19 September 2019 Morning Session Analysis

Fed remains hawkish, but for how long?

Greenback rebounds from its prior low level subsequent to Federal Reserve interest rate decision earlier this morning. As widely expected, Fed has cut its interest rates by 25 basis points from 2.25% to 2.00%. While the recent dot-plot shows no rate cuts throughout the year of 2020, 7 Fed members voiced out their support to have another rate cut this year. In an updated economic projections report, the central bank is expecting a higher economic growth and jobless rate in 2019 while not expecting any changes upon its inflation projections. While Fed still sustain a favorable view of the US economy, they indicated no hesitation to change their policy guidance if current outlook continues to worsen. During the press conference, Fed Chair Jerome Powell highlighted that to cut its interest rates further if the economy sustained further downside than what they have expected. Overall, although Fed’s tone was skewed towards hawkish, the possibility for yet another rate cut in the future has limit the gains upon the greenback. As such, investors would continue to scrutinize future economic data from the US in order to gauge the likelihood of an interest rate cut from the Federal Reserve. As of writing, the dollar index rose 0.29% to 98.08 while pair of USD/JPY ticks up 0.01% to 108.41.

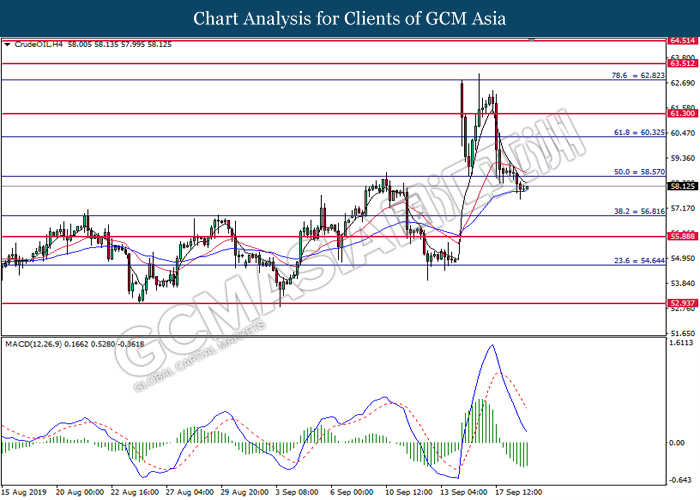

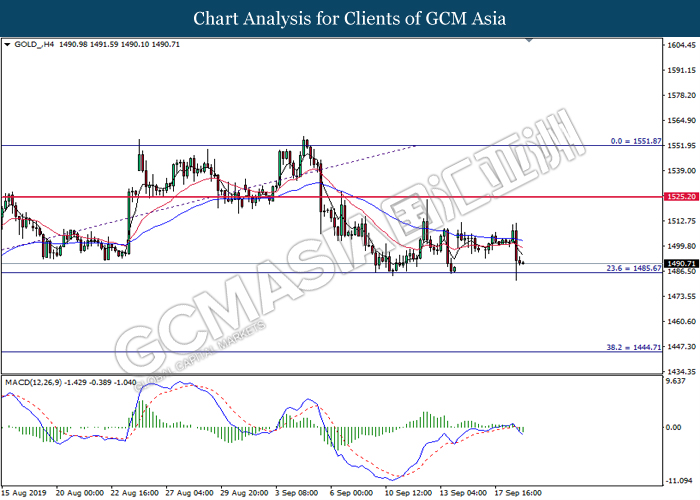

As for commodities, crude oil price depreciates by 0.12% to $58.19 per barrel. Oil futures suffered from a selloff after Energy Information Administration reported an increase in last week’s oil stocks by 1.058 million barrels, missing forecast to decrease by -2.496 million barrels. On the other hand, gold price slipped 0.05% to $1,493.30 a troy ounce due to hawkish tone portrayed by the Federal Reserve which stoked a shift in sentiment towards riskier assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative JPY BoJ Monetary Policy Statement

