19 September 2019 Afternoon Session Analysis

AUD surrenders as rate cut imminent.

Australian dollar extended its losses although recent economic data from the region fared better-than-expected. According to Australian Bureau of Statistics, the Employment Change for the month of August came in at 34,700 individuals, exceeding economist forecast for a reading up to 10,000 individuals. Similarly, Participation Rate of workforce notched up from 66.1% to 66.2% for the month of August. However, Australian dollar came under pressure as of recent due to internal and external fundamental factors. Most market participants speculate that the Reserve Bank of Australia may cut its interest rate further in order to provide more support towards its fragile economy. With trade war in between US and China remains unresolved, RBA may take precautionary measures in order to circumvent any possible downside risks which stems from their heavy reliance upon China as its main trading partner. Likewise, Aussie received further selloff following hawkish tones portrayed by US Federal Reserve. Although Fed cut its interest rates as expected, they continue to remain bullish upon future economic growth while reiterates to only seek further actions whenever necessary. As of writing, pair of AUD/USD slumped 0.58% to 0.6788.

In terms of commodities market, crude oil price depreciates by 0.05% to $58.23 per barrel. Oil prices came under pressure after US President Donald Trump vows to enact more sanctions against Iran following last weekend’s attack upon Saudi Arabia’s oil facility. Such signal increases the tension in the Middle East which sparked higher risk aversion in the market. On the other hand, gold price ticks up 0.01% to $1,494.20 a troy ounce following risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 CHF SNB Monetary Policy Assessment

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision | -0.75% | -0.75% | – |

| 16:30 | GBP – Retail Sales (MoM) (Aug) | 0.2% | -0.2% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Sep) | 0.75% | 0.75% | – |

| 20:30 | USD – Initial Jobless Claims | 204K | 213K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Sep) | 16.8 | 11.0 | – |

| 22:00 | USD – Existing Home Sales (Aug) | 5.42M | 5.37M | – |

Technical Analysis

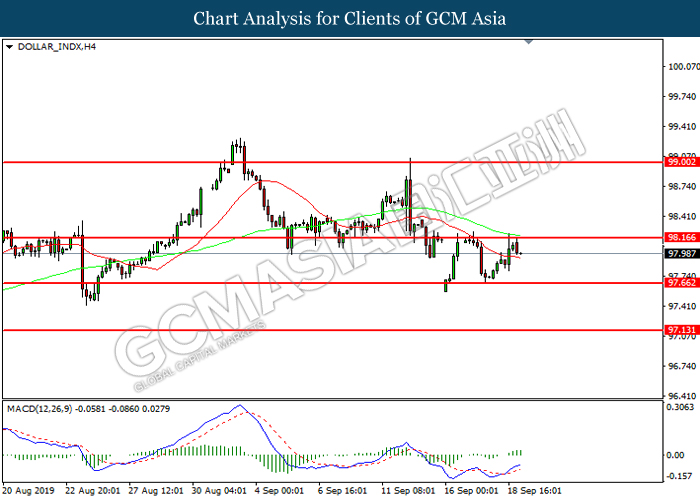

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from resistance level at 98.15. However, MACD which illustrated bullish momentum suggest the pair to be traded higher in short-run as technical correction.

Resistance level: 98.15, 99.00

Support level: 97.65, 97.15

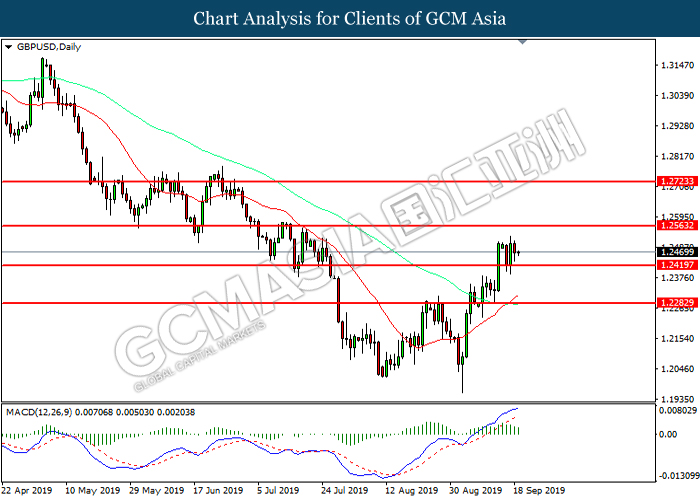

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2420. However, MACD which illustrate diminishing bullish signal suggests the pair to be traded lower as a short term technical correction toward the support at 1.2420.

