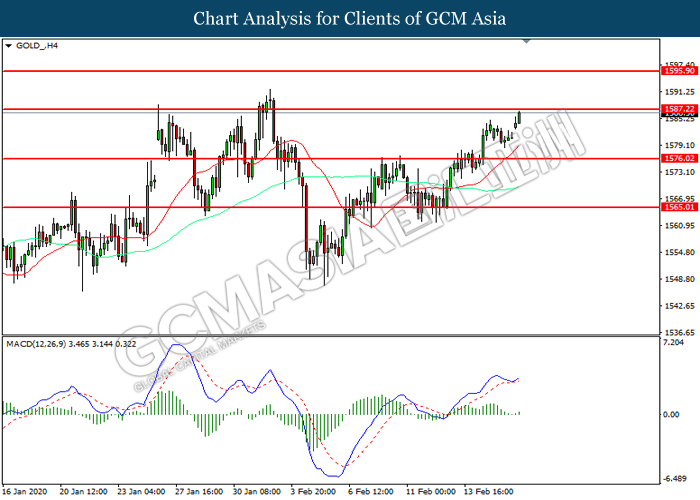

In the commodities market, crude oil price slumped by 0.77% to $51.76 per barrel. Oil futures were dumped on Tuesday due to lingering concerns over the economic impact of coronavirus outbreak in China and its effect upon global oil demand. On the other hand, gold price rose 0.37% to $1,586.61 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Average Earnings Index +Bonus (Dec) | 3.2% | 3.0% | – |

| 17:30 | GBP – Claimant Count Change (Jan) | 14.9K | 22.6K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 26.7 | 22.0 | – |

| 21:30 | USD – NY Empire State Manufacturing Index (Feb) | 4.80 | 5.00 | – |

Technical Analysis

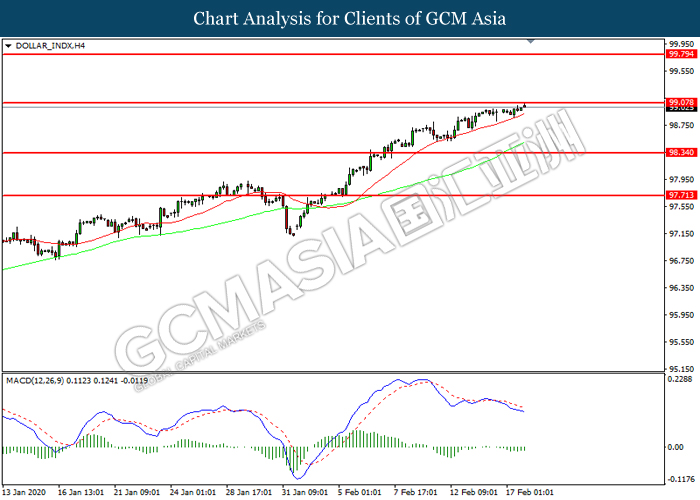

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 99.10. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 99.05, 99.80

Support level: 98.35, 97.70

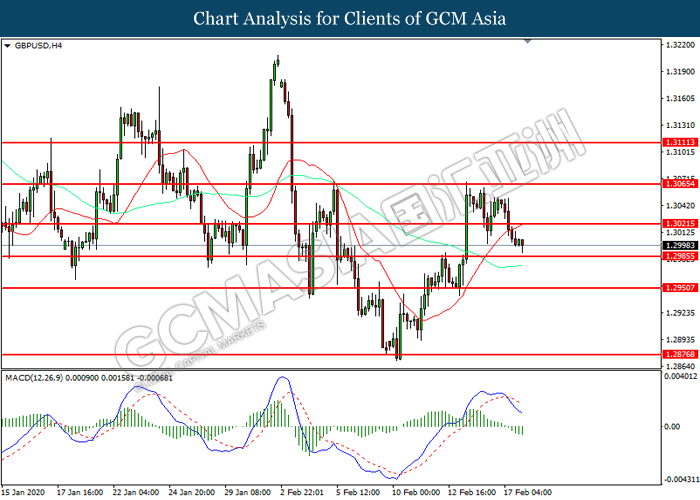

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3020. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.2985.

