18 February 2020 Morning Session Analysis

Yen fell following the negative data was released.

Japanese Yen received significant bearish momentum yesterday over the backdrop of the negative GDP data from the Japan region. According to Cabinet Office, Japan Gross Domestic Product (GDP) for last month notched down from the preliminary reading of 0.1% to -1.6%, worse than the economist forecast at -0.9%, dialing down the market optimisms toward the economic growth within the Japan region while prompting expectation for further rate cut in the future in order to improve the economic growth. However, the losses experienced by the Japanese Yen was limited as the deterioration of the risk appetite within the FX market following the outbreak of the coronavirus, which stoked a shift in sentiment toward the safe-haven asset such as Japanese Yen. According to Aljazeera, the death toll from the coronavirus outbreak in mainland China reached 1,770 as of the end of Sunday, China National Health Commission said. In fact, across the country, there were 2,048 new confirmed infections, about 1,993 from Hubei alone, pushing the new total for the infection of coronavirus to 70,548. At this time, investors would continue to scrutinize the latest updates with regards of the economic data as well as the updates of the coronavirus in order to determine future trading strategy. As of writing, USD/JPY depreciate by 0.05% to 109.80.

In the commodities market, as of writing, crude oil price slumped 0.35% to $52.21 per barrels. However, the oil market edged higher yesterday as concerns over the economic slowdown from the coronavirus outbreak in China were offset by expectation that potential production cuts from major producers in future. Investors are anticipating that the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, will approve a proposal to deepen production cuts and support the oil prices in future. On the other hand, as of writing the gold price appreciated by 0.25% to $1585.10 per troy ounces amid to risk-off sentiment in the FX market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Average Earnings Index +Bonus (Dec) | 3.2% | 3.0% | – |

| 17:30 | GBP – Claimant Count Change (Jan) | 14.9K | 22.6K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 26.7 | 22.0 | – |

| 21:30 | USD – NY Empire State Manufacturing Index (Feb) | 4.80 | 5.00 | – |

Technical Analysis

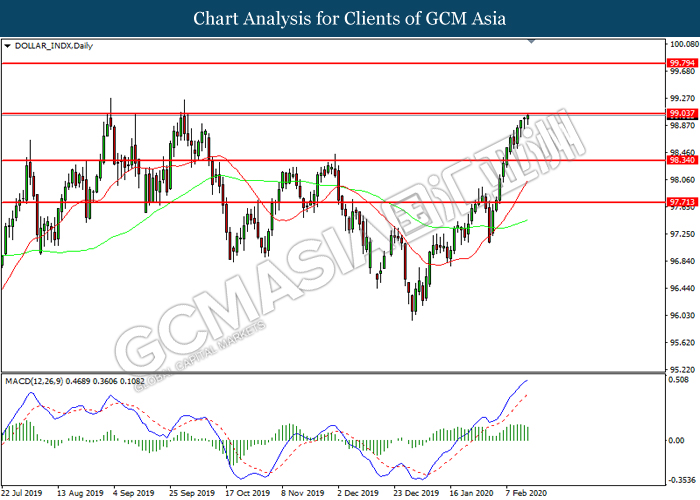

DOLLAR_INDX, Daily:Dollar index was traded higher while currently testing the resistance level at 99.05. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 99.05, 99.80

Support level: 98.35, 97.70

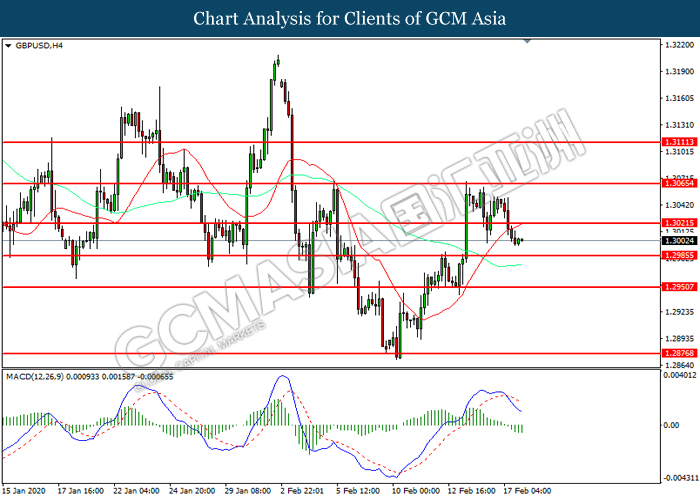

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3020. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.2985.