Resistance level: 1.2565, 1.2725

Support level: 1.2420, 1.2285

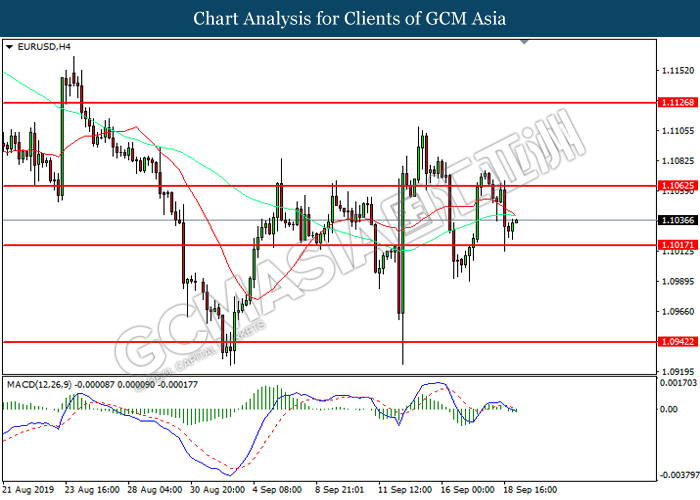

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1065. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.1015.

Resistance level: 1.1065, 1.1125

Support level: 1.1015, 1.0940

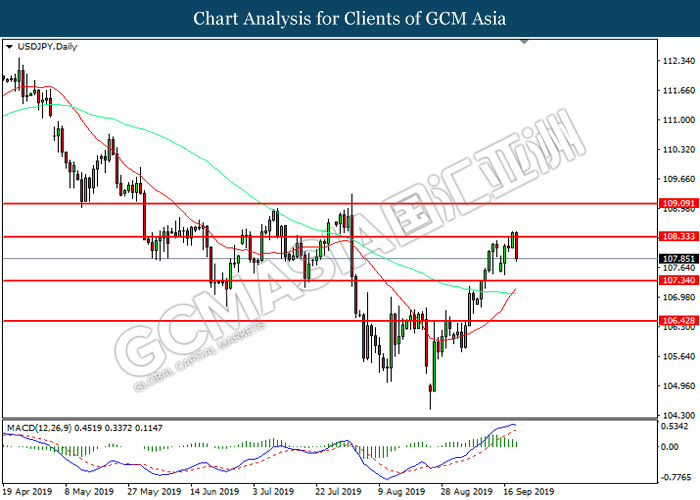

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 108.35. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 107.35.

Resistance level: 108.35, 109.10

Support level: 107.35, 106.45

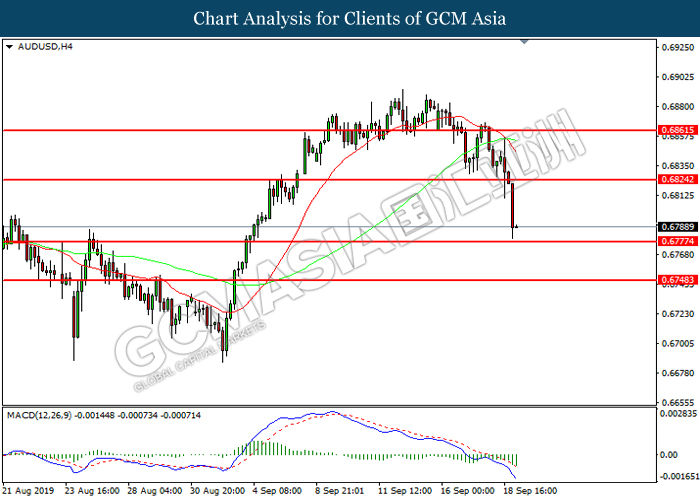

AUDUSD, H4: AUDUSD was traded lower while currently testing near the support level 0.6775.MACD which illustrated increasing bearish momentum suggests the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6825, 0.6860

Support level: 0.6775, 0.6750

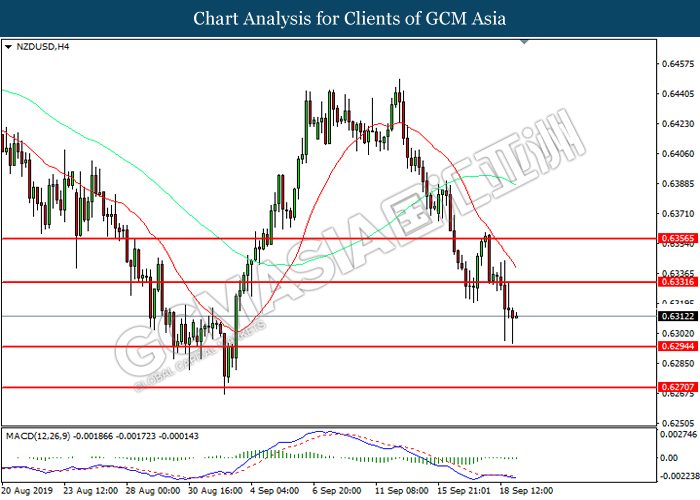

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level 0.6330. MACD which illustrated bearish signal suggests the pair to extend its losses toward the support level at 0.6295.

