20 September 2019 Morning Session Analysis

Greenback revived amid upbeat economic data.

Dollar index which gauge its value against a basket of six major currencies rebound from lower level following upbeat data been released from United States, indicating that previous trade escalation between two largest countries does not triggered significant pressure on US. Yesterday, US economic data which included Philadelphia Fed Manufacturing and Existing Home Sales data showed a positive reading where both came in at 12.0 and 5.49M respectively, beating the economist forecast of 11.0 and 5.37M. Both optimistic data portray that US labour market and manufacturing sector has been improved and still remain resilient despite NFP for the month of August showed a significant drop as comparing to previous month. As of writing, dollar index rose 0.01% to 98.00. On the other hand, the pair of GBP/USD rose following the release of latest monetary policy decision from Bank of England (BoE). Yesterday, BoE has voted to remain the current UK interest rate at 0.75% while eyeing on the development of Brexit and global growth pace. While the escalation of tensions between China and US continued to outweigh the global economy growth, BoE judges the underlying growth has slowed but still remain slightly positive toward the long-term growth in UK. Neutral tilt tone from BoE surprised the market as market were expecting BoE would remain dovish toward the economic outlook of UK as recent data such as GDP shows Brexit uncertainty continues to haunt the economy growth of UK. During Asian early trading session, the pair of GBP/USD inched up 0.04% to 1.2530.

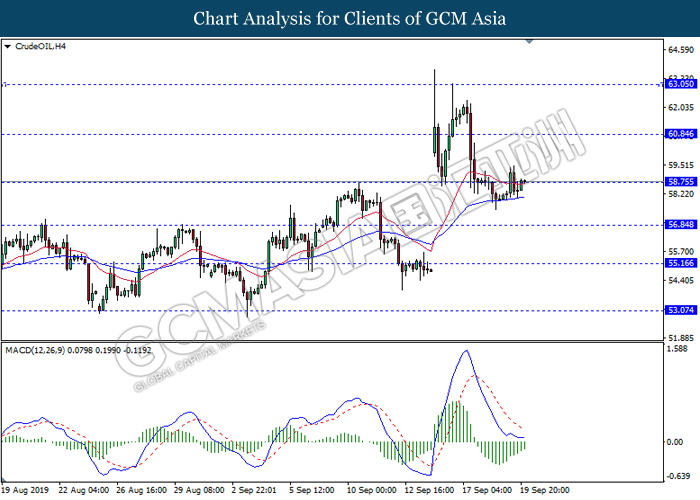

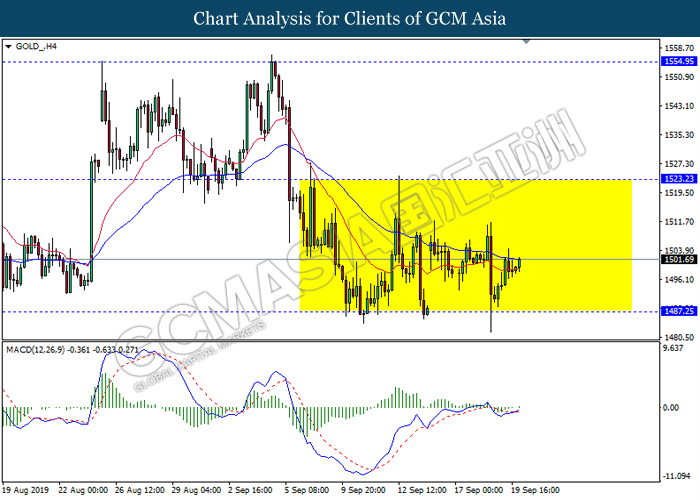

On the commodities market, crude oil price rose 0.29% to $58.75 per barrel amid market worries over the supply short of crude oil which caused by the attack launched on Saudi Arabia recently. Despite Saudi Arabia Prince has keep emphasize that the recent shutdown of two damaged oil production plants do not create huge problem for them, however markets are still concerns over the supplies of crude oil if there is another round of oil market shock happened. Besides, gold price quoted up 0.18% to $1501.60 a troy ounce amid fading of market risk appetite.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | German PPI (MoM)(Aug) | 0.9% | 0.2% | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Jul) | 0.1% | -0.2% | – |