Tentative JPY BoJ Press Conference

15:30 CHF SNB Monetary Policy Assessment

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | -0.10% | – |

| 15:30 | CHF – SNB Interest Rate Decision | -0.75% | -0.75% | – |

| 16:30 | GBP – Retail Sales (MoM) (Aug) | 0.2% | -0.2% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Sep) | 0.75% | 0.75% | – |

| 20:30 | USD – Initial Jobless Claims | 204K | 213K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Sep) | 16.8 | 11.0 | – |

| 22:00 | USD – Existing Home Sales (Aug) | 5.42M | 5.37M | – |

Technical Analysis

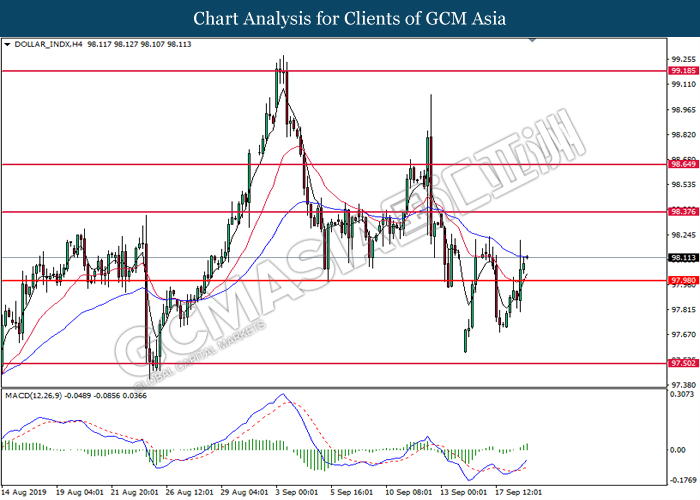

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the 50 moving average line (Blue). MACD which illustrate bullish momentum suggest the index to extend its gains after it successfully breakout above the 50 moving average line (Blue).

Resistance level: 98.40, 98.65

Support level: 98.00, 97.50

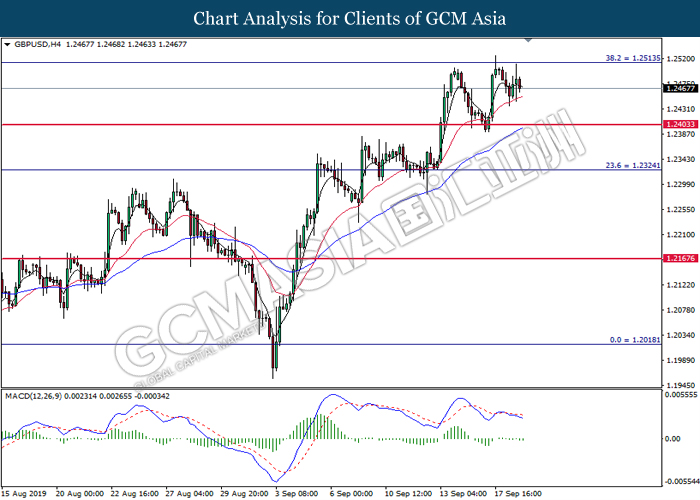

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2515. MACD which illustrate bearish signal suggest the pair to extend its losses toward the support level at 1.2405.

Resistance level: 1.2515, 1.2665

Support level: 1.2405, 1.2325

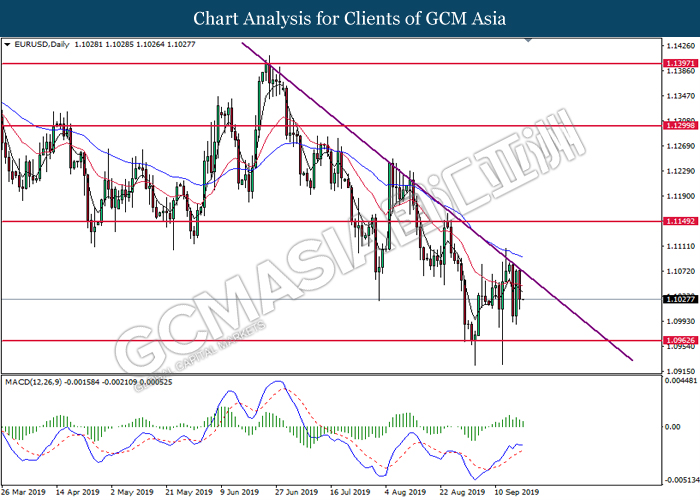

EURUSD, Daily: EURUSD was traded lower following prior retracement from the downward trend line. MACD which illustrate diminishing upward momentum suggests the pair to extend its losses toward the support level at 1.0965.

