18 September 2019 Afternoon Session Analysis

NZD/USD slump due to poor domestic data.

NZD/USD slump after a poor result of New Zealand Westpac Consumer Survey was released. The Westpac Consumer survey measures the change in the level of consumer confidence in economic activity. According to Westpac Banking Corporation, the Westpac Consumer Survey for the third quarter has dropped below the forecast 104.0 and 103.5 prior to 103.1. In fact, Westpac claimed that households are still reluctant to spend despite the fall in interest rates in recent months, due to high global market and political risks. Moreover, New Zealand’s seasonally adjusted current account deficit narrowed by $140 million to $2.4 billion in the June 2019 quarter. However, the reading was still poorer than the market expectation, according to Statistic New Zealand. These poor results cause the NZD/USD to suffer from further depreciation. On the other hand, Loonie depreciated as the Canadian manufacturing sales fell unexpectedly to -1.3% in July compared to a revised fall of -1.4% in the prior month. According to Statistic Canada, the manufacturing Sales fell -1.3% more than the market expectation of -0.3%, due to auto and metal plant shutdowns. Meanwhile, oil prices fall after Saudi Arabia claimed the oil production could be restored to normal levels faster than thought, which further weighed on the loonie, says Reuters. As of writing, NZD/USD depreciated by 0.19% to 0.6342 while USD/CAD surged 0.07% to 1.3245.

In the commodities market, crude oil price dropped sharply on Tuesday after Saudi Energy Minister Abdulaziz bin Salman said the country’s oil exports would not fall in the end of this month, as they will rely on reserves oil to keep export stable. On the other hand, gold price rose as a result of risk aversion due to rising geopolitical tensions. As of writing, the crude oil rose 0.43% to $58.83 per barrels while gold price surged 0.05% to $1501.95.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – CPI (YoY) (Aug) | 2.1% | 1.9% | – |

| 17:00 | EUR – CPI (YoY) (Aug) | 1.0% | 1.0% | – |

| 20:30 | USD – Building Permits (Aug) | 1.317M | 1.300M | – |

| 20:30 | CAD – Core CPI (MoM) (Aug) | 0.3% | – | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -6.912M | -2.889M | – |

Technical Analysis

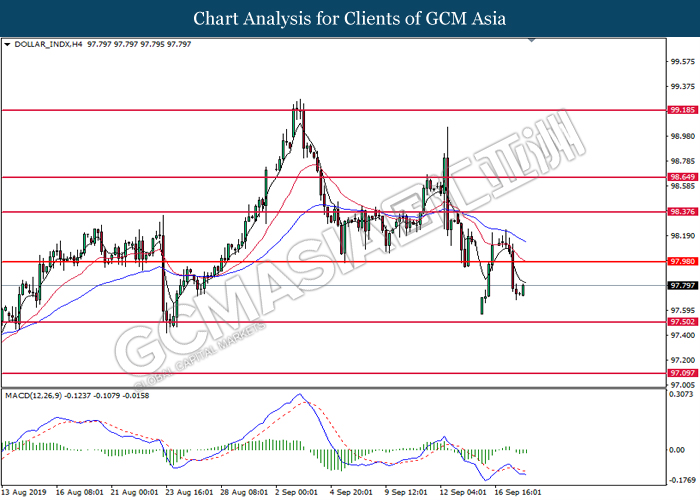

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the lower level. MACD which illustrate diminishing bearish momentum suggest the index to extend its gains toward the resistance level at 98.00.

Resistance level: 98.00, 98.40

Support level: 97.50, 97.10

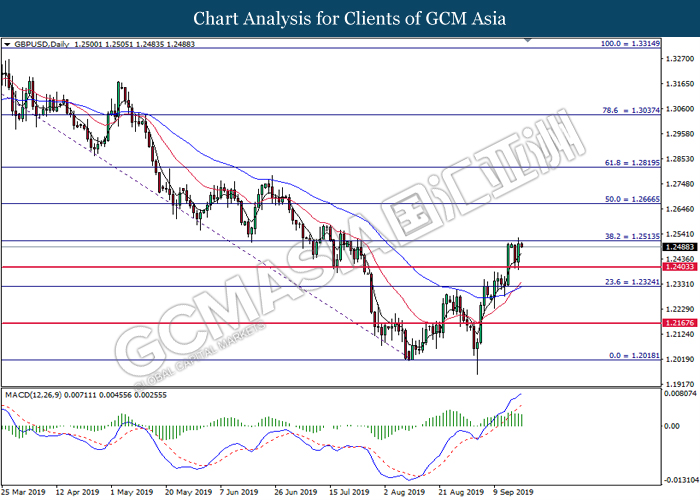

GBPUSD, Daily: GBPUSD was traded higher while currently testing at the resistance of 1.2515. MACD which illustrate bullish bias momentum suggests the pair to extend its gains after closing above 1.2515.