| 01:00

(21th) |

CrudeOIL – U.S. Baker Hughes Oil Rig Count | 733 | – | – |

Technical Analysis

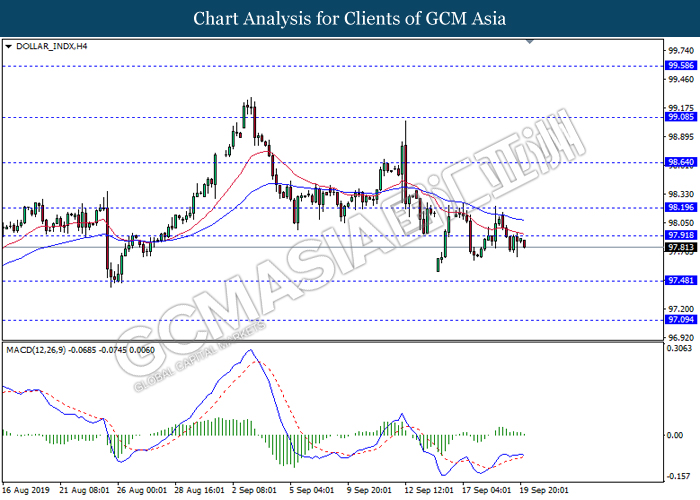

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from resistance level 97.90. MACD which illustrate bearish bias signal suggest the dollar to extend its losses towards the support level 97.50.

Resistance level: 97.90, 98.20

Support level: 97.50, 97.10

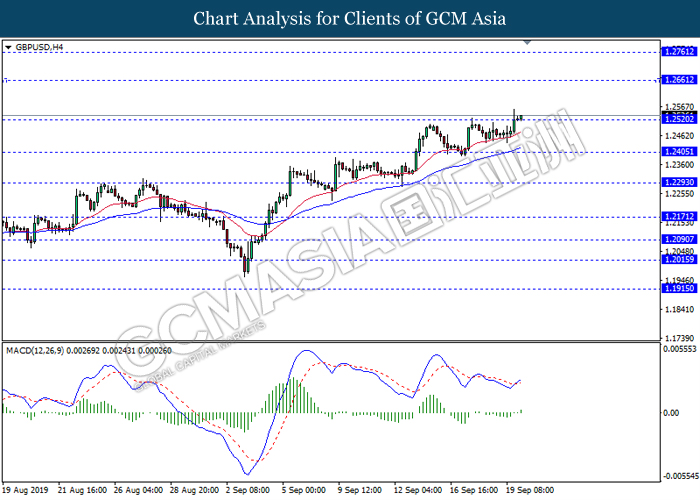

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2520. MACD which illustrate bullish momentum with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.2660.

Resistance level: 1.2660, 1.2760

Support level: 1.2520, 1.2405

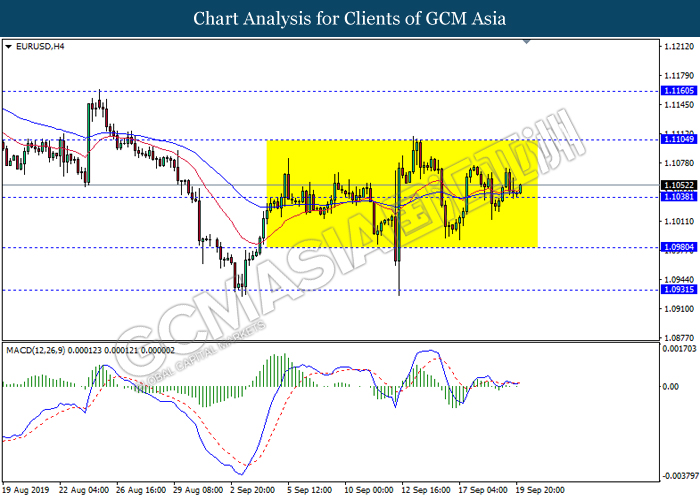

EURUSD, H4: EURUSD was traded in a sideway channel following recent rebound from support level 1.1040. Due to lack of clear signal and direction from MACD, it is suggested to wait until further clear signal appear such as breakout above the resistance level or support level before entering the market.