Resistance level: 1.3020, 1.3065

Support level: 1.2985, 1.2950

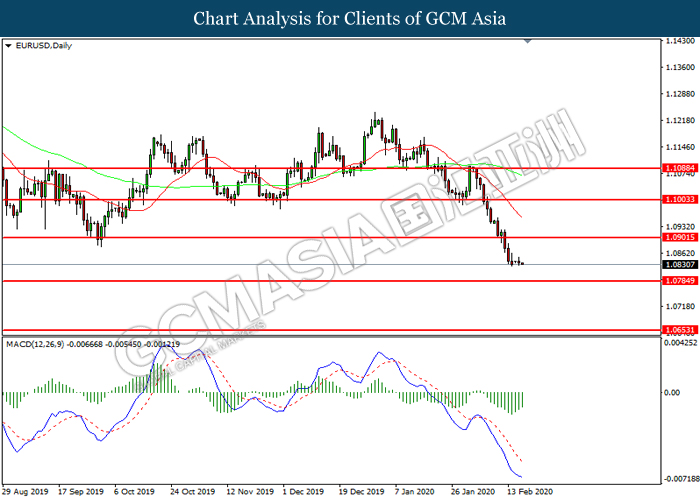

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0900. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0900, 1.1005

Support level: 1.0785, 1.0655

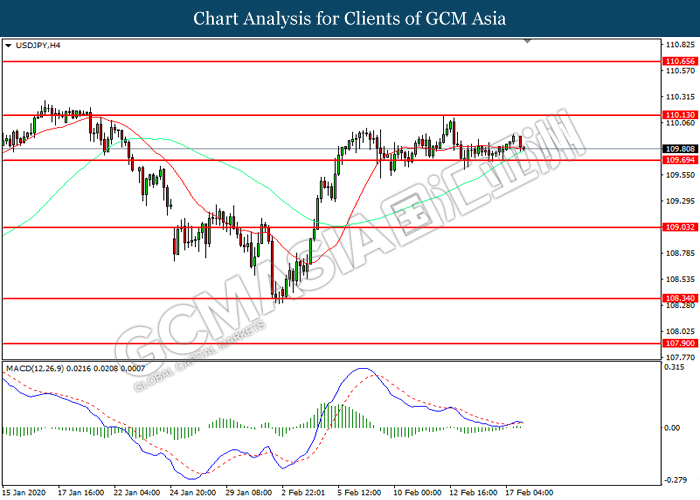

USDJPY, H4: USDJPY was traded within a range while currently near the resistance level at 109.70. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 110.15, 110.65

Support level: 109.70, 109.05

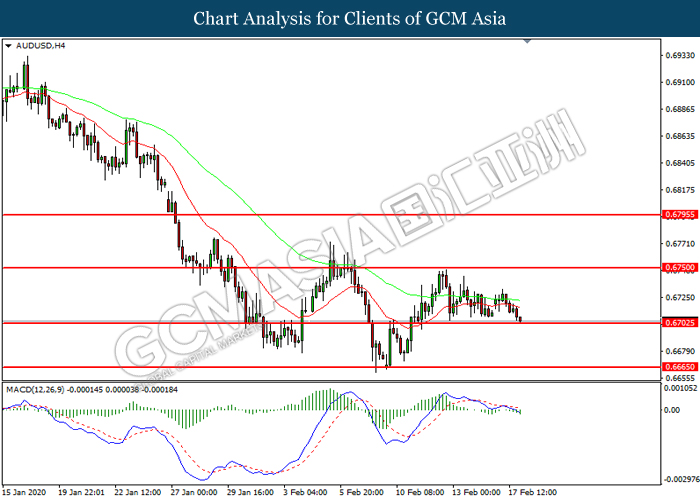

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6705. MACD which illustrated increasing bearish momentum suggest the pair to extend it losses after it breakout below the support level.

Resistance level: 0.6750, 0.6795

Support level: 0.6705, 0.6665

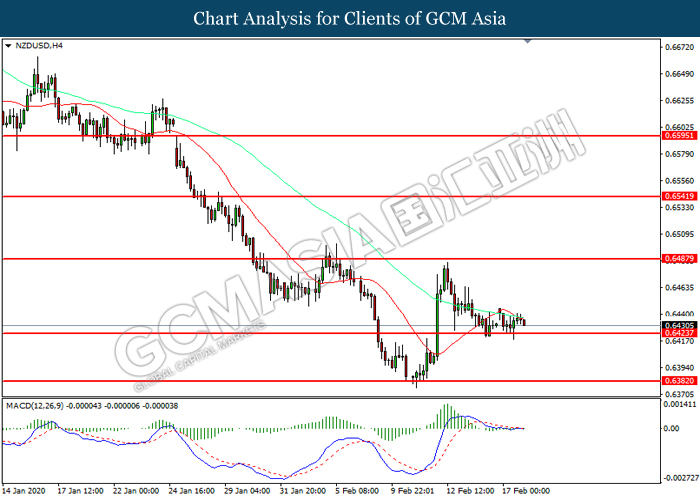

NZDUSD, H4: NZDUSD was traded lower while currently testing near the support level 0.6425. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6490, 0.6540