Resistance level: 1.2515, 1.2665

Support level: 1.2405, 1.2325

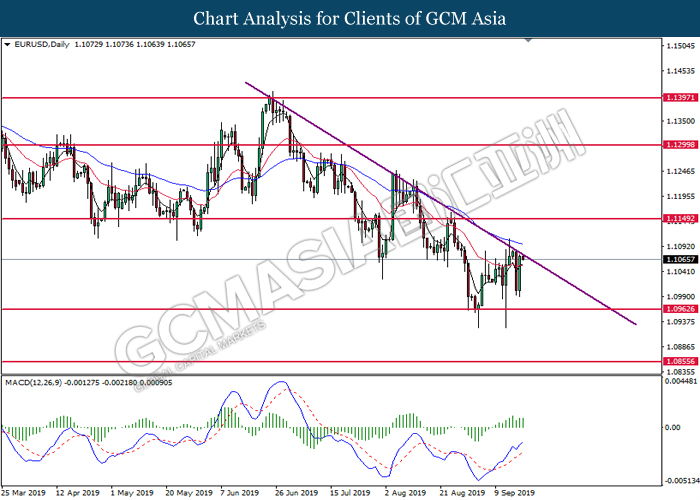

EURUSD, Daily: EURUSD was traded higher while currently testing the downward trendline. MACD which illustrate bullish signal suggests the pair to extend its gains after successfully breakout above the downward trendline.

Resistance level: 1.1150, 1.1300

Support level: 1.0965, 1.0855

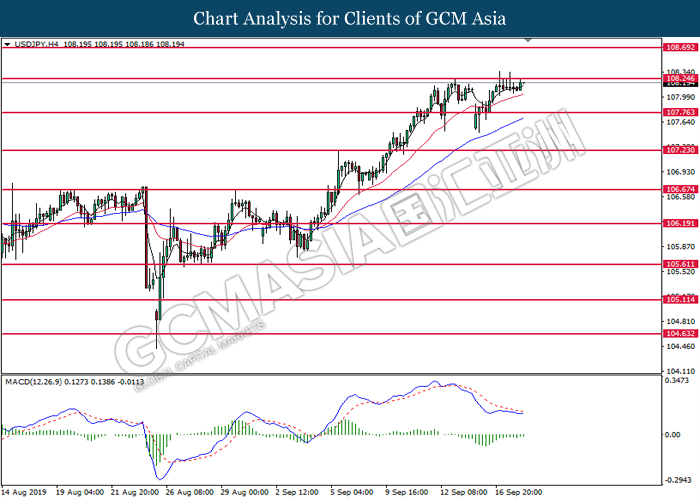

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 108.25. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains after successfully breakout above the resistance level at 108.25.

Resistance level: 108.25, 108.70

Support level: 107.75, 107.25

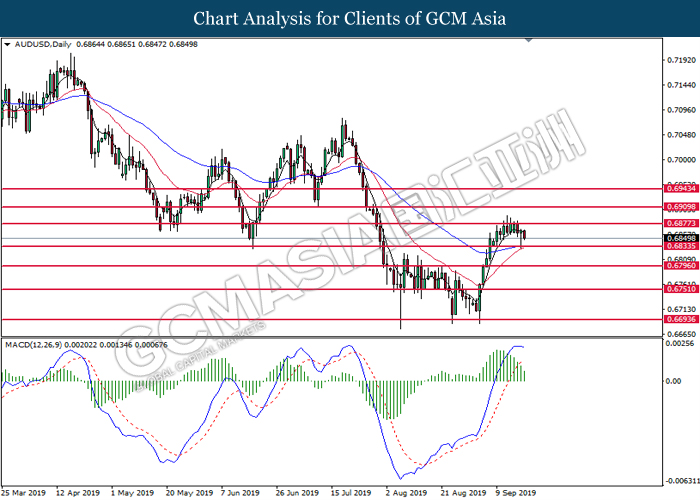

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6875. MACD which illustrate diminished upward momentum suggest the pair to extend its losses toward the support level at 0.6835.

Resistance level: 0.6875, 0.6910

Support level: 0.6835, 0.6795

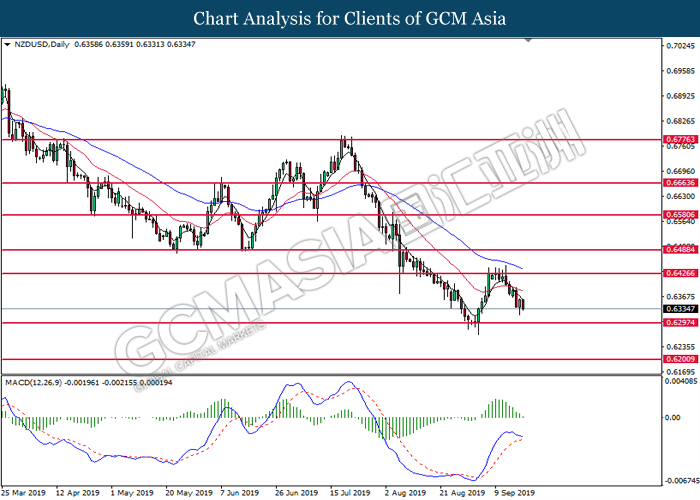

NZDUSD, Daily: NZDUSD was lower following prior retracement from the resistance level at 0.6425. MACD which illustrate diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6295.