Resistance level: 1.3020, 1.3065

Support level: 1.2985, 1.2950

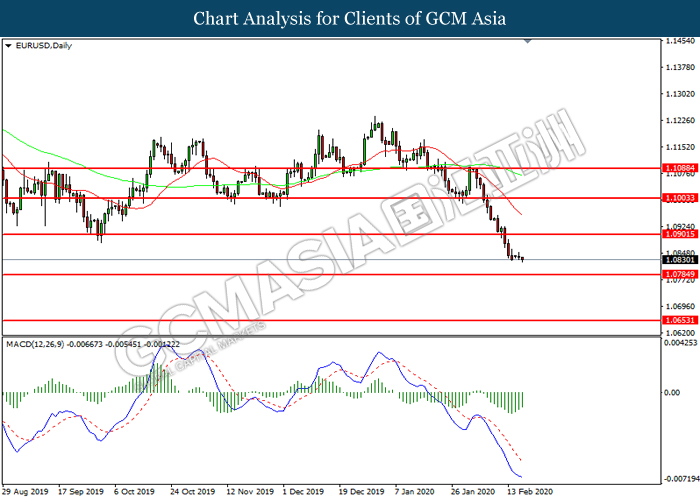

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0900. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0900, 1.1005

Support level: 1.0785, 1.0655

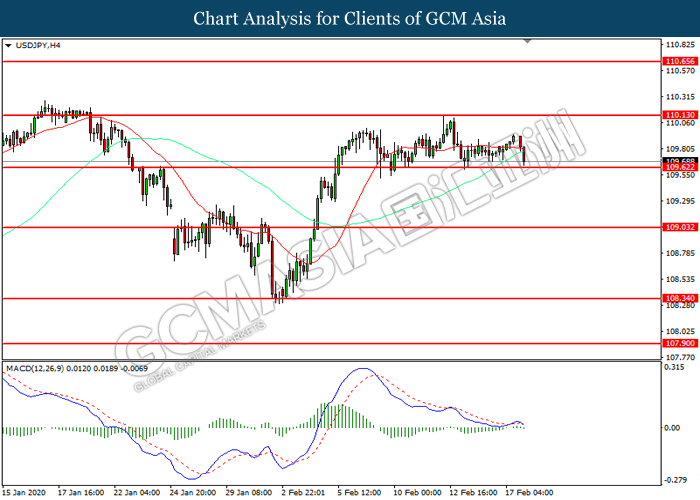

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 109.60. MACD which illustrated increasing bearish momentum suggest the pair to extend it losses after it successfully breakout below the support level.

Resistance level: 110.15, 110.65

Support level: 109.60, 109.05

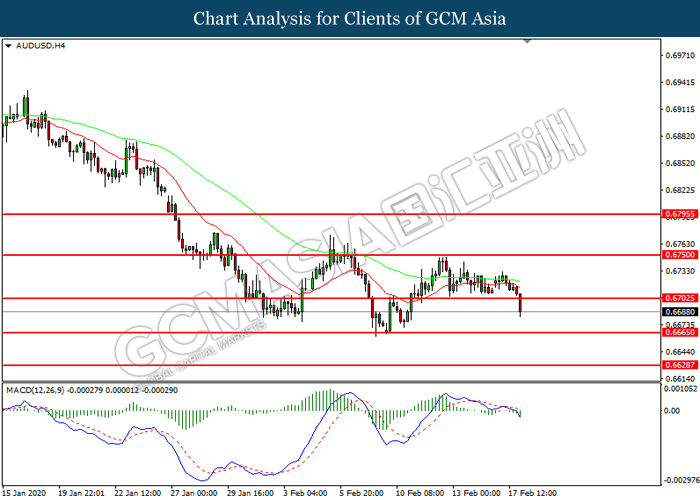

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.6705. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6665.