Resistance level: 1.1150, 1.1300

Support level: 1.0965, 1.0855

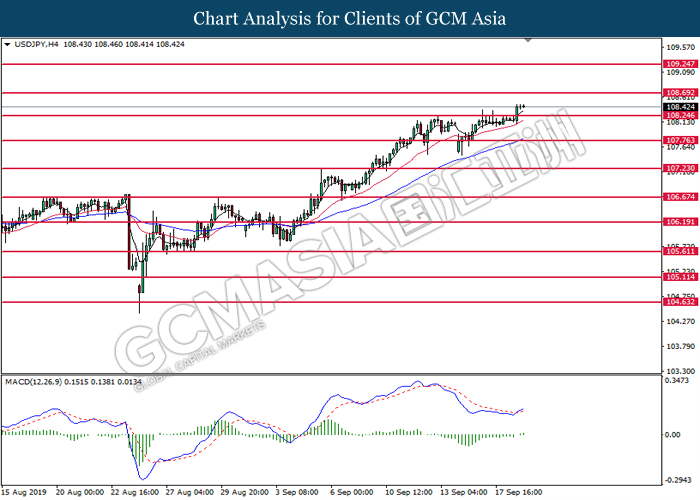

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 108.25. MACD which illustrate bullish signal suggests the pair to advance further up, towards the direction of 108.70.

Resistance level: 108.70, 109.25

Support level: 108.25, 107.75

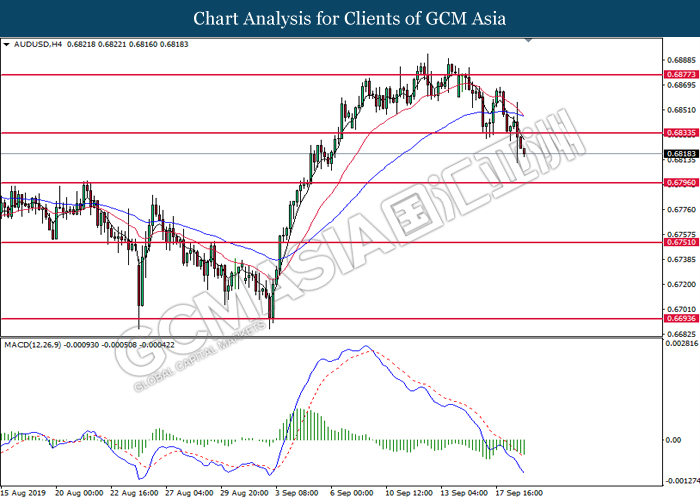

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.6835. MACD which illustrate bearish momentum suggest the pair to extend its losses toward the support level at 0.6795.