Resistance level: 0.6330, 0.6355

Support level: 0.6295, 0.6270

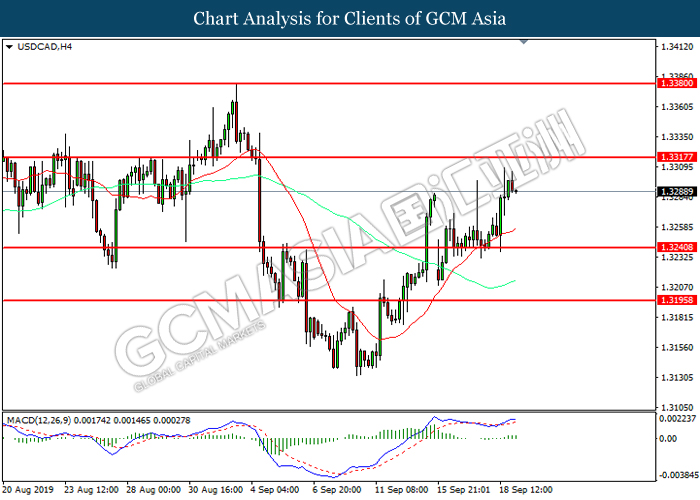

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3240. MACD which illustrates bullish bias suggests the pair to extend its gains towards the resistance level 1.3320.

Resistance level: 1.3320, 1.3380

Support level: 1.3240, 1.3195

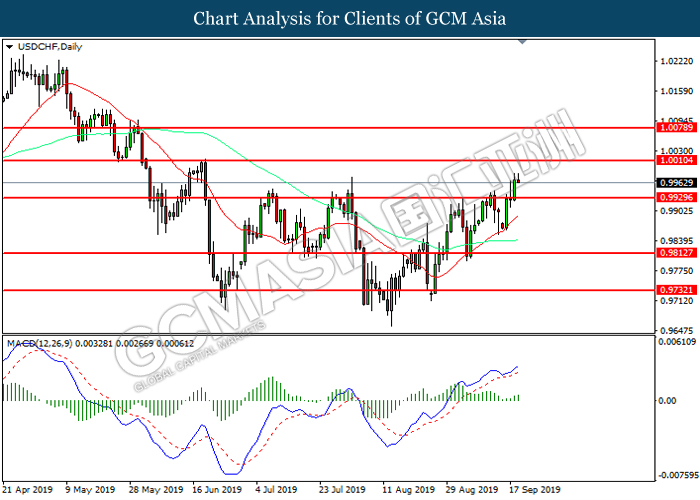

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9930. MACD which illustrates persistent bullish momentum suggests the pair to extend its gains toward resistance level at 1.0010.

Resistance level: 1.0010, 1.0080

Support level: 0.9930, 0.9815

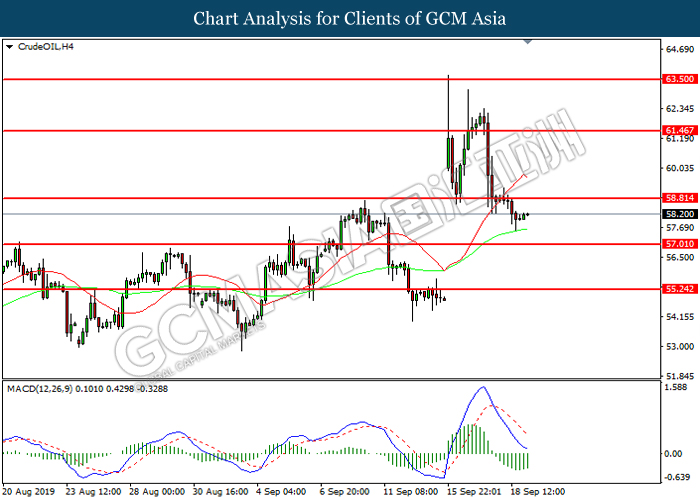

CrudeOIL, H4: Crude oil was traded lower following prior breakout below its resistance level at 58.80. MACD which illustrated bearish signal suggests the commodity to extend its losses toward the support level at 57.00.

Resistance level: 58.80, 61.45

Support level: 57.00, 55.25

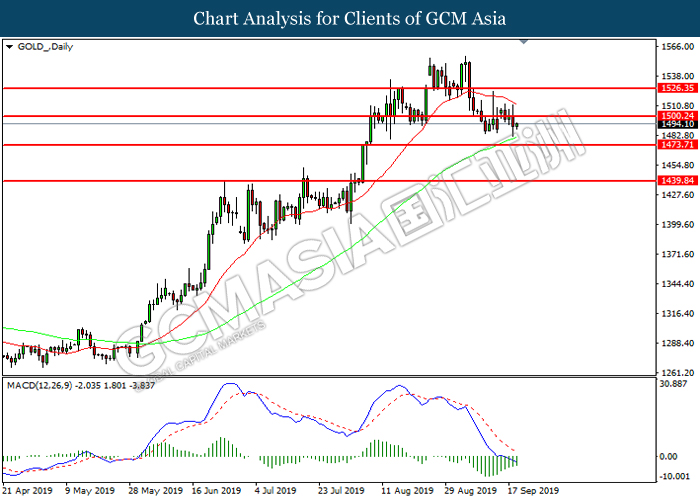

GOLD_Daily: Gold price was traded lower following prior retracement from the resistance level at 1500.25. MACD which illustrates bearish signal suggests the commodity to be traded lower toward the support level at 1473.70.

Resistance level: 1500.25, 1526.35

Support level: 1473.70, 1439.85