Resistance level: 1.1105, 1.1160

Support level: 1.1040, 1.0980

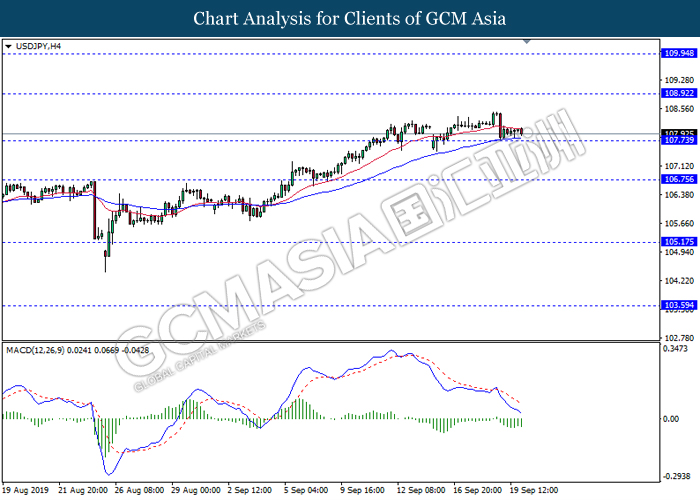

USDJPY, H4: USDJPY was traded lower while currently testing near the support level 107.75. MACD which illustrate ongoing bearish momentum suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 108.90, 109.95

Support level: 107.75, 106.75

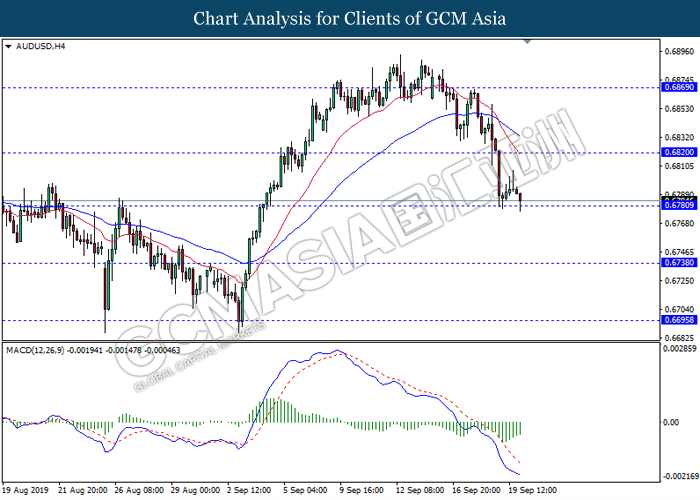

AUDUSD, H4: AUDUSD was traded lower while currently testing near the support level 0.6780. However, MACD which illustrate diminishing bearish momentum suggest the pair to experience a technical correction in short term towards the resistance level 0.6820.