Support level: 0.6425, 0.6380

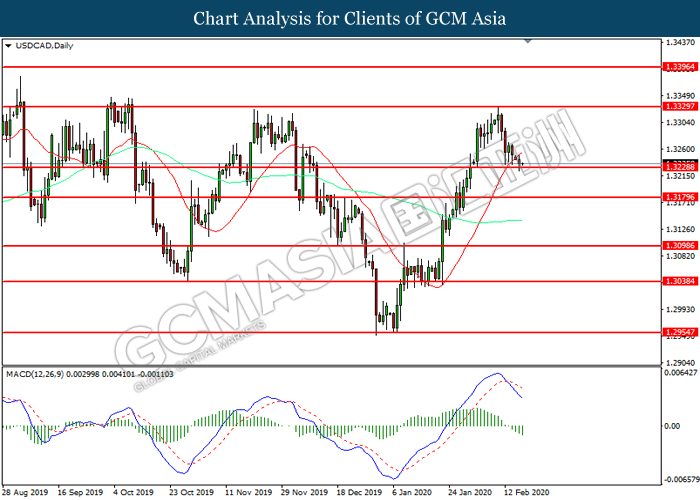

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3240. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout below the support level.

Resistance level: 1.3330, 1.3395

Support level: 1.3240, 1.3180

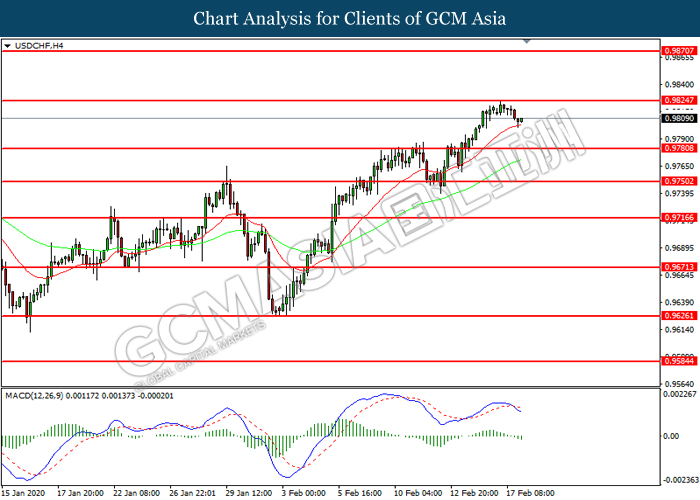

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9825. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9780.

Resistance level: 0.9825, 0.9870

Support level: 0.9780, 0.9750

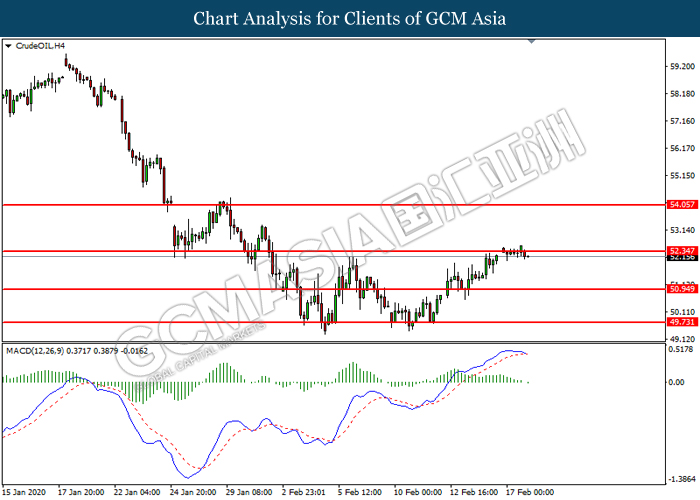

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 52.35. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 52.35, 54.05

Support level: 50.95, 49.75

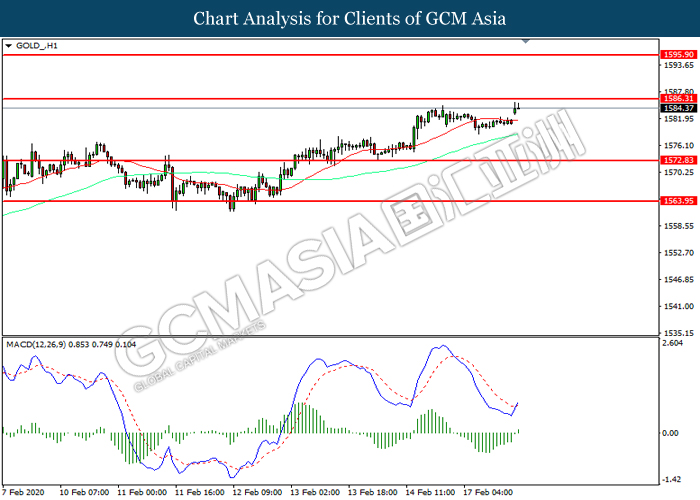

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1586.30. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1586.30, 1595.90

Support level: 1572.85, 1563.95