Resistance level: 0.6705, 0.6750

Support level: 0.6665, 0.6630

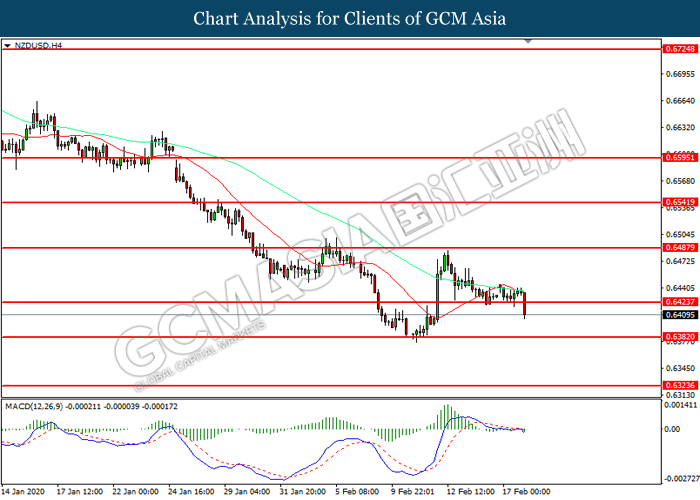

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level at 0.6425. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6380.

Resistance level: 0.6425, 0.6490

Support level: 0.6380, 0.6325

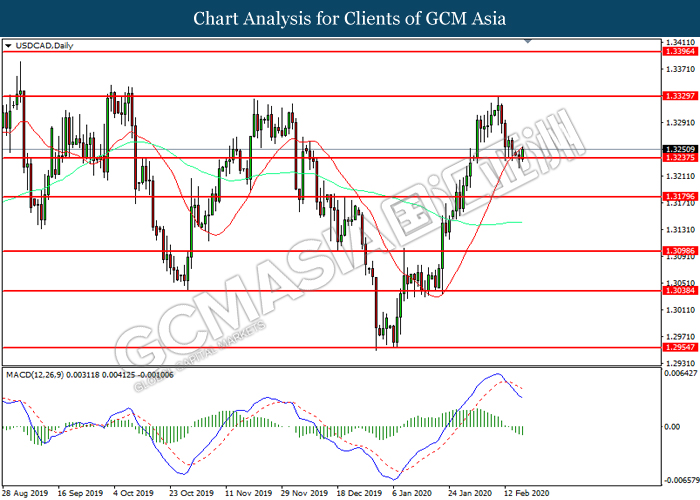

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3240. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3330, 1.3395

Support level: 1.3240, 1.3180

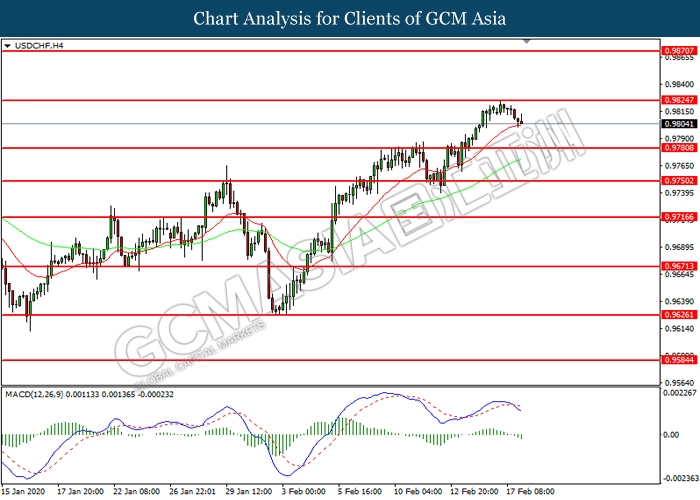

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9825. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9780.

Resistance level: 0.9825, 0.9870

Support level: 0.9780, 0.9750

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 52.35. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 50.95.

Resistance level: 52.35, 54.05

Support level: 50.95, 49.75

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1587.20. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it breakout the resistance level.

Resistance level: 1587.20, 1595.90

Support level: 1576.00, 1565.00