Resistance level: 0.6425, 0.6490

Support level: 0.6295, 0.6200

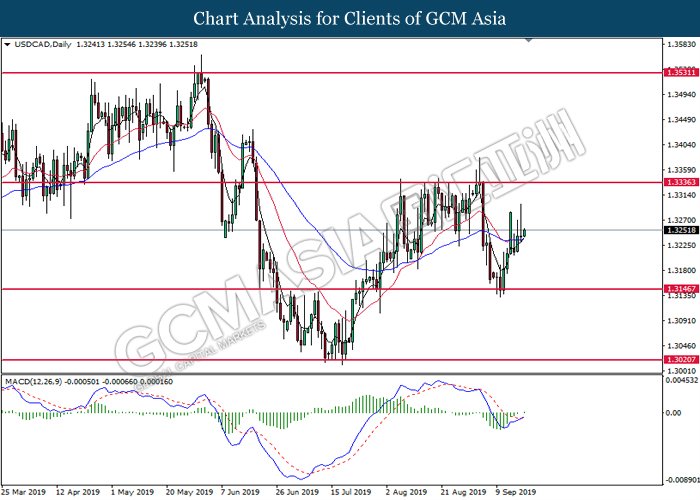

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3145. MACD which illustrate bullish signal suggests the pair to extend its gains toward the resistance level at 1.3335.

Resistance level: 1.3335, 1.3530

Support level: 1.3145, 1.3020

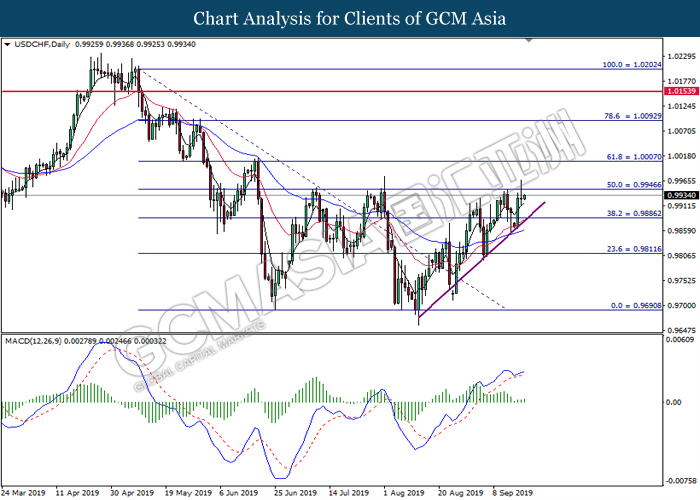

USDCHF, Daily: USDCHF was traded higher following prior rebound from the upward trendline. MACD which illustrate upward momentum suggests the pair to extend its gains toward the resistance level at 0.9945.

Resistance level: 0.9945, 1.0005

Support level: 0.9885, 0.9810

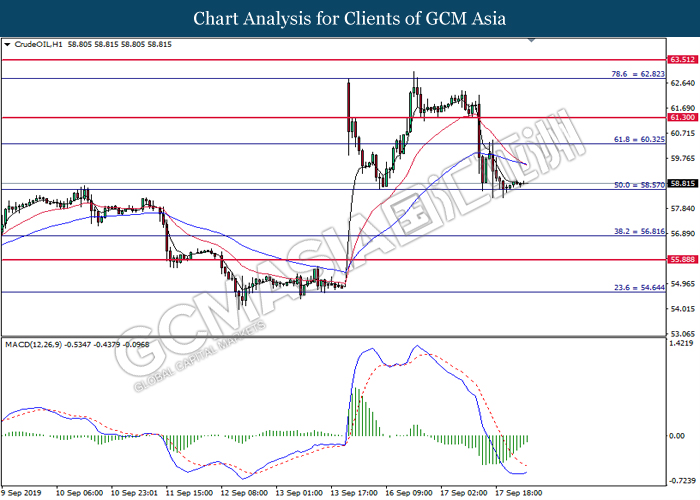

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 58.55. MACD which illustrate diminished downward momentum suggests the commodity to extend its gains toward the resistance level at 60.35.

Resistance level: 60.35, 61.30

Support level: 58.55, 56.80

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1485.65. MACD which illustrate diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1525.20.

Resistance level: 1525.20, 1551.85

Support level: 1485.65, 1444.70