Resistance level: 0.6835, 0.6875

Support level: 0.6795, 0.6750

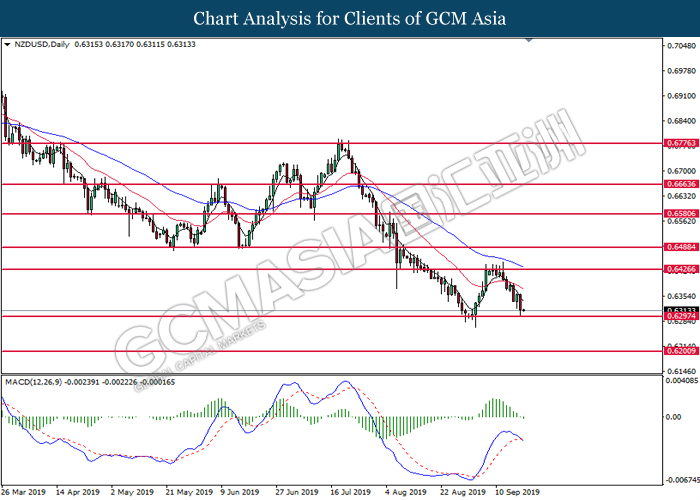

NZDUSD, Daily: NZDUSD was traded lower while currently testing near the support level at 0.6295. MACD which illustrate bearish momentum and the formation of death cross suggest the pair to extend its losses after it successfully breakout below the support level at 0.6295.

Resistance level: 0.6425, 0.6490

Support level: 0.6295, 0.6200

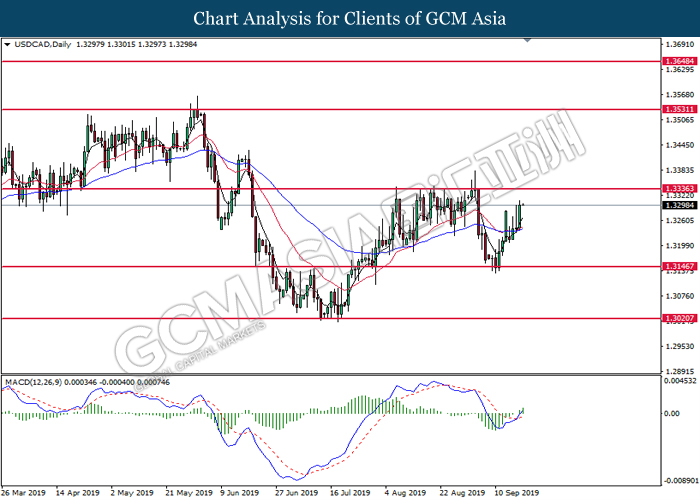

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3145. MACD which begins to form a bullish signal suggests the pair to extend its gains toward the resistance level at 1.3335.

Resistance level: 1.3335, 1.3530

Support level: 1.3145, 1.3020

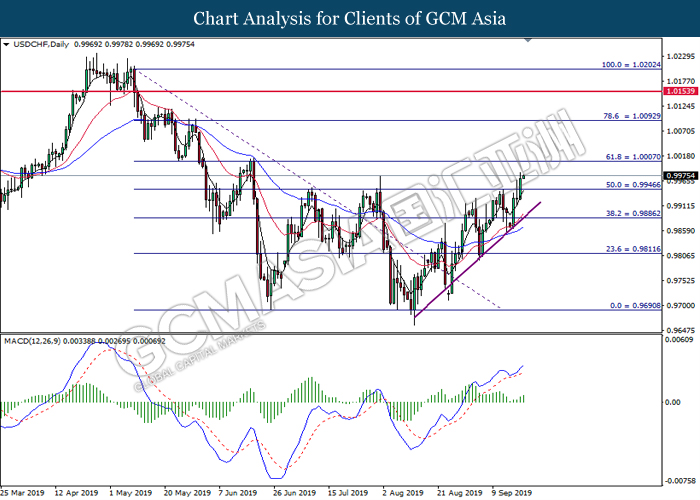

USDCHF, Daily: USDCHF was traded higher following prior closure above 0.9945. MACD which illustrate upward momentum suggests the pair to extend its gains toward the resistance level at 1.0005.

Resistance level: 1.0005, 1.0095

Support level: 0.9945, 0.9885

CrudeOIL, H4: Crude oil price was traded lower while currently testing the 50 moving average line (Blue). However, MACD which illustrate diminishing downward momentum suggests its price to be traded higher, towards the direction of 58.55.

Resistance level: 58.55, 60.35

Support level: 56.80, 55.90

GOLD_, H4: Gold price was traded lower following prior retracement from the higher level. MACD which illustrate bearish signal suggest the gold price to be traded lower toward the direction 1485.65.

Resistance level: 1525.20, 1551.85

Support level: 1485.65, 1444.70