Resistance level: 0.6820, 0.6870

Support level: 0.6780, 0.6740

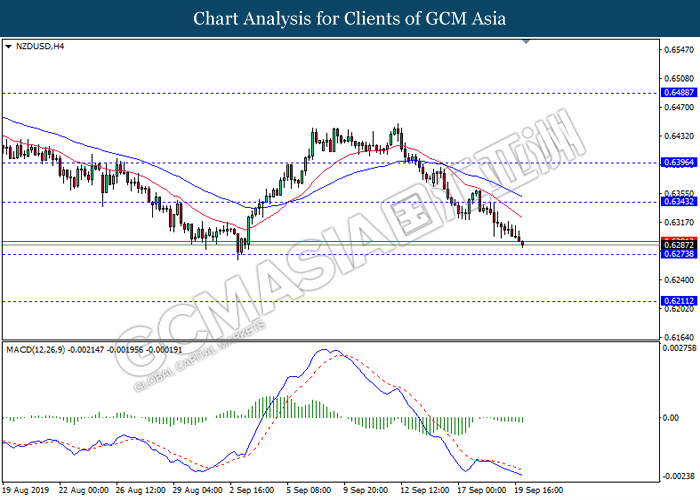

NZDUSD, H4: NZDUSD was traded lower while currently testing near the support level 0.6275. MACD which illustrate ongoing bearish momentum suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6345, 0.6395

Support level: 0.6275, 0.6210

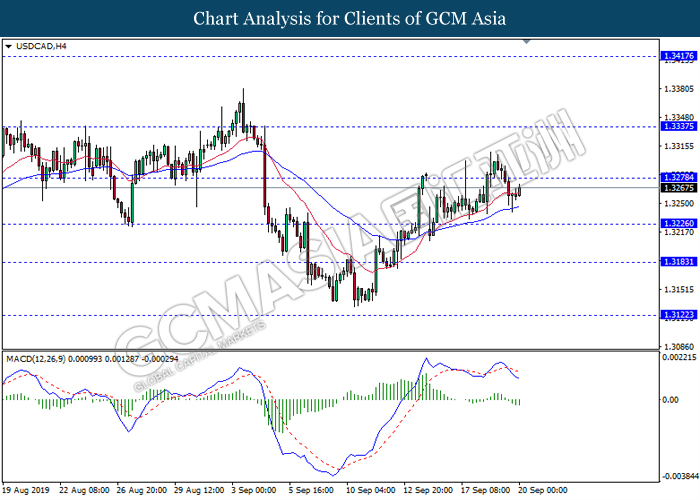

USDCAD, H4: USDCAD was traded higher while currently testing near the resistance level 1.3280. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains after it breaks above the resistance level 1.3280.

Resistance level: 1.3280, 1.3335

Support level: 1.3225, 1.3185

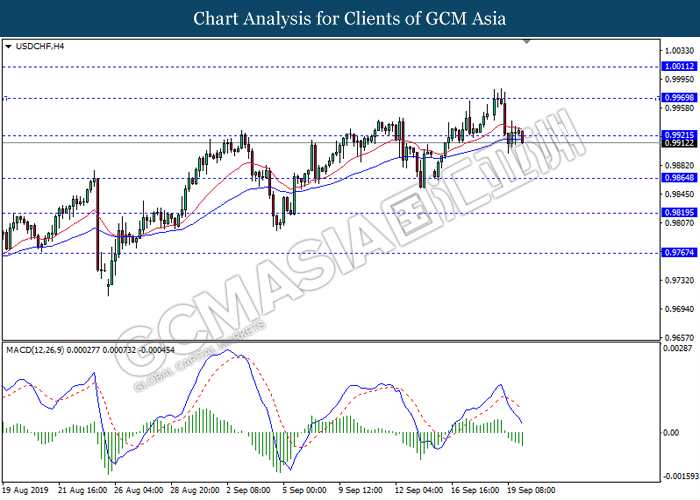

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.9920. MACD which illustrate persistent bearish bias signal with the formation of death cross suggest the pair to extend its losses after it close below the support level at 0.9920.

Resistance level: 0.9920, 0.9970

Support level: 0.9865, 0.9820

CrudeOIL, H4: Crude oil was traded higher while currently testing the resistance level at 58.75. MACD which illustrate diminishing bearish momentum suggest the commodity to extend its gains after successfully breakout above the 58.80.

Resistance level: 58.80, 61.45

Support level: 57.00, 55.25

GOLD_H4: Gold price was traded in a sideway channel following recent rebound from the support level 1487.25. Due to lack of momentum and signal from MACD, it is suggest the wait until further signal appear before entering the market.

Resistance level: 1523.25, 1554.95

Support level: 1487.25, 1449.65